IBSJ Multi Currency

Can I trade foreign products in supported currencies at Interactive Brokers Securities Japan (IBSJ)?

Yes, clients can trade in any currency that has a product listed in.

For example: Client with a cash account wants to buy a US stock. Our system will check if the client has sufficient available funds in USD or other supported currencies to cover 100% of the trade and, if so, the order will be sent to the exchange.

- If client has enough balance in USD, it will be used for execution of the order.

- If not, IBSJ will automatically convert an equivalent amount of USD from other supported currencies with a positive balance.

- If the same client wishes to sell his USD denominated security at a later date, IBSJ will NOT convert the proceeds back to one of the supported currencies.

- Client can use proceeds in USD for purchasing US stocks or withdraw them.

- Conversion to other currencies not connected to withdrawing funds is not allowed.

- Client can withdraw funds in supported cashiering currencies (JPY, USD, EUR, GBP). If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBSJ will automatically convert positive balances in the supported currencies to the requested one.

Please Note

- IBSJ does NOT charge a commission to clients for automatic currency conversion.

- Commissions for currency conversion used for closing a non-JPY cash balance are presented on our website.

- Supported cashiering currency is a currency in which client can make deposits and withdrawals.

Can I trade Forex and convert currencies at Interactive Brokers Securities Japan (IBSJ)?

Currency conversion at IBSJ must be connected to an investment service transaction (purchasing a stock, for instance) and its resulting cash flows. To comply with this regulation, clients can make a currency conversion in a trading platform only to close the negative balance from borrowing. In other cases, IBSJ makes a conversion automatically.

- The client CANNOT open long positions that create cash debits (loans). Nevertheless, client can open long positions in any foreign product regardless of the currency in which it is denominated. IBSJ will auto convert the value of the transaction from the positive balance in supported currencies held in the account.

- Any positive cash that is generated as the result of a trade or cash flows from a position you hold (e.g. dividends, coupon, interest) will NOT be auto-converted.

- The client can withdraw funds in JPY, EUR, USD, GBP. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBSJ will automatically convert positive balances in the supported currencies to the requested one.

- The client can use the option “Withdraw All Available Cash”, which allows to withdraw all available funds in one currency: supported currencies or base currency. IBSJ will automatically convert positive balances to the requested one without leaving residuals.

For further information please see the IBSJ Multi-Currency Account Foreign Exchange Restrictions Disclosure.

Please Note

- IBSJ does NOT charge clients commissions for automatic currency conversion.

- Commissions for currency conversion used for closing a non-JPY cash balance are presented on our website.

- Supported cashiering currency is a currency in which client can make deposits and withdrawals.

- Base currency: JPY.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

What currencies are available for deposits and withdrawals at Interactive Brokers Securities Japan (IBSJ)?

IBSJ clients can make deposits in four Supported Cashiering Currencies.

Withdrawals are allowed in base currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBSJ will automatically convert positive balances in the supported currencies to the requested one.

Client can use the option “Withdraw All Available Cash”, which allows to withdraw all available funds in one currency: supported currencies or base currency. IBSJ will automatically convert positive balances to the requested one without leaving residuals.

For further information please see the IBSJ Multi-Currency Account Foreign Exchange Restrictions Disclosure.

Please Note

- IBSJ does NOT charge clients commissions for automatic currency conversion.

- Commissions for currency conversion used for closing a non-JPY cash balance are presented on our website.

- Supported cashiering currency is a currency in which client can make deposits and withdrawals.

- Base currency: JPY.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

“EMIR”:交易報告庫報告義務和盈透證券的委託報告服務

Multi-Currency Trading at IBKR Central Europe

- If client has enough balance in USD, it will be used for execution of the order.

- If not, IBCE will automatically convert an equivalent amount of USD from other supported currencies with a positive balance.

- If the same client wishes to sell his USD denominated security at a later date, IBCE will NOT convert the proceeds back to one of the supported currencies.

- Client can use proceeds in USD for purchasing US stocks or withdraw them.

- Conversion to other currencies not connected to withdrawing funds is not allowed.

- Client can withdraw funds in Major Currencies, Home currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBCE will automatically convert positive balances in the supported currencies to the requested one.

- If client borrows EUR, he can decide what to do with the negative EUR balance. This negative balance can be closed by converting from any other supported currency or remain in the account.

- If the same client wishes to sell his EUR denominated security at a later date, IBCE will NOT convert the proceeds back to one of the supported currencies.

- Client can use proceeds in EUR for purchasing EU stocks or withdraw them.

- Conversion to other currencies not connected to withdrawing funds is not allowed.

- Client can withdraw funds in Major Currencies, Home currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBCE will automatically convert positive balances in the supported currencies to the requested one.

- IBCE does NOT charge clients for automatic currency conversion.

- Commissions for currency conversion used for closing a negative balance are presented on our website.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- Major currencies: USD and EUR.

- Home currency: Currency of client’s country of legal residence.

- If the same client wishes to sell his CAD denominated security at a later date, IBCE will auto convert the proceeds back to the base currency.

- The same process occurs when cash flows are generated from positions (e.g. dividends, interest). Conversion takes place when the cash is credited to or debited from the account, not when it is accrued.

- Client can decide what to do with the negative CAD balance. This negative balance can be closed by converting from any other supported currency or remain in the account.

- If the same client wishes to sell his CAD stock at a later date, IBCE will automatically convert the proceeds to the base currency as CAD is not a supported currency.

- IBCE does NOT charge clients for automatic currency conversion.

- Commissions for currency conversion used for closing a negative balance are presented on our website.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- For Margin accounts, the client can open long positions that create cash debits (loans) in any currency. IBCE will not auto-convert your transaction but will create an investment loan in the currency of the trade. It will be the client’s discretion when to initiate a currency conversion to close the negative balance in part or in full.

- For Cash accounts, the client CANNOT open long positions that create cash debits (loans). Nevertheless, client can open long positions in any foreign product regardless of the currency in which it is denominated. IBCE will auto convert the value of the transaction from the positive balance in supported currencies held in the account.

- For both Margin and Cash accounts, any positive cash that is generated as the result of a trade or cash flows from a position you hold (e.g. dividends, coupon, interest) will NOT be auto-converted if it is the supported currency (EUR, USD, CHF, GBP, HUF, CZK, PLN, DKK, SEK and NOK).

- For both Margin and Cash accounts, any positive cash that is generated as the result of a trade or cash flows from a position you hold (e.g. dividends, coupon, interest) will be auto-converted if it is NOT the supported currency.

- For both Margin and Cash accounts, the client can withdraw funds in Major Currencies, Home currency and positive balances held in the account. If the client wants to withdraw funds, the system checks first if there is sufficient available funds in the requested or other supported currencies to cover 100% of the withdrawal amount. If there is no sufficient funds in the requested currency, IBCE will automatically convert positive balances in the supported currencies to the requested one.

- For both Margin and Cash accounts, the client can use the option “Withdraw All Available Cash”, which allows to withdraw all available funds in one currency: Major Currencies or Home currency. IBCE will automatically convert positive balances in the supported currencies to the requested one without leaving residuals.

- IBCE does NOT charge clients for automatic currency conversion.

- Commissions for currency conversion used for closing a negative balance are presented on our website.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- Major currencies: USD and EUR.

- Home currency: Currency of client’s country of legal residence.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

- Interactive Brokers Central Europe accounts are not allowed to withdraw funds on margin due to regulatory reasons.

- The same currency pairs can be traded as Forex CFD. Contracts For Difference are complex instruments, and we invite you to carefully review the CFDs risk warnings before trading these instruments.

- IBCE does NOT charge clients for automatic currency conversion.

- Supported currency is a currency in which client can make deposits and hold a positive balance: EUR, USD, CHF, GBP, HUF, CZK, PLN, NOK, DKK and SEK.

- Major currencies: USD and EUR.

- Home currency: Currency of client’s country of legal residence.

- System shows the projected Cash Available for Withdrawal. The final withdrawal amount may differ from the requested due to fluctuation in currency exchange rates.

- Interactive Brokers Central Europe accounts are not allowed to withdraw funds on margin due to regulatory reasons.

- The changes mentioned above are effective since October 17, 2022.

有關俄羅斯盧布(RUB)的重要信息

跟許多金融機構一樣,IBKR已降低對俄羅斯盧布(RUB)的風險敞口,幷已停止俄羅斯盧布的所有資金服務,包括所有取款和貨幣兌換。

具體而言:

盧布存款:IBKR不再接受盧布存款。任何盧布存款均會被拒絕。

IBKR會根據您賬戶所屬IBKR實體定期將盧布餘額兌換成美元或歐元。

|

IBKR實體 |

目標貨幣 |

|

IBLLC |

USD |

|

IBCE |

EUR |

|

IBUK |

EUR |

|

IBIE |

EUR |

|

所有其它實體 |

USD |

盧布取款:IBKR現在無法支持盧布取款。

基礎貨幣:目前IBKR不允許客戶將盧布作爲基礎貨幣。 如果您賬戶的基礎貨幣是盧布,我們會根據您賬戶所在的IBKR實體將其更改爲美元或歐元(見上表)。

IBKR完全遵守所有適用的制裁法律。感謝您的理解與配合。

IMPORTANT NOTICE REGARDING THE RUSSIAN RUBLE (RUB)

In line with many financial institutions, IBKR has reduced exposure to the Russian Ruble, (“RUB”) and has discontinued all cashiering services for Russian Rubles, including all withdrawals and currency conversions.

Specifically:

Deposits in RUB: IBKR is no longer accepting deposits of RUB. Any deposit in RUB will be rejected.

IBKR will periodically convert RUB balances to USD or EUR, depending on the IBKR entity with which you have an account.

|

IBKR Entity |

Target Currency |

|

IBLLC |

USD |

|

IBCE |

EUR |

|

IBUK |

EUR |

|

IBIE |

EUR |

|

All Others |

USD |

Withdrawals in RUB: IBKR is not able to accommodate RUB withdrawals at this time.

Base Currency: IBKR does not currently allow clients to maintain RUB as their base currency. If you previously used RUB as your base currency, we converted it to USD or EUR depending on which IBKR entity your account is with (see chart above).

IBKR is fully committed to complying with all applicable sanctions laws. We appreciate your cooperation and your business.

如果我交易的產品是以我賬戶中沒有的幣種計價的會怎麼樣?

買賣給定的產品所需的特定幣種是交易所決定的,不是IBKR決定的。例如,當您下單買入某種以您的賬戶中沒有的幣種計價的證券,假設您使用的是保證金賬戶且在滿足了保證金要求後有多餘的資產,則IBKR會借入該幣種的資金。請注意,IBKR有義務以指定的計價幣種和清算所結算該交易。如您不希望我們借入資金進而產生利息成本,則您需先向您的賬戶存入所需的幣種及金額的資金,或通過IdealPro或各種零數(odd lot)交易場所將賬戶中的資金兌換為所需的幣種及金額——對於超過25,000美元或等值的金額,通過IdealPro兌換;對於小於25,000美元或等值的金額,通過零數交易場所兌換,這兩種渠道都可在TWS中找到。

需注意的還有,當您平倉了以特定幣種計價的證券,所獲資金將始終以該幣種保留在您的賬戶中,不論該幣種是否是您為賬戶選擇的基礎貨幣。相應地,這部分資金相對於您的基礎貨幣將存在匯率風險,直至您完成換匯或用這些資金交易其它以該幣種計價的產品。

關於使用止損單的更多信息

美股市場偶爾會發生極端波動和價格混亂。 有時這類情況持續時間很長,有時又很短。止損單可能會對價格施加下行壓力、加劇市場波動,且可能使委託單在大幅偏離觸發價格的位置上成交。.

每日活動報表中的現金外匯轉換盈虧表示什麽?如何計算?

為了對賬戶資產進行全面概覽、生成報表,賬戶中所有以非基礎貨幣計價的多頭或空頭現金餘額都將按現行匯率進行轉換。由於匯率隨時會變,這一轉換過程就可能導致現金外匯轉換餘額呈正(即盈利)或呈負(即虧損)。請注意,這些盈虧只是市場計算的一種標記(即假設所有非基礎貨餘額都以日末匯率平倉),實際的盈虧(如有)直到非基礎貨幣餘額平倉之後才能確定。

要計算非基礎貨幣的現金外匯轉換盈虧,首先要計算當前的基礎貨幣匯率和前一個每日報表週期基礎貨幣匯率之間的差額(匯率C – 匯率P,匯率可,參見每份報表的基礎貨幣匯率部分)。然後用這個差額(或正或負)乘以當前報表週期的期初現金餘額,所得結果就是現金外匯轉換盈利(如果是正數)或虧損(如果是負數)。由於所有其它非基礎貨幣項目(如淨賣出和買入、傭金、利息等)均在日末記帳,其本質上就沒有轉換盈虧。

IBKR Metals CFDs – Facts and Q&A

The following article is intended to provide a general introduction to London Gold and Silver Contracts for Differences (CFDs) issued by IBKR.

Please follow these links for information on IBKR Share CFDs, Index CFDs and Forex CFDs.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the

high risk of losing your money.

ESMA Rules for CFDs (Retail Clients only)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August

2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per

account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

Introduction

A London Gold CFD enables you to have exposure to price movements of physical Gold without actually owning it. A London Gold CFD is an agreement between you and IBKR to exchange the difference in price of the underlying over a period of time. The difference to be exchanged is determined by the change in the reference price of the underlying. Thus, if the price of physical Gold traded on the London bullion market rises and you are long the CFD, you receive cash from IBKR and vice versa. A London Gold CFD can be bought long or sold short to suit your view of market direction in the future.

Contract Specifications

| Contract | IBKR Symbol | Per Trade Fee | Minimum per Order | Multiplier |

| London Gold | XAUUSD | 0.015% | USD 2.00 | 1 |

| London Silver | XAGUSD | 0.03% | USD 2.00 | 1 |

Price Determination

The IBKR London Gold and Silver CFDs reference physical Gold and Silver traded on the London bullion market. The London bullion market is a wholesale over-the-counter market for the trading of precious metals. Trading is conducted among members of the London Bullion Market Association (LBMA). Most of the members are major international banks.

IBKR receives quote streams from approximately 10 such major banks, in much the same way it does for cash forex. IBKR Smart routes between the banks, and the best available price at any given time becomes the reference price for the CFDs. IBKR does not add a spread to the banks’ quotes.

Low Commissions and Financing Rates: Unlike other CFD providers IBKR charges a transparent

commission, rather than widening the spread. Commission rates are only 0.015% for London Gold and 0.03% for London Silver. Overnight financing rates are just benchmark +/- 1.5% (an additional 1% surcharge is added for retail accounts).

Transparent Quotes: Because IBKR does not widen the spread, the Metals CFD quotes accurately

represent the spreads and price movements of the related cash metal, as described above.

Margin Efficiency: IBKR establishes house-margin requirements based on historic volatility of the

underlying and other factors. Retail clients are subject to regulatory minimum initial margins of 5% for

London Gold or 10% for London Silver.

Trading Permissions: Same as for Share and Index CFDs.

Market Data Permissions: Metals CFD market data is free, but a permission is required for system

reasons.

Worked Trade Example (Professional Clients):

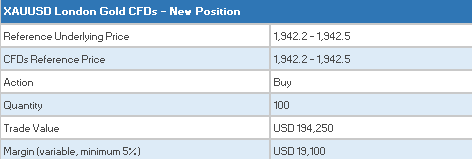

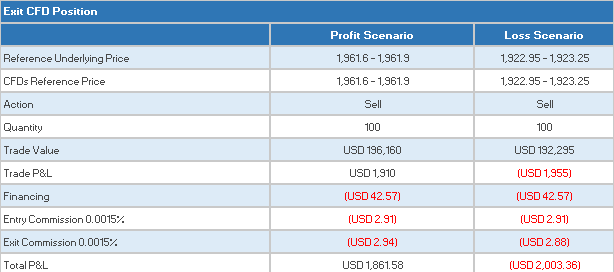

You purchase 100 XAUUSD CFDs at $1,942.5 for USD 194,250 which you then hold for 5 days.

![]()

Closing the Position

CFD Resources

Below are some useful links with more detailed information on IB’s CFD offering:

Frequently asked Questions

Are short Metals CFDs subject to forced buy-in?

No.

Can I take delivery of the underlying metal?

No, IBKR does not support physical delivery for Metals CFDs.

Are there any market data requirements?

The market data for Metal CFDs is free, and is included the market data for Index CFDs. However, you need to subscribe to the permission for system reasons. To do this, log into Account Management, and click through the following tabs: Settings/User Settings/Trading Platform/Market Data Subscriptions. Alternatively you can set up an Index or Metals CFD in your TWS quote monitor and click the “Market Data Subscription Manager” button that appears on the quote line.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Account Management.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

In what type of IB accounts can I trade CFDs e.g., Individual, Friends and Family,

Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening

orders.

Can anyone trade IB CFDs?

All clients can trade IB CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and

Israel. There are no exemptions based on investor type to the residency-based exclusions.

外匯(FX)入門

IB提供的交易場所和交易平臺既適用於專注外匯交易的交易者也適用於因多幣種股票和/或衍生品交易需要偶爾進行外匯交易的交易者。下方文章概述了在TWS平臺上下達外匯定單的基本要點以及報價管理和頭寸報告相關信息。

外匯(FX)交易涉及同時買入一種貨幣並賣出另一種貨幣,兩種貨幣組合在一起通常被稱為交叉貨幣對。在下方例子中,EUR.USD交叉貨幣對中的前一種貨幣(EUR)為交易者想買入或賣出的交易貨幣,後一種貨幣(USD)則為結算貨幣。

跳轉至指定主題;

外匯報價

貨幣對即外匯市場上一種貨幣單位相對於另一種貨幣單位的相對價值的報價。用以作為參考的貨幣被稱為報價貨幣,而參考該貨幣給出報價的貨幣則被稱為基礎貨幣。在TWS中,每個貨幣對有一個交易代碼。您可以使用外匯交易者(FXTrader)調換報價方向。交易者買入或賣出基礎貨幣的同時在賣出或買入報價貨幣。例如,EUR/USD貨幣對的代碼為:

EUR.USD

其中:

- EUR為基礎貨幣

- USD為報價貨幣

上方貨幣對的價格表示需要多少單位的USD(報價貨幣)能交易一個單位的EUR(基礎貨幣)。也就是說,1 EUR是在按USD報價。

EUR.USD的買單表示買入EUR並賣出同等金額的USD,具體取決於交易價格。

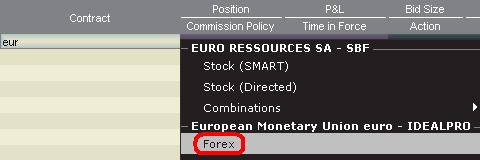

創建報價行

在TWS添加外匯報價行具體步驟如下:

1. 輸入交易貨幣(如EUR),然後按回車鍵(enter)。

2. 選擇產品類型——外匯

3. 選擇結算貨幣(如USD),然後選擇外匯交易場所。

.jpg)

注:

IDEALFX對於超過其最低數量要求(通常為25,000美元)的定單可直接接入銀行間外匯報價。傳遞到IDEALFX但未達到其最低數量要求的定單基本會被自動傳遞到小額定單交易場所進行外匯轉換。點擊此處瞭解IDEALFX的最低數量要求和最高數量限制相關信息。

外匯交易商會按特定方向對外匯貨幣對進行報價。因此,交易者需通過調整輸入的貨幣代碼來查找想要的貨幣對。例如,如果輸入貨幣代碼CAD,交易者會發現合約選擇窗口中沒有結算貨幣USD。這是因為,該貨幣對是按USD.CAD報價的,只能先輸入底層代碼USD,然後再選擇貨幣對。

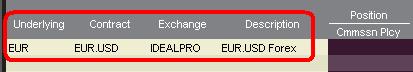

下單

具體取決於顯示的欄標頭,貨幣對將顯示如下:

合約(Contract)和描述(Description)欄將按交易貨幣.結算貨幣的形式顯示貨幣對(如EUR.USD)。底層代碼(Underlying)欄則只顯示交易貨幣。

點擊此處瞭解如何更改更改顯示的數據欄標頭。

1. 要輸入定單,左鍵點擊買價(下賣單)或賣價(下買單).

2. 指定想要買入或賣出的交易貨幣的數量。定單的數量按基礎貨幣(即貨幣對中的前一種貨幣)顯示。

盈透證券在外匯交易上沒有代表固定金額基礎貨幣的合約的概念,您的交易尺寸便是所需交易的基礎貨幣金額。

例如,100,000單位EUR.USD的買單會買入100,000單位EUR,並根據顯示的匯率賣出等值USD。

3. 指定想使用的定單類型、匯率(價格),然後傳遞定單。

注:下達的定單必須是完整的貨幣單位,除上述交易場所最低數量要求外,沒有最低合約或手數要求。

點值

點(pip)是貨幣對變化的衡量單位,對於大多數貨幣對來說其代表最小變化,但有時也允許存在非整點的變化。

例如,在EUR.USD中,1個點是0.0001,而在USD.JPY中,1個點事0.01。

要計算報價貨幣1個點的點值,可採用以下公式:

(名義金額) x (1個點)

例如:

- 代碼 = EUR.USD

- 金額 = 100,000 EUR

- 1個點 = 0.0001

1個點點值 = 100’000 x 0.0001= 10 USD

- 代碼 = USD.JPY

- 金額 = 100’000 USD

- 1個點 = 0.01

1個點點值 = 100’000 x (0.01)= JPY 1000

要計算基礎貨幣1個點的點值,可採用以下公式:

(名義金額) x (1個點/匯率)

例如:

- 代碼 = EUR.USD

- 金額 = 100’000 EUR

- 1個點 = 0.0001

- 匯率 = 1.3884

1個點點值 = 100’000 x (0.0001/1.3884)= 7.20 EUR

- 代碼 = USD.JPY

- 金額 = 100’000 USD

- 1個點 = 0.01

- 匯率 = 101.63

1個點點值 = 100’000 x (0.01/101.63)= 9.84 USD

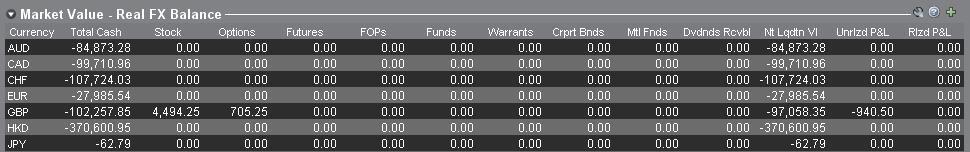

頭寸(交易後)報告

外匯頭寸信息是在IB進行交易的一個重要方面,在真實賬戶中開始交易之前需對其進行充分瞭解。IB的交易軟件在兩個不同的地方反映了外匯頭寸,二者均可在賬戶窗口查看。

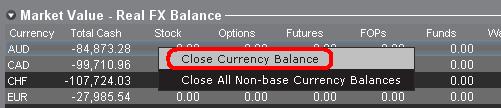

1. 市場價值

賬戶窗口的市場價值部分反映的是實時貨幣頭寸,按貨幣(而非貨幣對)顯示。

賬戶窗口的市場價值部分是唯一一個可供交易者查看實時外匯頭寸信息的地方。持有多種貨幣頭寸的交易者不一定要使用開倉時用的貨幣對來平倉。例如,買了EUR.USD(買EUR賣USD)還買了USD.JPY(買USD賣JPY)的交易者也可以通過交易EUR.JPY(賣EUR買JPY)來平倉頭寸。

注:

市場價值部分可展開/收起。交易者應點擊淨清算價值欄上方的符號確保顯示出綠色“減號”。如果是綠色“加號“,某些頭寸可能被隱藏。

交易者可以從市場價值部分發起平倉交易:右鍵點擊想要平倉的貨幣,選擇”平倉貨幣餘額“或”平倉所有非基礎貨幣餘額“。

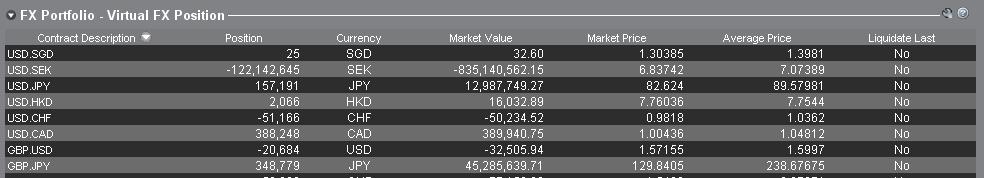

2. 外匯投資組合

賬戶窗口的外匯投資組合部分展示的是虛擬頭寸,以貨幣對的形式顯示頭寸信息,這與市場價值部分按貨幣顯示不同。這種特定的顯示形式是為了考慮機構外匯交易者的常用慣例,零售或非頻繁外匯交易者基本上可以無視該部分信息。外匯投資組合的頭寸數量並不反映所有外匯活動,但是,交易者可以對此部分顯示的頭寸數量和平均成本進行修改。這一無需執行交易便可隨意調整頭寸和平均成本信息的功能對於除交易非基礎貨幣產品外還參與其它貨幣交易的交易者可能會有幫助。其可讓交易者手動將自動貨幣轉換(交易非基礎貨幣產品時會自動發生)與單純的外匯交易活動分隔開來。

外匯投資組合部分的外匯頭寸和盈虧信息均來自所有其它交易窗口顯示的信息。這在確定真實的實時頭寸信息時可能會造成一定困惑。為減少或消除此類困惑,交易者可以選擇以下操作:

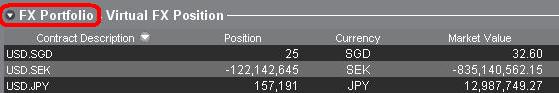

a. 收起外匯投資組合部分

點擊外匯投資組合(FX Portfolio)文字左邊的箭頭可收起外匯投資組合部分。收起該部分後,虛擬頭寸信息便不再在各交易頁面顯示。(注:這並不會讓市場價值信息顯示出來,其只會阻止外匯投資組合信息顯示。)

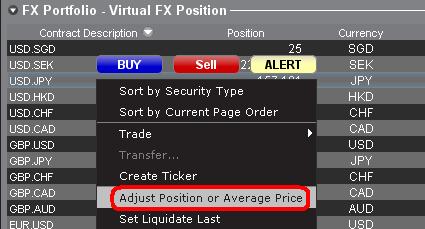

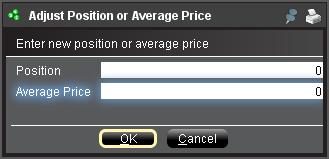

b. 調整頭寸或平均價格

右鍵點擊賬戶窗口的外匯投資組合部分,交易者可以選擇調整頭寸或平均價格。交易者平倉掉所有非基礎貨幣頭寸並確定市場價值部分反映了被平倉的所有非基礎貨幣頭寸後,便可將頭寸和平均價格區域重置為0。此操作會重置外匯投資組合部分的頭寸數量,可讓交易者在交易界面看到更加準確的頭寸和盈虧信息。(注:這是手動操作,每次貨幣頭寸平倉後都需進行一次)。交易者應隨時對市場價值部分的頭寸信息進行確認,確保傳遞的定單達到開倉或平倉頭寸想要的結果)

我們鼓勵交易者在真實賬戶中開始交易前,先在模擬交易或演示賬戶中熟悉一下外匯交易。如關於以上信息仍有任何疑問,請聯繫IB。

其它常見問題: