ЧаВО – ирландский налог у источника

Как ирландская компания, Interactive Brokers Ireland Limited (IBIE) обязана собирать налог у источника (англ. withholding tax) с процентов, выплачиваемых определенным клиентам, в размере 20%.

Это требование установлено разделом 246 закона "О налоговой консолидации" 1997 г. Ирландии и, как правило, применяется к процентам, которые получают следующие категории клиентов:

(i) Физические лица, проживающие в Ирландии;

(ii) Физические лица, проживающие за пределами Ирландии, если клиент не получил разрешение на освобождение от удержания или снижение налоговой ставки согласно соглашению об избежании двойного налогообложения между Ирландией и страной проживания клиента;

(iii) Ирландские компании;

(iv) Компании, зарегистрированные в странах, с которыми Ирландия НЕ имеет соглашения об избежании двойного налогообложения.

Эта статья содержит ответы на некоторые часто задаваемые вопросы о данном налоговом удержании.

Информация в этой статье приврдится исключительно в справочных целях и не представляет собой налоговую, правовую или другую рекомендацию. Чтобы узнать о своих налоговых обязательствах, обратитесь в налоговое управление Ирландии, местные налоговые органы или к налоговому специалисту.

ЧаВО

Что такое "налог у источника"?

Какие проценты облагаются налоговым удержанием?

Взимается ли налог с процентов, полученных по "Программе повышения доходности акций"?

Нужно ли платить налог с купонов по облигациям?

Я не торгую ирландскими акциями, нужно ли мне платить налог у источника?

Какая базовая ставка налога у источника?

Когда налог в 20% будет удержан с моего счета?

В какой валюте взимается налог?

Я проживаю в Ирландии. Нужно ли мне платить налоговое удержание?

Я не проживаю в Ирландии. С меня будет взиматься налоговое удержание?

Взимается ли данный налог с компаний?

Как запросить освобождение от уплаты налога или сниженную ставку?

Где можно скачать форму 8-3-6?

Куда отправлять заполненную форму 8-3-6?

Как отправить форму 8-3-6 и подтверждающие документы в IBIE?

Есть ли срок для подачи заявления на освобождение от налога или снижение ставки?

Могу ли я вернуть списанный налог до подачи заявления на освобождение от налога или снижение ставки?

Как вернуть налоговое удержание, списанное с моего счета?

Сколько времени форма 8-3-6 остается действительной?

Обязательно ли заполнять форму 8-3-6? Могу ли я торговать, если не заполнил(а) форму?

Где отображена информация о налоговом удержании в выписке по счету?

Как узнать налоговую ставку, установленную соглашением между моей страной проживания и Ирландией?

Что такое "налог у источника"?

Withholding tax – это фиксированный удерживаемый налог (также "налог у источника"), взимаемый с доходов нерезидента.

По законам Ирландии, процентные выплаты считаются доходом. Таким образом, компания IBIE обязана вычитать данное налоговое удержание с процентов по неинвестированным наличным балансам на счетах ценных бумаг клиентов.

Какие проценты облагаются налоговым удержанием?

Налогом у источника Ирландии облагаются проценты по кредиту, выплачиваемые по свободным длинным неинвестированным балансам денежных средств, и короткие проценты по кредиту, когда клиент занимает ценные бумаги у IBIE.

Взимается ли налог с процентов, полученных по "Программе повышения доходности акций"?

Нет. Проценты, полученные по Программе повышения доходности акций, не облагаются налогом у источника. Данный налог взимается только с процентов по неинвестированным денежным балансам на счете.

Нужно ли платить налог с купонов по облигациям?

Нет. Проценты, полученные от облигаций, не облагаются налогом у источника. Данный налог взимается только с процентов по неинвестированным денежным балансам на счете.

Я не торгую ирландскими акциями, нужно ли мне платить налог у источника?

Да. Если ваш счет открыт в IBIE, то на него распространяются правила налоговых удержаний Ирландии. Торгуете ли вы акциями Ирландии или нет, значения не имеет.

Какая базовая ставка налога у источника?

Стандартная ставка для налога у источника составляет 20%. Более подробную информацию можно узнать на нашем сайте.

Когда налог в 20% будет удержан с моего счета?

Если выплачиваемые вам проценты облагаются налогом у источника, то налог будет удержан одновременно с зачислением процентов на счет.

IBIE выплачивает проценты по неинвестированным остаткам на счете на третий рабочий день месяца, следующего за месяцем, в который проценты были начислены. Например, проценты за январь будут выплачены на третий рабочий день февраля.

В какой валюте взимается налог?

Ирландский налог у источника взимается в той же валюте, в которой выплачиваются проценты по неинвестированным остаткам на вашем счете.

Я проживаю в Ирландии. Нужно ли мне платить налоговое удержание?

Да. Согласно налоговому законодательству Ирландии, все физические лица, проживающие в Ирландии, и товарищества, зарегистрированные в Ирландии, должны выплачивать с процентных выплат налог в размере 20%. Данным налогом также облагается доход ирландских компаний, но в некоторых случаях для них действует исключение.

Я не проживаю в Ирландии. С меня будет взиматься налоговое удержание?

Да, как правило, ирландский налог у источника действует для всех физических лиц, вне зависимости от страны проживания.

Однако, если Ирландия заключила соглашение об избежании двойного налогообложения с вашей страной проживания, то оно может предусматривать освобождение от налога у источника или снижение налоговой ставки. Более подробная информация приведена ниже.

Информация о налоговых соглашениях Ирландии с другими странами доступна на сайте налогового управления Ирландии: https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

Взимается ли данный налог с компаний?

Налог у источника не взимается с компаний, учрежденных в странах, с которыми Ирландия заключила соглашение об избежании двойного налогообложения.

Как правило, данный налог взимается с доходов ирландских компаний за некоторыми исключениями, в том числе:

(a) инвестиционные компании (investment undertaking) согласно определению, установленному разделом 739B закона о консолидации налогов 1997 г.;

(b) процентный доход, выплаченный в Ирландии компаниям, которые отвечают условиям, изложенным в разделе 110.

Полный список исключений приведен в разделе 246(3) закона о консолидации налогов.

Законом не установлена стандартная форма для освобождения от налога для корпоративных клиентов. Чтобы воспользоваться льготой, клиенту необходимо предоставить IBIE подтверждение статуса юридического лица.

Как запросить освобождение от уплаты налога или сниженную ставку?

Если вы хотите подать заявление на освобождение от уплаты налога у источника или снижение налоговой ставки, заполните форму 8-3-6 и отправьте ее в IBIE.

При заполнении формы 8-3-6 укажите:

1. Свое имя (убедитесь, что оно совпадает с именем, указанным на вашем счете в IBKR);

2. Адрес;

3. Идентификационный номер налогоплательщика в вашей стране проживания;

4. Страну налогового резидентства;

5. Ставку, установленную налоговым соглашением между вашей страной налогового резидентства и Ирландией (см. ЧаВО);

6. Подпись;

7. Дату.

Перед отправкой формы 8-3-6 в IBIE обратитесь в местные налоговые органы, чтобы они подписали и поставили печать на форме.

Более подробные инструкции по заполнению формы 8-3-6 доступны на сайте Налогового управления Ирландии: https://www.revenue.ie/en/companies-and-charities/financial-services/withholding-tax-interest-payments/index.aspx

Если вы обратились в местный налоговый орган и попросили подписать форму 8-3-6, но получили отказ, то можете предоставить сертификат налогового резидента (Tax Residency Certificate), выданный местным налоговым органом, а также заполненную форму 8-3-6 без печати и подписи налоговых органов. Это правило было введено в январе 2023 г. после того, как IBIE уведомило Налоговое управление Ирландии о трудностях, с которыми сталкиваются клиенты при подаче формы.

В сертификате налогового резидента должно быть явно указано, что вы являетесь налоговым резидентом вашей страны проживания согласно соответствующему положению соглашения об избежании двойного налогообложения между Ирландией и вашей страной проживания.

Обратите внимание, что данный сертификат будет принят, только если вы сначала обратились в местные налоговые органы, чтобы они поставили подпись и штамп на форме 8-3-6, и не получили своевременный ответ или получили отказ.

Где можно скачать форму 8-3-6?

Форма 8-3-6 и инструкции по ее заполнению доступны на сайте Налогового управления Ирландии.

В качестве помощи IBIE также подготовила различные версии формы 8-3-6, в которых уже заполнены некоторые поля в зависимости от вашей страны налогового резидентства. Вы можете скачать нужную версию ниже.

Форма 8-3-6 была переведена на французский, немецкий, испанский, итальянский и нидерландский*.

1. Страны ЕЭЗ с нулевым налогом у источника

2. Страны ЕЭЗ с налогом у источника больше 0%

|

|

3. Другие страны, заключившие налоговое соглашение с Ирландией (символом * отмечены страны с нулевой ставкой во всех случаях)

|

Грузия |

Молдавия |

Сингапур |

|

|

Армения |

Гана |

Черногория |

Южная Африка* |

|

Австралия |

Гонконг |

Морокко |

Южная Корея* |

|

Бахрейн* |

Индия |

Новая Зеландия |

Швейцария* |

|

Беларусь |

Израиль |

Северная Македония* |

Таиланд |

|

Босния и Герцеговина* |

Япония |

Норвегия |

Турция |

|

Ботсвана |

Казахстан |

Пакистан |

Украина |

|

Канада |

Кения |

Панама |

Объединенные Арабские Эмираты* |

|

Чили |

Косово |

Катар* |

Великобритания* |

|

Китай |

Кувейт* |

Российская Федерация* |

Соединенные Штаты Америки* |

|

Египет |

Малайзия |

Саудовская Аравия* |

Узбекистан |

|

Эфиопия |

Мексика |

Сербия |

Вьетнам |

|

|

|

|

Замбия* |

Каждый владелец совместного счета должен предоставить свой пакет документов. То есть каждый владелец должен заполнить свою форму 8-3-6 и (при необходимости) предоставить сертификат налогового резидента.

Куда отправлять заполненную форму 8-3-6?

Отправьте заполненную форму в IBIE. Вам НЕ нужно отправлять ее в Налоговое управление Ирландии.

Как отправить форму 8-3-6 и подтверждающие документы в IBIE?

Отправьте письмо с подписанным экземпляром формы в формате PDF или JPEG на tax-withholding@interactivebrokers.com. Если налоговые органы отказались поставить печать на форме, то также отправьте на этот же адрес сертификат налогового резидента.

Либо загрузите подписанную форму 8-3-6 на "Портале клиентов" на странице "Задача по предоставлению документов". Если вы также хотите предоставить налоговый сертификат, его необходимо отправить на указанный выше адрес отдельным письмом.

Укажите в теме письма номер своего счета в IBIE для каждого электронного письма. В противном случае обработка вашей заявки может быть затруднена или невозможна.

При правильной подаче документов вы получите электронное письмо от IBIE, подтверждающее получение и одобрение вашего заявления.

Если документы были поданы неправильно или не в полном объеме, вы получите письмо с уточняющей информацией и инструкциями.

Если вы не получили от IBIE ответ в течение четырех недель, свяжитесь с нами.

Есть ли срок для подачи заявления на освобождение от налога или снижение ставки?

Срок не установлен. Однако для заявлений, поданных в 2023 г., освобождение от уплаты или снижение ставки начнет действовать только для процентных выплат, полученных после подачи заявления.

Если ваше заявление не было обработано до следующей процентной выплаты, мы возместим налог, удержанный после даты, когда мы получили ваше заявление. Налоговый возврат будет отображен в разделе "Удерживаемый налог" отчета по операциям.

Могу ли я вернуть списанный налог до подачи заявления на освобождение от налога или снижение ставки?

Да, если ваш доход не облагается налогом у источника, или для вас действует сниженная ставка согласно налоговому соглашению между Ирландией и вашей страной проживания, вы можете запросить возврат уплаченного налога, превышающего ставку, оговоренную в соглашении.

Как вернуть налоговое удержание, списанное с моего счета?

Как правило, процедуры (1) подачи заявления на освобождение от налога или снижение налоговой ставки и (2) возврата уже удержанного налога сильно отличаются. IBIE ожидает ответа от Налогового управления Ирландии о процедуре возврата удержанного налога, и опубликует эту информацию, как только она станет доступна.

Тем не менее, в 2022 г. Налоговое управление разрешило использовать заполненную форму 8-3-6 (с подписью и штампом соответствующего налогового органа), полученную IBIE до 31 декабря 2022 г., для возврата налога у источника за 2022 г. То есть если IBIE получила от вас заполненную форму 31 декабря 2022 г. или раньше, и налог был удержан с вашего счета в период с января по декабрь 2022 г., IBIE вернет вам часть или всю сумму списанного налога (в зависимости от договоренностей Ирландии и вашей страны проживания).

Если вы не предоставили форму 8-3-6 до 31 декабря 2022 г. или форма была предоставлена в неполном виде (например, без подписи или печати налоговых органов), вам необходимо отдельно запросить возврат налога, уплаченного в 2022 г. Как указано выше, IBIE ожидает ответа от Налогового управления Ирландии о процедуре возврата удержанного налога.

Сколько времени форма 8-3-6 остается действительной?

Заполненная в полном объеме форма 8-3-6 остается действительной в течение 5 лет, если в указанных обстоятельствах и данных не произошло значительных изменений. То же относится к случаям, когда вместо формы 8-3-6 с печатью и подписью налоговых органов клиент предоставляет сертификат налогового резидента. Если в ваших данных и обстоятельствах произошли существенные изменения с точки зрения налогообложения, вы должны незамедлительно сообщить о них IBIE и при необходимости предоставить новую форму 8-3-6. Например, если вы поменяли страну налогового резидентства, уведомите IBIE и отправьте в IBIE новую форму 8-3-6, которая содержит печать и подпись налогового органа в новой стране резидентства.

Обязательно ли заполнять форму 8-3-6? Могу ли я торговать, если не заполнил(а) форму?

Вы не обязаны заполнять форму 8-3-6 и можете вести торговлю без предоставления формы.

Однако, если вы не заполнили форму 8-3-6, IBIE обязана удерживать налог у источника в размере 20% с процентов по неинвестированным наличным балансам на вашем счете.

Где отображена информация о налоговом удержании в выписке по счету?

Просмотреть информацию о налоге у источника можно в разделе "Удерживаемый налог" ежемесячного отчета по операциям.

Эта информация также доступна в ежедневном отчете в 3ий рабочий день месяца (когда выплачиваются проценты).

Более подробно об этом можно узнать на сайте IBIE: https://www.interactivebrokers.ie/en/index.php?f=46788

Как узнать налоговую ставку, установленную соглашением между моей страной проживания и Ирландией?

Чтобы узнать налоговые ставки, посетите сайт Налогового управления Ирландии и/или обратитесь в местные налоговые органы. В качестве справки данные о налоговом удержании Ирландии также приведены ниже.

Щелкните по стране, чтобы открыть соответствующую форму 8-3-6.

*Форма 8-3-6 была переведена на французский, немецкий, испанский, итальянский и нидерландский*.

1. Страны ЕЭЗ с нулевым налогом у источника

2. Страны ЕЭЗ с налогом у источника больше 0%

|

|

3. Другие страны, заключившие налоговое соглашение с Ирландией (символом * отмечены страны с нулевой ставкой во всех случаях)

|

Грузия |

Молдавия |

Сингапур |

|

|

Армения |

Гана |

Черногория |

Южная Африка* |

|

Австралия |

Гонконг |

Морокко |

Южная Корея* |

|

Бахрейн* |

Индия |

Новая Зеландия |

Швейцария* |

|

Беларусь |

Израиль |

Северная Македония* |

Таиланд |

|

Босния и Герцеговина* |

Япония |

Норвегия |

Турция |

|

Ботсвана |

Казахстан |

Пакистан |

Украина |

|

Канада |

Кения |

Панама |

Объединенные Арабские Эмираты* |

|

Чили |

Косово |

Катар* |

Великобритания* |

|

Китай |

Кувейт* |

Российская Федерация* |

Соединенные Штаты Америки* |

|

Египет |

Малайзия |

Саудовская Аравия* |

Узбекистан |

|

Эфиопия |

Мексика |

Сербия |

Вьетнам |

|

|

|

|

Замбия* |

Проценты по выручке от коротких продаж

Как определить сумму процентных выплат и комиссий, связанных с займом акций.

Когда владелец счета открывает короткую позицию по акциям, IBKR занимает эквивалентные акции от его лица, чтобы исполнить свои обязательства по поставке акций покупателю. Договор о кредитовании ценных бумаг, по которому данные бумаги берутся в кредит, обязывает IBKR предоставить кредитору ценных бумаг денежный залог. Сумма залога основана на отраслевом стандарте расчета стоимости акций.

Кредитор акций выплачивает IBKR проценты по денежному залогу и также взимает комиссию за услуги, снижая сумму процентов ниже преобладающей рыночной процентной ставки по денежным залогам (как правило, ставка зависит от фактической ставки ФРС для денежных депозитов в USD). В случае с труднозанимаемыми акциями комиссия кредитора за предоставление акций может привести к отрицательной процентной ставке, взимаемой с IBKR.

Хотя многие брокеры предлагают часть этой скидки только институциональным клиентам, все клиенты IBKR получают проценты по выручке от короткой продажи акций, если она превышает 100 000 USD или эквивалентную сумму в другой валюте. Когда предложение по кредитованию ценной бумаги превышает спрос на ее заем, владельцы счетов могут получить проценты по своему короткому балансу, равные базовой ставке (например, ставке по однодневным кредитам ФРС для балансов, номинированных в USD) за вычетом спреда (который в данный момент составляет от 1,25% для балансов в 100 000 USD до 0,25% для балансов больше 3 000 000 USD). Ставки могут меняться без уведомления.

Когда спрос и предложение по ценной бумаге находятся на таком уровне, что бумаги становятся труднодоступными, скидка кредитора снижается и даже может стать отрицательной, и тогда со счета будут списаны средства. Скидка или списание будет перенаправлено на владельца счета в виде более высокой комиссии за кредит, которая может превысить проценты по выручке от короткой продажи и привести к списанию средств со счета. Поскольку в разные даты и с разных ценных бумаг взимаются разные ставки, IBKR рекомендует клиентам воспользоваться инструментом поиска акций для шортинга, доступным в разделе "Поддержка" на "Портале клиентов" или в "Управлении счетом", в котором можно просмотреть примерные ставки по коротким продажам. Обратите внимание, что ориентировочные ставки, указанные в данных инструментах, отражают проценты по выручке от коротких продаж, которые IBKR выплачивает по балансам III уровня, то есть по дополнительной выручке от короткой продажи на сумму в 3 млн USD или больше. Для балансов ниже этого порога ставка меняется в зависимости от суммы и базовой ставки для валюты сделки. Точную ставку можно узнать с помощью калькулятора в разделе "Выплачиваемые вам проценты по сальдо выручки от коротких продаж".

Больше примеров и калькулятор доступны на странице "Кредитование ценных бумаг".

ВАЖНОЕ ПРИМЕЧАНИЕ

Информация в TWS и инструменте поиска акций, которая касается доступности акций и ориентировочных ставок, предлагается по мере возможности, и мы не можем гарантировать точность и верность приводимых данных. Информация о доступности акций включает данные от сторонних организаций и не обновляется в реальном времени. Информация о ставках приводится только в справочных целях. Расчет по сделкам, которые исполняются в текущую торговую сессию, как правило, выполняется через 2 рабочих дня, и фактическая стоимость займа и доступность акций определяются в день расчетов. Трейдерам следует учитывать, что доступность и стоимость займа акций может значительно измениться за период расчета, особенно это касается низколиквидных акций, акций компаний с низкой капитализацией и акций с предстоящими корпоративными действиями (включая выплату дивидендов). Более подробная информация приведена в статье "Операционные риски коротких продаж".

Использование свободных денежных средств (cash sweep)

Согласно законодательству, все транзакции с ценными бумагами должны исполняться и обеспечиваться в сегменте ценных бумаг универсального счета, а транзакции с товарами – в сегменте товаров1. Хотя законом разрешено хранение позиций с полностью оплаченными ценными бумагами в сегменте товаров в качестве маржинального залога, IB хранит бумаги и товары в разных сегментах, тем самым ограничивая размер залога согласно более строгим правилам SEC. Поскольку решение о хранении позиций в том или ином сегменте определяется законодательством, единственным активом, который можно перемещать между сегментами с согласия клиента, являются наличные средства.

Ниже описаны варианты использования свободных денежных средств (применения cash sweep), как выбрать подходящий вариант и что при этом следует учесть.

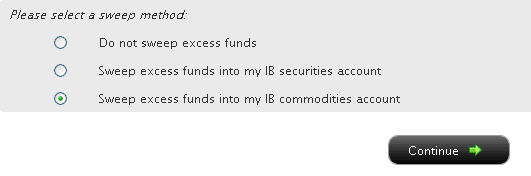

Выберите графу рядом с нужным вариантом и нажмите "Далее" (Continue). Настройки начнут действовать на следующий рабочий день и будут активны до тех пор, пока вы не выберите другой вариант. Обратите внимание, что если у вас есть необходимые торговые разрешения, описанные выше, менять настройки можно в любое время без ограничений.

A Comparison of U.S. Segregation Models (сравнение моделей разделения активов клиентов в США);

Начисляются ли проценты по внесенным средствам в период резервирования?

Ответ зависит от метода внесения средств. Если перевод был сделан через ACH, то проценты начисляются с даты поступления средств, включая период резервирования в 4 рабочих дня, после которого зачисляются на счет. В случае с чековыми депозитами (кроме банковских чеков), в период резервирования проценты не начисляются. Банковские чеки и безналичные переводы зачисляются на счет сразу после поступления, поэтому не имеют периода резервирования.

Сумма процентов зависит от условий рынка. Актуальная информация о процентах по кредитовым остаткам на счете доступна на странице www.interactivebrokers.com/ru/trading/margin-rates.php

Что отображается в разделе "Возврат начислений процентов" отчета по операциям?

IBKR каждый день рассчитывает прогноз или накопление процентов к уплате или получению за определенный период и отображает эти данные разделе "Возврат начислений процентов" отчета по операциям. В первую неделю каждого месяца проценты, накопленные за предыдущий месяц, "отменяются", или возвращаются, и в разделе "Отчет о денежных средствах" публикуются фактические проценты за этот месяц. Сумма возвратов, которые выполняются раз в месяц, как правило, должна примерно совпадать с фактически начисленными процентами, но может немного отличаться, поскольку является прогнозом.

Также обращаем внимание, что проценты, накопленные за данный период, публикуются только в том случае, если их сумма превышает 1 $, как при зачислении, так и при списании. Проценты в размере меньше 1 $ будут опубликованы после того, как вместе с последующими начислениями их сумма превысит1 $.

Как взимаются проценты при кредитовом балансе на счете

Со счета могут взиматься проценты несмотря на общий положительный или кредитовый остаток наличных средств в следующих случаях:

1. На счете есть отрицательный или дебетовый остаток в определенной валюте.

Например, если на счете есть кредитовый остаток, равный 5000 USD, который состоит из длинного баланса в 8000 USD и короткого остатка в евро, эквивалентного 3000 USD, то с такого счета будут взиматься проценты по короткому евровому остатку. Невозможно компенсировать кредитовую часть баланса за счет длинного баланса в USD, поскольку он меньше лимита I уровня, равного 10 000 USD, при превышении которого начинают начисляться проценты.

Обращаем внимание, что если вы покупаете ценную бумагу, номинированную в валюте, которой нет на вашем счете, IBKR оформит кредит в этой валюте, чтобы провести расчет по этой сделке с клиринговой палатой. Если вы хотите избежать оформления такого кредита и удержания процентов, то перед исполнением сделки вам необходимо либо внести на счет средства в данной валюте, либо сконвертировать существующий денежный баланс через Ideal Pro (для балансов от 25 000 USD) или площадку, исполняющую сделки с неполными лотами (для балансов меньше 25 000 USD).

2. Кредитовый баланс состоит главным образом из выручки от короткой продажи ценных бумаг.

Например, если на счете есть чистый кредитовый остаток в 12 000 USD, который состоит из дебета в 6000 USD на субсчете ценных бумаг (минус рыночная стоимость всех коротких позиций по акциям) и кредита из коротких акций на 18 000 USD, то с него будут взиматься проценты по дебету в 6000 USD I-го уровня, и не будут начисляться проценты по кредиту с короткими акциями, поскольку он не превышает порог лимита I-го уровня в 100 000 USD.

3. По некоторым средствам на кредитовом балансе не выполнен расчет.

IBKR определяет начисления и списания процентов на основе только тех средств, по которым выполнен расчет. Таким образом, со счета не взимаются проценты по средствам, взятым в кредит для покупки ценных бумаг, до тех пор, пока по этой транзакции не выполнен расчет, и также на счет не начисляются процентные выплаты по средствам от продажи ценных бумаг, и за счет этих процентов нельзя компенсировать дебетовый баланс, пока не проведен расчет по продаже (и IBKR не получит средства от клиринговой палаты).

FAQs – Irish Income Withholding Tax

As an Irish company, Interactive Brokers Ireland Limited (IBIE) is generally required to collect withholding tax (WHT) at a rate of 20% on interest paid to certain clients.

This requirement is set out in section 246 of the Irish Taxes Consolidation Act 1997 and generally applies to interest paid to clients that are:

(i) natural persons resident in Ireland,

(ii) natural persons resident outside Ireland unless the client has successfully applied for an exemption or a reduction in the WHT rate under a Double Tax Treaty (DTT) between Ireland and the person’s country of residence.

(iii) Irish companies

(iv) Companies established in countries with which Ireland has NOT concluded a DTT.

The purpose of this document is to set out our responses to some frequently asked questions (FAQs) on the WHT.

This document is for information purposes only and does not constitute tax, regulatory or any other kind of advice. If you are unsure of your tax obligations please consult the Irish Revenue Commissioners, your local tax authority or an appropriate tax professional.

FAQs

What type of interest does Irish WHT apply to?

Does Irish WHT apply to interest I earn through the Stock Yield Enhancement Program?

If I earn interest through Bond Coupons, am I required to pay Irish WHT?

I do not trade Irish stocks, do I still have to pay Irish WHT?

What is the standard Irish WHT Rate?

When is the 20% WHT applied to my account?

What currency is used for Irish WHT?

I am resident in Ireland. Do I have to pay Irish WHT?

I am not resident in Ireland. Does Irish WHT apply to me?

Does WHT apply to clients who are companies?

How do I apply for an exemption from WHT or a reduced WHT rate?

What do joint account holders need to submit to obtain a WHT exemption/reduction?

Where should I send my completed Form 8-3-6?

How do I submit Form 8-3-6 and supporting documentation to IBIE?

Do I need to apply for an exemption from WHT or a reduction in the WHT rate by a certain deadline?

How do I apply to reclaim WHT applied to my account?

How long does a completed Form 8-3-6 remain valid for?

Do I have to complete a Form 8-3-6? Can I still trade if I don’t complete it?

Where can I see information relating to Irish WHT on my account statement?

How do I know what WHT rate has been agreed between my country of residence and Ireland?

WHT is a set amount of income tax that is withheld at the time income is paid to a person.

Under Irish law, interest payments are considered income. This means that IBIE is legally required to deduct WHT from credit interests on uninvested cash balances in our clients’ securities accounts.

What type of interest does Irish WHT apply to?

Irish WHT applies to credit interest paid to long settled uninvested cash balances as well as short credit interest where you have borrowed stock from IBIE.

Does Irish WHT apply to interest I earn through the Stock Yield Enhancement Program?

No. The interest you earn under the Stock Yield Enhancement Program is not within scope for Irish WHT obligations. Irish WHT only applies to credit interest paid on uninvested cash balances in your account.

If I earn interest through Bond Coupons, am I required to pay Irish WHT?

No. Interest that you earn on Bond Coupons is not within scope for Irish WHT obligations. Irish WHT applies only to credit interest paid on uninvested cash balances in your account.

I do not trade Irish stocks, do I still have to pay Irish WHT?

Yes. If your account is held by IBIE, your account is in scope for Irish WHT on credit interest payments. It is irrelevant whether or not you trade in Irish stocks.

What is the standard Irish WHT Rate?

The standard rate of WHT is 20%. You can find further information on credit interest rates on our webpage.

When is the 20% WHT applied to my account?

If IBIE is required to apply WHT to your interest payments, we will do so at the same time any credit interest is paid to your account.

IBIE pays interest due on the uninvested cash balance in your account on the third business day of the month following the month in which the interest accrued. For example, interest accrued in January will be paid on the third business day in February.

What currency is used for Irish WHT?

Irish WHT is charged in the same currency as the credit interest paid on the uninvested cash balances in your account.

I am resident in Ireland. Do I have to pay Irish WHT?

Yes. Under Irish tax law, all Irish resident individuals and partnerships are subject to 20% WHT on credit interest payments. Irish companies are also subject to WHT, although some limited exemptions may apply.

I am not resident in Ireland. Does Irish WHT apply to me?

Yes, generally Irish WHT applies to natural persons whether or not they reside in Ireland.

However, if Ireland has entered a Double Taxation Treaty (DTT) with your country of residence, that DTA may allow you to apply for an exemption from or reduction in WHT, depending on its terms. Please see further below.

You can find information about Ireland’s DTTs on the Irish Revenue website https://www.revenue.ie/en/tax-professionals/tax-agreements/rates/index.aspx

Does WHT apply to clients who are companies?

WHT does not apply to companies resident in countries that have a DTT with Ireland.

In general, WHT applies to Irish resident companies with a few exceptions, including;

(a) an investment undertaking within the meaning of section 739B of the Taxes Consolidation Act 1997,

(b) interest paid in the State to a qualifying company (within the meaning of section 110).

For a full list of exemptions, please refer to Section 246(3) of the Taxes Consolidation Act.

There is no standard exemption form for corporate clients. In order to avail of these exemptions, clients will have to provide proof of their corporate status requested by IBIE.

How do I apply for an exemption from WHT or a reduced WHT rate?

If you wish to apply for a WHT exemption or reduction under the terms of a DTT, you should complete Form 8-3-6, and return that Form to IBIE.

The following is a summary of the information you must provide when completing Form 8-3-6:

1. Your name (please ensure this matches the name on your IBKR account)

2. Your address

3. Your tax reference number in country of residence

4. The country in which you are tax resident

5. The WHT rate agreed between your country of tax residence and Ireland (see FAQ on this topic).

6. Signature.

7. Date.

You must request your local Tax Authority to sign and stamp Form 8-3-6 before returning it to us.

For more detailed information on how to complete Form 8-3-6, please refer to the Irish Revenue Commissioners’ website here https://www.revenue.ie/en/companies-and-charities/financial-services/withholding-tax-interest-payments/index.aspx

If you have asked your local tax authority to sign Form 8-3-6 and they have refused, you can instead submit a Tax Residency Certificate (TRC) from your local Tax Authority, with a completed Form 8-3-6 that has not been signed and stamped by your local tax authority. Revenue introduced this possibility in January 2023, after being informed by IBIE of the difficulties clients were experiencing in completing the Form.

To be acceptable, the TRC must explicitly state that you are tax resident in your country of residence in accordance with the relevant provision of the double taxation treaty between Ireland and your country of residence.

Please note that a TRC will only be accepted where you have first requested your local tax authority to sign and stamp Form 8-3-6 and it has refused to do so or has failed to do so within a reasonable time.

Form 8-3-6 and information about completing the Form 8-3-6 is available on the website of the Irish Revenue Commissioners.

To assist you, IBIE has also prepared a number of versions of Form 8-3-6 with certain information pre-filled, depending on your jurisdiction of tax residency. You can select the most appropriate form from the list below.

Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch*

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

What do joint account holders need to submit to obtain a WHT exemption/reduction?

Each account holder in a joint account needs to complete their own documentation. This means that a separate Form 8-3-6 must be completed by each account holder and (if relevant) a separate TRC must be provided by each account holder.

Where should I send my completed Form 8-3-6?

You should send your completed Form to IBIE. You should NOT send the Form to Irish Revenue.

How do I submit Form 8-3-6 and supporting documentation to IBIE?

You should email a PDF or JPEG copy of the signed form to tax-withholding@interactivebrokers.com. If you have not been able to obtain a stamp from your local tax authority, please ensure that you also email your Tax Residency Certificate (TRC) to this same email address.

Alternatively, you can upload your signed Form 8-3-6 to your Client Portal through the ‘Document Submission Task’ tab. However, if you are submitting a TRC with your Form you will still need to send this separately to the above email address.

Please put your IBIE account number in the email subject line in all email correspondence. A failure to do so may delay or prevent the processing of your application,

If your submitted documentation is in order, IBIE will send you a confirmation email stating that your Form has been received and processed.

If your submitted documentation is not in order, we will send you an email setting out the additional information or documentation we require to process your application.

Please follow up with IBIE if you have not heard from us within four weeks.

Do I need to apply for an exemption from WHT or a reduction in the WHT rate by a certain deadline?

There is no deadline. However, for applications made in 2023, a WHT exemption or rate reduction will only apply to interest payments made after IBIE has received a complete application.

If we have not processed your Form 8-3-6 by the time the next interest payment is made to your account we will refund any WHT deducted after the date we received your application. Refunds will be visible in the Withholding Tax section of a statement.

Yes, if you are not subject to WHT, or are subject to a reduced WHT rate by virtue of a Double Taxation Treaty between Ireland and your country of residence, you will be entitled to reclaim WHT paid in excess of the WHT rate set out in the DTT.

How do I apply to reclaim WHT applied to my account?

Generally, the application process (i) to apply for an exemption from WHT or a reduction in the WHT rate going forward and (ii) to reclaim WHT already charged, are two separate processes. IBIE is awaiting full details from the Irish Revenue Authority on how clients can make reclaims on WHT and will make these details available once provided.

However, for 2022, Revenue has agreed to allow a completed Form 8-3-6 (signed and stamped by the relevant Tax Authority) received by IBIE before 31 December 2022, to be used to reclaim WHT applied in 2022. This means that if IBIE received a completed form from you on or before 31 December 2022 and WHT was applied to your account from January – December 2022, IBIE will refund all or part of that WHT, depending on Ireland’s arrangements with your tax jurisdiction.

If you did not provide a Form 8-3-6 before 31 December 2022 or, if you provided a Form 8-3-6 but it was incomplete (for example by not being stamped by your local tax authority), you must separately apply for a full or partial reclaim of WHT paid in 2022 and 2023. Further details on the reclaim process may be found in an article titled Irish Tax Withholding Reclaim Process. For your convenience, the full article may be viewed here.

How long does a completed Form 8-3-6 remain valid for?

A fully completed Form 8-3-6 remains valid for 5 years unless there is a material change in your facts and circumstances. This also applies if you have provided IBIE with a TRC in lieu of having your Form 8-3-6 stamped by your local tax authority. If there is a material change to your circumstances from a tax perspective, you must advise IBIE immediately and provide an updated Form 8-3-6 where appropriate. For example, if you move tax residency from one country to another, you should advise IBIE and provide IBIE with a Form 8-3-6, signed and stamped by your local tax authority from your new country of residence.

Do I have to complete a Form 8-3-6? Can I still trade if I don’t complete it?

You do not have to complete Form 8-3-6 and you will still be able to trade if you do not complete the form.

However, if you do not complete Form 8-3-6 IBIE must continue to deduct WHT at a rate of 20% from the credit interest earned on cash balances in your account.

Where can I see information relating to Irish WHT on my account statement?

You can review information relating to Irish WHT in the ‘Withholding Tax’ section of your monthly account activity statement.

You can also view this information in your daily statement on the 3rd business day of the month (when credit interest is paid).

Please see the IBIE website here for more information: https://www.interactivebrokers.ie/en/index.php?f=46788

How do I know what WHT rate has been agreed between my country of residence and Ireland?

This information is available from the Irish Revenue Commissioners and/or your own local tax authority. However, in order to assist you, IBIE has also prepared a list of Irish WHT information by jurisdiction below.

By clicking on the country below, it will bring you to the relevant Form 8-3-6.

*Form 8-3-6 has been translated into French, German, Spanish, Italian and Dutch*

1. EEA countries with 0% Withholding Tax.

2. EEA countries with rates above 0% Withholding Tax.

|

|

3. Other countries with a DTA with Ireland (* denotes where there is 0% withholding tax in all situations).

|

Georgia |

Moldova |

Singapore |

|

|

Armenia |

Ghana |

Montenegro |

South Africa* |

|

Australia |

Hong Kong |

Morocco |

South Korea* |

|

Bahrain* |

India |

New Zealand |

Switzerland* |

|

Belarus |

Israel |

North Macedonia* |

Thailand |

|

Bosnia & Herzegovina* |

Japan |

Norway |

Turkey |

|

Botswana |

Kazakhstan |

Pakistan |

Ukraine |

|

Canada |

Kenya |

Panama |

United Arab Emirates* |

|

Chile |

Kosovo |

Qatar* |

United Kingdom* |

|

China |

Kuwait* |

Russian Federation* |

United States of America* |

|

Egypt |

Malaysia |

Saudi Arabia* |

Uzbekistan |

|

Ethiopia |

Mexico |

Serbia |

Vietnam |

|

|

|

|

Zambia* |

Почему "цена" труднореализуемых акций не совпадает с их ценой при закрытии?

При определении суммы денежного депозита, необходимой для обеспечения позиции заемных акций, общее соглашение рынка предписывает, что кредитор должен получить депозит в размере 102% от расчетной цены предыдущего рабочего дня**, округленных в бо́льшую сторону до ближайшего целого доллара и умноженных на число заимствованных акций. Поскольку ставки по займам определяются на основании стоимости залога по кредиту, данное правило влияет на стоимость поддержания короткой позиции, при этом влияние наиболее значимо для дешевых и труднозанимаемых акций. Обратите внимание, что для акций, выраженных не в долларах США, метод расчета будет другим. Таблица с условиями расчета для разных валют приведена ниже:

| Валюта | Метод расчета |

| USD | 102%; округление до ближайшего доллара |

| CAD | 102%; округление до ближайшего доллара |

| EUR | 105%; округление до ближайшего цента |

| CHF | 105%; округление до ближайшего раппена |

| GBP | 105%; округление до ближайшего пенса |

| HKD | 105%; округление до ближайшего цента |

Держатели счетов могут просмотреть скорректированную цену транзакций в ежедневном отчете по операциям в разделе "Сведения о недоступных для коротких продаж акциях". Ниже приведены два примера расчета залога и его влияние на плату по займу.

Пример 1

Короткая продажа 100 000 акций ABC по $1,50

Полученная прибыль от короткой продажи = $150 000,00

Предположим, что цена ABC падает до $0,25 и ставка по займу составляет 50%

Расчет стоимости залога по коротким акциям

Цена = 0,25 x 102% = 0,255; округление до $1,00

Стоимость = 100 000 акций x $1, 00 = $100 000,00

Плата по займу = $100 000 x 50% / 360 дней в году = $138,89 в день

Предполагая, что остаток денежных средств владельца не включает доход от других операций короткой продажи, эта плата по займу не будет компенсироваться за счет каких-либо кредитовых процентов от данной короткой продажи, поскольку остаток не превышает минимальный порог в $100 000 (уровень 1), требуемый для начисления процентов.

Пример 2 (акции, выраженные в EUR)

Короткая продажа 100 000 акций ABC по EUR 1,50

Предположим, что цена закрытия в предыдущий день составила EUR 1,55 и ставка по займу составляет 50%

Расчет стоимости залога по коротким акциям

Цена = EUR 1,55 x 105% = 1,6275; округление до EUR 1,63

Стоимость = 100 000 акций x 1,63 = $163 000,00

Плата по займу = EUR 163 000 x 50% / 360 дней в году = EUR 226,38 в день

** Обратите внимание, что суббота и воскресенье расцениваются как пятница, и при расчете суммы депозита в эти дни будет использоваться расчетная цена четверга.

Программа повышения доходности акций (SYEP): ЧаВО

В чем цель "Программы повышения доходности акций"?

"Программа повышения доходности акций" (англ. Stock Yield Enhancement program, или SYEP) предоставляет клиентам возможность получать дополнительный доход от позиций по ценным бумагам, которые в противном случае бы не использовались (т.е. полностью оплаченных ценных бумаг и ценных бумаг с избыточной маржей), разрешая IBKR передавать эти бумаги в кредит третьим сторонам. Участники программы получают денежный залог для обеспечения возврата ссуды акций по ее окончании, а также проценты по денежному залогу, выплачиваемые заемщиком за каждый день ссуды.

Что такое полностью оплаченные ценные бумаги и бумаги с избыточной маржей?

Полностью оплаченные ценные бумаги – это бумаги на счете клиента, которые были оплачены целиком. Ценные бумаги с избыточной маржей – это бумаги, которые не были полностью оплачены, но рыночная стоимость которых превышает 140% от маржевого дебетового остатка на счете клиента.

Как определяется доход, полученный клиентом по какой-либо кредитной сделке в рамках "Программы повышения доходности акций"?

Доход, получаемый клиентом в обмен на предоставленные акции, зависит от кредитных ставок на внебиржевом рынке ценных бумаг. Эти ставки отличаются для разных ценных бумаг и сроков кредита. Как правило, IBKR выплачивает участникам проценты по их денежному залогу в размере примерно 50% от суммы, полученной IBKR за предоставление акций в кредит.

Как определяется сумма денежного залога для ссуды?

Денежный залог, который лежит в основе ссуды ценных бумаг и используется для расчета процентных выплат, определяется с помощью соглашений рынка. По этим соглашениям цена акции при закрытии рынка умножается на определенный процент (обычно 102-105%) и затем округляется в бо́льшую сторону до ближайшего доллара / цента / пенса и т.д. Условия соглашения отличаются для разных валют. Например, заем в 100 акций в USD, цена закрытия которых составляет $59,24, будет равен $6100 ($59,24 * 1,02 = $60,4248; округленное до $61, умноженное на 100). Ниже приведена таблица с условиями соглашений для разных валют:

| USD | 102%; округление до ближайшего доллара |

| CAD | 102%; округление до ближайшего доллара |

| EUR | 105%; округление до ближайшего цента |

| CHF | 105%; округление до ближайшего раппена |

| GBP | 105%; округление до ближайшего пенса |

| HKD | 105%; округление до ближайшего цента |

Подробнее можно узнать в статье KB1146.

Как и где хранится залог по кредитам SYEP?

В случае с клиентами IBLLC залог будет храниться в виде наличных средств или казначейских ценных бумаг США и будет передан на хранение партнеру IBLLC – IBKR Securities Services LLC ("IBKRSS"). Залог по Вашему займу в рамках данной программы будет храниться в IBKRSS на счете, в отношении которого у Вас будет первоочередное обеспечительное право. В случае дефолта со стороны IBLLC у Вас будет доступ к залогу напрямую через IBKRSS без посредничества IBLLC. Подробнее об условиях хранения можно узнать в соглашении об управлении счетом ценных бумаг. Если Ваш счет открыт в другом филиале IBKR, то залог будет храниться и застрахован данным филиалом. Например, залог для счетов в IBIE хранится и застрахован IBIE.

Как длинная продажа и перевод акций, предоставленных в кредит через SYEP, или выход из программы влияет на проценты?

Начисление процентов прекращается на следующий рабочий день после сделки (T+1). Также проценты перестают начисляться на следующий рабочий день после даты начала перевода или выхода из программы.

Каковы условия участия в "Программе повышения доходности акций" IBKR?

| Филиалы, участвующие в программе* |

| IB LLC |

| IB UK (кроме счетов SIPP) |

| IB IE |

| IB CE |

| IB HK |

| IB Canada (кроме счетов RRSP/TFSA) |

| IB Singapore |

| Типы счетов, которые могут участвовать в программе |

| Наличный (капитал не менее $50 000 на день вступления) |

| Маржевый |

| Счета клиентов финансового консультанта* |

| Счета клиентов представляющего брокера: с полным раскрытием информации и без раскрытия информации* |

| Омнибус-счета представляющего брокера |

| Счета с раздельным торговым лимитом (Separate Trading Limit, или STL) |

*Счета-участники должны соответствовать критериям в отношении минимального капитала маржевого или наличного счета.

Программа недоступна для клиентов IB Japan, IB Europe SARL, IBKR Australia и IB India. Клиенты из Японии и Индии, имеющие счета в IB LLC, могут участвовать в программе.

Также присоединиться к программе могут счета клиентов финансового консультанта, клиенты IBroker с полным раскрытием информации и омнибус-брокеры, отвечающие требованиям выше. В случае с финансовыми консультантами и брокерами IBroker их клиенты должны сами подписать соглашения. В случае омнибус-брокера соглашение подписывает он сам.

Могут ли в программе SYEP участвовать пенсионные IRA-счета?

Да.

Могут ли в программе SYEP участвовать сегменты IRA-счетов под "Управлением активами" Interactive Brokers?

Нет.

Могут ли в программе SYEP участвовать пенсионные счета SIPP Великобритании?

Нет.

Что произойдет, если остаток средств на участвующем счете упадет ниже требуемого порога в $50 000?

Наличный счет должен соответствовать данному требованию о минимальном капитале только на момент регистрации в программе. Если впоследствии сумма капитала упадет ниже данного уровня, это не повлияет на существующие ссуды и возможность предоставлять новые.

Как стать участником "Программы повышения доходности акций" IBKR?

Присоединиться к программе можно на "Портале клиентов". Авторизуйтесь на портале и затем откройте меню пользователя (иконка профиля в правом верхнем углу) и зайдите в Настройки. Затем в Настройках счета найдите раздел Торговля и выберите пункт Программа повышения доходности акций, чтобы присоединиться. На экране отобразятся формы и уведомления, необходимые для участия в программе. Прочитайте и подпишите документы, после чего Ваш запрос будет отправлен на обработку. Одобрение занимает 24-48 ч.

Как выйти из "Программы повышения доходности акций"?

Чтобы выйти из программы, зайдите на "Портал клиентов". Откройте меню пользователя (иконка профиля в правом верхнем углу) и зайдите в Настройки. В Настройках счета найдите раздел Торговля, выберите пункт Программа повышения доходности акций и следуйте инструкциям. Ваш запрос будет отправлен на обработку. Запросы на выход из программы, как правило, выполняются в конце дня.

Если счет становится участником, а позже выходит из программы, когда он сможет снова к ней присоединиться?

После выхода из программы счет не может снова участвовать в SYEP в течение 90 календарных дней.

Какие типы позиций по ценным бумагам могут быть предоставлены в кредит?

| Рынок США | Рынок ЕС | Рынок Гонконга | Рынок Канады |

| Обыкновенные акции (котируемые на бирже, внебиржевом рынке PINK и на OTCBB) | Обыкновенные акции (котируемые на бирже) | Обыкновенные акции (котируемые на бирже) | Обыкновенные акции (котируемые на бирже) |

| ETF | ETF | ETF | ETF |

| Привилегированные акции | Привилегированные акции | Привилегированные акции | Привилегированные акции |

| Корпоративные облигации* |

*Недоступно для муниципальных облигаций.

Есть ли ограничения на кредитование акций, торгуемых на вторичном рынке после IPO?

Нет, при условии, что на счет не распространяются ограничения на торговлю данными ценными бумагами.

Как IBKR определяет количество акций, которые могут быть предоставлены в кредит?

Сначала IBKR определяет стоимость ценных бумаг (если таковые имеются), в отношении которых IBKR обладает залоговым правом и которые может выдавать в кредит без участия клиента в "Программе повышения доходности акций". Брокер, который кредитует покупку ценных бумаг клиентами с помощью маржинальных займов, по закону может выдавать кредит или предоставлять в качестве залога ценные бумаги этого клиента на сумму до 140% от денежного дебетового остатка. Например, если клиент с денежным балансом в $50 000 покупает ценные бумаги, рыночная стоимость которых составляет $100 000, то дебетовый или остаток по кредиту составит $50 000, и брокер имеет право взыскать до 140% этого остатка (т.е. ценные бумаги на $70 000). Любые ценные бумаги клиента сверх этой суммы являются ценными бумагами с избыточной маржей (в данном примере $30 000) и должны быть обособлены, если только клиент не предоставит IBKR разрешение на кредитование через "Программу повышения доходности акций".

Дебетовый остаток определяется путем конвертации в USD всех денежных остатков в других валютах и затем вычитания прибыли от коротких продаж акций (при необходимости сконвертированных в USD). Если полученное значение является отрицательным, то мы высвобождаем до 140% от этой суммы. Кроме того, не учитываются остатки денежных средств в товарном сегменте или предназначенные для спот-металлов и CFD. Подробное объяснение доступно на этой странице.

ПРИМЕР 1. Клиент имеет длинную позицию в 100 000 EUR на счете, базовая валюта которого – USD, курс пары EUR.USD составляет 1,40. Клиент покупает акции, выраженные в USD, на сумму $112 000 (80 000 EUR). Все ценные бумаги считаются полностью оплаченными, поскольку денежный остаток, сконвертированный в USD, является кредитовым.

| Составляющая | EUR | USD | База (USD) |

| Наличные средства | 100 000 | (112 000) | $28 000 |

| Длинные акции | $112 000 | $112 000 | |

| NLV | $140 000 |

ПРИМЕР 2. Клиент имеет длинную позицию в 80 000 USD, длинную позицию по акциям, выраженным в USD, на сумму $100 000, и короткую позицию по акциям, выраженным в USD, на сумму $100 000. Длинные акции на общую сумму в $28 000 считаются маржинальными бумагами, а оставшиеся (на сумму $72 000) являются бумагами с избыточной маржей. Это значение получено путем вычитания доходов от короткой продажи акций из остатка денежных средств ($80 000 - $100 000) и умножением получившегося значения дебета на 140% ($20 000 * 1,4 = $28 000).

| Составляющая | База (USD) |

| Наличные средства | $80 000 |

| Длинные акции | $100 000 |

| Короткие акции | ($100 000) |

| NLV | $80 000 |

Будет ли IBKR выдавать в кредит все подходящие акции?

Мы не гарантируем, что все участвующие в SYEP акции будут выданы в кредит, поскольку для некоторых бумаг может не быть рынка с выгодной ставкой, IBKR может не иметь доступа к рынку с желающими взять данные акции в кредит, или IBKR может решить не выдавать Ваши акции в кредит.

Кредиты в рамках SYEP выдаются только с шагом в 100?

Нет. Кредиты предоставляются на любую целую сумму акций, но внешне мы выдаем ссуды только в количестве, кратном 100. Таким образом, существует вероятность, что при наличии внешнего спроса на заимствование 100 акций мы предоставим в кредит 75 акций от одного клиента и 25 от другого.

Как ссуды распределяются среди клиентов, когда число доступных акций превышает спрос на заем?

В случае если спрос на заем определенной ценной бумаги меньше, чем предложение доступных акций от участников "Программы повышения доходности акций", ссуды будут распределены пропорционально. Например, если совокупное предложение составляет 20 000, а спрос – 10 000, то в кредит будет выдано 50% акций каждого клиента.

Акции выдаются в кредит только клиентам IBKR или другим третьим лицам?

Акции могут быть предоставлены в кредит любому контрагенту, а не только другим клиентам IBKR.

Может ли участник SYEP указать, какие акции IBKR может предоставить в кредит?

Нет. Программа полностью управляется IBKR. Определив ценные бумаги (если таковые есть), которые IBKR может предоставить в кредит на основании залогового права, компания может по своему усмотрению решить, какие из полностью оплаченных ценных бумаг или бумаг с избыточной маржей могут быть выданы в кредит.

Есть ли ограничения на продажу ценных бумаг, выданных в кредит по программе SYEP?

Участвующие в программе акции можно продать в любое время без каких-либо ограничений. Акции не нужно возвращать для расчета по сделке, а доход от продажи зачисляется на счет клиента в обычный срок. Кроме того, кредитный договор будет прекращен при открытии рынка в рабочий день, следующий за датой продажи ценных бумаг.

Может ли клиент продать покрытый колл по акциям, предоставленным в кредит в рамках SYEP, и получить условия маржи покрытого колла?

Да. Ссуда акций не влияет на маржинальные требования на непокрытой или хеджированной основе, поскольку кредитор сохраняет право на любую прибыль и несет ответственность за любые убытки, связанные с выданной в кредит позицией.

Что произойдет с выданными в кредит акциями, если они будут поставлены в результате уступки колла или исполнения пута?

Такой кредитный договор будет прекращен в режиме T+1 после соответствующего действия (сделки, уступки, исполнения), которое привело к закрытию или уменьшению позиции.

Что произойдет с выданными в кредит акциями, если позднее торговля ими на бирже будет приостановлена?

Временное прекращение торгов не оказывает прямого влияния на возможность выдавать акции в кредит, и пока IBKR может предоставлять их в кредит, такая ссуда будет оставаться в силе вне зависимости от статуса торгов.

Можно ли перенести денежный залог от ссуды в товарный сегмент для покрытия маржи и/или колебаний?

Нет. Денежный залог для обеспечения ссуды никак не влияет на маржу или финансирование.

Что произойдет, если участник программы возьмет маржинальный кредит или увеличит остаток по кредиту?

Если у клиента есть полностью оплаченные ценные бумаги, предоставленные в кредит по "Программе повышения доходности акций", и он возьмет маржинальный кредит, то этот кредит будет прекращен в той степени, в которой ценные бумаги не имеют избыточной маржи. Аналогичным образом, если у клиента есть ценные бумаги с избыточной маржей, предоставленные в кредит по программе SYEP, и он увеличивает существующий маржинальный кредит, то этот кредит может быть прекращен в той степени, в которой бумаги не имеют избыточной маржи.

При каких условиях кредит будет прекращен?

Ссуда ценных бумаг будет автоматически прекращена в следующих случаях:

- Если клиент решает выйти из программы

- Перевод акций

- Заимствование определенной суммы под залог акций

- Продажа акций

- Уступка колла/исполнение пута

- Закрытие счета

Получают ли участники SYEP дивиденды по предоставленным в кредит акциям?

Акции, участвующие в программе SYEP, как правило, отзываются у заемщиков до экс-дивидендной даты с целью получить дивиденды и избежать плату в возмещение дивидендов. Однако участники также могут получить такую плату.

Остается ли у участников SYEP право голоса по выданным в кредит акциям?

Нет. Право голоса и предоставления согласия в отношении акций переходит к заемщику ценных бумаг, если дата регистрации акционеров или срок для голосования, предоставления согласия или принятия других мер выпадает на срок займа.

Получают ли участники SYEP права, варранты или "спин-офф" акции выданных в кредит бумаг?

Да. Кредитор ценных бумаг получит любые права, варранты, акции "спин-офф" (акции в результате создания дочерней компании) и размещения, принадлежащие предоставленным в кредит бумагам.

Как ссуды отображены в отчете по операциям?

Денежный залог, акции в обращении, активность и доход отражены в следующих 6 разделах:

1. Сведения о денежных средствах – сведения о начальном балансе денежного залога (казначейских бумагах США или наличных средствах), чистое изменение в результате ссуды (положительное значение, если открыты новые ссуды; отрицательное в случае чистой прибыли) и конечный баланс денежного залога.

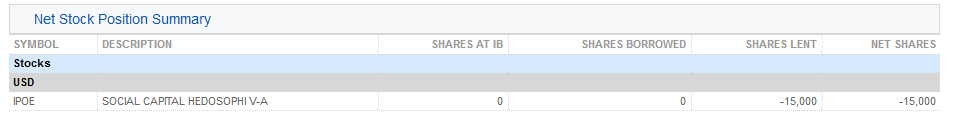

2. Данные о чистой позиции по акциям (Net Stock Position Summary) – для каждой акции указаны следующие сведения: общее количество акций в IBKR; количество заимствованных акций; число акций, выданных в кредит; и чистое число акций (= акции в IBKR + взятые в кредит акции - акции, выданные в кредит).

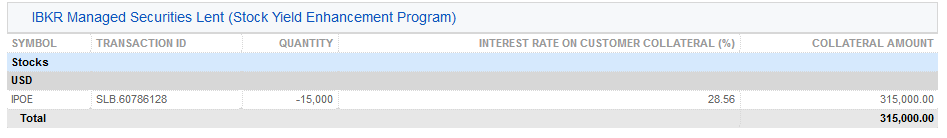

3. Выданные в кредит акции под управлением IBKR (IB Managed Securities Lent) – отражает для каждой акции, участвующей в SYEP, количество выданных в кредит акций, процентную ставку (%).

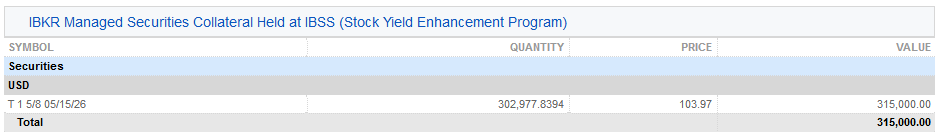

3a. Залог за бумаги под управлением IBKR, хранимый в IBSS (IBKR Managed Securities Collateral Held at IBSS) – на счетах клиентов IBLLC отображается дополнительный раздел с данными о казначейских бумагах США, используемых в качестве залога, количестве, цене и общей сумме, обеспечивающей заем акций.

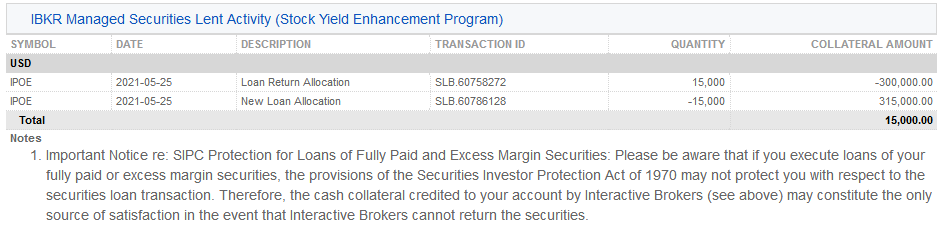

4. Операции с выданными в кредит ценными бумагами под управлением IBKR (IBKR Managed Securities Lent Activity) – отражает операции по кредиту для каждой ценной бумаги, включая распределения возврата займа (т.е. прекращенные ссуды); распределения новых займов (т.е. новые ссуды); количество акций; чистую процентую ставку; ставку по залогу клиента и сумму залога.

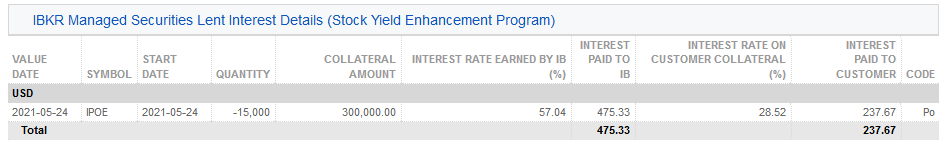

5. Проценты по операциям с выданными в кредит ценными бумагами под управлением IBKR (IBKR Managed Securities Lent Activity Interest Details) – отражает сведения об индивидуальной кредитной базе, включая проценты, полученные IBKR; доход, полученный IBKR (отражает общий доход, который получает по кредиту IBKR, вычисляемый как {сумма залога * процентная ставка}/360); ставку по залогу клиента (примерно половина от суммы дохода IB по кредиту) и проценты, выплаченные клиенту (сумма процентов, полученная по залогу клиента).

Примечание. Данный раздел будет отображаться только в том случае, если начисленные проценты, полученные клиентом за отчетный период, превышают 1 USD.

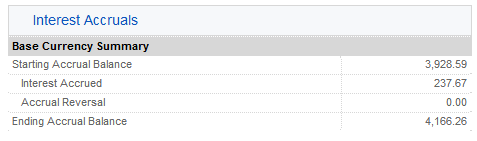

6. Процентные начисления (Interest Accruals) – процентный доход учитывается как процентное начисление и рассматривается как любое другое начисление процентов (совокупное значение, отображаемое как начисление только когда оно превышает $1 и зачисляемое на счет ежемесячно). Для годовой отчетности процентный доход регистрируется в Форме 1099 налогоплательщика США.

Расчет ставок-ориентиров - Принципы фиксинга

| Принцип фиксинга | Описание |

| Fed Funds Effective | (только USD) Взвешенное по объему среднее от транзакций, произведенных через Federal Reserve между банками-участниками. Предположительно дает лучшую оценку деятельности межбанковского финансирования для членов Reserve Bank и является ориентиром для множества краткосрочных транзакций активного рынка капиталов. |

| LIBOR | (несколько валют) Аббревиатура London Inter-Bank Offered Rate. Ежедневный фиксинг для депозитов со сроком от 1 дня до 1 года, который определяется группой крупных банков Лондона. Это самая широко используемая мера определения процентных ставок по большинству валют за пределами внутренних рынков. |

| EONIA | (только EUR) Мировой стандарт для депозитов в евро-валюте со сроком до начала следующего рабочего дня. Определяется на основе взвешенного среднего по настоящим транзакциям между главными банками континентальной Европы, посредником которых является Европейский центральный банк (European Central Bank). |

| HIBOR | (только HKD) Ежедневный фиксинг на основе группы крупных банков Гонконга. Используются методы и сроки, схожие с используемыми для валют LIBOR. |

| KORIBOR | (только KRW) Среднее от ведущих процентных ставок на KRW, определяемое группой крупных банков Кореи. Данный ориентир использует KORIBOR со сроком в 1 неделю. |

| STIBOR | (только SEK) Ежедневный фиксинг на основе группы крупных банков Швеции. Используются те же методы и сроки, как и для валют LIBOR. |

| RUONIA | (RUB) Взвешенная ставка суточных рублевых ссуд. RUONIA вычисляется Банком России. |

| PRIBOR | (CZK) Средняя процентная ставка срочных вкладов, предлагаемых основными банками. |

| BUBOR | (HUF) Средняя процентная ставка срочных вкладов, предлагаемых основными банками. |

| TIIE | (только MXN) "Сбалансированная" межбанковская ставка, основанная на данных, предоставленных банками денежного рынка, и рассчитанная Mexican Central Bank. Эталон TIIE базируется на 28-дневных депозитах, поэтому является нетипичным для оценки краткосрочных капиталов (для большинства валют используется суточный (overnight) или другой схожий ориентир). |

| Overnight | (O/N) Является самым широко используемым краткосрочным ориентиром и представляет из себя ставку для остатков средств от сегодняшнего и до начала следующего рабочего дня. |

| Spot-Next | (S/N) Ставка для остатков средств от следующего рабочего дня до рабочего дня после него. В связи с разницей часовых поясов и наличием других факторов, коэффициенты Spot-Next иногда используются как краткосрочный ориентир. |

| RBA Daily Cash Target | (AUD) Ссылается на однодневную ставку, устанавливаемую Reserve Bank of Australia, оказывающую влияние на краткосрочные процентные ставки. |

| NZD Daily Cash Target | (NZD) Ссылается на однодневную ставку, устанавливаемую Reserve Bank of New Zealand и оказывающую влияние на краткосрочные процентные ставки. |

| Ставки CNH HIBOR за ночное установление | Рассчитывая проценты, IB следует правилам рынка и не включает установки, сделанные в государственные праздники CNH, CNY или HKD. |

| Календарное соглашение: | Компания IB следует международным стандартам начисления процентов, согласно которым ставки для большинства валют выражены на основе 360-дневного календарного года, а для других валют (например, GBP) за основу расчетов берется 365-дневный год. |