非美国居民要缴纳预扣税吗?

纳税义务相关信息根据要求上报给您居住国家以及其它国家(如果交易的产品有地方预扣税要求)的税务机关。除非有税务机关明确要求,某则IBKR不会就证券交易收入扣缴税款。根据美国税法规定,我们对美国公司向外国人士支付的股息按30%的税率进行扣税。如果美国与您的所在国有税务协定,税率可能会有一定优惠。此外,投资利息收入没有美国预扣税。非美国人士和大多数实体的所有预扣税均将在每年年末通过表格1042-S申报。更多信息,请参见美国国税局901和/或咨询您的税务顾问。

股票收益提升计划(SYEP)常见问题

股票收益提升计划推出的目的是什么?

股票收益提升计划可供客户通过允许IBKR将其账户内原本闲置的证券头寸(即全额支付和超额保证金证券)出借给第三方来赚取额外收益。参与此计划的客户会收到用以确保股票在借贷终止时顺利归还的抵押(美国国债或现金)。

什么是全额支付和超额保证金证券?

全额支付证券是客户账户中全款付清的证券。超额保证金证券是虽然没有全款付清但本身市场价值已超过保证金贷款余额的140%的证券。

客户股票收益提升计划的借出交易收益如何计算?

客户借出股票的收益取决于场外证券借贷市场的借贷利率。借出的股票不同,出借的日期不同,都会对借贷利率造成很大差异。通常,IBKR会按自己借出股票所得金额的大约50%向参与计划的客户支付利息。

借贷交易的抵押金额如何确定?

证券借贷的抵押(美国国债或现金)金额采用行业惯例确定,即用股票的收盘价乘以特定百分比(通常为102-105%),然后向上取整到最近的美元/分。每个币种的行业惯例不同。例如,借出100股收盘价为$59.24美元的美元计价股票,现金抵押应为$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表为各个币种的行业惯例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 欧元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英镑 | 105%;向上取整到最近的便士 |

| 港币 | 105%;向上取整到最近的分 |

更多信息,请参见KB1146。

股票收益提升计划下的抵押如何保管以及保管在何处?

对于IBLLC的客户,抵押将采用现金或美国国债的形式,并将转入IBLLC的联营公司IBKR Securities Services LLC (“IBKRSS”)进行保管。您在该计划下借出股票的抵押会由IBKRSS以您为受益人保管在一个账户中,您将享有第一优先级担保权益。如果IBLLC违约,您将可以直接从IBKRSS取得抵押,无需经过IBLLC。请参见 此处的《证券账户控制协议》了解更多信息。对于非IBLLC的客户,抵押将由账户所在实体保管。例如,IBIE的账户其抵押将由IBIE保管。例如,IBIE的账户其抵押将由IBIE保管。

退出IBKR股票收益提升计划或卖出/转账通过此计划借出的股票会对利息造成什么影响?

交易日的下一个工作日(T+1)停止计息。对于转账或退出计划,利息也会在发起转账或退出计划的下一个工作日停止计算。

参加IBKR股票收益提升计划有什么资格要求?

| 可参加股票收益提升计划的实体* |

| 盈透证券有限公司(IB LLC) |

| 盈透证券英国有限公司(IB UK)(SIPP账户除外) |

| 盈透证券爱尔兰有限公司(IB IE) |

| 盈透证券中欧有限公司(IB CE) |

| 盈透证券香港有限公司(IB HK) |

| 盈透证券加拿大有限公司(IB Canada)(RRSP/TFSA账户除外) |

| 盈透证券新加坡有限公司(IB Singapore) |

| 可参加股票收益提升计划的账户类型 |

| 现金账户(申请参加时账户资产超过$50,000美元) |

| 保证金账户 |

| 财务顾问客户账户* |

| 介绍经纪商客户账户:全披露和非披露* |

| 介绍经纪商综合账户 |

| 独立交易限制账户(STL) |

*参加的账户必须是保证金账户或满足上述现金账户最低资产要求的现金账户。

盈透证券日本、盈透证券卢森堡、盈透证券澳大利亚和盈透证券印度公司的客户不能参加此计划。账户开在IB LLC下的日本和印度客户可以参加。

此外,满足上方条件的财务顾问客户账户、全披露介绍经纪商客户和综合经纪商可以参加此计划。如果是财务顾问和全披露介绍经纪商,必须由客户自己签署协议。综合经纪商由经纪商签署协议。

IRA账户可以参加股票收益提升计划吗?

可以。

IRA账户由盈透证券资产管理公司(Interactive Brokers Asset Management)管理的账户分区可以参加股票收益提升计划吗?

不能。

英国SIPP账户可以参加股票收益提升计划吗?

不能。

如果参加计划的现金账户资产跌破最低资产要求$50,000美元会怎么样?

现金账户只有在申请参加计划当时必须满足这一最低资产要求。之后资产跌破此要求并不会对现有借贷造成任何影响,也不影响您继续借出股票。

如何申请参加IBKR股票收益提升计划?

要参加股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。然后,在账户设置内,寻找交易板块并点击股票收益提升计划以申请参加。 您将会看到参加该计划所需填写的表格和披露。阅读并签署表格后,您的申请便会提交处理。可能需要24到48小时才能完成激活。

如何终止股票收益提升计划?

要退出股票收益提升计划,请登录客户端。登录后,点击使用者菜单(右上角的小人图标),然后点击设置。在账户 设置板块内会找到交易,然后点击股票 收益 提升 计划,然后参照所需步骤。您的申请便会提交处理。 中止参加的请求通常会在当日结束时进行处理。

如果一个账户参加了计划然后又退出,那么该账户多久可以重新参加计划?

退出计划后,账户需要等待90天才能重新参加。

哪些证券头寸可以出借?

| 美国市场 | 欧洲市场 | 香港市场 | 加拿大市场 |

| 普通股(交易所挂牌、粉单和OTCBB) | 普通股(交易所挂牌) | 普通股(交易所挂牌) | 普通股(交易所挂牌) |

| ETF | ETF | ETF | ETF |

| 优先股 | 优先股 | 优先股 | 优先股 |

| 公司债券* |

*市政债券不适用。

借出IPO后在二级市场交易的股票有什么限制吗?

没有,只要账户本身没有就相应的证券受到限制就可以。

IBKR如何确定可以借出的股票数量?

第一步是确定IBKR有保证金扣押权从而可以在没有客户参与的情况下通过股票收益提升计划借出的证券的价值(如有)。根据规定,通过保证金贷款借钱给客户购买证券的经纪商可以将该客户的证券借出或用作抵押,金额最高不超过贷款金额的140%。例如,如果客户现金余额为$50,000美元,买入市场价值为$100,000美元的证券,则贷款金额为$50,000美元,那么经纪商对$70,000美元($50,000的140%)的证券享有扣押权。客户持有的证券超出这一金额的部分被称为超额保证金证券(此例子中为$30,000),需要记在隔离账户,除非客户授权IBKR通过股票收益提升计划将其借出。

计算贷款金额首先要将所有非美元计价的现金余额转换成美元,然后减去股票卖空所得(转换成美元)。如果结果为负数,则我们最高可抵押此数目的140%。此外,商品账户段中持有的现金余额和现货金属和差价合约相关现金不纳入考虑范围。 详细说明请参见此处。

例1: 客户在基础货币为美元的账户内持有100,000欧元,欧元兑美元汇率为1.40。客户买入价值$112,000美元(相当于80,000欧元)的美元计价股票。由于转换成美元后现金余额为正数,所有证券被视为全额支付。

| 项目 | 欧元 | 美元 | 基础货币(美元) |

| 现金 | 100,000 | (112,000) | $28,000 |

| 多头股票 | $112,000 | $112,000 | |

| 净清算价值 | $140,000 |

例2: 客户持有80,000美元、多头持有价值$100,000美元的美元计价股票并且做空了价值$100,000美元的美元计价股票。总计$28,000美元的多头证券被视为保证金证券,剩余的$72,000美元为超额保证金证券。计算方法是用现金余额减去卖空所得($80,000 - $100,000),所得贷款金额再乘以140% ($20,000 * 1.4 = $28,000)

| 项目 | 基础货币(美元) |

| 现金 | $80,000 |

| 多头股票 | $100,000 |

| 空头股票 | ($100,000) |

| 净清算价值 | $80,000 |

IBKR会把所有符合条件的股票都借出去吗?

不保证账户内所有符合条件的股票都能通过股票收益提升计划借出去,因为某些证券可能没有利率有利的市场,或者IBKR无法接入有意愿的借用方所在的市场,也有可能IBKR不想借出您的股票。

通过股票收益提升计划借出股票是否都要以100为单位?

不能。只要是整股都可以,但是借给第三方的时候我们只以100为倍数借出。这样,如果有第三方需要借用100股,就可能发生我们从一个客户那里借出75股、从另一个客户那里借出25股的情况。

如果可供借出的股票超过借用需求,如何在多个客户之间分配借出份额?

如果我们股票收益提升计划的参与者可用以借出的股票数量大于借用需求,则借出份额将按比例分配。例如,可供借出XYZ数量为20,000股,而对于XYZ的需求只有10,000股的情况下,每个客户可以借出其所持股数的一半。

股票是只借给其它IBKR客户还是也会借给其它第三方?

股票可以借给IBKR客户和第三方。

股票收益提升计划的参与者可以自行决定哪些股票IBKR可以借出吗?

不能。此计划完全由IBKR管理,IBKR在确定了自己因保证金贷款扣押权可以借出的证券后,可自行决定哪些全额支付或超额保证金证券可以借出,并发起借贷。

通过股票收益提升计划借出去的证券其卖出是否会受到限制?

借出去的股票可随时卖出,没有任何限制。卖出交易的结算并不需要股票及时归还,卖出收益会按正常结算日记入客户的账户。此外,借贷会于证券卖出的下一个工作日开盘终止。

客户就通过股票收益提升计划借出去的股票沽出持保看张期权还能享受持保看涨期权保证金待遇吗?

可以。由于借出去的股票其盈亏风险仍然在借出方身上,借出股票不会对相关保证金要求造成任何影响。

借出去的股票由于看涨期权被行权或看跌期权行权被交付会怎么样?

借贷将于平仓或减仓操作(交易、被行权、行权)的T+1日终止。

借出去的股票被暂停交易会怎么样?

暂停交易对股票借出没有直接影响,只要IBKR能继续借出该等股票,则无论股票是否被暂停交易,借贷都可以继续进行。

借贷股票的抵押可以划至商品账户段冲抵保证金和/或应付行情变化吗?

不能。股票借贷的抵押不会对保证金或融资造成任何影响。

计划参与者发起保证金贷款或提高现有贷款金额会怎么样?

如果客户有全额支付的证券通过股票收益提升计划借出,之后又发起保证金贷款,则不属于超额保证金证券的部分将被终止借贷。同样,如果客户有超额保证金证券通过此计划借出,之后又要增加现有保证金贷款,则不属于超额保证金证券的部分也将被终止借贷。

什么情况下股票借贷会被终止?

发生以下情况(但不限于以下情况),股票借贷将被自动终止:

- 客户选择退出计划

- 转账股票

- 以股票作抵押借款

- 卖出股票

- 看涨期权被行权/看跌期权行权

- 账户关闭

股票收益提升计划的参与者是否会收到被借出股票的股息?

通过股票收益提升计划借出的股票通常会在除息日前召回以获取股息、避免股息替代支付。但是仍然有可能获得股息替代支付。

股票收益提升计划的参与者是否对被借出的股票保有投票权?

不能。如果登记日或投票、给予同意或采取其它行动的截止日期在贷款期内,则证券的借用者有权就证券相关事项进行投票或决断。

股票收益提升计划的参与者是否能就被借出的股票获得权利、权证和分拆股份?

可以。被借出股票分配的任何权利、权证和分拆股份都将属于证券的借出方。

股票借贷在活动报表中如何呈现?

借贷抵押、借出在外的股数、活动和收益在以下6个报表区域中反映:

1. 现金详情 – 详细列出了期初抵押(美国国债或现金)余额、借贷活动导致的净变化(如果发起新的借贷则为正;如果股票归还则为负)和期末现金抵押余额。

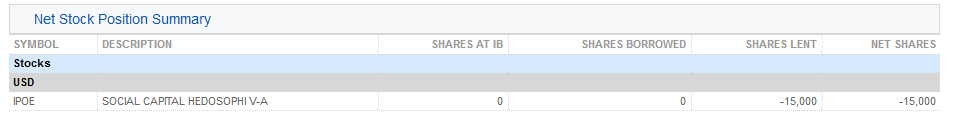

2. 净股票头寸总结 – 按股票详细列出了在IBKR持有的总股数、借入的股数、借出的股数和净股数(=在IBKR持有的总股数 + 借入的股数 - 借出的股数)。

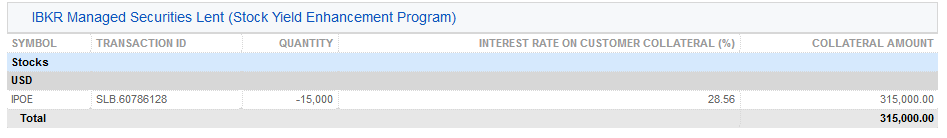

3. 借出的IBKR管理证券(股票收益提升计划) – 对通过股票收益提升计划借出的股票按股票列出了借出的股数以及利率(%)。

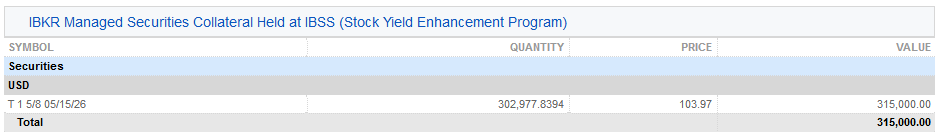

3a. 在IBSS保管的IBKR管理证券的抵押(股票收益提升计划)– IBLLC的客户会看到其报表中多出来一栏,显示作为抵押的美国国债以及抵押的数量、价格和总价值。

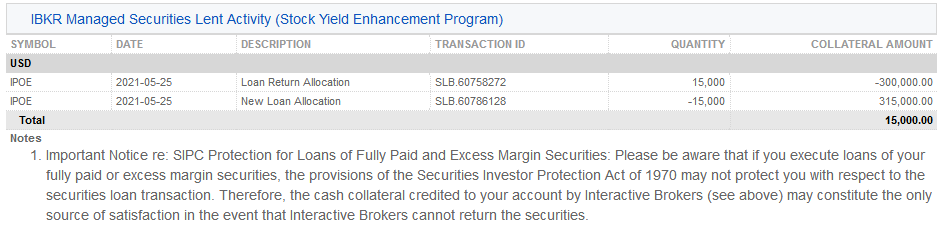

4. IBKR管理证券借出活动 (股票收益提升计划)– 详细列出了各证券的借贷活动,包括归还份额分配(即终止的借贷);新借出份额分配(即新发起的借贷);股数;净利率(%);客户抵押金额及其利率(%)。

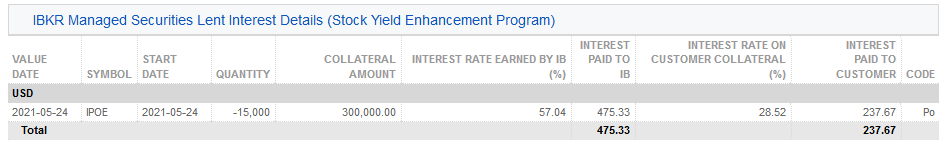

5. IBKR管理的证券借出活动利息详情 (股票收益提升计划)– 按每笔借出活动详细列出了IBKR赚取的利率(%);IBKR赚取的收益(为IBKR从该笔借出活动赚取的总收益,等于{抵押金额 * 利率}/360);客户抵押的利率(为IBKR从该笔借出活动赚取的收益的一半)以及支付给客户的利息(为客户的现金抵押赚取的利息收入)

注:此部分只有在报表期内客户赚取的应计利息超过1美元的情况下才会显示。

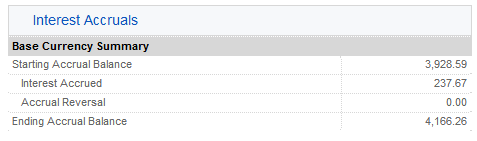

6. 应计利息 – 此处利息收入列为应计利息,与任何其它应计利息一样处理(累积计算,但只有超过$1美元才会显示并按月过账到现金)。年末申报时,该笔利息收入将上报表格1099(美国纳税人)。

Special Dividends: "Due Bill" Process

In some cases, special dividends may have different rules than regular dividends concerning the ex-dividend date. If a special dividend is less than 25% of the stock price, standard rules apply regarding the ex-dividend date (ex-date is before the record and pay date). However, if a special dividend is greater than 25% of the stock price*, the ex-dividend date will be after the record date and pay date.

In the case of a regular dividend or a special dividend of less than 25% of the share price, one would need to own a stock by the record date in order to be entitled to the dividend. However, this is not the case for special dividends that are more than 25% of the stock price. If one were to sell a stock after the record date but before the ex-dividend date, they would no longer be entitled to the dividend. The shares would be tagged with something called a "due bill" which means that the seller is obligated to pay the dividend to the buyer. Likewise, if one were to buy a stock after the record date but before the ex-dividend date (and hold it through the ex-date), they would be entitled to the dividend from the seller.

*Please note, the 25% or more rule is a general rule and will not apply in all cases. Certain foreign stock dividends will not follow the rule and some domestic stocks are granted an exclusion. For information regarding regular dividends, please reference KB 47.

T+2结算概述

简介

- 降低金融系统的风险 – 由于证券价格变动的可能性会随时间上升,缩短结算周期能降低由于未付款或未交付证券导致的信用风险敞口。 通过降低待结算义务的名义价值,能够提高金融系统抵御严重市场冲击带来的潜在系统性后果。

- 提高现金调用效率 – 对于持“现金”账户的客户,若资金结算未完成,则无法交易(即不得空买空卖——在不支付的情况下买卖证券)。 实施T+2制度后,销售证券所得的资金将比之前早一个工作日到账,因此客户将能更快地将资金用于后续交易。

- 提高全球结算一致性 - 当前欧洲和亚洲等市场实行T+2制度,向T+2结算周期的转变将使美国和加拿大市场更好地与其它主要国际市场接轨。

买卖期权、期货或期货期权合约的结算规则是否会变化?

不要。此类产品当前在T+1日结算,结算周期不变。

股息等值支付预征税款 - 常见问题

背景

重要提示: 我方不提供税务、法律或财务建议。客户应咨询其自有顾问,以确定法规871(m)对其交易活动的影响。

Withholding Tax on Dividend Equivalent Payments - FAQs

Background

IMPORTANT NOTE: We do not provide tax, legal or financial advice. Each customer must speak with the customer’s own advisors to determine the impact that the Section 871(m) rules may have on the customer’s trading activity.

IBKR股票差价合约概述

下方文章对IBKR发行的股票差价合约(CFD)进行了总体介绍。

有关IBKR指数差价合约的信息,请点击此处。有关外汇差价合约的信息,请点击此处。

涵盖主题如下:

I. 差价合约定义

II. 差价合约与底层股票之比较

III. 成本与保证金

IV. 范例

V. 差价合约的相关资源

VI. 常见问题

风险警告

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA差价合约规定(仅限零售客户)

欧洲证券与市场管理局(ESMA)颁布了新的差价合约规定,自2018年8月1日起生效。

新规包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;以及3) 以单个账户为单位的负余额保护规则;

ESMA新规仅适用于零售客户。专业客户不受影响。

请参见ESMA差价合约新规推行了解更多详细信息。

I. 股票差价合约定义

IBKR差价合约是场外交易合约,提供底层股票的收益,包括股息与公司行动(了解更多有关差价合约公司行动的信息)。

换句话说,这是买家(您)与IBKR就交易一只股票当前价值与未来价值之差额而达成的协定。如果您持有多头头寸,且差额为正,则IBKR会付钱给您。而如果差额为负,则您应向IBKR付钱。

IBKR股票差价合约通过您的保证金账户进行交易,因此您可建立多头以及空头杠杆头寸。差价合约的价格即是底层股票的交易所报价。实际上,IBKR差价合约报价与股票的智能传递报价(可在TWS中查看)相同,且IBKR提供直接市场接入(DMA)。与股票类似,您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。 这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。

要将IBKR透明的差价合约模型与市场上其他差价合约进行比较,请参见我们的差价合约市场模型概述。

IBKR目前提供约7100只股票差价合约,覆盖美国、欧洲和亚洲的主要市场。下表所列的主要指数其成分股目前都可做IBKR股票差价合约。在许多国家,IBKR还可供交易高流动性小盘股。这些股票自由流通量调整市值至少为5亿美元,每日交易量中间值至少为60万美元。 详情请见差价合约产品列表。不久将会增加更多国家。

| 美国 | 标普500、道琼斯股价平均指数、纳斯达克100、标普400中盘股、高流动性小盘股 |

| 英国 | 富时350 + 高流动性小盘股(包括IOB) |

| 德国 | Dax、MDax、TecDax + 高流动性小盘股 |

| 瑞士 | 斯托克欧洲600指数(48只股票)+ 高流动性小盘股 |

| 法国 | CAC大盘股、CAC中盘股 + 高流动性小盘股 |

| 荷兰 | AEX、AMS中盘股 + 高流动性小盘 |

| 比利时 | BEL 20、BEL中盘股 + 高流动性小盘 |

| 西班牙 | IBEX 35 + 高流动性小盘股 |

| 葡萄牙 | PSI 20 |

| 瑞典 | OMX斯德哥尔摩30指数 + 高流动性小盘股 |

| 芬兰 | OMX赫尔辛基25指数 + 高流动性小盘股 |

| 丹麦 | OMX哥本哈根30指数 + 高流动性小盘股 |

| 挪威 | OBX |

| 捷克 | PX |

| 日本 | 日经225指数 + 高流动性小盘股 |

| 香港 | 恒生指数 + 高流动性小盘股 |

| 澳大利亚 | ASX 200指数 + 高流动性小盘股 |

| 新加坡* | 海峡时报指数 + 高流动性小盘股 |

| 南非 | Top 40 + 高流动性小盘股 |

*对新加坡居民不可用

II. 差价合约与底层股票之比较

| IBKR差价合约的优势 | IBKR差价合约的缺点 |

|---|---|

| 无印花税和金融交易税(英国、法国、比利时) | 无股权 |

| 佣金和保证金利率通常比股票低 | 复杂公司行动并不总能完全复制 |

| 股息享受税务协定税率,无需重新申请 | 收益的征税可能与股票有所不同(请咨询您的税务顾问) |

| 不受即日交易规则限制 |

III. 成本与保证金

在欧洲股票市场,IBKR差价合约可以比IB极具竞争力的股票产品更加高效。

首先,IBKR差价合约佣金比股票低,且有着与股票一样低的融资点差:

| 欧洲 | 差价合约 | 股票 | |

|---|---|---|---|

| 佣金 | GBP | 0.05% | 英镑6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| 融资** | 基准+/- | 1.50% | 1.50% |

*每单 + 超出5万英镑部分的0.05%

**对于差价合约是总头寸价值的融资;对于股票是借用金额的融资

交易量更大时,差价合约佣金会变得更低,最低至0.02%。头寸更大时,融资利率也会降低,最低至0.5%。 详情请参见差价合约佣金和差价合约融资利率。

其次,差价合约的保证金要求比股票低。零售客户须满足欧洲监管机构ESMA规定的额外保证金要求。请参见ESMA差价合约新规推行了解详细信息。

| 差价合约 | 股票 | ||

|---|---|---|---|

| 所有 | 标准 | 投资组合保证金 | |

| 维持保证金要求* |

10% |

25% - 50% | 15% |

*蓝筹股特有保证金。零售客户最低初始保证金要求为20%。股票标准的25%日内维持保证金,50%隔夜保证金。 显示的投资组合保证金为维持保证金(包括隔夜)。波动较大的股票保证金要求更高

请参见CFD保证金要求了解更多详细信息。

IV. 范例(专业客户)

让我们来看一下例子。联合利华在阿姆斯特丹的挂牌股票在过去一个月(2012年5月14日前20个交易日)回报率为3.2%,您认为其会继续有良好表现。您想建立20万欧元的仓位,并持仓5天。您以10笔交易建仓并以10笔交易平仓。您的直接成本如下:

股票

| 差价合约 | 股票 | ||

|---|---|---|---|

| 200,000欧元头寸 | 标准 | 投资组合保证金 | |

| 保证金要求 | 20,000 | 100,000 | 30,000 |

| 佣金(双向) | 200.00 | 400.00 | 400.00 |

| 利率(简化) | 1.50% | 1.50% | 1.50% |

| 融资金额 | 200,000 | 100,000 | 170,000 |

| 融资天数 | 5 | 5 | 5 |

| 利息支出(1.5%的简化利率) | 41.67 | 20.83 | 35.42 |

| 总计直接成本(佣金+利息) | 241.67 | 420.83 | 435.42 |

| 成本差额 | 高74% | 高80% | |

注意:差价合约的利息支出根据总的合约头寸进行计算,而股票的利息支出则是根据借用金额进行计算。股票和差价合约的适用利率相同。

但是,假设您只有2万欧元可用来做保证金。如果联合利华继续上月的表现,您的潜在盈利比较如下:

| 杠杆回报 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | 1,600 | 320 | 1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | 1,358.33 | 235.83 | 776.39 |

| 保证金投资金额回报 | 0.07 | 0.01 | 0.04 |

| 差额 | 收益少83% | 收益少43% | |

| 杠杆风险 | 差价合约 | 股票 | |

|---|---|---|---|

| 可用保证金 | 20,000 | 20,000 | 20,000 |

| 总投入 | 200,000 | 40,000 | 133,333 |

| 总收益(5天) | -1,600 | -320 | -1,066.66 |

| 佣金 | 200.00 | 80.00 | 266.67 |

| 利息支出(1.5%的简化利率) | 41.67 | 4.17 | 23.61 |

| 总计直接成本(佣金+利息) | 241.67 | 84.17 | 290.28 |

| 净收益(总收益减去直接成本) | -1,841.67 | -404.17 | -1,356.94 |

| 差额 | 损失少78% | 损失少26% | |

V. 差价合约相关资源

下方链接可帮助您了解更多有关IBKR差价合约产品的详细信息:

还可参看以下视频教程:

VI. 常见问题

什么股票可进行差价合约交易?

美国、西欧、北欧与日本的大盘和中盘股股票。许多市场上的高流动性小盘股也可以。请参见差价合约产品列表了解更多详细信息。不久将会增加更多国家。

IB提供股票指数和外汇的差价合约吗?

是的。请参见IBKR指数差价合约 - 事实与常见问题以及外汇差价合约 - 事实与常见问题。

IB如何确定股票差价合约报价?

IBKR差价合约报价与底层股票的智能传递报价相同。IBKR不会扩大价差或与您对赌。要了解更多信息,请参见差价合约市场模型概述。

我能看到自己的限价定单反映在交易所中吗?

是的。IBKR提供直接市场接入(DMA),这样您的非适销(即限价)定单会使底层对冲直接呈现在其进行交易之交易所的深度定单册中。这也意味着您可以下单以底层买价买入差价合约或以底层卖价卖出差价合约。此外,如果其他客户的定单以优于公开市场的价格与您的定单交叉,您还可能会获得价格改善。

IB如何确定股票差价合约的保证金?

IBKR根据每只底层股票的历史波动率建立了基于风险的保证金要求机制。最低保证金为10%。 大多数IBKR差价合约都应用该保证金率,这使差价合约在大多数情况下都比底层股票交易更具效率。 零售客户须满足欧洲监管机构ESMA规定的额外保证金

要求。 请参见ESMA差价合约新规推行了解详细信息。单个差价合约头寸之间或差价合约与底层股票头寸之间没有投资组合抵消。集中头寸和超大头寸可能需要准备额外的保证金。请参见差价合约保证金要求了解更多详细信息。

空头股票差价合约会要强制补仓吗?

是的。如果底层股票很难或者根本不可能借到,则空头差价合约头寸的持有者将需要进行补仓。

IB如何处理股息和公司行动?

IBKR通常会为差价合约持有者反映公司行动的经济效应,就好像他们一直持有着底层证券一样。股息会表现为现金调整,而其他行动则会通过现金或头寸调整表现。例如,如果公司行动导致股票数量发生变化(如股票分隔和逆向股票分隔),差价合约的数量也会相应地进行调整。如果行动导致产生新的上市实体,且IBKR决定将其股票作为差价合约交易,则需要创建适当数量之新的多头或空头头寸。要了解概述信息,请参见差价合约公司行动。

*请注意,某些情况下对于合并等复杂公司行动可能无法对差价合约进行准确调整。这时候,IBKR可能会在除息日前终止差价合约。

任何人都能交易IBKR差价合约吗?

除美国、加拿大和香港的居民,其他所有客户都能交易IBKR差价合约。新加坡居民可交易除新加坡上市之股票差价合约以外的其它IBKR差价合约。任何投资者类型都不能免于这一基于居住地的限制。

我需要做什么才可以开始在IBKR交易差价合约?

您需要在账户管理中设置差价合约交易许可,并同意相关交易披露。如果您的账户是在IB LLC开立,则IBKR将设置一个新的账户板块(即您当前的账户号码加上后缀“F”)。设置确认后您便可以开始交易了。您无需单独为F账户注资,资金会从您的主账户自动转入以满足差价合约保证金要求。

有什么市场数据要求吗?

IBKR股票差价合约的市场数据便是底层股票的市场数据。因此需要具备相关交易所的市场数据许可。如果您已经为股票交易设置了交易所的市场数据许可,那么就无需再进行任何操作。如果您想在当前并无市场数据许可的交易所交易差价合约,您可以设置许可,操作与底层股票的市场数据许可设置相同。

差价合约交易与头寸在报表中如何反映?

如果您是在IB LLC持有账户,且您的差价合约头寸持有在单独的账户板块(主账户号码加后缀“F”)中。您可以选择单独查看F板块的活动报表,也可以选择与主账户合并查看。您可在账户管理的报表窗口进行选择。对于其他账户,差价合约通常会与其他交易产品一起在您的账户报表中显示。

我可以从其他经纪商处转入差价合约头寸吗?

IBKR当前不支持差价合约头寸转账。

股票差价合约可以使用图表功能吗?

是的。

在IBKR交易差价合约有什么账户保护?

差价合约以IB英国作为您的交易对方,不是在受监管的交易所进行交易,也不是在中央结算所进行结算。因IB英国是您差价合约交易的对方,您会面临与IB英国交易相关的财务和商业风险,包括信用风险。但请注意,所有客户资金永远都是完全隔离的,包括对机构客户。IB英国是英国金融服务补偿计划(“FSCS”)参与者。IB英国不是美国证券投资者保护公司(“SIPC”)成员。请参见IB英国差价合约风险披露文件了解有关差价合约交易风险的详细信息。

在哪种类型(如个人、朋友和家庭、机构等)的IBKR账户中可交易差价合约?

所有保证金账户均可进行差价合约交易。现金账户和SIPP账户不能。

在某一特定差价合约中我最多可持有多少头寸?

没有预设限制。但请注意,超大头寸可能会有更高保证金要求。请参见CFD保证金要求了解更多详细信息。

我能否通过电话交易差价合约?

不要。在极端情况下我们可能同意通过电话处理平仓定单,但绝不会通过电话处理开仓定单。

差价合约属于复杂金融产品,其交易存在高风险,由于杠杆的作用,可能会出现迅速亏损。

在通过IBKR(UK)交易差价合约时,有67%的零售投资者账户出现了亏损。

您应考虑自己是否理解差价合约的运作机制以及自己是否能够承受亏损风险。

ESMA规定

欧洲证券与市场管理局(ESMA)发布临时产品干涉措施,自2018年8月1日起生效。

ESMA决议实施的限制包括:1) 开仓差价合约头寸的杠杆限制;2) 以单个账户为单位的保证金平仓规则;3) 以单个账户为单位的负余额保护规则;4) 对交易差价合约激励措施的限制;以及5) 标准的风险警告。

ESMA新规仅适用于零售客户。 专业客户不受影响。

Dividend Accruals

If you are a shareholder of record as of the close of business on a dividend Record Date (see KB47), you are entitled to receive the dividend on its Payment Date. While the actual dividend amount is not assured until the payment has been made by the issuer on the Payment Date, information deemed reliable is available such that IB will accrue the value of the dividend, net of any withholding taxes, on the Ex-Date. This information can be confirmed via the Daily Activity Statement posted to Account Management. The details of the accrual will be reflected in the statement section titled "Change in Dividend Accruals" and the net amount in a line item titled "Dividend Accruals" under the "Net Asset Value" section. If you wish to see information regarding dividends that you held through the Ex Date but which have not yet been paid out, choose "Legacy Full" from the Statements drop down when launching your statement. This will include an additional section called "Open Dividend Accruals" which will give you information on any pending dividends.

Note that dividend accruals may be either a debit (if short and borrowing the stock on the Record Date) or a credit (if long the stock on the Record date). In terms of account valuation, the dividend accrual is included in Equity with Loan Value as well as equity for purposes of determining compliance with the Pattern day Trading rules. A dividend credit accrual does not increase Available Funds and can therefore not be withdrawn until paid. A dividend accrual which is a debit does reduce Available Funds to ensure that funds are available to meet the obligation when payment is due.

Overview of IBKR's Dividend Reinvestment Program (DRIP)

IBKR offers a dividend reinvestment program whereby accountholders may elect to reinvest qualifying cash dividends to purchase shares in the issuing company. Outlined below are a series of FAQs which describe the program and its operation.

1. How can I participate in the program?

Requests to participate are initiated online via Client Portal. The menu options vary by account type and are outlined below:

• Individual, Joint, Trust, IRA, Small Business Accounts – click on the User menu (head and shoulders icon in the top right corner) followed by Settings. Under Trading, click Dividend Election where you can enable the program. Read the agreement, type your signature in the field provided and click Subscribe.

• Advisor and Broker Master and Proprietary Trading Group STL Master Users – Select the Contacts tab from the Dashboard on the Home page. Click the Information icon “I” for the desired client account or service account to open the Client Account Details page. Enable dividend reinvestment by clicking the Edit link in the Account Configuration section.

Once enabled, you’ll be provided with an acknowledgement requiring entry of your electronic signature in order to click the Continue button. Automatic dividend reinvestment will be effective the next business day.

2. What accounts are eligible to participate in IBKR's Dividend Reinvestment Program?

Dividend Reinvestment is available to IB LLC, IB AU, IB CAN, IB HK, IB IE, IB JP, IB SG and IB UK clients only.

3. Which securities are eligible for dividend reinvestment?

Only U.S. and Canada-listed common and preferred stocks paying cash dividends are eligible for reinvestment.

4. When does reinvestment occur?

If you are a shareholder of record as of the close of the dividend record date (see KB47) and enrolled in the dividend reinvestment program prior to the dividend payment date, IBKR will use the dividend payment to purchase additional shares of that stock on the morning of the trading day which follows confirmation of our receipt of the dividend. For accounts with AutoFX enabled, when the DRIP system runs that what-if credit check, the Credit Manager will now consider the cash balances across all the currencies the account has, allowing for FX to be booked to fund the DRIP trade if needed. If a customer's credit-check fails on the day dividend was paid, the system continues to check for the next 30 days and may include it in the DRIP file when the credit-check passes. In this case the system may book a delayed DRIP trade (i.e. trade date after paydate). IBKR will also look back 30 days from the date of enrollment and will reinvest any dividends paid to the account within that 30 day time period. Note that shares are not purchased via an issuer-sponsored reinvestment plan but rather in the open market.

5. At what price does reinvestment take place?

As shares are purchased in the open market, generally at or near the opening of trading and subject to market conditions, the price cannot determined until the total number of shares for all program participants have been purchased using combined funds. In the event that the purchase is executed in multiple smaller trades at varying prices, participants will receive the weighted-average price of such shares (i.e., each participant receives the same price). In the event IBKR is unable to reinvest the combined proceeds, each participant will receive shares on a pro rata basis (based on the dividend amount to which each participating client is entitled).

6. Are the full proceeds of the cash dividend available for reinvestment?

No. Only the proceeds net of commissions and taxes (if the account is subject to withholding) is reinvested.

7. Are dividends from shares purchased on margin and loaned by IBKR eligible for reinvestment?

Yes. If IBKR maintains a lien on shares as a result of a margin loan, the account holder will receive a cash payment in lieu of and equal to the dividend payment. This payment in lieu will be used to purchase additional shares of that stock.

8. Are dividends from shares loaned through IBKR’s Yield Enhancement Program eligible for reinvestment?

Yes. While IBKR makes every effort to recall shares loaned through this program prior to the dividend record date, if such shares are not recalled the account holder will receive a cash payment in lieu of and equal to the dividend payment. This payment in lieu will be used to purchase additional shares of that stock.

9. Is the dividend reinvestment subject to a commission charge?

Yes, standard commissions as listed on the IBKR website are applied for the purchase. Please note that the minimum commission charge is the lesser of the stated minimums (USD 1 for the Fixed structure and USD 0.35 for the Tiered structure) or 1% of the trade value.

10. What happens if my account is subject to a margin deficiency when reinvestment occurs?

If your account is in a margin deficit and can’t initiate new positions, dividends will not be reinvested, even if you have dividend reinvestment enabled. Please note that dividend reinvestment orders are credit-checked at the time of entry—should an account go into margin deficiency at any time after that, including as a result of the end-of-day SMA check and the end of Soft Edge Margin, the account will become subject to automated liquidation.

11. Can account holders elect which securities are eligible for reinvestment?

Yes, account holders may elect which securities are eligible for dividend reinvestment.

12. Are fractional shares eligible for the Dividend Reinvestment Program (DRIP)?

Yes, it is possible to receive fractional shares for a reinvested dividend through the Dividend Reinvestment Program (DRIP) as long as the account has fractional share permissions.

13. Does dividend reinvestment cover solely regular cash dividends or are special cash dividends reinvestment as well?

All cash dividends are reinvested.

14. What are the tax considerations associated with dividend reinvestment?

The purchase of a shares via DRIP is similar to that of any other share purchase for purposes of tax reporting. In the case of U.S. taxpayers:

- When the shares purchased via DRIP are sold they will be reported on the Form 1099B for US taxpayers in the year in which they are sold. The gain or loss will be calculated based on the FIFO method unless the account holder has selected a different method. The cost basis will be that price at which the shares were purchased and the acquisition date the date of reinvestment or purchase (not the day the dividend is paid).

- Shares purchased via dividend reinvestment are subject to wash sale calculations (i.e., if you sold a security for a loss within 30 days before or after the purchase, a wash sale will occur and that loss deferred).

- Dividend payments are subject to reporting on the Form 1099DIV as current year income even when reinvested.

In the case of non-U.S. taxpayers:

- The cash dividend is subject to U.S. tax withholding prior to reinvestment. Withholding is performed at the statutory rate or at the treaty rate, where available. All income and withholding will be reported on the Form 1042-S for the year in which the dividend payment was received.

Overview of Dividend Payments in Lieu ("PIL")

Payment In Lieu of a Dividend (“payment in lieu” or “PIL”) is a term commonly used to describe a cash payment to an account in an amount equivalent to the ordinary dividend. Generally, the amount paid is per share owned. In addition, the dividend in most cases is paid quarterly (i.e., four times per year). The dividend payment is classified as follows: (1) ordinary dividend; and/or (2) payment in lieu of dividend. The former designation is for a payment received directly from the issuer or its paying agent. The latter designation is used when a cash payment is received from other than the issuer or the issuer’s agent.

Payment in lieu of an ordinary dividend may be received when the shares have been bought on margin, or when the account has a subsequent margin loan due to borrowing money to facilitate the payment for additional purchases of shares or as the result of a withdrawal from the margin account. Payment in lieu of a dividend may also be received when shares are owed to the brokerage firm and have not been received by the dividend record date.

To better understand the difference between an ordinary dividend and a payment in lieu, we will explain the steps taken by IB to comply with US regulations. Each business day, the Firm analyzes the positions in each customer account, every borrow, every loan, every pledge of shares for each security held by its customers to determine how many shares are held on margin and the associated margin loan balances. For each security that is fully paid, we are required to segregate those shares in a good control location (for example, a depository or a US bank. See KB1964). For shares that are held as collateral for a margin loan we are allowed to hypothecate and re-hypothecate shares valued up to 140 percent of the total debit balance in the customer account (See KB1967).

While the guidelines noted above for segregation of securities are clear, there are exceptions that are outside of the Firm's control. For instance, through no fault of its own, IB may have a deficit in segregated shares due to customer activity that changes the Firm’s overall segregation requirement for a security. This may be for a variety of reasons including a delay in receiving shares that have been loaned out to a counterparty after segregation requirements are recalculated and the Firm has issued a stock loan recall, sales of securities by one or more customers that reduce or eliminate margin loans, the deposit of cash by customers that similarly reduce or eliminate margin loans, or a failure of a counterparty to deliver shares for a trade settlement.

Upon issuing a recall of shares loaned, rules permit the borrower of the shares up to 3 business days to return them. The borrower of the shares is required to return them to us when we issue a recall, but if by business day 3 the shares have not been returned, IB may then issue a buy-in notice to begin the process of regaining possession of the shares. An additional 3 business days is generally needed for the purchased shares to settle and be delivered to the firm. Similarly if a counterparty fails to deliver by settlement date, shares to IB to settle a customer purchase, IB can issue a buy-in notice but the purchase of such shares are also subject to trade settlement in 3 days.

To summarize, if by the record date of a dividend certain shares have not been delivered to IB, the Firm will be paid an amount of cash that is equivalent to the dividend amount, but IB will not receive a qualified dividend payment directly from the issuer. In such cases, the Firm will receive PIL and will have no choice but to allocate such payment in lieu to customer accounts. The firm first allocates PIL to those accounts who hold the shares as collateral for a margin loan. If, after PIL is allocated to all shareholders whose accounts are not fully paid, any portion of PIL remains to be paid, it is allocated on a pro-rata basis to each remaining client account.

Account holders should be aware that a PIL may have different tax consequences than an ordinary dividend and should consult a tax advisor to understand such differences and whether they apply to their particular situation.