Methodology for Determining Effective Rates

BACKGROUND

In determining the interest that account holders are paid on cash credit balances and charged on debit balances, each currency is assigned an IBKR Reference Benchmark rate. The IBKR Reference Benchmark rate is determined from short-term market rates but capped above/below widely used external reference rates or, where appropriate, bank deposit rates. This page explains how IBKR Reference Benchmark rates are determined.

Reference Rates

Reference rates are determined using a three-step process. The rates are capped above/below traditional external reference rates. For currencies and IBKR affiliates where Forex swap market pricing does not affect the rates we pay and charge our customers, Step 1 is omitted from the final rate determination.

1. Market implied rates

For market pricing, we utilize short-term Forex swap markets. Since most of the transactions involve the US dollar, Forex swap prices of currencies vs. the US dollar are sampled over a pre-determined time period referred to as the "Fixing Time Window" that is intended to be representative of liquid trading hours and primary turnover. The specific swap tenor and fixing windows used depend on the currency. We use the best bid and ask from a group of up to 12 of the largest Forex dealing banks to calculate the implied non-USD short-term rates - generally Overnight (T/T+1), Tom Next (T+1/T+2) or Spot Next (T+2/T+3). At the Fixing Time Window close, these calculations are sorted with the lowest and highest rates disregarded and the remainder averaged to determine the market implied reference rate.

2. Traditional external benchmark reference rates

For traditional benchmarks, we utilize published reference rates and, where appropriate, bank deposit rates. These rates generally are determined by either bank survey or actual transactions. The Hong Kong Inter-Bank Offered Rate (HIBOR), for example, is determined by surveying a panel of banks for the rate at which they could borrow funds from other banks at a specific time each day. In contrast, the US dollar Fed Funds effective rate is calculated as the weighted average of interbank lending rates transacted in the Fed Funds market.

The reform on interest rate benchmarks (IBOR reform), launched in 2013 by the G20 nations and conducted by regulatory authorities and public and private sector working groups, is gradually replacing bank survey based rates with new transaction driven reference rates.

3. IBKR Reference Benchmark Rates

The final IBKR Reference Benchmark rates are then determined by using the market implied reference rate, as described in 1. above, but capped by a certain amount above/below the traditional external benchmark reference rate as described in 2. above. For currencies and IBKR affiliates where Forex swap market pricing is not relevant, the final IBKR Reference Benchmark rates are determined by using traditional benchmarks or bank deposit rates, capped as above. The caps can change at any time without explicit prior notice and are listed in the table below, along with relevant currency and benchmark reference rates.

Examples

a. Assume the market implied overnight rate for GBP is 0.55%. The Sterling Overnight Index Average (SONIA) reference rate is 0.65%. The effective rate is then equal to the market implied rate of 0.55%, as it is still within the 1.00% cap around the SONIA reference rate at 0.65%.

b. If, for example, the market implied rate for CNH was 4.5% but the overnight CNH reference rate for the same period was 1.0%, the effective rate would be capped at 2.0% above the CNH reference rate, or 3.0% (1.0% reference rate + 2.0% cap).

|

Currency

|

Benchmark Description

|

Cap Below1

|

Cap Above1

|

|

USD

|

Fed Funds Effective (Overnight Rate)

|

0.00%

|

0.00%

|

|

AUD

|

RBA Daily Cash Rate Target

|

1.00%

|

1.00%

|

| AED | EIBOR, Emirates Interbank Offered Rate | 3.00% | 3.00% |

|

CAD

|

Bank of Canada Overnight Lending Rate

|

1.00%

|

1.00%

|

|

CHF

|

Swiss Average Rate Overnight (SARON)

|

1.00%

|

1.00%

|

|

CNY/CNH

|

CNH HIBOR Overnight Fixing Rate (TMA)

|

2.00%

|

2.00%

|

|

CZK

|

Prague ON Interbank Offered Rate

|

1.00%

|

1.00%

|

|

DKK

|

Danish Tom/Next Index

|

1.00%

|

1.00%

|

|

EUR

|

Euro Short-Term Rate (€STR)

|

1.00%

|

1.00%

|

|

GBP

|

Sterling Overnight Index Average (SONIA)

|

1.00%

|

1.00%

|

|

HKD

|

HKD HIBOR (Overnight rate)

|

1.00%

|

1.00%

|

|

HUF

|

Budapest Interbank Offered Rate

|

1.00%

|

1.00%

|

|

ILS

|

Tel Aviv Interbank Offered O/N Rate

|

1.00%

|

1.00%

|

|

INR

|

Central Bank of India Base Rate

|

0.00%

|

0.00%

|

|

JPY

|

Tokyo Overnight Average Rate (TONAR)

|

1.00%

|

1.00%

|

|

KRW

|

Korean Won KORIBOR (1 week)

|

0.00%

|

0.00%

|

|

MXN

|

Mexican Interbank TIIE (28 day rate)

|

3.00%

|

3.00%

|

|

NOK

|

Norwegian Overnight Weighted Average

|

1.00%

|

1.00%

|

|

NZD

|

New Zealand Dollar Official Cash Daily Rate

|

1.00%

|

1.00%

|

|

PLN

|

WIBOR (Warsaw Interbank Overnight Rate)

|

1.00%

|

1.00%

|

| SAR | SAIBOR Saudi Arabia Interbank Offered Rate | 3.00% | 3.00% |

|

SEK

|

SEK STIBOR (Overnight Rate)

|

1.00%

|

1.00%

|

|

SGD

|

Singapore Dollar SOR (Swap Overnight) Rate

|

1.00%

|

1.00%

|

|

TRY

|

TRLIBOR (Turkish Lira Overnight Interbank offered rate)

|

NO CAP

|

NO CAP

|

|

ZAR

|

South Africa Benchmark Overnight Rate on Deposits (Sabor)

|

3.00%

|

3.00%

|

Introduction to Market Implied Rates

BACKGROUND

In determining the interest that account holders are paid on cash credit balances and assessed on debit balances, each currency is assigned a reference or benchmark rate, from which a spread is deducted for credit interest and added for debit interest.1 As account holders may withdraw unencumbered cash balances upon demand and regulations generally restrict the reinvestment of such balances to short-term instruments of high credit quality, benchmarks typically represent the rate at which local banks may borrow on an overnight or short-term basis (e.g., EONIA, Fed Funds).

While the current benchmarks are useful in that they tend to be longstanding, widely accepted and published rates, often used as the basis for determining consumer borrowing, some have characteristics which limit their effectiveness, particularly in the case of brokerage accounts where the spread as applied by IBKR is relatively narrow. A discussion of these limitations is provided in the overview below.

OVERVIEW

Benchmark rates are often determined by either bank survey or actual transactions. The Hong Kong Interbank Offered Rate (HKD HIBOR), for example, is determined by surveying a panel of banks for the rate at which they could borrow funds from other banks of at a specific time each day. The final rate is determined by discarding a set of the top and bottom survey responses and averaging the remainder. Transaction based benchmarks such as EONIA are determined using a weighted average of all overnight unsecured lending transactions by panel banks in the interbank market as reported to the European Central Bank.

There are shortcomings to both methods which, at times, causes them to be an inadequate mechanism for establishing client debit and credit interest rates. Examples of these are provide below:

- Survey rates often represent an offer rate which, by definition stands above the bid rate and can be skewed well above the mid-point when spreads are large;

- Survey rates are typically based upon an inquiry performed at a specific time of the day and may not represent the rates available over a broader period of time;

- The population of institutions surveyed or whose transactions are considered may be small and/or may have borrowing characteristics that are not representative of financial institutions as a whole;

- During periods of market stress, interbank transactions may suffer from reduced liquidity, on either a regional or global basis, thereby distorting benchmark rates.2

- Survey processes often provide little transparency as to how the benchmark was determined and in the past have been subject to manipulation.

AN ALTERNATIVE APPROACH - MARKET IMPLIED RATES

To address these shortcomings, IBKR proposes to implement an alternative method for determining benchmark rates which we refer to as Market Implied Rates. This method combines the optimal attributes of each of the survey and transaction methods and uses as its basis Forex swap prices and the interest rate differentials embedded therein. The Forex swap market is one of the largest and most competitive markets with a daily turnover of 2.4 trillion USD3, representing aggregate transactions well in excess of that used for the current transaction-based benchmarks.

As over 90% of these transactions involve the U.S. Dollar, Forex swap prices of currencies vs. the U.S. Dollar will be sampled over a pre-determined time period referred to as the “Fixing Time Window” that is intended to be representative of liquid hours and primary turnover. The specific swap tenor and fixing windows used depend on the currency. Using the best bid and ask from a group of up to 12 of the largest Forex dealing banks4, implied non-USD short-term rates (generally Overnight (T/T+1, Tom Next (T+1/T+2) or Spot Next (T+2/T+3) ) will be calculated. At the Fixing Time Window close, these calculations will be sorted with the lowest and highest disregarded and the remainder averaged to determine the Final Fixing Rate. This Final Fixing Rate will then be used as part of the effective rate for that day’s interest calculations.

To provide complete transparency as to the rates used to determine interest on client credit and debit balances, IBKR has historically posted and updated to the public website each day all of the information an account holder would need to determine the interest they might pay or receive on cash balances (e.g., the stated benchmark, current and historical benchmark levels, spreads and tiers). Similar transparency will be provided with the implementation of Market Implied Rates. Here, rates will be posted to the website in 3 stages:

- Live – the last benchmark rate calculated prior to the start of the current day’s Fixing Time Window;

- Fixing Period – represents a running calculation of the current day’s benchmark rate using available data obtained while Fixing Time Window remains open.

- Fixing – the benchmark rate as calculated upon close of the Fixing Time This rate will remain unchanged for the remainder of the day and serve as the benchmark rate.

NEXT STEPS

Merging interest rate benchmarks and Market Implied Rates is intended to better align the rates offered to clients to the true funding costs and opportunities available to IBKR. The analysis performed thus far suggests that for certain currencies the new benchmark (effective rate) resulting from Forex swap implied rates but capped 25 bps5 above/below the benchmark fixing will be higher at various times and for others lower. As for the impact to clients, a higher benchmark generally benefits depositors and a lower, borrowers. What is important is that the new methodology is calculated in a consistent manner, using readily available and substantially representative data.

As the proposed change is significant in terms of its logic and its potential impact to certain clients, IBKR has been calculating and displaying, but not yet applying, market implied rates until clients have had sufficient opportunity to review the data. By August 1, 2017 we will start migrating the benchmarks from fixed to the new system where we use effective rates which are composed of market implied interest rates capped 25 bps above or below the current benchmark fixings.

______________________________________________________________________________________

1 In the case of the USD, a spread of 0.50% is deducted from the benchmark for purposes of credit interest and a spread of 1.50% added for purposes of debit interest. The benchmark rate for the USD is the Fed Funds Effective Overnight Rate.

2 Examples of this were experienced during the financial crisis of 2007-2010.

3 Source: BIS Triennial Central Bank Survey, Forex turnover April 2016. http://www.bis.org/publ/rpfx16fx.pdf

4 The actual number of banks selected may vary by currency.

5 The 25 basis points is subject to change at any time without advance notice.

如何确定您有无从IBKR借入资金

若某账户内的总现金余额为负,则存在资金借入,借款需支付利息。 然而,有时即使账户的总现金余额为正,由于余额轧差或时间差,仍可能存在资金借入。 以下是最常见的例子:

IBKR股票差价合约概述

下方文章对IBKR发行的股票差价合约(CFD)进行了总体介绍。

有关IBKR指数差价合约的信息,请点击此处。有关外汇差价合约的信息,请点击此处。

涵盖主题如下:

I. 差价合约定义

II. 差价合约与底层股票之比较

III. 成本与保证金

IV. 范例

V. 差价合约的相关资源

VI. 常见问题

风险警告

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA差价合约规定(仅限零售客户)

欧洲证券与市场管理局(ESMA)颁布了新的差价合约规定,自2018年8月1日起生效。

新规包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;以及3) 以单个账户为单位的负余额保护规则;

ESMA新规仅适用于零售客户。专业客户不受影响。

请参见ESMA差价合约新规推行了解更多详细信息。

I. 股票差价合约定义

IBKR差价合约是场外交易合约,提供底层股票的收益,包括股息与公司行动(了解更多有关差价合约公司行动的信息)。

换句话说,这是买家(您)与IBKR就交易一只股票当前价值与未来价值之差额而达成的协定。如果您持有多头头寸,且差额为正,则IBKR会付钱给您。而如果差额为负,则您应向IBKR付钱。

IBKR股票差价合约通过您的保证金账户进行交易,因此您可建立多头以及空头杠杆头寸。差价合约的价格即是底层股票的交易所报价。实际上,IBKR差价合约报价与股票的智能传递报价(可在TWS中查看)相同,且IBKR提供直接市场接入(DMA)。与股票类似,您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。 这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。

要将IBKR透明的差价合约模型与市场上其他差价合约进行比较,请参见我们的差价合约市场模型概述。

IBKR目前提供约7100只股票差价合约,覆盖美国、欧洲和亚洲的主要市场。下表所列的主要指数其成分股目前都可做IBKR股票差价合约。在许多国家,IBKR还可供交易高流动性小盘股。这些股票自由流通量调整市值至少为5亿美元,每日交易量中间值至少为60万美元。 详情请见差价合约产品列表。不久将会增加更多国家。

| 美国 | 标普500、道琼斯股价平均指数、纳斯达克100、标普400中盘股、高流动性小盘股 |

| 英国 | 富时350 + 高流动性小盘股(包括IOB) |

| 德国 | Dax、MDax、TecDax + 高流动性小盘股 |

| 瑞士 | 斯托克欧洲600指数(48只股票)+ 高流动性小盘股 |

| 法国 | CAC大盘股、CAC中盘股 + 高流动性小盘股 |

| 荷兰 | AEX、AMS中盘股 + 高流动性小盘 |

| 比利时 | BEL 20、BEL中盘股 + 高流动性小盘 |

| 西班牙 | IBEX 35 + 高流动性小盘股 |

| 葡萄牙 | PSI 20 |

| 瑞典 | OMX斯德哥尔摩30指数 + 高流动性小盘股 |

| 芬兰 | OMX赫尔辛基25指数 + 高流动性小盘股 |

| 丹麦 | OMX哥本哈根30指数 + 高流动性小盘股 |

| 挪威 | OBX |

| 捷克 | PX |

| 日本 | 日经225指数 + 高流动性小盘股 |

| 香港 | 恒生指数 + 高流动性小盘股 |

| 澳大利亚 | ASX 200指数 + 高流动性小盘股 |

| 新加坡* | 海峡时报指数 + 高流动性小盘股 |

| 南非 | Top 40 + 高流动性小盘股 |

*对新加坡居民不可用

II. 差价合约与底层股票之比较

| IBKR差价合约的优势 | IBKR差价合约的缺点 |

|---|---|

| 无印花税和金融交易税(英国、法国、比利时) | 无股权 |

| 佣金和保证金利率通常比股票低 | 复杂公司行动并不总能完全复制 |

| 股息享受税务协定税率,无需重新申请 | 收益的征税可能与股票有所不同(请咨询您的税务顾问) |

| 不受即日交易规则限制 |

III. 成本与保证金

在欧洲股票市场,IBKR差价合约可以比IB极具竞争力的股票产品更加高效。

首先,IBKR差价合约佣金比股票低,且有着与股票一样低的融资点差:

| 欧洲 | 差价合约 | 股票 | |

|---|---|---|---|

| 佣金 | GBP | 0.05% | 英镑6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| 融资** | 基准+/- | 1.50% | 1.50% |

*每单 + 超出5万英镑部分的0.05%

**对于差价合约是总头寸价值的融资;对于股票是借用金额的融资

交易量更大时,差价合约佣金会变得更低,最低至0.02%。头寸更大时,融资利率也会降低,最低至0.5%。 详情请参见差价合约佣金和差价合约融资利率。

其次,差价合约的保证金要求比股票低。零售客户须满足欧洲监管机构ESMA规定的额外保证金要求。请参见ESMA差价合约新规推行了解详细信息。

| 差价合约 | 股票 | ||

|---|---|---|---|

| 所有 | 标准 | 投资组合保证金 | |

| 维持保证金要求* |

10% |

25% - 50% | 15% |

*蓝筹股特有保证金。零售客户最低初始保证金要求为20%。股票标准的25%日内维持保证金,50%隔夜保证金。 显示的投资组合保证金为维持保证金(包括隔夜)。波动较大的股票保证金要求更高

请参见CFD保证金要求了解更多详细信息。

IV. 范例(专业客户)

让我们来看一下例子。联合利华在阿姆斯特丹的挂牌股票在过去一个月(2012年5月14日前20个交易日)回报率为3.2%,您认为其会继续有良好表现。您想建立20万欧元的仓位,并持仓5天。您以10笔交易建仓并以10笔交易平仓。您的直接成本如下:

股票

| 差价合约 | 股票 | ||

|---|---|---|---|

| 200,000欧元头寸 | 标准 | 投资组合保证金 | |

| 保证金要求 | 20,000 | 100,000 | 30,000 |

| 佣金(双向) | 200.00 | 400.00 | 400.00 |

| 利率(简化) | 1.50% | 1.50% | 1.50% |

| 融资金额 | 200,000 | 100,000 | 170,000 |

| 融资天数 | 5 | 5 | 5 |

| 利息支出(1.5%的简化利率) | 41.67 | 20.83 | 35.42 |

| 总计直接成本(佣金+利息) | 241.67 | 420.83 | 435.42 |

| 成本差额 | 高74% | 高80% | |

注意:差价合约的利息支出根据总的合约头寸进行计算,而股票的利息支出则是根据借用金额进行计算。股票和差价合约的适用利率相同。

但是,假设您只有2万欧元可用来做保证金。如果联合利华继续上月的表现,您的潜在盈利比较如下:

| 杠杆回报 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | 1,600 | 320 | 1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | 1,358.33 | 235.83 | 776.39 |

| 保证金投资金额回报 | 0.07 | 0.01 | 0.04 |

| 差额 | 收益少83% | 收益少43% | |

| 杠杆风险 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | -1,600 | -320 | -1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | -1,841.67 | -404.17 | -1,356.94 |

| 差额 | 损失少78% | 损失少26% | |

V. 差价合约相关资源

下方链接可帮助您了解更多有关IBKR差价合约产品的详细信息:

还可参看以下视频教程:

VI. 常见问题

什么股票可进行差价合约交易?

美国、西欧、北欧与日本的大盘和中盘股股票。许多市场上的高流动性小盘股也可以。请参见差价合约产品列表了解更多详细信息。不久将会增加更多国家。

IB提供股票指数和外汇的差价合约吗?

是的。请参见IBKR指数差价合约 - 事实与常见问题以及外汇差价合约 - 事实与常见问题。

IB如何确定股票差价合约报价?

IBKR差价合约报价与底层股票的智能传递报价相同。IBKR不会扩大价差或与您对赌。要了解更多信息,请参见差价合约市场模型概述。

我能看到自己的限价定单反映在交易所中吗?

是的。IBKR提供直接市场接入(DMA),这样您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。此外,如果其他客户的定单以优于公开市场的价格与您的定单交叉,您还可能会获得价格改善。

IB如何确定股票差价合约的保证金?

IBKR根据每只底层股票的历史波动率建立了基于风险的保证金要求机制。最低保证金为10%。 大多数IBKR差价合约都应用该保证金率,这使差价合约在大多数情况下都比底层股票交易更具效率。 零售客户须满足欧洲监管机构ESMA规定的额外保证金

要求。 请参见ESMA差价合约新规推行了解详细信息。单个差价合约头寸之间或差价合约与底层股票头寸之间没有投资组合抵消。集中头寸和超大头寸可能需要准备额外的保证金。请参见差价合约保证金要求了解更多详细信息。

空头股票差价合约会要强制补仓吗?

是的。如果底层股票很难或者根本不可能借到,则空头差价合约头寸的持有者将需要进行补仓。

IB如何处理股息和公司行动?

IBKR通常会为差价合约持有者反映公司行动的经济效应,就好像他们一直持有着底层证券一样。股息会表现为现金调整,而其他行动则会通过现金或头寸调整表现。例如,如果公司行动导致股票数量发生变化(如股票分隔和逆向股票分隔),差价合约的数量也会相应地进行调整。如果行动导致产生新的上市实体,且IBKR决定将其股票作为差价合约交易,则需要创建适当数量之新的多头或空头头寸。要了解概述信息,请参见差价合约公司行动。

*请注意,某些情况下对于合并等复杂公司行动可能无法对差价合约进行准确调整。这时候,IBKR可能会在除息日前终止差价合约。

任何人都能交易IBKR差价合约吗?

除美国、加拿大和香港的居民,其他所有客户都能交易IBKR差价合约。新加坡居民可交易除新加坡上市之股票差价合约以外的其它IBKR差价合约。任何投资者类型都不能免于这一基于居住地的限制。

我需要做什么才可以开始在IBKR交易差价合约?

您需要在账户管理中设置差价合约交易许可,并同意相关交易披露。如果您的账户是在IB LLC开立,则IBKR将设置一个新的账户板块(即您当前的账户号码加上后缀“F”)。设置确认后您便可以开始交易了。您无需单独为F账户注资,资金会从您的主账户自动转入以满足差价合约保证金要求。

有什么市场数据要求吗?

IBKR股票差价合约的市场数据便是底层股票的市场数据。因此需要具备相关交易所的市场数据许可。如果您已经为股票交易设置了交易所的市场数据许可,那么就无需再进行任何操作。如果您想在当前并无市场数据许可的交易所交易差价合约,您可以设置许可,操作与底层股票的市场数据许可设置相同。

差价合约交易与头寸在报表中如何反映?

如果您是在IB LLC持有账户,且您的差价合约头寸持有在单独的账户板块(主账户号码加后缀“F”)中。您可以选择单独查看F板块的活动报表,也可以选择与主账户合并查看。您可在账户管理的报表窗口进行选择。对于其他账户,差价合约通常会与其他交易产品一起在您的账户报表中显示。

我可以从其他经纪商处转入差价合约头寸吗?

IBKR当前不支持差价合约头寸转账。

股票差价合约可以使用图表功能吗?

是的。

在IBKR交易差价合约有什么账户保护?

差价合约以IB英国作为您的交易对方,不是在受监管的交易所进行交易,也不是在中央结算所进行结算。因IB英国是您差价合约交易的对方,您会面临与IB英国交易相关的财务和商业风险,包括信用风险。但请注意,所有客户资金永远都是完全隔离的,包括对机构客户。IB英国是英国金融服务补偿计划(“FSCS”)参与者。IB英国不是美国证券投资者保护公司(“SIPC”)成员。请参见IB英国差价合约风险披露文件了解有关差价合约交易风险的详细信息。

在哪种类型(如个人、朋友和家庭、机构等)的IBKR账户中可交易差价合约?

所有保证金账户均可进行差价合约交易。现金账户和SIPP账户不能。

在某一特定差价合约中我最多可持有多少头寸?

没有预设限制。但请注意,超大头寸可能会有更高保证金要求。请参见CFD保证金要求了解更多详细信息。

我能否通过电话交易差价合约?

不要。在极端情况下我们可能同意通过电话处理平仓定单,但绝不会通过电话处理开仓定单。

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA规定

欧洲证券与市场管理局(ESMA)发布临时产品干涉措施,自2018年8月1日起生效。

ESMA决议实施的限制包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;3) 以单个账户为单位的负余额保护规则;4) 对交易差价合约激励措施的限制;以及5) 标准的风险警告。

ESMA新规仅适用于零售客户。 专业客户不受影响。

How to determine if you are borrowing funds from IBKR

If the aggregate cash balance in a given account is a debit, or negative, then funds are being borrowed and the loan is subject to interest charges. A loan may still exist, however, even if the aggregate cash balance is a credit, or positive, as a result of balance netting or timing differences. The most common examples of this are as follows:

Overview of IBKR issued Share CFDs

The following article is intended to provide a general introduction to share-based Contracts for Differences (CFDs) issued by IBKR.

For Information on IBKR Index CFDs click here. For Forex CFDs click here. For Precious Metals click here.

Topics covered are as follows:

I. CFD Definition

II. Comparison Between CFDs and Underlying Shares

III. CFD Tax and Margin Advantage

IV. US ETFs

V. CFD Resources

VI. Frequently Asked Questions

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ESMA Rules for CFDs (Retail Clients of IBKRs European entities, including so-called F segments)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August 2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

I. Overview

IBKR CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions).

Said differently, it is an agreement between the buyer (you) and IBKR to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBKR pays you. If it is negative, you pay IBKR.

Our Share CFDs offer Direct Market Access (DMA). Our Share CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Workstation. Similar to shares, your non-marketable (i.e. limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBKR’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

We currently offer approximately 8500 Share CFDs covering the principal markets in the US, Europe and Asia. Eligible shares have minimum market capitalization of USD 500 million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail.

Most order types are available for CFDs, including auction orders and IBKR Algos.

CFDs on US share can also be traded during extended exchange hours and overnight. Other CFDs are traded during regular hours.

II. Comparison Between CFDs and Underlying Shares

| BENEFITS of IBKR CFDs | DRAWBACKS of IBKR CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium, Spain) | No ownership rights |

| Generally lower margin rates than shares* | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules | |

| US ETFs tradable as CFDs** |

*IB LLC and IB-UK accounts.

**EEA area clients cannot trade US ETFs directly, as they do not publish KIDs.

III. CFD Tax and Margin Advantage

Where stamp duty or financial transaction tax is applied, currently in the UK (0.5%), France (0.3%), Belgium (0.35%) and Spain (0.2%), it has a substantially detrimental impact on returns, particular in an active trading strategy. The taxes are levied on buy-trades, so each time you open a long, or close a short position, you will incur tax at the rates described above.

The amount of available leverage also significantly impacts returns. For European IBKR entities, margin requirements are risk-based for both stocks and CFDs, and therefore generally the same. IB-UK and IB LLC accounts however are subject to Reg T requirements, which limit available leverage to 2:1 for positions held overnight.

To illustrate, let's assume that you have 20,000 to invest and wish to leverage your investment fully. Let's also assume that you hold your positions overnight and that you trade in and out of positions 5 times in a month.

Let's finally assume that your strategy is successful and that you have earned a 5% return on your gross (fully leveraged) investment.

The table below shows the calculation in detail for a UK security. The calculations for France, Belgium and Spain are identical, except for the tax rates applied.

| UK CFD | UK Stock | UK Stock | |

|---|---|---|---|

| All Entities |

EU Account

|

IB LLC or IBUK Acct

|

|

| Tax Rate | 0% | 0.50% | 0.50% |

| Tax Basis | N/A | Buy Orders | Buy Orders |

| # of Round trips | 5 | 5 | 5 |

| Commission rate | 0.05% | 0.05% | 0.05% |

| Overnight Margin | 20% | 20% | 50% |

| Financing Rate | 1.508% | 1.508% | 1.508% |

| Days Held | 30 | 30 | 30 |

| Gross Rate of Return | 5% | 5% | 5% |

| Investment | 100,000 | 100,000 | 40,000 |

| Amount Financed | 100,000 | 80,000 | 20,000 |

| Own Capital | 20,000 | 20,000 | 20,000 |

| Tax on Purchase | 0.00 | 2,500.00 | 1,000.00 |

| Round-trip Commissions | 500.00 | 500.00 | 200.00 |

| Financing | 123.95 | 99.16 | 24.79 |

| Total Costs | 623.95 | 3099.16 | 1224.79 |

| Gross Return | 5,000 | 5,000 | 2,000 |

| Return after Costs | 4,376.05 | 1,900.84 | 775.21 |

| Difference | -57% | -82% |

The following table summarizes the reduction in return for a stock investment, by country where tax is applied, compared to a CFD investment, given the above assumptions.

| Stock Return vs cfD | Tax Rate | EU Account | IB LLC or IBUK Acct |

|---|---|---|---|

| UK | 0.50% | -57% | -82% |

| France | 0.30% | -34% | -73% |

| Belgium | 0.35% | -39% | -75% |

| Spain | 0.20% | -22% | -69% |

IV. US ETFs

EEA area residents who are retail investors must be provided with a key information document (KID) for all investment products. US ETF issuers do not generally provide KIDs, and US ETFs are therefore not available to EEA retail investors.

CFDs on such ETFs are permitted however, as they are derivatives for which KIDs are available.

Like for all share CFDs, the reference price for CFDs on ETFs is the exchange-quoted, SMART-routed price of the underlying ETF, ensuring economics that are identical to trading the underlying ETF.

V. Extended and Overnight Hours

US CFDs can be traded from 04:00 to 20:00EST, and the again overnight from 20:00 to 03:30 the following day. Trades in the overnight session are attributed to the day when the session ends, even if a trade is entered before midnight the previous day. This has implications for corporate actions and financing.

Trades entered before midnight on the day before ex-date will not have a dividend entitlement. Trades before midnight will settle as if they had been traded the following day, delaying the start of financing.

VI. CFD Resources

Below are some useful links with more detailed information on IBKR’s CFD offering:

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

VII. Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on other asset classes?

Yes. Please see IBKR Index CFDs - Facts and Q&A, Forex CFDs - Facts and Q&A and Metals CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBKR CFD quotes are identical to the Smart routed quotes for the underlying share. IBKR does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBKR offers Direct market Access (DMA) whereby your non-marketable (i.e. limit) orders have the underlying hedges directly represented on the deep books of the exchanges on which they trade. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets.

How do you determine margins for Share CFDs?

IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 10%, making CFDs more margin-efficient than trading the underlying share in many cases. Retail investors are subject to additional margin requirements mandated by the European regulators. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Concentrated positions and very large positions may be subject to additional margin. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position may become subject to buy-in.

How do you handle dividends and corporate actions?

IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stock-split, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

*Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBKR may terminate the CFD prior to the ex-date.

Can anyone trade IBKR CFDs?

All clients can trade IBKR CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and Israel. There are no exemptions based on investor type to the residency based exclusions.

What do I need to do to start trading CFDs with IBKR?

You need to set up trading permission for CFDs in Client Portal, and agree to the relevant disclosures. If your account is with IBKR (UK) or with IBKR LLC, IBKR will then set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD initial margin requirements from your main account.

If your account is with another IBKR entity, only the permission is required; an additional account segment is not necessary.

Are there any market data requirements?

The market data for IBKR Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

Can I transfer in CFD positions from another broker?

IBKR does not facilitate the transfer of CFD positions at this time.

Are charts available for Share CFDs?

Yes.

In what type of IBKR accounts can I trade CFDs e.g., Individual, Friends and Family, Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

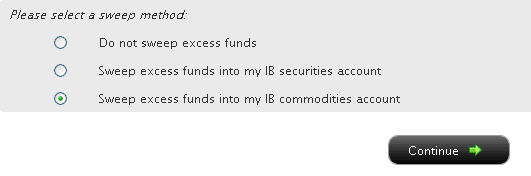

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

Why does the "price" on hard to borrow stocks not agree to the closing price of the stock?

In determining the cash deposit required to collateralize a stock borrow position, the general industry convention is for the lender to require a deposit equal to 102% of the prior business day's** settlement price, rounded up to the nearest whole dollar and then multiplied by the number of shares borrowed. As borrow rates are determined based upon the value of the loan collateral, this convention impacts the cost of maintaining the short position, with the impact being most significant in the case of low-priced and hard-to-borrow shares. Note, for shares not denominated in USD the calculation will differ. Find below a table summarizing the calculations per currency:

| Currency | Calculation Method |

| USD | 102%; rounded up to the nearest dollar |

| CAD | 102%; rounded up to the nearest dollar |

| EUR | 105%; rounded up to the nearest cent |

| CHF | 105%; rounded up to the nearest rappen |

| GBP | 105%; rounded up to the nearest pence |

| HKD | 105%; rounded up to the nearest cent |

For US Treasuries and corporate bonds, the collateral amount on which the borrow fee is charged will include the accrued interest.

Account holders may view this adjusted price for a given transaction in the "Borrow Fee Details" section of the daily account statement. Two examples of this collateral calculation and its impact upon borrow fees are provided below.

Example 1

Sell short 100,000 shares of ABC at a price of $1.50

Short sale proceeds received = $150,000.00

Assume the price of ABC falls to $0.25 and the stock has a borrow fee rate of 50%

Short stock collateral value calculation

Price = 0.25 x 102% = 0.255; round up to $1.00

Value = 100,000 shares x $1.00 = $100,000.00

Borrow fee = $100,000 x 50% / 360 days in year = $138.89 per day

Assuming the account holder's cash balance does not include proceeds from any other short sale transaction then this borrow fee will not be offset by any credit interest on the short sale proceeds as the balance does not exceed the minimum $100,000 Tier 1 threshold necessary to accrue interest.

Example 2 (EUR denominated stock)

Sell short 100,000 shares of ABC at a price of EUR 1.50

Assume a prior business day's close price of EUR 1.55 and a borrow fee rate of 50%

Short stock collateral value calculation

Price = EUR 1.55 x 105% = 1.6275; round up to EUR 1.63

Value = 100,000 shares x 1.63 = $163,000.00

Borrow fee = EUR 163,000 x 50% / 360 days in year = EUR 226.38 per day

** Please note, Saturdays and Sundays are treated as a Friday and will use Thursday's settlement price to calculate the required deposit.

Interest Benchmark Definitions

Fed Funds Effective (USD only) is the volume weighted average of the transactions processed through the Federal Reserve between member banks. It is intended to reflect the best estimate of interbank financing activity for Reserve Bank members and is the reference for many short term money market transactions in the broader market.

EONIA (EUR only) is the global standard for overnight Euro deposits and is determined by a weighted average of the actual transactions between major continental European banks mediated through the European Central Bank.

HIBOR (CNY and HKD) is a daily fixing based on a group of large Hong Kong banks.

KORIBOR (KRW only) is an average of the leading interest rates for KRW as determined by a group of large Korean banks. The benchmark utilizes the KORIBOR with 1 week maturity.

STIBOR (SEK only) is a daily fixing based on a group of large Swedish banks.

TIIE (MXN only) is the interbank "equilibrium" rate based on the quotes provided by money center banks as calculated by the Mexican Central Bank. The benchmark TIIE is based on 28-day deposits so is atypical as a measure for short term funds (most currencies have an overnight or similar short term benchmark).

Overnight (O/N - CZK, HUF, ILS and SGD) rate is the most widely used short term benchmark and represents the rate for balances held from today until the next business day.

Spot-Next (S/N - DKK only) refers to the rate on balances from the next business day to the business day thereafter. Due to time zone and other criteria, Spot-Next rates are sometimes used as the short-term reference.

Day-Count conventions: it is beyond the scope of this document to describe day-count conventions and their use in interest calculations. IBKR conforms to the international standards for day-counting wherein deposits rates for most currencies are expressed in terms of a 360 day year, while for exceptional currencies (ex: GBP) the convention is a 365 day year.

Understanding interest charges when the net cash balance is a credit

An account will be subject to interest charges despite maintaining an overall net long or credit cash balance under the following circumstances:

1. The account maintains a short or debit balance in a given currency.

For example, an account maintaining a net cash credit balance equivalent to USD 5,000 comprised of a long USD balance of 8,000 and a short EUR balance equivalent to USD 3,000 would be subject to an interest debit based upon the short EUR balance. There would be no offsetting credit on the long USD balance as it is less than the USD 10,000 Tier I level above which interest is earned.

Account holders should note that in the event they purchase a security which is denominated in a currency that they do not hold in their account, IBKR will create a loan in that currency in order to settle the trade with the clearinghouse. If one wishes to avoid such loans and their associated interest charges, they would need to either deposit funds denominated in that particular currency or convert existing cash balances via the Ideal Pro (for balances of USD 25,000 or above) or odd lot (for balances less than USD 25,000) venue prior to entering into your trade.

2. The credit balance is comprised principally of proceeds from the short sale of securities.

For example, an account maintaining a net cash credit balance of USD 12,000 which is comprised of a USD debit of 6,000 in the security sub-account (less the market value of any short stock positions) and a short stock market value credit of USD 18,000 would be charged interest on the Tier 1 debit of USD 6,000 and would earn no interest on the short stock credit as it falls below the USD 100,000 Tier I level.

3. The credit balance includes unsettled funds.

IBKR determines interest debits and credits solely based upon settled funds. Just as an account holder is not assessed interest charges on funds borrowed to purchase a security until such time that purchase transaction settles, the account holder will not receive an interest credit, or offset against a debit balance, on funds originating from the sale of a security until such time the transaction has settled (and IBKR has been credited funds by the clearinghouse).