Проценты по выручке от коротких продаж

Как определить сумму процентных выплат и комиссий, связанных с займом акций.

Когда владелец счета открывает короткую позицию по акциям, IBKR занимает эквивалентные акции от его лица, чтобы исполнить свои обязательства по поставке акций покупателю. Договор о кредитовании ценных бумаг, по которому данные бумаги берутся в кредит, обязывает IBKR предоставить кредитору ценных бумаг денежный залог. Сумма залога основана на отраслевом стандарте расчета стоимости акций.

Кредитор акций выплачивает IBKR проценты по денежному залогу и также взимает комиссию за услуги, снижая сумму процентов ниже преобладающей рыночной процентной ставки по денежным залогам (как правило, ставка зависит от фактической ставки ФРС для денежных депозитов в USD). В случае с труднозанимаемыми акциями комиссия кредитора за предоставление акций может привести к отрицательной процентной ставке, взимаемой с IBKR.

Хотя многие брокеры предлагают часть этой скидки только институциональным клиентам, все клиенты IBKR получают проценты по выручке от короткой продажи акций, если она превышает 100 000 USD или эквивалентную сумму в другой валюте. Когда предложение по кредитованию ценной бумаги превышает спрос на ее заем, владельцы счетов могут получить проценты по своему короткому балансу, равные базовой ставке (например, ставке по однодневным кредитам ФРС для балансов, номинированных в USD) за вычетом спреда (который в данный момент составляет от 1,25% для балансов в 100 000 USD до 0,25% для балансов больше 3 000 000 USD). Ставки могут меняться без уведомления.

Когда спрос и предложение по ценной бумаге находятся на таком уровне, что бумаги становятся труднодоступными, скидка кредитора снижается и даже может стать отрицательной, и тогда со счета будут списаны средства. Скидка или списание будет перенаправлено на владельца счета в виде более высокой комиссии за кредит, которая может превысить проценты по выручке от короткой продажи и привести к списанию средств со счета. Поскольку в разные даты и с разных ценных бумаг взимаются разные ставки, IBKR рекомендует клиентам воспользоваться инструментом поиска акций для шортинга, доступным в разделе "Поддержка" на "Портале клиентов" или в "Управлении счетом", в котором можно просмотреть примерные ставки по коротким продажам. Обратите внимание, что ориентировочные ставки, указанные в данных инструментах, отражают проценты по выручке от коротких продаж, которые IBKR выплачивает по балансам III уровня, то есть по дополнительной выручке от короткой продажи на сумму в 3 млн USD или больше. Для балансов ниже этого порога ставка меняется в зависимости от суммы и базовой ставки для валюты сделки. Точную ставку можно узнать с помощью калькулятора в разделе "Выплачиваемые вам проценты по сальдо выручки от коротких продаж".

Больше примеров и калькулятор доступны на странице "Кредитование ценных бумаг".

ВАЖНОЕ ПРИМЕЧАНИЕ

Информация в TWS и инструменте поиска акций, которая касается доступности акций и ориентировочных ставок, предлагается по мере возможности, и мы не можем гарантировать точность и верность приводимых данных. Информация о доступности акций включает данные от сторонних организаций и не обновляется в реальном времени. Информация о ставках приводится только в справочных целях. Расчет по сделкам, которые исполняются в текущую торговую сессию, как правило, выполняется через 2 рабочих дня, и фактическая стоимость займа и доступность акций определяются в день расчетов. Трейдерам следует учитывать, что доступность и стоимость займа акций может значительно измениться за период расчета, особенно это касается низколиквидных акций, акций компаний с низкой капитализацией и акций с предстоящими корпоративными действиями (включая выплату дивидендов). Более подробная информация приведена в статье "Операционные риски коротких продаж".

Программа повышения доходности акций в IBKR

ОБЗОР ПРОГРАММЫ

Программа повышения доходности (Stock Yield Enhancement Program или SYEP) дает Вам возможность дополнительного заработка, наделяя IBKR правом одалживать Ваши полностью оплаченные акции в обмен на залог, а затем выдавать эти акции в кредит трейдерам, желающим использовать их для коротких продаж и платить за это. Дополнительная информация о "Программе повышения доходности акций" доступна здесь и на странице часто задаваемых вопросов.

КАК ПРИСОЕДИНИТЬСЯ К "ПРОГРАММЕ ПОВЫШЕНИЯ ДОХОДНОСТИ АКЦИЙ"

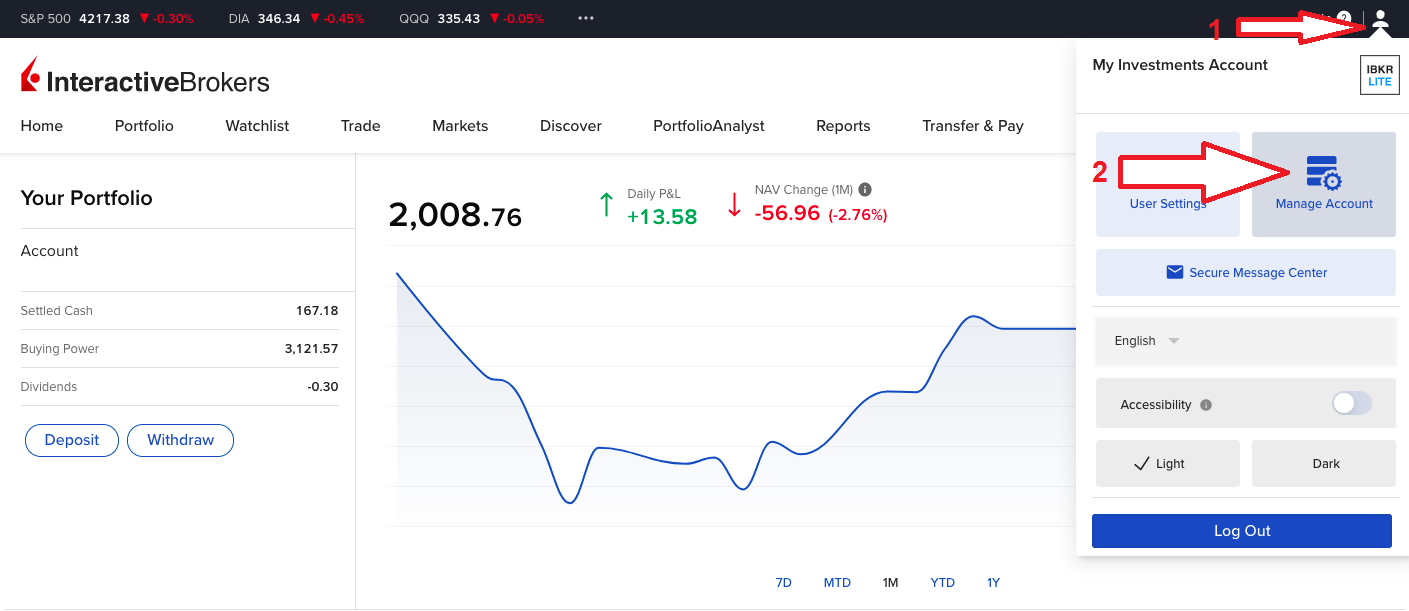

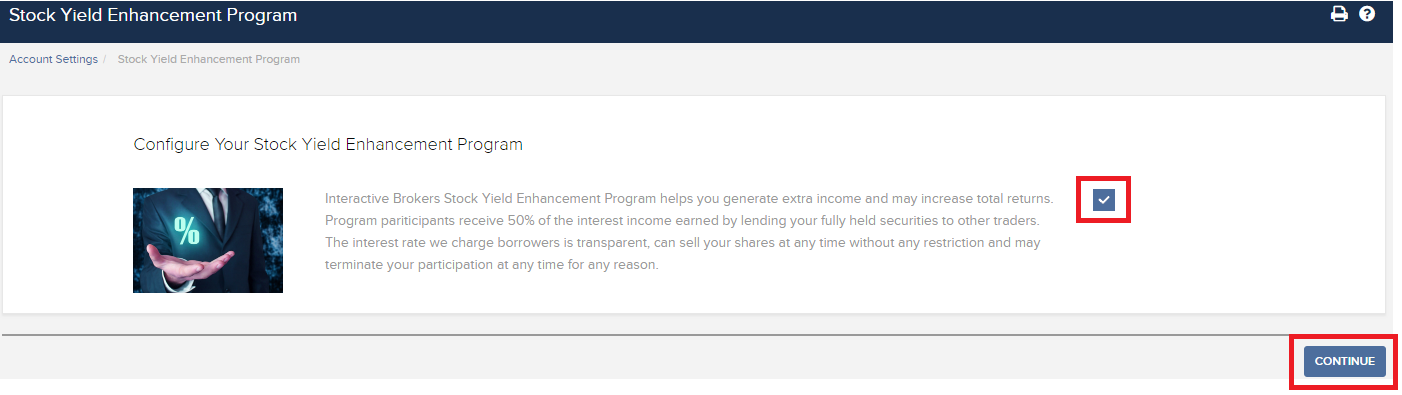

Чтобы присоединиться, войдите в "Портал клиентов". Войдя, откройте меню пользователя (значок силуэта в правом верхнем углу) и выберите "Параметры". В разделе настроек нажмите на кнопку конфигурации (значок шестеренки) рядом с пунктом "Программа повышения доходности акций". На открывшейся странице поставьте галочку в соответствующую графу и щелкните "Далее". Затем Вам будут предоставлены обязательные для участия в программе формы и уведомления. Когда Вы изучите и подпишете их, Ваш запрос будет отправлен на обработку. Рассмотрение запроса может занять от 24 до 48 часов.

.png)

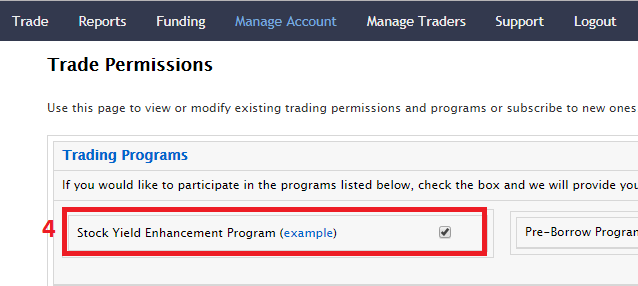

Чтобы присоединиться к программе через классическое "Управление счетом", нажмите на изображенные ниже кнопки в указанном порядке.

Программа повышения доходности акций (SYEP): ЧаВО

В чем цель "Программы повышения доходности акций"?

"Программа повышения доходности акций" (англ. Stock Yield Enhancement program, или SYEP) предоставляет клиентам возможность получать дополнительный доход от позиций по ценным бумагам, которые в противном случае бы не использовались (т.е. полностью оплаченных ценных бумаг и ценных бумаг с избыточной маржей), разрешая IBKR передавать эти бумаги в кредит третьим сторонам. Участники программы получают денежный залог для обеспечения возврата ссуды акций по ее окончании, а также проценты по денежному залогу, выплачиваемые заемщиком за каждый день ссуды.

Что такое полностью оплаченные ценные бумаги и бумаги с избыточной маржей?

Полностью оплаченные ценные бумаги – это бумаги на счете клиента, которые были оплачены целиком. Ценные бумаги с избыточной маржей – это бумаги, которые не были полностью оплачены, но рыночная стоимость которых превышает 140% от маржевого дебетового остатка на счете клиента.

Как определяется доход, полученный клиентом по какой-либо кредитной сделке в рамках "Программы повышения доходности акций"?

Доход, получаемый клиентом в обмен на предоставленные акции, зависит от кредитных ставок на внебиржевом рынке ценных бумаг. Эти ставки отличаются для разных ценных бумаг и сроков кредита. Как правило, IBKR выплачивает участникам проценты по их денежному залогу в размере примерно 50% от суммы, полученной IBKR за предоставление акций в кредит.

Как определяется сумма денежного залога для ссуды?

Денежный залог, который лежит в основе ссуды ценных бумаг и используется для расчета процентных выплат, определяется с помощью соглашений рынка. По этим соглашениям цена акции при закрытии рынка умножается на определенный процент (обычно 102-105%) и затем округляется в бо́льшую сторону до ближайшего доллара / цента / пенса и т.д. Условия соглашения отличаются для разных валют. Например, заем в 100 акций в USD, цена закрытия которых составляет $59,24, будет равен $6100 ($59,24 * 1,02 = $60,4248; округленное до $61, умноженное на 100). Ниже приведена таблица с условиями соглашений для разных валют:

| USD | 102%; округление до ближайшего доллара |

| CAD | 102%; округление до ближайшего доллара |

| EUR | 105%; округление до ближайшего цента |

| CHF | 105%; округление до ближайшего раппена |

| GBP | 105%; округление до ближайшего пенса |

| HKD | 105%; округление до ближайшего цента |

Подробнее можно узнать в статье KB1146.

Как и где хранится залог по кредитам SYEP?

В случае с клиентами IBLLC залог будет храниться в виде наличных средств или казначейских ценных бумаг США и будет передан на хранение партнеру IBLLC – IBKR Securities Services LLC ("IBKRSS"). Залог по Вашему займу в рамках данной программы будет храниться в IBKRSS на счете, в отношении которого у Вас будет первоочередное обеспечительное право. В случае дефолта со стороны IBLLC у Вас будет доступ к залогу напрямую через IBKRSS без посредничества IBLLC. Подробнее об условиях хранения можно узнать в соглашении об управлении счетом ценных бумаг. Если Ваш счет открыт в другом филиале IBKR, то залог будет храниться и застрахован данным филиалом. Например, залог для счетов в IBIE хранится и застрахован IBIE.

Как длинная продажа и перевод акций, предоставленных в кредит через SYEP, или выход из программы влияет на проценты?

Начисление процентов прекращается на следующий рабочий день после сделки (T+1). Также проценты перестают начисляться на следующий рабочий день после даты начала перевода или выхода из программы.

Каковы условия участия в "Программе повышения доходности акций" IBKR?

| Филиалы, участвующие в программе* |

| IB LLC |

| IB UK (кроме счетов SIPP) |

| IB IE |

| IB CE |

| IB HK |

| IB Canada (кроме счетов RRSP/TFSA) |

| IB Singapore |

| Типы счетов, которые могут участвовать в программе |

| Наличный (капитал не менее $50 000 на день вступления) |

| Маржевый |

| Счета клиентов финансового консультанта* |

| Счета клиентов представляющего брокера: с полным раскрытием информации и без раскрытия информации* |

| Омнибус-счета представляющего брокера |

| Счета с раздельным торговым лимитом (Separate Trading Limit, или STL) |

*Счета-участники должны соответствовать критериям в отношении минимального капитала маржевого или наличного счета.

Программа недоступна для клиентов IB Japan, IB Europe SARL, IBKR Australia и IB India. Клиенты из Японии и Индии, имеющие счета в IB LLC, могут участвовать в программе.

Также присоединиться к программе могут счета клиентов финансового консультанта, клиенты IBroker с полным раскрытием информации и омнибус-брокеры, отвечающие требованиям выше. В случае с финансовыми консультантами и брокерами IBroker их клиенты должны сами подписать соглашения. В случае омнибус-брокера соглашение подписывает он сам.

Могут ли в программе SYEP участвовать пенсионные IRA-счета?

Да.

Могут ли в программе SYEP участвовать сегменты IRA-счетов под "Управлением активами" Interactive Brokers?

Нет.

Могут ли в программе SYEP участвовать пенсионные счета SIPP Великобритании?

Нет.

Что произойдет, если остаток средств на участвующем счете упадет ниже требуемого порога в $50 000?

Наличный счет должен соответствовать данному требованию о минимальном капитале только на момент регистрации в программе. Если впоследствии сумма капитала упадет ниже данного уровня, это не повлияет на существующие ссуды и возможность предоставлять новые.

Как стать участником "Программы повышения доходности акций" IBKR?

Присоединиться к программе можно на "Портале клиентов". Авторизуйтесь на портале и затем откройте меню пользователя (иконка профиля в правом верхнем углу) и зайдите в Настройки. Затем в Настройках счета найдите раздел Торговля и выберите пункт Программа повышения доходности акций, чтобы присоединиться. На экране отобразятся формы и уведомления, необходимые для участия в программе. Прочитайте и подпишите документы, после чего Ваш запрос будет отправлен на обработку. Одобрение занимает 24-48 ч.

Как выйти из "Программы повышения доходности акций"?

Чтобы выйти из программы, зайдите на "Портал клиентов". Откройте меню пользователя (иконка профиля в правом верхнем углу) и зайдите в Настройки. В Настройках счета найдите раздел Торговля, выберите пункт Программа повышения доходности акций и следуйте инструкциям. Ваш запрос будет отправлен на обработку. Запросы на выход из программы, как правило, выполняются в конце дня.

Если счет становится участником, а позже выходит из программы, когда он сможет снова к ней присоединиться?

После выхода из программы счет не может снова участвовать в SYEP в течение 90 календарных дней.

Какие типы позиций по ценным бумагам могут быть предоставлены в кредит?

| Рынок США | Рынок ЕС | Рынок Гонконга | Рынок Канады |

| Обыкновенные акции (котируемые на бирже, внебиржевом рынке PINK и на OTCBB) | Обыкновенные акции (котируемые на бирже) | Обыкновенные акции (котируемые на бирже) | Обыкновенные акции (котируемые на бирже) |

| ETF | ETF | ETF | ETF |

| Привилегированные акции | Привилегированные акции | Привилегированные акции | Привилегированные акции |

| Корпоративные облигации* |

*Недоступно для муниципальных облигаций.

Есть ли ограничения на кредитование акций, торгуемых на вторичном рынке после IPO?

Нет, при условии, что на счет не распространяются ограничения на торговлю данными ценными бумагами.

Как IBKR определяет количество акций, которые могут быть предоставлены в кредит?

Сначала IBKR определяет стоимость ценных бумаг (если таковые имеются), в отношении которых IBKR обладает залоговым правом и которые может выдавать в кредит без участия клиента в "Программе повышения доходности акций". Брокер, который кредитует покупку ценных бумаг клиентами с помощью маржинальных займов, по закону может выдавать кредит или предоставлять в качестве залога ценные бумаги этого клиента на сумму до 140% от денежного дебетового остатка. Например, если клиент с денежным балансом в $50 000 покупает ценные бумаги, рыночная стоимость которых составляет $100 000, то дебетовый или остаток по кредиту составит $50 000, и брокер имеет право взыскать до 140% этого остатка (т.е. ценные бумаги на $70 000). Любые ценные бумаги клиента сверх этой суммы являются ценными бумагами с избыточной маржей (в данном примере $30 000) и должны быть обособлены, если только клиент не предоставит IBKR разрешение на кредитование через "Программу повышения доходности акций".

Дебетовый остаток определяется путем конвертации в USD всех денежных остатков в других валютах и затем вычитания прибыли от коротких продаж акций (при необходимости сконвертированных в USD). Если полученное значение является отрицательным, то мы высвобождаем до 140% от этой суммы. Кроме того, не учитываются остатки денежных средств в товарном сегменте или предназначенные для спот-металлов и CFD. Подробное объяснение доступно на этой странице.

ПРИМЕР 1. Клиент имеет длинную позицию в 100 000 EUR на счете, базовая валюта которого – USD, курс пары EUR.USD составляет 1,40. Клиент покупает акции, выраженные в USD, на сумму $112 000 (80 000 EUR). Все ценные бумаги считаются полностью оплаченными, поскольку денежный остаток, сконвертированный в USD, является кредитовым.

| Составляющая | EUR | USD | База (USD) |

| Наличные средства | 100 000 | (112 000) | $28 000 |

| Длинные акции | $112 000 | $112 000 | |

| NLV | $140 000 |

ПРИМЕР 2. Клиент имеет длинную позицию в 80 000 USD, длинную позицию по акциям, выраженным в USD, на сумму $100 000, и короткую позицию по акциям, выраженным в USD, на сумму $100 000. Длинные акции на общую сумму в $28 000 считаются маржинальными бумагами, а оставшиеся (на сумму $72 000) являются бумагами с избыточной маржей. Это значение получено путем вычитания доходов от короткой продажи акций из остатка денежных средств ($80 000 - $100 000) и умножением получившегося значения дебета на 140% ($20 000 * 1,4 = $28 000).

| Составляющая | База (USD) |

| Наличные средства | $80 000 |

| Длинные акции | $100 000 |

| Короткие акции | ($100 000) |

| NLV | $80 000 |

Будет ли IBKR выдавать в кредит все подходящие акции?

Мы не гарантируем, что все участвующие в SYEP акции будут выданы в кредит, поскольку для некоторых бумаг может не быть рынка с выгодной ставкой, IBKR может не иметь доступа к рынку с желающими взять данные акции в кредит, или IBKR может решить не выдавать Ваши акции в кредит.

Кредиты в рамках SYEP выдаются только с шагом в 100?

Нет. Кредиты предоставляются на любую целую сумму акций, но внешне мы выдаем ссуды только в количестве, кратном 100. Таким образом, существует вероятность, что при наличии внешнего спроса на заимствование 100 акций мы предоставим в кредит 75 акций от одного клиента и 25 от другого.

Как ссуды распределяются среди клиентов, когда число доступных акций превышает спрос на заем?

В случае если спрос на заем определенной ценной бумаги меньше, чем предложение доступных акций от участников "Программы повышения доходности акций", ссуды будут распределены пропорционально. Например, если совокупное предложение составляет 20 000, а спрос – 10 000, то в кредит будет выдано 50% акций каждого клиента.

Акции выдаются в кредит только клиентам IBKR или другим третьим лицам?

Акции могут быть предоставлены в кредит любому контрагенту, а не только другим клиентам IBKR.

Может ли участник SYEP указать, какие акции IBKR может предоставить в кредит?

Нет. Программа полностью управляется IBKR. Определив ценные бумаги (если таковые есть), которые IBKR может предоставить в кредит на основании залогового права, компания может по своему усмотрению решить, какие из полностью оплаченных ценных бумаг или бумаг с избыточной маржей могут быть выданы в кредит.

Есть ли ограничения на продажу ценных бумаг, выданных в кредит по программе SYEP?

Участвующие в программе акции можно продать в любое время без каких-либо ограничений. Акции не нужно возвращать для расчета по сделке, а доход от продажи зачисляется на счет клиента в обычный срок. Кроме того, кредитный договор будет прекращен при открытии рынка в рабочий день, следующий за датой продажи ценных бумаг.

Может ли клиент продать покрытый колл по акциям, предоставленным в кредит в рамках SYEP, и получить условия маржи покрытого колла?

Да. Ссуда акций не влияет на маржинальные требования на непокрытой или хеджированной основе, поскольку кредитор сохраняет право на любую прибыль и несет ответственность за любые убытки, связанные с выданной в кредит позицией.

Что произойдет с выданными в кредит акциями, если они будут поставлены в результате уступки колла или исполнения пута?

Такой кредитный договор будет прекращен в режиме T+1 после соответствующего действия (сделки, уступки, исполнения), которое привело к закрытию или уменьшению позиции.

Что произойдет с выданными в кредит акциями, если позднее торговля ими на бирже будет приостановлена?

Временное прекращение торгов не оказывает прямого влияния на возможность выдавать акции в кредит, и пока IBKR может предоставлять их в кредит, такая ссуда будет оставаться в силе вне зависимости от статуса торгов.

Можно ли перенести денежный залог от ссуды в товарный сегмент для покрытия маржи и/или колебаний?

Нет. Денежный залог для обеспечения ссуды никак не влияет на маржу или финансирование.

Что произойдет, если участник программы возьмет маржинальный кредит или увеличит остаток по кредиту?

Если у клиента есть полностью оплаченные ценные бумаги, предоставленные в кредит по "Программе повышения доходности акций", и он возьмет маржинальный кредит, то этот кредит будет прекращен в той степени, в которой ценные бумаги не имеют избыточной маржи. Аналогичным образом, если у клиента есть ценные бумаги с избыточной маржей, предоставленные в кредит по программе SYEP, и он увеличивает существующий маржинальный кредит, то этот кредит может быть прекращен в той степени, в которой бумаги не имеют избыточной маржи.

При каких условиях кредит будет прекращен?

Ссуда ценных бумаг будет автоматически прекращена в следующих случаях:

- Если клиент решает выйти из программы

- Перевод акций

- Заимствование определенной суммы под залог акций

- Продажа акций

- Уступка колла/исполнение пута

- Закрытие счета

Получают ли участники SYEP дивиденды по предоставленным в кредит акциям?

Акции, участвующие в программе SYEP, как правило, отзываются у заемщиков до экс-дивидендной даты с целью получить дивиденды и избежать плату в возмещение дивидендов. Однако участники также могут получить такую плату.

Остается ли у участников SYEP право голоса по выданным в кредит акциям?

Нет. Право голоса и предоставления согласия в отношении акций переходит к заемщику ценных бумаг, если дата регистрации акционеров или срок для голосования, предоставления согласия или принятия других мер выпадает на срок займа.

Получают ли участники SYEP права, варранты или "спин-офф" акции выданных в кредит бумаг?

Да. Кредитор ценных бумаг получит любые права, варранты, акции "спин-офф" (акции в результате создания дочерней компании) и размещения, принадлежащие предоставленным в кредит бумагам.

Как ссуды отображены в отчете по операциям?

Денежный залог, акции в обращении, активность и доход отражены в следующих 6 разделах:

1. Сведения о денежных средствах – сведения о начальном балансе денежного залога (казначейских бумагах США или наличных средствах), чистое изменение в результате ссуды (положительное значение, если открыты новые ссуды; отрицательное в случае чистой прибыли) и конечный баланс денежного залога.

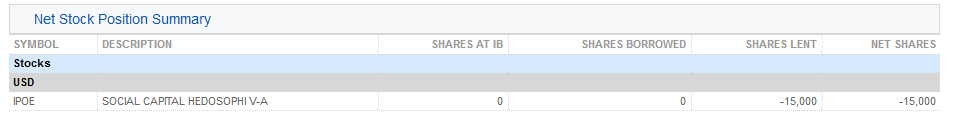

2. Данные о чистой позиции по акциям (Net Stock Position Summary) – для каждой акции указаны следующие сведения: общее количество акций в IBKR; количество заимствованных акций; число акций, выданных в кредит; и чистое число акций (= акции в IBKR + взятые в кредит акции - акции, выданные в кредит).

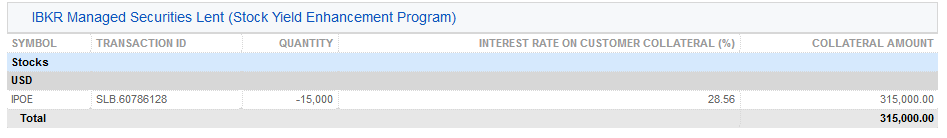

3. Выданные в кредит акции под управлением IBKR (IB Managed Securities Lent) – отражает для каждой акции, участвующей в SYEP, количество выданных в кредит акций, процентную ставку (%).

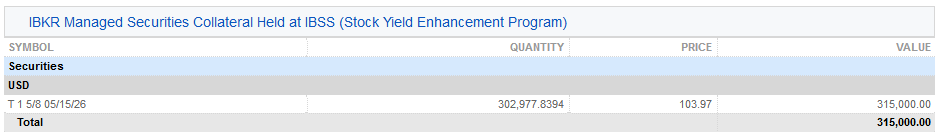

3a. Залог за бумаги под управлением IBKR, хранимый в IBSS (IBKR Managed Securities Collateral Held at IBSS) – на счетах клиентов IBLLC отображается дополнительный раздел с данными о казначейских бумагах США, используемых в качестве залога, количестве, цене и общей сумме, обеспечивающей заем акций.

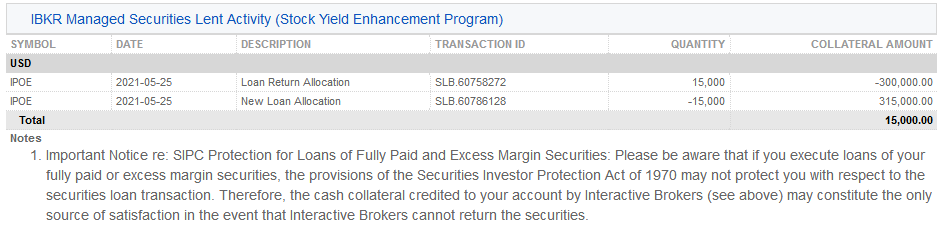

4. Операции с выданными в кредит ценными бумагами под управлением IBKR (IBKR Managed Securities Lent Activity) – отражает операции по кредиту для каждой ценной бумаги, включая распределения возврата займа (т.е. прекращенные ссуды); распределения новых займов (т.е. новые ссуды); количество акций; чистую процентую ставку; ставку по залогу клиента и сумму залога.

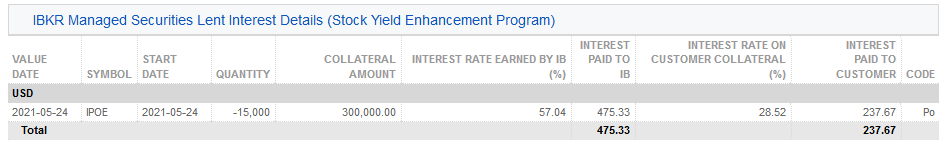

5. Проценты по операциям с выданными в кредит ценными бумагами под управлением IBKR (IBKR Managed Securities Lent Activity Interest Details) – отражает сведения об индивидуальной кредитной базе, включая проценты, полученные IBKR; доход, полученный IBKR (отражает общий доход, который получает по кредиту IBKR, вычисляемый как {сумма залога * процентная ставка}/360); ставку по залогу клиента (примерно половина от суммы дохода IB по кредиту) и проценты, выплаченные клиенту (сумма процентов, полученная по залогу клиента).

Примечание. Данный раздел будет отображаться только в том случае, если начисленные проценты, полученные клиентом за отчетный период, превышают 1 USD.

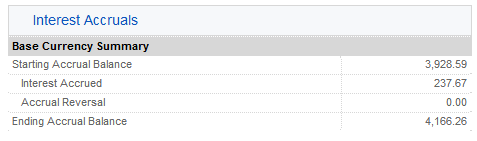

6. Процентные начисления (Interest Accruals) – процентный доход учитывается как процентное начисление и рассматривается как любое другое начисление процентов (совокупное значение, отображаемое как начисление только когда оно превышает $1 и зачисляемое на счет ежемесячно). Для годовой отчетности процентный доход регистрируется в Форме 1099 налогоплательщика США.

Общие сведения о расчете T+2

Введение

- Снижение риска для финансовой системы – со временем возрастает вероятность уменьшения цены определенной бумаги; сокращение расчетного периода снизит кредитный риск, связанный с несовершением оплаты или доставки бумаги. Уменьшив стоимость облигаций, ожидающих расчета, финансовый сектор будет надежнее защищен от потенциальных системных последствий при серьезной дестабилизации рынка.

- Эффективность использования средств – для клиентов с денежными или “наличными” счетами действуют ограничения на торговлю с вовлечением средств, не прошедших расчет (т.е. быструю куплю-продажу ценных бумаг без оплаты). При T+2 деньги от продажи активов будут доступны на 1 рабочий день раньше, что даст возможность быстрее использовать их для новых покупок.

- Глобальное урегулирование расчетов – переход на цикл T+2 синхронизирует американские и канадские рынки с другими крупными международными рынками в Европе и Азии, уже работающими по режиму T+2.

Изменится ли режим расчета для покупок и продаж опционов, фьючерсов или опционов на фьючерсы?

Нет. На данный момент эти продукты рассчитываются по плану T+1, и этот цикл останется прежним.

Обзор предлагаемых IBKR CFD на акции

Данная статья содержит вводную информацию о контрактах на разницу (CFD) акций, предлагаемых в IBKR.

Информацию о CFD IBKR на индексы можно найти здесь. Сведения о Forex CFD доступны здесь.

Список тем:

I. Определение CFD

II. Сравнение CFD с базисными активами

III. Особенности сборов и маржи

IV. Пример

V. Материалы по CFD

VI. Часто задаваемые вопросы

Предупреждение о рисках

CFD - это комплексные контракты, несущие высокий риск денежных потерь ввиду кредитного плеча.

67% счетов розничных инвесторов терпят убытки, торгуя CFD через IBKR (UK).

Вам следует убедиться, что Вы понимаете принцип работы CFD и можете позволить себе подвергнуть Ваш капитал такому риску.

Правила ESMA по CFD (только для розничных клиентов)

Европейская служба по ценным бумагам и рынкам (ESMA) ввела новые правила для CFD, вступившие в силу 1 августа 2018 года.

В эти правила входят: 1) ограничения кредитного плеча при открытии позиции по CFD; 2) правило ликвидации согласно марже конкретного счета; и 3) защита счета от отрицательного баланса.

Решение ESMA касается только розничных клиентов. Оно не распространяется на профессиональных клиентов.

Подробнее можно узнать на странице Ввод правил ESMA по CFD в IBKR.

I. Определение CFD на акции

CFD IBKR - это внебиржевые (OTC) контракты, которые дают право на доходность базовой акции, включая дивиденды и корпоративные действия (подробнее о корпоративных действиях по CFD).

Другими словами, это договор между покупателем (Вами) и IBKR на обмен разницей между текущей и будущей стоимостью акции. Если у Вас длинная позиция и разница положительная, то IBKR платит Вам. Если она отрицательная, то Вы платите IBKR.

Торговля CFD IBKR на акции происходит с Вашего маржевого счета, а поэтому Вы можете устанавливать длинные и короткие позиции с кредитными плечом. Цена CFD - это биржевая котировка стоимости базисной акции. Более того, котировки CFD IBKR идентичны Smart-маршрутизированным котировкам акций, которые Вы можете увидеть в Trader Workstation, а IBKR обеспечивает прямой рыночный доступ (DMA) к ним. Подобно акциям, базовый хедж Ваших нерыночных (т.е. лимитных) ордеров будет напрямую отражаться в углубленных данных (deep book) бирж, на которых он находится. Это также значит, что Вы можете размещать ордера на покупку CFD по биду и продавать по аску андерлаинга.

Для сравнения прозрачной модели CFD IBKR с другими, доступными на рынке, ознакомьтесь с Обзором рыночных моделей CFD.

На данный момент IBKR предлагает примерно 7100 CFD на акции, охватывая основные рынки США, Европы и Азии. Составляющие нижеперечисленных крупных индексов также доступны в качестве CFD IBKR на акции. Помимо этого во многих странах компания IBKR поддерживает торговлю ликвидными акциями с низкой капитализацией. Это акции со скорректированной на свободный оборот рыночной капитализацией, составляющей как минимум USD 500 млн., и средней дневной стоимостью от USD 600 тыс. Подробнее на странице Списки продуктов CFD. Скоро будут добавлены и другие страны.

| США | S&P 500, DJA, Nasdaq 100, S&P 400 (средн. кап.), ликвидн. низк. кап. |

| Великобритания | FTSE 350 + ликв. низк. кап. (вкл. IOB) |

| Германия | Dax, MDax, TecDax + ликв. низк. кап. |

| Швейцария | Швейцарская часть STOXX Europe 600 (48 акций) + ликв. низк. кап. |

| Франция | CAC высок. кап., CAC средн. кап. + ликв. низк. кап. |

| Нидерланды | AEX, AMS средн. кап. + ликв. низк. кап. |

| Бельгия | BEL 20, BEL средн. кап. + ликв. низк. кап. |

| Испания | IBEX 35 + ликв. низк. кап. |

| Португалия | PSI 20 |

| Швеция | OMX Stockholm 30 + ликв. низк. кап. |

| Финляндия | OMX Helsinki 25 + ликв. низк. кап. |

| Дания | OMX Copenhagen 30 + ликв. низк. кап. |

| Норвегия | OBX |

| Чехия | PX |

| Япония | Nikkei 225 + ликв. низк. кап. |

| Гонконг | HSI + ликв. низк. кап. |

| Австралия | ASX 200 +ликв. низк. кап. |

| Сингапур* | STI + ликв. низк. кап. |

| Южная Африка | Top 40 + ликв. низк. кап. |

*недоступно жителям Сингапура

II. Сравнение CFD с базисными активами

| ПРЕИМУЩЕСТВА CFD IBKR | НЕДОСТАТКИ CFD IBKR |

|---|---|

| Нет гербовых сборов или налога на финансовые транзакции (Британия, Франция, Бельгия) | Нет права владения |

| Более низкие комиссии и ставки маржи, чем у акций | Комплексные корпоративные действия не всегда повторимы |

| Налоговые льготы по международному соглашению без необходимости требования о возврате | Налог с прибыли может отличаться от акций (уточните у своего налогового консультанта) |

| Не действуют правила дневного трейдинга |

III. Особенности сборов и маржи

CFD IBKR могут оказаться еще более эффективным способом торговли на Европейских фондовых рынках, чем экономичные предложения IBKR по акциям.

Во-первых, по сравнению с акциями, у CFD IBKR низкие комиссии и такие же низкие спреды финансирования:

| ЕВРОПА | CFD | АКЦИИ | |

|---|---|---|---|

| Комиссии | GBP | 0.05% | GBP 6.00 + 0.05%* |

| EUR | 0.05% | 0.10% | |

| Финансирование** | Бенчмарка +/- | 1.50% | 1.50% |

*За ордер + 0.05% при превышении GBP 50,000

**При финансирование CFD - на основе общей стоимости позиции; при финансировании акций - на основе занятой суммы

Чем больше Вы торгуете, тем меньше становятся комиссии по CFD (могут опуститься до 0.02%). Ставки финансирования понижаются для более крупных позиций (плоть до 0.5%). См. Комиссии CFD и Ставки финансирования CFD.

Во-вторых, маржинальные требования CFD ниже, чем у акций. Для розничных клиентов действуют дополнительные маржинальные требования, предписанные европейским надзорным органом ESMA. См. Ввод правил ESMA по CFD в IBKR.

| CFD | АКЦИИ | ||

|---|---|---|---|

| Все | Стандарт | Маржевый портфель | |

| Минимальные маржинальные требования* |

10% |

25% - 50% | 15% |

*Типичная маржа "голубых фишек". Для розничных клиентов действует минимум начальной маржи в 20%. Стандартная внутридневная минимальная маржа 25%; ночью 50%. Отображаемая маржа портфеля - это минимальная маржа (вкл. ночную). Для более волатильных активов действуют повышенные требования.

Подробнее на странице Маржинальные требования CFD.

IV. Рабочий пример (для профессиональных клиентов)

Рассмотрим пример. Доходность Unilever’s Amsterdam за прошлый месяц составила 3.2% (20 торговых дней до 14-го мая 2012), и Вы считаете, что результативность сохранится. Вам нужно открыть позицию в 200,000 EUR и сохранять ее 5 дней. Вы совершаете 10 сделок для ее образования и 10 для закрытия. Ваши затраты составят:

АКЦИИ

| CFD | АКЦИИ | ||

|---|---|---|---|

| Позиция EUR 200,000 | Стандарт | Маржевый портфель | |

| Маржинальное требование | 20,000 | 100,000 | 30,000 |

| Комиссия (в обе стороны) | 200 | 400 | 400 |

| Процентная ставка (упрощенная) | 1.50% | 1.50% | 1.50% |

| Профинансированные объем | 200,000 | 100,000 | 170,000 |

| Профинансированные дни | 5 | 5 | 5 |

| Процентные затраты (упрощенная ставка 1.5%) | 41.67 | 20.83 | 35.42 |

| Общая прямая стоимость (комиссии + процент) | 241.67 | 420.83 | 435.42 |

| Разница стоимости | 74% выше | 80% выше | |

Примечание: Процентные сборы по CFD рассчитываются на основе всей позиции, а по акциям согласно занятой сумме. Для акций и CFD действуют одинаковые ставки.

Тем не менее предположим, что для обеспечения маржи у Вас есть только 20,000 EUR. Если показатели Unilever останутся такими же, как в прошлом месяце, то Ваша потенциальная прибыль составит:

| ВЫГОДА КРЕДИТНОГО ПЛЕЧА | CFD | АКЦИИ | |

|---|---|---|---|

| Доступная маржа | 20,000 | 20,000 | 20,000 |

| Общее вложение | 200,000 | 40,000 | 133,333 |

| Валовая прибыль (5 дней) | 1,600 | 320 | 1,066.66 |

| Комиссии | 200 | 80.00 | 266.67 |

| Процентные затраты (упрощенная ставка 1.5%) | 41.67 | 4.17 | 23.61 |

| Общая прямая стоимость (комиссии + процент) | 241.67 | 84.17 | 290.28 |

| Чистая прибыль (валовая прибыль минус прямая стоимость) | 1,358.33 | 235.83 | 776.39 |

| Сумма дохода по маржинальным инвестициям | 0.07 | 0.01 | 0.04 |

| Разница | 83% меньше прибыли | 43% меньше прибыли | |

| РИСК КРЕДИТНОГО ПЛЕЧА | CFD | АКЦИИ | |

|---|---|---|---|

| Доступная маржа | 20,000 | 20,000 | 20,000 |

| Общее вложение | 200,000 | 40,000 | 133,333 |

| Валовая прибыль (5 дней) | -1,600 | -320 | -1,066.66 |

| Комиссии | 200 | 80.00 | 266.67 |

| Процентные затраты (упрощенная ставка 1.5%) | 41.67 | 4.17 | 23.61 |

| Общая прямая стоимость (комиссии + процент) | 241.67 | 84.17 | 290.28 |

| Чистая прибыль (валовая прибыль минус прямая стоимость) | -1,841.67 | -404.17 | -1,356.94 |

| Разница | 78% меньше убытков | 26% меньше убытков | |

V. Материалы по CFD

Ниже Вы найдете полезные ссылки на более подробную информацию о предлагаемых IBKR CFD:

Также доступен следующий видеоурок:

Как создать сделку с CFD в Trader Workstation

VI. Часто задаваемые вопросы

Какие акции доступны в качестве CFD?

Акции с высоким или средним уровнем капитализации в США, Северной и Западной Европе, Японии. На многих рынках также доступны ликвидные акции с низкой капитализацией. Подробнее на странице Списки продуктов CFD. Скоро будут добавлены и другие страны.

У Вас есть CFD на биржевые и валютные индексы?

Да. См. Индексные CFD IBKR: Факты и частые вопросы и Forex CFD: Факты и частые вопросы.

Как устанавливаются котировки CFD на акции?

Котировки CFD IBKR идентичны Smart-маршрутизированным котировкам базисной акции. IBKR не расширяет спред и не открывает противонаправленные позиции. Подробнее в статье Обзор рыночных моделей CFD.

Могу ли я видеть свои лимитные ордера на бирже?

Да. IBKR обеспечивает прямой рыночный доступ (DMA), благодаря которому базовый хедж Ваших нерыночных (т.е. лимитных) ордеров будет напрямую отражаться в углубленных данных (deep book) бирж, где он находится. Это также значит, что Вы можете размещать ордера на покупку CFD по биду и продавать по аску андерлаинга. Улучшение цены возможно при наличии аналогичного ордера другого клиента с ценой, которая выгоднее доступной на открытых рынках.

Как рассчитывается маржа CFD на акции?

IBKR устанавливает рисковую маржу на основе исторической волатильности каждого базового актива. Минимальная маржа составляет 10%. Большинство CFD IBKR маржируются по этой ставке, зачастую делая CFD выгоднее базовых акций в этом плане/ Для розничных клиентов действуют дополнительные маржинальные требования, предписанные европейским надзорным органом

ESMA. См. Ввод правил ESMA по CFD в IBKR. Отдельные позиции по CFD, а также воздействие на CFD базисных акций не компенсируются портфелем. Концентрированные и особо крупные позиции могут подлежать дополнительной марже. Подробнее на странице Маржинальные требования CFD.

Подлежат ли короткие позиции по CFD на акции вынужденному выкупу?

Да. При сложности/невозможности займа базисной акции обладатель короткой CFD-позиции станет объектом выкупа.

Как поступают с дивидендами и корпоративными действиями?

Экономический эффект от корпоративного действия для владельцев CFD передается таким же образом, как при владении базисным активом. Дивиденды выражаются в виде денежных корректировок, в то время как прочие процессы могут вылиться в корректировку средств, позиции или и того, и другого. Например, если корпоративное действие приводит к изменению количества акций (скажем, обычный или обратный сплит), то в число CFD будет внесена надлежащая поправка. Если в результате действия формируется новое юр. лицо с котирующимися акциями, которые IBKR решает предлагать в качестве CFD, то создаются новые длинные или короткие позиции на соответствующие суммы. Дополнительные сведения можно найти в разделе Корпоративные действия по CFD.

*Обращаем внимание, что в некоторых случаях точная корректировка CFD для комплексных корпоративных действий может быть невозможна. Тогда IBKR может аннулировать CFD до экс-дивидендной даты.

Все ли могут торговать CFD в IBKR?

Торговля CFD IBKR доступна всем клиентам, кроме резидентов США, Канады, Гонконга. Жители Сингапура могут торговать всеми CFD, кроме базирующихся на андерлаингах, которые котируются в Сингапуре. Правила доступности на основе места жительства действуют для всех, независимо от типа инвестора.

Что нужно сделать, чтобы начать торговать CFD через IBKR?

Разрешение на торговлю CFD необходимо активировать в "Управлении счетом", подтвердив прочтение соответствующих уведомлений. Если Ваш счет находится в IBKR LLC, то IBKR создаст новый сегмент счета (с тем же номером и дополнительной приставкой “F”). Получив подтверждение, Вы сможете начать торговлю. F-счет не нужно финансировать отдельно - средства для поддержания маржи CFD будут автоматически переводиться с основного сегмента.

Обязательны ли какие-либо рыночные данные?

Рыночные данные по CFD IBKR на акции - это данные по базисным активам. Поэтому наличие разрешений на получение рыночных данных от соответствующих бирж обязательно. Если у Вас уже есть необходимые разрешения, ничего делать не нужно. При желании торговать CFD на бирже, на рыночные данные которой у Вас пока нет прав, Вы можете активировать их точно так же, как сделали бы для торговли базовыми акциями

Как мои сделки и позиции по CFD отражаются в выписках?

Если Ваш счет находится в IBKR LLC, то его позиции по CFD хранятся на обособленном сегменте, отличающемся от номера основного счета приставкой “F”. Наша система поддерживает как раздельные, так и совмещенные выписки. Вы можете изменить настройки в соответствующем разделе "Управления счетом". CFD на других счетах отображаются в выписке вместе с другими инструментами.

Можно ли перевести CFD-позиции от другого брокера?

IBKR с радостью поможет Вам с переводом позиций по CFD при согласии Вашего стороннего брокера. Поскольку процесс перевода CFD сложнее, чем перевод акций, мы, как правило, требуем, чтобы позиция составляла как минимум 100 000 USD (или эквивалент в другой валюте).

Доступны ли графики для CFD по акциям?

Да.

Какой вид защиты счета действует при торговле CFD в IBKR?

CFD - это контракты, контрагентом которых является IB UK. Торговля ими не ведется на регулируемой бирже, а клиринг не производится в центральной клиринговой палате. Имея IB UK в качестве второй стороны Ваших сделок с CFD, Вы подвергаетесь финансовым и деловым рискам, включая кредитный риск, характерный торговле через IB UK. Стоит помнить, что средства клиентов, в том числе и институциональных, всегда полностью сегрегируются. Компания IB UK участвует в Программе Великобритании по компенсации в сфере финансовых услуг ("FSCS"), а также IB UK не является участницей Корпорации защиты фондовых инвесторов (“SIPC”). Дополнительную информацию о рисках торговли CFD можно найти в Уведомлении IB UK о рисках CFD.

Какие типы счетов IBKR поддерживают торговлю CFD (напр., частный, "Друзья и семья", институциональный и т.д.)?

Все маржевые счета поддерживают торговлю CFD. Наличиные и SIPP-счета - нет.

Каковы максимальные позиции, которые у меня могут быть по конкретному CFD?

Хотя предустановленного лимита нет, помните, что для особо крупных позиций могут действовать повышенные маржинальные требования. Подробнее на странице Маржинальные требования CFD.

CFD можно торговать по телефону?

Нет. В исключительных случаях мы можем согласиться обработать ордер на закрытие по телефону, но ни в коем случае не открытие.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

Overview of IBKR issued Share CFDs

The following article is intended to provide a general introduction to share-based Contracts for Differences (CFDs) issued by IBKR.

For Information on IBKR Index CFDs click here. For Forex CFDs click here. For Precious Metals click here.

Topics covered are as follows:

I. CFD Definition

II. Comparison Between CFDs and Underlying Shares

III. CFD Tax and Margin Advantage

IV. US ETFs

V. CFD Resources

VI. Frequently Asked Questions

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ESMA Rules for CFDs (Retail Clients of IBKRs European entities, including so-called F segments)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August 2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

I. Overview

IBKR CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions).

Said differently, it is an agreement between the buyer (you) and IBKR to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBKR pays you. If it is negative, you pay IBKR.

Our Share CFDs offer Direct Market Access (DMA). Our Share CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Workstation. Similar to shares, your non-marketable (i.e. limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBKR’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

We currently offer approximately 8500 Share CFDs covering the principal markets in the US, Europe and Asia. Eligible shares have minimum market capitalization of USD 500 million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail.

Most order types are available for CFDs, including auction orders and IBKR Algos.

CFDs on US share can also be traded during extended exchange hours and overnight. Other CFDs are traded during regular hours.

II. Comparison Between CFDs and Underlying Shares

| BENEFITS of IBKR CFDs | DRAWBACKS of IBKR CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium, Spain) | No ownership rights |

| Generally lower margin rates than shares* | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules | |

| US ETFs tradable as CFDs** |

*IB LLC and IB-UK accounts.

**EEA area clients cannot trade US ETFs directly, as they do not publish KIDs.

III. CFD Tax and Margin Advantage

Where stamp duty or financial transaction tax is applied, currently in the UK (0.5%), France (0.3%), Belgium (0.35%) and Spain (0.2%), it has a substantially detrimental impact on returns, particular in an active trading strategy. The taxes are levied on buy-trades, so each time you open a long, or close a short position, you will incur tax at the rates described above.

The amount of available leverage also significantly impacts returns. For European IBKR entities, margin requirements are risk-based for both stocks and CFDs, and therefore generally the same. IB-UK and IB LLC accounts however are subject to Reg T requirements, which limit available leverage to 2:1 for positions held overnight.

To illustrate, let's assume that you have 20,000 to invest and wish to leverage your investment fully. Let's also assume that you hold your positions overnight and that you trade in and out of positions 5 times in a month.

Let's finally assume that your strategy is successful and that you have earned a 5% return on your gross (fully leveraged) investment.

The table below shows the calculation in detail for a UK security. The calculations for France, Belgium and Spain are identical, except for the tax rates applied.

| UK CFD | UK Stock | UK Stock | |

|---|---|---|---|

| All Entities |

EU Account

|

IB LLC or IBUK Acct

|

|

| Tax Rate | 0% | 0.50% | 0.50% |

| Tax Basis | N/A | Buy Orders | Buy Orders |

| # of Round trips | 5 | 5 | 5 |

| Commission rate | 0.05% | 0.05% | 0.05% |

| Overnight Margin | 20% | 20% | 50% |

| Financing Rate | 1.508% | 1.508% | 1.508% |

| Days Held | 30 | 30 | 30 |

| Gross Rate of Return | 5% | 5% | 5% |

| Investment | 100,000 | 100,000 | 40,000 |

| Amount Financed | 100,000 | 80,000 | 20,000 |

| Own Capital | 20,000 | 20,000 | 20,000 |

| Tax on Purchase | 0.00 | 2,500.00 | 1,000.00 |

| Round-trip Commissions | 500.00 | 500.00 | 200.00 |

| Financing | 123.95 | 99.16 | 24.79 |

| Total Costs | 623.95 | 3099.16 | 1224.79 |

| Gross Return | 5,000 | 5,000 | 2,000 |

| Return after Costs | 4,376.05 | 1,900.84 | 775.21 |

| Difference | -57% | -82% |

The following table summarizes the reduction in return for a stock investment, by country where tax is applied, compared to a CFD investment, given the above assumptions.

| Stock Return vs cfD | Tax Rate | EU Account | IB LLC or IBUK Acct |

|---|---|---|---|

| UK | 0.50% | -57% | -82% |

| France | 0.30% | -34% | -73% |

| Belgium | 0.35% | -39% | -75% |

| Spain | 0.20% | -22% | -69% |

IV. US ETFs

EEA area residents who are retail investors must be provided with a key information document (KID) for all investment products. US ETF issuers do not generally provide KIDs, and US ETFs are therefore not available to EEA retail investors.

CFDs on such ETFs are permitted however, as they are derivatives for which KIDs are available.

Like for all share CFDs, the reference price for CFDs on ETFs is the exchange-quoted, SMART-routed price of the underlying ETF, ensuring economics that are identical to trading the underlying ETF.

V. Extended and Overnight Hours

US CFDs can be traded from 04:00 to 20:00EST, and the again overnight from 20:00 to 03:30 the following day. Trades in the overnight session are attributed to the day when the session ends, even if a trade is entered before midnight the previous day. This has implications for corporate actions and financing.

Trades entered before midnight on the day before ex-date will not have a dividend entitlement. Trades before midnight will settle as if they had been traded the following day, delaying the start of financing.

VI. CFD Resources

Below are some useful links with more detailed information on IBKR’s CFD offering:

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

VII. Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on other asset classes?

Yes. Please see IBKR Index CFDs - Facts and Q&A, Forex CFDs - Facts and Q&A and Metals CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBKR CFD quotes are identical to the Smart routed quotes for the underlying share. IBKR does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBKR offers Direct market Access (DMA) whereby your non-marketable (i.e. limit) orders have the underlying hedges directly represented on the deep books of the exchanges on which they trade. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets.

How do you determine margins for Share CFDs?

IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 10%, making CFDs more margin-efficient than trading the underlying share in many cases. Retail investors are subject to additional margin requirements mandated by the European regulators. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Concentrated positions and very large positions may be subject to additional margin. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position may become subject to buy-in.

How do you handle dividends and corporate actions?

IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stock-split, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

*Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBKR may terminate the CFD prior to the ex-date.

Can anyone trade IBKR CFDs?

All clients can trade IBKR CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and Israel. There are no exemptions based on investor type to the residency based exclusions.

What do I need to do to start trading CFDs with IBKR?

You need to set up trading permission for CFDs in Client Portal, and agree to the relevant disclosures. If your account is with IBKR (UK) or with IBKR LLC, IBKR will then set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD initial margin requirements from your main account.

If your account is with another IBKR entity, only the permission is required; an additional account segment is not necessary.

Are there any market data requirements?

The market data for IBKR Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

Can I transfer in CFD positions from another broker?

IBKR does not facilitate the transfer of CFD positions at this time.

Are charts available for Share CFDs?

Yes.

In what type of IBKR accounts can I trade CFDs e.g., Individual, Friends and Family, Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

IBKR Stock Yield Enhancement Program

PROGRAM OVERVIEW

The Stock Yield Enhancement Program provides the opportunity to earn extra income on the fully-paid shares of stock held in your account by allowing IBKR to borrow shares from you in exchange for collateral (either U.S. Treasuries or cash), and then lend the shares to traders who want to sell them short and are willing to pay interest to borrow them. For additional information on the Stock Yield Enhancement Program please see here or review the Frequently Asked Questions page.

HOW TO ENROLL IN THE STOCK YIELD ENHANCEMENT PROGRAM

To enroll, please login to the Client Portal. Once logged in, click the User menu (head and shoulders icon in the top right corner) followed by Settings.

In the Trading section of the Settings page, click the link for the Stock Yield Enhancement Program. Select the checkbox on the next screen and click Continue. You will then be presented with the requisite forms and disclosures needed to enroll in the program. Once you have reviewed and signed the forms, your request will be submitted for processing. Please allow 24-48 hours for enrollment to become active.

.png)

.png)

India Intra-Day Shorting Risk Disclosure

Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. In accordance with IB’s intra-day shorting rules, traders are required to deliver shares sold or close short stock positions prior to the end of the trading session.

Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at 15:20 IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market.

It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. If your account holds a short position ten minutes prior to the end of the trading session and you have placed working orders to close those positions, there is the possibility your closing order will execute and that IB will act to close out your short position. In this situation you will be responsible for both executions and will need to manage your long position accordingly.

A fee of INR 2,000 will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid this.

When I short a stock, when will the hard to borrow interest begin accruing?

Short positions will have a borrow interest/fee associated with them.

Borrow interest will begin being charged on a short position from short settlement date to buy-to-cover settlement date.

For example, you sell XYZ on Monday, and you close the position on Tuesday. Borrow interest would start to be charged upon Wednesday's settlement date (T+2). Interest would cease to be charged on Thursday, the settlement date (T+2) of the buy-to-cover order.