Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

Exchange name change

Overview:

Interactive Brokers is completing an effort to update and consolidate exchange names where appropriate. When this effort is complete, the following updates will be in effect:

- GLOBEX and CMECRYPTO will be consolidated to a single exchange, ‘CME’

- ECBOT will be updated to ‘CBOT’

- COMEX listed metals (previously reflected as NYMEX) will be updated to exchange ‘COMEX’

- NYMEX, no change

Given the breadth of products involved, we are migrating in four waves based on underlying products:

| Key | Effective Trade Date | Products |

| Wave 1 | October 30, 2022 | GLOBEX: ZAR, LB, DA, IXE |

| Wave 2 | November 6, 2022 | GLOBEX: EMD, BRE, CHF, SOFR3, E7, NKD CMECRYPTO: BTCEURRR, ETHEURRR, MET |

| Wave 3 | November 13, 2022 | GLOBEX: All remaining products CMECRYPTO: All remaining products ECBOT: ZO, ZR, 2YY, 30Y NYMEX: ALI, QI, QC |

| Wave 4 | December 4, 2022 | ECBOT: All remaining products NYMEX: All remaining "Metal" products |

I am trading via API, how does this impact me?

For API clients the only requirement would be to provide a new exchange name, for example: exchange=”CME”, for existing contracts for the affected exchanges.

Old exchanges names will no longer be available after the change.

More details can be found within our FAQs through the following link: Upcoming Exchange name Changes

Note: If you are using a third party software connected to TWS or IB Gateway and that software does not recognize the new contract definitions, please contact the third party vendor directly.

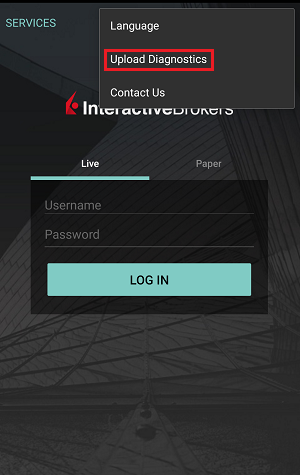

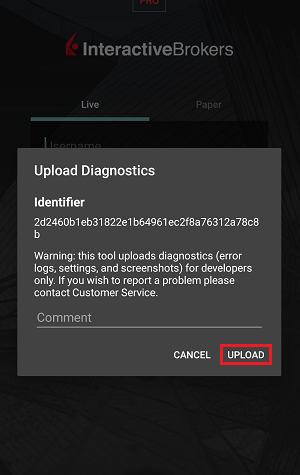

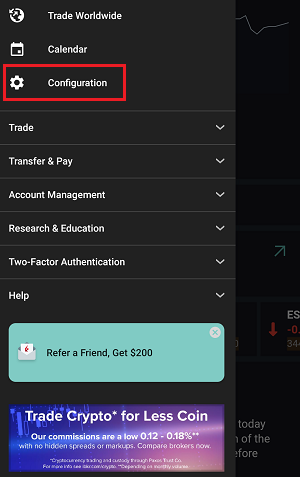

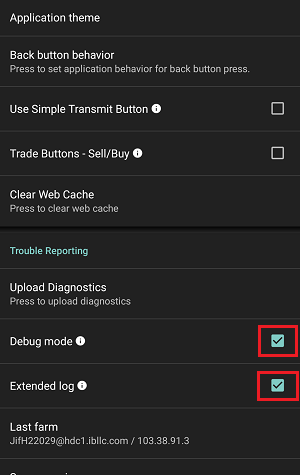

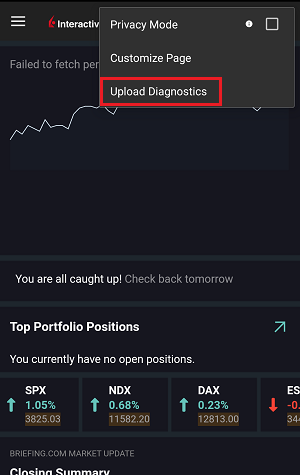

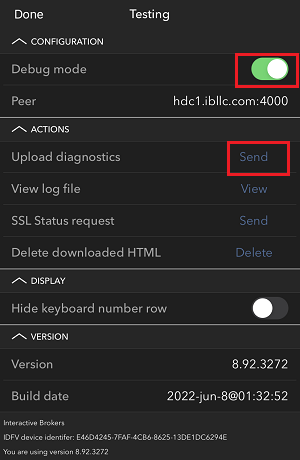

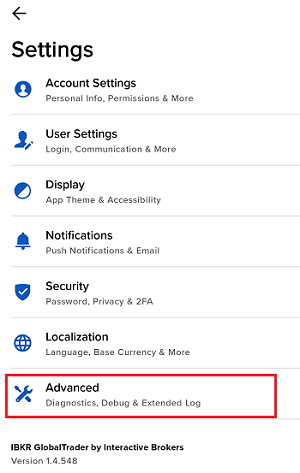

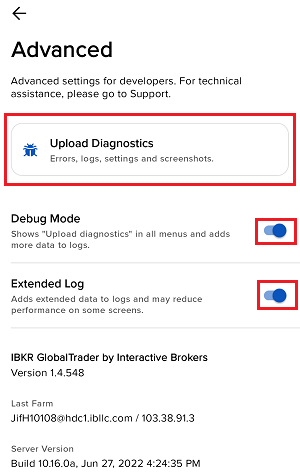

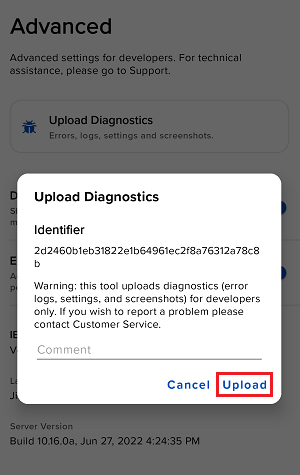

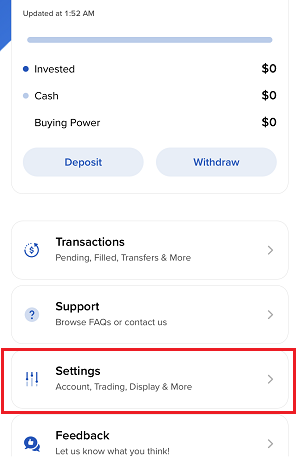

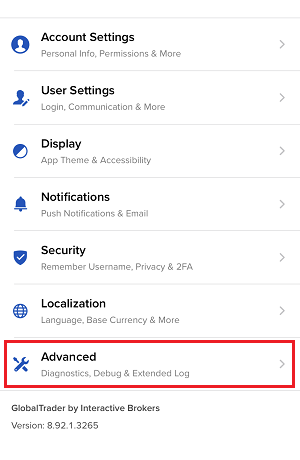

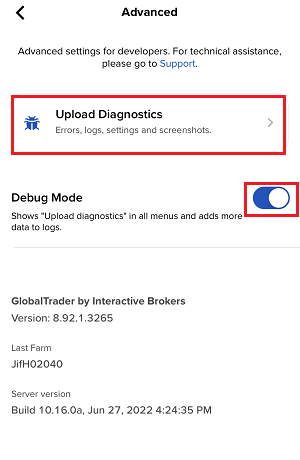

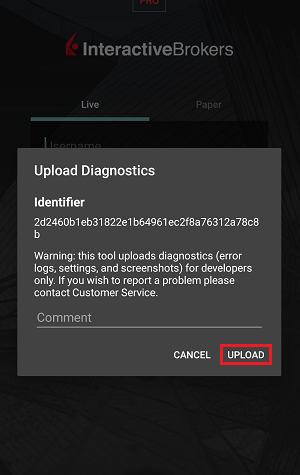

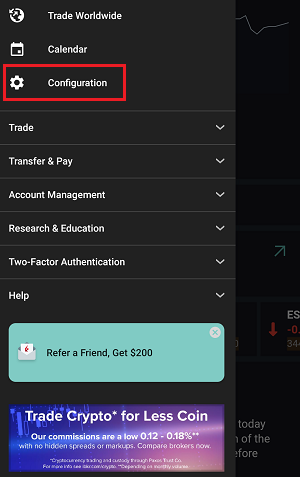

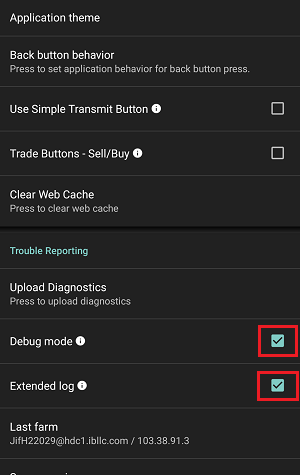

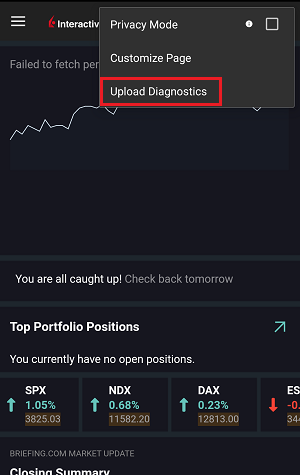

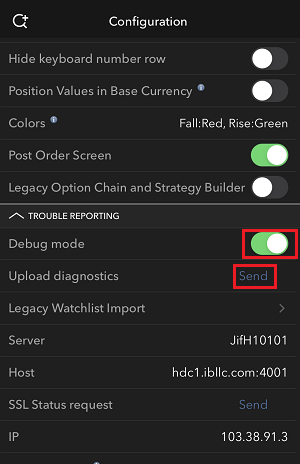

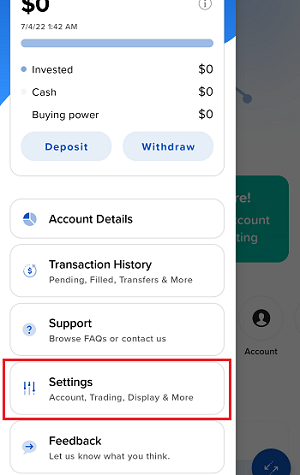

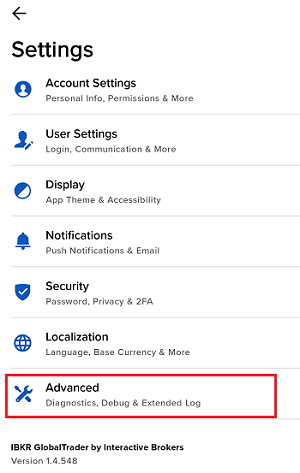

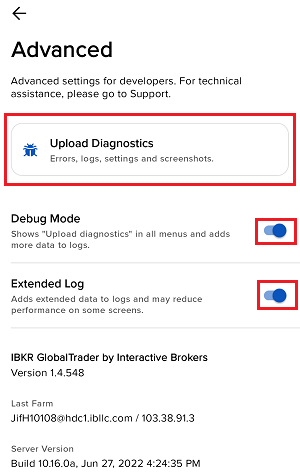

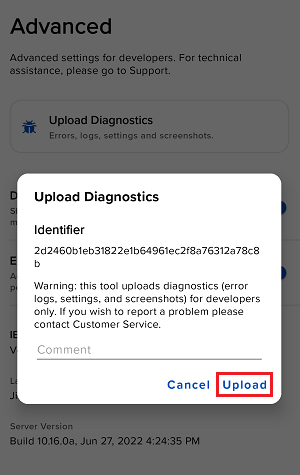

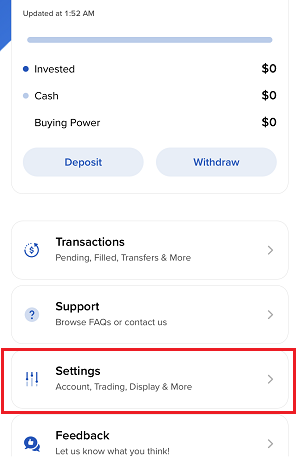

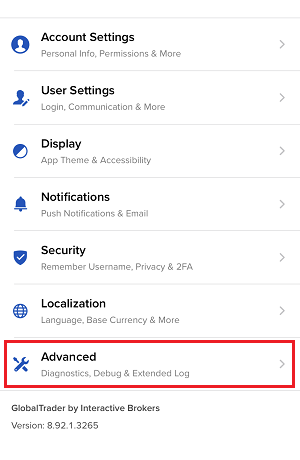

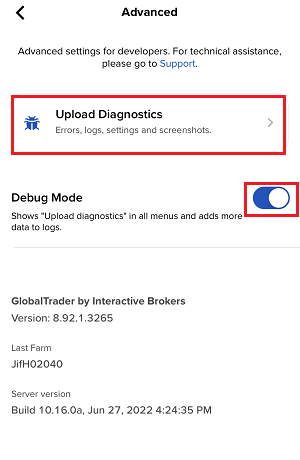

如何從IBKR平台上傳診斷包

某些支持相關的問題除了需要提供截圖外還需要上傳診斷文件與日志。這些信息可幫助我們調查幷解决您遇到的問題。

本文詳細說明了如何通各盈透證券交易平臺上傳診斷文件與日志。

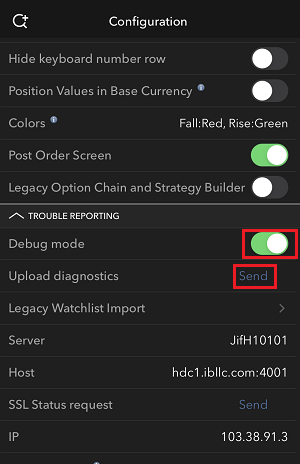

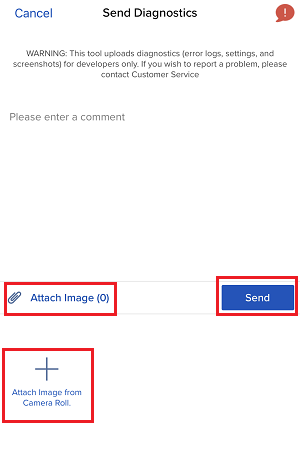

請注意:IBKR不會實時監控診斷包信息庫。如果您在沒有盈透證券明確要求的情况下自行决定上傳診斷包,請通過諮詢單或電話通知我們的客戶服務人員,否則我們可能會注意不到您的錯誤報告。

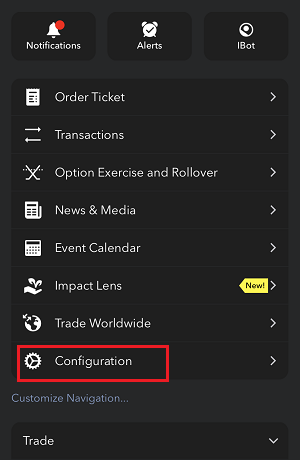

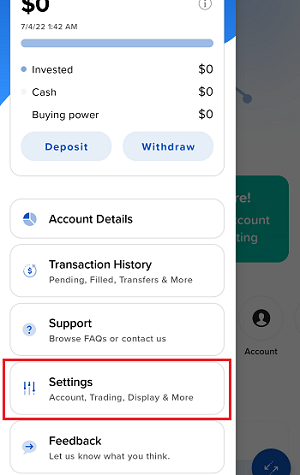

請根據您使用的平臺點擊對應鏈接:

-

移動IBKR(Android版)

-

移動IBKR(iOS版)

- Windows和Linux操作系統:按Ctrl+Alt+Q

- Mac:按Cmd+Option+H

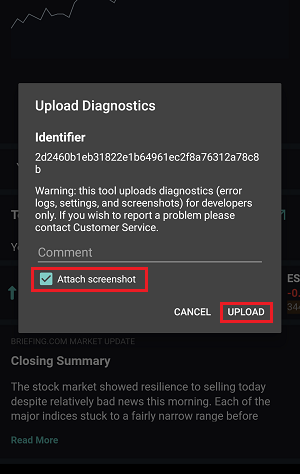

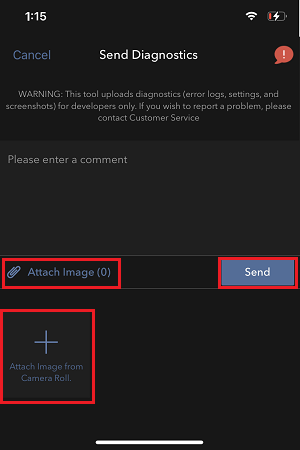

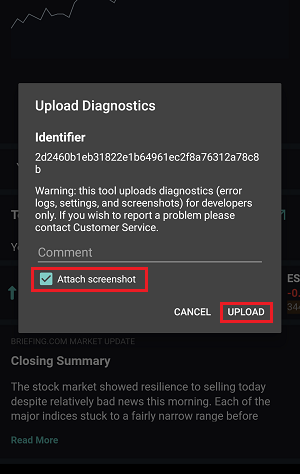

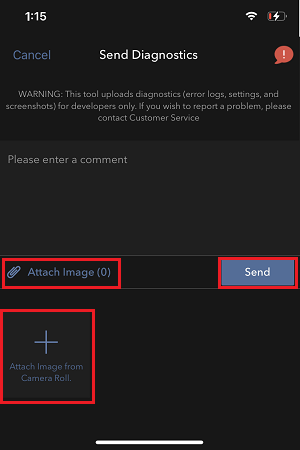

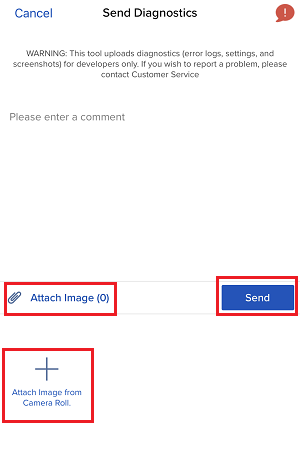

7. 輸入您的評論,點擊“附上圖片”按鈕附上您已保存到相册的問題頁面截圖

客戶端的診斷上傳請參見IBKB3512

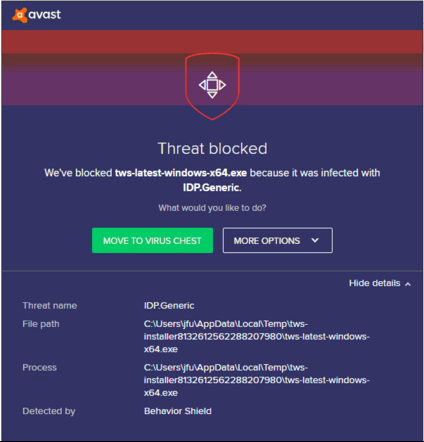

TWS安裝和更新過程中可能出現的警報

IBKR的交易者工作站(TWS)是一個全球交易系統,可供客戶使用一整套在綫交易工具。TWS可以安裝于Windows、Mac OS X和Linux系統,需要Java運行時環境(JRE)。因此,在安裝TWS時,同時還會下載必要的Java文件以使用Java虛擬機(JVM)運行。

有時在TWS的安裝或更新過程中,諸如殺毒軟件之類的應用程序會彈出警報幷阻止安裝或更新程序完成。這種情况下出現的警告和其它消息可以忽略,您可以繼續完成交易平臺的安裝。

目錄

ibkr.com或IBKR地區網站上下載頁面的TWS安裝程序均采用行業標準要求的所有安全程序進行數字簽名和封存,沒有任何惡意代碼或程序。TWS更新包也是采用同樣的行業標準,啓動TWS時,會自動下載安裝更新包(當且僅當有更新的時候)。但是,如果您收到警報,我們還是建議您謹慎對待。如果您想將TWS安裝文件保留在電腦上以備將來使用,您應確保對其應用同樣的預防措施,保護數據免受病毒和惡意軟件攻擊。

您可能會看到一條警報(類似于圖1但不限于圖1的情况),然後您的安全系統會等您來告訴它如何處理可疑文件。通常您可以選擇隔離文件、删除文件、忽略文件或爲該文件創建一個例外。

請注意,您的殺毒軟件可能會自動隔離或删除TWS安裝文件或其部分組件,而不會先請求您的確認也不會顯示任何警告。但是,這只有在您對殺毒軟件進行了特定設置讓其作出這種反應的情况下才會發生。

圖1

如果在TWS安裝或更新過程中收到警告,我們建議您按以下步驟操作:

1. 删除TWS安裝程序幷重新從IBKR主網站或地區網站上下載

a) 删除您電腦上已有的TWS安裝文件,然後再從回收站將其删除(清空回收站)

b) 在下表中點擊與您所在地區對應的TWS下載區域

| 所在地 | TWS下載區域 |

| 美國 | https://www.ibkr.com |

| 亞洲/大洋洲 | https://www.interactivebrokers.com.hk |

| 印度 | https://www.interactivebrokers.co.in |

| 歐洲 | https://www.interactivebrokers.co.uk https://www.interactivebrokers.eu |

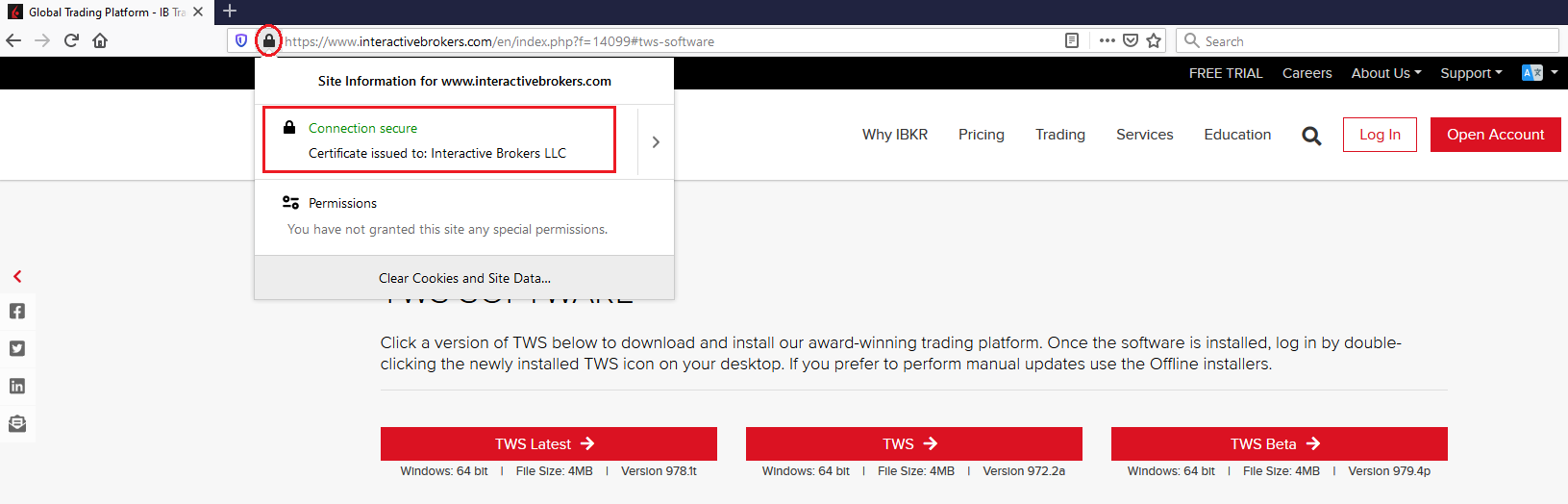

c) 檢查網站證書。如果網站證書失效、受損或過期,大多數瀏覽器會立即向您發出警報。但是,如果您想手動檢查網站證書的有效性,請點擊地址(URL)旁邊的安全鎖,確保連接顯示爲安全幷且沒有出現任何安全警告(見下方圖2)。

圖2

d) 點擊您想要使用的TWS版本對應的按鈕,再次下載TWS安裝程序

2. 檢查您所下載的TWS安裝文件的數字簽名

通常如果文件的數字簽名有問題,您會立即收到安全警告。但是,如果您想手動檢查,請根據您的操作系統按以下步驟操作:

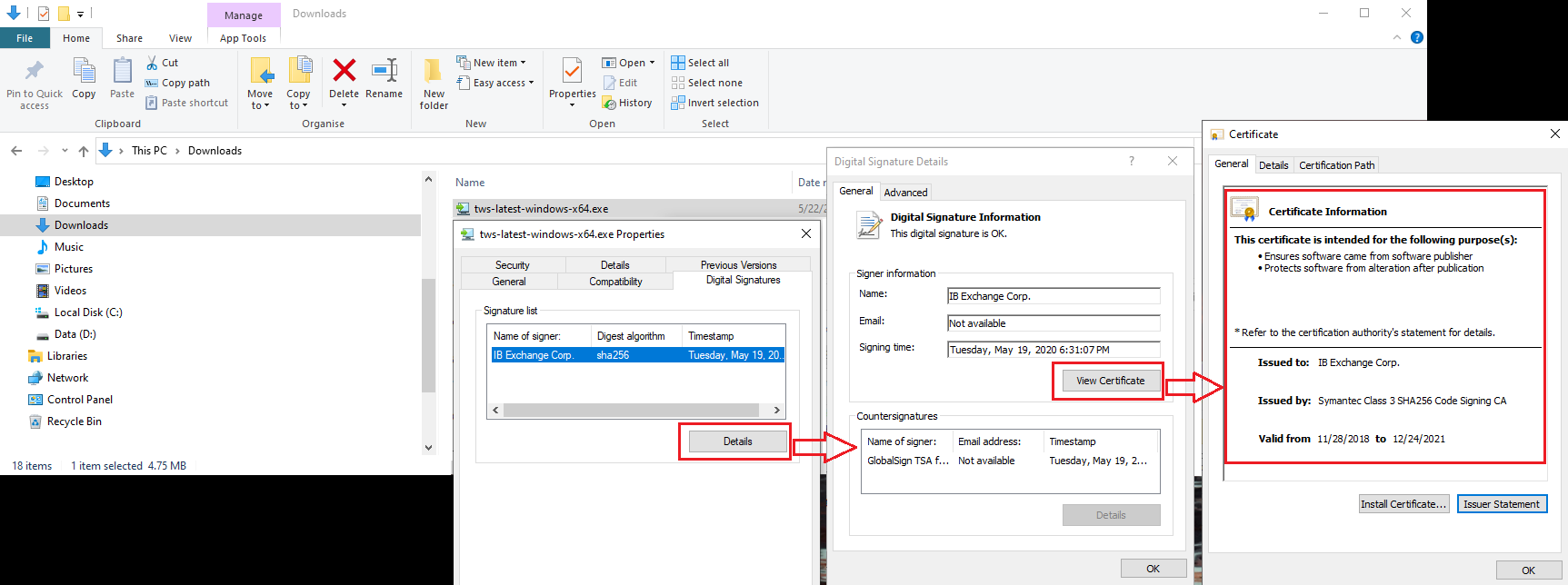

Windows

a) 從Windows文件資源管理器打開下載(Downloads)文件夾或您保存TWS安裝程序的文件夾

b) 右鍵點擊TWS安裝文件,選擇屬性(Properties)然後點擊“數字簽名(Digital Signatures)”

c) 點擊“詳細信息(Details)”然後點擊“查看證書(View Certificate)”檢查證書狀態和簽署者。合法的簽署者爲“IB Exchange Corp.”(見下方圖3)

圖3

Mac OS X

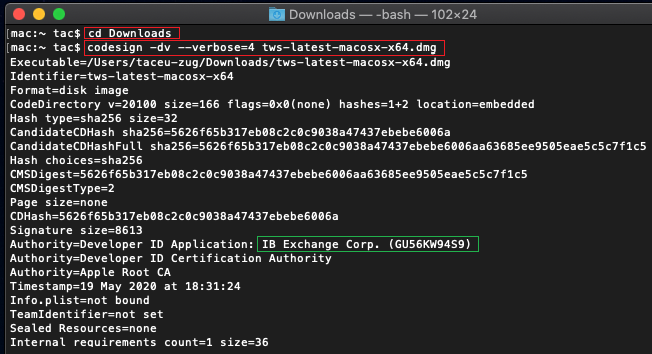

a) 點擊屏幕右上角的放大鏡(Spotlight搜索)然後輸入Terminal。從搜索結果中啓動Terminal應用程序

b) 輸入cd Downloads然後按Enter鍵

c) 輸入codesign -dv --verbose=4 tws-latest-macosx-x64.dmg然後按Enter鍵。請注意,文件名稱(tws-latest-macosx-x64.dmg)可能會因您下載的TWS版本不同而有所不同。如需要,您可在命令行更換文件名稱

d) 檢查命令輸出,確保“Developer ID Application”是“IB Exchange Corp.”(見下方圖4)

圖4

3. 運行您下載的TWS安裝文件

下載好TWS安裝程序幷確定文件爲原版文件後(上方第1點和第2點),您便可以繼續安裝了。 這時如果還收到殺毒軟件的警告,您可合理相信其爲誤報幷予以忽略。 如果在這一步需要指導,請直接進入下一節。

現在的安全系統都會允許添加例外,正是爲了解决誤報的問題。 例外規則會强制殺毒軟件引擎不對特定文件或程序進行掃描,因而使該特定文件或程序被認爲是安全可靠,從而不對其發出警報。

取决于您所使用的安全軟件,添加例外情况的程序可能會有所差异。您可以直接從警報彈窗添加臨時性或永久性例外,也可以從主配置面板的特定區域手動創建例外。

如果不確定怎麽操作,建議您參閱您的殺毒軟件文檔。

爲TWS安裝文件或TWS更新程序添加了例外之後,其將不再被阻止,從而能成功完成相應任務。

如果您有理由相信自己的電腦中毒了,我們建議您進行全面的系統掃描。通常,您可以右鍵點擊底部任務欄(Windows)或頂部菜單欄(MacOS)中的殺毒軟件圖標,届時您會看到一個可以啓動全面系統掃描的選項。或者,您也可以從殺毒軟件主窗口啓動該任務。如果不確定怎麽操作,建議您參閱您的殺毒軟件文檔。

技術背景信息

安全系統如何掃描我從網上下載的文件?

現在的殺毒軟件和反惡意軟件引擎會根據以下方面識別威脅:

基于簽名的掃描:殺毒軟件掃描器會搜索之前被歸類爲惡意或可疑程序的特定字節模式。殺毒軟件可能還會比對已知威脅數據庫(病毒定義)檢查文件簽名(哈希)。

行爲分析:殺毒軟件引擎會探測那些單獨拎出來可能不構成威脅、但放在一起與惡意軟件活動幷無二致的行爲(如代碼可以複製或隱身、從網上下載其它文件、通過互聯網聯繫外部主機、修改操作系統注册表)。此類掃描旨在發現先前未知的計算機威脅。

啓發式探測:掃描器會反向編譯代碼或在虛擬的限制環境中運行代碼。然後其會對照預定義的規則集合對代碼的行動進行評估和分類。

基于雲端的保護和機器學習:這些都是相對較新的技術。需要分析的文件會發送到殺毒軟件/安全系統供應商的雲端,在那裏會有算法對代碼的可靠性和行爲進行深度分析。

這些掃描方法絕對可靠嗎?

現在的威脅非常複雜狡猾,就像生物病毒一樣,可以改變其代碼和簽名。此外,每天都有新的惡意軟件和漏洞利用程序被開發出來幷在網上快速傳播。因此,上方提到的威脅識別方法幷不絕對可靠,但是結合起來使用,它們可以幫助識別絕大多數惡意程序。

儘管基于簽名的技術在識別已知威脅方面做得非常成功且不太容易發生誤報,但在識別未知的惡意程序和已有惡意程序的變種方面就不那麽有效了。在這一領域,行爲和啓發式方法的表現要好得多,儘管由于它們是基于一定程度的解譯而非完全的裸代碼匹配,因而存在一定不確定性,從而容易發生誤報。

“誤報”是指安全系統把無惡意的文件或程序歸爲惡意文件或程序的情况。

參考:

Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

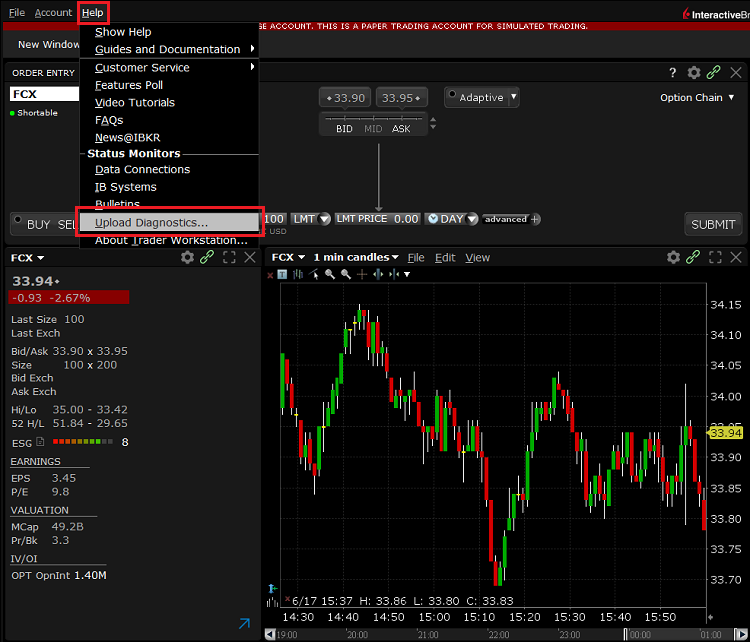

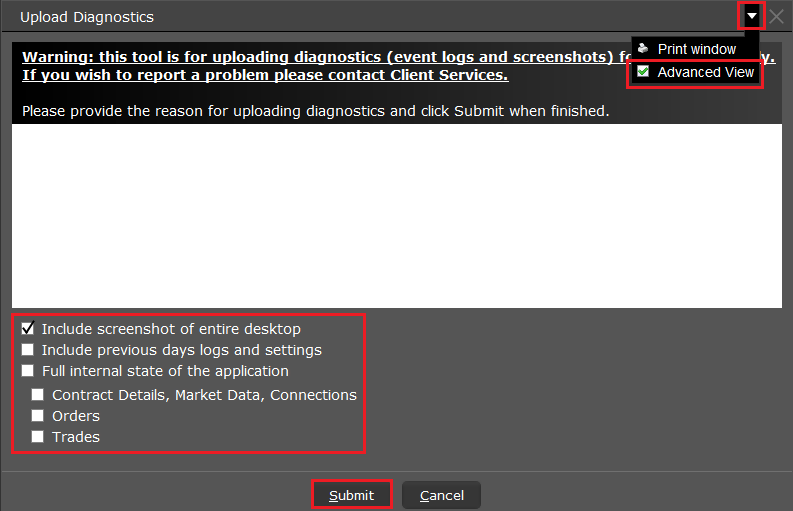

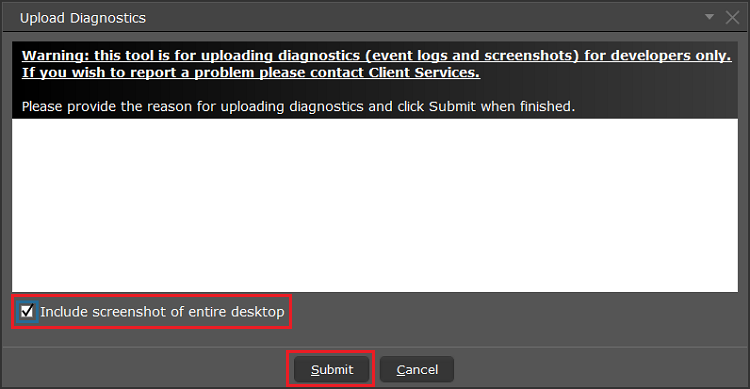

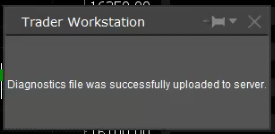

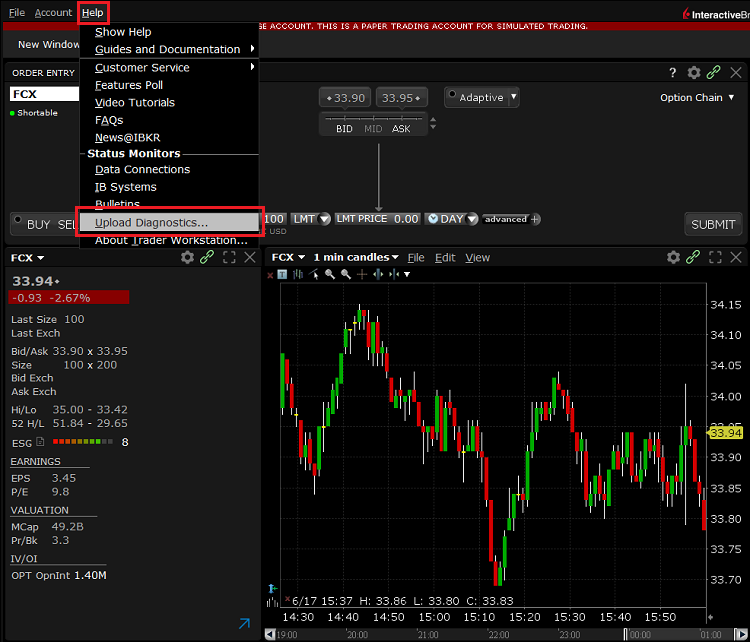

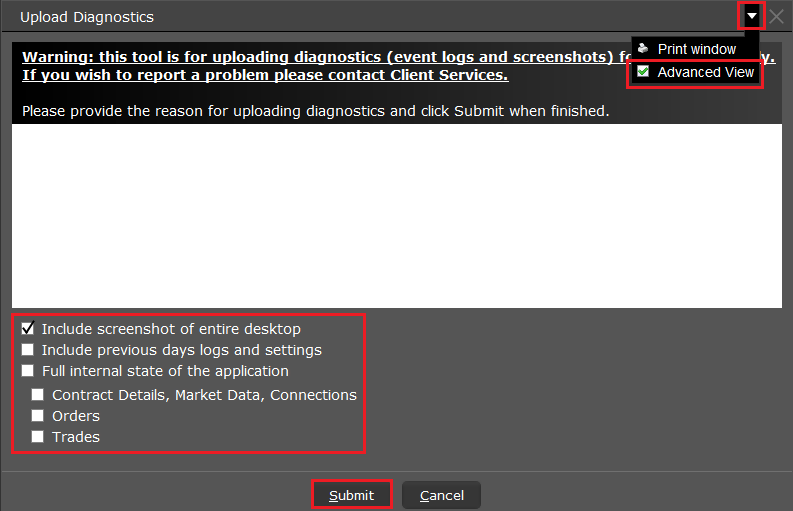

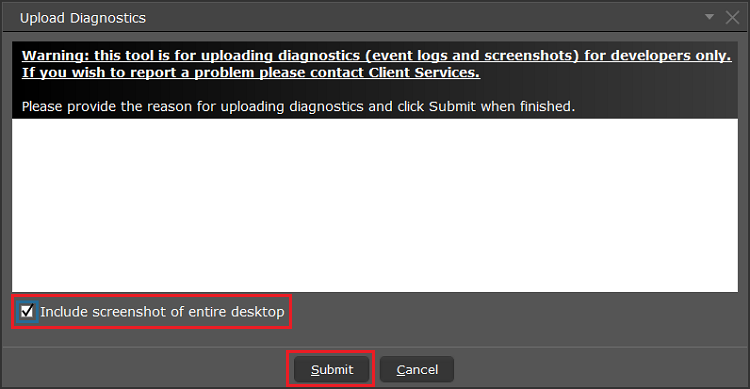

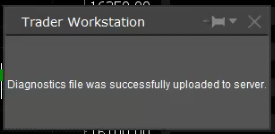

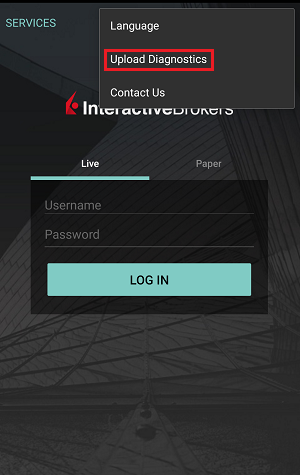

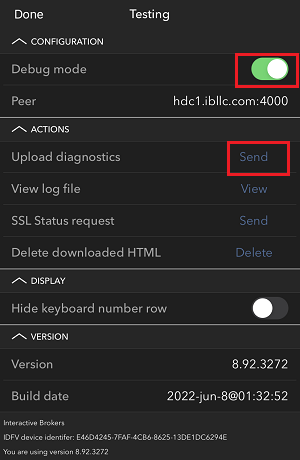

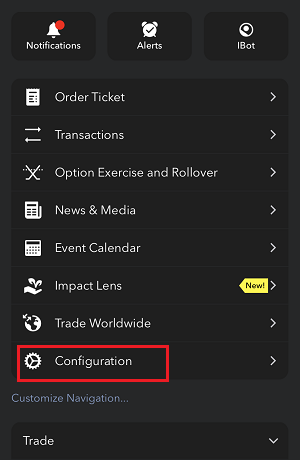

How to Upload a Diagnostic Bundle from an IBKR Platform

Some support related issues require diagnostics files and logs to be uploaded along with screenshots. The information will help our team to investigate and resolve the issue that you are experiencing.

This article will help you with detailed steps on how to upload diagnostics files and logs from various Interactive Brokers’ trading platforms.

Note: IBKR does not monitor the diagnostic bundle repository throughout the day. Should you spontaneously decide to upload a diagnostic bundle, without being instructed by Interactive Brokers, please inform our Client Services via Message Center ticket or phone call otherwise your error report will go unnoticed.

Please click on one of the links below, according to the platform you are using:

-

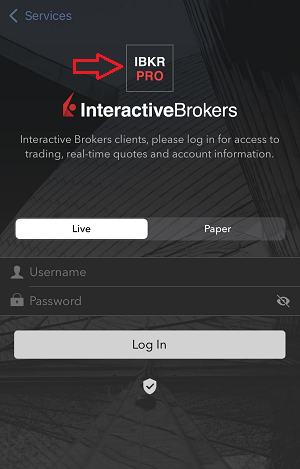

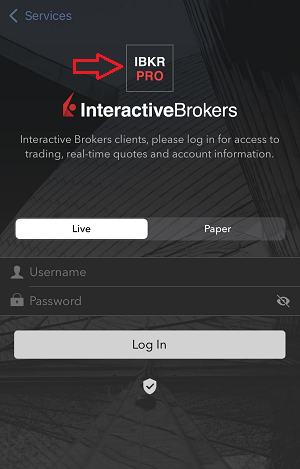

IBKR Mobile (Android)

-

IBKR Mobile (iOS)

- For Windows and Linux Operating system: Press Ctrl+Alt+Q

- For Mac: Press Cmd+Option+H

7. Enter your comments in the field and tap ‘Attach Image’ to attach the screenshot/s you previously saved in your camera roll

A diagnostic trace for Client Portal can be captured following the steps on IBKB3512

關於使用止損單的更多信息

美股市場偶爾會發生極端波動和價格混亂。 有時這類情況持續時間很長,有時又很短。止損單可能會對價格施加下行壓力、加劇市場波動,且可能使委託單在大幅偏離觸發價格的位置上成交。.

請升級TWS

2021年12月9日,Apache Log4j發現了一個高危安全漏洞——Log4Shell。Log4j是一個日志記錄組件,被廣泛用于消費者和企業服務、網站、應用程序和設備,用來記錄安全和性能信息。 攻擊者可以利用該漏洞遠程控制目標系統、執行任意代碼。由于Log4j被廣泛應用幷且該漏洞的攻擊難度非常低,此次事件不僅危害極大,影響範圍也極廣。

IBKR采取什麽措施來保護客戶?

我們正在緊急行動以期從多個層面减緩威脅:

- 我們已采用不受該漏洞影響的Log4j版本對所有可從外部訪問(因特網)的服務器進行了修復。

- 我們已采用不受該漏洞影響的Log4j版本對TWS軟件和TWS安裝包進行了升級。

- 我們已采用最新的保護措施對我們的安全框架(包括網絡防火墻、應用程序防火墻和入侵檢測工具等)進行了更新,可檢測幷攔截利用Log4j漏洞發起的網絡攻擊。

- 我們會繼續努力,找出所有受影響的內部系統(不可通過Internet訪問的系統)幷進行修復。

- 我們會持續監控不斷演變的威脅幷采取必要的應對措施。

需要采取的行動

我們始終致力于創造安全的環境,爲您的資産和交易活動提供安全保障。爲此,我們請所有客戶務必使用最新版本的TWS(該版本會自動更新)。如果您使用的是不會自動更新的穩定版或離綫版,請務必采取必要步驟確保TWS更新了最新的安全修復。

Please Upgrade TraderWorkstation (TWS)

On December 9, 2021, a critical security vulnerability in Apache's Log4j software library was disclosed, (now commonly referred to as “Log4Shell”). Log4j is very broadly used in a wide variety of consumer and enterprise services, websites, applications, and devices to log security and performance information. The vulnerability allows an unauthenticated remote actor to take control of an affected system and execute arbitrary code on it. The ubiquitous nature of Log4j and the ease of exploitation of the vulnerability makes this threat not only critical but also nearly universal.

WHAT IS IBKR DOING TO PROTECT ITS CLIENTS?

We are actively working, with high priority, to mitigate the threat on several levels:

- We have patched all our servers accessible externally (from the Internet) with a version of Log4j that is not susceptible to this vulnerability.

- We have upgraded our Trader Workstation (TWS) software and our TWS installers with a version of Log4j that is not susceptible to this vulnerability.

- We have updated our security infrastructure (including network firewalls, application firewalls, intrusion detection tools, etc.) with the latest protection measures that help detect and block cyber-attacks that attempt to exploit the Log4j vulnerability.

- We continue our ongoing efforts to fully identify and patch any impacted internal systems (those that are not accessible from the Internet).

- We continue monitoring the evolving industry threats and adopt additional mitigation measures as needed.

ACTION REQUIRED

We are committed to providing a secure environment for your assets and trading activities. To that end, we request that our clients give priority to the use of the LATEST TWS version, which will auto-update. Should you have the STABLE or any OFFLINE version, which does not auto-update, please ensure that you take the necessary steps to keep your TWS in line with the latest security fixes.

TWS和MacOS 12 (Monterey)的兼容問題

本文討論的是交易者工作站(TWS)在MacOS Monterey(版本12)上的性能問題,已有多位客戶碰到了該問題。TWS在MacOS 12上運行時可能出現死機或意外關閉(閃退)的問題。這可能在TWS啓動階段發生,也可能在啓動後幾分鐘甚至幾小時後發生。

故障修複的實施

修復已在TWS Beta版發布,可點擊此處下載。

該過程涉及大量測試工作,以確定哪個替代性Java平臺與交易者工作站的兼容性最高,同時避免在解决當前問題時引入新的問題。

感謝您的耐心等待!