EMIR: обязательства по отчетности в торговые репозитарии и услуги Interactive Brokers по предоставлению отчетности за клиентов

Обзор методологии расчета маржи SPAN

Стандартный анализ риска портфеля (англ. Standard Portfolio Analysis of Risk, сокр. SPAN) – методология, созданная Чикагской товарной биржей (CME), на основе которой клиринговые палаты и биржи по всему миру рассчитывают гарантийный залог (маржинальные требования) для фьючерсов и фьючерсных опционов. Клиринговая палата берет данный залог с фьючерсной фирмы-посредника, а эта фирма, в свою очередь, – с клиента.

По методологии SPAN, размер маржи рассчитывается исходя из наихудшего возможного убытка для портфеля за определенный период (как правило, один день). Убыток определяется на основе 16 гипотетических сценариев, которые моделируют изменение цены актива, лежащего в основе фьючерсного или опционного контракта, и, в случае с опционами, уменьшение стоимости по мере приближения к экспирации и изменение подразумеваемой волатильности.

Первым шагом в расчете требований SPAN является объединение всех позиций с одинаковым андерлаингом в одну группу. Затем производится расчет (и объединение по схожим сценариям) риска для каждой позиции в данной группе, при этом сценарий, приводящий к наибольшим потенциальным убыткам, устанавливается в качестве "индикатора риска". Расчет по 16 сценариям выполняется на основе диапазона изменения цены (максимальное вероятное изменение цены андерлаинга за определенный период) и волатильности (максимальное вероятное изменение подразумеваемой волатильности для опционов) данной группы.

Например, возьмем портфель, в котором есть один длинный фьючерс и один короткий пут на фондовый индекс ABC с базисной ценой в $1000, коэффициентом 100 и диапазоном сканирования цены в 6%. Для этого портфеля индикатором риска стал бы сценарий 14 – $1125.

|

№ |

1 длинный фьючерс |

1 длинный пут |

Сумма |

Описание сценария |

|

1 |

$0 |

$20 |

$20 |

Цена не меняется; волатильность в верхнем отрезке диапазона сканирования |

|

2 |

$0 |

($18) |

($18) |

Цена не меняется; волатильность в нижнем отрезке диапазона сканирования |

|

3 |

$2000 |

($1290) |

$710 |

Повышение цены на 1/3 диапазона изменения цены; волатильность в верхнем отрезке диапазона сканирования |

|

4 |

$2000 |

($1155) |

$845 |

Повышение цены на 1/3 диапазона изменения цены; волатильность в нижнем отрезке диапазона сканирования |

|

5 |

($2000) |

$1600 |

($400) |

Понижение цены на 1/3 диапазона изменения цены; волатильность в верхнем отрезке диапазона сканирования |

|

6 |

($2000) |

$1375 |

($625) |

Понижение цены на 1/3 диапазона изменения цены; волатильность в нижнем отрезке диапазона сканирования |

|

7 |

$4000 |

($2100) |

$1900 |

Повышение цены на 2/3 диапазона изменения цены; волатильность в верхнем отрезке диапазона сканирования |

|

8 |

$4000 |

($2330) |

$1670 |

Повышение цены на 2/3 диапазона изменения цены; волатильность в нижнем отрезке диапазона сканирования |

|

9 |

($4000) |

$3350 |

($650) |

Понижение цены на 2/3 диапазона изменения цены; волатильность в верхнем отрезке диапазона сканирования |

|

10 |

($4000) |

$3100 |

($900) |

Понижение цены на 2/3 диапазона изменения цены; волатильность в нижнем отрезке диапазона сканирования |

|

11 |

$6000 |

($3100) |

$2900 |

Повышение цены на 3/3 диапазона изменения цены; волатильность в верхнем отрезке диапазона сканирования |

|

12 |

$6000 |

($3375) |

$2625 |

Повышение цены на 3/3 диапазона изменения цены; волатильность в нижнем отрезке диапазона сканирования |

|

13 |

($6000) |

$5150 |

($850) |

Понижение цены на 3/3 диапазона изменения цены; волатильность в верхнем отрезке диапазона сканирования |

|

14 |

($6000) |

$4875 |

($1125) |

Понижение цены на 3/3 диапазона изменения цены; волатильность в нижнем отрезке диапазона сканирования |

|

15 |

$5760 |

($3680) |

$2080 |

Максимальное увеличение цены (в 3 раза больше диапазона изменения цены) * 32% |

|

16 |

($5760) |

$5400 |

($360) |

Максимальное снижение цены (в 3 раза больше диапазона изменения цены) * 32% |

Затем плата за соответствующий риск прибавляется к плате за межтоварные спреды (для покрытия базового риска календарных спредов фьючерсов) и спот-позиции (для покрытия повышенного риска позиций с поставляемыми инструментами с приближающейся экспирацией), и из суммы вычитается кредит по межтоварным спредам (маржинальный остаток для компенсации позиций со связанными продуктами). Затем эта сумма сравнивается с минимальным требованием для коротких опционов (с целью обеспечить минимальную маржу для портфелей с опционами со значительным убытком), и в качестве риска для группы устанавливается наибольшее из двух значений. Данные расчеты производятся для всех групп инструментов, у которых общее маржинальное требование портфеля равно сумме риска для всей группы за вычетом кредита по компенсации риска за счет других групп.

Программное обеспечение для расчета маржи по методологии SPAN – PC-SPAN – доступно на сайте CME.

Дополнительная информация об использовании стоп-ордеров

На рынках США могут возникать периоды чрезвычайно высокой волатильности и смещения цен. Такие периоды могут быть как кратковременными, так и продолжительными. Стоп-ордера могут способствовать снижению цены и волатильности на рынке, а также могут приводить к исполнению по цене, которая сильно отличается от цены-триггера.

Что будет, если я куплю продукт в валюте, которой нет на моем счете?

Валюта, необходимая для покупки и расчета по сделке, определяется котирующей биржей, а не IBKR. Например, если Вы хотите купить ценную бумагу, деноминированную в валюте, которой у Вас нет, и у Вас маржевый счет с достаточным избытком маржи, то IBKR выдаст Вам кредит на эту сумму. Такая мера необходима, поскольку IBKR обязана проводить операции с расчетной палатой в той валюте, в которой деноминирована транзакция. Если Вы не хотите брать кредит и платить по нему проценты, Вам нужно либо заранее внести на счет средства в необходимой валюте, либо конвертировать валюту на счете в TWS с помощью IdealPro (для сумм больше 25 000 USD (или эквивалентной суммы в другой валюте)) или неполных лотов (для сумм меньше 25 000 USD (или эквивалентной суммы в другой валюте)).

Также обращаем Ваше внимание, что при закрытии позиции с ценными бумагами, деноминированными в той или иной валюте, доходы от продажи останутся в этой же валюте независимо от базовой валюты Вашего счета. Соответственно, вырученные средства будут подвержены валютному риску по отношению к базовой валюте Вашего счета до тех пор, пока Вы их не конвертируете или не купите другой продукт, деноминированный в той же валюте.

Почему в моем отчете о денежных средствах отображается внутренний перевод между ценными бумагами и товарами?

Согласно нормативным правилам, IBKR обязана разделять ценные бумаги и биржевые товары на счетах клиентов. Товарный сегмент может включать рыночную стоимость позиций с опционами на фьючерсы, а также денежные средства, необходимые для обеспечения маржи по товарным фьючерсам и фьючерсным опционам. IBKR время от времени проводит перерасчет маржинальных требований по товарным позициям, и в случае снижения этих требований переводит избыточные средства с товарного сегмента счета на сегмент с ценными бумагами. Аналогичным образом, если маржинальные требования для товаров увеличиваются, IBKR переводит доступные средства из сегмента с ценными бумагами в товарный сегмент. Страхование SIPC распространяется на ценные бумаги, но не на товары, а такие переводы позволяют обеспечить максимальную защиту Вашего денежного баланса. Обращаем внимание, что данное движение средств целиком выполняется в пределах Вашего счета, и остаток в сегментах автоматически обновляется, поэтому оно не влияет на общий остаток средств на счете (см. столбец "Всего" в разделе "Отчет о денежных средствах" отчета по операциям).

Как рассчитываются маржинальные требования для фьючерсов и фьючерсных опционов?

Маржинальные требования для фьючерсных опционов и фьючерсов устанавливают биржи согласно алгоритму Cтандартного анализа риска портфеля (англ. Standard Portfolio Analysis of Risk, сокр. SPAN). Подробнее об алгоритме SPAN можно узнать на сайте CME Group: www.cmegroup.com. Для этого просто введите в поиске сайта "SPAN", и вы увидите много информации об алгоритме и принципах его работы. SPAN является сложной методологией для расчета маржинальных требований для облигаций с помощью анализа почти любых гипотетических сценариев движения рынка.

Общий принцип работы SPAN:

SPAN оценивает общий риск, вычисляя наихудший возможный убыток, который может понести портфель из деривативных и физических инструментов за определенный период (как правило, один день). Для этого моделируются различные изменения на рынке и их влияние на прибыль и убытки портфеля. В основе этой методологии лежит массив рисков SPAN – набор числовых значений, которые показывают, как изменится цена контракта при разных состояниях рынка. Каждое состояние называется сценарием риска. Числовое значение для каждого сценария представляет собой прибыль или убыток отдельного контракта при определенном изменении цены (или цены андерлаинга), волатильности или приближении срока экспирации.

Биржа отправляет файлы SPAN в IBKR в течение дня через определенные промежутки времени, и IBKR передает их в калькулятор маржи. В рамках расчета маржи считается, что фьючерсные опционы подвержены риску до тех пор, пока они не закрыты или не истекли, даже если опционы находятся "вне денег". Каждый сценарий должен учитывать возможность высокой волатильности рынка, поэтому фьючерсные опционы всегда включены в расчет маржи, пока существует эта опционная позиция. Маржинальные требования, рассчитанные по методологии SPAN, сравниваются со сценариями движения рынка, смоделированные IBKR, и в качестве маржинального требования устанавливается больший из двух результатов.

Margin Considerations for Intramarket Futures Spreads

Background

Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation.

Spread Margin Adjustment

This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:

- On the 3rd business day prior to close out, the initial and maintenance margin requirements will be equal to 10% of their respective requirements on each contract month as if there was no spread, plus 90% of the spread requirement;

- On the 2nd business day prior to close out, the initial and maintenance margin requirements will be equal to 20% of their respective requirements on each contract month as if there was no spread, plus 80% of the spread requirement;

- On the business day prior to close out, the initial and maintenance margin requirements will be equal to 30% of their respective requirements on each contract month as if there was no spread, plus 70% of the spread requirement.

Working Example

Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:

| XYZ | Front Month - 1 Short Contract (Uncovered) | Back Month - 1 Long Contract (Uncovered) | Spread - 1 Short Front Month vs. 1 Long Back Month |

| Initial Margin | $1,250 | $1,500 | $500 |

| Maintenance Margin | $1,000 | $1,200 | $400 |

Further assume a position consisting of 1 short front month contract and 1 long back month contract with the front month contract close out date = T. using this hypothetical example, the initial margin requirement over the 3 business day period preceding close out date is outlined in the table below:

| Day | Initial Margin Requirement | Calculation Details |

| T-4 | $500 | Unadjusted |

| T-3 | $725 | .1($1,250 + $1,500) + .9($500) |

| T-2 | $950 | .2($1,250 + $1,500) + .8($500) |

| T-1 | $1,175 | .3($1,250 + $1,500) + .7($500) |

| T | $1,175 | Positions not in compliance with close out requirements are subject to liquidation. |

Совместимость MetaTrader и Interactive Brokers

Interactive Brokers (IBKR) обеспечивает клиентов бесплатным ассортиментом своих торговых платформ и поэтому не рекламирует и не предлагает системы или дополнительное ПО от других поставщиков. Тем не менее, поскольку основная торговая платформа IBKR, TraderWorkstation (TWS), поддерживает открытый программный интерфейс (API), некоторые сторонние разработчики создают свои собственные модули для ввода ордеров, построения графиков и выполнения других аналитических функций, работающие в комплексе с TWS и позволяющие производить сделки через IBKR. Такие приложения API, интегрируемые в TWS, публикуются независимо от нас, и мы не всегда знаем об их существовании, из-за чего мы открыли Площадку инвесторов - самостоятельное сообщество, объединяющее сторонних поставщиков, которые готовы предложить свои продукты и услуги клиентам IB и трейдерам с определенными нуждами.

Несмотря на то, что служба MetaQuotes Software не участвует в "Площадке инвесторов" IBKR, она предлагает представляющим брокерам приложение oneZero Hub Gateway, позволяющее использовать платформу MetaTrader 5 для торговли через счета IBKR[1]. Заинтересованным лицам следует связаться с oneZero напрямую. Это можно сделать через функцию "Contact Us" в одном из разделов следующей страницы.

Примечание: Помимо oneZero Hub Gateway у нас также поддерживаются такие сторонние поставщики, как Trade-Commander, jTWSdata и PrimeXM, предлагающие ПО, которое соединяет MetaTrader 4/5 с TWS. Как и в случае с любыми другими сторонними приложениями, IBKR не имеет права предоставлять информацию или рекомендации касательно их совместимости или работы.

1: Служба oneZero недоступна для частных счетов. Дополнительные сведения о представляющих брокерах доступны здесь.

How to Complete CFTC Form 40

Clients maintaining a U.S. futures or futures option position at a quantity exceeding the CFTC's reportable thresholds may be contacted directly by the CFTC file with a request that they complete a Form 40. Contact will generally be made via email and clients are encouraged to respond to such requests in a timely manner to avoid trading restrictions and/or fines imposed by CFTC upon their account at the FCM.

Completion of the Form requires the following steps:

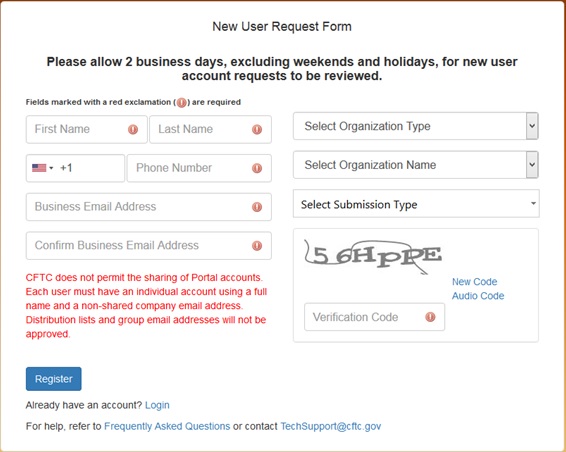

- Register for a CFTC Portal Account - performed online at: https://portal.cftc.gov/Account/Register.aspx Registration will require entry of the 9-digit code that the CFTC provided to you within the email requesting that you register. If you cannot locate your code or receive an invalid entry message, contact TechSupport@cftc.gov. When entering "Organization Type" from the drop-down selector, choose "LTR (Large Traders)".

2. Complete Form 40 - You will receive an email notification from the CFTC once your Portal Account has been approved. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The email will contain a link to the Portal where you will be prompted to log in: https://portal.cftc.gov/

Instructions for completing the form are available at: https://www.ecfr.gov/cgi-bin/text-idx?node=ap17.1.18_106.a

Note that Portal provides the opportunity to save a copy of your submission in XML format, a recommended step, as this allows for uploading the file to the Portal should you need to make modifications at a later date. This will eliminate the need to renter the form in its entirety.

The CFTC will send a confirmation email upon successful completion of your Form 40.

3. Confirm with IBKR - forward your confirmation email, or other evidence that you have submitted the Form 40 to cftc_form40_filing@interactivebrokers.com. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines.

Overview of CFTC Form 40

The CFTC, the primary regulator of U.S. commodity futures markets and Futures Commission Merchants (FCMs), operates a comprehensive system of collecting information on market participants as part of its market surveillance and large trader reporting program.

IBKR, as a registered FCM providing clients with access to those markets, is obligated to report to the CFTC information on clients who hold a position in a quantity that exceeds defined thresholds (i.e., a "reportable position"). In order to report this information, IBKR requires clients trading U.S. futures or futures options to complete an online CFTC Ownership and Control Reporting form at the point the client requests futures trading permissions.

Once a client holds a "reportable position", the CFTC may then contact that client directly and require them to file more detailed information via CFTC Form 40. The information required of this report includes the following:

- Trader's name and address

- Principal business

- Form of ownership (e.g., individual, joint, partnership, corporation, trust, etc.)

- Whether the reporting trader is registered under the Commodity Exchange Act

- Whether the reporting trader controls trading for others

- Whether any other person controls the trading of the reportable trader

- Name and location of all firms through which the reportable trader carries accounts

- Name and location of other persons providing a trading guarantee or having a financial interest in account of 10% or greater

- Name of accounts not in the reporting trader's name in which the trader provides a guarantee or has a financial interest of 10% or more.

Clients who fail to complete this Form in a timely manner may be subject to trading restrictions and/or fines imposed by CFTC upon their account at the FCM. It is therefore imperative that clients immediately respond to these CFTC requests.

To complete the CFTC Form 40, clients must first register for a CFTC Portal Account, an online process which is subject to a review period of 2 business days from the point of initial registration to acknowledgement of approval by the CFTC. For information regarding this registration process and completing the Form 40, see KB3149.