盈透证券欢迎您

现在您的账户已完成入金并获批,您可以开始交易了。以下信息可以帮助您入门。

- 您的资金

- 设置您的账户以进行交易

- 如何交易

- 在全球范围进行交易

- 拓展您IB经验的五个要点

1. 您的资金

存款&取款基本信息。所有转账都通过您的账户管理进行管理

存款

首先,通过您的账户管理 > 资金 > 资金转账 > 转账类型:“存款”创建一个存款通知(如何创建存款通知)。 第二步,通知您的银行进行电汇转账,在存款通知中提供详细银行信息。

取款

通过您的账户管理 > 资金 > 资金转账 > 转账类型:“取款”创建一个取款指令(如何创建取款指令)

如果您通知要进行超出取款限额的取款,则会被视为异常取款,我们因此将需要匹配银行账户持有人和IB账户。如果目的地银行账户已被用作存款,那么取款将会被处理;否则,您必须联系客户服务并提供所需文件。

错误排查

存款:我的银行发出了资金,但我没有看到资金记入我的IB账户。可能的原因:

a) 资金转账需要1至4个工作日。

b) 存款通知缺失。您必须通过账户管理创建存款通知并向客户服务发送一条咨询单。

c) 修改详情缺失。转账详情中缺失您的姓名或IB账户号码。您必须联系您的银行索取完整的修改详情。

d) IB发起的ACH存款7个工作日内限额为10万美元。如果您开立的是初始要求为11万美元的投资组合保证金账户,最好选择电汇存款以减少您第一笔交易的等待时间。如果选择ACH,会需要等待近2周时间,或者可以选择临时升级至RegT。

取款:我已经请求了取款,但我没有看到资金记入我的银行账户。可能的原因:

a) 资金转账需要1至4个工作日。

b) 被拒。超出最大取款限额。请检查您账户的现金余额。注意,出于监管要求,存入资金时会有三天置存期,之后才可以被取出。

c) 您的银行退回了资金。可能是因为接收银行账户与汇款银行账户名称不匹配。

2. 设置您的账户以进行交易

现金与保证金账户的区别:如果您选择快速申请,默认您的账户类型为配备美国股票许可的现金账户。如果您想使用杠杆并以保证金交易,参见此处如何升级为RegT保证金账户

交易许可

为了能够交易特定国家的某一特定资产类别,您需要通过账户管理获得该资产类别的交易许可。请注意,交易许可是免费的。但您可能需要签署当地监管部门所要求的风险披露。如何请求交易许可

市场数据

如果想获取某一特定产品/交易所的实时市场数据,您需要订阅交易所收费的市场数据包。如何订阅市场数据

市场数据助手会帮助您选择正确的数据包。请观看该视频,其解释了市场数据助手是如何工作的。

客户可以通过从未订阅的代码行点击免费延时数据按钮选择接收免费的延时市场数据。

顾问账户

请阅读用户指南顾问入门指南。在这里,您可以看到如何向您的顾问账户创建其他使用者以及如何授予其访问权限等等。

3. 如何交易

如果想学习如何使用我们的交易平台,您可以访问交易者大学。在这里您可以找到我们以10种语言提供的实时与录制网研会以及有关交易平台的课程与文档。

交易者工作站(TWS)

要求更高级交易工具的交易者可以使用我们做市商设计的交易者工作站(TWS)。TWS有着便于操作的电子表格式界面,可优化您的交易速度和效率,支持60多种定单类型,配备可适应任何交易风格的特定任务交易工具,并可实时监控账户余额与活动。试试两种不同模式:

魔方TWS:直观可用性,简便的交易准入,定单管理,自选列表与图表全部在一个窗口呈现。

标准模式TWS:为需要更高级工具与算法的交易者提供高级定单管理。

基本描述与信息 / 快速入门指南 / 用户指南

互动课程:TWS基础 / TWS设置 / 魔方TWS

如何下单交易:标准模式TWS视频 / 魔方TWS视频

交易工具:基本描述与信息 / 用户指南

要求:如何安装适用于Windows的Java / 如何安装适用于MAC的Java / 需打开端口4000和4001

登录TWS / 下载TWS

网络交易者(WebTrader)

偏好干净简洁界面的交易者可以使用我们基于HTML的网络交易者。网络交易者便于查看市场数据、提交定单以及监控您的账户与执行。从各浏览器使用最新版本网络交易者

快速入门指南 / 网络交易者用户指南

简介:网络交易者视频

如何下单交易:网络交易者视频

登录网络交易者

移动交易者(MobileTrader)

我们的移动解决方案可供您随时随地用您的IB账户进行交易。IB TWS iOS版和IB TWS BlackBerry版是为这些型号定制设计的,而通用的移动交易者支持大多数其他智能手机。

基本描述与信息

定单类型 可用定单类型与描述 / 视频 / 课程 / 用户指南

模拟交易 基本描述与信息 / 如何获得模拟交易账户

一旦您的模拟交易账户创建成功,您便可用模拟交易账户分享您真实账户的市场数据:账户管理 > 管理账户 > 设置 > 模拟交易

4. 在全球范围进行交易

IB账户为多币种账户。您的账户可以同时持有不同的货币,可供您从一个账户交易全球范围内的多种产品。

基础货币

您的基础货币决定了您报表的转换货币以及用于确定保证金要求的货币。基础货币在您开立账户时决定。客户随时可通过账户管理改变其基础货币。

我们不会自动将货币转换为您的基础货币

货币转换必须由客户手动完成。在该视频中,您可以学习如何进行货币转换。

要开仓以您账户所不持有之货币计价的头寸,您可以有以下两种选择:

A) 货币转换。

B) IB保证金贷款。(对现金账户不可用)

请查看该课程,其解释了外汇交易方法。

5. 拓展您IB经验的五个要点

1. 合约搜索

在这里,您会找到我们的所有产品、代码与说明。

2. IB知识库

IB知识库包含了一系列术语、指导性文章、错误排查技巧以及指南,旨在帮助IB客户管理其IB账户。只需在搜索按钮输入您想要了解的内容,您便会得到答案。

3. 账户管理

我们的交易平台可供您访问市场,账户管理则可供您访问自己的IB账户。使用账户管理可管理账户相关任务,如存入或取出资金、查看您的报表、修改市场数据与新闻订阅、更改交易许可并验证或更改您的个人信息。

登录账户管理 / 账户管理快速入门指南 / 账户管理用户指南

4. 安全登录系统

为向您提供最高级别的在线安全,盈透证券推出了安全登录系统(SLS),通过安全登录系统访问账户需要进行双因素验证。双因素验证旨在于登录时采用两项安全因素确认您的身份:1)您的用户名与密码组合;和2)生成随机、一次性安全代码的安全设备。因为登录账户需要既知晓您的用户名/密码又持有实物安全设备,所以参加安全登录系统基本上可以杜绝除您之外的其他任何人访问您账户的可能性。

如何激活您的安全设备 / 如何获取安全代码卡 / 如何退还安全设备

如果忘记密码或丢失安全代码卡,请联系我们获取即时帮助。

5. 报表与报告

我们的报表与报告方便查看和进行自定义,覆盖了您盈透账户的方方面面。如何查看活动报表

Order Preview - Check Exposure Fee Impact

IB provides a feature which allows account holders to check what impact, if any, an order will have upon the projected Exposure Fee. The feature is intended to be used prior to submitting the order to provide advance notice as to the fee and allow for changes to be made to the order prior to submission in order to minimize or eliminate the fee.

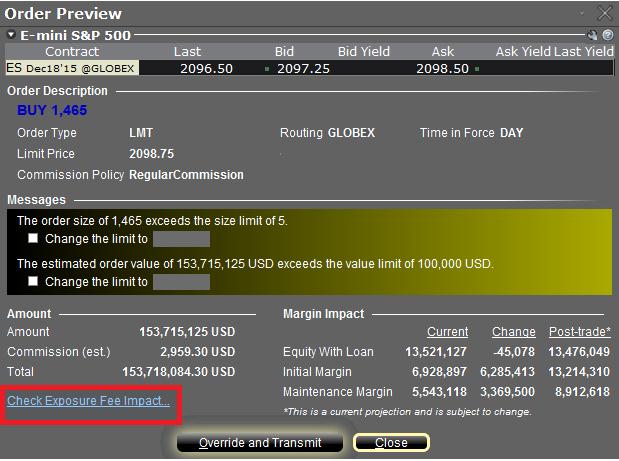

The feature is enabled by right-clicking on the order line at which point the Order Preview window will open. This window will contain a link titled "Check Exposure Fee Impact" (see red highlighted box in Exhibit I below).

Exhibit I

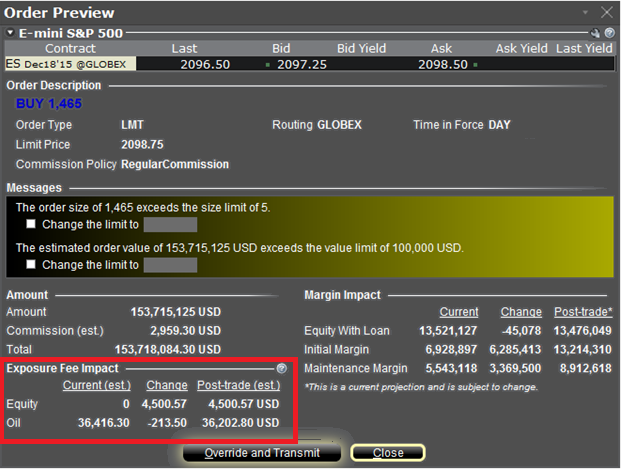

Clicking the link will expand the window and display the Exposure fee, if any, associated with the current positions, the change in the fee were the order to be executed, and the total resultant fee upon order execution (see red highlighted box in Exhibit II below). These balances are further broken down by the product classification to which the fee applies (e.g. Equity, Oil). Account holders may simply close the window without transmitting the order if the fee impact is determined to be excessive.

Exhibit II

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2344 for monitoring fees through the Account Window

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. The Check Exposure Fee Impact is only available for accounts that have been charged an exposure fee in the last 30 days

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Overview of Margin Methodologies

Introduction

Where to Learn More

Tools provided to monitor and manage margin

How to determine if you are borrowing funds from IBKR

Why does IBKR calculate and report a margin requirement when I am not borrowing funds?

Margin Treatment for Foreign Stocks Carried by a U.S. Broker

As a U.S. broker-dealer registered with the Securities & Exchange Commission (SEC) for the purpose of facilitating customer securities transactions, IB LLC is subject to various regulations relating to the extension of credit and margining of those transactions. In the case of foreign equity securities (i.e., non-U.S. issuer), Reg T. allows a U.S. broker to extend margin credit to those which either appear on the Federal Reserve Board's periodically published List of Foreign Margin Stocks, or are deemed to have a have a "ready market" under SEC Rule 15c3-1 or SEC no-action letter.

Prior to November 2012, "ready market" was deemed to include equity securities of a foreign issuer that are listed on what is now known as the FTSE World Index. This definition was based upon a 1993 SEC no-action letter and was premised upon the fact that, while there may not have been a ready market for such securities within the U.S., the securities could be readily resold in the applicable foreign market. In November of 2012, the SEC issued a follow-up no-action letter (www.sec.gov/divisions/marketreg/mr-noaction/2012/finra-112812.pdf) which expanded the population of foreign equity securities deemed to have a ready market to also include those not listed on the FTSE World Index provided that the following four conditions are met:

1. The security is listed on a foreign exchange located within a FTSE World Index recognized country, where the security has been trading on the exchange for at least 90 days;

2. Daily bid, ask and last quotations for the security as provided by the foreign listing exchange are made continuously available to the U.S. broker through an electronic quote system;

3. The median daily trading volume calculated over the preceding 20 business day period of the security on its listing exchange is either at least 100,000 shares or $500,000 (excluding shares purchased by the computing broker);

4. The aggregate unrestricted market capitalization in shares of the security exceed $500 million over each of the preceding 10 business days.

Note: if a security previously meeting the above conditions no longer does so, the broker is provided with a 5 business day window after which time the security will no longer be deemed readily marketable and must be treated as non-marginable.

Foreign equity securities which do not meet the above conditions, will be treated as non-marginable and will therefore have no loan value. Note that for purposes of this no-action letter foreign equity securities do not include options.

Key Margin Definitions

Below is a listing of some of the more commonly used margin terms:

Equity with Loan Value (ELV) – Forms the basis for determining whether a client has the necessary assets to either initiate or maintain security positions. Equals cash + stock value + bond value + mutual fund value + European and Asian options value (excludes market value U.S. securities & futures options and cash maintained in futures segment).

Will IBKR delay liquidation while I deposit funds in my account?

IBKR's margin compliance policy does not allow for transfers or other deposits if there is a margin violation/deficit in the account. In the case of a margin violation/deficit, the account in deficit is immediately subject to liquidation. Automated liquidations are accomplished with market orders, and any/all positions in the account can be liquidated. There are cases where, due to specific market conditions, a deficit is better addressed via a manual liquidation.

Funds deposited or wired into the account are not taken into consideration from a risk standpoint until those funds have cleared all the appropriate funds and banking channels and are officially in the account. The liquidation system is automated and programmed to act immediately if there is a margin violation/deficit.

Note for Prime Clients: Executing away is not a means to resolve real time deficits as away trades will not be taken into consideration for beneficial margin purposes until 9 pm ET on Trade Date or when the trades have been reported and matched with external confirms, whichever is later. Trading away for expiring options, on expiration day, is also discouraged due to the potential for late or inaccurate reporting which can lead to erroneous margin calculations or incorrect exercise and assignment activity. Clients who wish to trade expiring options on expiration day and away from IB, must load their FTP file no later than 2:50 pm ET, and do so at their own risk.

What formulas do you use to calculate the margin on options?

There are many different formulas used to calculate the margin requirement on options. Which formula is used will depend on the option type or strategy determined by the system. There are a significant number of detailed formulas that are applied to various strategies. To find this information go to the IBKR home page at www.interactivebrokers.com. Go to the Trading menu and click on Margin. From the Margin Requirements page, click on the Options tab. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each.

The information above applies to equity options and index options. Options on futures employ an entirely different method known as SPAN margining. For information on SPAN margining, conduct a search on this page for “SPAN” or “Futures options margin”.

When I sell stock, how much does it increase SMA?

When an account holder sells a marginable security, it will typically increase their SMA by 50% of the value of the security sold.

Why was I liquidated?

The majority of all liquidations occur due to margin violations. There are two main types of margin violations that apply to margins accounts, Maintenance Margin and Reg. T Margin.

In addition to a margin deficit, liquidations may occur as a result of post expiration exposure or various other account-specific reasons which may be dependent upon the account type as well as the specific holdings within the account. For a detailed list of Risk Management algorithms applied to ensure account compliance and which may result in account liquidations, please review IBKR's website under Trading - Margin.

1. Maintenance Margin violation: In an account, the Equity with Loan Value (ELV) must always be greater than the Current Maintenance Margin Requirement (MMR) on the positions that are being held in the account. The difference between ELV and MMR is Current Excess Liquidity; therefore, an easier way for some people to monitor their account is to remember that the Current Excess Liquidity in their account must always be positive. If the Current Excess Liquidity in an account goes negative, this is a maintenance margin violation.

2. Reg T violation: In the Balances section of the Account Window there is a figure titled Special Memorandum Account (SMA). The US Fed has an enforcement period for this account; 15:50-17:20 ET each trading day. During this window, the SMA balance must be positive. If the SMA is negative at any point between 15:50 and 17:20 EST, this constitutes a Reg T margin violation.

In the event of a margin violation, the account is subject to automatic liquidation on a real-time basis. Liquidations are accomplished with market orders, and any/all positions in the account can be liquidated.