20-Minute Reconnect Grace Period, Unless Fingerprint/PIN Device Lock is Enabled

We recently introduced 30-hour Extended Trading access for mobile users (see the Android or iOS release notes).

IB TWS for Mobile - Extended Trading Access

Get extended trading access in IB TWS for Mobile when you enabled fingerprint security on your device.

Once logged in to TWS for Mobile, all users have a 20-minute grace period during which they can take a call or use another app and still retain full access to their trading session without having to perform a full login (username/password + second factor authentication). After this grace period, users who have fingerprint security enabled on their device will enjoy secure trading for up to 30 hours without having to complete the full login.

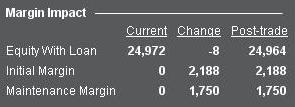

How to adjust font size in TWS

By default, Trader Workstation (TWS) is designed to display in a font size and style which can be read comfortably for the average user across various screen sizes and resolutions. With the advent of new technologies, there has been an exponential push to make monitors with higher display sizes and your layout may need to be further adjusted manually. This document serves to explain how to manually adjust the font size for TWS.

Procedure

To adjust font size throughout TWS:

- From the Anchor window, click the Font Size Adjustment icon.

- Check the button Adjust window & column widths to ensure all windows will resize automatically to keep the same font:window ratio. (If unchecked, only font size will change but window size will remain the same).

- Click the button Smaller or Larger until the font size is correct.

Notice that the font size will change immediately as you click the button. - Click the Font Size Adjustment icon

when done.

when done.

Note: It is possible that currently not all windows will be adjusted in the same way.

預覽定單/檢查保證金

預覽定單/檢查保證金功能可供您在定單傳遞前了解其預計成本、佣金和保證金影響。. 該功能在TWS和WebTrader上均可使用,TWS版本顯示的信息更為詳盡。

交易者工作站(TWS)

TWS檢查保證金功能可將建議定單的保證金影響與現有頭寸隔離開來,並在假設定單執行的基礎上顯示新的保證金要求。包括初始和維持保證金要求在內的關鍵保證金餘額報告為含貸款價值資產。要使用該功能,請將鼠標停留在定單行,右鍵點擊並從下拉菜單中選擇檢查保證金。

舉例:以1387.25的價格買入1手2012年6月的ES期貨

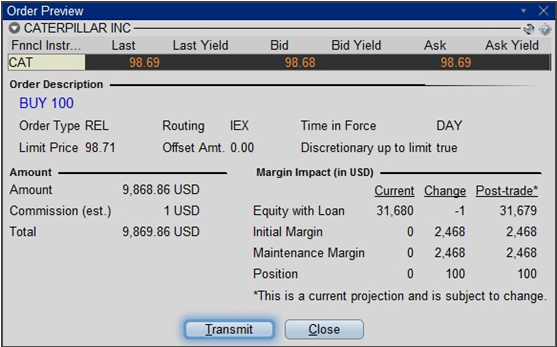

定單預覽的第一部分顯示該證券的買價、賣價和最後交易價。

第二部分顯示基本定單詳情。

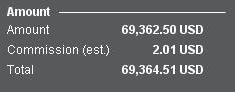

金額部分顯示定單的價值以及適用的估算佣金。

保證金影響部分顯示下方信息的明細:

當前 = 當前賬戶價值,不包含正在傳遞的定單。

變化 = 正在傳遞之定單的影響,忽略賬戶的所有頭寸。

交易後 = 正在傳遞之定單執行併計入賬戶投資組合後的預期賬戶價值。

網絡交易者(WebTrader)

WebTrader定單預覽顯示僅顯示TWS交易後價值的對應值。

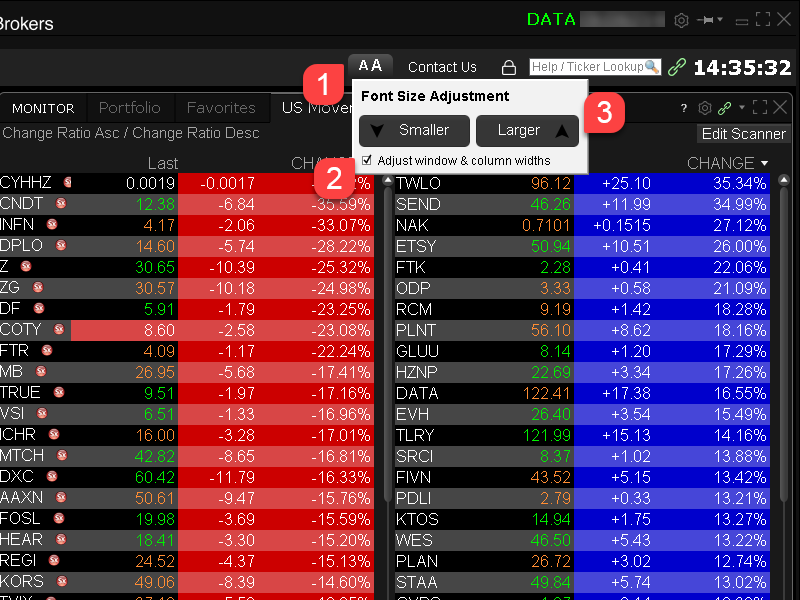

IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

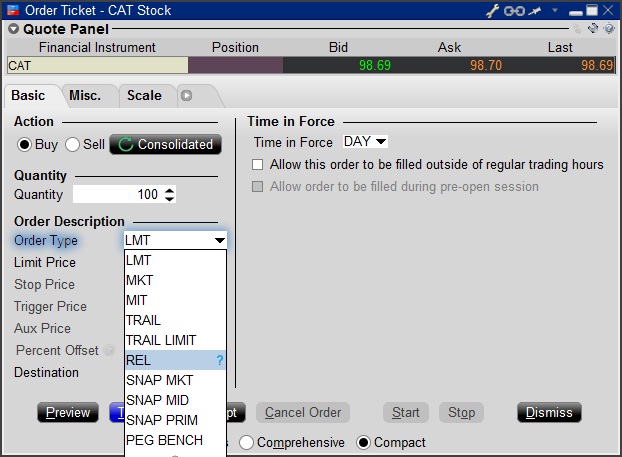

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

Step 1

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

Step 2

Select the REL order type from the Order Type drop down menu.

Step 3

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

IBot Quick Guide

Availability

- Quotes: “quote Interactive Brokers”, “show the price of Interactive Brokers”

- IBot can also display fundamental information

- Options: In cases where there is more than one option contract on the same exchange with the same expiry, strike and right, IBot will choose a contract as follows:

- Choose smart over non-smart

- Choose non-weekly contracts

- Choose the contract with a standard multiplier

- Partial Instrument Match: In cases where you leave out a parameter, IBot will try to identify the option contract with an educated guess based on the following logic:

- If the underlying is missing, assume the last used underlying if one is available

- If the type is missing, use a CALL.

- If the expiration is missing, use the nearest month.

- If the strike is missing, use the at-the-money strike.

- Charts: “10 day 1 hour bar chart for Interactive Brokers”, “chart Interactive Brokers”

- If you omit bar sizes or time ranges, IBot will display the most reasonable chart based on what you entered

- Orders: “buy 100 shares of Interactive Brokers at market”, “sell 100 shares of IBKR at 40”, “close my Interactive Brokers position”, “close 10% of my long positions”

- You MUST click the Submit button located within IBot to place the order

- Trades: “show trades in Interactive Brokers”

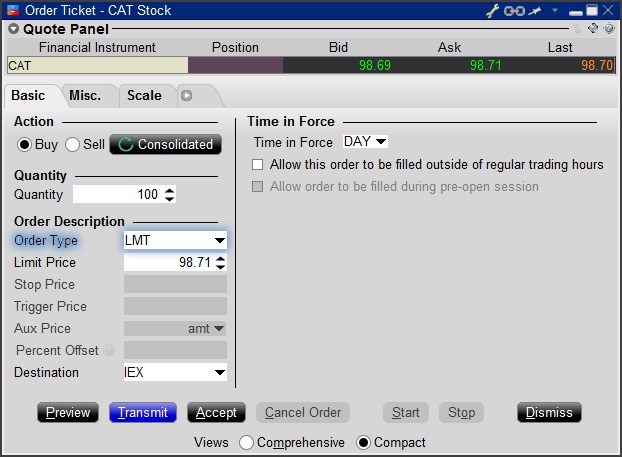

- Market Scanners: “top gaining US stocks", "biggest US market winners"

- Market Depth Level II Data: “market depth for Interactive Brokers”, “level 2 for IBKR”

- Option Chains: “option chains for Interactive Brokers”, “jan options for IBKR”

- Calendar: "show portfolio events", "upcoming events for portfolio companies"

- Your Account: “show my P&L”, “show my buying power”, “what is my net liquidation value”

- Modify a Command: after creating an order, “change this order to market”

- Help: get help with IBot by typing help before a type of command, “help with orders”, “help with chart”

- Company Fundamentals: “show summary for Interactive Brokers”, “Return on Equity for IBKR”

- Customer Service Information: “customer support”, “support”

- Will include a link to the Contact Client Services page of our website

- IBKR web site information: Use the terms Search: or Search for to return reference information from the IBKR web site. IBot will return the top matches with links to the relevant web page.

Snapshot Market Data

BACKGROUND

IBKR offers eligible clients the option of receiving a real-time price quote for a single instrument on a request basis. This service, referred to as “Snapshot Quotes” differs from the traditional quote services which offer continuous streaming and updates of real-time prices. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and require data from specific exchanges1 when submitting an order. Additional details regarding this quote service is provided below.

QUOTE COMPONENTS

The Snapshot quote includes the following data:

- Last price

- Last size

- Last exchange

- Current bid-ask

- Size for each of current bid-ask

- Exchange for each of current bid-ask

AVAILABLE SERVICES

| Service | Restrictions | Price per Quote Request (USD)2 |

|---|---|---|

| AMEX (Network B/CTA) | $0.01 | |

| ASX Total | No access to ASX24. Limited to Non-Professional subscribers |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| Canadian Exchange Group (TSX/TSXV) | Limited to Non-Professional subscribers who are not clients of IB Canada | $0.03 |

| CBOT Real-Time | $0.03 | |

| CME Real-Time | $0.03 | |

| COMEX Real-Time | $0.03 | |

| Eurex Core | Limited to Non-Professional subscribers | $0.03 |

| Euronext Basic | Limited to Non-Professional subscribers Includes Euronext equities, indices, equity derivatives and index derivatives. |

$0.03 |

| German ETF's and Indices | Limited to Non-Professional subscribers | $0.03 |

| Hong Kong (HKFE) Derivatives | $0.03 | |

| Hong Kong Securities Exchange (Stocks, Warrants, Bonds) | $0.03 | |

| Johannesburg Stock Exchange | $0.03 | |

| Montreal Derivatives | Limited to Non-Professional subscribers | $0.03 |

| NASDAQ (Network C/UTP) | $0.01 | |

| Nordic Derivatives | $0.03 | |

| Nordic Equity | $0.03 | |

| NYMEX Real-Time | $0.03 | |

| NYSE (Network A/CTA) | $0.01 | |

| OPRA (US Options Exchanges) | $0.03 | |

| Shanghai Stock Exchange 5 Second Snapshot (via HKEx) | $0.03 | |

| Shenzhen Stock Exchange 3 Second Snapshot (via HKEx) | $0.03 | |

| SIX Swiss Exchange | Limited to Non-Professional subscribers | $0.03 |

| Spot Market Germany (Frankfurt/Xetra) | Limited to Non-Professional subscribers | $0.03 |

| STOXX Index Real-Time Data | Limited to Non-Professional subscribers | $0.03 |

| Toronto Stk Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| TSX Venture Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| UK LSE (IOB) Equities | $0.03 | |

| UK LSE Equities | $0.03 |

1In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients. All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, IB does not show this quote when entering parameters for an order in a US stock quote. IB customers are able to access a snapshot of real-time quote information for US stocks at the point of order entry.

2Cost is per snapshot quote request and will be assessed in the Base Currency equivalent, if not USD.

ELIGIBILITY

- Accounts must maintain the Market Data Subscription Minimum and Maintenance Equity Balance Requirements in order to qualify for Snapshot quotes.

- The Users must operate TWS Build 976.0 or higher to access Snapshot quote functionality.

PRICING DETAILS

- Clients will receive $1.00 of snapshot quotes free of charge each month. Free snaphots may be applied to either U.S. or non-U.S. quote requests and charges will be applied, without additional notice, once the free allocation has been exhausted. Clients may review their snapshot usage as of the close of each business day via the Client Portal.

- Quote fees are assessed on a lag basis, generally in the first week after the month in which Snapshot services were provided. Accounts which do not have sufficient cash or Equity With Loan Value to cover the monthly fee will be subject to position liquidations.

- The monthly fee for snapshots will be capped at the related streaming real-time monthly service price. At which time the streaming quotes will be provided at no additional cost for the remainder of the month. The switch to streaming quotes will take place at approximately 18:30 EST the following business day after reaching the snapshot threshold. At the close of the month, the streaming service will automatically terminate and the snapshot counter will reset. Each service is capped independently of the others and quote requests for one service cannot be counted towards the cap of another. See table below for sample details.

| Service | Price per Quote Request (USD) | Non-Pro Subscriber Cap (Requests/Total Cost)2 | Pro Subscriber Cap (Requests/Total Cost)3 |

|---|---|---|---|

| AMEX (Network B/CTA) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ (Network C/UTP) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE (Network A/CTA) | $0.01 | 150/$1.50 | 4,500/$45.00 |

IBKR主機與端口文檔

如果使用SSL,TWS會通過4000和4001端口連接IBKR的服務器。如果您使用的是代理服務器,則其需同時開放入站端口和出站端口,使其成爲透明代理,這樣TWS才能正常運行。

下方表格列出了在您使用我方服務的過程中TWS可能會用到的所有網關及對應的目的主機,請允許訪問該等主機。

要測試您的連接是否需要特殊設置或者是否已配置妥當,最簡便的方法便是使用 IBKR的專用測試頁面,其可針對您的網絡與我方主交易與數據服務器的連接提供動態測試。如果返回的響應結果爲“成功”,則您無需再進行進一步操作。如果響應結果爲“失敗”,我們建議您在網絡配置中爲新主機添加例外或檢查您的更改。

注:如果您的網絡使用的是瀏覽器代理,測試頁面可能會産生錯誤正值。這種情况下,或者如果您不確定自己的網絡設置情况,您可求助于您的網絡管理員,網絡管理員可對下表所列主機進行ping和telnet測試以確認符合連接要求。

說明:

|

客戶端及網站 |

||||

|

地區/産品 |

服務器(主機) |

端口1 |

||

|

IBKR網站 – 美國 |

443 |

|||

|

IBKR網站 – 加拿大 |

443 |

|||

|

IBKR網站– 英國 |

443 |

|||

|

IBKR網站 – 印度2 |

443 |

|||

|

IBKR網站 – 日本2 |

443 |

|||

|

IBKR網站– 香港2 |

www.interactivebrokers.com.hk | 443 | ||

|

IBKR網站 – 中國2 |

www.ibkr.com.cn | 443 | ||

|

IBKR網站 - 澳大利亞 |

www.interactivebrokers.com.au | 443 | ||

|

客戶端 – 東部 |

443 |

|||

|

客戶端 – 中部 |

443 |

|||

1: 標準通信: TCP端口80| SSL通信: TCP端口443。

2: 本IB服務器主機不支持ping請求。

重要提示:如您通過企業網絡訪問客戶端,且企業網絡是通過負載平衡設備提供互聯網連接的,則您在登錄時或登錄後可能會收到會話已過期/無效及/或網頁內容丟失等錯誤信息。負載平衡器會將您的連出請求循環連至兩個或以上網絡界面以平衡網絡負載。由于該機制,您的HTTP請求會通過不同的IP地址達到我們的系統,從而使您的客戶端會話無效。在這種情况下,請聯繫您的網絡管理員或IT部門配置您的設備以繞過負載平衡器。這樣您的會話將繼續有效。

|

桌面端TWS |

|||

|

地區/工具 |

主要/備用 |

服務器(主機) |

端口 |

|

|

主要 |

|

|

|

備用 |

|||

|

|

主要 |

|

|

|

備用 |

|||

|

|

主要 |

|

|

|

備用 |

|||

|

TWS亞洲 |

主要 |

4000 / 4001 |

|

|

備用 |

|||

|

TWS亞洲 - 中國3 |

主要 |

4000 / 4001 |

|

|

備用 |

mcgw1_hb1.ibllc.com.cn | ||

| TWS自動更新 | 主要 | 443 | |

|

風險漫游 |

主要 |

443 |

|

|

TWS雲設置 |

主要 |

443 |

|

|

IB CAM |

主要 |

4000 / 4001 |

|

|

診斷報告 |

主要 |

443 |

|

3:網關面向賬戶被分配至香的服務器、但實際從中國大陸訪問的客戶。

IBKR Host and Ports Documentation

TWS connects to IBKR servers via port 4000 and 4001, if using SSL, and will not operate on any other port. If you are using a proxy server, it needs to be a transparent with both inbound and outbound ports open so that the TWS can function properly.

Below are listed all the gateways, along with the corresponding destination host that might be used by the TWS when you use our services, please allow access to those hosts.

The easiest way to test whether your connection needs any special setup or has been configured properly is to use IBKR's Dedicated Test page, which will provide a dynamic test of your network’s connection against our main trading and market data servers. If a “Success” response is returned, there is nothing more for you to do. If the response is “Failure”, we recommend adding an exception for the new hosts to your network’s configuration or review your changes.

Note: If your network uses a browser proxy, the test page can produce false positives. In this case, or if you are not sure what your network setup is, turn to your network administrators, who can perform ping and telnet tests to the hosts listed below to confirm compliance with the connectivity requirements.

Specs:

|

CLIENT PORTAL AND WEBSITE |

||||

|

REGION/PRODUCT |

SERVER (HOST) |

PORTS1 |

||

|

IBKR WEBSITE – AMERICA |

443 |

|||

|

IBKR WEBSITE – Canada |

443 |

|||

|

IBKR WEBSITE – UK |

443 |

|||

|

IBKR WEBSITE – INDIA2 |

443 |

|||

|

IBKR WEBSITE – JAPAN2 |

443 |

|||

|

IBKR WEBSITE – HONG KONG2 |

www.interactivebrokers.com.hk | 443 | ||

|

IBKR WEBSITE – CHINA2 |

www.ibkr.com.cn | 443 | ||

|

IBKR WEBSITE - AUSTRALIA |

www.interactivebrokers.com.au | 443 | ||

|

CLIENT PORTAL – EAST |

443 |

|||

|

CLIENT PORTAL – CENTRAL |

443 |

|||

1: Standard Communication: TCP Port 80 | SSL Communication: TCP Port 443.

2: This IB Server host does not support ping request.

Important Note: If you are accessing Client Portal from a corporate network where the Internet access is provided through a load balancing equipment, you may receive error messages about expired/invalid session and/or missing web content upon or after the login phase. The load-balancer cycles your outbound connections over two or more network interfaces to equalize the network workload. Because of this mechanism, your HTTP requests reach our systems from different IP addresses, invalidating your Client Portal session. In this scenario, as a solution, please ask your network administrator or IT group to configure your machine/device for bypassing the load-balancer. This will allow your session to remain valid and alive.

|

DESKTOP TWS |

|||

|

REGION/TOOL |

PRIMARY/BACKUP |

SERVER (HOST) |

PORTS |

|

|

PRIMARY |

|

|

|

BACKUP |

|||

|

|

PRIMARY |

|

|

|

BACKUP |

|||

|

|

PRIMARY |

|

|

|

BACKUP |

|||

|

TWS ASIA |

PRIMARY |

4000 / 4001 |

|

|

BACKUP |

|||

|

TWS ASIA - CHINA3 |

PRIMARY |

4000 / 4001 |

|

|

BACKUP |

mcgw1_hb1.ibllc.com.cn | ||

| TWS AUTO-UPDATE | PRIMARY | 443 | |

|

RISK NAVIGATOR |

PRIMARY |

443 |

|

|

TWS CLOUD SETTINGS |

PRIMARY |

443 |

|

|

IB CAM |

PRIMARY |

4000 / 4001 |

|

|

DIAGNOSTICS REPORTS |

PRIMARY |

443 |

|

3: Gateway dedicated to clients with accounts assigned to the Hong Kong server, but are physically connecting from Mainland China.

How to check and solve connectivity issues affecting the Trader Workstation (TWS)

The Trader Workstation (TWS) software needs to connect to our gateways and market data servers in order to work properly. Connectivity issues affecting your local network or your Internet Service Provider network may negatively affect the TWS functionality. In this article we will indicate how to test your connectivity using an automated connectivity test web page.

How to test the connectivity using the automated "IB Connectivity Test" web page?

2) Please wait until all the tests have been completed and results have been displayed. If you see "Success" as outcome for all tests, your connectivity to IB Servers is reliable at the present moment. No additional connectivity troubleshooting or configuration should be needed.

3) If you see "Fail" as outcome for one or more test/s, please click on the link "Fail" itself in order to display the "IB Network Troubleshooting Guide". That section will help you conduct some manual tests to identify the cause of the failure.

Note for Corporative environments and Proxy server users: the automated "Connectivity Test" page may return misleading results in case your machine is accessing the Internet through a Proxy server. This usually happens if you are connected to a company network. If this is your case, we kindly ask you to contact your Network Administrator or your IT Team and ask them to perform a manual connectivity tests towards the destination servers indicated in the table on the top of the IB automated "Connectivity Test" web page itself. The manual connectivity test should be conducted using destination TCP ports 4000 and 4001. Should they prefer to have the server list in another format or should they need to set up the firewall / IP Management rules, you can forward them this page.