空売り株式からの収益に対する利息

株式借入ポジションに関連する利息または費用の割り出し方

口座保有者が株式を空売りする場合、IBKRでは購入者に株式を引き渡す義務を履行するため、口座保有者に変わって同額の株式の借入を行います。 株式の借入を行うための株式借入に関する同意書は、IBKRが株式の貸し手に対し、借入のための現金担保を提供することを義務としています。 現金担保の金額は、担保マークと呼ばれる、株価の業界標準計算に基づいています。

株式の貸し手は、現金担保の利息をIBKRに提供し、また現金担保預金の実勢市場金利(通常、米ドル建て現金預金に対するフェデラル・ファンド実行金利に固定されています)よりも低い金額に支払われる利息を調整することによって、このサービスを提供することに対する手数料を請求します。 借入困難な銘柄の場合、株式提供に対する貸し手の手数料により、IBKRにマイナス金利が請求される可能性があります。

多くの証券会社ではこのリベートの一部を機関投資家にのみパススルーしますが、IBKRではすべてのお客様に対し、 USD 100,000または他通貨での同等額を超える空売り株式の売却収益に対して利息をお支払いしています。借入可能な証券の供給が借入需要に対して多い場合、口座保有者は、ベンチマーク・レート(例:米ドル建て残高に対するフェデラル・ファンドによるオーバーナイト実行金利)からスプレッド(現在、USD 100,000の残高に対して1.25%、USD 3,000,000以上の残高に対して0.25%の範囲)を差し引いた額と同額の空売り株式残高に対する利息の受け取りを期待できます。レートは予告なく変更される可能性があります。

特定の銘柄の需要と供給の属性によって銘柄が借入困難になる場合、貸し手が提供するリベートが減少し、口座に対する請求が発生する可能性があります。リベートまたは請求は、より高い借入手数料として口座保有者にパススルーされ、これが空売り収益の利息を上回り、口座に対する請求となる可能性があります。レートは銘柄と日付の両方に左右されるため、IBKRでは、クライアントポータル/アカウント・マネジメントからアクセス可能な空売り可能株式ツールを使用して、空売りに対する指標レートをご確認いただくことをお勧めします。ツールに表示される指標レートは、IBKRがTier IIIの残高に対して支払う空売り収益利息、つまり300万米ドル以上の空売り収益にも適用されることにご留意ください。残高が少ない場合、レートは取引通貨に関連するティアおよびベンチマークレートに基づいて調整されます。正確なレートは、「空売り(ショートセル)の売却代金の現金に対する受取金利計算機能」からご確認いただけます。

その他の例や計算機能は、有価証券ファイナンシングのページをご参照ください。

ご留意事項

空売り可能株式ツール及びTWSで提供される、借入可能な株式及び指標レートに関する情報は、正確性または有効性に関する保証なしに、ベストエフォートベースで提供されます。空売り可能株式には、リアルタイムで更新されない、サードパーティからの情報が含まれます。レートに関する情報はあくまでも目安です。現在の取引セッションで約定される取引は通常、2営業日で決済され、実際の借入可能株式と借入にかかるコストは決済日に決定されます。取引が特に少ない株式、小型株、および今後のコーポレートアクション(配当を含め)がある株式クラスの場合、取引日から決済日までの間にレートと利用可能株が大幅に変化する可能性があることにご注意ください。詳細は、空売りにかかる運用リスクをご参照ください。

アクティビティステートメントの未払金払戻とは何ですか?

IBKRでは、毎日、アクティビティステートメントの未払い利息の項目において、計算期間中に獲得される又は支払われる利息の予想額や金額を計算し報告します。毎月の第1週目頃に、前月に発生した利息が取消/払い戻しされ、当月の実際の利息が現金報告の項目に掲載されます。月1回行われる払い戻しは実際の利息の予想額であるため、必ずしも完全に同じ金額になるわけではありませんが、実際の利息に近い金額となります。

未払い利息は金額がプラスまたはマイナスのいずれであっても、報告期間中に$1を超えた場合のみ掲載されることにご留意ください。$1未満の残高はいったん取りおかれ、将来の未払い利息と合計して金額が$1を超えた時点で掲載されます。

クレジット保留の対象となる入金には保留期間中に利息が発生しますか?

入金方法によって異なります。ACH を利用して入金が行われる場合、着金した日から4営業日のクレジット保留期間まで利息が発生し、その後、口座に入金されます。銀行小切手以外の小切手による入金の場合、クレジット保留期間に発生する利息はありません。銀行小切手およびワイヤ送金の場合には着金と同時に口座への入金が行われるため、クレジット保留期間の対象になりません。

お客様にお支払いされる利息は、市場の状況によって異なります。 現在クレジット残高に支払われる利息額に関する詳細は、こちらをご参照ください:www.interactivebrokers.com/interest

FAQs – Irish Income Withholding Tax

As an Irish company, Interactive Brokers Ireland Limited (IBIE) is generally required to collect withholding tax (WHT) at a rate of 20% on interest paid to certain clients.

This requirement is set out in section 246 of the Irish Taxes Consolidation Act 1997 and generally applies to interest paid to clients that are:

(i) natural persons resident in Ireland,

(ii) natural persons resident outside Ireland unless the client has successfully applied for an exemption or a reduction in the WHT rate under a Double Tax Treaty (DTT) between Ireland and the person’s country of residence.

(iii) Irish companies

(iv) Companies established in countries with which Ireland has NOT concluded a DTT.

The purpose of this document is to set out our responses to some frequently asked questions (FAQs) on the WHT.

This document is for information purposes only and does not constitute tax, regulatory or any other kind of advice. If you are unsure of your tax obligations please consult the Irish Revenue Commissioners, your local tax authority or an appropriate tax professional.

FAQs

What type of interest does Irish WHT apply to?

Does Irish WHT apply to interest I earn through the Stock Yield Enhancement Program?

If I earn interest through Bond Coupons, am I required to pay Irish WHT?

I do not trade Irish stocks, do I still have to pay Irish WHT?

What is the standard Irish WHT Rate?

When is the 20% WHT applied to my account?

What currency is used for Irish WHT?

I am resident in Ireland. Do I have to pay Irish WHT?

I am not resident in Ireland. Does Irish WHT apply to me?

Does WHT apply to clients who are companies?

How do I apply for an exemption from WHT or a reduced WHT rate?

What do joint account holders need to submit to obtain a WHT exemption/reduction?

Where should I send my completed Form 8-3-6?

How do I submit Form 8-3-6 and supporting documentation to IBIE?

Do I need to apply for an exemption from WHT or a reduction in the WHT rate by a certain deadline?

How do I apply to reclaim WHT applied to my account?

How long does a completed Form 8-3-6 remain valid for?

Do I have to complete a Form 8-3-6? Can I still trade if I don’t complete it?

Where can I see information relating to Irish WHT on my account statement?

How do I know what WHT rate has been agreed between my country of residence and Ireland?

WHT is a set amount of income tax that is withheld at the time income is paid to a person.

Under Irish law, interest payments are considered income. This means that IBIE is legally required to deduct WHT from credit interests on uninvested cash balances in our clients’ securities accounts.

What type of interest does Irish WHT apply to?

Irish WHT applies to credit interest paid to long settled uninvested cash balances as well as short credit interest where you have borrowed stock from IBIE.

Does Irish WHT apply to interest I earn through the Stock Yield Enhancement Program?

No. The interest you earn under the Stock Yield Enhancement Program is not within scope for Irish WHT obligations. Irish WHT only applies to credit interest paid on uninvested cash balances in your account.

If I earn interest through Bond Coupons, am I required to pay Irish WHT?

No. Interest that you earn on Bond Coupons is not within scope for Irish WHT obligations. Irish WHT applies only to credit interest paid on uninvested cash balances in your account.

I do not trade Irish stocks, do I still have to pay Irish WHT?

Yes. If your account is held by IBIE, your account is in scope for Irish WHT on credit interest payments. It is irrelevant whether or not you trade in Irish stocks.

What is the standard Irish WHT Rate?

The standard rate of WHT is 20%. You can find further information on credit interest rates on our webpage.

When is the 20% WHT applied to my account?

If IBIE is required to apply WHT to your interest payments, we will do so at the same time any credit interest is paid to your account.

IBIE pays interest due on the uninvested cash balance in your account on the third business day of the month following the month in which the interest accrued. For example, interest accrued in January will be paid on the third business day in February.

What currency is used for Irish WHT?

Irish WHT is charged in the same currency as the credit interest paid on the uninvested cash balances in your account.

I am resident in Ireland. Do I have to pay Irish WHT?

Yes. Under Irish tax law, all Irish resident individuals and partnerships are subject to 20% WHT on credit interest payments. Irish companies are also subject to WHT, although some limited exemptions may apply.

I am not resident in Ireland. Does Irish WHT apply to me?

Yes, generally Irish WHT applies to natural persons whether or not they reside in Ireland.

However, if Ireland has entered a Double Taxation Treaty (DTT) with your country of residence, that DTA may allow you to apply for an exemption from or reduction in WHT, depending on its terms. Please see further below.

You can find information about Ireland’s DTTs on the Irish Revenue website https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

Does WHT apply to clients who are companies?

WHT does not apply to companies resident in countries that have a DTT with Ireland.

In general, WHT applies to Irish resident companies with a few exceptions, including;

(a) an investment undertaking within the meaning of section 739B of the Taxes Consolidation Act 1997,

(b) interest paid in the State to a qualifying company (within the meaning of section 110).

For a full list of exemptions, please refer to Section 246(3) of the Taxes Consolidation Act.

There is no standard exemption form for corporate clients. In order to avail of these exemptions, clients will have to provide proof of their corporate status requested by IBIE.

How do I apply for an exemption from WHT or a reduced WHT rate?

If you wish to apply for a WHT exemption or reduction under the terms of a DTT, you should complete Form 8-3-6, and return that Form to IBIE.

The following is a summary of the information you must provide when completing Form 8-3-6:

1. Your name (please ensure this matches the name on your IBKR account)

2. Your address

3. Your tax reference number in country of residence

4. The country in which you are tax resident

5. The WHT rate agreed between your country of tax residence and Ireland (see FAQ on this topic).

6. Signature.

7. Date.

You must request your local Tax Authority to sign and stamp Form 8-3-6 before returning it to us.

For more detailed information on how to complete Form 8-3-6, please refer to the Irish Revenue Commissioners’ website here https://www.revenue.ie/en/companies-and-charities/financial-services/withholding-tax-interest-payments/index.aspx

If you have asked your local tax authority to sign Form 8-3-6 and they have refused, you can instead submit a Tax Residency Certificate (TRC) from your local Tax Authority, with a completed Form 8-3-6 that has not been signed and stamped by your local tax authority. Revenue introduced this possibility in January 2023, after being informed by IBIE of the difficulties clients were experiencing in completing the Form.

To be acceptable, the TRC must explicitly state that you are tax resident in your country of residence in accordance with the relevant provision of the double taxation treaty between Ireland and your country of residence.

Please note that a TRC will only be accepted where you have first requested your local tax authority to sign and stamp Form 8-3-6 and it has refused to do so or has failed to do so within a reasonable time.

Form 8-3-6 and information about completing the Form 8-3-6 is available on the website of the Irish Revenue Commissioners.

To assist you, IBIE has also prepared a number of versions of Form 8-3-6 with certain information pre-filled, depending on your jurisdiction of tax residency. You can select the most appropriate form from the list below.

Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch*

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

What do joint account holders need to submit to obtain a WHT exemption/reduction?

Each account holder in a joint account needs to complete their own documentation. This means that a separate Form 8-3-6 must be completed by each account holder and (if relevant) a separate TRC must be provided by each account holder.

Where should I send my completed Form 8-3-6?

You should send your completed Form to IBIE. You should NOT send the Form to Irish Revenue.

How do I submit Form 8-3-6 and supporting documentation to IBIE?

You should email a PDF or JPEG copy of the signed form to tax-withholding@interactivebrokers.com. If you have not been able to obtain a stamp from your local tax authority, please ensure that you also email your Tax Residency Certificate (TRC) to this same email address.

Alternatively, you can upload your signed Form 8-3-6 to your Client Portal through the ‘Document Submission Task’ tab. However, if you are submitting a TRC with your Form you will still need to send this separately to the above email address.

Please put your IBIE account number in the email subject line in all email correspondence. A failure to do so may delay or prevent the processing of your application,

If your submitted documentation is in order, IBIE will send you a confirmation email stating that your Form has been received and processed.

If your submitted documentation is not in order, we will send you an email setting out the additional information or documentation we require to process your application.

Please follow up with IBIE if you have not heard from us within four weeks.

Do I need to apply for an exemption from WHT or a reduction in the WHT rate by a certain deadline?

There is no deadline. However, for applications made in 2023, a WHT exemption or rate reduction will only apply to interest payments made after IBIE has received a complete application.

If we have not processed your Form 8-3-6 by the time the next interest payment is made to your account we will refund any WHT deducted after the date we received your application. Refunds will be visible in the Withholding Tax section of a statement.

Yes, if you are not subject to WHT, or are subject to a reduced WHT rate by virtue of a Double Taxation Treaty between Ireland and your country of residence, you will be entitled to reclaim WHT paid in excess of the WHT rate set out in the DTT.

How do I apply to reclaim WHT applied to my account?

Generally, the application process (i) to apply for an exemption from WHT or a reduction in the WHT rate going forward and (ii) to reclaim WHT already charged, are two separate processes. IBIE is awaiting full details from the Irish Revenue Authority on how clients can make reclaims on WHT and will make these details available once provided.

However, for 2022, Revenue has agreed to allow a completed Form 8-3-6 (signed and stamped by the relevant Tax Authority) received by IBIE before 31 December 2022, to be used to reclaim WHT applied in 2022. This means that if IBIE received a completed form from you on or before 31 December 2022 and WHT was applied to your account from January – December 2022, IBIE will refund all or part of that WHT, depending on Ireland’s arrangements with your tax jurisdiction.

If you did not provide a Form 8-3-6 before 31 December 2022 or, if you provided a Form 8-3-6 but it was incomplete (for example by not being stamped by your local tax authority), you must separately apply for a full or partial reclaim of WHT paid in 2022 and 2023. Further details on the reclaim process may be found in an article titled Irish Tax Withholding Reclaim Process. For your convenience, the full article may be viewed here.

How long does a completed Form 8-3-6 remain valid for?

A fully completed Form 8-3-6 remains valid for 5 years unless there is a material change in your facts and circumstances. This also applies if you have provided IBIE with a TRC in lieu of having your Form 8-3-6 stamped by your local tax authority. If there is a material change to your circumstances from a tax perspective, you must advise IBIE immediately and provide an updated Form 8-3-6 where appropriate. For example, if you move tax residency from one country to another, you should advise IBIE and provide IBIE with a Form 8-3-6, signed and stamped by your local tax authority from your new country of residence.

Do I have to complete a Form 8-3-6? Can I still trade if I don’t complete it?

You do not have to complete Form 8-3-6 and you will still be able to trade if you do not complete the form.

However, if you do not complete Form 8-3-6 IBIE must continue to deduct WHT at a rate of 20% from the credit interest earned on cash balances in your account.

Where can I see information relating to Irish WHT on my account statement?

You can review information relating to Irish WHT in the ‘Withholding Tax’ section of your monthly account activity statement.

You can also view this information in your daily statement on the 3rd business day of the month (when credit interest is paid).

Please see the IBIE website here for more information: https://www.interactivebrokers.ie/en/index.php?f=46788

How do I know what WHT rate has been agreed between my country of residence and Ireland?

This information is available from the Irish Revenue Commissioners and/or your own local tax authority. However, in order to assist you, IBIE has also prepared a list of Irish WHT information by jurisdiction below.

By clicking on the country below, it will bring you to the relevant Form 8-3-6.

*Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch*

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

株式利回り向上プログラムに関連してよくあるご質問

株式利回り向上プログラムの目的

株式利回り向上プログラムは、分離管理されている証券ポジション(全額支払い済みや超過証拠金となる株式)をIBKRがサードパーティに貸付することを許可することによって副収入につなげるプログラムです。ご参加されるお客様は、貸付されている株式が終了時に確実に返却されるための担保(米国国債または現金)をお受取りされます。

全額支払済みおよび超過証拠金となる株式とは

全額支払済みの株式とは、口座に保有されている有価証券で完全に支払いの済んでいるものを指します。超過証拠金となる株式とは、支払いの済んでいない株式で、市場価格が証拠金バランスの140%を超えているものを指します。

株式利回り向上プログラムの貸付による取引から発生する収入はどのように計算されますか?

株式の貸付によってお客様に発生する収入は、店頭株式貸付市場の金利によって変わります。金利は貸付される株式の種類だけでなく、貸付日にも大きく左右されます。弊社では通常、参加者のお客様に対し、株式の貸付によって弊社に発生した金額の約50%の利息を担保にお支払い致します。

貸付の担保額はどのように計算されるのですか?

株式の貸付に必要となる金利を決定する担保(米国国債または現金)は、株式の終値に一定の割合(通常102-105%)掛けた上で一番近いドル/セント/ペンス等に切り上げられる、業界協定による方法で設定されます。通貨によって業界協定が異なります。例えば終値がUSD 59.24の株式100株貸付は$6,100に値します($59.24 * 1.02 = $60.4248。これが$61に切り上げられた上で100を掛けたもの)。下記は通貨ごとの業界協定のチャートになります:

| USD | 102%: 一番近いドルに切り上げ |

| CAD | 102%: 一番近いドルに切り上げ |

| EUR | 105%: 一番近いセントに切り上げ |

| CHF | 105%: 一番近いラッペンに切り上げ |

| GBP | 105%: 一番近いペンスに切り上げ |

| HKD | 105%: 一番近いセントに切り上げ |

詳細はKB1146をご確認ください。

株式利回り向上プログラム用の担保はどこにどうやって保有されるのですか?

IBLLCのお客様の担保は米国国債または現金として、IBLLCの関連会社であるIBKR Securities Services LLC(「IBKRSS」)に移管の上で保有されます。本プログラムによる担保はIBKRSSがお客様用の口座に保有し、担保に対する権利は完全にお客様が優先となります。万が一、IBLLCが債務不履行を起こした場合でも、IBLLCを経由せずにIBKRSSを通して直接、担保にアクセスすることができます。詳細はこちらより、証券口座の管理に関する同意書をご参照ください。IBLLCのお客様ではない方の担保は、口座を管理する事業体による保有および保管となります。例えば、IBIE口座の場合、担保はIBIEによる保有および保管となります。

IBKRの株式利回り向上プログラムによって貸付されている株式が売却や移管された場合や、プログラムへの参加をやめた場合にはどのような影響がありますか?

金利は取引が行われた日の翌日(T+1)より発生しなくなります。また、移管やプログラム参加の解約があった場合には、翌営業日より金利が発生しなくなります。

株式利回り向上プログラムへの参加資格はどのようになっていますか?

| 参加資格のある事業体* |

| IB LLC |

| IB UK(SIPP口座は対象外) |

| IB IE |

| IB CE |

| IB HK |

| IB Canada(RRSP/TFSA口座は対象外) |

| IB Singapore |

| 参加対象となる口座 |

| キャッシュ(登録日の時点で資産が最低$50,000であること) |

| マージン |

| ファイナンシャルアドバイザー管理のクライアント口座* |

| 証券会社管理のクライアント口座: Fully DisclosedおよびNon-Disclosed* |

| 証券会社管理のオムニバス口座 |

| セパレート・トレーディング・リミット口座(STL) |

*お申込みされる口座は、マージン口座やキャッシュ口座の必要最低額を達成している必要があります。

こちらのプログラムは、IBジャパン、IBヨーロッパSARL、IBKRオーストラリア、ならびにIBインドのお客様にはご利用いただけません。IB LLCにおける口座をお持ちの日本およびインドのお客様はプログラムにご参加いただくことができます。

また、ファイナンシャルアドバイザー管理のクライアント口座、fully disclosedタイプの証券会社管理のクライアント口座、ならびにオムニバス・ブローカー口座をお持ちのお客様で上記の条件を達成されている方にはご利用いただくことができます。ファイナンシャルアドバイザーおよびfully disclosedタイプの証券会社管理のクライアント口座の場合には、クライアントによる同意書へのサインが必要となります。オムニバス・ブローカー口座の場合には、ブローカーによる同意書へのサインが必要となります。

IRA口座は株式利回り向上プログラムに参加できますか?

できます。

Interactive Brokers Asset Managementの管理によるIRA口座のパーティションは、株式利回り向上プログラムに参加できますか?

いいえ。

UK SIPP口座は株式利回り向上プログラムに参加できますか?

いいえ。

プログラムに参加しているキャッシュ口座の資産が必要額である$50,000を下回った場合にはどうなりますか?

キャッシュ口座に必要となる最低資金額は、プログラムへの参加時点のみに必要となります。それ以降に資金額が下がったとしても、既存の貸付および新規の貸付に対する影響はありません。

株式利回り向上プログラムへはどうやって申込みできますか?

お申込みはクライアント・ポータルからできます。ログインしたら、ユーザーメニュー(右上にある人型のアイコン)をクリックし、設定を選択します。この後、口座設定にある取引の項目の株式利回り向上プログラムをクリックしてお申込みください。プログラムへのお申込みにあたって必要となる書類とディスクロージャーが表示されます。フォームをご確認のうえ、ご署名ください。リクエストがお手続きのために送信されます。お申込みの完了には24-48時間かかります。

株式利回り向上プログラムはどのように解約できますか?

ご解約はクライアント・ポータルからできます。ログインしたら、ユーザーメニュー(右上にある人型のアイコン)をクリックし、設定を選択します。この後、口座設定にある取引の項目の株式利回り向上プログラムをクリックして必要手続きを行ってください。リクエストがお手続きのために送信されます。 解約リクエストは通常、同日の終了時に処理されます。

プログラム参加後に解約した場合、いつからまたプログラムへの参加ができるようになりますか?

プログラム解約後、暦日で90日間はお申込みいただくことができません。

貸付対象となる有価証券ポジションのタイプ

| 米国マーケット | ヨーロッパマーケット | 香港マーケット | カナダマーケット |

| 普通株(上場株式、PINKおよびOTCBB) | 普通株(上場株式) | 普通株(上場株式) | 普通株(上場株式) |

| ETF | ETF | ETF | ETF |

| 優先株 | 優先株 | 優先株 | 優先株 |

| 社債* |

*地方債は対象外です。

IPOに続いて流通市場で取引されている株式を貸付するにあたって何か規制はありますか?

口座に保有される対象証券に規制がない限りありません。

貸付対象となる株数はどうやって割り出されますか?

株式がある場合には先ずこの価値を割り出します。IBKRではこれに対する担保権を保有し、お客様が株式利回り向上プログラムにご参加されていない場合でも貸し出すことができます。お客様が株式を購入する際に証拠金貸付によって融資を行うブローカーは、お客様の株式を現金負債額の140%まで担保として貸出できるよう、規制によって許可されています。$50,000の現金残高を保有するお客様が、市場価格が$100,000の株式を購入するケースを例として見てみます。この場合の貸付高は$50,000となり、ブローカーはこの残高の140%に値する金額または$70,000の株式を担保権として保有します。この金額を超えてお客様が保有する株式は超過証拠金証株式(この例では$30,000となります)とみなされ、株式利回り向上プログラムの一環として弊社がこれの貸付を行うことを許可されない場合には分別管理が必要になります。

負債額はまずUSD建てでない残高をすべてUSDに変換し、この後ショート株式からの収益がある場合にはこれを差し引いて(必要な場合にはUSDに変換し)割り出されます。結果としてマイナスの数値が出る場合には、これの140%までを弊社が確保します。またコモディティのセグメントやスポットメタル、およびCFD用に保有される残高は計算に入りません。 詳細は、こちらをご参照ください。

例 1: USDを基準通貨とする口座において、EUR.USDが1.40の換算レートでEUR 100,000保有しています。USD建てで株価が$112,000(EUR 80,000同等額)の株式を購入します。USDに変換された現金額がプラス残高であるため、株式は全額支払い済みとみなされます。

| 要素 | EUR | USD | 基準(USD) |

| 現金 | 100,000 | (112,000) | $28,000 |

| ロング株式 | $112,000 | $112,000 | |

| 流動性資産価値(NLV) | $140,000 |

例 2: USDで$80,000、USD建てで$100,000のロング株式、そしてUSD建てで$100,000のショート株式を保有しています。合計$28,000のロング株式は証拠金証券、また残りの$72,000は超過証拠金証券とみなされます。これはショート株式の収益を現金残高から差し引き($80,000 - $100,000)この結果となるマイナス残高に140%をかけて算出されます($20,000 * 1.4 = $28,000)。

| 要素 | 基準(USD) |

| 現金 | $80,000 |

| ロング株式 | $100,000 |

| ショート株式 | ($100,000) |

| 流動性資産価値(NLV) | $80,000 |

IBKRでは利用可能な株式すべてを貸付するのですか?

貸付対象となる株式に対する有利なレートを提供するマーケットがない、借手のいるマーケットに弊社がアクセスできない、または弊社が貸付を希望しないなどの理由により、口座内の貸付可能な株式すべてが株式利回り向上プログラムを通して貸付される保証はありません。

株式利回り向上プログラムの貸付は100株単位で行われますか?

いいえ。弊社から外部への貸付は100株単位のみで行っていますが、お客様からの貸付には決まった単位はなく、外部へ100株の貸付が必要となる場合には、1人のお客様からの75株、また別のお客様からの25株をあわせて100株しにて貸付を行う可能性があります。

貸付することのできる株数が必要な株数を上回る場合、貸付は顧客に対してどのように振り分けられるのですか?

プログラムによって貸付可能な株数が借手が必要とする株数を超える場合、貸付は比例計算で割当られます。例えば、プログラムによるXYZ株の合計数が20,000株で、10,000株が必要とされている場合、それぞれのお客様より対象となる株式の50%が貸付されます。

株式の貸付はIBKRの顧客のみにされますか?それともサードパーティにもされるのでしょうか?

株式は、IBKRおよびサードパーティの顧客に貸付されることがあります。

株式利回り向上プログラムの参加者は、IBKRが貸付する株式を指定することができますか?

いいえ。こちらのプログラムは弊社が完全に管理を行うものであり、証拠金ローンの抵当権により弊社が貸付許可を有する貸付可能な証券がある場合、全額支払い済みまたは超過証拠金の株式の貸付が可能かどうか、またこれの開始は弊社の裁量により決定されます。

株式利回り向上プログラムで貸付に出されている株式の売却には何か規制がありますか?

貸付されている株式に規制はなく、いつでも売却することができます。株式は売却にあたって返還の必要はなく、売却からの収益は通常の決済日にお客様の口座に入金されます。貸付は売却日の翌営業日開始時に終了します。

株式利回り向上プログラムで貸付されている株式に対してカバード・コールを売却し、証拠金信用力を受けることはできますか?

できます。貸付されているポジションに関連する損益は株式所有者のものとなるため、株式の貸付によってアンカバードやヘッジベースの必要証拠金に影響はありません。

貸付対象の株式で実際に引渡しが行われたものに対してコールの割当やプットの権利行使が発生した場合にはどうなりますか?

ポジションのクローズまたは減少となるアクションからT+1(取引、割当、権利行使)の時点で貸付停止となります。

貸付の対象となった後で取引が中止された株式はどうなりますか?

取引中止によって株式の貸付機能への直接的な影響はなく、対象株式の貸付が可能である限り、中止に関わらず株式の状態は変わりません。

証拠金や変動をカバーするために貸付による担保をコモディティ口座にスイープすることはできますか?

いいえ。貸付保証のための担保が証拠金などに関わることはありません。

プログラム参加者が証拠金ローンを始める、または既存のローン残高を増やすとどうなりますか?

全額支払い済みの株式をお持ちのお客様がプログラムを利用してこれを貸付された後で証拠金ローンを行う場合、超過証拠金証券の対象とならなくなるため貸付は停止されます。同様に、超過証拠金証券をお持ちのお客様がプログラムを利用してこれを貸付された後で証拠金ローンを上げる場合には、これも超過証拠金証券の対象とならなくなるため貸付は停止されます。

貸付されている株式はどのような状況で解約されますか?

以下のいずれかの状況(これに限らず)が発生した場合、株式の貸付は解約となります:

- プログラムの解約

- 株式の移管

- 株式を元にした借入

- 株式の売却

- コール割当/プット権利行使

- 口座の解約

株式利回り向上プログラムの参加者は、貸付されている株式の配当を受け取ることができますか?

貸出された株式利回り向上プログラムの株式は、 配当金を獲得し、配当金相当額(PIL)による受け取りを回避するため、通常、配当の権利落日前日までにリコールを試みます。ただし、PILとしての受け取りとなる場合もあります。

株式利回り向上プログラムの参加者には、貸付されている株式への議決権がありますか?

いいえ。承諾やアクションを行う選択日や基準日が貸付期間内の場合、選択や承諾を行う権利は証券の借手のものとなります。

株式利回り向上プログラムの参加者は、貸付されている株式のライツやワラント、またをスピンオフによる株式を受け取ることができますか?

できます。貸付されている株式のライツ、ワラント、スピンオフ株式や分配はすべて株式所有者が受け取ります。

貸付されている株式はアクティビティ・ステートメント上にどのように表示されますか?

貸付担保、発行済み株式、アクティビティおよび収入は、以下の6項目に表示されます:

1. 現金詳細 – 開始時の担保(米国国債または現金)残高、貸付アクティビティによる純変化(新しい貸付の場合にはプラス、純利益の場合にはマイナス)および終了時の現金担保残高が記載されます。

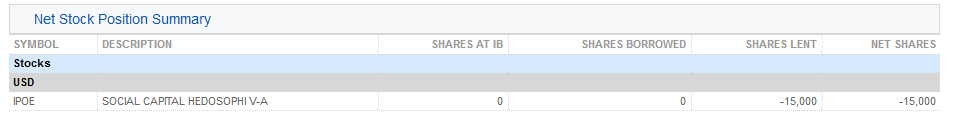

2. 純株式ポジションのサマリー – 株式ごとにIBKRにおける合計株数、借入られている株数、貸付られている株数および純株数(IBKRでの株数+借入株数+貸付株数)が記載されます。

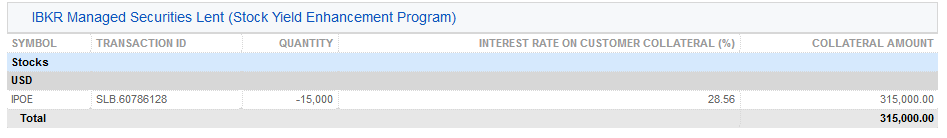

3. IBKR管理の貸付証券(株式利回り向上プログラム) – 株式利回り向上プログラムで貸付された株式ごとに、貸付株数および金利(%)が記載されます。

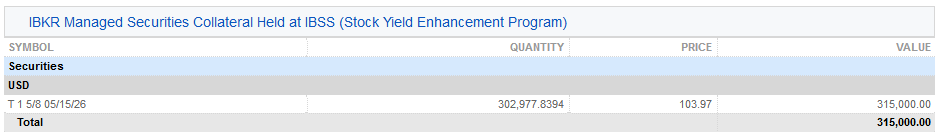

3a. IBSSに保管されるIBKR管理の証券担保(株式利回り向上プログラム) – 証券の貸付用担保として保有される米国国債とその数量、価格、合計価値がIBLLCのお客様のステートメントに表示されます。

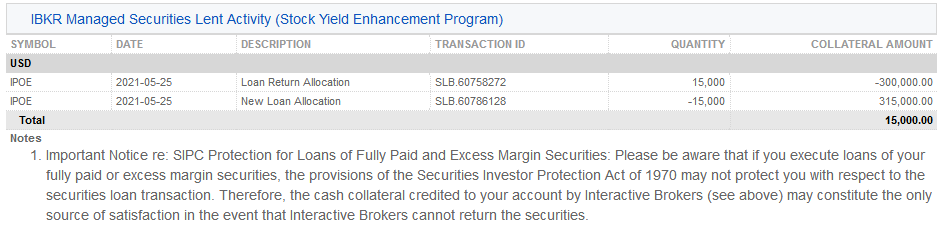

4. IBKR管理の証券貸付状況 (株式利回り向上プログラム)– 証券ごとに、貸付返却の割当(解約された貸付)、新しい貸付の割当(開始された貸付)、株数、純利率(%)、お客様の担保への利率(%)、ならびに担保額の詳細が記載されます。

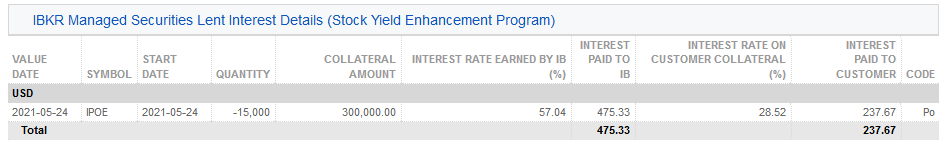

5. IBKR管理の貸付証券アクティビティ金利詳細 (株式利回り向上プログラム)– 貸付ごとに、IBKRのものとなる利子(%)、IBKRの収入({担保額*金利}/360に相当する、貸付によってIBKRのものとなる収入の合計)、お客様の担保への利子(貸付によってIBKRのものとなる収入の約半分)、ならびにお客様のものとなる利子(お客様の担保への利子)の詳細が記載されます。

注意: この項目は発生した利子がステートメント期間にUSD $1を超える場合のみ表示されます。

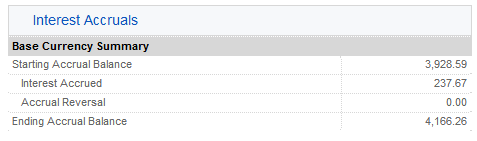

6. 未払い利息 – ここでの利子収入は未払い利息であり、その他の未払い利息と同じように扱われます(集約してUSD $1以上になる場合のみ未払い利息として、マンスリーの現金に表示されます)。年末報告のため、この利息は米国納税者に発行されるForm 1099にレポートされます。

実行レートの決定にあたって使用されるメソッド

背景

口座を保有されるお客様のプラス残高に対して支払われる利子、およびマイナス残高にかかる金利の設定のため、各通貨にはベンチマークまたは参照レートが割当てられています。IBKRの参照レートは短期の市場価格によって決定されますが、広く利用される外部の参照レート、また適切な場合には銀行の預金金利の上下に上限と下限が設けられています。このページでは、実行レートがどのように決定されるかをご説明します。

参照レート

参照レートは、通常の固定ベンチマークの上下に制限される市場のインプライド・レートから3段階プロセスを経て決定されます。Forexスワップ価格が、弊社よりお客様に支払うまたは請求するレートに影響しない通貨とIBKRの関連会社の場合には、最終レートの決定にあたって手順1は適用されません。

1. 市場インプライド・レート

市場価格には短期のForexスワップ・マーケットを使用します。ほとんどの取引には米ドルが関わるため、通貨のForexスワップ価格vs米ドルは、流動的取引時間とボリュームを表すことを目的とする「固定時間ウィンドウ」と呼ばれる、事前に設定される期間分のサンプルが集められます。使用される特定のスワップの方向と固定ウィンドウは通貨によって異なります。Forexを取り扱う銀行の中でも大手のもの12銀行までの最良ビットおよびアスク価格、ならびに米国外通貨の短期インプライド・レート(通常はオーバーナイト:T/T+1、Tom Next:T+1/T+2、またはSpot Next:T+2/T+3)が使用されます。固定時間ウィンドウの終了時において計算されたものを分類した上で、最低および最高値が取り除かれ、残りの値の平均値が固定の市場インプライド・レートとなります。

2. 通常の固定ベンチマーク

通常のベンチマークには、公開されている参照レート、適切な場合には銀行の預金金利を参照します。こちらのレートは銀行調査または実際の取引に基いて決定されることがよくあります。London Inter-Bank Offered Rate (LIBOR)を例にとると、これは銀行が各日、特定の時間に他の銀行から資金借入に使用するレートを調査して決定されます。一方、米ドルのフェデラル・ファンド実行レートは、フェデラル・ファンド市場で取引された銀行間貸出金利の加重平均として算出されます。

3. 参照レート

IBKRにおける最終的な参照レートは1に記載されるように市場インプライド・レートを使用して決定されますが、2に記載されるように通常のベンチマーク固定レートの上下に特定額が上限/下限として設定されます。Forexスワップ価格による影響のない通貨とIBKRの関連会社の場合、IBKRの最終的な参照ベンチマーク・レートは、上記のように上限と下限付きで、通常のベンチマークまたは銀行の預金金利を使用して決定されます。上限/下限は関連通貨およびベンチマークの固定レートを含め、下記の表5をご確認ください。これらは事前の予告なしで変更される可能性があります。

例

a. GBPの市場インプライド・レートが0.55%と仮定します。LiborによるGBPの固定オーバーナイト・レートは0.65%です。この場合の実行レートは、Libor参照レートの0.65%に設定される1.00%の上限内になるため、市場インプライド・レートと同率の0.55%になります。

b. 例えばCNHの市場インプライド・レートが4.5%で、CNHのオーバーナイトの参照レートが1.0%だった場合、実行レートはCNHの参照レート以上の2.0%に上限設定されるか、3.0% (1.0%参照レート+ 2.0%上限)になります。

注意: 上限/下限は事前の予告なしで変更される可能性があります。

| 通貨 | ベンチマーク詳細 | 下限2 | 上限<2 |

| USD | Fed Funds Effective (オーバーナイトレート) | 0.00% | 0.00% |

| USD | 11 am GMT USD LIBOR (USD-CFD、GoldおよびSilver借入手数料のみに使用) | 0.00% | 0.00% |

| AUD | RBA Daily Cash Rate Target | 1.00% | 1.00% |

| CAD | Bank of Canada Overnight Lending Rate | 1.00% | 1.00% |

| CHF | Swiss Franc LIBOR (Spot-Nextレート) | 1.00% | 1.00% |

| CNY/CNH | CNH HIBOR Overnight Fixing Rate (TMA) | 2.00% | 2.00% |

| CZK | Prague ON Interbank Offered Rate | 1.00% | 1.00% |

| DKK | Danish Tom/Next Index | 1.00% | 1.00% |

| EUR | EONIA (ユーロ・オーバーナイト指数標準) | 1.00% | 1.00% |

| GBP | GBP LIBOR (オーバーナイトレート) | 1.00% | 1.00% |

| HKD | HKD HIBOR (オーバーナイトレート) | 1.00% | 1.00% |

| HUF | Budapest Interbank Offered Rate | 1.00% | 1.00% |

| ILS | Tel Aviv Interbank Offered O/N Rate | 1.00% | 1.00% |

| INR | Central Bank of India Base Rate | 0.00% | 0.00% |

| JPY | JPY LIBOR (Spot-Nextレート) | 1.00% | 1.00% |

| KRW | Korean Won KORIBOR (1週間) | 0.00% | 0.00% |

| MXN | Mexican Interbank TIIE (28日レート) | 3.00% | 3.00% |

| NOK | Norwegian Overnight Weighted Average | 1.00% | 1.00% |

| NZD | New Zealand Dollar Official Cash Daily Rate | 1.00% | 1.00% |

| PLN | WIBOR (ワルシャワ・インターバンク・オーバーナイトレート) | 1.00% | 1.00% |

| RUB | RUONIA (ルーブル・オーバーナイト指数標準) | 3.00% | 3.00% |

| SEK | SEK STIBOR (オーバーナイトレート) | 1.00% | 1.00% |

| SGD | Singapore Dollar SOR (スワップ・オーバーナイト) Rate | 1.00% | 1.00% |

| TRY | TRLIBOR (トルコ・リラ・オーバーナイト銀行間レート) | 3.00% | 3.00% |

| ZAR | South Africa Benchmark Overnight Rate on Deposits (Sabor) | 3.00% | 3.00% |

2 固定ベンチマークの上下に可能となる実行レートの上限/下限および偏差は、事前の予告なしでいつでも変更される可能性があります。

Benchmark Interest Calculation – Reference Rate Descriptions

|

Currency

|

Reference rate

|

Description

|

|

USD

|

Fed Funds Effective

|

Volume weighted average of the transactions processed through the Federal Reserve between member banks. It is intended to reflect the best estimate of interbank financing activity for Reserve Bank members and is the reference for many short-term money market transactions in the broader market.

|

| AED | EIBOR | Is the daily reference rate at which the Panel Banks are able and willing to access UAE Dirham funding, just prior to 11:00 local time. The Contributor Banks use a waterfall in order to contribute their Contributions. For Level 1 of the waterfall, volume weighted average prices of all eligible unsecured Saudi Riyal transactions are used. |

|

AUD

|

RBA Daily Cash Target

|

Refers to a 1-day rate set by the Reserve Bank of Australia to influence short term interest rates.

|

| BGN | LEONIA Plus (Lev Overnight Index Average Plus) | Is a weighted reference rate of concluded and effected overnight deposit transactions on the interbank market. |

|

BRL

|

Brazil CETIP DI Interbank Deposit Rate

|

Brazil’s Interbank Deposit Rate is the daily average annualized rate calculated by the number of business days in the month, of the one-day interbank deposit rates.

|

|

CAD

|

Bank of Canada Overnight Lending Rate

|

Refers to a 1-day rate set by Bank of Canada to influence short term interest rates.

|

|

CHF

|

SARON

|

Stands for Swiss Average Rate Overnight and represents the overnight interest rate of the secured funding market for the Swiss Franc. SARON is administered by SIX.

|

|

CNH

|

CNH HIBOR

|

Stands for Hong Kong Interbank Offered Rate and is the offered rate at which deposits in CNH are being quoted to prime banks in the Hong Kong interbank market.

|

|

CZK

|

PRIBOR

|

Average interest rate at which term deposits are offered between prime banks.

|

|

DKK

|

Denmark Tomorrow/Next

|

The interest rate at which a bank is prepared to lend Danish kroner to a prime bank on an uncollateralized basis day to day.

|

|

EUR

|

€STR

|

Stands for Euro Short-Term Rate and is the rate which reflects the wholesale euro unsecured overnight borrowing costs of euro area banks. The rate is published by the ECB and is based on transactions conducted and settled on the previous day and which are deemed to be executed at arm’s length and thereby reflect market rates in an unbiased way.

|

|

GBP

|

SONIA

|

Stands for Sterling Overnight Index Average and is the effective overnight interest rate paid by banks for unsecured transactions in the British sterling market. SONIA is administered by the Bank of England.

|

|

HKD

|

HKD HIBOR

|

Stands for Hong Kong Interbank Offered Rate and is the offered rate at which deposits in HKD are being quoted to prime banks in the Hong Kong interbank market.

|

|

HUF

|

BUBOR

|

Stands for Budapest Interbank Offered Rates and is the average interest rate at which term deposits are offered between prime banks.

|

| HUF | Hungary 3 Month Treasury Bill | Is an annualized yield on Hungarian 3 month Treasury bills. |

|

ILS

|

TELBOR

|

Stands for Tel Aviv Inter-Bank Offered Rate and is based on interest rate quotes by a number of contributors in the inter-bank market.

|

|

INR

|

Indian Rupee Overnight Interest Rate Fixing

|

A rate based on overnight call money trade data from the NDS-Call system within the first hour of trading.

|

|

JPY

|

TONAR

|

Stands for Tokyo Overnight Average Rate and is a measure of the cost of borrowing in the Japanese yen unsecured overnight money market for Japanese Yen. TONAR is administered by the Bank of Japan.

|

|

KRW

|

KORIBOR

|

Average of the leading interest rates for KRW as determined by a group of large Korean banks. The benchmark utilizes the KORIBOR with 1 week maturity.

|

|

MXN

|

TIIE

|

The interbank "equilibrium" rate based on the quotes provided by money center banks as calculated by the Mexican Central Bank. The benchmark TIIE is based on 28-day deposits so is atypical as a measure for short term funds (most currencies have an overnight or similar short-term benchmark).

|

|

NOK

|

Norwegian Overnight Weighted Average

|

The interest rate on unsecured overnight interbank loans between banks that are active in the Norwegian overnight market.

|

|

NZD

|

NZD Daily Cash Target

|

Refers to a 1-day rate set by the Reserve Bank of New Zealand to influence short term interest rates.

|

|

PLN

|

WIBOR

|

Stands for Warsaw Interbank Offered Rates and is a measure of unsecured deposits concluded between market participants.

|

| RON | ROBOR (Romanian Overnight Interbank Offered Rate) | Calculated daily as a trimmed arithmetic average of the quotations by main banks on the interbank market. |

| SAR | SAIBOR | Is a daily benchmark using contributions from a panel of Contributor Banks. The Contributor Banks use a waterfall in order to contribute their Contributions. For Level 1 of the waterfall, volume weighted average prices of all eligible unsecured Saudi Riyal transactions are used. |

|

SEK

|

STIBOR

|

Daily fixing based on a group of large Swedish banks.

|

|

SGD

|

SOR

|

Stands for the SGD Swap Offer Rate and represents the cost of borrowing SGD synthetically by borrowing USD for the same maturity and swapping USD in return for SGD.

|

|

TRY

|

TLREF

|

The Turkish Lira Overnight Rate (TLREF) is calculated as the volume-weighted mean rate, based on the central 70% of the the volume-weighted distribution of overnight repo rate transactions. |

|

ZAR

|

SABOR

|

Stands for South African Benchmark Overnight Rate and is calculated based on interbank funding.

|

|

|

|

|

|

|

|

|

|

|

Overnight

|

(O/N) rate is the most widely used short term benchmark and represents the rate for balances held from today until the next business day.

|

|

|

Spot-Next

|

(S/N) refers to the rate on balances from the next business day to the business day thereafter. Due to time zone and other criteria, Spot-Next rates are sometimes used as the short-term reference.

|

|

|

Day-Count conventions:

|

IBKR conforms to the international standards for day-counting wherein deposits rates for most currencies are expressed in terms of a 360-day year, while for other currencies (ex: GBP) the convention is a 365-day year.

|

Methodology for Determining Effective Rates

BACKGROUND

In determining the interest that account holders are paid on cash credit balances and charged on debit balances, each currency is assigned an IBKR Reference Benchmark rate. The IBKR Reference Benchmark rate is determined from short-term market rates but capped above/below widely used external reference rates or, where appropriate, bank deposit rates. This page explains how IBKR Reference Benchmark rates are determined.

Reference Rates

Reference rates are determined using a three-step process. The rates are capped above/below traditional external reference rates. For currencies and IBKR affiliates where Forex swap market pricing does not affect the rates we pay and charge our customers, Step 1 is omitted from the final rate determination.

1. Market implied rates

For market pricing, we utilize short-term Forex swap markets. Since most of the transactions involve the US dollar, Forex swap prices of currencies vs. the US dollar are sampled over a pre-determined time period referred to as the "Fixing Time Window" that is intended to be representative of liquid trading hours and primary turnover. The specific swap tenor and fixing windows used depend on the currency. We use the best bid and ask from a group of up to 12 of the largest Forex dealing banks to calculate the implied non-USD short-term rates - generally Overnight (T/T+1), Tom Next (T+1/T+2) or Spot Next (T+2/T+3). At the Fixing Time Window close, these calculations are sorted with the lowest and highest rates disregarded and the remainder averaged to determine the market implied reference rate.

2. Traditional external benchmark reference rates

For traditional benchmarks, we utilize published reference rates and, where appropriate, bank deposit rates. These rates generally are determined by either bank survey or actual transactions. The Hong Kong Inter-Bank Offered Rate (HIBOR), for example, is determined by surveying a panel of banks for the rate at which they could borrow funds from other banks at a specific time each day. In contrast, the US dollar Fed Funds effective rate is calculated as the weighted average of interbank lending rates transacted in the Fed Funds market.

The reform on interest rate benchmarks (IBOR reform), launched in 2013 by the G20 nations and conducted by regulatory authorities and public and private sector working groups, is gradually replacing bank survey based rates with new transaction driven reference rates.

3. IBKR Reference Benchmark Rates

The final IBKR Reference Benchmark rates are then determined by using the market implied reference rate, as described in 1. above, but capped by a certain amount above/below the traditional external benchmark reference rate as described in 2. above. For currencies and IBKR affiliates where Forex swap market pricing is not relevant, the final IBKR Reference Benchmark rates are determined by using traditional benchmarks or bank deposit rates, capped as above. The caps can change at any time without explicit prior notice and are listed in the table below, along with relevant currency and benchmark reference rates.

Examples

a. Assume the market implied overnight rate for GBP is 0.55%. The Sterling Overnight Index Average (SONIA) reference rate is 0.65%. The effective rate is then equal to the market implied rate of 0.55%, as it is still within the 1.00% cap around the SONIA reference rate at 0.65%.

b. If, for example, the market implied rate for CNH was 4.5% but the overnight CNH reference rate for the same period was 1.0%, the effective rate would be capped at 2.0% above the CNH reference rate, or 3.0% (1.0% reference rate + 2.0% cap).

|

Currency

|

Benchmark Description

|

Cap Below1

|

Cap Above1

|

|

USD

|

Fed Funds Effective (Overnight Rate)

|

0.00%

|

0.00%

|

|

AUD

|

RBA Daily Cash Rate Target

|

1.00%

|

1.00%

|

| AED | EIBOR, Emirates Interbank Offered Rate | 3.00% | 3.00% |

|

CAD

|

Bank of Canada Overnight Lending Rate

|

1.00%

|

1.00%

|

|

CHF

|

Swiss Average Rate Overnight (SARON)

|

1.00%

|

1.00%

|

|

CNY/CNH

|

CNH HIBOR Overnight Fixing Rate (TMA)

|

2.00%

|

2.00%

|

|

CZK

|

Prague ON Interbank Offered Rate

|

1.00%

|

1.00%

|

|

DKK

|

Danish Tom/Next Index

|

1.00%

|

1.00%

|

|

EUR

|

Euro Short-Term Rate (€STR)

|

1.00%

|

1.00%

|

|

GBP

|

Sterling Overnight Index Average (SONIA)

|

1.00%

|

1.00%

|

|

HKD

|

HKD HIBOR (Overnight rate)

|

1.00%

|

1.00%

|

|

HUF

|

Budapest Interbank Offered Rate

|

1.00%

|

1.00%

|

|

ILS

|

Tel Aviv Interbank Offered O/N Rate

|

1.00%

|

1.00%

|

|

INR

|

Central Bank of India Base Rate

|

0.00%

|

0.00%

|

|

JPY

|

Tokyo Overnight Average Rate (TONAR)

|

1.00%

|

1.00%

|

|

KRW

|

Korean Won KORIBOR (1 week)

|

0.00%

|

0.00%

|

|

MXN

|

Mexican Interbank TIIE (28 day rate)

|

3.00%

|

3.00%

|

|

NOK

|

Norwegian Overnight Weighted Average

|

1.00%

|

1.00%

|

|

NZD

|

New Zealand Dollar Official Cash Daily Rate

|

1.00%

|

1.00%

|

|

PLN

|

WIBOR (Warsaw Interbank Overnight Rate)

|

1.00%

|

1.00%

|

| SAR | SAIBOR Saudi Arabia Interbank Offered Rate | 3.00% | 3.00% |

|

SEK

|

SEK STIBOR (Overnight Rate)

|

1.00%

|

1.00%

|

|

SGD

|

Singapore Dollar SOR (Swap Overnight) Rate

|

1.00%

|

1.00%

|

|

TRY

|

TRLIBOR (Turkish Lira Overnight Interbank offered rate)

|

NO CAP

|

NO CAP

|

|

ZAR

|

South Africa Benchmark Overnight Rate on Deposits (Sabor)

|

3.00%

|

3.00%

|

Introduction to Market Implied Rates

BACKGROUND

In determining the interest that account holders are paid on cash credit balances and assessed on debit balances, each currency is assigned a reference or benchmark rate, from which a spread is deducted for credit interest and added for debit interest.1 As account holders may withdraw unencumbered cash balances upon demand and regulations generally restrict the reinvestment of such balances to short-term instruments of high credit quality, benchmarks typically represent the rate at which local banks may borrow on an overnight or short-term basis (e.g., EONIA, Fed Funds).

While the current benchmarks are useful in that they tend to be longstanding, widely accepted and published rates, often used as the basis for determining consumer borrowing, some have characteristics which limit their effectiveness, particularly in the case of brokerage accounts where the spread as applied by IBKR is relatively narrow. A discussion of these limitations is provided in the overview below.

OVERVIEW

Benchmark rates are often determined by either bank survey or actual transactions. The Hong Kong Interbank Offered Rate (HKD HIBOR), for example, is determined by surveying a panel of banks for the rate at which they could borrow funds from other banks of at a specific time each day. The final rate is determined by discarding a set of the top and bottom survey responses and averaging the remainder. Transaction based benchmarks such as EONIA are determined using a weighted average of all overnight unsecured lending transactions by panel banks in the interbank market as reported to the European Central Bank.

There are shortcomings to both methods which, at times, causes them to be an inadequate mechanism for establishing client debit and credit interest rates. Examples of these are provide below:

- Survey rates often represent an offer rate which, by definition stands above the bid rate and can be skewed well above the mid-point when spreads are large;

- Survey rates are typically based upon an inquiry performed at a specific time of the day and may not represent the rates available over a broader period of time;

- The population of institutions surveyed or whose transactions are considered may be small and/or may have borrowing characteristics that are not representative of financial institutions as a whole;

- During periods of market stress, interbank transactions may suffer from reduced liquidity, on either a regional or global basis, thereby distorting benchmark rates.2

- Survey processes often provide little transparency as to how the benchmark was determined and in the past have been subject to manipulation.

AN ALTERNATIVE APPROACH - MARKET IMPLIED RATES

To address these shortcomings, IBKR proposes to implement an alternative method for determining benchmark rates which we refer to as Market Implied Rates. This method combines the optimal attributes of each of the survey and transaction methods and uses as its basis Forex swap prices and the interest rate differentials embedded therein. The Forex swap market is one of the largest and most competitive markets with a daily turnover of 2.4 trillion USD3, representing aggregate transactions well in excess of that used for the current transaction-based benchmarks.

As over 90% of these transactions involve the U.S. Dollar, Forex swap prices of currencies vs. the U.S. Dollar will be sampled over a pre-determined time period referred to as the “Fixing Time Window” that is intended to be representative of liquid hours and primary turnover. The specific swap tenor and fixing windows used depend on the currency. Using the best bid and ask from a group of up to 12 of the largest Forex dealing banks4, implied non-USD short-term rates (generally Overnight (T/T+1, Tom Next (T+1/T+2) or Spot Next (T+2/T+3) ) will be calculated. At the Fixing Time Window close, these calculations will be sorted with the lowest and highest disregarded and the remainder averaged to determine the Final Fixing Rate. This Final Fixing Rate will then be used as part of the effective rate for that day’s interest calculations.

To provide complete transparency as to the rates used to determine interest on client credit and debit balances, IBKR has historically posted and updated to the public website each day all of the information an account holder would need to determine the interest they might pay or receive on cash balances (e.g., the stated benchmark, current and historical benchmark levels, spreads and tiers). Similar transparency will be provided with the implementation of Market Implied Rates. Here, rates will be posted to the website in 3 stages:

- Live – the last benchmark rate calculated prior to the start of the current day’s Fixing Time Window;

- Fixing Period – represents a running calculation of the current day’s benchmark rate using available data obtained while Fixing Time Window remains open.

- Fixing – the benchmark rate as calculated upon close of the Fixing Time This rate will remain unchanged for the remainder of the day and serve as the benchmark rate.

NEXT STEPS

Merging interest rate benchmarks and Market Implied Rates is intended to better align the rates offered to clients to the true funding costs and opportunities available to IBKR. The analysis performed thus far suggests that for certain currencies the new benchmark (effective rate) resulting from Forex swap implied rates but capped 25 bps5 above/below the benchmark fixing will be higher at various times and for others lower. As for the impact to clients, a higher benchmark generally benefits depositors and a lower, borrowers. What is important is that the new methodology is calculated in a consistent manner, using readily available and substantially representative data.

As the proposed change is significant in terms of its logic and its potential impact to certain clients, IBKR has been calculating and displaying, but not yet applying, market implied rates until clients have had sufficient opportunity to review the data. By August 1, 2017 we will start migrating the benchmarks from fixed to the new system where we use effective rates which are composed of market implied interest rates capped 25 bps above or below the current benchmark fixings.

______________________________________________________________________________________

1 In the case of the USD, a spread of 0.50% is deducted from the benchmark for purposes of credit interest and a spread of 1.50% added for purposes of debit interest. The benchmark rate for the USD is the Fed Funds Effective Overnight Rate.

2 Examples of this were experienced during the financial crisis of 2007-2010.

3 Source: BIS Triennial Central Bank Survey, Forex turnover April 2016. http://www.bis.org/publ/rpfx16fx.pdf

4 The actual number of banks selected may vary by currency.

5 The 25 basis points is subject to change at any time without advance notice.

弊社からの資金借り入れ状況の判別方法

口座の現金残高の合計がマイナスになる場合には資金を借りることになり、借入は利子の対象となります。 借入は合計の現金残高がプラスの場合にも残高の清算やタイミングによっては存在することがあります。 下記はこういったケースの最もよくある例になります: