米国証券のオプションポジションの割当てが翌日まで通知されない理由

満期日以外の日におけるアメリカスタイルのオプションに対する権利行使通知の処理はリアルタイムではなく、オプション清算会社(OCC)による夜間のバッチ処理の一部として行われます。 処理の流れは定義上、通知が割当てられる顧客に少なくとも1日遅れて行われますが、詳細は以下の様になります:

- OCCは通常、清算会員がロングポジションを保有する顧客の代理として、1日を通じて電子的に権利行使通知の送信をすることを許可していますが、 これは通常、夕方(Day E)の重要な処理が開始される前に送信されます。

- 夕方のポジション処理の流れの一環として、OCCでは受け取った権利行使通知を、清算会員のオープン金利にランダムに割り当てます。 情報はこの後、OCCによって翌日の早朝(Day E+1)に清算会員に提供されます。

- 情報が提供される時点においてIBKRなどの清算業者では、顧客に対して適時の報告を行うため、また証拠金や決済に関する情報を提供するために、その日の取引活動の処理はすでに終わらせています。 またOCCでは、清算会員の顧客のポジションをオムニバス方式(顧客の情報は持たずに清算業者の情報のみ)で行うため、清算会員では特定のポジションを持つ顧客に対し、ランダムに権利行使通知を割当てる必要があります。

- IBKRでOCCから割当ての通知を受取り、ランダムな割当て処理を完了させ次第、この割当ては該当する口座のトレーダー・ワークステーションにすぐに表示され、その日の終了時点(E+1)で日次アクティビティ・ステートメントに反映されます。

また、この処理の流れとロングオプションに残り時間がある可能性のために、IBKRでは引渡し義務をオフセットする手段として割当てられているショートポジションに対するロングオプションのスプレッドに関する権利行使通知を、OCCに自動的に提供することができません。

口座をお持ちのお客様は、口座申請の時点でオプションの取引資格の対象となるすべてのお客様に対してIBKRよりご提供させていただいている「一般的なオプション取引に掛る商品性とリスクに関するディスクロージャー」をご参照の上、ここに明記される割当てに関するリスクをご確認ください。 こちらのディスクロージャーは、OCC のウェブサイトからもご参照可能です。

U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

How Can I Lapse Long Options?

Account holders have the ability to lapse equity options (also known as providing contrary intentions) they hold long in their account.

From Trader Workstation, go to the Trade menu and select Option Exercise.

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To lapse one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

.bmp)

Select “Lapse” from the drop down menu.

.bmp)

Review the request, and click the blue “ T” Transmit button to submit the lapse request.

.bmp)

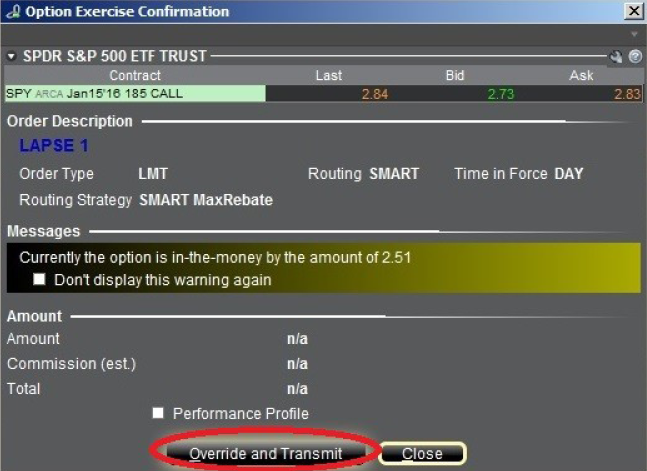

The Option Exercise Confirmation window will appear and will show how much the option is in-the-money. If the option is out-of-the-money, a warning message will appear. To submit the Lapse request, click the Override and Transmit button.

Your Lapse request will now show as an order line on your Trader Workstation until the clearinghouse processes the request.

Unless the lapse request is final it is still considered a position in the credit system and subject to the expiration exposure calculations. The Orders page of Global Configuration provides a selection box where you can specify that an option exercise request be final, and therefore cannot be canceled or editable until the cutoff time (default), which varies by clearing house. To specify this parameter, from the Mosaic File menu or Classic Edit menu, select Global Configuration and go to Orders followed by Settings from the configuration tree on the left side. Make your selection using the “Option exercise requests are” drop down menu. Please note that some contracts will not follow this rule and will remain revocable up until the clearing house deadline.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Option Lapse Requests (whether received through the TWS Option Exercise window or by a ticket sent via Account Management/Message Center) must be submitted as follows:

Note: "Contrary intentions" are handled on a best efforts basis.

満期前のコールオプション権利行使について

概要

満期前の株式コールオプションの権利行使は、以下の点により通常は経済的利点がありません:

- オプション・タイムバリューの喪失;

- 株式受け渡しへの支払い、借入にかかる費用の増加;

- オプションプレミアムに関連する株式損失リスクの増加

しかしながら、支払や借入、ダウンサイドのマーケットリスク増加に対応できる口座保有者にとって、アメリカンスタイルのコールオプションの早期権利行使は支払予定の配当金の受け取りが可能なため、経済的利点が発生する可能性があります。

背景

配当金は割り当て日の株式保有者に対して支払われるため、コールオプションの保有者への支払はありません。その他の条件が同じ場合、株価は配当落ち日に配当金分、下落します。オプション価格理論上、コールオプションの価格は限月中、配当金支払い見込みが反映されたものとなりますが、配当落ち日に下落することがあります。この様なシナリオで早期権利行使が好まれる条件は以下のような場合です:

1. オプションがディープ・イン・ザ・マネーでデルタが100

2. オプションのタイムバリューが少額、もしくはゼロ

3. 配当金が比較的高く、配当落ち日がオプション満期日の前にある

例

早期権利行使の影響を例にして見てみます。口座の現金残高が$9,000であり、架空の株式ABCのロング・コール(権利行使価格$90.00)が10日後に満期を迎えると仮定します。ABCの株価は$100.00、配当金額は1株あたり$2.00、権利落ち日は明日であるとします。また、オプション価格と株価の動向は類似しており、権利落ち後に配当金額分下落すると仮定します。

100株のデルタポジションを、パリティ価格でのオプションの売却とパリティ価格以上でのオプションの売却の二つのオプション価格をを想定し、資産の最大化を査定します。

シナリオ1:オプション価格がパリティの時 - $10.00

パリティ価格でオプションが取引されている場合、株式が配当落ち後に資金に変わる際、早期権利行使でポジションデルタを維持し、ロングオプションの損失を避けます。現金は権利行使価格で株式を購入するために使用され、オプションプレミアムは喪失し、株式および配当金受取は口座に反映されます。これは配当落ち日の前にオプションを売却し、株式を購入することで達成できますが、手数用およびスプレッドも考慮してください:

| シナリオ1 | ||||

|

口座 バランス |

当初 バランス |

早期 権利行使 |

アクション 無し |

オプション売 &株式買 |

| 現金 | $9,000 | $0 | $9,000 | $0 |

| オプション | $1,000 | $0 | $800 | $0 |

| 株式 | $0 | $9,800 | $0 | $9,800 |

| 配当金受取 | $0 | $200 | $0 | $200 |

| 資産合計 | $10,000 | $10,000 | $9,800 | $10,000 |

シナリオ2:オプション価格がパリティ価格より上の時 - $11.00

パリティ価格以上でオプションが取り引きされる場合、配当金確保のための早期権利行使には経済的利点がない場合があります。このシナリオでは早期権利行使によりオプション・タイムバリューに$100の損失が発生しますが、オプションを売却して株式を購入した場合、手数料を差し引いた結果、アクションを取らない方がかえって良い可能性もあります。この場合、最も好まれるアクションはオプションを取らないことです。

| シナリオ2 | ||||

|

口座 バランス |

当初 バランス |

早期 権利行使 |

アクション 無し |

オプション売 |

| 現金 | $9,000 | $0 | $9,000 | $100 |

| オプション | $1,100 | $0 | $900 | $0 |

| 株式 | $0 | $9,800 | $0 | $9,800 |

| 配当金受取 | $0 | $200 | $0 | $200 |

| 資産合計 | $10,100 | $10,000 | $9,900 | $10,100 |

![]() 注意: ロングコール・ポジションをスプレッド取引の一部として保有している場合には、ショートポジションの割り当てが発生した際に、ロングポジションの権利行使を行わないリスクに特に注意を払う必要があります。割り当て日に株式ショートポジションを保有していて、ショートコールの割り当てが発生した場合、株式の貸し手に配当金を支払う義務が発生しますのでご注意ください。また、権利行使処理を行うクリアリング機関は、割り当ての対応として権利行使処理を行いません。

注意: ロングコール・ポジションをスプレッド取引の一部として保有している場合には、ショートポジションの割り当てが発生した際に、ロングポジションの権利行使を行わないリスクに特に注意を払う必要があります。割り当て日に株式ショートポジションを保有していて、ショートコールの割り当てが発生した場合、株式の貸し手に配当金を支払う義務が発生しますのでご注意ください。また、権利行使処理を行うクリアリング機関は、割り当ての対応として権利行使処理を行いません。

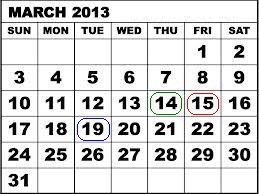

例:SPDR S&P 500 ETF Trust(SPY)のショート100枚(March '13 権利行使$146)とロング100枚(March '13 権利行使$147)を含むクレジットコール(ベア)スプレッドを例にとって考えて見ます。2013年3月14日に1株あたり$0.69372の配当金が発表されたとします。2013年3月19日付で、20134月30日支払の配当金支払見込みが株主の口座に反映されました。米国株式の3営業日決済により、配当金を受け取るには2013年3月14日までに株式の購入、もしくはコールオプションの権利行使を行わなければなりません。それ以降は配当落ち株式となります。

2013年3月14日には満期まで取引日が1日しか残されていません。二つのオプションはパリティ価格で取引され、1枚当たり$100、または100枚のポジションに$10,00の最大リスクが伴います。しかし、配当金の受け取りと、配当金受取を見込んだ、相手方の割り当てからの保護としてのロングコールの権利行使に失敗するとショートコール割り当てに対する配当金支払い義務が発生し、1枚当たり$67.372、または100枚のポジションに$6,737.20の追加のリスクが発生します。以下の表の通り、ショートコール・オプションの割り当てが発生しなかった場合、ポジションの最終決済価格が2013年3月15日に決定し、最大損失リスクは1枚あたり$100に留まります。

| 期日 | SPY 終値 | March '13 $146 コール | March '13 $147 コール |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

お持ちのお口座が米国債ルール871(m)により米国源泉徴収税の対象となっている場合、権利落ち日前に一度ロングポジションをクローズし、権利落ち日後に再度オープンされることにより、効果的に作用する可能性があります。

早期権利行使通知の提出方法については弊社ウェブサイトをご確認ください。

このページは情報提供のみを目的とするものであり、推奨や取引アドバイスではなく、早期権利行使がすべてのお客様やトレーダーに適していることを結論付けるものではありません。口座を保有されるお客様は専門の税理士にご相談の上、早期権利行使による課税への影響をご確認ください。また、ロングポジションの変わりに株式ポジションを保有するにあたって発生する可能性のあるリスクにご注意ください。

満期に関わる強制決済

リアルタイムの証拠金不足にあたってクライアントのポジションを強制決済するポリシーに加え、IBでは過度のリスクや運用上の懸念につながるイベントに関連する満期やコーポレートアクションに基づいてポジションの強制決済を行います。 下記はその例になります。

オプション権利行使

権利行使や割当てによって口座に証拠金不足が発生する場合、IBでは株式オプションの権利行使および/またはショートオプションのクローズを禁止する権利を有します。ポジションは全額の支払いとなるため通常オプションの購入に証拠金は必要ありませんが、権利行使され次第、その後のロング株式ポジションを全額支払うか(キャッシュ口座内のコールが権利行使される、または株式の証拠金が100%になる場合)、ロング/ショート株式ポジションの融資(マージン口座内のコール/プットが権利行使される場合)が義務となります。 権利行使前に十分な資産のない口座は、引渡しによって原資産の価格が不利に変化した場合、過度なリスクにつながります。無担保の場合のリスクは特に顕著であり、クリアリングハウスが株あたり$0.01のイン・ザ・マネーレベルでオプションを自動的に権利行使する際の満期の際には特にロングオプションが保有していた可能性のあるイン・ザ・マネーの価値を大幅に超える可能性があります。

ここでは原資産が$51のコントラクトを満期に1枚当たり$1でクローズした仮想の株式XYZを例にとります。1日目における口座資産は権利行使価格が$50のコールオプションがロングで20のみです。シナリオ1ではオプションがすべて自動で権利行使され、2日目に$51で開始すると仮定します。シナリオ2ではオプションがすべて自動で権利行使され、2日目に$48で開始すると仮定します。

| 口座残高 | 満期前 | シナリオ 1 - XYZが$51で開始 | シナリオ 2 - XYZが$48で開始 |

|---|---|---|---|

| キャッシュ | $0.00 | ($100,000.00) | ($100,000.00) |

| ロング株式 | $0.00 | $102,000.00 | $96,000.00 |

|

ロングオプション* |

$2,000.00 | $0.00 | $0.00 |

| 流動性総資産/(不足) | $2,000.00 | $2,000.00 | ($4,000.00) |

| 必要証拠金 | $0.00 | $25,500.00 | $25,500.00 |

| 証拠金超過分/(不足) | $0.00 | ($23,500.00) | ($29,500.00) |

*ロングオプションには貸出価値がありません。

満期を迎えた時点でこのような状況を回避するため、IBでは妥当な原資産価格シナリオの想定と、株式引き渡しの前提で各口座のエクスポージャーの査定を行うことによって、満期による営業をシミュレーションします。エクスポージャーが過度であると判断された場合、IBは以下のいずれかを行う権利を有します: 1) 権利行使前にオプションを強制決済する、2) オプションを失効させる、および/または 3) 原資産の引渡しと共生決済をいつでもできるように許可する。 さらにエクスポージャーの増加を避けるため、新しいポジションのオープンに対する規制が口座にかけられることがあります。IBでは満期日の取引終了後間もなくIB /自動権利行使によって失効することになるコントラクトの枚数を割り出します。その日の取引時間後に行われた取引の影響はエクスポージャーの計算に入らないことがあります。

弊社ではこういった作業を行う権利を有していますが、口座内のポジションに関連する権利行使/割当てリスクの管理は口座を保有される方の責任になります。IBではこのようなリスクを管理する義務を負いません。

弊社ではまた決済が証拠金不足につながるとシステムが予想した場合、決済前の午後にポジションの強制決済を行う権利を有します。満期を迎えた時点でこのような状況を回避するため、IBでは妥当な原資産価格シナリオの想定と、決済後の各口座のエクスポージャーの査定を行うことによって、満期による営業をシミュレーションします。 例:決済の結果ポジションが口座から削除されると考えられる場合(ポジションがアウト・オブ・ザ・マネーで満期になる場合や、現金決済されたオプションがイン・ザ・マネーで満期になる場合)、IBのシステムが該当する決済の証拠金に対する影響を査定します。

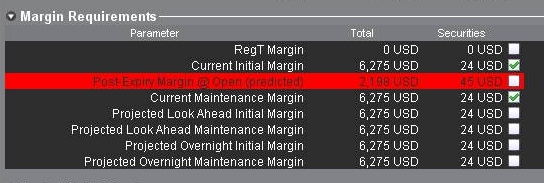

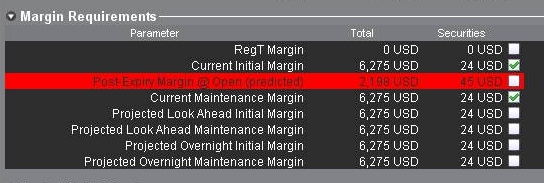

エクスポージャーが過度であると考えられる場合、弊社では予想される証拠金付属を解消するために口座内のポジションを強制決済することがあります。 満期に関連する証拠金のエクスポージャーは、TWS内の口座ウィンドウより確認することができます。予想される証拠金不足は「満期後証拠金」(下記をご覧ください)の行に表示されます。値がマイナスかつ赤でハイライトされる場合には口座のポジションが強制決済される可能性を意味します。エクスポージャーの計算は次の満期の3日前に計算され、15分ごとにアップデートされます。 体系が段階的になっている口座の場合(セパレート・トレーディング・リミット口座など)、これは計算が集約されるマスター口座レベルのみに表示されます。

弊社では通常、終了時2時間前に満期関連の強制決済を始めますが、状況が確実である場合には2時間前の前後に強制決済を開始する権利を有します。強制決済はさらに流動性総資産価値や満期後に予想される不足額、ならびにオプション権利行使価格と原資産の関係などを含める口座特有の基準に基づいて優先順位がつけられます。

権利落ち日前のコール・スプレッド

権利落ち日前に原資産にコールスプレッド(同じ原資産のロングとショートコール)を保有されていて、かつスプレッドの強制決済をされていない、またはロングコールの権利行使をされていない場合、弊社では以下を行う権利を有します:i)ロングコールを部分的またはすべて権利行使する、および/またはii)以下が予想される場合にはIBの裁量によりスプレッドを部分的またはすべて強制決済(クローズ処理を意味します)する: a)ショートコールが割り当てられる可能性がある、およびb)配当金を支払う義務を満たすに足る資産が口座にないか、一般的に必要証拠金を満たしていない。 このシナリオでIBがロングコールを権利行使し、お客様にショートコールを割当てられてない場合、損失がお客様に発生する可能性があります。同様にお客様のポジションをIBが部分的またはすべて強制決済する場合、お客様に損失が発生する、または当初の目的と異なる投資結果となる可能性があります。

このシナリオを避けるため、原資産の権利落ち日前にオプションのポジションと口座資産を注意深くご確認いただき、またこれに基づいてリスクと口座管理を行ってください。

実際に引渡しされる先物

原資産に通貨を含む特定の先物コントラクト以外、IBでは実際に決済された先物や先物オプションコントラクトの原資産の引渡しを許可していません。満期になるコントラクトの引渡しを避けるため、コントラクトをロールオーバーするか、コントラクトに指定される最終取引期限前(ウェブサイトにリストがあります)にポジションのクローズを行う必要があります。

最終取引期限および実際に引渡しされるコントラクトで指定されている時間内に最終取引されないものをIBが事前通知なく強制決済する可能性を認識しておいていただくことはお客様の責任となります。

現物引渡しに関わる規定

IBKRでは、ほとんどの商品に対し現物引渡しを調整できる機能をご提供しておりません。原資産コモディティ(現物引渡し先物)の現物引渡しによって決済される先物コントラクトの場合、口座保有者は原資産コモディティの受渡しを行うことも、受け取ることもできません。

各商品の最終取引期限の把握は、口座保有者であるお客様の責任となります。口座保有者が最終取引期限までに先物コントラクトの現物引渡しによってポジションの決済を行わない場合、IBKRでは満期となるコントラクトのポジション事前通知なく強制決済することがあります。なお、強制決済を行っても現在有効な注文には影響ありません。口座保有者は、ポジションを決済するためのオープン注文が、実際のリアルタイムのポジションに合わせて調整されていることの確認が必要です。

満期を迎える先物コントラクトの引渡しを避けるため、最終取引期限前にロールオーバーするか、ポジションを決済してください。

下記は、先物と先物オプションコントラクトの最終取引期限に関連する概要となります。 関連する「First Notice Date」、「First Position Date」、また「Last Trading Date/最終取引日」の詳細は、IBKRウェブサイト内のIBKRサポートページより、コントラクト検索を選択してご確認ください。日程に関連してご提供する情報はすべてベストエフォート・ベースとなっておりますので、取引所のウェブサイトに記載されるコントラクトの仕様をご確認ください。

現物引渡し先物に関する方針のサマリー

|

銘柄 |

引渡しの許可 |

最終取引期限(Close-Out Deadline) |

|

ZB, ZN, ZF (CBOT) |

不可 |

「First Notice Day」(ロングの場合)、または最終取引日(ショートの場合)の前営業日の公開買付取引終了の2時間前 |

|

ZT(CBOT)先物、日本政府債先物(JGB) |

不可 |

「First Position Day」(ロングの場合) 、または最終取引日(ショートの場合)の前々営業日終了時 |

|

EUREXUS先物 |

不可 |

「First Position Day」(ロングの場合) 、または最終取引日(ショートの場合)の前営業日終了時 |

|

EUREXUS 2年ジャンボ債券(FTN2)および3年債券(FTN3) futures |

不可 |

「First Position Day」(ロングの場合) 、または最終取引日(ショートの場合)の前々営業日終了時 |

|

IPEコントラクト(GAS、NGS) |

不可 |

「First Position Day」(ロングの場合)の前々営業日終了時、または最終取引日(ショートの場合)の前営業日終了時 |

|

CME LIVE CATTLE (LE) |

不可 |

「First Intent Day」(ロングの場合)の前々営業日終了時 、または最終取引日(ショートの場合)の前営業日終了時 |

|

CME NOK、SEK、PLZ、CZK、ILS、KRWおよびHUF、ならびに対応するユーロ率 |

不可 |

ロングおよびショートの両方に対し、最終取引日の5営業日前終了時 |

|

GBL、GBM、GBS、GBX(Eurex)、CONF(Eurex) |

不可 |

最終取引日の取引時間終了2時間前 |

|

CME通貨先物(EUR、GBP、CHF、AUD、CAD、JPY、HKD) |

可能* |

適用外* |

|

CMEエタノール先物(ET) |

不可 |

「First Position Day」(ロングの場合) 、または最終取引日(ショートの場合)の5営業日前終了時 |

| NG先物(NYMEX) | 不可 | 「First Position Day」または最終取引日(いずれか早い方)の前営業日終了時(ロングの場合)、または最終取引日(ショートの場合)の前営業日終了時 |

|

その他すべてのコントラクト |

不可 |

「First Position Day」または最終取引日(いずれか早い方)の前々営業日終了時(ロングの場合)、または最終取引日(ショートの場合)の前々営業日終了時 |

*キャッシュおよびIRA口座では外国通貨の保有ができないため、上記のその他すべてのコントラクトに適用となる強制決済スケジュールは、該当する外国通貨のキャッシュおよびIRA口座にも適用されます。

現物引渡し先物オプションに関する方針のサマリー

| 銘柄 | 引渡しの許可 | 最終取引期限(Close-Out Deadline) |

| すべてのコントラクト | 可能 | オプションの満期日が、原資産となる先物の「First Position Day」より前である場合、先物コントラクトの受け渡しが発生することがあります(アウトオブザマネーの場合、別途買手による権利行使がない限り、権利は消滅します)。これにより先物のポジションができた場合は、上に記載されるそれぞれの最終取引期限(Close-Out Deadline)の対象となります。 |

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

Overview of SEC Fees

Under Section 31 of the Securities Exchange Act of 1934, U.S. national securities exchanges are obligated to pay transaction fees to the SEC based on the volume of securities that are sold on their markets. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to their customers.

This fee is intended to allow the SEC to recover costs associated with its supervision and regulation of the U.S. securities markets and securities professionals. It applies to stocks, options and single stock futures (on a round turn basis); however, IB does not pass on the fee in the case of single stock futures trades. Note that this fee is assessed only to the sale side of security transactions, thereby applying to the grantor of an option (fee based upon the option premium received at time of sale) and the exerciser of a put or call assignee (fee based upon option strike price).

For the fiscal year 2016 the fee was assessed at a rate of $0.0000218 per $1.00 of sales proceeds, however, the rate is subject to annual and,in some cases, mid-year adjustments should realized transaction volume generate fees sufficiently below or in excess of targeted funding levels.1

Examples of the transactions impacted by this fee and sample calculations are outlined in the table below.

|

Transaction |

Subject to Fee? |

Example |

Calculation |

|

Stock Purchase |

No |

N/A |

N/A |

|

Stock Sale (cost plus commission option) |

Yes |

Sell 1,000 shares MSFT@ $25.87 |

$0.0000218 * $25.87 * 1,000 = $0.563966 |

|

Call Purchase |

No |

N/A |

N/A |

|

Put Purchase |

No |

N/A |

N/A |

|

Call Sale |

Yes |

Sell 10 MSFT June ’11 $25 calls @ $1.17 |

$0.0000218 * $1.17 * 100 * 10 = $0.025506 |

|

Put Sale |

Yes |

Sell 10 MSFT June ’11 $25 puts @ $0.41 |

$0.0000218 * $0.41 * 100 * 10 = $0.008938 |

|

Call Exercise |

No |

N/A |

N/A |

|

Put Exercise |

Yes |

Exercise of 10 MSFT June ’11 $25 puts |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Call Assignment |

Yes |

Assignment of 10 MSFT June ’11 $25 calls |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Put Assignment |

No |

N/A |

N/A |

1Information regarding current Section 31 fees may be found on the SEC's Frequently Requested Documents page located at: http://www.sec.gov/divisions/marketreg/mrfreqreq.shtml#feerate

FAQs - U.S. Securities Option Expiration

The following page has been created in attempt to assist traders by providing answers to frequently asked questions related to US security option expiration, exercise, and assignment. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer.

Click on a question in the table of contents to jump to the question in this document.

Table Of Contents:

How do I provide exercise instructions?

Do I have to notify IBKR if I want my long option exercised?

What if I have a long option which I do not want exercised?

What can I do to prevent the assignment of a short option?

Is it possible for a short option which is in-the-money not to be assigned?

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Am I charged a commission for exercise or assignments?

Q&A:

How do I provide exercise instructions?

Instructions are to be entered through the TWS Option Exercise window. Procedures for exercising an option using the IBKR Trader Workstation can be found in the TWS User's Guide.

![]() Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Do I have to notify IBKR if I want my long option exercised?

In the case of exchange listed U.S. securities options, the clearinghouse (OCC) will automatically exercise all cash and physically settled options which are in-the-money by at least $0.01 at expiration (e.g., a call option having a strike price of $25.00 will be automatically exercised if the stock price is $25.01 or more and a put option having a strike price of $25.00 will be automatically exercised if the stock price is $24.99 or less). In accordance with this process, referred to as exercise by exception, account holders are not required to provide IBKR with instructions to exercise any long options which are in-the-money by at least $0.01 at expiration.

![]() Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

What if I have a long option which I do not want exercised?

If a long option is not in-the-money by at least $0.01 at expiration it will not be automatically exercised by OCC. If it is in-the-money by at least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to let the option lapse. These instructions would need to be entered through the TWS Option Exercise window prior to the deadline as stated on the IBKR website.

What can I do to prevent the assignment of a short option?

The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day (for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes). When you sell an option, you provided the purchaser with the right to exercise which they generally will do if the option is in-the-money at expiration.

Is it possible for a short option which is in-the-money not to be assigned?

While is unlikely that holders of in-the-money long options will elect to let the option lapse without exercising them, certain holders may do so due to transaction costs or risk considerations. In conjunction with its expiration processing, OCC will assign option exercises to short position holders via a random lottery process which, in turn, is applied by brokers to their customer accounts. It is possible through these random processes that short positions in your account be part of those which were not assigned.

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Spread positions can have unique expiration risks associated with them. For example, an expiring spread where the long option is in-the-money by less than $0.01 and the short leg is in-the-money more than $0.01 may expire unhedged. Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money.

Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned?

No. There is no provision for issuing conditional exercise instructions to OCC. OCC determines the assignment of options based upon a random process which is initiated only after the deadline for submitting all exercise instructions has ended. In order to avoid the delivery of a long or short underlying stock position when only the short leg of an option spread is in-the-money at expiration, the account holder would need to either close out that short position or consider exercising an at-the-money long option.

What happens to my long stock position if a short option which is part of a covered write is assigned?

If the short call leg of a covered write position is assigned, the long stock position will be applied to satisfy the stock delivery obligation on the short call. The price at which that long stock position will be closed out is equal to the short call option strike price.

Am I charged a commission for exercise or assignments?

There is no commissions charged as the result of the delivery of a long or short position resulting from option exercise or assignment of a U.S. security option (note that this is not always the case for non-U.S. options).

What happens if I am unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment?

You should review your positions prior to expiration to determine whether you have adequate equity in your account to exercise your options. You should also determine whether you have adequate equity in the account if an in-the-money short option position is assigned to your account. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money.

If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account to meet the anticipated post-delivery margin requirement.

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either:

- Liquidate options prior to expiration. Please note: While IBKR retains the right to liquidate at any time in such situations, liquidations involving US security positions will typically begin at approximately 9:40 AM ET as of the business day following expiration;

- Allow the options to lapse; and/or

- Allow delivery and liquidate the underlying at any time.

In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

For more information, please see Expiration & Corporate Action Related Liquidations