Consideraciones de seguridad luego de optar por dejar de usar el sistema de acceso seguro

Los titulares de cuentas que hayan optado por dejar de usar el sistema de acceso seguro (SLS) de IBKR efectivamente renuncian a las protecciones que ofrece la autenticación en dos factores. Se le recomienda enfáticamente utilizar medidas de seguridad alternativas, siendo una de ellas las restricciones de IP. Al seleccionar esta configuración mediante Client Portal, le estará diciendo a Interactive Brokers que solo desea acceder a sus plataformas de negociación desde una dirección de IP específica. Además, en caso de tener varios operadores autorizados para una determinada cuenta, estas restricciones podrán configurarse a nivel de operador individual a través del usuario principal de la cuenta.

Lista de comprobación preliminar>

Antes de configurar las restricciones de IP, deberá:

- Conocer su dirección de IP WAN. Esta es la dirección de IP expuesta en el lado externo (Internet) de su red, y es distinta de su dirección de IP local (denominada también dirección de IP LAN). Si opera desde las oficinas de una empresa, puede solicitarle a su departamento de informática o de redes la dirección de IP WAN de su ordenador. Si se conecta a la Internet a través de una conexión privada de banda ancha, cable o satélite, puede obtener esta información de su proveedor de servicios de internet (ISP).

- Asegúrese de que su dirección de IP sea estática. Esto significa que su dirección de IP siempre será la misma, y que no cambiará luego de reiniciar el enrutador o módem luego de un determinado periodo. Las mismas entidades que le proporcionaron la dirección de IP WAN podrán confirmarle si se trata de una dirección estática o dinámica.

- Tenga en cuenta que las restricciones de IP no tienen efecto inmediato. Nuestros sistemas aplican filtros durante su reinicio trasnoche a diario. Pueden tardar hasta 24 horas para que estén activas, dependiendo del momento en el que envíe su solicitud de restricciones de IP. Lo mismo se aplica cuando modifica o elimina restricciones de IP existentes. Asegúrese de tener esto en cuenta cuando planifique sus medidas a tomar.

- Las restricciones de IP se aplicarán para TODAS las plataformas de negociación que ofrece IBKR. No afectará el acceso a Client Portal, el cual seguirá siendo accesible desde cualquier dirección de IP.

Nota:

Tenga en cuenta que existe la capacidad técnica de indicar malinterpretar la dirección de IP, y la protección total de la cuenta solo se garantiza utilizando la autenticación en dos factores del sistema de acceso seguro (SLS) (ibkr.com/sls).

Si tiene inquietudes respecto de esta cuestión, no dude en contactar con el centro de asistencia técnica de IBKR.

Cómo configurar las restricciones de IP:

-

Inicie sesión en Client Portal y haga clic en el icono del menú

-

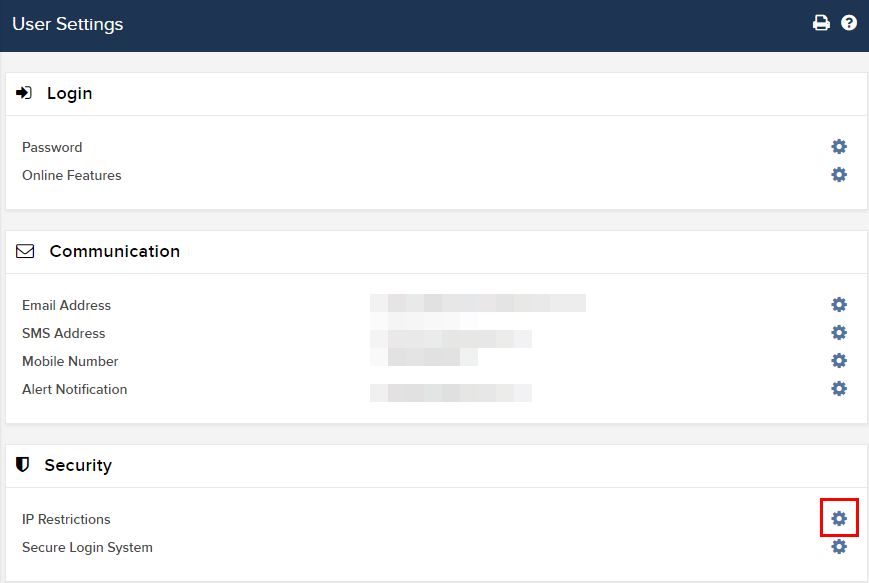

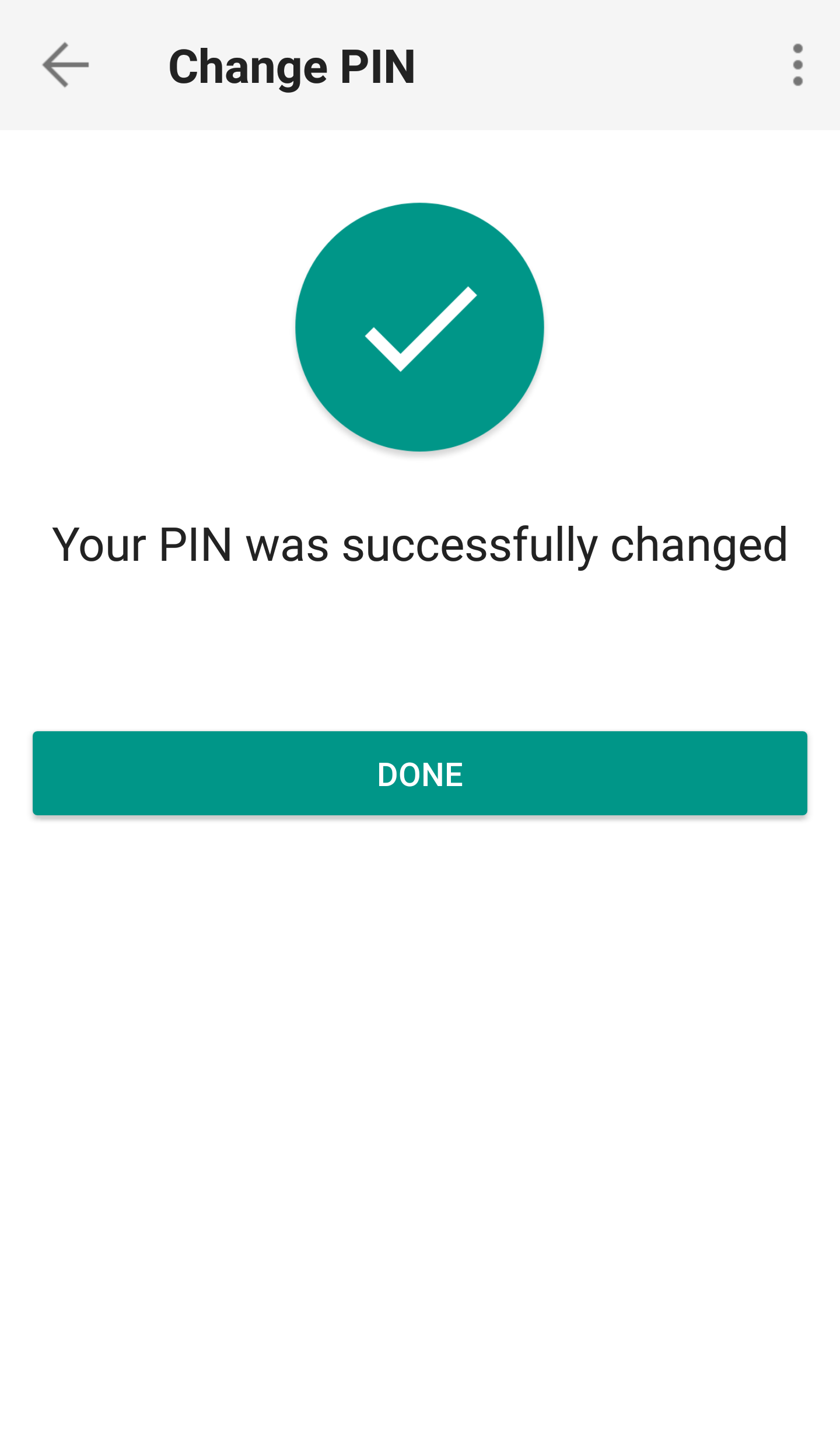

Desde el menú, haga clic en Configuración y luego en Configuración del usuario. Luego, haga clic en el icono del engranaje (configurar) junto a Restricciones de IP.

-

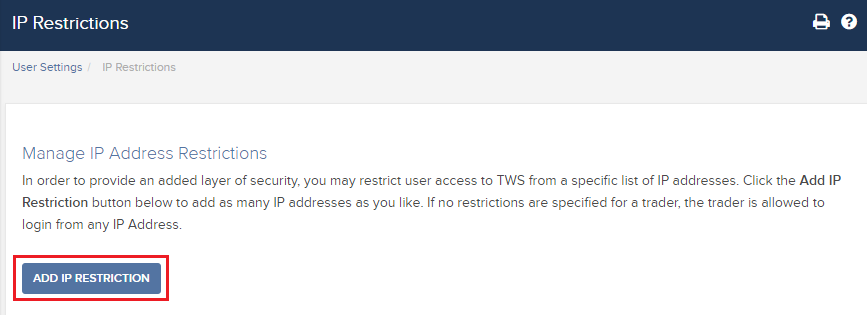

Verá una breve descripción de los efectos de las restricciones de IP. Para configurar una nueva restricción de IP, haga clic en Añadir restricción de IP.

-

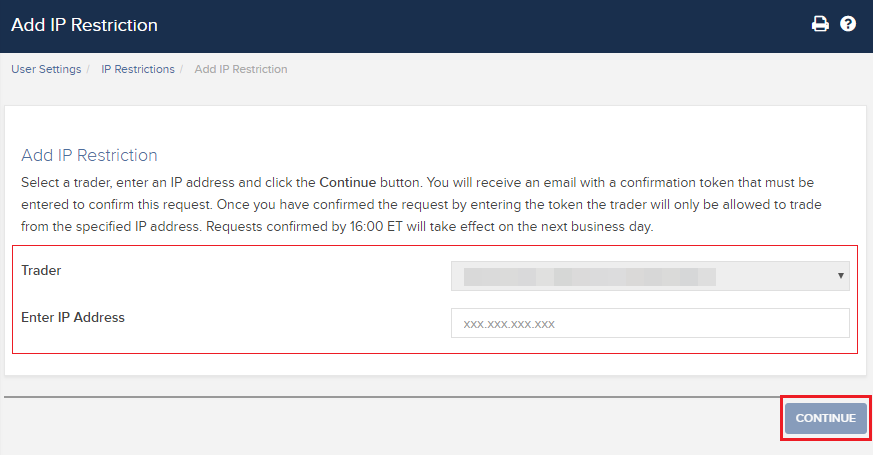

Seleccione Operador desde la lista desplegable e ingrese la dirección de IP (en el formato xxx.xxx.xxx.xxx) que desea permitirle a su operador. Luego, haga clic en Continuar.

-

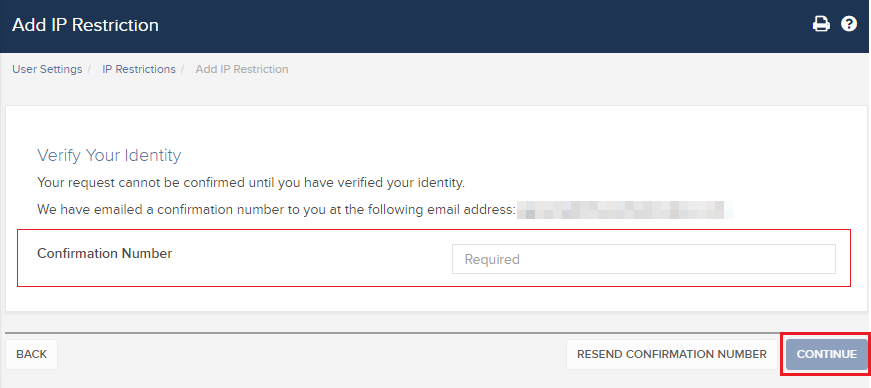

Si inició sesión en Client Portal sin utilizar la autenticación en dos factores, recibirá un correo electrónico 1 con un número de confirmación. Ingréselo en el campo Número de confirmación. Una vez que haya hecho esto, haga clic en Continuar para enviar la solicitud. Si se conectó a Client Portal utilizando un dispositivo de acceso seguro, continúe directamente con el punto 6.

-

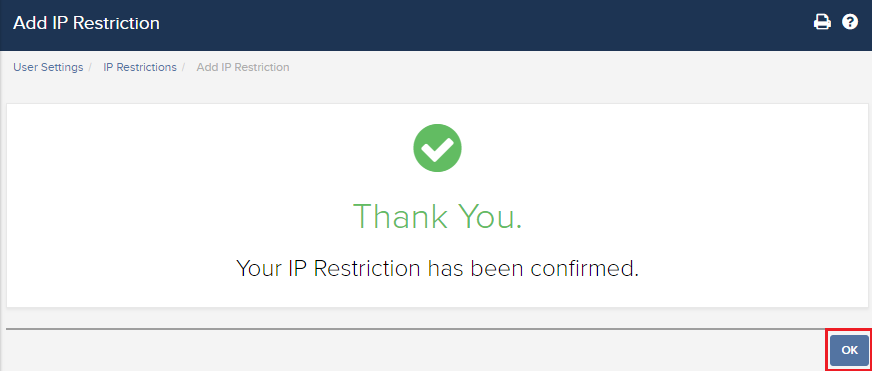

Si la operación se realizó correctamente, verá una ventana de confirmación. Haga clic en Aceptar.

-

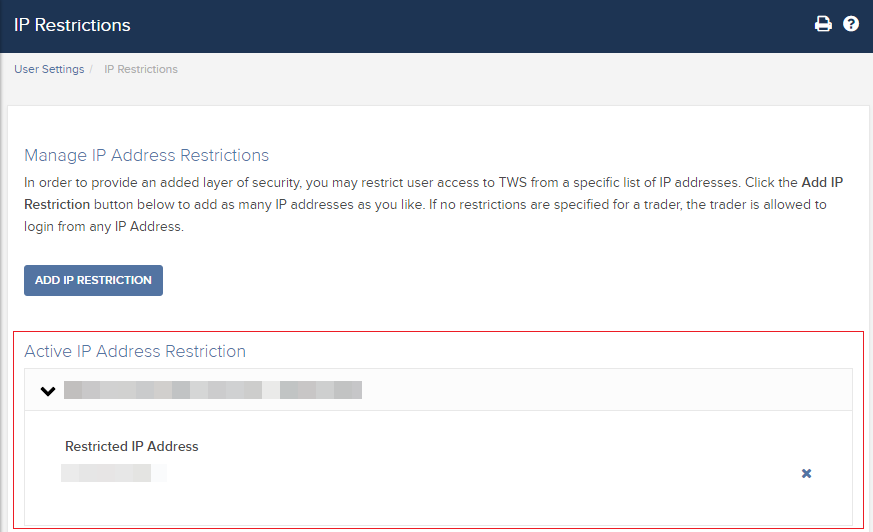

El sistema le mostrará una lista con sus restricciones de dirección de IP activas. En caso de que desee crear una adicional, haga clic nuevamente en Añadir restricción de IP, de lo contrario abandone esta sección

Opción de no usar el sistema de acceso seguro y restricciones IP para operadores de penny stocks (acciones especulativas):

Los clientes que hayan optado por no usar el sistema de acceso seguro, y solo utilicen la autenticación en dos factores para Client Portal, deberán activar las restricciones de IP para poder activar los permisos de negociación para penny stocks.

Mejores prácticas adicionales para asegurar su ordenador y su red:

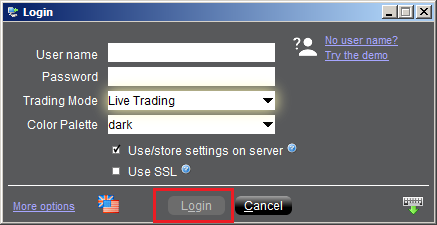

- Al iniciar sesión en TWS, active la casilla "Usar SSL" en la ventana de acceso. El sistema SSL (Secure Socket Layer) garantiza que toda la información intercambiada entre su ordenador y nuestros servidores esté protegida utilizando un cifrado de 128-bit.

- Utilice un cortafuegos para evitar accesos no autorizados a los servicios expuestos por su red u ordenador. Durante la configuración del cortafuegos, asegúrese de autorizar los hosts/puertos que se indican en la sección TWS DE ESCRITORIO en el artículo KB2816.

- Utilice software antivirus para identificar y eliminar virus que pudieran haber afectado su ordenador. Debido a que se crean nuevos virus constantemente, deberá actualizar la base de datos de amenazas de su software antivirus regularmente.

- Utilice software para programas informáticos malintencionados (malware) para detectar y eliminar programas de espía o malintencionados (spyware/malware) que puedan recopilar distintos tipos de información personal, controlar su actividad de búsqueda e interferir con el control de su ordenador. Hoy en día, las soluciones antivirus incluyen una protección contra programas informáticos malintencionados incorporada.

- Evite utilizar conexiones inalámbricas (Wi-Fi) que sean públicas, no seguras o que no estén operadas por usted. Si utiliza una red no segura (p. ej., zonas de cobertura inalámbrica públicas), deberá evitar conectarse a cuentas de instituciones financieras que posea, lo que incluye su cuenta de IBKR.

¿Cómo puedo solicitar el reemplazo de un dispositivo de acceso seguro o código de seguridad temporario?

IBKR se ha comprometido a proteger su cuenta y los activos que haya en ella frente a prácticas fraudulentas. El sistema de acceso seguro añade una importante capa extra de seguridad a su cuenta. Por motivos de seguridad, todas las solicitudes de reemplazo de dispositivos de acceso seguro deberán realizarse telefónicamente y solo luego de haberse verificado verbalmente la identidad del titular de cuenta o usuario autorizado. Para obtener asistencia para acceder su cuenta inmediatamente y obtener un dispositivo de acceso seguro de reemplazo, contacte con atención al cliente telefónicamente para recuperar el acceso de conexión.

Referencias

- Consulte el artículo KB69 para obtener información acerca de la validez de la clave de acceso temporaria

- Consulte el artículo KB1131 para obtener un resumen sobre el sistema de acceso seguro

- Consulte el artículo KB2636 para obtener información y consultar los procedimientos relacionados con dispositivos de acceso seguro

- Consulte el artículo KB2481 para obtener instrucciones acerca de cómo compartir el dispositivo de acceso seguro entre dos o más usuarios

- Consulte el artículo KB2545 para obtener instrucciones acerca de cómo dejar de usar el sistema de acceso seguro

- Consulte el artículo KB975 para obtener instrucciones acerca de cómo devolver su dispositivo de acceso seguro a IB

- Consulte el artículo KB2260 para obtener instrucciones para activar la autenticación con IB Key a través de IBKR Mobile

- Consulte el artículo KB2895 para obtener información acerca del sistema múltiple en dos factores (M2FS)

- Consulte el artículo KB1861 para obtener información acerca de los cargos o gastos relacionados con los dispositivos de acceso seguro

Cómo utilizar las rellamadas para recibir códigos de autenticación de acceso

Si tiene los mensajes de texto (SMS) activados como el método de autenticación en dos factores, puede utilizar las rellamadas para recibir códigos de autenticación para el acceso. El siguiente artículo proporciona instrucciones paso a paso para conseguir esto.

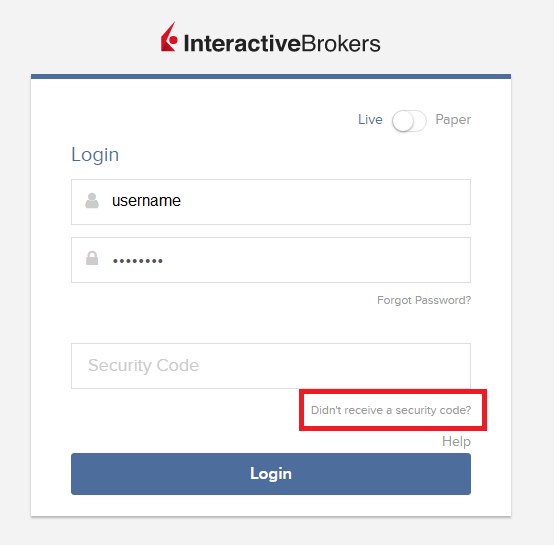

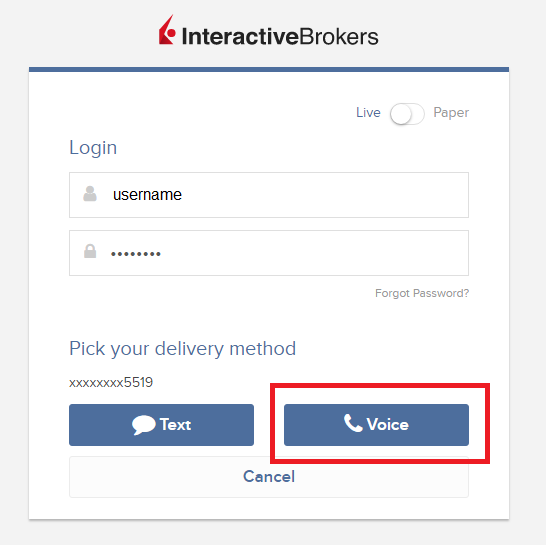

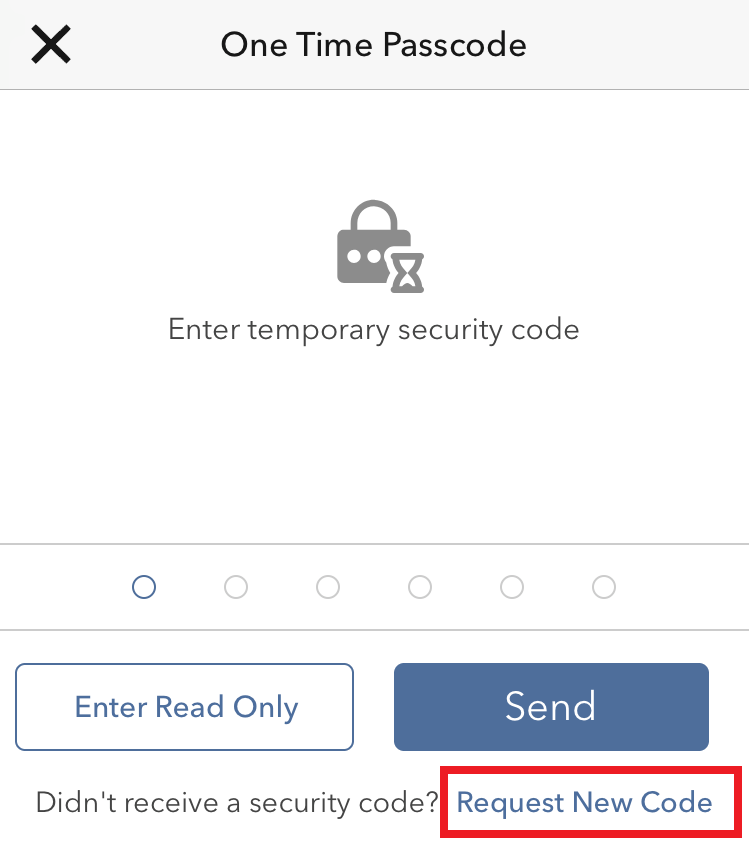

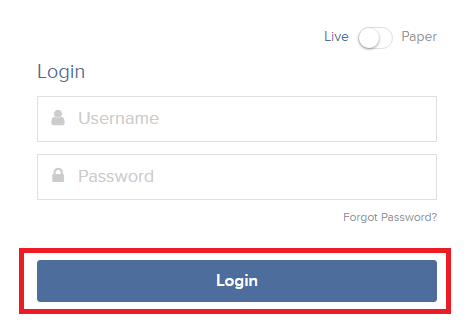

Client Portal

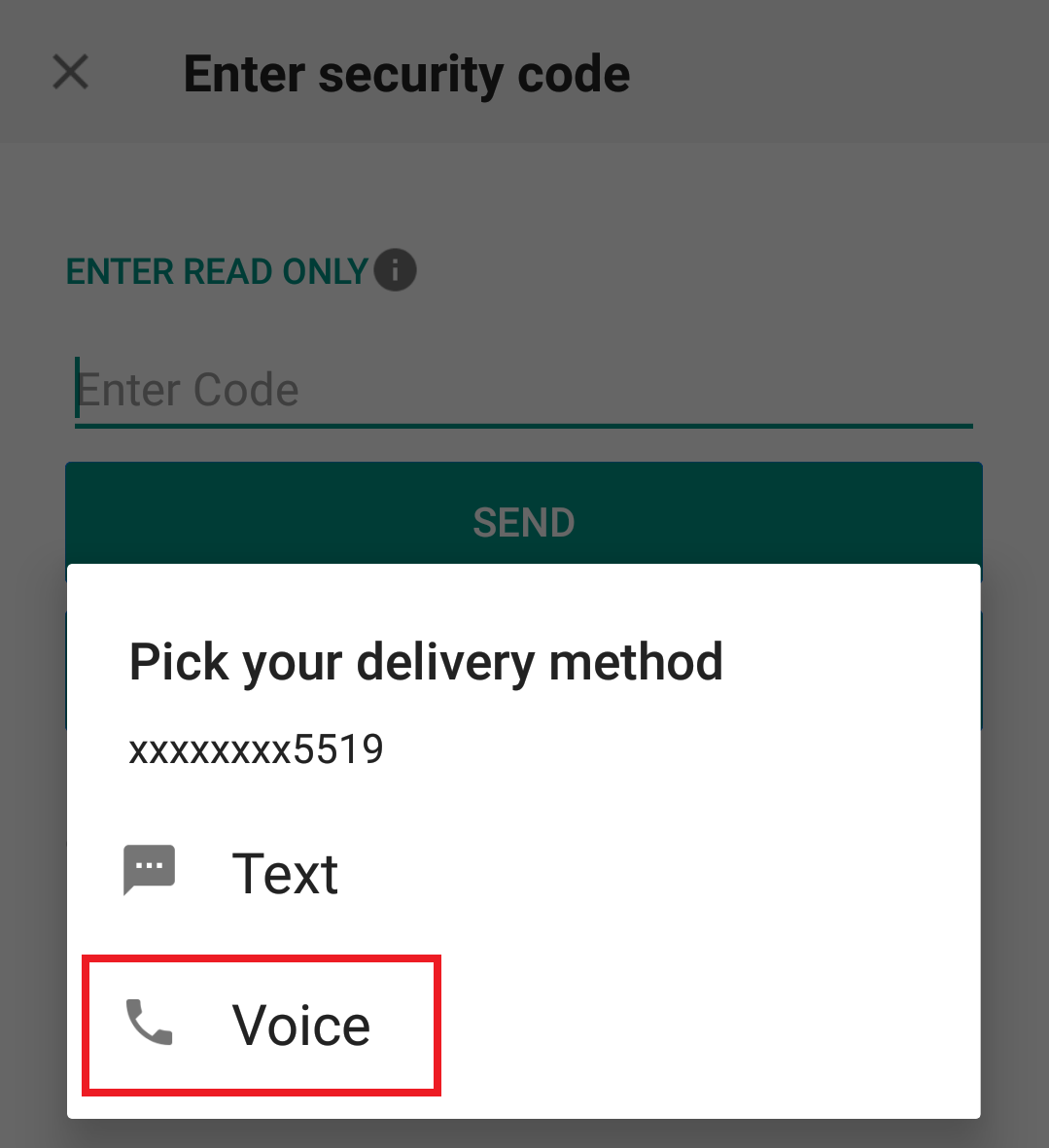

1. Haga clic en "¿No ha recibido un código de seguridad?"

2. De las dos opciones, seleccione "Voz" y espere la rellamada.

3. Luego de seleccionar Voz, debería recibir la rellamada dentro de un minuto. Espere la rellamada y esté listo para escribir el código que se le proporcionará.

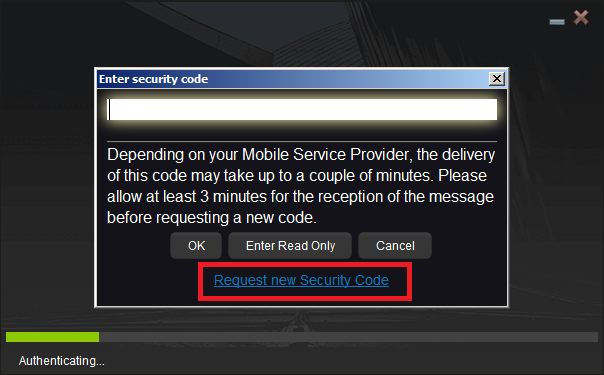

TWS

1. Haga clic en "Solicitar nuevo código de seguridad"

2. Para las dos nuevas opciones, seleccione "Voz" y haga clic en Aceptar. Luego, espere la rellamada

3. Luego de seleccionar Voz, debería recibir la rellamada dentro de un minuto. Espere la rellamada y esté listo para escribir el código que se le proporcionará.

Nota: las rellamadas para TWS solo están disponibles en las versiones ÚLTIMA y BETA.

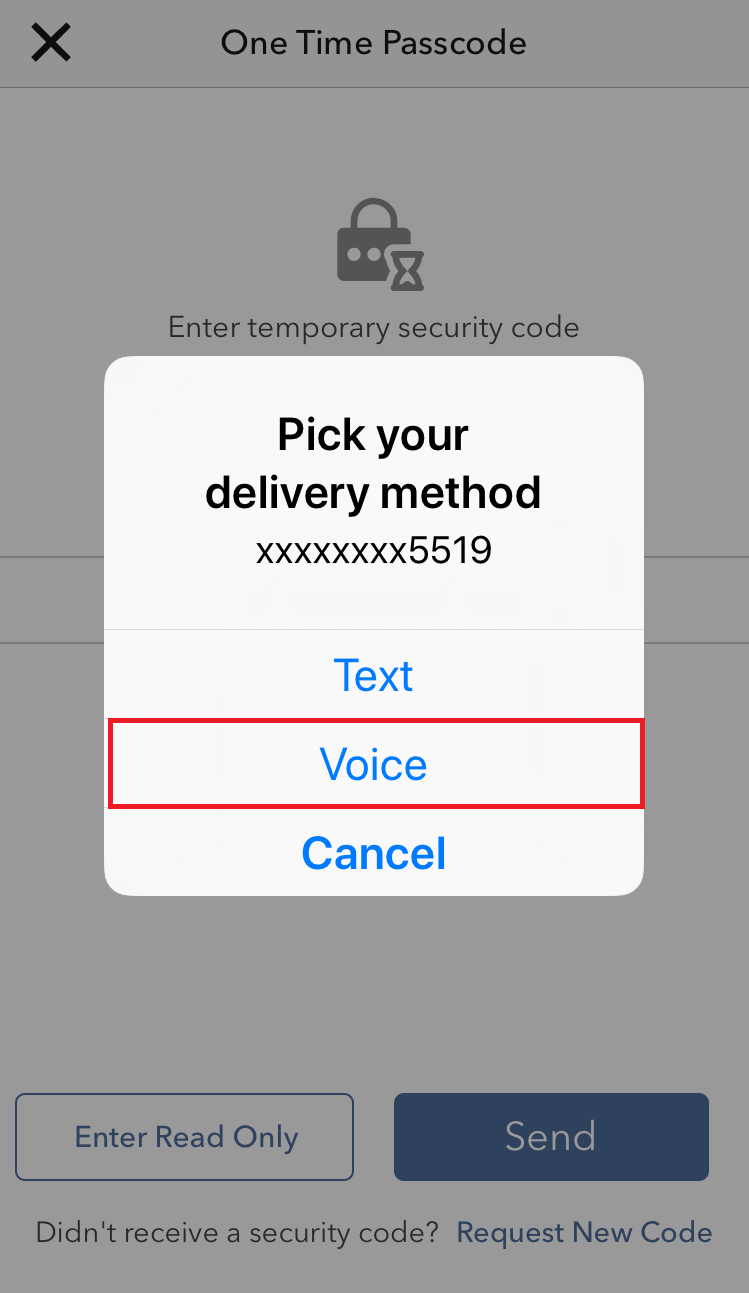

IBKR Mobile - iOS

1. Haga clic en "Solicitar nuevo código"

2. De las dos opciones, seleccione "Voz" y espere la rellamada.

3. Luego de seleccionar Voz, debería recibir la rellamada dentro de un minuto. Espere la rellamada y esté listo para escribir el código que se le proporcionará.

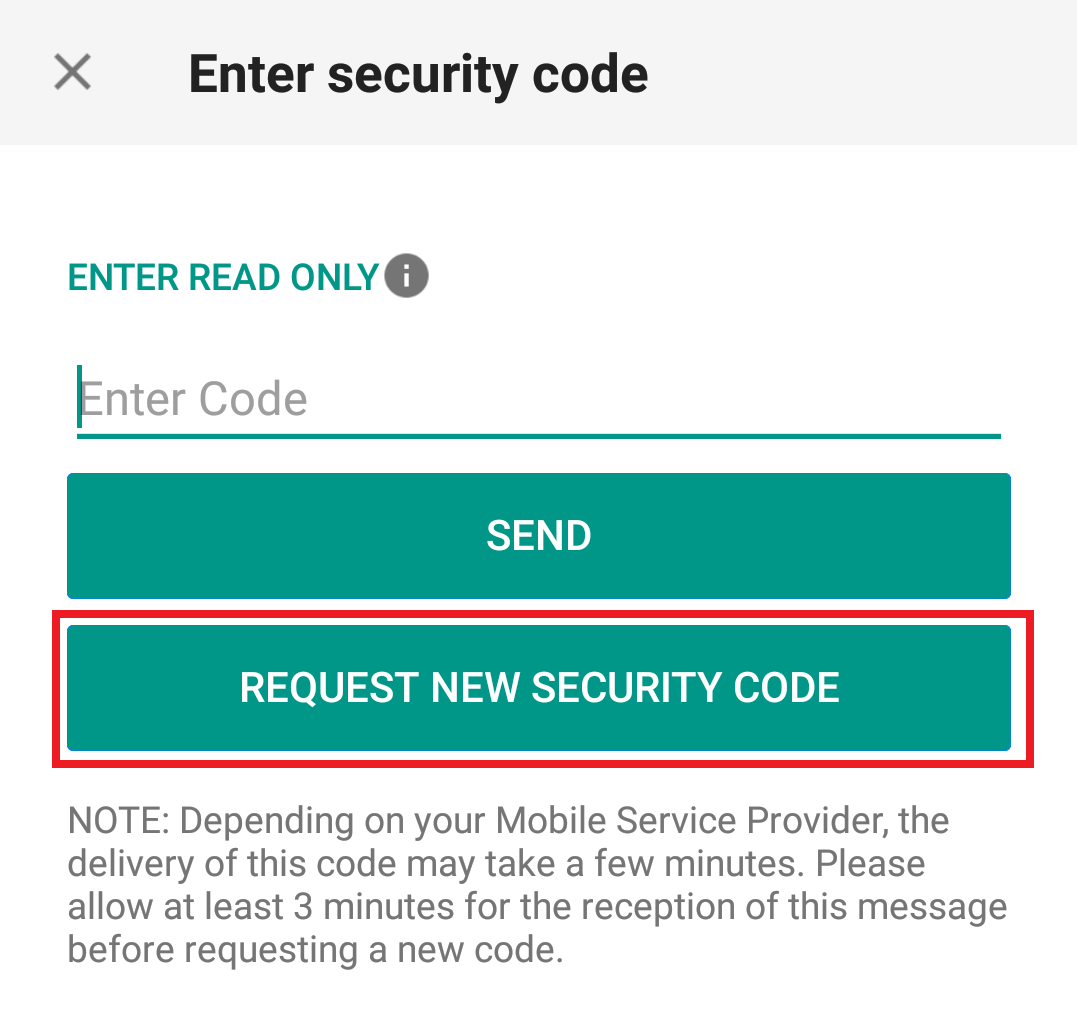

IBKR Mobile - Android

1. Haga clic en "Solicitar nuevo código de seguridad"

2. De las dos opciones, seleccione "Voz" y espere la rellamada.

3. Luego de seleccionar Voz, debería recibir la rellamada dentro de un minuto. Espere la rellamada y esté listo para escribir el código que se le proporcionará.

Referencias:

- Cómo conectarse con la autenticación por SMS

- Resumen del sistema de acceso seguro

- Información y procedimientos relacionados con dispositivos de seguridad

- Método de autenticación de IBKR Mobile

Cómo cambiar el número de PIN de su dispositivo de acceso seguro

Interactive Brokers le recomienda cambiar su número de PIN regularmente para añadir una capa adicional de seguridad.

NOTA: si no conoce su número de PIN actual, deberá llamar a Interactive Brokers directamente para reconfigurarlo. Utilice cualquiera de los números telefónicos que aparecen en https://www.interactivebrokers.com/es/index.php?f=6492

A continuación, encontrará el procedimiento para cambiar el código PIN de su dispositivo de seguridad, de acuerdo con el tipo de dispositivo que se encuentre utilizando:

- Tarjeta de seguridad digital+ (TSD+)

- IBKR Mobile para Android

(Este procedimiento no se aplica para los dispositivos iOS debido a que el PIN utilizado es el de su smartphone)

Tarjeta de seguridad digital+ (TSD+)

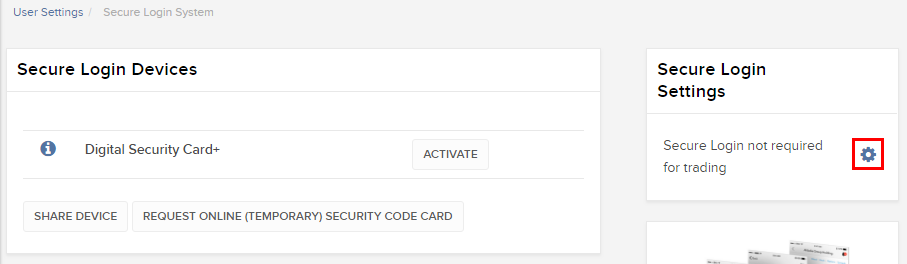

El PIN de la TSD+ debe cambiarse desde la página de Client Portal siguiendo los pasos a continuación:

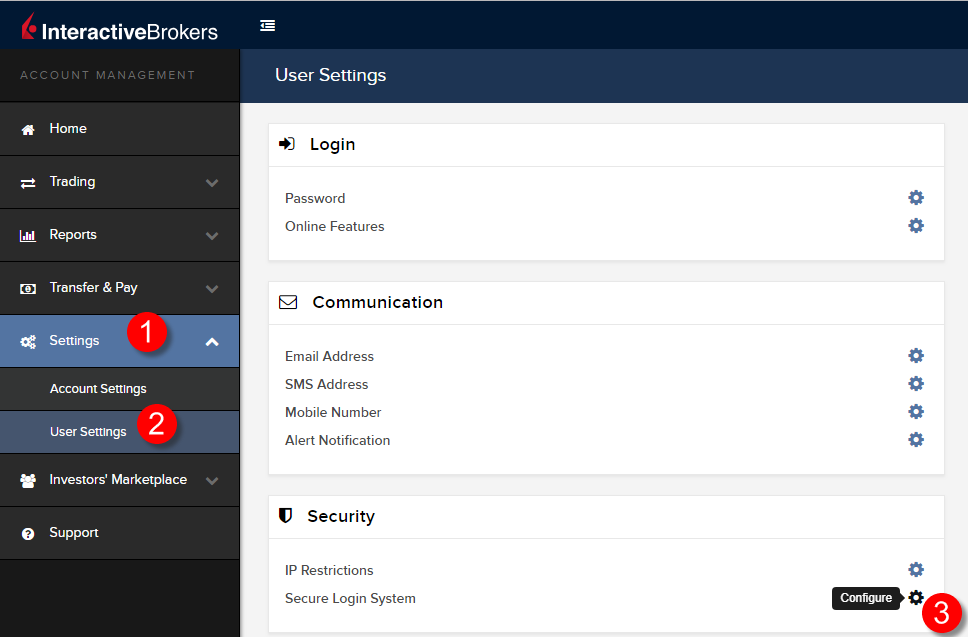

- Inicie sesión en Client Portal utilizando su dispositivo de seguridad y haga clic en el icono de menú en la esquina superior izquierda.

- Seleccione las opciones de menú Configuración --> Configuración del usuario --> Sistema de acceso seguro

- Haga clic en el engranaje (Configurar)

- Haga clic en el icono i (Información) junto a su TSD+ activa

.png)

- Haga clic en Cambiar PIN en la parte inferior derecha de la ventana emergente

.png)

- Ingrese el nuevo PIN que desearía utilizar y confírmelo. Se mostrará un código de desafío. Opere su TSD+ con el código de desafío y su PIN nuevo para generar un código de respuesta. Ingréselo en el campo Clave de acceso y haga clic en Continuar

.png)

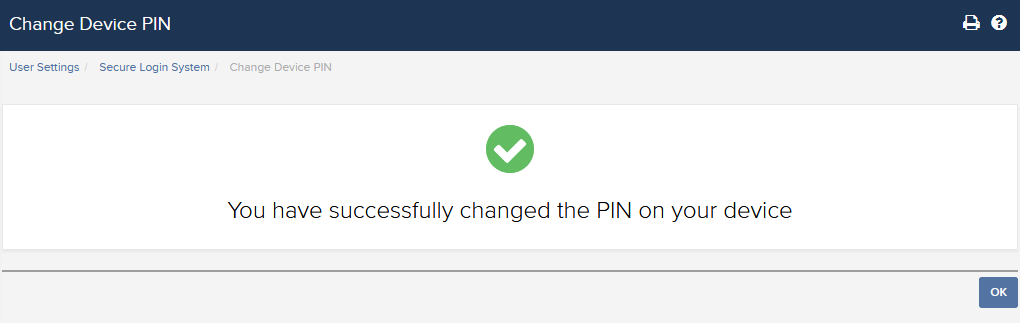

- Si el sistema acepta el nuevo PIN, verá una ventana de confirmación. Haga clic en Aceptar en la parte inferior derecha para finalizar el procedimiento.

IBKR Mobile para usuarios de Android

.png)

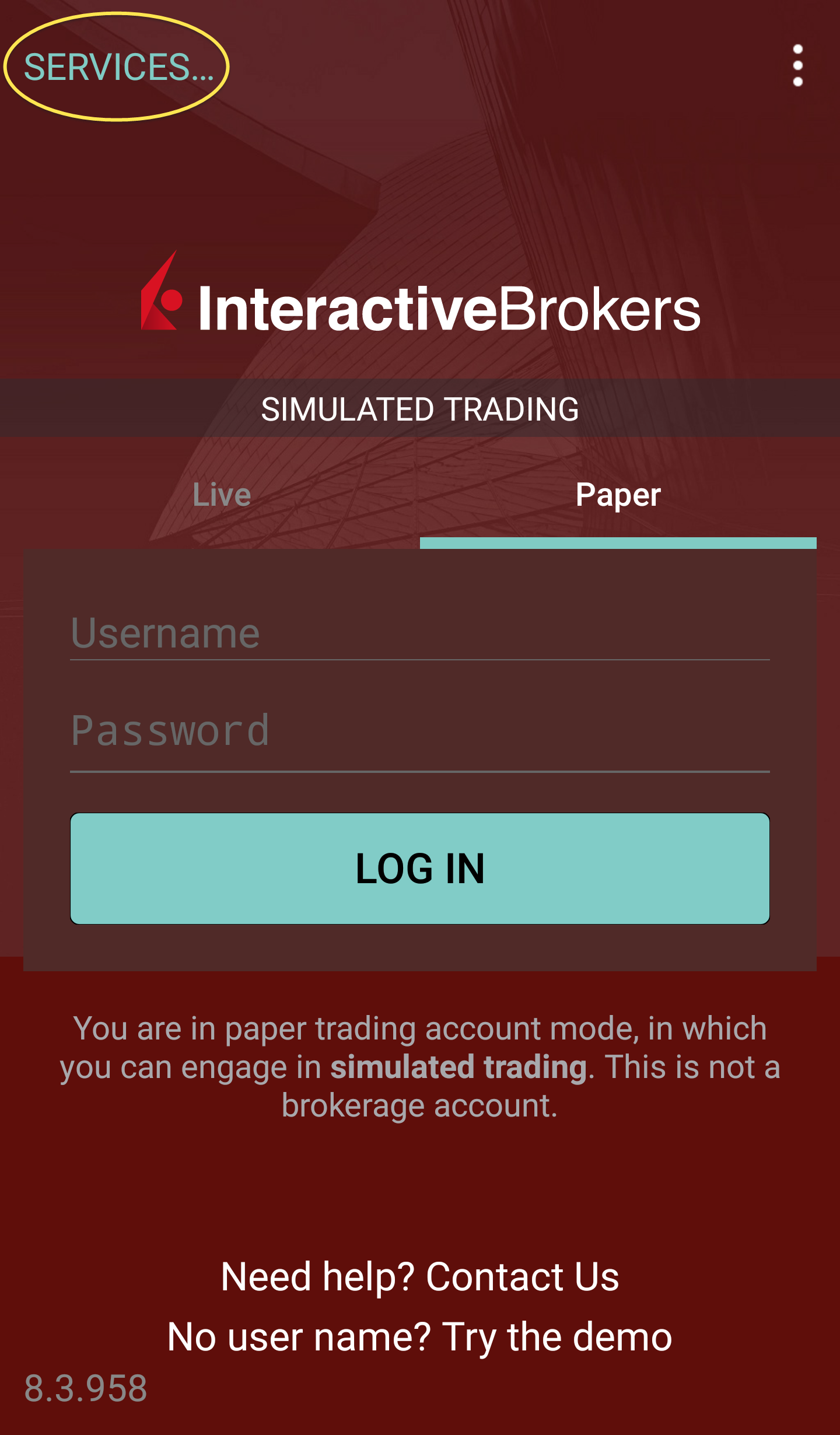

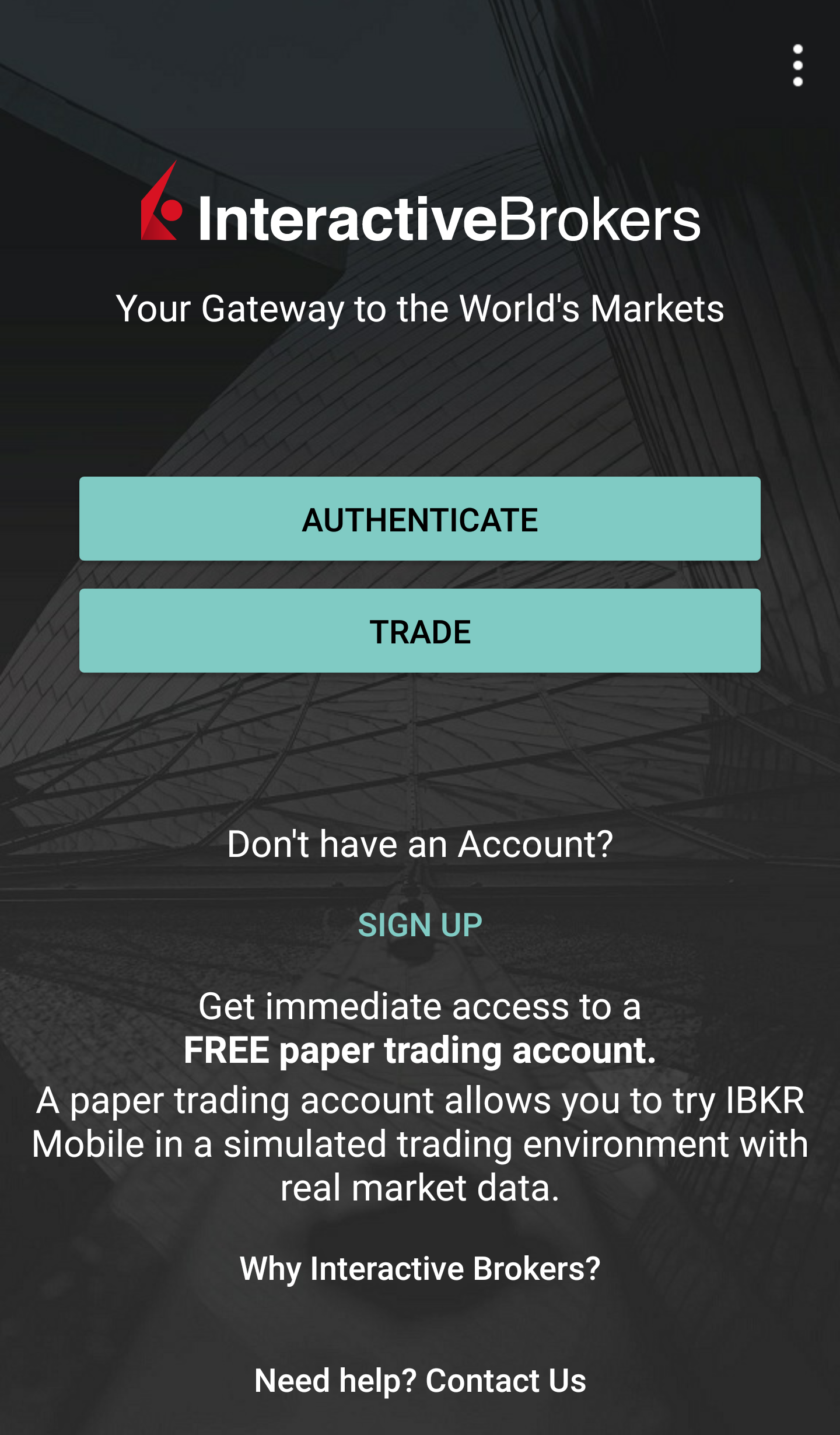

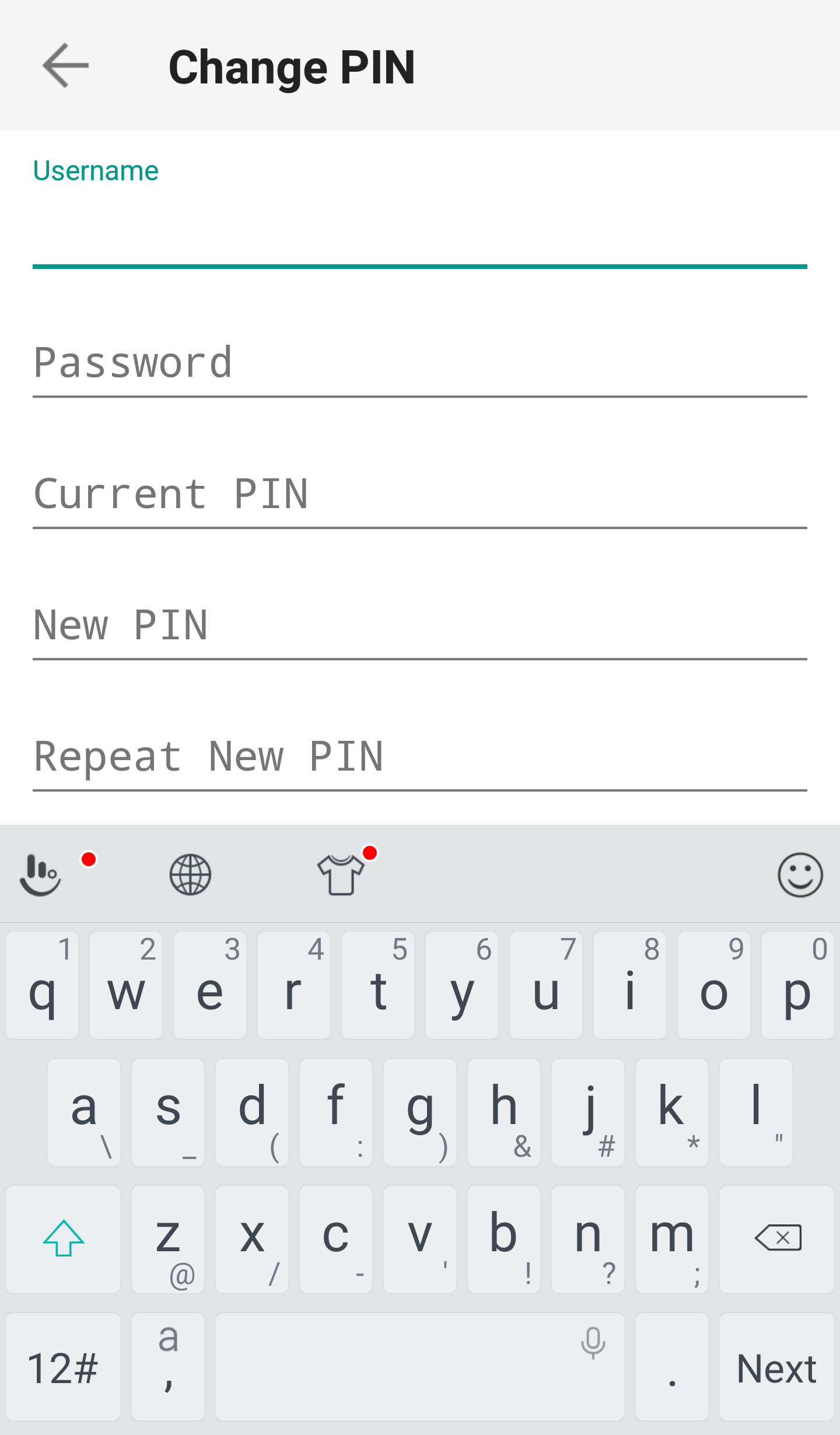

Abra la aplicación IBKR Mobile.

-

Pulse el botón Servicios en la esquina superior izquierda

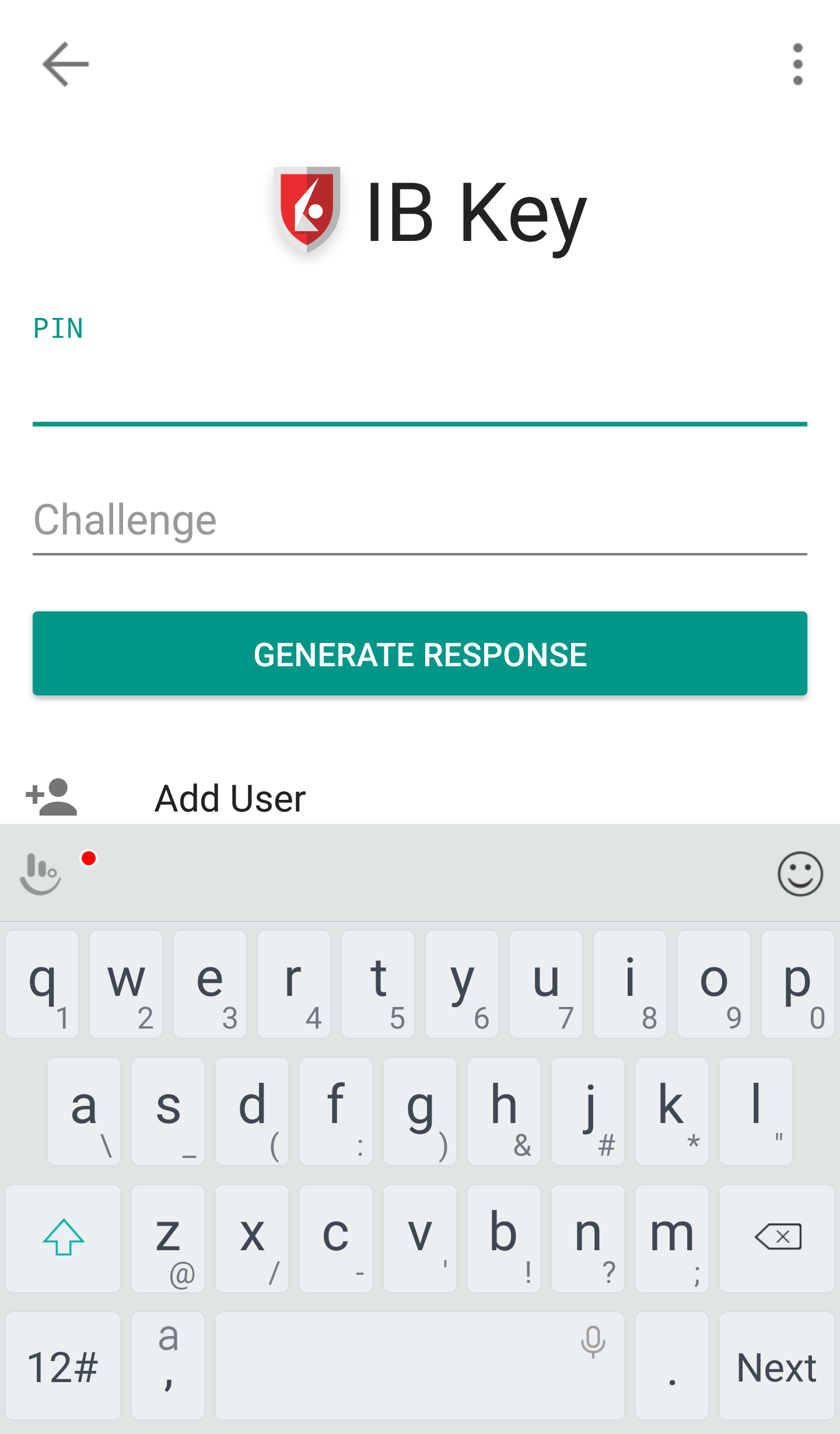

- Pulse el botón Autenticar

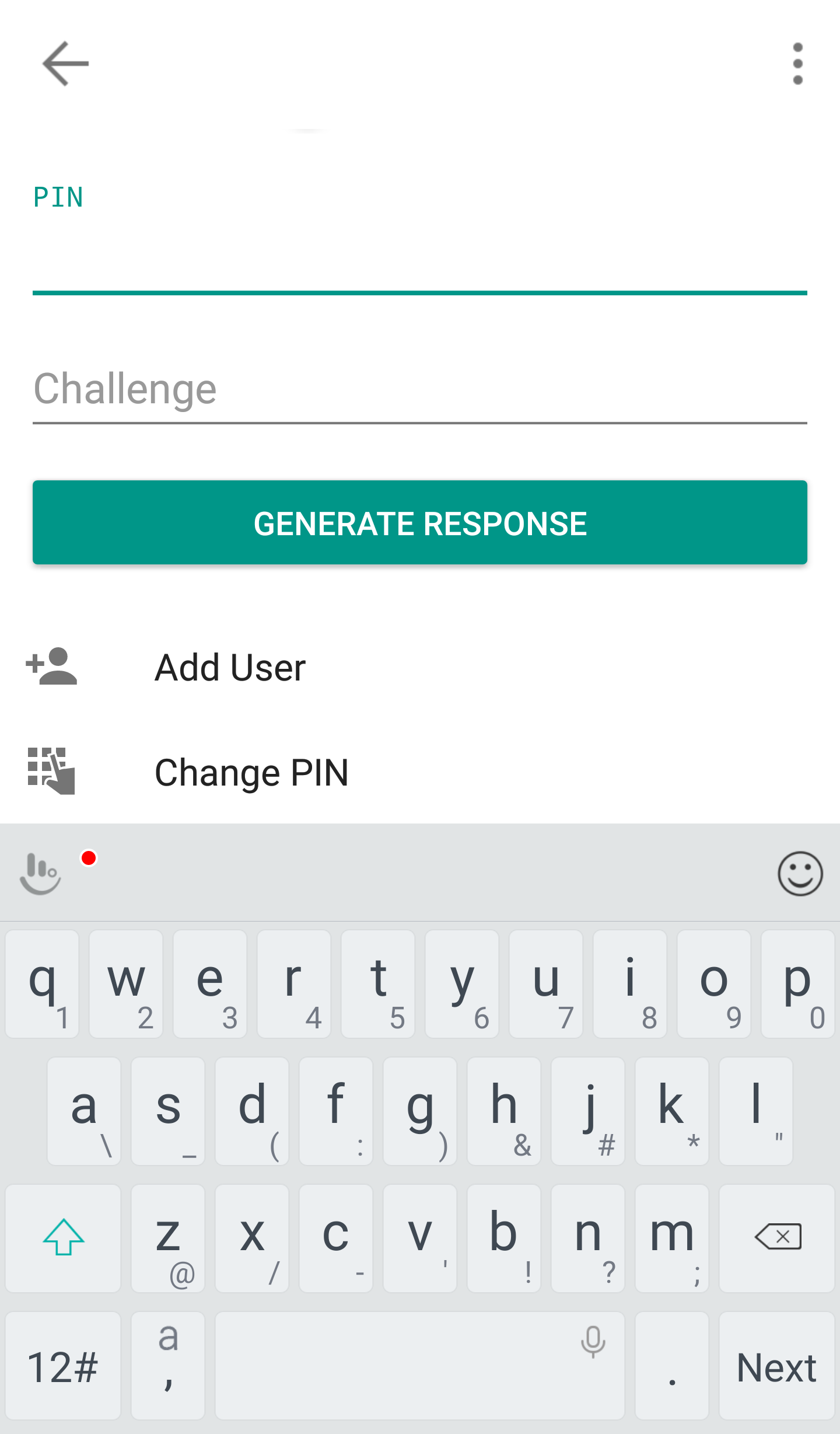

-

Pulse Cambiar PIN. Algunos teléfonos podrán requerirle que se deslice hacia abajo para ver la opción.

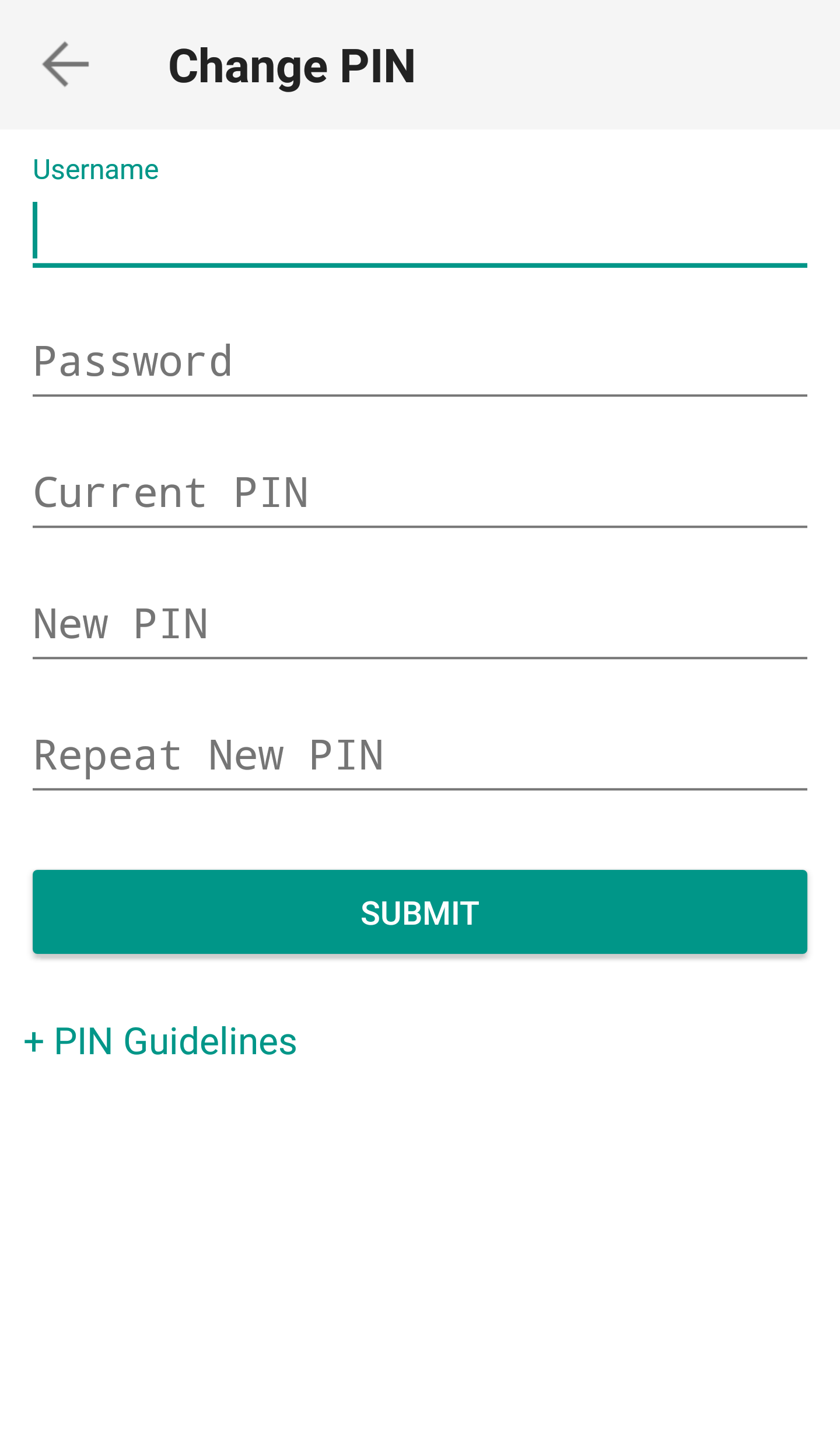

- Ingrese su nombre de usuario, contraseña, el PIN actual y su nuevo PIN dos veces. Haga clic en Enviar. Es probable que algunos móviles requieran que se deslice hacia abajo para ver todos estos elementos.

- El PIN se ha cambiado correctamente. Pulse en el botón Hecho.

Una vez que el PIN se ha cambiado correctamente, puede cerrar la aplicación IBKR Mobile e iniciar sesión en Client Portal o en su plataforma de negociación utilizando el PIN nuevo.

Cómo habilitar y usar SMS como el método de autenticación en dos factores

El método de autenticación en dos factores por SMS es un método rápido y fácil de realizar sus tareas de autenticación. Este artículo explica cómo configurar su número de móvil para recibir códigos de autenticación a través de SMS.

- Cómo registrarse para la autenticación por SMS (mensaje de texto)

- Cómo conectarse con la autenticación por SMS

Cómo registrarse para la autenticación por SMS

Para registrarse en la autenticación en dos factores por mensaje de texto, deberá tener un número de móvil verificado en nuestros registros. Si la verificación de su número de teléfono no se completó durante la solicitud de cuenta, puede completarla en cualquier momento si sigue estos pasos:

- Inicie sesión en Client Portal.

- Desde el menú lateral, haga clic en Configuración y luego en Configuración del usuario. Haga clic en el engranaje de configuración que corresponde a Número de móvil.

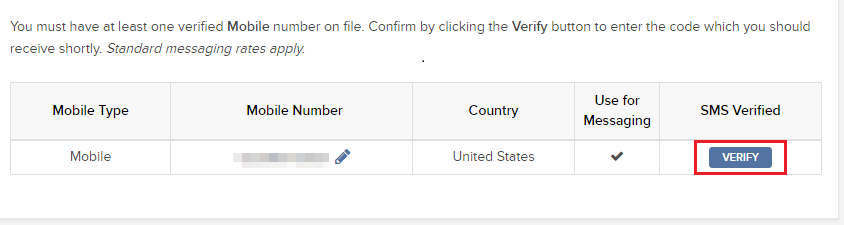

- Haga clic en VERIFICAR

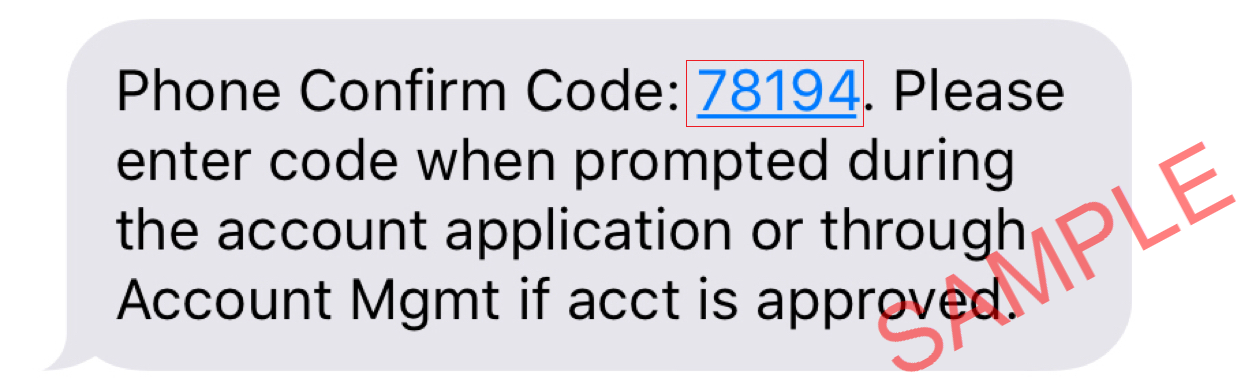

- Abra la aplicación para mensajes de texto de su móvil y encontrará un SMS con el código de confirmación que le enviamos.

NOTA: el tiempo de entrega del mensaje podrá variar y, en algunas circunstancia, podrá tardar varios minutos. Solo podrá solicitar un nuevo SMS cada 2 minutos.

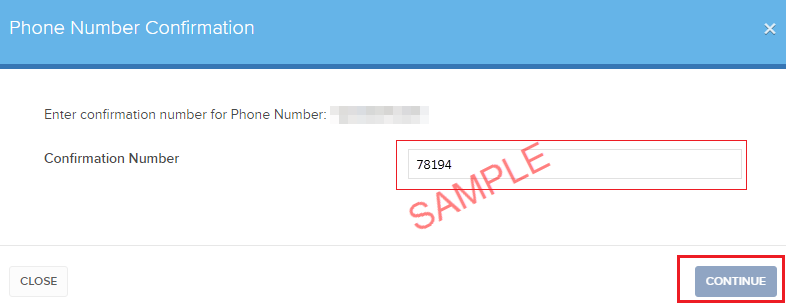

- Ingrese el código de confirmación que ha recibido en el campo número de confirmación y haga clic en CONTINUAR.

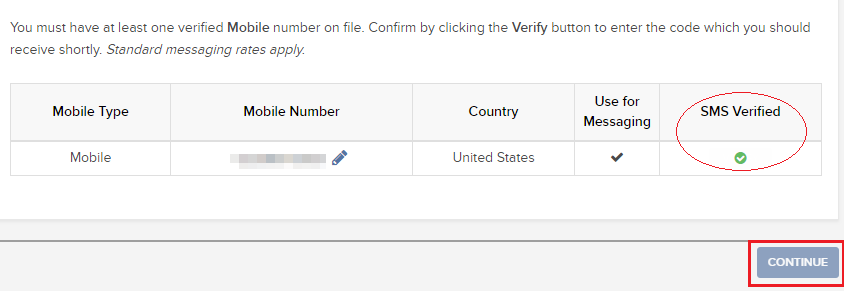

- Si se ha aceptado el código, aparecerá una tilde en verde en la columna Verificado mediante SMS. Haga clic en CONTINUAR para finalizar el procedimiento.

- Si su usuario no tiene un dispositivo de SLS, se registrará automáticamente en la autenticación en dos factores por SMS a la brevedad.

Subir

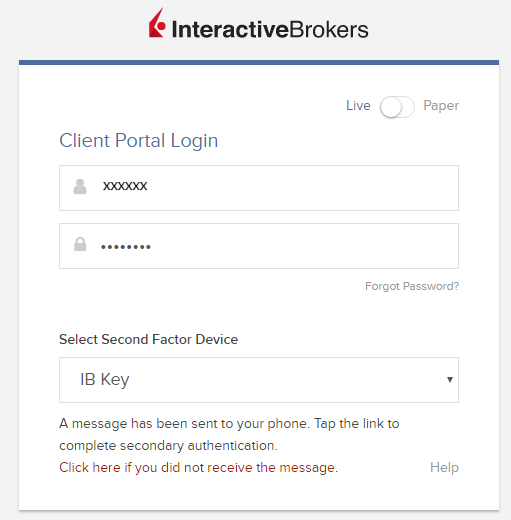

Cómo conectarse con la autenticación por SMS

Una vez que se han habilitado los SMS como el método de autenticación en dos factores, podrá utilizarlos del siguiente modo:

- Abra TWS o visite Client Portal

- Ingrese su nombre de usuario y contraseña en los campos correspondientes y haga clic en Iniciar sesión

- A continuación se le solicitará ingresar el código de autenticación que se le envió por SMS. Abra la aplicación de mensajes de su móvil y busque el mensaje que contiene el código.

.png)

- Ingrese el código de autenticación en el campo de Código de seguridad que se encuentra en la pantalla de acceso, y luego haga clic en Iniciar sesión o Aceptar

.png)

.png)

Cómo volver a usar el sistema de acceso seguro

Los clientes que hayan dejado de usar el dispositivo desde el programa Sistema de acceso seguro (SLS) se exponen a ciertos riesgos y, por lo tanto, quedan condicionados a determinadas restricciones (p. ej., capacidad de negociar acciones Pink Sheet y OTCBB). Teniendo esto en cuenta, junto con los beneficios de protección que se obtienen mediante una protección SLS completa, podrá decidir volver a usar el sistema de acceso seguro. El siguiente artículo proporciona instrucciones paso a paso para conseguir esto.

Tenga en cuenta que, para modificar los ajustes de configuración para una cuenta, el usuario primario debe iniciar sesión en Client Portal. En caso de que su usuario no tenga permitido cambiar los ajustes de seguridad, el sistema le mostrará un aviso y le indicará cuál es el usuario que tiene los derechos.

Para volver a usar el sistema de acceso seguro, proceda del siguiente modo:

1. Abra su explorador y visite la página web ibkr.com.

(1).png)

.png)

.png)

.png)

Notas

1. Si está usando la versión clásica de Client Portal, haga clic en el menú arriba Gestionar cuenta, luego en Seguridad >Sistema de acceso seguro > Volver a usar SLS. Seleccione el botón Volver a usar en la línea correspondiente a su usuario.

Referencias

- Consulte el artículo KB1131 para obtener un resumen sobre el sistema de acceso seguro

- Consulte el artículo KB1943 para obtener instrucciones para solicitar una tarjeta de seguridad digital+ de reemplazo

- Consulte el artículo KB2636 para obtener información y consultar los procedimientos relacionados con dispositivos de acceso seguro

- Consulte el artículo KB2481 para obtener instrucciones acerca de cómo compartir el dispositivo de acceso seguro entre dos o más usuarios

- Consulte el artículo KB975 para obtener instrucciones acerca de cómo devolver su dispositivo de acceso seguro a IBKR

- Consulte el artículo KB2260 para obtener instrucciones para activar la autenticación con IB Key a través de IBKR Mobile

- Consulte el artículo KB2895 para obtener información sobre el sistema de autenticación múltiple en 2 factores (M2FS)

- Consulte el artículo KB1861 para obtener información acerca de los cargos o gastos relacionados con los dispositivos de acceso seguro

- Consulte el artículo KB69 para obtener información acerca de la validez de la clave de acceso temporaria

Cómo compartir un dispositivo de seguridad

IBKR les permite a los clientes individuales mantener varios nombres de usuario dentro de una sola cuenta o entre cuentas distintas bajo su control. Las personas que no deseen mantener varios dispositivos de seguridad físicos pueden elegir consolidar y compartir un solo dispositivo entre sus usuarios. Los requisitos previos y el procedimiento para compartir los dispositivos se detalla a continuación.

Requisitos previos

La posibilidad de compartir un dispositivo de seguridad físico se concederá solamente si se cumplen TODAS las condiciones a continuación:

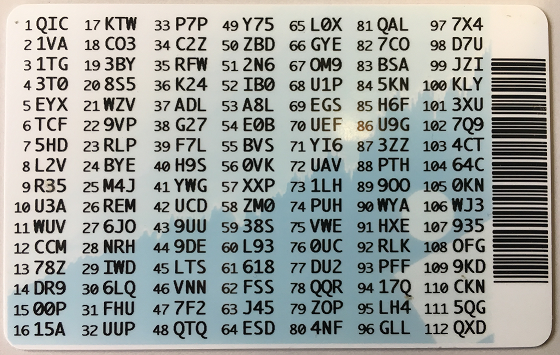

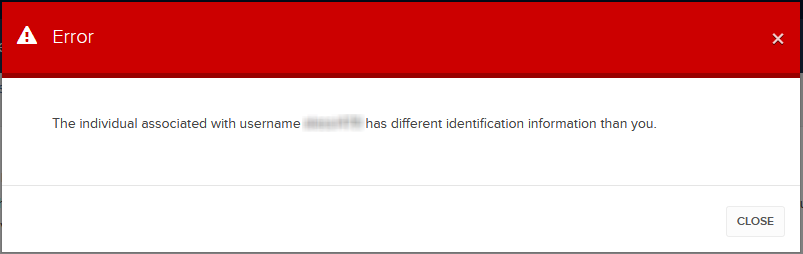

a) Los usuarios participantes pertenecen a la misma entidad o a distintas entidades pero con la misma información de identificación (fecha de nacimiento, ciudadanía, país de residencia legal, tipo y número de documento de identificación o número de seguro social para ciudadanos y residentes estadounidenses).

b) Los usuarios participantes NO tienen un dispositivo de seguridad temporario (código temporario, tarjeta de código de seguridad en línea) asignado.

|

Nivel de seguridad |

Nombre del dispositivo |

Imagen del dispositivo |

| Más alto | Tarjeta de seguridad digital+ (TSD+) |  |

| Más bajo | Tarjeta de código de seguridad (tarjeta SLS) |  |

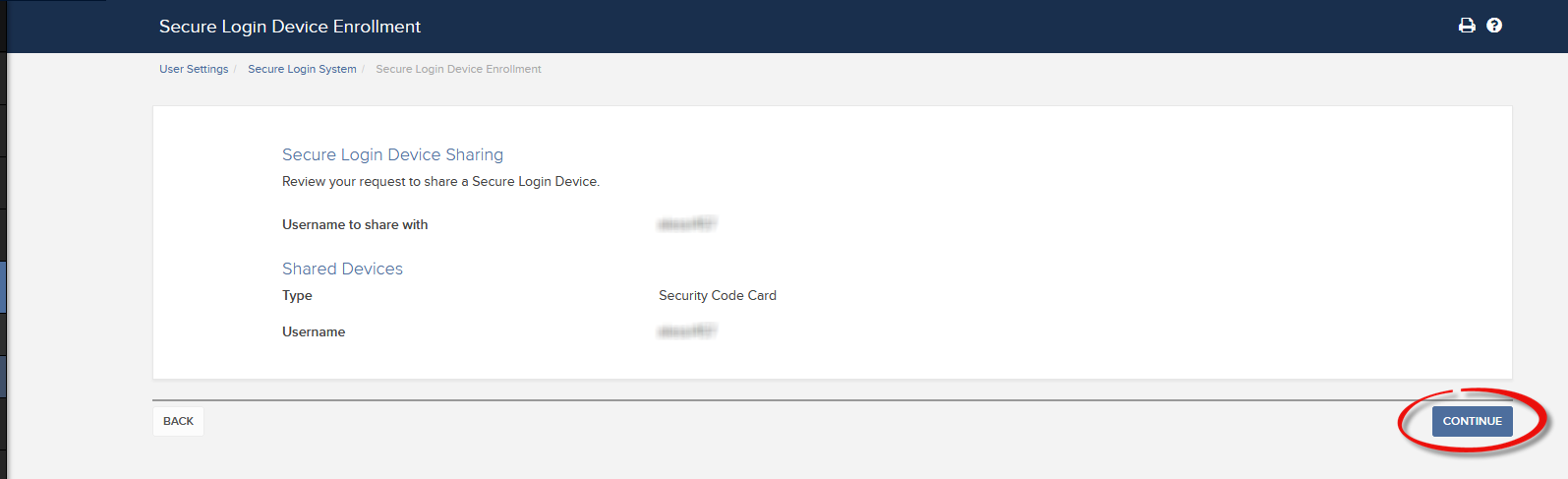

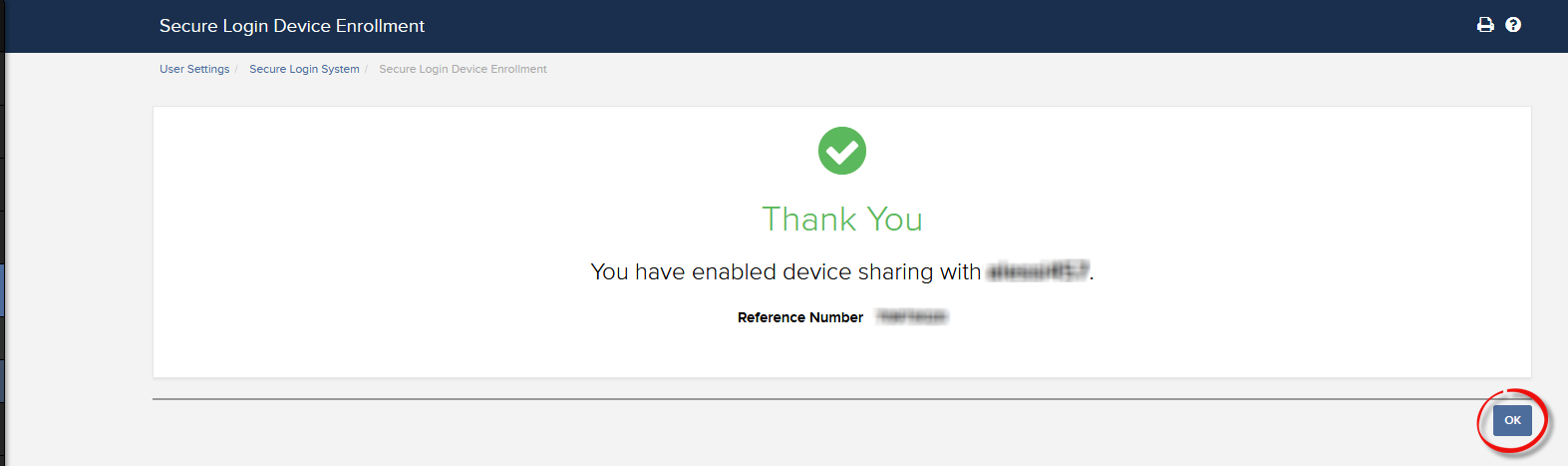

Procedimiento:

1. De entre los posibles candidatos, identifique el dispositivo que ofrezca el nivel más alto de protección y el usuario al cual pertenece el dispositivo. Denominaremos a ese usuario el propietario del dispositivo

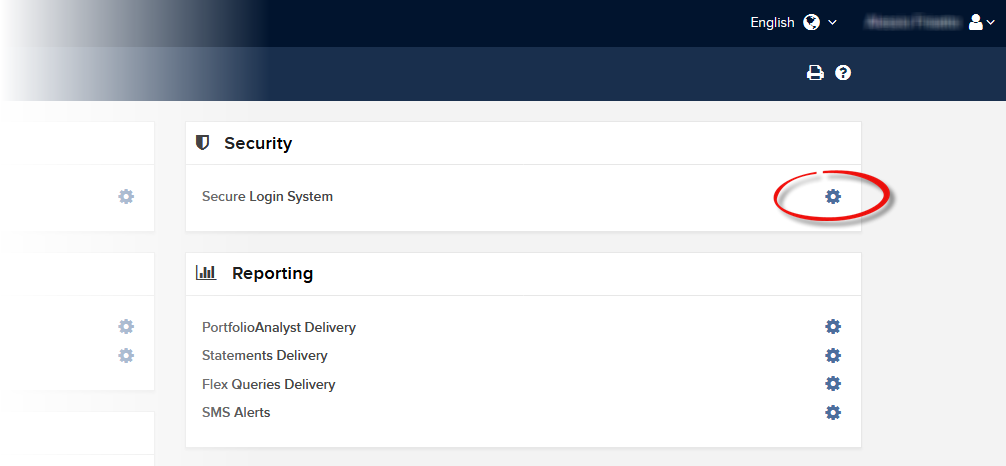

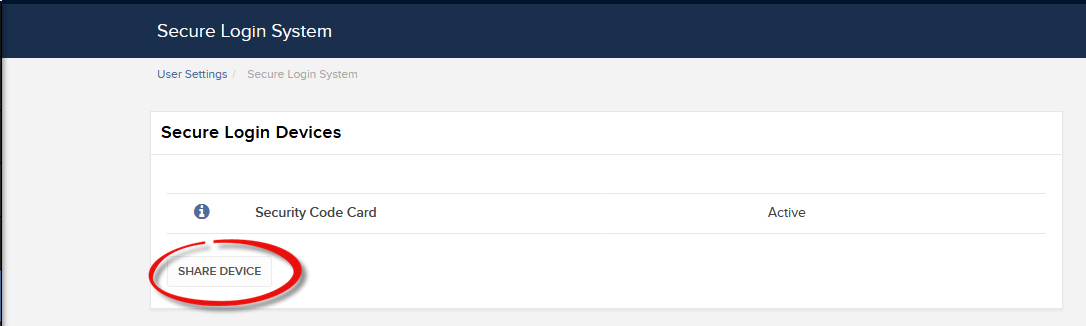

2. Inicie sesión en su página de Client Portal con el usuario solicitante (NO el propietario del dispositivo)

(1).png)

.png)

.png)

a. En la gran mayoría de los casos, su solicitud para compartir se aprobará, procesará e implementará automática e inmediatamente. En caso de que se requiera la aprobación de nuestro departamento de cumplimiento, su solicitud permanecerá en estado pendiente hasta que se haya completado este paso.

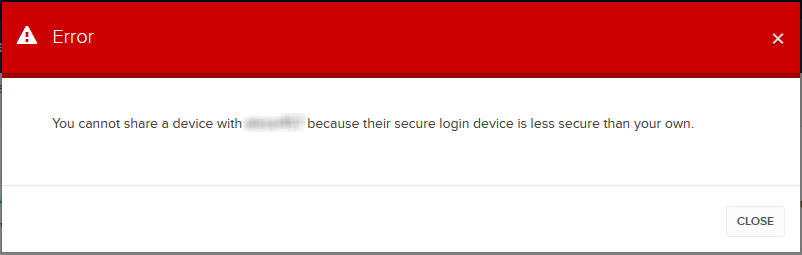

c. A continuación podrá ver los mensajes de error más comunes y sus causas:

- Dispositivo menos seguro: este error aparece si configura el token menos seguro como el que va a compartir. Identifique el dispositivo más seguro y compártalo.

Referencias:

- Resumen del sistema de acceso seguro: KB1131 o ibkr.com/sls

- Sistema de autenticación múltiple en dos factores (M2FS): KB2895

- Cómo compartir el dispositivo de acceso seguro entre dos o más usuarios: KB2481

- Cómo dejar de usar el sistema de acceso seguro: KB2545

- Consideraciones acerca de la seguridad luego de dejar de usar el sistema SLS: KB1198

- ¿Existen cargos o costes relacionados con los dispositivos de seguridad? KB1861

- Cómo solucionar errores de conexión con Client Portal: KB1132

- Cómo solucionar errores de conexión con las plataformas de negociación: KB1133

¿Cuánto tiempo dura un código de seguridad temporario?

IBKR emitirá una clave de acceso temporaria para los participantes del sistema de acceso seguro en caso de que su dispositivo de seguridad se haya extraviado o dañado. El propósito de la clave de acceso temporaria es proporcionarle acceso completo a Client Portal y a las plataformas de negociación durante un periodo de 2 días. Luego de 2 días, la clave de acceso temporaria ya no podrá utilizarse para acceder a las plataformas de negociación pero podrá utilizarse para acceder a Client Portal durante un periodo adicional de 8 días. Sin embargo, el acceso Client Portal estará limitado solamente a imprimir o guardar la tarjeta de código de seguridad en línea.

Por el contrario, la tarjeta de código de seguridad en línea tiene una vida útil de 21 días, lo que le ofrece al titular de cuenta una oportunidad de ubicar el dispositivo extraviado o de tener acceso continuo en caso de que el dispositivo se extravíe o dañe y deba reemplazarse. Los titulares de cuentas que permanezcan sin sus dispositivos de seguridad físicos y que no puedan conectarse utilizando la clave de acceso temporaria ni la tarjeta de código de seguridad en línea deberán contactar con atención al cliente (https://www.interactivebrokers.eu/es/index.php?f=6492&p=contact) para acceder a su cuenta.

La solución más rápida para recuperar el acceso permanente a su cuenta es instalar y activar la autenticación con IB Key a través de IBKR Mobile. La información acerca de la activación instantánea de la aplicación en el móvil podrá encontrarse aquí.

AVISO IMPORTANTE

A modo de política, IBKR no emite claves de acceso temporarias consecutivas para una determinada cuenta, sino que tomará medidas para recuperar la protección de cuenta al nivel más seguro, el cual se proporciona mediante un dispositivo de seguridad físico.

Referencias

- Consulte el artículo KB70 para obtener instrucciones acerca de la solicitud de claves de acceso temporarias

- Consulte el artículo KB1131 para ver un resumen del sistema de acceso seguro

- Consulte el artículo KB2636 para obtener información y consultar los procedimientos relacionados con dispositivos de acceso seguro

- Consulte el artículo KB2481 para obtener instrucciones acerca de cómo compartir el dispositivo de acceso seguro entre dos o más usuarios

- Consulte el artículo KB2545 para obtener instrucciones acerca de cómo dejar de usar el sistema de acceso seguro

- Consulte el artículo KB975 para obtener instrucciones acerca de cómo devolver su dispositivo de acceso seguro a IBKR

- Consulte el artículo KB2260 para obtener instrucciones para activar la autenticación con IB Key a través de IBKR Mobile

- Consulte el artículo KB2895 para obtener información acerca del sistema múltiple en dos factores (M2FS)

- Consulte el artículo KB1861 para obtener información acerca de los cargos o gastos relacionados con los dispositivos de acceso seguro

Cargo por reemplazo del dispositivo de seguridad

Los titulares de cuentas que se conecten a su cuenta a través del sistema de acceso seguro de IBKR reciben un dispositivo de seguridad, el cual proporciona una capa de protección adicional a la proporcionada por el nombre de usuario y la contraseña, y cuyo objetivo es evitar el robo de información a manos de piratas informáticos y que otras personas no autorizadas accedan a su cuenta. Si bien IBKR no cobra una tarifa por el uso de este dispositivo, algunas versiones requieren que el titular de cuenta devuelva el dispositivo luego del cierre de la cuenta. De lo contrario, se cobrará una tarifa por reemplazo. Los titulares de cuentas existentes también están condicionados a esta tarifa por reemplazo en caso de que el dispositivo se pierda, sea robado o se dañe (tenga en cuenta que no cobramos una tarifa por la devolución del dispositivo en caso de que la batería esté dañada).

Además, mientras que IBKR no evalúa una tarifa por reemplazo a menos que se determine que el dispositivo se ha perdido, ha sido robado o se ha dañado o no se ha devuelto, se colocará una reserva equivalente a la tarifa en la cuenta luego de la emisión del dispositivo para garantizar su devolución. Esta reserva no tendrá efecto sobre el capital de la cuenta disponible para negociar pero actuará como un límite para las retiradas o transferencias hasta que se haya devuelto el dispositivo (es decir, el saldo de la reserva no se podrá retirar).

A continuación se detallan las tarifas por reemplazo relacionadas con cada dispositivo.

| DISPOSITIVO DE SEGURIDAD | TARIFA POR REEMPLAZO |

| Tarjeta de código de seguridad1 | 0.00 USD1 |

| Tarjeta de seguridad digital+ | 20.00 USD |

Para obtener instrucciones respecto de la devolución de dispositivos, consulte el artículoKB975

1 No es necesario devolver la tarjeta de código de seguridad luego del cierre de la cuenta, y podrá destruirse y eliminarse una vez que los fondos se hayan devuelto y la cuenta se haya cerrado por completo. El acceso a Client Portal luego del cierre para ver y recuperar extractos de actividad y documentos fiscales se mantendrá utilizando solamente la combinación de nombre de usuario y contraseña existentes. Este tipo de seguridad de autenticación en dos factores ya no se emite.

Sistema de autenticación múltiple en dos factores (M2FS)

General

Esta página cubre los puntos específicos del sistema de autenticación múltiple en 2 factores (M2FS) y cómo funciona. Para consultar las preguntas generales acerca del sistema de acceso seguro, consulte el artículo KB1131.

Tabla de contenidos

¿Qué es el sistema M2FS?

El sistema M2FS les permite a los clientes mantener más de un dispositivo de seguridad activo al mismo tiempo. Ya no tiene que elegir entre un dispositivo de seguridad físico y la aplicación IBKR Mobile, ya que se puede usar cualquiera de los dos indistintamente. En caso de que ya tenga un dispositivo de seguridad activo, las activaciones en otros dispositivos resultarán en que ambos dispositivos permanecerán activos en forma simultánea.

Activación

En caso de que actualmente utilice la tarjeta de código de seguridad/tarjeta de seguridad digital+: si utiliza un dispositivo físico de acceso seguro, podrá descargar y activar la aplicación IBKR Mobile. Consulte las instrucciones para Android y iOS.

En caso de que actualmente utilice la aplicación IBKR Mobile: Si utiliza la aplicación IBKR Mobile y tiene una cuenta con un saldo igual o mayor que 500 000 USD, usted califica para la tarjeta de seguridad digital+ . Podrá conectarse a Client Portal y solicitar la TSD+ siguiendo las instrucciones que se detallan aquí.

Operación

Una vez que tenga el dispositivo físico y la aplicación IBKR Mobile activada, el sistema M2FS estará representado mediante un menú desplegable una vez que inicie sesión. Ahora puede seleccionar el dispositivo con el cual desea realizar la autenticación siguiendo los pasos a continuación:

1. Introduzca su nombre de usuario y contraseña en pantalla de inicio de sesión de la plataforma de negociación o de Client Portal y haga clic en Iniciar sesión. Si las credenciales han sido aceptadas, aparecerá una lista desplegable que le permitirá seleccionar un dispositivo de doble factor. Si inicia sesión en TWS, tenga en cuenta que el sistema M2FS es compatible a partir de la versión 966.

TWS:

Client Portal:

.png)

2. Una vez que seleccione un dispositivo de acceso seguro, se le presentará la ventana correspondiente para la autenticación. Consulte las instrucciones para:

- IB Key a través de IBKR Mobile (iOS)

- IB Key a través de IBKR Mobile (Android)

- Tarjeta de código de seguridad

- Tarjeta de seguridad digital+

3. Si el segundo factor de autenticación se realiza correctamente, se procederá automáticamente a la conexión.

Límites de retirada

El dispositivo utilizado para autenticar su retirada definirá sus límites de retirada de acuerdo con el cuadro a continuación:

|

Dispositivo de seguridad |

Máximo de retirada |

Máximo de retirada |

| Tarjeta de código de seguridad1 | 200 000 USD | 600 000 USD |

| Aplicación IBKR Mobile | 1 000 000 USD | 1 000 000 USD |

| Tarjeta digital de seguridad1 | 1 000 000 USD | 1 500 000 USD |

| Tarjeta de seguridad digital+ | Sin límite | Sin límite |

| Dispositivo dorado1 | Sin límite | Sin límite |

| Dispositivo platino1 | Sin límite | Sin límite |

1: Representa un dispositivo anterior que ya no se emite.

Ejemplo: tiene la aplicación IBKR Mobile y la tarjeta digital de seguridad+ activadas y necesita retirar más de 200 000 USD. Puede utilizar el dispositivo para iniciar sesión en Client Portal pero no se le requerirá utilizar la tarjeta de seguridad digital+ para confirmar su solicitud de retirada.

Beneficios

El sistema M2FS ofrece más flexibilidad en el sistema de acceso seguro de IBKR al permitirle elegir qué dispositivo de seguridad desea utilizar para autenticar su conexión. Además de la practicidad de utilizar un dispositivo de confianza y accesible a diario, puede eliminar las demoras relacionadas con la autenticación cuando necesita ingresar una operación rápidamente.