Перечень сторонних сборов за финансовые операции

Великобритания

- Гербовый сбор в 0,5% от стоимости сделки

- Комитет по поглощениям и слияниям облагает налогом в 1,00 GBP все ордера на сумму более 10 000 с акциями компаний, зарегистрированных в Великобритании, на о. Мэн или на Нормандских островах.

Ирландия

- Гербовый сбор в 1% от стоимости сделки

Швейцария

- Interactive Brokers не взимает автоматически налог на финансовые операции в Швейцарии с частных счетов. Клиенты, обязанные оплачивать данный налог, должны проконсультироваться со специалистом по налогообложению для выяснения своих налоговых обязательств.

Франция

- Налог на финансовые операции во Франции: налог в 0,30% от стоимости сделки применяется в отношении акций компаний, если их головной офис расположен во Франции и рыночная капитализация превышает 1 млрд EUR.

Италия

- Налог на финансовые операции в Италии: 0,10% для акций, транзакции по которым выполняются на регулируемых рынках и многосторонних торговых площадках, и 0,20% для остальных акций.

Испания

- Налог на финансовые операции в Испании: налог в 0,20% от стоимости сделки применяется в отношении акций испанских компаний с рыночной капитализацией больше 1 млрд EUR по состоянию на 1 декабря года, предшествующему дате приобретения.

Бельгия

- Interactive Brokers не взимает автоматически налог на фондовые операции (TST) Бельгии с частных счетов. Клиенты, обязанные оплачивать данный налог, должны проконсультироваться со специалистом по налогообложению для выяснения своих налоговых обязательств.

Гонконг

- Для акций, варрантов и структурированных продуктов, торгуемых на SEHK:

- Государственный гербовый сбор: 0,13%, округленные до ближайшего целого для акций на SEHK, как правило, применяется только к акциям

- Сбор SFC за операции: 0,0027%, как правило, применяется к акциям, варрантам и контрактам CBBC

- Сбор FRC за операции: 0,00015%, как правило, применяется к акциям, варрантам и контрактам CBBC

- Для продуктов, торгуемых на Stock Connect Шанхай-Гонконг в северном направлении и на Stock Connect Шэньчжень-Гонконг:

- Гербовый сбор в 0,1% от выручки от продажи

Summary of Third Party Transaction Fees

United Kingdom

- 0.5% of trade value Stamp Tax

- Panel of Takeovers and Mergers Levy of GBP 1.00 on all orders over GBP 10,000 on shares of companies registered in the United Kingdom, Isle of Man or Channel Islands

Ireland

- 1% of trade value Stamp Tax

Switzerland

- The Swiss transaction tax is not charged automatically by Interactive Brokers on individual accounts. Clients who are subject to the tax should consult a local tax advisor for support with their tax obligations.

France

- French Financial Transaction Tax: 0.30% of trade value applied to shares of companies whose head office is located in France and whose market capitalisation exceeds EUR 1 billion

Italy

- Italian Financial Transaction Tax: 0.10% for shares transacted on regulated markets and MTFs and 0.20% for those transacted outside of these markets.

Spain

- Spanish Financial Transaction Tax: 0.20% or trade value applied to shares of Spanish companies whose market capitalisation exceeds EUR 1,000 million as of December 1 of the year preceding the date of acquisition.

Belgium

- The Belgian Tax on stock-exchange transactions (TST) is not charged automatically by Interactive Brokers on individual accounts. Clients who are subject to the tax should consult a local tax advisor for support with their tax obligations.

Hong Kong

- For stocks, warrants and structured products traded on the SEHK:

- Government stamp duty: 0.13%, rounded up to the nearest 1.00 for SEHK stocks, normally applies only to stocks

- SFC transaction levy: 0.0027%, normally applies to stocks, warrants and CBBCs

- FRC Transaction levy: 0.00015%, normally applies to stocks, warrants and CBBCs

- For products traded on the Shanghai-Hong Kong Stock Connect Northbound Trading Link and Shenzhen-Hong Kong Stock Connect:

- 0.1% Sale Proceeds Stamp Duty

Плата за замену устройства безопасности

Клиентам, пользующимся "Системой безопасного входа" IBKR, выдается устройство, которое обеспечивает дополнительный уровень защиты и помогает обезопасить счет от взлома хакерами или другими несанкционированными лицами. И хотя в IBKR отсутствуют сборы за пользование таким устройством, оно может подлежать возврату при закрытии счета или оплате при необходимости замены. Плата за замену в случае потери, кражи или поломки устройства распространяется и на существующих владельцев счетов.

Вдобавок, несмотря на то, что IBKR взимает плату за замену, только если установлен факт потери, кражи, поломки или невозврата устройства, соответствующая сумма резервируется на счете в качестве залога. Это не повлияет на капитал, доступный для торговли, но ограничит возможность вывода и перевода средств, пока устройство не будет возвращено (т.е. зарезервированную сумму нельзя вывести со счета).

Ниже приведена стоимость замены каждого устройства.

| УСТРОЙСТВО | ПЛАТА ЗА ЗАМЕНУ |

| Карта кодов безопасности1 | $0.001 |

| Цифровая карта безопасности+ | $20.00 |

Инструкции по возврату устройства безопасности доступны в статье KB975

1 Карту кодов безопасности не нужно возвращать при закрытии счета; ее можно уничтожить или выбросить, как только оставшиеся средства будут выведены, а счет полностью закрыт. После этого доступ к "Порталу клиентов" для просмотра и создания отчетов по операциям и налоговых документов будет осуществляться только при помощи Вашего имени пользователя и пароля. Данное средство двухфакторной защиты больше не выдается.

Информация о налоге на финансовые операции в Испании

Общая информация

Статья содержит общую информацию о том, как Interactive Brokers будет исполнять положения об испанском налоге на финансовые операции (НФО).

Новый налог на покупку определенных испанских акций начинает действовать с 16 января 2021 года.

Налоговая ставка

Размер налоговой ставки – 0,20%.

Сфера применения

НФО действует для акций испанских компаний, рыночная капитализация которых превышает 1 000 млн евро по состоянию на декабрь года, предшествующего году, когда акции были приобретены. Акции компании должны быть допущены к обращению на регулируемом рынке, будь то испанский рынок, рынок другой страны Евросоюза или аналогичные рынки в третьих странах. Министерство финансов Испании будет публиковать список компаний с рыночной капитализацией выше порога до 31 декабря каждого года. Министерство финансов Испании пересмотрит и заново опубликует список в первый месяц действия НФО.

НФО действует в следующих случаях:

- Акции приобретены в результате биржевой сделки

- Акции приобретены при исполнении или расчете по ценным бумагам с фиксированным доходом, которые можно конвертировать или обменять на акции

- Акции приобретены в результате исполнения или расчета по финансовым деривативам (т.е. исполнения опционов на акции)

- Акции приобретены в результате исполнения финансовых контрактов, описанных в статье 2.1 Постановления EHA3537/2005 (контракты, не обращаемые на официальных вторичных рынках, за которые кредитная организация получает денежные средства или ценные бумаги от клиентов, которые берут на себя обязательство по возврату средств)

Начисление

Налог подлежит выплате в день расчета по сделке

Налоговая база

Для внутридневных операций действует особая система расчетов, поэтому налогом будет облагаться только нетто-расчет.

Акции, облагаемые налогом на финансовые операции в Испании

В таблице ниже перечислены компании, для которых действует налог на финансовые операции (НФО) Испании по состоянию на декабрь 2020 года. На основании декларации Испании, под действие закона об НФО попадают компании, соответствующие следующим критериям:

- Акции компании допущены к обращению на регулируемом рынке, будь то испанский рынок, рынок другой страны Евросоюза или аналогичные рынки в третьих странах

- Рыночная капитализация компании превышает 1 000 млн EUR на декабрь года, предшествующего году, когда акции были приобретены (пересматривается ежегодно)

Список компаний представлен по мере возможностей и может быть изменен в любое время без уведомления.

Внизу страницы перечислены американские депозитарные расписки (ADR), облагаемые испанским НФО.

| Название компании |

Символ | Биржа |

| ACS ACTIVIDADES CONS Y SERV | ACS | BM |

| ACERINOX SA | ACX | BM |

| ACERINOX SA | ACXN | MEXI |

| AENA SME SA | AENA | BM |

| AENA SME SA | AENAN | MEXI |

| CORPORACION FINANCIERA ALBA | ALB | BM |

| ALMIRALL SA | ALM | BM |

| AMADEUS IT GROUP SA | AMS2 | BM |

| ACCIONA SA | ANA | BM |

| APPLUS SERVICES SA | APPS | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | MEXI |

| BANKIA SA | BKIA | BM |

| BANKIA SA | BKIAN | MEXI |

| BANKINTER SA | BKT | BM |

| BANKINTER SA | BKTN | MEXI |

| BANCO SANTANDER SA | BNC | LSE |

| CAIXABANK S.A | CABK | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAF | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAFEN | MEXI |

| PROSEGUR CASH SA | CASH2 | BM |

| PROSEGUR CASH SA | CASHN | MEXI |

| CIE AUTOMOTIVE SA | CIE | BM |

| CIE AUTOMOTIVE SA | CIEAN | MEXI |

| CELLNEX TELECOM SA | CLNX | BM |

| CELLNEX TELECOM SA | CLNXN | MEXI |

| INMOBILIARIA COLONIAL SOCIMI | COL | BM |

| AMREST HOLDINGS SE | EAT | WSE |

| AMREST HOLDINGS SE | EAT | BM |

| AMREST HOLDINGS SE | EATN | MEXI |

| EBRO FOODS SA | EBRO | BM |

| EDP RENOVAVEIS SA | EDPR | BVL |

| EUSKALTEL SA | EKT1 | BM |

| EUSKALTEL SA | EKTN | MEXI |

| ENDESA SA | ELE | BM |

| ENDESA SA | ELE1N | MEXI |

| ENAGAS SA | ENG | BM |

| FAES FARMA SA - | FAE | BM |

| FOMENTO DE CONSTRUC Y CONTRA | FCC | BM |

| FLUIDRA SA | FDR | BM |

| FLUIDRA SA | FDRN | MEXI |

| FERROVIAL SA | FER | BM |

| SIEMENS GAMESA RENEWABLE ENE | GAM | BM |

| NATURGY ENERGY GROUP SA | GAS | BM |

| GRUPO CATALANA OCCIDENTE SA | GCO | BM |

| GRUPO CATALANA OCCIDENTE SA | GCON | MEXI |

| GESTAMP AUTOMOCION SA | GEST | BM |

| GESTAMP AUTOMOCION SA | GESTN | MEXI |

| GRIFOLS SA | GRF | BM |

| GRIFOLS SA - B | GRF.P | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAG | LSE |

| INTL CONSOLIDATED AIRLINE-DI | IAG | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAGN | MEXI |

| IBERDROLA SA | IBE | BM |

| IBERDROLA SA | IBEN | MEXI |

| INDRA SISTEMAS S.A. | IDR | BM |

| INDUSTRIA DE DISENO TEXTIL | ITX | BM |

| INDUSTRIA DE DISENO TEXTIL | ITXN | MEXI |

| CIA DE DISTRIBUCION INTEGRAL | LOG | BM |

| MAPFRE SA | MAP | BM |

| MELIA HOTELS INTERNATIONAL | MEL | BM |

| MELIA HOTELS INTERNATIONAL | MELN | MEXI |

| MERLIN PROPERTIES SOCIMI SA | MRL | BM |

| NH HOTEL GROUP SA | NHH | BM |

| PHARMA MAR SA | PHM | BM |

| PHARMA MAR SA | PHM1N | MEXI |

| PROSEGUR COMP SEGURIDAD | PSG | BM |

| RED ELECTRICA CORPORACION SA | REE | BM |

| RED ELECTRICA CORPORACION SA | REEN | MEXI |

| REPSOL SA | REP | BM |

| REPSOL SA | REPSN | MEXI |

| LABORATORIOS FARMACEUTICOS R | ROVI | BM |

| BANCO DE SABADELL SA | SAB2 | BM |

| BANCO SANTANDER SA | SAN | MEXI |

| BANCO SANTANDER SA | SAN | WSE |

| BANCO SANTANDER SA | SAN1 | BM |

| SACYR SA | SCYR | BM |

| SIEMENS GAMESA RENEWABLE ENE | SGREN | MEXI |

| SOLARIA ENERGIA Y MEDIO AMBI | SLR | BM |

| TELEFONICA SA | TEF | BM |

| TELEFONICA SA | TEF1N | MEXI |

| TELEFONICA SA | TEFOF | PINK |

| MEDIASET ESPANA COMUNICACION | TL5 | BM |

| MEDIASET ESPANA COMUNICACION | TL5N | MEXI |

| UNICAJA BANCO SA | UNI2 | BM |

| VIDRALA SA | VID | BM |

| VISCOFAN SA | VIS | BM |

| VISCOFAN SA | VISCN | MEXI |

| ZARDOYA OTIS SA | ZOT | BM |

| ZARDOYA OTIS SA | ZOTN | MEXI |

Ниже перечислены ADR, для которых в Испании действует налог на финансовые операции.

| Название компании |

Символ | Биржа |

| ACERINOX SA-UNSPON ADR | ANIOY | PINK |

| ACS ACTIVIDADES CONS-UNS ADR | ACSAY | PINK |

| AENA SME SA-ADR | ANYYY | PINK |

| AMADEUS IT GROUP-UNSP ADR | AMADY | PINK |

| BANCO BILBAO VIZCAYA-SP ADR | BBVA | NYSE |

| BANCO DE SABADELL-UNSPON ADR | BNDSY | PINK |

| BANCO SANTANDER SA-SPON ADR | SAN | NYSE |

| BANKIA SA-UNSP ADR | BNKXY | PINK |

| BANKINTER SA-SPONS ADR | BKNIY | PINK |

| CAIXABANK- UNSPON ADR | CAIXY | PINK |

| CELLNEX TELECOM SAU-UNSP ADR | CLLNY | PINK |

| EBRO FOODS SA -UNSP ADR | EBRPY | PINK |

| ENAGAS-UNSPONSORED ADR | ENGGY | PINK |

| ENDESA SA-UNSP ADR | ELEZY | PINK |

| FERROVIAL SA-UNSPONSORED ADR | FRRVY | PINK |

| FOMENTO DE CONST-UNSPON ADR | FMOCY | PINK |

| GRIFOLS SA-ADR | GRFS | NASDAQ |

| GRIFOLS SA-SPON ADR | GIKLY | PINK |

| IBERDROLA SA-SPONSORED ADR | IBDRY | PINK |

| INDITEX-UNSPON ADR | IDEXY | PINK |

| INDRA SISTEMAS SA-UNSP ADR | ISMAY | PINK |

| MAPFRE SA-UNSP ADR | MPFRY | PINK |

| NATURGY ENERGY GROUP SA-ADR | GASNY | PINK |

| PROSEGUR CASH SA - UNSP ADR | PGUCY | PINK |

| RED ELECTRICA COR-UNSPON ADR | RDEIY | PINK |

| REPSOL SA-SPONSORED ADR | REPYY | PINK |

| TELEFONICA SA-SPON ADR | TEF | NYSE |

| TELEFONICA SA-SPON ADR | TNE2 | IBIS |

| TELEFONICA SA-SPON ADR | TEFN | MEXI |

| ABENGOA SA-UNSPON ADR | ABGOY | PINK |

| ABERTIS INFRAESTR-UNSPON ADR | ABRTY | VALUE |

| ATRESMEDIA CORP DE -UNSP ADR | ATVDY | PINK |

| BOLSAS Y MERCADOS ESP-UN ADR | BOLYY | VALUE |

| DISTRIBUIDORA INT-UNSP ADR | DIDAY | PINK |

| GAMESA CORP TECN-UNSPON ADR | GCTAY | PINK |

| PROMOTORA DE INFORMA-ADR | PRISY | PINK |

Shares Subject To The Spanish Financial Transaction Tax

The following table lists the companies included in the scope of the Spanish Financial Transaction Tax as of December 2020. Based on the Spanish declaration, companies meeting the following qualifications would fall within the scope of the FTT:

- The shares must have been admitted to trading on a regulated market which may be the Spanish market, a market of another European Union Member state or an equivalent market in a third country

- The company's market capitalization must exceed EUR 1,000 million as of December 1 of the year preceding the year that the acquisition takes place (reviewed annually)

The list of companies provided below is being done on a best efforts basis and may be subject to ammendments at any time and without notification.

The list of ADRs which are subject to the Spanish Financial Transaction Tax are detailed at the bottom of this page.

| Company Name | Symbol | Exchange |

| ACS ACTIVIDADES CONS Y SERV | ACS | BM |

| ACERINOX SA | ACX | BM |

| ACERINOX SA | ACXN | MEXI |

| AENA SME SA | AENA | BM |

| AENA SME SA | AENAN | MEXI |

| CORPORACION FINANCIERA ALBA | ALB | BM |

| ALMIRALL SA | ALM | BM |

| AMADEUS IT GROUP SA | AMS2 | BM |

| ACCIONA SA | ANA | BM |

| APPLUS SERVICES SA | APPS | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | BM |

| BANCO BILBAO VIZCAYA ARGENTA | BBVA | MEXI |

| BANKIA SA | BKIA | BM |

| BANKIA SA | BKIAN | MEXI |

| BANKINTER SA | BKT | BM |

| BANKINTER SA | BKTN | MEXI |

| BANCO SANTANDER SA | BNC | LSE |

| CAIXABANK S.A | CABK | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAF | BM |

| CONSTRUCC Y AUX DE FERROCARR | CAFEN | MEXI |

| PROSEGUR CASH SA | CASH2 | BM |

| PROSEGUR CASH SA | CASHN | MEXI |

| CIE AUTOMOTIVE SA | CIE | BM |

| CIE AUTOMOTIVE SA | CIEAN | MEXI |

| CELLNEX TELECOM SA | CLNX | BM |

| CELLNEX TELECOM SA | CLNXN | MEXI |

| INMOBILIARIA COLONIAL SOCIMI | COL | BM |

| AMREST HOLDINGS SE | EAT | WSE |

| AMREST HOLDINGS SE | EAT | BM |

| AMREST HOLDINGS SE | EATN | MEXI |

| EBRO FOODS SA | EBRO | BM |

| EDP RENOVAVEIS SA | EDPR | BVL |

| EUSKALTEL SA | EKT1 | BM |

| EUSKALTEL SA | EKTN | MEXI |

| ENDESA SA | ELE | BM |

| ENDESA SA | ELE1N | MEXI |

| ENAGAS SA | ENG | BM |

| FAES FARMA SA - | FAE | BM |

| FOMENTO DE CONSTRUC Y CONTRA | FCC | BM |

| FLUIDRA SA | FDR | BM |

| FLUIDRA SA | FDRN | MEXI |

| FERROVIAL SA | FER | BM |

| SIEMENS GAMESA RENEWABLE ENE | GAM | BM |

| NATURGY ENERGY GROUP SA | GAS | BM |

| GRUPO CATALANA OCCIDENTE SA | GCO | BM |

| GRUPO CATALANA OCCIDENTE SA | GCON | MEXI |

| GESTAMP AUTOMOCION SA | GEST | BM |

| GESTAMP AUTOMOCION SA | GESTN | MEXI |

| GRIFOLS SA | GRF | BM |

| GRIFOLS SA - B | GRF.P | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAG | LSE |

| INTL CONSOLIDATED AIRLINE-DI | IAG | BM |

| INTL CONSOLIDATED AIRLINE-DI | IAGN | MEXI |

| IBERDROLA SA | IBE | BM |

| IBERDROLA SA | IBEN | MEXI |

| INDRA SISTEMAS S.A. | IDR | BM |

| INDUSTRIA DE DISENO TEXTIL | ITX | BM |

| INDUSTRIA DE DISENO TEXTIL | ITXN | MEXI |

| CIA DE DISTRIBUCION INTEGRAL | LOG | BM |

| MAPFRE SA | MAP | BM |

| MELIA HOTELS INTERNATIONAL | MEL | BM |

| MELIA HOTELS INTERNATIONAL | MELN | MEXI |

| MERLIN PROPERTIES SOCIMI SA | MRL | BM |

| NH HOTEL GROUP SA | NHH | BM |

| PHARMA MAR SA | PHM | BM |

| PHARMA MAR SA | PHM1N | MEXI |

| PROSEGUR COMP SEGURIDAD | PSG | BM |

| RED ELECTRICA CORPORACION SA | REE | BM |

| RED ELECTRICA CORPORACION SA | REEN | MEXI |

| REPSOL SA | REP | BM |

| REPSOL SA | REPSN | MEXI |

| LABORATORIOS FARMACEUTICOS R | ROVI | BM |

| BANCO DE SABADELL SA | SAB2 | BM |

| BANCO SANTANDER SA | SAN | MEXI |

| BANCO SANTANDER SA | SAN | WSE |

| BANCO SANTANDER SA | SAN1 | BM |

| SACYR SA | SCYR | BM |

| SIEMENS GAMESA RENEWABLE ENE | SGREN | MEXI |

| SOLARIA ENERGIA Y MEDIO AMBI | SLR | BM |

| TELEFONICA SA | TEF | BM |

| TELEFONICA SA | TEF1N | MEXI |

| TELEFONICA SA | TEFOF | PINK |

| MEDIASET ESPANA COMUNICACION | TL5 | BM |

| MEDIASET ESPANA COMUNICACION | TL5N | MEXI |

| UNICAJA BANCO SA | UNI2 | BM |

| VIDRALA SA | VID | BM |

| VISCOFAN SA | VIS | BM |

| VISCOFAN SA | VISCN | MEXI |

| ZARDOYA OTIS SA | ZOT | BM |

| ZARDOYA OTIS SA | ZOTN | MEXI |

The following is a list of ADRs which are subject to the Spanish Financial Transaction Tax.

| Company Name | Symbol | Exchange |

| ACERINOX SA-UNSPON ADR | ANIOY | PINK |

| ACS ACTIVIDADES CONS-UNS ADR | ACSAY | PINK |

| AENA SME SA-ADR | ANYYY | PINK |

| AMADEUS IT GROUP-UNSP ADR | AMADY | PINK |

| BANCO BILBAO VIZCAYA-SP ADR | BBVA | NYSE |

| BANCO DE SABADELL-UNSPON ADR | BNDSY | PINK |

| BANCO SANTANDER SA-SPON ADR | SAN | NYSE |

| BANKIA SA-UNSP ADR | BNKXY | PINK |

| BANKINTER SA-SPONS ADR | BKNIY | PINK |

| CAIXABANK- UNSPON ADR | CAIXY | PINK |

| CELLNEX TELECOM SAU-UNSP ADR | CLLNY | PINK |

| EBRO FOODS SA -UNSP ADR | EBRPY | PINK |

| ENAGAS-UNSPONSORED ADR | ENGGY | PINK |

| ENDESA SA-UNSP ADR | ELEZY | PINK |

| FERROVIAL SA-UNSPONSORED ADR | FRRVY | PINK |

| FOMENTO DE CONST-UNSPON ADR | FMOCY | PINK |

| GRIFOLS SA-ADR | GRFS | NASDAQ |

| GRIFOLS SA-SPON ADR | GIKLY | PINK |

| IBERDROLA SA-SPONSORED ADR | IBDRY | PINK |

| INDITEX-UNSPON ADR | IDEXY | PINK |

| INDRA SISTEMAS SA-UNSP ADR | ISMAY | PINK |

| MAPFRE SA-UNSP ADR | MPFRY | PINK |

| NATURGY ENERGY GROUP SA-ADR | GASNY | PINK |

| PROSEGUR CASH SA - UNSP ADR | PGUCY | PINK |

| RED ELECTRICA COR-UNSPON ADR | RDEIY | PINK |

| REPSOL SA-SPONSORED ADR | REPYY | PINK |

| TELEFONICA SA-SPON ADR | TEF | NYSE |

| TELEFONICA SA-SPON ADR | TNE2 | IBIS |

| TELEFONICA SA-SPON ADR | TEFN | MEXI |

| ABENGOA SA-UNSPON ADR | ABGOY | PINK |

| ABERTIS INFRAESTR-UNSPON ADR | ABRTY | VALUE |

| ATRESMEDIA CORP DE -UNSP ADR | ATVDY | PINK |

| BOLSAS Y MERCADOS ESP-UN ADR | BOLYY | VALUE |

| DISTRIBUIDORA INT-UNSP ADR | DIDAY | PINK |

| GAMESA CORP TECN-UNSPON ADR | GCTAY | PINK |

| PROMOTORA DE INFORMA-ADR | PRISY | PINK |

Information Regarding the Spanish Financial Transaction Tax

Overview

This document provides an overview of how the Spanish Financial Transaction Tax (FTT) will be handled by Interactive Brokers.

Effective January 16, 2021, a new tax will be implemented on the purchase of certain Spanish securities.

Tax Rate

The announced tax is 0.20%.

Scope

The FTT will be applied to shares of Spanish companies whose market capitalisation exceeds EUR 1,000 million as of December 1 of the year preceding the year that the acquisition takes place. The shares must have been admitted to trading on a regulated market which may be the Spanish market, a market of another European Union Member state or an equivalent market in a third country. The Spanish Ministry of Finance will publish a list of Spanish companies with a market cap exceeding this threshold by December 31 each year. The Ministry of Finance will review and republish the list the first month the FTT is in place.

The following cases are subject to the Spanish FTT:

- Shares acquired on an exchange transaction

- Shares acquired on the execution or settlement of fixed-income securities which may be converted or exchanged for shares

- Shares acquired as a result of execution or settlement of financial derivatives (i.e. stock option exercise/assignment)

- Shares acquired from the execution of finance contracts defined in article 2.1 of Order EHA3537/2005 (contracts not traded on official secondary markets for which a credit institution receives money or securities from customers assuming a repayment obligation)

Accrual

Tax becomes payable on the settlement date of the transaction

Tax Base

There will be a special calculation for intra-day transactions. Therefore, only the net settlement will be taxed.

Сводки рыночных данных

ВВОДНАЯ ИНФОРМАЦИЯ

Клиенты IBKR могут узнать цену отдельного инструмента в реальном времени по запросу. Такие запросы – "Сводные котировки" – отличаются от традиционных сервисов, представляющих собой непрерывно обновляемый поток цен в реальном времени. Сводные котировки являются экономичной альтернативой для клиентов, которые не ведут регулярную торговлю и не хотят при отправке ордера опираться на данные с задержкой1. Дополнительная информация о таких котировках приведена ниже.

ДАННЫЕ КОТИРОВКИ

В сводную котировку входит следующая информация:

- Последняя цена

- Последний размер

- Последняя биржа

- Текущий бид-аск

- Размер каждого текущего бида-аска

- Биржа для каждого текущего бида-аска

ДОСТУПНЫЕ СЕРВИСЫ

| Сервис | Ограничения | Цена запроса котировки (USD)2 |

|---|---|---|

| AMEX (Network B/CTA) | $0.01 | |

| ASX Total | Без доступа к ASX24. Только для непрофессиональных подписчиков |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| Canadian Exchange Group (TSX/TSXV) | Только для непрофессиональных подписчиков, не являющихся клиентами IB Canada | $0.03 |

| CBOT Real-Time | $0.03 | |

| CME Real-Time | $0.03 | |

| COMEX Real-Time | $0.03 | |

| Eurex Core | Только для непрофессиональных подписчиков | $0.03 |

| Euronext Basic | Только для непрофессиональных подписчиков Включает акции, индексы, а также деривативы акций и индексов Euronext. |

$0.03 |

| German ETF's and Indices | Только для непрофессиональных подписчиков | $0.03 |

| Hong Kong (HKFE) Derivatives | $0.03 | |

| Hong Kong Securities Exchange (Stocks, Warrants, Bonds) | $0.03 | |

| Johannesburg Stock Exchange | $0.03 | |

| Montreal Derivatives | Только для непрофессиональных подписчиков | $0.03 |

| NASDAQ (Network C/UTP) | $0.01 | |

| Nordic Derivatives | $0.03 | |

| Nordic Equity | $0.03 | |

| NYMEX Real-Time | $0.03 | |

| NYSE (Network A/CTA) | $0.01 | |

| OPRA (US Options Exchanges) | $0.03 | |

| Shanghai Stock Exchange, 5-сек. сводка (через HKEx) | $0.03 | |

| Shenzhen Stock Exchange, 3-сек. сводка (через HKEx) | $0.03 | |

| SIX Swiss Exchange | Только для непрофессиональных подписчиков | $0.03 |

| Spot Market Germany (Frankfurt/Xetra) | Только для непрофессиональных подписчиков | $0.03 |

| STOXX Index Real-Time Data | Только для непрофессиональных подписчиков | $0.03 |

| Toronto Stk Exchange | Только для непрофессиональных подписчиков-клиентов IB Canada | $0.03 |

| TSX Venture Exchange | Только для непрофессиональных подписчиков-клиентов IB Canada | $0.03 |

| UK LSE (IOB) Equities | $0.03 | |

| UK LSE Equities | $0.03 |

1Согласно требованиям регулятивных органов, IBKR больше не предлагает котировки с задержкой для акций США клиентам Interactive Brokers LLC.

2Цена указана для каждого запроса сводной котировки; конвертируется в базовую валюту счета, если в качестве нее не установлена USD.

УСЛОВИЯ

- Для запроса сводных котировок на счете должен быть минимальный капитал для активации и продления подписки на рыночные данные.

- Должна быть установлена TWS версии 976.0 или новее.

ИНФОРМАЦИЯ О ПЛАТЕ

- Каждый месяц клиентам бесплатно предоставляются сводки котировок на $1.00. Бесплатные сводки можно использовать для запроса котировок США и иностранных бирж, а после того, как будут израсходованы бесплатные запросы, начнет взиматься плата без дополнительного уведомления. Количество запрошенных сводок можно узнать в конце рабочего дня на "Портале клиентов".

- Плата за котировки взимается не сразу – обычно это происходит в первую неделю следующего месяца. Если на счете недостаточный денежный баланс или стоимость капитала с кредитом для покрытия всей стоимости, то позиции на счете могут быть ликвидированы.

- Максимальная плата за сводки за месяц равна ежемесячной цене соответствующего сервиса потоковых данных в реальном времени. При достижении этой суммы оставшуюся часть месяца клиенту будут предоставляться потоковые котировки без дополнительной платы. Переход на потоковые котировки произойдет примерно в 18:30 EST (по восточному времени) на следующий рабочий день после достижения лимита сводок. В конце месяца потоковый сервис будет автоматически аннулирован, а счетчик сводных котировок сброшен. Для каждого сервиса установлен свой лимит, и запросы по одному сервису не суммируются с другими запросами. Ниже приведена сравнительная таблица.

| Сервис | Цена запроса котировки (USD) | Лимит для непрофессиональных подписчиков (запросы/общая стоимость)2 | Лимит для профессиональных подписчиков (запросы/общая стоимость)3 |

|---|---|---|---|

| AMEX (Network B/CTA) | $0.01 | 150/$1.50 | 2 300/$23.00 |

| NASDAQ (Network C/UTP) | $0.01 | 150/$1.50 | 2 500/$25.00 |

| NYSE (Network A/CTA) | $0.01 | 150/$1.50 | 4 500/$45.00 |

ЗАПРОС СВОДНЫХ КОТИРОВОК

Настольная версия TWS (классическая раскладка):

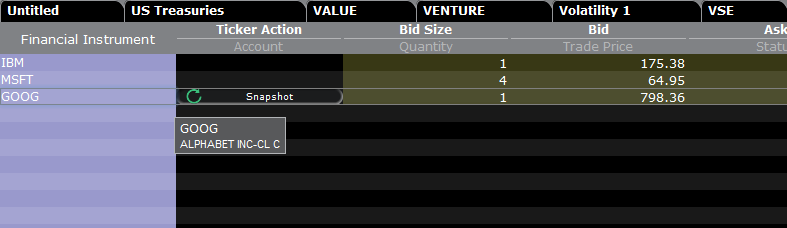

Если Вы используете данные с задержкой и имеете разрешение на сводные котировки, то в столбце Действие тикера (Ticker Action) увидите кнопку Сводка (Snapshot):

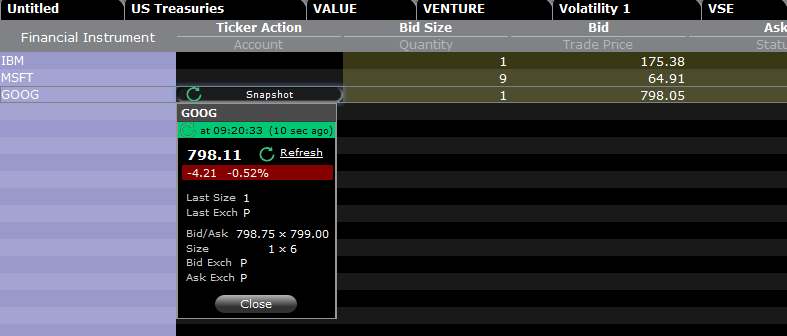

Если нажать на кнопку Сводка, данные будут загружены в окно деталей котировки. В момент получения котировки NBBO и другой информации символа будет зафиксировано время:

Если нажать Обновить (Refresh), данные котировки NBBO будут обновлены.

Пример:

В случае выше GOOG – это символ, котируемый на NASDAQ (Network C/UTP). За каждый запрос (сводку) взимается 0,01 USD.

- Непрофессионалы могут запросить еще 149 сводок по GOOG или любым другим акциям, котируемым на NASDAQ (Network C/UTP), после чего сервис переключится на потоковую передачу данных.

- Профессионалы могут запросить еще 2 499 сводок по GOOG или любым другим акциям, котируемым на NASDAQ (Network C/UTP), после чего сервис переключится на потоковую передачу данных.

Плата будет взиматься только за запросы в пределах лимита, а по его достижении начисление сборов прекратится, и весь оставшийся месяц Вы будете получать потоковые котировки по этому сервису.

Настольная версия TWS (раскладка Mosaic):

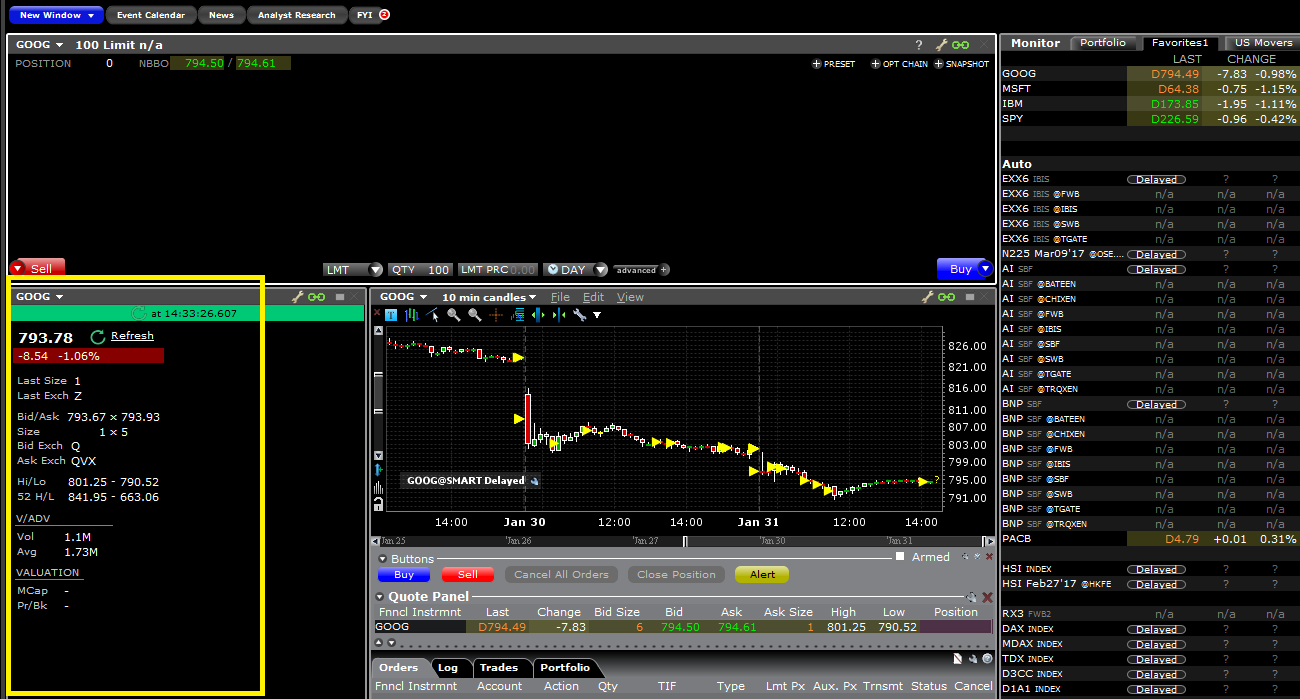

Если Вы используете данные с задержкой и имеете разрешение на сводные котировки, то выберите строку на вкладке "Монитор" (Monitor), и в окне ввода ордеров отобразится кнопка запроса сводки (+SNAPSHOT).

Если нажать на кнопку +СВОДКА, данные будут загружены в окно деталей котировки. В момент получения котировки NBBO и другой информации о символе будет зафиксировано время:

Если нажать Обновить (Refresh), данные котировки NBBO будут обновлены.

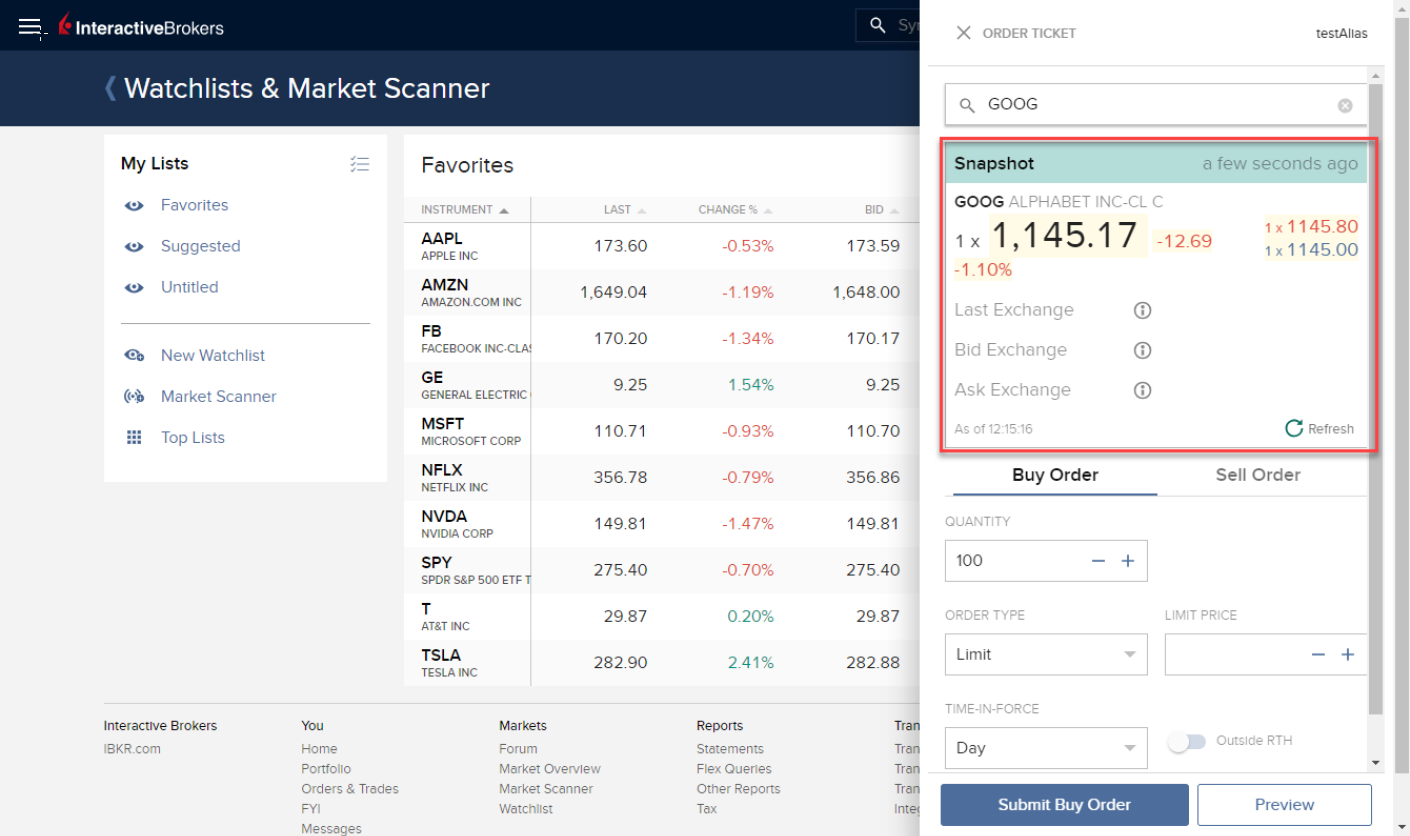

Портал клиентов:

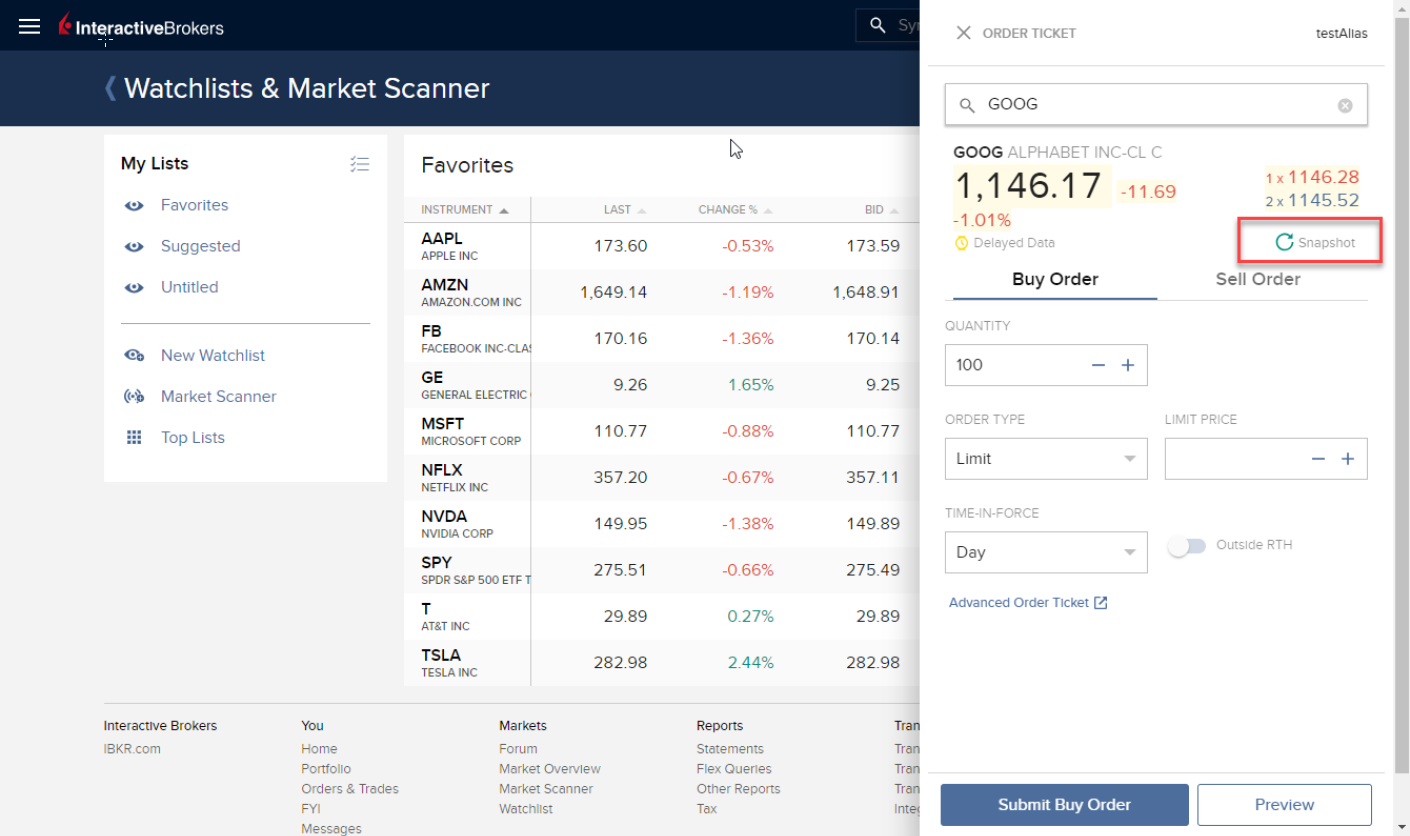

Если Вы используете данные с задержкой и имеете разрешение на сводные котировки, то в окне тикета ордера под ценами бида/аска увидите кнопку Сводка (Snapshot):

Если нажать Сводка, данные будут загружены в окно деталей котировки. В момент получения котировки NBBO будет зафиксировано время:

Если нажать Обновить (Refresh), данные котировки NBBO будут обновлены.

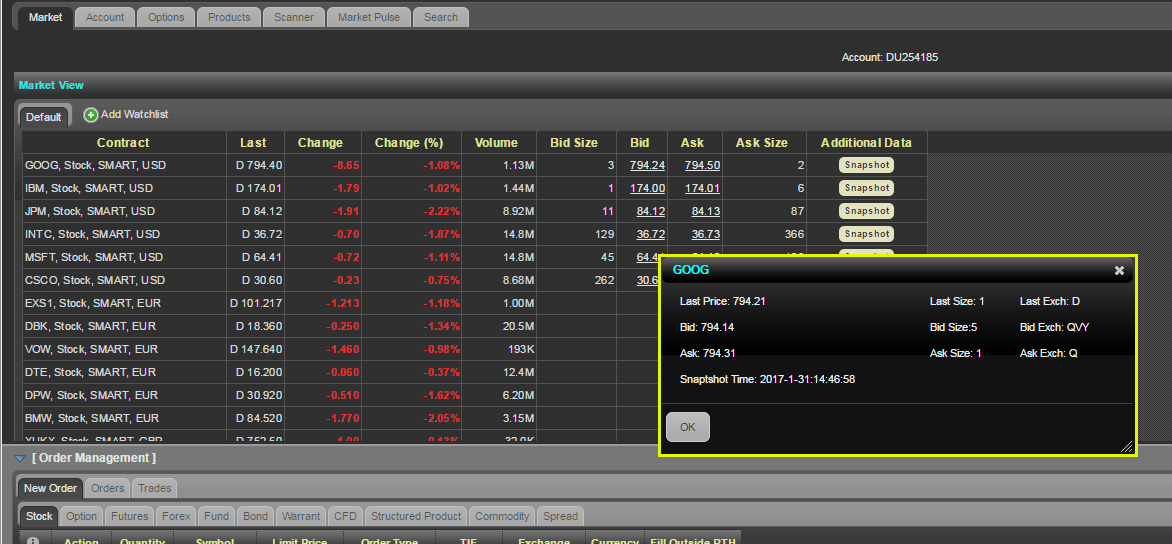

Веб-торговля – WebTrader:

Если Вы используете данные с задержкой и имеете разрешение на сводные котировки, то открыв вкладку "Рынок", Вы увидите кнопку Сводка в столбце Дополнительные данные:

При нажатии на кнопку Сводка данные будут загружены в окно деталей котировки. В момент получения котировки NBBO будет зафиксировано время:

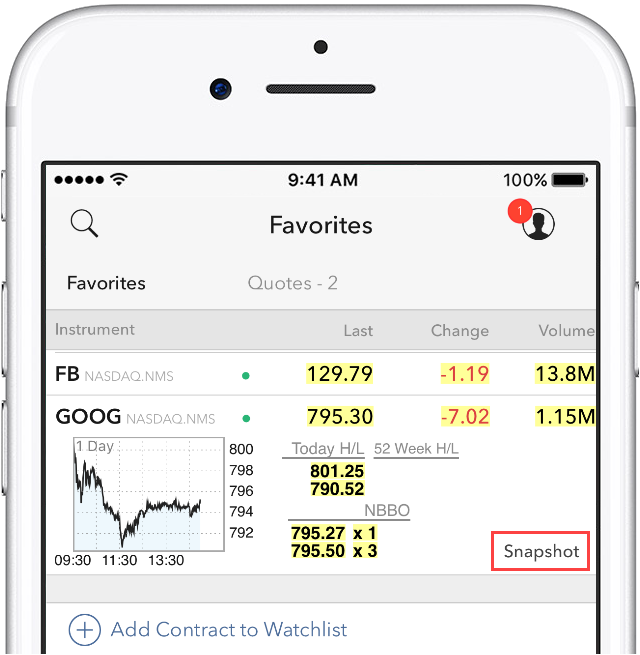

Мобильное приложение IBKR Mobile:

В окне котировок нажмите на символ, отобразится поле с его данными. Если Вы используете данные с задержкой и имеете разрешение на сводные котировки, то увидите кнопку Сводка (Snapshot):

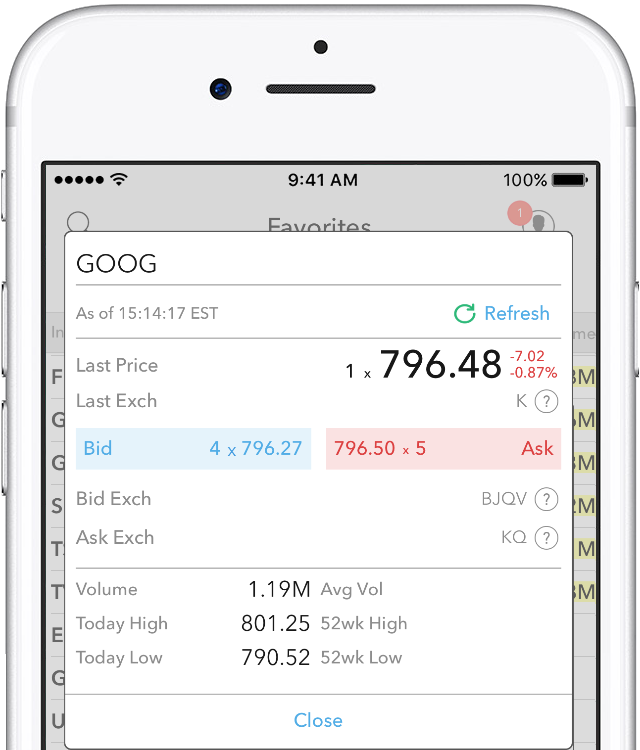

Нажмите на кнопку Сводка, данные будут загружены в окно деталей котировки. В момент получения котировки NBBO и другой информации символа будет зафиксировано время:

Общие сведения о расчете платы за риск

Введение

Практика IBKR по глобальному управлению рисками включает в себя ежедневный расчет, в ходе которого каждый клиентский портфель проходит стресс-тест, с целью определить уровень его подверженности ценовым изменениям, выходящим за пределы гарантийного обеспечения клиента. Эти тесты помогают выявить счета, которые, несмотря на свое соответствие маржинальным требованиям, в худшем случае могут понести убытки, превосходящие их текущий капитал. В попытке повысить осведомленность клиентов об их потенциальных рисках компания IBKR ввела ежедневную плату, которая взимается со всех счетов с непокрытым риском, выходящим за определенные пределы в конце дня.

Обзор текущей платы за риск

В текущем виде плата за риск применяется к акциям, волатильности акций, а также неочищенной и обработанной нефти. Interactive Brokers симулируют прибыльные и убыточные сценарии для всех счетов, основываясь на теоретических движениях рынка различной интенсивности. По каждому из сценариев вычисляется общая прибыль и убытки, а затем из самого крупного убытка, если он есть, вычитается чистая ликвидационная стоимость счета, чтобы определить, превышают ли потенциальные потери Ваш капитал. При наличии такой непокрытой части взимается ежедневная плата за риск.

Изменение расчета платы за риск (вступает в силу 19 марта 2018 года)

Текущий принцип расчета платы за риск будет изменен с целью охвата более полного спектра рыночных сценариев и зависимости цен между ранее не учитываемыми типами продуктов. Новый метод базируется на алгоритме Монте-Карло, рассматривающем тысячи симулированных рыночных сценариев и прогнозирующем подверженность Вашего портфеля риску согласно предполагаемому изменению цен в различных секторах (напр., такие отдельные акции и сектора, как нефть, газ, мясо, сахар, какао, металлы, иностранная и криптовалюта); этот принцип применяется ко всем остальным продуктам на основе их отношения к конкретному сектору.

Контроль платы за риск

Впервые определив необходимость платы за риск, мы отправляем уведомление владельцу счета, чтобы разъяснить ситуацию и дать ему неделю на корректировку позиций и капитала, прежде чем сбор, если он все еще будет применим, вступит в силу. Чтобы помочь клиентам предотвратить или снизить данный сбор, IBKR предоставляет ежедневный отчет "Расчет платы за риск" в "Управлении счетом". Он содержит подробную информацию о плате, а также примеры гипотетических корректировок портфеля, которые по прогнозам помогли бы уменьшить сумму сбора.

Основные факторы риска

Портфели будут оцениваться путем стресс-теста каждого из основных факторов риска, связанных с определенным индексом или ETF, а все другие продукты в составе портфеля будут корректироваться согласно их связи с рассматриваемым фактором.

Ниже приведена сводка факторов риска, соответствующих им индексов или ETF, а также пределов, на основе которых производится стресс-тест.

|

Фактор риска

|

Инструмент

|

Нижний предел

|

Верхний предел

|

|

Ценные бумаги

|

SPX

|

-30.00%

|

20.00%

|

|

Отдельные акции

|

|

-50%

|

50%

|

|

Какао

|

CHOC

|

-31.80%

|

47.40%

|

|

Хлопок

|

COTN

|

-50%

|

50%

|

|

Крипто

|

NYXBT

|

-100%

|

93.90%

|

|

Газ

|

UNG

|

-19.70%

|

84.90%

|

|

Пром. металлы

|

DBB

|

-29.50%

|

29.30%

|

|

Мясо

|

COW

|

-15.00%

|

21.40%

|

|

Нефть

|

USO

|

-18.80%

|

62.00%

|

|

Драг. металлы

|

DBP

|

-28.70%

|

32.30%

|

|

Сахар

|

SGG

|

-34.50%

|

52.30%

|

|

Казначейские облигации

|

TLT

|

-19.80%

|

15.60%

|

|

Пшено

|

OD7S

|

-40.90%

|

64.70%

|

| Соевые бобы | SOYB | -22.6% | 27.4% |

| Кукуруза | CORN | -23.5% | 41.5% |

|

Факторы риска Forex

|

Нижний предел

|

Верхний предел

|

|

AUD

|

-18.10%

|

18.10%

|

|

CAD

|

-13.70%

|

13.70%

|

|

CHF

|

-13.90%

|

13.90%

|

|

CNH

|

-8.20%

|

8.20%

|

|

CNY

|

-6.70%

|

6.70%

|

|

CZK

|

-9.50%

|

9,50%

|

|

DKK

|

-7.90%

|

7.90%

|

|

EUR

|

-9.90%

|

9.90%

|

|

GBP

|

-13.00%

|

13.00%

|

|

HKD

|

-8.00%

|

8,00%

|

|

HUF

|

-20.50%

|

20.50%

|

|

ILS

|

-8.80%

|

8.80%

|

|

INR

|

-12.40%

|

12.40%

|

|

JPY

|

-16.80%

|

16.80%

|

|

KRW

|

-18.00%

|

18.00%

|

|

MXN

|

-16.70%

|

16.70%

|

|

NOK

|

-12.90%

|

12.90%

|

|

NZD

|

-14.60%

|

14.60%

|

|

PLN

|

-31.40%

|

31.40%

|

|

RUB

|

-27.80%

|

27.80%

|

|

SEK

|

-13.20%

|

13.20%

|

|

SGD

|

-6.30%

|

6.30%

|

|

TRY

|

-40.10%

|

40.10%

|

|

USD

|

-9.30%

|

9.30%

|

|

ZAR

|

-19.00%

|

19.00%

|

Дополнительная информация об отчете "Расчет платы за риск" доступна в статье KB3113.

Exposure Fee Calculations Overview

Introduction

IBKR's global risk management routine includes a daily execution of computations through which each client’s portfolio is stress tested to determine its exposure to a series of prices changes beyond that protected by margin. These stress tests serve to identify accounts that, while margin compliant, project losses which exceed the account’s equity were these scenarios to be realized and which IBKR regards as excessive. In an effort to increase client awareness as to their potential exposure, IBKR has implemented a daily Exposure Fee, that is assessed to any account reporting end of day uncovered risk in excess of specified levels.

Current Exposure Fee Overview

The current Exposure Fee calculation is intended to reflect a more comprehensive set of market scenarios in addition to price dependencies among all products types. The calculation is based upon a Monte Carlo simulation which incorporates thousands of market scenarios and projects the exposure of your portfolio assuming sector-based price changes (e.g., individual stock and sectors such as oil, gas, meat, sugar, cocoa, metals, foreign exchange & crypto-currencies), and then applying this evaluation to all other products based upon their respective sector correlation.

Managing the Exposure Fee

At the initial point an account is detected as being subject to the Exposure Fee, a communication will be sent out explaining the fee and affording the account holder one week to adjust positions and equity before the Fee, if still applicable, will take effect. To assist with avoidance or mitigation of the Fee, IBKR provides a daily Exposure Fee Calculation report via Account Management which details the Fee and provides examples of hypothetical adjustments to existing positions which, if implemented, are projected to reduce the Fee given information then available.

Primary Risk Factors

Each portfolio will be re-valued based upon stressing each primary risk factor, which is represented by a future contract, index or ETF, and all other product(s) in the portfolio will adjusted based upon their correlation associated with that primary risk factor.

Below is a summary of each risk factor, the representing Future Contract, Index or ETF, and the upper and lower range in which we stress each risk factor.

| Risk Factors | Product | Lower Bound | Upper Bound |

| Equity | S&P 500 Index (SPX) | -30.00% | 20.00% |

| Australia Equity | S&P 500 / ASX 200 Index Australia Index (AP) | -30.00% | 20.00% |

| United Kingdom Equity | FTSE 100 Index (Z) | -30.00% | 20.00% |

| European Equity | Dow Jones Euro STOXX50 Index (ESTX50) | -30.00% | 20.00% |

| Hong Kong Equity | Hang Seng Index (HSI) | -30.00% | 20.00% |

| Japanese Equity | Nikkei 225 Index (N225) | -30.00% | 20.00% |

| Korean Equity | Korean Stock Exchange KOSPI 200 Index (K200) | -30.00% | 20.00% |

| Mainland China Equity | FTSE China A50 Index (XINA50) | -30.00% | 20.00% |

| Indian Equity | CNX NIFTY Index (NIFTY) | -30.00% | 20.00% |

| Individual Stocks | -50.00% | 50.00% | |

| Oil (Crude Oil) | Light Sweet Crude Oil Futures | -32.00% | 62.00% |

| Oil (Brent Oil) | Brent Crude Oil Futures | -30.00% | 60.00% |

| CO2 | ICE ECX EUA Futures (ECF) | -74.30% | 59.50% |

| Treasury | iShares 20+ Year Treasury Bond ETF (TLT) | -19.80% | 15.60% |

| Treasury1 | iShares 1-3 Year Treasury Bond ETF (SHY) | -1.80% | 1.20% |

| Treasury2 | iShares 1-3 Year International Treasury Bond ETF (ISHG) | -9.80% | 10.00% |

| Italian Govt Bond | Euro-BTP Italian Government Bond | -13.00% | 13.00% |

| BAX | 3 Month Canadian Bankers' Acceptance Futures | -0.40% | 0.40% |

| EuroBund | Euro Fund (10 Year Bond - GBL) | -7.60% | 8.60% |

| JGB | Japanese Government Bonds (JGB) | -2.20% | 2.20% |

| Live Cattle | Live Cattle (LE) | -30.00% | 30.00% |

| Feeder Cattle | Feeder Cattle (GF) | -30.00% | 30.00% |

| Hogs | Lean Hogs Index (HE) | -30.00% | 30.00% |

| Ind. Metals. | COMEX Copper Index (HG) | -25.30% | 22.10% |

| Prec. Metals | SPDR Gold Shars (GLD) | -20.70% | 34.50% |

| Silver | COMEX Silver Index (SI) | -26.20% | 28.80% |

| Wheat | ETFS Wheat (OD7S) | -40.90% | 64.70% |

| Corn | Teucrium Corn Fund (CORN) | -23.50% | 41.50% |

| Soybean | Teucrium Soybean Fund (SOYB) | -22.60% | 27.40% |

| Rice | Rough Rice Futures (ZR) | -22.60% | 27.40% |

| Cocoa | iPath Bloomberg Cocoa Subindex Total Return (NIB) | -28.60% | 37.40% |

| Gas | United States Natural Gas Fund (UNG) | -18.80% | 62.00% |

| Crypto | The NYSE bitcoin Index (NYXBT) | -100.00% | 93.90% |

| Sugar | iPath Bloomberg Sugar Subindex Total Return (SGGFF) | -34.50% | 52.30% |

| Cotton | ETFS Cotton (COTN) | -50.00% | 50.00% |

| Coffee | iPath Bloomberg Coffee Subindex Total Return (JJOFF) | -30.00% | 50.00% |

| Lumber | Random Length Lumber (LB) | -30.00% | 30.00% |

| Milk | Milk Class III Index (DA) | -15.00% | 15.00% |

| Orange Juice | FC Orange Juice "A" (OJ) | -35.00% | 35.00% |

| Forex Risk Factor | Lower Bound | Upper Bound |

| AUD | -18.10% | 18.10% |

| BGN | -6.80% | 6.80% |

| BRL | -17.00% | 17.00% |

| CAD | -13.70% | 13.70% |

| CHF | -13.90% | 13.90% |

| CNH | -8.20% | 8.20% |

| CNY | -6.70% | 6.70% |

| CYP | -7.20% | 7.20% |

| CZK | -9.50% | 9.50% |

| DKK | -7.90% | 7.90% |

| EEK | -5.50% | 5.50% |

| EUR | -9.90% | 9.90% |

| GBP | -13.00% | 13.00% |

| HKD | -8.00% | 8.00% |

| HRK | -7.00% | 7.00% |

| HUF | -20.50% | 20.50% |

| ILS | -8.80% | 8.80% |

| INR | -12.40% | 12.40% |

| ISK | -9.90% | 9.90% |

| JPY | -16.80% | 16.80% |

| KRW | -18.00% | 18.00% |

| LTL | -7.20% | 7.20% |

| LVL | -7.00% | 7.00% |

| MTL | -7.20% | 7.20% |

| MXN | -16.70% | 16.70% |

| NOK | -12.90% | 12.90% |

| NZD | -14.60% | 14.60% |

| PLN | -31.40% | 31.40% |

| RON | -6.90% | 6.90% |

| RUB | -40.00% | 40.00% |

| SEK | -13.20% | 13.20% |

| SGD | -6.30% | 6.30% |

| SIT | -7.20% | 7.20% |

| SKK | -7.20% | 7.20% |

| TRY | -40.10% | 40.10% |

| TWD | -14.20% | 14.20% |

| USD | -9.30% | 9.30% |

| ZAR | -19.00% | 19.00% |

For additional information concerning this Exposure Fee Calculation report, please see KB3113.