Information Regarding Australian Regulatory Status Under IBKR Australia

Introduction

Australian resident customers maintaining an account with Interactive Brokers Australia Pty Ltd (IBKR

Australia), which holds an Australian Financial Services License, number 453554, are initially

classified as a retail investor, unless they satisfy one or more of the requirements to be classified as a

wholesale or professional investor according to the relevant provisions of the Corporations Act 2001.

This article outlines how this process is handled by IBKR Australia.

Australian Regulatory Status

All new customers of IBKR Australia default to being classified as a retail investor unless they produce to

IBKR Australia the required documentary evidence to allow IBKR Australia to treat them as a wholesale or

professional investor. Investors of IBKR Australia will only have their regulatory status change from

retail investor to either wholesale or professional investor subsequent to the required

documentation being received and approved by IBKR Australia.

What is a Wholesale Investor?

The most common way to be classified as a wholesale investor is to obtain a qualified accountant’s

certificate stating that you have net assets or net worth of at least $2.5 million AUD OR have a gross

annual income of at least $250,000 AUD in each of the last two financial years. The qualified

accountant’s certificate is only valid for two years before it needs to be renewed. We have prepared a

wholesale investor booklet, including a pro forma certificate for your accountant to complete, that

can be downloaded [here].

What is a Professional Investor?

In order to qualify as a professional investor, you must have an AFSL, be a body regulated by APRA, be a superannuation fund (but not a SMSF) and/or have net worth or liquid net worth of at least $10 million AUD. If you meet ONLY the financial criteria (i.e. net worth or liquid net worth of at least $10 million AUD), you will need to complete and submit to IBKR Australia the professional investor declaration contained within the professional investor booklet that we have prepared, which can be downloaded [here]. However, if you meet the criteria by virtue of having an AFSL, being a body regulated by APRA, or as a listed company (but not a SMSF), no booklet needs to be submitted.

What about Self-Managed Super Funds (SMSF’s)?

IBKR Australia have decided to treat all SMSF’s as retail investors, notwithstanding that they may meet the requirements to otherwise be classified as a wholesale or professional investor.

What about trusts?

For a trust to be considered as a wholesale investor, all trustees must be considered a wholesale

investor based on the tests described above.

Similarly, for a trust to be considered as a professional investor, all trustees must be considered a

professional investor based on the tests described above.

As a result, if at least one trustee is considered retail, the trust is considered a retail trust, regardless

of the status of any other trustees (if applicable).

Other

- For a full list of the disclosure documents and legal terms which govern the services IBKR Australia will make available please refer to the IBKR website.

- For further information on IBKR Australia, click on our Financial Services Guide.

- For more information or assistance, please contact IBKR Investor Services.

法律實體識別號碼概述

背景

法律實體識別號碼(LEI)是一個20位的參考代碼,該代碼能夠標識參與全球各市場或司法轄域的金融交易的獨立法律實體。LEI體系是G20集團根據ISO標准 發展而來的,由LEI的簽發機搆——當地運營單位(LOU)提供注冊和延期服務。為參與金融交易的每一家法律實體提供獨特的識別號碼(以及與實體相關的關鍵參考信息)的目的是提高市場透明度。

DTC和SWIFT充當美國的LEI簽發方,且有專門的網站負責分配新的LEI和提供已有LEI的搜索服務。詳情請見:http://www.gmeiutility.org/

需使用LEI的情況

在某些情況下,法律法規會要求經紀商報告有關客戶的信息,這其中就包括客戶識別信息。對於諸如信托和機搆等實體,該識別信息即為LEI。需報告LEI的 情況包括:

CFTC所有權及控制權報告

MIFIR交易報告

中國股票互聯互通

EMIR交易信息庫報告

獲取LEI

法律實體可聯系經授權的LEI簽發機搆(也稱為當地運營單位/LOU)獲取LEI。DTC和SWIFT充當美國的LEI簽發方,且有專門的網站負責LEI注冊和延期。請注意,LEI申請人可使用任何被認可的LOU的服務,不限於其所在國家的LEI簽發機搆。

此外,作為向客戶提供的一項服務,IBKR會通過賬戶管理向需要LEI用於交易或滿足其它監管報告職能的實體發送邀請。通過該邀請,客戶可授權IBKR通過DTC的加速通道(需3個工作日)請求LEI,之后再從客戶的賬戶中扣取申請費用和年度延期費用。

針對大麻類證券的清算所限制

斯圖加特交易所(Boerse Stuttgart)和明訊銀行(Clearstream Banking)宣布其將不再對主營業務與大麻及其它毒品直接或間接相關的證券提供服務。 因此,該等證券將不會再於斯圖加特(SWB)或法蘭克福(FWB)證券交易所交易。自2018年9月19日收槃開始,IBKR將釆取以下行動:

- 對於客戶未釆取行動平倉,但也不能轉至美國掛牌市場的受影響頭寸,進行強制平倉;

- 對於客戶未釆取行動平倉,但能夠轉至美國掛牌市場的受影響頭寸,將股票轉至其美國掛牌市場。

下方表格列出了斯圖加特交易所和明訊銀行截至2018年8月7日公布的受影響證券。該表格還標記了受影響證券是否能夠轉至美國掛牌市場。注意,清算所已聲明該列表可能尚不完整,建議客戶檢查其各自網站了解最新信息。

| ISIN | 名稱 | 交易所 | 是否可轉至美國? | 美國代碼 |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | 是 |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | 是 |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | 是 |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | 是 |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | 是 |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | 是 |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | 是 |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | 是 |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | 是 |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | 是 |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | 是 |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | 是 |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | 是 |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | 否 | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | 否 | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | 否 | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | 否 | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | 否 |

重要注意事項:

- 請注意,美國掛牌證券通常為場外交易(PINK),且以美元(而非歐元)計價, 因此,除市場風險外,您還將面對匯率風險。

- 持有粉單(PINK Sheet)證券的賬戶持有人需要有美國(仙股) 交易許可才能下達開倉定單。

- 擁有美國(仙股) 交易許可之賬戶的所有使用者均須使用雙因素驗證登錄賬戶。

Clearinghouse Restrictions on Cannabis Securities

Boerse Stuttgart and Clearstream Banking have announced that they will no longer provide services for issues whose main business is connected directly or indirectly to cannabis and other narcotics products. Consequently, those securities will no longer trade on the Stuttgart (SWB) or Frankfurt (FWB) stock exchanges. Effective as of the 19 September 2018 close, IBKR will take the following actions:

- Force close any impacted positions which clients have not acted to close and that are not eligible for transfer to a U.S. listing; and

- Force transfer to a U.S. listing any impacted positions which clients have not acted to close and that are eligible for such transfer.

Outlined in the table below are impacted issues as announced by the Boerse Stuttgart and Clearstream Banking as of 7 August 2018. This table includes a notation as to whether the impacted issue is eligible for transfer to a U.S. listing. Note that the clearinghouses have indicated that this list may not yet be complete and clients are advised to review their respective websites for the most current information.

| ISIN | NAME | EXCHANGE | U.S. TRANSFER ELIGIBLE? | U.S. SYMBOL |

| CA00258G1037 |

ABATTIS BIOCEUTICALS CORP |

FWB2 | YES |

ATTBF |

| CA05156X1087 |

AURORA CANNABIS INC |

FWB2, SWB2 | YES |

ACBFF |

| CA37956B1013 |

GLOBAL CANNABIS APPLICATIONS |

FWB2 | YES |

FUAPF |

| US3988451072 |

GROOVE BOTANICALS INC |

FWB | YES |

GRVE |

| US45408X3089 |

INDIA GLOBALIZATION CAPITAL |

FWB2, SWB2 | YES |

ICG |

| CA4576371062 |

INMED PHARMACEUTICALS INC |

FWB2 | YES |

IMLFF |

| CA53224Y1043 |

LIFESTYLE DELIVERY SYSTEMS I |

FWB2, SWB2 | YES |

LDSYF |

| CA56575M1086 |

MARAPHARM VENTURES INC |

FWB2, SWB2 | YES |

MRPHF |

| CA5768081096 |

MATICA ENTERPRISES INC |

FWB2, SWB2 | YES |

MQPXF |

| CA62987D1087 |

NAMASTE TECHNOLOGIES INC |

FWB2, SWB2 | YES |

NXTTF |

| CA63902L1004 |

NATURALLY SPLENDID ENT LTD |

FWB2, SWB2 | YES |

NSPDF |

| CA88166Y1007 |

TETRA BIO-PHARMA INC |

FWB2 | YES |

TBPMF |

| CA92347A1066 |

VERITAS PHARMA INC |

FWB2 | YES |

VRTHF |

| CA1377991023 |

CANNTAB THERAPEUTICS LTD |

FWB2 | NO | |

| CA74737N1042 |

QUADRON CANNATECH CORP |

FWB2 | NO | |

| CA84730M1023 |

SPEAKEASY CANNABIS CLUB LTD |

FWB2, SWB2 | NO | |

| CA86860J1066 |

SUPREME CANNABIS CO INC/THE |

FWB2 | NO | |

| CA92858L2021 |

VODIS PHARMACEUTICALS INC |

FWB2 | NO |

IMPORTANT NOTES:

- Note that the U.S. listings generally trade over-the-counter (PINK) and are denominated in USD not EUR thereby exposing you to exchange rate risk in addition to market risk.

- Account holders maintaining PINK Sheet securities require United States (Penny Stocks) trading permissions in order to enter opening orders.

- All users on accounts maintaining United States (Penny Stocks) trading permissions are required use 2 Factor login protection when logging into the account.

打包零售和保險類投資產品法規(PRIIP)

“打包零售投資和保險類投資産品法規” - 歐盟編號1286/2014(“PRIIP法規”或“PRIIP”)簽署于2014年12月29日,其規定于2018年1月1日生效。法規要求産品生産者創建幷維護關鍵信息文件(KID),銷售或就打包零售投資和保險類投資産品提供諮詢建議的人士向所有在歐洲經濟區(EEA)的零售投資者提供關鍵信息文件,以幫助這些投資者更好地瞭解和比較産品。英國金融市場行爲監管局(FCA)對英國居民也有同等的要求。

PRIIP法規的目的。

自2008年金融危機以來,歐盟委員會的主要目標之一即爲加强投資者保護以及重建公衆對金融市場的信心。

法規提出了新的標準化“關鍵信息文件(KID)”,以提升零售投資者對打包零售投資和保險類投資産品的瞭解,幷能更好地比較這些産品。打包零售投資和保險類投資産品是指向投資者支付的金額隨參照值變動而變動的任意投資産品。除保險産品外,PRIIPs還包括ETF、期權、期貨、差價合約和結構化産品等。

該法規是一項投資者保護法規,其主要目標爲:

- 確保投資者能理解幷比較相似的産品,從而做出投資决策。

- 提高零售投資市場的透明度及公衆的信心。

- 促進一體化歐盟保險市場的形成。

法規旨在通過規定關鍵信息文件的標準格式和內容來達成以上目標。

什麽是關鍵信息文件?

關鍵信息文件是一份3頁的文件,包括有關産品的重要信息,如産品的一般描述、成本、風險回報情况及可能的業績情境。

該法規適用于哪些實體?

法規適用于打包零售投資和保險類投資産品的生産者和經銷商。創建幷維護文件的責任由産品生産者承擔。然而,任何銷售、就打包零售投資和保險類投資産品向零售投資者提供諮詢建議、或接受零售投資者的買入該類産品的定單的經銷商或金融中介機構都必須向投資者提供關鍵信息文件。這也適用于僅執行的綫上環境。

誰應收到關鍵信息文件?

居住在歐洲經濟區的零售投資者應在投資打包零售投資和保險類投資産品前收到關鍵信息文件。如生産者不提供關鍵信息文件,歐洲經濟區的零售客戶將無法交易該産品。

通常,關鍵信息文件必須以客戶常住國家的官方語言提供。

但是,IBKR的客戶已同意接收英語通訊,因此,關鍵信息文件的語言爲英語,所有歐洲經濟區客戶和英國客戶,無論其法定居住國家,均可交易該等産品。

如果關鍵信息文件的語言不是英語,而是其它語言,比如德語,則只有常住在以該語言爲官方語言之國家(在該例子中爲德國、奧地利、比利時、盧森堡或列支敦士登)的零售客戶可以交易PRIIP。

對盈透證券的影響:

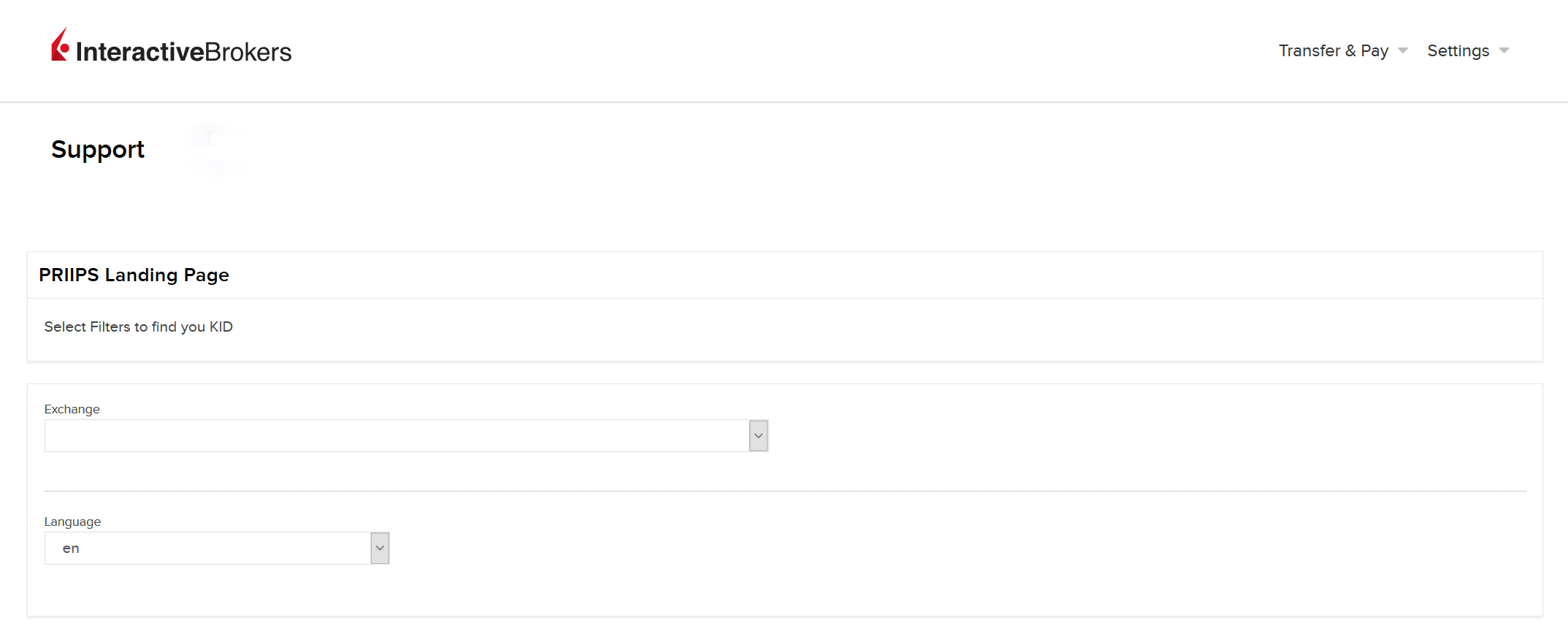

爲遵守PRIIP法規,IB英國將通過網站以電子化的形式提供關鍵信息文件(“PRIIP關鍵信息文件登陸頁”)。

我在哪裏可以找到PRIIP關鍵信息文件登陸頁?

關鍵信息文件可通過我們專門的PRIIP關鍵信息文件登陸頁找到。您可通過三種不同的方式找到關鍵信息文件。即通過IBKR交易者工作站(“TWS”)、IBKR網站和客戶端均可找到。

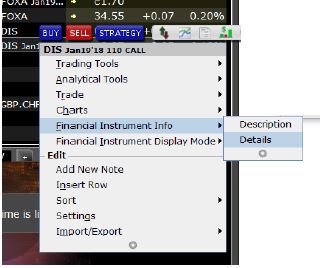

1. 通過TWS找到關鍵信息文件:

- 登錄TWS

- 右擊您想要獲取關鍵信息文件的産品代碼。

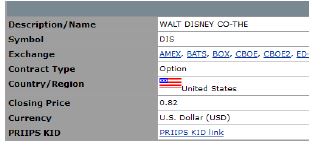

- 在金融産品信息下選擇“詳情”。

- 在合約詳情頁面,您可選擇PRIIP關鍵信息文件鏈接。這將帶您前往客戶端中的PRIIP關鍵信息文件登陸頁。

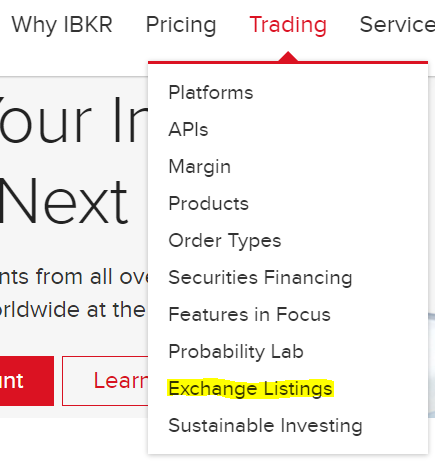

2. 通過IBKR網站找到關鍵信息文件:

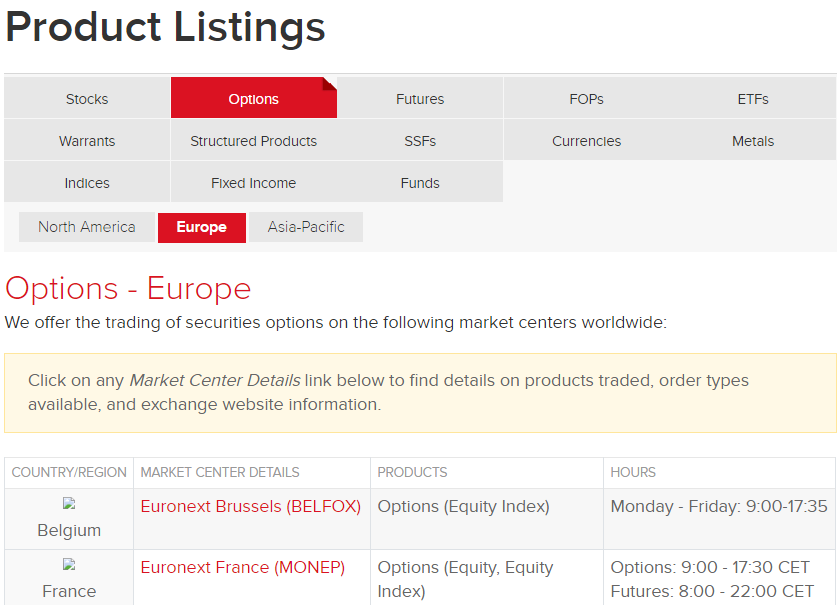

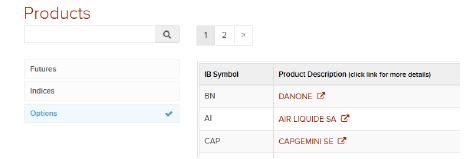

- 打開“交易”標簽幷選擇“交易所列表”。

- 從這裏選擇“産品列表”。選擇您想要獲得合約信息的産品的衍生品類型、區域和交易所。

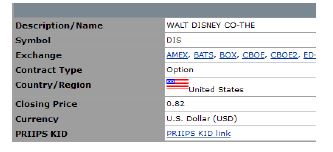

- 選擇您想要查看關鍵信息文件的産品,轉至合約詳情頁面。

- 在如下所示的合約詳情頁面上,您可點擊PRIIPs關鍵信息文件鏈接,即可轉至客戶端中的PRIIP關鍵信息文件登陸頁。

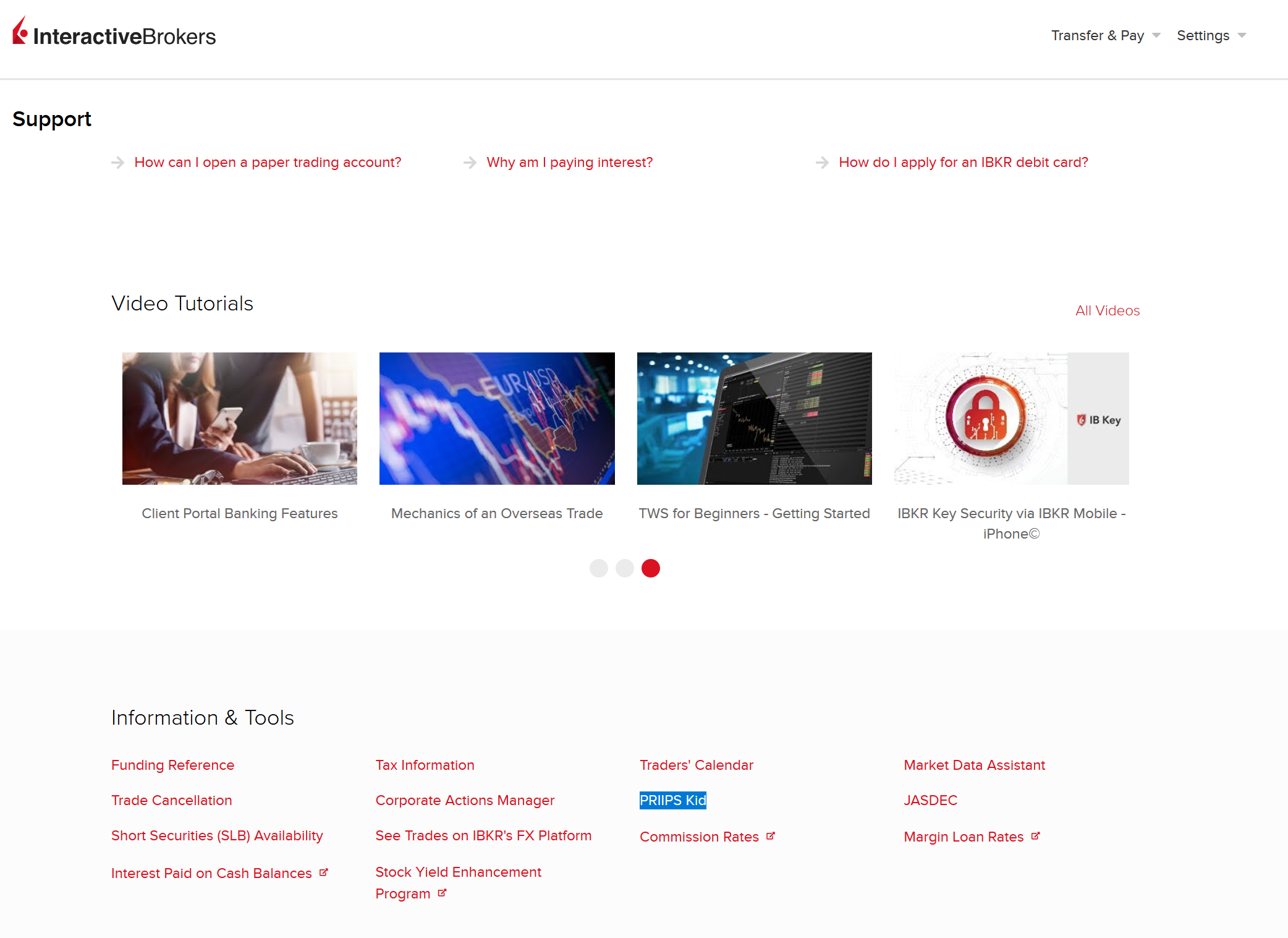

3. 通過客戶端找到關鍵信息文件:

- 登錄客戶端。

- 點擊“幫助”(?)圖標進入“支持中心”。

- 在“信息與工具”部分,選擇“PRIIP關鍵信息文件”,即可前往PRIIP關鍵信息文件登陸頁。

我有可能通過差價合約投資美國ETF/其它PRIIP限制産品嗎?

投資者在交易差價合約時有可能可以獲得美國ETF/其它PRIIP限制産品的風險敞口,因爲有些差價合約就是設計成跟踪底層資産(包括ETF和其它PRIIP産品)的表現的。

如果投資者交易的差價合約就是追踪美國ETF或其它PRIIP産品的表現的,則投資者也可能是在間接投資其底層資産。這是因爲差價合約的價值是基于底層資産的價值確定的,底層資産價值的任何盈虧都會反映在差價合約的價值當中。

Legal Entity Identifier Overview

BACKGROUND

The Legal Entity Identifier (LEI) is a 20-digit reference code that uniquely identifies legally distinct entities engaging in financial transactions globally, and across markets and jurisdictions. The LEI system was developed by the G-20 in accordance with ISO standards and the issuers of LEIs, referred to as Local Operating Units (LOU), supply registration and renewal services. Providing a unique identifier for each legal entity (along with key reference information associated with the entity) participating in financial transactions is intended to promote transparency.

DTC, in collaboration with SWIFT, operate as the local (U.S.) source provider of LEIs and maintains a website for the assignment of new and search of existing LEIs. See: http://www.gmeiutility.org/

SITUATIONS REQUIRING A LEI

In certain instances, brokers are required by regulation to report information regarding a client and include in that information a client identifier. For entities such as trusts and organizations, that identifier is referred to an a LEI. Examples of these reporting instances include the following:

CFTC Ownership and Control Reporting

MiFIR Transaction Reporting

China Stock Connect

EMIR reporting to trade repository

OBTAINING THE LEI

A LEI can be obtained by contacting an authorized LEI issuer, also referred to as a Local Operating Unit (LOU). The DTC, in collaboration with SWIFT, operates as a U.S. LOU and maintains a website for purposes of LEI registration and renewal. Note that LEI applicants can use the services of any accredited LOU and are not limited to using an LEI issuer in their own country.

In addition, as a service to its clients, IBKR will send an invite via Account Management to those who are required to obtain a LEI for trading or other regulatory reporting functions. Through this invite, the client can authorize IBKR to request an LEI through DTC on an accelerated basis (24 hours) and debit the client's account for the application fee and the annual renewal fee thereafter.

中國股票交易“北向通”投資者ID模型

2017年11月,香港證監會(SFC)和中國證監會(CSRC)宣布就大陸-香港股票互聯互通機制下的“北向通”交易推出投資者識別體系。該體系旨在增強對香港投資者交易大陸股票的合規監管,要求經紀商向上海證交所或深圳交易所報告客戶的身份。 該法規自2018年9月26日起生效。 更多信息請見以下常見問題。

股票互聯互通機制是香港、上海和深圳證券交易所間的合作項目,該機制使國際投資者和中國大陸投資者得以通過其所屬交易所的交易和清算設施交易其它證券交易所的證券。

“北向通”交易是指通過香港證券交易所交易在中國大陸上市的股票(即在上交所或深交所上市的股票)。

要收集和報告的信息取決於客戶分類。對於個人,要收集和報告的信息如下:

- 中英文姓名

- 身份證件的簽發國家/司法轄域

- 身份證件類型(香港身份證、相關國家/地區政府機關簽發的身份證、護照、或其它任意官方的身份證明文件,如駕照)

- 身份證號碼(身份證明文件號碼)

- 實體名稱

- 其它正式的成立文件(IBKR會盡可能使用客戶開戶時提供的文件)。

- 法律實體識別號碼(如您沒有LEI,您可在請求“互聯互通”交易許可時通過IBKR申請一個。請注意,申請LEI最長可能需要三天,需向LEI簽發機搆繳納申請費,之后每年還需續費)。

想通過股票互聯互通機制交易的客戶必須同意IBKR向香港交易及結算所有限公司和中國的監管機搆提供其信息,其中中國的監管機搆包括:

- 上海和深圳證券交易所

- 中國證券登記結算(香港)有限公司

- 中國大陸的監管機搆和執法機關

已有“北向通”交易許可的客戶在登錄賬戶管理時即會看到一份在線表格。該表格將授權IBKR收集必要的信息并就提交定單時分享該信息徵求客戶同意。

“北向通”投資者ID模型將於2018年10月22日實施。

SFC和CSRC也同意在“北向通”投資者ID模型成功實施后盡快為“南向通”建立類似的投資者識別體系。

“北向通”投資者ID模型實施后,客戶若不提供必要的信息或不同意我們報告必要的信息,則其將無法提交“北向通”開倉定單,但可平倉已有頭寸。

要交易中國股票互聯互通機制下的股票,客戶需登錄賬戶管理請求相應的交易許可:設置 -> 賬戶設置 -> 交易許可 -> 香港/中國股票互聯互通。

PRIIP Order Reject Translations

Clients entering opening orders for products covered by the PRIIPs Regulation where the issuer has not provided the required disclosure documents or Key Information Documents (KIDS) will have their order rejected and will receive the following reject message:

English

This product is currently unavailable to clients classified as 'retail clients'.

Note: Individual clients and entities that are not large institutions generally are classified as 'retail' clients.

There may be other products with similar economic characteristics that are available for you to trade.

French

Ce produit n’est pas actuellement disponible pour les clients considérés comme des clients “Particuliers/de détail”. Remarque : les clients particuliers et entreprises de détail qui ne sont pas de larges établissements sont classifiés comme des clients “de détail”.

D’autres produits aux caractéristiques similaires peuvent exister mais ne vous sont pas proposés au trading.

German

Dieses Produkt ist derzeit für Kunden, die als „Retail-Kunden” eingestuft werden, nicht verfügbar. Hinweis: Einzelkunden und Körperschaften, bei denen es sich nicht um große Institutionen handelt, werden grundsätzlich als „Retail”-Kunden bezeichnet.

Es ist möglich, dass Ihnen andere Produkte mit ähnlichen wirtschaftlichen Merkmalen zum Handel zur Verfügung stehen.

Italian

Questo prodotto al momento non è disponibile per i clienti “retail”. Nota: i clienti privati e le organizzazioni di non grandi dimensioni sono in genere classificati come clienti “retail”.

Potrebbero esserci altri prodotti con simili caratteristiche disponibili per le negoziazioni.

Spanish

Este producto no está actualmente disponible para clientes clasificados como “clientes minoristas”. Nota: los clientes individuales y las entidades que no sean grandes instituciones son clasificados, generalmente, como clientes “minoristas”.

Podría haber otros productos con características económicas similares que estén disponibles para que usted opere en ellos.

Russian

На данный момент этот продукт недоступен для розничных клиентов. Примечание: Частные лица и юридические структуры, не являющиеся крупными предприятиями, как правило, относятся к числу розничных клиентов.

Вам могут быть доступны другие продукты с похожими экономическими характеристиками.

Japanese

こちらの商品は現在「リテール・クライアント」として分類されるお客様にはご利用いただけません。注意:大きな機関ではない個人のお客様および事業体のお客様は、通常「リテール」クライアントとして分類されます。

似た経済特性を持つその他の商品で、お客様にお取引いただくことのできる商品がある可能性があります。

Chinese Simplified

该产品目前不适用于"零售客户"。 请注意:个人用户和非大型机构实体通常均被划分为"零售"客户。

可能有其他具有类似经济特征的产品适用于您的交易。

Chinese Traditional

該產品目前不適用於"零售客戶"。請注意: 個人用戶和非大型機構實體通常均被劃分為"零售"客戶。

可能有其他具有類似經濟特徵的產品適用於您的交易。

Please note, it is possible to be reclassified from Retail to Professional once certain qualitative, quantitative and procedural requirements are met. For more information on requirements, please see: How can I update my MiFID client category?

China Connect Northbound Investor ID Model

In November 2017, the Securities and Futures Commission (SFC) and China Securities Regulatory Commission (CSRC) announced an agreement to introduce an investor identification regime for Northbound trading under Mainland-Hong Kong Stock Connect. This regime is intended to enhance regulatory surveillance of mainland-listed stock trading from Hong Kong and requires brokers to report the identity of clients submitting orders to either the Shanghai or Shenzhen Stock Exchange. This regulation will be effective as of September 26, 2018. Additional information is provided in the series of FAQs below.

The Stock Connect is a collaboration between the Hong Kong, Shanghai and Shenzhen Stock Exchanges which allows international and Mainland Chinese investors to trade securities in each other's markets through the trading and clearing facilities of their home exchange.

Northbound trading refers to the trading of mainland-listed stocks (e.g., Shanghai and Shenzhen Stock Exchanges) from the Hong Kong Stock Exchange.

The information collected and reported depends upon the client classification. In the case of individuals, the information is as follows:

- Name in English and Chinese

- ID issuing country/jurisdiction

- ID type (Hong Kong ID card, ID card issued by the government authority of relevant country/region, passport, or any other official identity document e.g. driver's license)

- ID number (number of ID document)

- Entity name

- Other official incorporation documents (IBKR will attempt to us the documents clients provided at the point of account opening, whenever possible).

- Legal Entity Identifier (if you do not already have an LEI, you can order one through IBKR when requesting trading permissions for China Connect. Note that obtaining a LEI can take up to three days, is associated with an application fee imposed by the LEI issuing organization, and an annual renewal fee thereafter).

Clients who wish to access the Stock Connect must provide IBKR with consent to provide their information to the Hong Kong Exchanges and Clearing Ltd and the Chinese regulatory bodies such as:

- Shanghai and Shenzhen Stock Exchanges

- China Securities Depository and Clearing (Hong Kong) Company Limited

- Mainland regulatory authorities and law enforcement agencies

Clients with existing Northbound trading permissions will be presented with the online form upon log in to Client Portal. This form will allow IBKR to collect the required information and consent to submit this information upon order submission.

The Northbound Investor ID model will be effective as of October 22, 2018.

The SFC and the CSRC also agreed to introduce a similar investor identification regime for Southbound trading as soon as possible after the regime for Northbound trading is implemented.

Once the Northbound Investor ID model is in effect, clients who either fail to provide the required information or elect not to provide consent to report the required information will not be allowed to submit opening Northbound orders but will be allowed to close existing positions.

In order to trade China Connect stocks clients are required to login to Client Portal and request the necessary trading permissions. To do so:

- Log into Client Portal

- Click the User menu (head and shoulders icon in the top right corner) followed by Manage Account

- If you manage multiple accounts, select an account by clicking on the account number to popup the Account Selector

- Click the Configure (gear) icon next to Trading Experience & Permissions

- Click on "Stocks" and check the box next to "Hong Kong/China Stock Connect"

- Click CONTINUE and follow the prompts on screen.

China Connect - Disclosure Obligation and Foreign Shareholding Restriction

The following is a high-level summary of the disclosure obligations and foreign investors’ shareholding restriction applicable to the trading of Shanghai Stock Exchange (SSE) Securities or Shenzhen Stock Exchange (SZSE) Securities under Stock Connect.

Both Interactive Brokers, in its role as a China Connect Exchange Participant, and investors trading SSE/SZSE Securities through Interactive Brokers are required to comply with these requirements.

I. Disclosure Obligation

- When an investor holds or controls up to 5% of the issued shares of a Mainland listed company, the investor is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

- The investor is not allowed to continue purchasing or selling shares in that Mainland listed company during the three day notification period.

- For such investor, whenever there is an increase or decrease in his shareholding that equals or exceeds 5% of the existing holdings, he is required to make disclosure within three working days of the change. From the day the disclosure obligation arises to two working days after the disclosure is made, the investor may not buy or sell the shares in the relevant Mainland listed company.

- If a change in shareholding of the investor is less than 5% but results in the shares held or controlled by him/her falling below 5% of the relevant Mainland listed company, the investor is required to disclose the information within three working days of the event.

II. Shareholding Restriction

- A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares.

- When the aggregate foreign shareholding of an individual A share reaches 26%, SSE or SZSE will publish a notice on its website.

- Once SSE or SZSE informs the Stock Exchange of Hong Kong Limited (SEHK) that the aggregate foreign shareholding of an SSE or SZSE Security reaches 28%, further Northbound buy orders in that SSE or SZSE Security will not be allowed, until the aggregate foreign shareholding of that SSE or SZSE Security is sold down to 26%.

- If the 30% threshold is exceeded due to Shanghai Connect or Shenzhen Connect, HKEX will identify the relevant China Connect Exchange Participant and require it to follow the forced-sale requirements, whereupon the foreign investors concerned will be requested to sell the shares on a last-in-first-out basis within five trading days of notifying the relevant China Connect Exchange Participant.

III. Additional Information

For additional information, including details of position disclosure and restriction, please refer to the following website links:

Stock Connect FAQ (10 April 2017): http://www.hkex.com.hk/-/media/hkexmarket/mutual-market/stock-connect/getting-started/information-bookletand-faq/faq/faq_en

Chapter 14A China Connect Service - Shanghai:

http://www.hkex.com.hk/-/media/hkex-market/services/rules-and-forms-andfees/rules/sehk/securities/rules/chap-14a_eng

Chapter 14B China Connect Service - Shenzhen:

http://www.hkex.com.hk/-/media/hkex-market/services/rules-and-forms-andfees/rules/sehk/securities/rules/chap-14b_eng