Exposure Fee Monitoring via Account Window

The Account Window provides the high-level information suitable for monitoring one's account on a real-time basis. This includes key balances such as total equity and cash, the portfolio composition and margin balances for determining compliance with requirements and available buying power. This window also includes information relating to the most recently assessed exposure fee and a projection of the next fee taking into consideration current positions.

To open the Account Window:

• From TWS classic workspace, click on the Account icon, or from the Account menu select Account Window (Exhibit 1)

Exhibit 1

.jpg)

• From TWS Mosaic workspace, click on Account from the menu, and then select Account Window (Exhibit 2)

Exhibit 2

.jpg)

After opening the window, scroll down to the Margin Requirements section and click on the + sign in the upper-right hand corner to expand the section. There, the "Last" and "Estimated Next" exposure fees will be detailed for each of the product classifications to which the fee applies (e.g., Equity, Oil). Note that the "Last" balance represents the fee as of the date last assessed (note that fees are computed based upon open positions held as of the close of business and assessed shortly thereafter). The "Estimated Next" balance represents the projected fee as of the current day's close taking into account position activity since the prior calculation (Exhibit 3).

Exhibit 3.jpg)

To set the default view when the section is collapsed, click on the checkbox alongside any line item and those line items will remain displayed at all times.

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2276 for verifying exposure fee through the Order Preview screen.

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. Exposure Fee Monitoring via the Account window is only available for accounts that have been charged an exposure fee in the last 30 days

Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

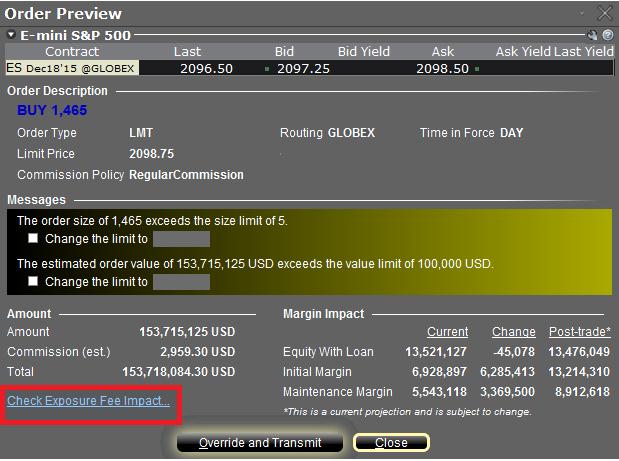

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

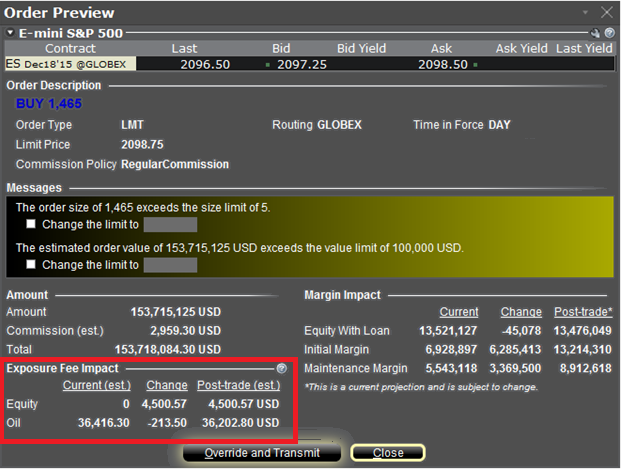

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days

Using Risk Navigator to Project Exposure Fees

IB's Risk Navigator provides a custom scenario feature which allows one to determine what effect, if any, changes to their portfolio will have to the Exposure fee. Outlined below are the steps for creating a “what-if” portfolio through assumed changes to an existing portfolio or through an entirely new proposed portfolio along with determining the resultant fee. Note that this feature is available through TWS build 971.0i and above.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

Please see KB2344 for information on monitoring the Exposure fee through the Account Window and KB2276 for verifying exposure fee through the Order Preview screen.

Important Note

1. The on-demand Exposure Fee check represents a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

Overview of Dodd-Frank

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd-Frank, is a U.S. law enacted in July of 2010, the purpose of which is to prevent the recurrence of events which lead to the 2008 financial crisis. Its principal goals are to:

- Promote U.S. financial stability by improving accountability and transparency within the financial system;

- Protect taxpayers from future bailouts of institutions deemed “too big to fail”; and

- Protect consumers from financial services practices considered abusive.

For additional information, please review the following sections:

- Dodd-Frank reforms

- Dodd-Frank and your IB Account

Dodd-Frank Reforms

To accomplish its goals, Dodd-Frank proposed the following reforms:

- Enhanced oversight and supervision of financial institutions through the creation of Financial Stability Oversight Council

- Creation of a new agency responsible for implementing and enforcing compliance with consumer financial laws (Bureau of Consumer Financial Protection)

- Implementation of more stringent regulatory capital requirements

- Changes in the regulation of over the counter derivatives including restrictions upon access to Federal credit by swaps entities, establishment of regulatory oversight and mandatory trading and clearing requirements

- Enhanced regulation of credit rating agencies intended to eliminate exemptions from liability, enhance rating agency disclosure, establish prohibited activities and impose standards for independent Board governance

- Changes to corporate governance and executive compensation practices

- Incorporation of the Volcker Rule which imposes restrictions upon the speculative proprietary trading activities of banking entities

- Mandating studies intended to reform investor protection rules

- Changes to the securitization market including requirements that mortgage bankers retain a % of risky loans.

Dodd-Frank and Your IB Account

Perhaps most visible to IB account holders of all the Dodd-Frank regulations are those relating to money transfers. Here, Section 1073 of the Act introduces consumer protections designed to increase transparency with respect to the costs, timing and the right to repudiate cross-border transactions.

For purpose of Section 1073, a cross-border transaction is defined as an electronic transfer of money from a consumer in the United States to a person or business in a foreign country. As IB LLC is a U.S. based broker, all its account holders regardless of whether they are domiciled in the U.S. or not, benefit from this protection and it covers withdrawals denominated in a currency other than the U.S. dollar as well as USD denominated withdrawals sent to a non-U.S. bank. Account holders submitting a withdrawal which is covered by this regulation will be provided with a disclosure after confirming the request within Account Management. This disclosure will include the following information:

- The name and address of the sender and recipient

- The amount to be deducted from the sender’s IB account

- The amount projected to be credited to the recipient’s bank account including an estimate of fees which the receiving bank's correspondent bank(s) may charge. Note that these correspondent bank fees are not set by nor is any part of them earned by IB.

- A disclaimer that additional fees and foreign taxes may apply.

- Notice of the sender’s right to cancel the transfer request for a full refund within 30 minutes of it being authorized.

- Regulatory contact information in the event of questions or complaints.

When estimating correspondent bank transfer fees, IB takes into consideration information collected from past customer transactions in addition to data made available by our agent banks. We encourage our customers to review and consider this information when making decisions regarding cross-border transactions.

Information Regarding Italian Financial Transaction Tax on Derivatives

This document is designed to provide an overview of how the Italian Financial Transaction Tax (I-FTT) will be handled by Interactive Brokers for Italian derivatives.

Effective September 1, 2013, the tax will be implemented on the purchase and sale of Italian derivatives.

Tax Rate

The tax rate is dependent on the type of financial instrument traded, whether the instrument was traded OTC or on a regulated exchange or MTF and on the value of the contract. The tax is applied per contract.

Scope

The I-FTT will be applied to transactions on derivatives whose underlying assets are mainly I-FTT taxable shares or whole value depends mainly on I-FTT taxable shares. It will also be applied on any other financial instrument which allows the purchase or share of I-FTT taxable shares or involving a cash settlement determined with reference to I-FTT taxable shares.

Calculation Method

The I-FTT will be applied to both the purchaser and the seller of the derivative contract. As such, there is no benefit of netting as there is when trading stocks.

The rates as set for 2013 when trading on a regulated exchange or MTF are outlined below. Note that a transaction occurring OTC will be charged 5 times the rates displayed below. The values displayed below are in EUR.

| Instrument |

Value < 2,500 |

2,500 to 4,999 | 5,000 to 9,999 | 10,000 to 49,999 | 50,000 to 99,999 | 100,000 to 499,999 | 500,000 to 999,999 | 1,000,000 + |

| Futures, certificates, covered warrants, options on yields, measures or indices related to shares | 0.00375 | 0.0075 | 0.015 | 0.075 | 0.15 | 0.75 | 1.5 | 3 |

| Futures, warrants, certificates, covered warrants and options on shares | 0.025 | 0.05 | 0.1 | 0.5 | 1 | 5 | 10 | 20 |

| All other products not listed above | 0.05 | 0.1 | 0.2 | 1 | 2 | 10 | 20 | 40 |

The information above is being provided on a best efforts basis only and is subject to change.

Security Device Replacement Charge

Account holders logging into their account via IBKR's Secure Login System are issued a security device, which provides an additional layer of protection to that afforded by the user name and password, and which is intended to prevent online hackers and other unauthorized individuals from accessing their account. While IBKR does not charge any fee for the use of the device, certain versions require that the account holder return the device upon account closing or incur a replacement fee. Existing account holders are also subject to this replacement fee in the event their device is lost, stolen or damaged (note that there is no fee to replace a device returned as a result of battery failure).

In addition, while IBKR does not assess a replacement fee unless a determination has been made that the device has been lost, stolen, damaged or not returned, a reserve equal to the fee will placed upon the account upon issuance of the device to secure its return. This reserve will have no effect upon the equity of the account available for trading, but will act as limit to full withdrawals or transfers until such time the device is returned (i.e., cannot withdraw the reserve balance).

Outlined below are the replacement fee associated with each device.

| SECURITY DEVICE | REPLACEMENT FEE |

| Security Code Card1 | $0.001 |

| Digital Security Card + | $20.00 |

For instructions regarding the return of security devices, please see KB975

1 The Security Code Card is not required to be returned upon account closing and may be destroyed and discarded once remaining funds have been returned and the account has been fully closed. Access to Client Portal after closure for purposes of viewing and retrieving activity statements and tax documents is maintained using solely the existing user name and password combination. This type of two-factor security is no longer being issued.

Why Do Commission Charges on U.S. Options Vary?

IBKR's option commission charge consists of two parts:

1. The execution fee which accrues to IBKR. For Smart Routed orders this fee is set at $0.65 per contract, reduced to as low as $0.15 per contract for orders in excess of 100,000 contracts in a given month (see website for costs on Direct Routed orders, reduced rates on low premium options and minimum order charges); and

2. Third party exchange, regulatory and/or transaction fees.

In the case of third party fees, certain U.S. option exchanges maintain a liquidity fee/rebate structure which, when aggregated with the IBKR execution fee and any other regulatory and/or transaction fees, may result in an overall per contract commission charge that varies from one order to another. This is attributable to the exchange portion of the calculation, the result of which may be a payment to the customer rather than a fee, and which depends upon a number of factors outside of IBKR's control including the customer's order attributes and the prevailing bid-ask quotes.

Exchanges which operate under this liquidity fee/rebate model charge a fee for orders which serve to remove liquidity (i.e., marketable orders) and provide a credit for orders which add liquidity (i.e., limit orders which are not marketable). Fees can vary by exchange, customer type (e.g., public, broker-dealer, firm, market maker, professional), and option underlying with public customer rebates (credits) generally ranging from $0.10 - $0.90 and public customer fees from $0.01 - $0.95.

IBKR is obligated to route marketable option orders to the exchange providing the best execution price and the Smart Router takes into consideration liquidity removal fees when determining which exchange to route the order to when the inside market is shared by multiple (i.e., will route the order to the exchange with the lowest or no fee). Accordingly, the Smart Router will only route a market order to an exchange which charges a higher fee if they can better the market by at least $0.01 (which, given the standard option multiplier of 100 would result in price improvement of $1.00 which is greater than the largest liquidity removal fee).

For additional information on the concept of adding/removing liquidity, including examples, please refer to KB201.

Overview of SEC Fees

Under Section 31 of the Securities Exchange Act of 1934, U.S. national securities exchanges are obligated to pay transaction fees to the SEC based on the volume of securities that are sold on their markets. Exchange rules require their broker-dealer members to pay a share of these fees who, in turn, pass the responsibility of paying the fees to their customers.

This fee is intended to allow the SEC to recover costs associated with its supervision and regulation of the U.S. securities markets and securities professionals. It applies to stocks, options and single stock futures (on a round turn basis); however, IB does not pass on the fee in the case of single stock futures trades. Note that this fee is assessed only to the sale side of security transactions, thereby applying to the grantor of an option (fee based upon the option premium received at time of sale) and the exerciser of a put or call assignee (fee based upon option strike price).

For the fiscal year 2016 the fee was assessed at a rate of $0.0000218 per $1.00 of sales proceeds, however, the rate is subject to annual and,in some cases, mid-year adjustments should realized transaction volume generate fees sufficiently below or in excess of targeted funding levels.1

Examples of the transactions impacted by this fee and sample calculations are outlined in the table below.

|

Transaction |

Subject to Fee? |

Example |

Calculation |

|

Stock Purchase |

No |

N/A |

N/A |

|

Stock Sale (cost plus commission option) |

Yes |

Sell 1,000 shares MSFT@ $25.87 |

$0.0000218 * $25.87 * 1,000 = $0.563966 |

|

Call Purchase |

No |

N/A |

N/A |

|

Put Purchase |

No |

N/A |

N/A |

|

Call Sale |

Yes |

Sell 10 MSFT June ’11 $25 calls @ $1.17 |

$0.0000218 * $1.17 * 100 * 10 = $0.025506 |

|

Put Sale |

Yes |

Sell 10 MSFT June ’11 $25 puts @ $0.41 |

$0.0000218 * $0.41 * 100 * 10 = $0.008938 |

|

Call Exercise |

No |

N/A |

N/A |

|

Put Exercise |

Yes |

Exercise of 10 MSFT June ’11 $25 puts |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Call Assignment |

Yes |

Assignment of 10 MSFT June ’11 $25 calls |

$0.0000218 * $25.00 * 100 * 10 = $0.545 |

|

Put Assignment |

No |

N/A |

N/A |

1Information regarding current Section 31 fees may be found on the SEC's Frequently Requested Documents page located at: http://www.sec.gov/divisions/marketreg/mrfreqreq.shtml#feerate

Overview of Fees

Clients and as well as prospective clients are encouraged to review our website where fees are outlined in detail.

An overview of the most common fees is provided below:

1. Commissions - vary by product type and listing exchange and whether you elect a bundled (all in) or unbundled plan. In the case of US stocks, for example, we charge $0.005 per share with a minimum per trade of $1.00.

2. Interest - interest is charged on margin debit balances and IBKR uses internationally recognized benchmarks on overnight deposits as a basis for determining interest rates. We then apply a spread around the benchmark interest rate (“BM”) in tiers, such that larger cash balances receive increasingly better rates, to determine an effective rate. For example, in the case of USD denominated loans, the benchmark rate is the Fed Funds effective rate and a spread of 1.5% is added to the benchmark for balances up to $100,000. In addition, individuals who short stock should be aware of special fees expressed in terms of daily interest where the stock borrowed to cover the short stock sale is considered 'hard-to-borrow'.

3. Exchange Fees - again vary by product type and exchange. For example, in the case of US securities options, certain exchanges charge a fee for removing liquidity (market order or marketable limit order) and provide payments for orders which add liquidity (limit order). In addition, many exchanges charge fees for orders which are canceled or modified.

4. Market Data - you are not required to subscribe to market data, but if you do you may incur a monthly fee which is dependent upon the vendor exchange and their subscription offering. We provide a Market Data Assistant tool which assists in selecting the appropriate market data subscription service available based upon the product you wish to trade. To access, log in to Portal click on the Support section and then the Market Data Assistant link.

5. Minimum Monthly Activity Fee - there is no monthly minimum activity requirement or inactivity fee in your IBKR account.

6. Miscellaneous - IBKR allows for one free withdrawal per month and charges a fee for each subsequent withdrawal. In addition, there are certain pass-through fees for trade bust requests, options and futures exercise & assignments and ADR custodian fees.

For additional information, we recommend visiting our website and selecting any of the options from the Pricing menu option.

Priority of Professional Customer Orders

U.S. option exchanges have rules that distinguish between orders originating from public customers (i.e., not broker-dealers) whose trading behavior is deemed to be “Professional” (i.e., persons or entities trading in a manner more akin to a market maker than to a typical customer) and those whose trading behavior is not. In accordance with these rules, any customer that is not a broker-dealer and averages more than 390 option orders (for its own beneficial account(s)) per day in U.S.-listed options in at least one month of a calendar quarter will be classified as Professional.

Orders submitted on behalf of Professional customers are treated the same as those of broker-dealers for purposes of execution priority and fees.

Brokers are required to conduct a review on at least a quarterly basis to identify those customers who have exceeded the 390 order threshold for any month in that quarter, and such customers will be designated as Professional as of the next calendar quarter.

Order Counting

The definition of an order for these purposes varies slightly across exchanges, and customers seeking specific options counting rules (especially in connection with the use of algorithmic order types that might result in placing orders on both sides of the market under certain circumstances) should review the relevant exchange rulebooks and guidance. However, for purposes of options order counting, an order is generally defined as:

- A single order;

- A complex order of 8 or fewer option legs;

- Each option leg of a complex order of 9 or more option legs; or

- A parent order, even if that order is broken into multiple child orders on the same side/series by a broker for execution or routing purposes (except in connection with orders pegged to the NBBO, as discussed below).

A customer-initiated cancelation and replacement (by any method, including, for example, as a result of Scale orders) of a parent order counts as a new order(s) according to the logic above (e.g., a cancel/replace of a single-leg order counts as one new order, whereas a cancel/replace of a nine-option-leg order counts as nine new orders).

Orders Pegged to the NBBO/BBO

Note that for customers who use options orders pegged to the NBBO or BBO (such as, for example, relative orders or Pegged Volatility orders, or other parent order types designed to move with the NBBO/BBO), each cancel/replace of a child order based on a change in the NBBO/BBO constitutes an additional new order. Customers resting pegged orders in IBUSOPT for participation in RFQ auctions should also be aware that a pegged order will be treated as canceled and replaced each time such order participates in an RFQ auction in IBKR’s system (whether or not such order becomes an initiating order in an on-exchange auction).

Account Aggregation

In calculating order totals, brokers must aggregate the options orders of all beneficially-owned accounts of the customer. IBKR aggregates options orders from an individual’s or entity’s account with those of related joint accounts, trust accounts, and organizational accounts.

Customers will be notified by IBKR upon a status change from a retail customer to a Professional customer. In addition, IBKR’s smart order router is designed to take exchange fees (including differences between professional and non-professional customer fees) into consideration when making routing decisions.

For additional details, please see the following links:

CBOE Regulatory Circular RG16-064