Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

加密货币产品市场数据

股票/ETF

美国

GBTC @ PINK

- 非专业

- 一级:场外市场(非专业,一级)【OTC Markets (NP,L1)】

- 一级:美国证券快照与期货数据组(非专业,一级)【US Securities Snapshot and Futures Value Bundle (NP,L1)】

- 二级:场外市场(非专业,二级)【OTC Markets (NP,L2)】

- 二级:全球场外交易和场外市场(非专业,二级)【Global OTC and OTC Markets (NP,L2)】

- 专业

- 一级:场外市场(专业,一级)【OTC Markets (P,L1)】

- 一级:专业美国证券快照数据组(专业,一级)【Professional US Securities Snapshot Bundle (P,L1)】

- 二级:场外市场(专业,二级)【Level 2: OTC Markets (P,L2)】

- 二级:全球场外交易和场外市场(专业,二级)【Global OTC and OTC Markets (P,L2)】

非美国

BITCOINXB @ SFB

- 非专业

- 一级:北欧股票(非专业,一级)【Nordic Equity (NP,L1)】

- 二级:北欧股票(非专业,二级)【Nordic Equity (NP,L2)】

- 专业

- 一级:北欧股票(专业,一级)【Nordic Equity (P,L1)】

- 二级:北欧股票(专业,二级)【Nordic Equity (P,L2)】

COINETH @ SFB

- 非专业

- 一级:北欧股票(非专业,一级)【Nordic Equity (NP,L1)】

- 二级:北欧股票(非专业,二级)【Nordic Equity (NP,L2)】

- 专业

- 一级:北欧股票(专业,一级)【Nordic Equity (P,L1)】

- 二级:北欧股票(专业,二级)【Nordic Equity (P,L2)】

COINETHE @ SFB

- 非专业

- 一级:北欧股票(非专业,一级)【Nordic Equity (NP,L1)】

- 二级:北欧股票(非专业,二级)【Nordic Equity (NP,L2)】

- 专业

- 一级:北欧股票(专业,一级)【Nordic Equity (P,L1)】

- 二级:北欧股票(专业,二级)【Nordic Equity (P,L2)】

指数

BRR/BRTI @ CME

- 非专业

- 芝商所实时非专业一级(CME Real-Time Non-Professional Level 1)

- 美国证券快照与期货数据组(非专业,一级)【US Securities Snapshot and Futures Value Bundle (NP,L1)】

- 专业

- 芝商所实时专业二级(CME Real-Time Professional Level 2)(没有芝商所专业一级产品)

NYXBT @ FWB/SWB

- 非专业

- FWB:现货市场德国(法兰克福/Xetra)(非专业,一级)【Spot Market Germany (Frankfurt/Xetra)(NP,L1)】

- SWB:斯图加特交易所包含Euwax(SWB)(非专业,一级)【Stuttgart Boerse incl. Euwax (SWB) (NP,L1)】

- 专业

- FWB:现货市场德国(法兰克福/Xetra)(专业,一级)【Spot Market Germany (Frankfurt/Xetra)(P,L1)】

- SWB:斯图加特交易所包含Euwax(SWB)(专业,一级)【Stuttgart Boerse incl. Euwax (SWB) (P,L1)】

期货

BRR @ CME

ETHUSDRR @ CME

- 非专业

- 一级:芝商所实时非专业一级(CME Real-Time Non-Professional Level 1)

- 一级:美国证券快照与期货数据组(非专业,一级)【US Securities Snapshot and Futures Value Bundle (NP,L1)】

- 二级:芝商所实时专业二级(CME Real-Time Professional Level 2)

- 二级:美国数据组增强版(非专业,二级【US Value Bundle PLUS (NP,L2)】

- 需要订阅美国证券快照与期货数据组

- 仅针对深度在册

- 专业

- 二级:芝商所实时专业二级(CME Real-Time Professional Level 2)(没有芝商所专业一级产品)

BAKKT @ ICECRYPTO

- 非专业

- ICE Futures US (NP)

- Professional

- 洲际交易所期货美国(专业)【ICE Futures US (P)】

返回目录:IBKR的比特币和其它加密货币产品

如何确定哪些市场数据订阅适合某一指定证券?

IBKR为账户持有人提供了市场数据助手,可帮助其选择想要交易的证券(股票、期权或权证)所适用的订阅服务。搜索结果会显示产品进行交易的所有交易所、订阅服务及其月费(专业客户和非专业客户)以及每种订阅服务的市场深度数据。

要访问市场数据助手:

- 登录客户端

- 点击“帮助”菜单(右上角的问号图标),然后点击“支持中心”

- 向下滚动,选择“市场数据助手”

- 输入代码或ISIN以及交易所

- 选择筛选条件:专业/非专业订户状态、币种和资产

- 点击“搜索”

- 查看搜索结果并决定哪些订阅最符合自己的需求。

更多信息请参见IBKR网站的市场数据选择页面。

订阅美国市场数据(非专业)应该考虑的因素

在确定要提供的市场数据订阅服务范畴时,IBKR力求能平衡广大客户的需求,既考虑交易产品的范畴,也要考虑数据使用的频率。为了帮助客户节省美国数据的每月订阅费用,我们提供了组合订阅和分项订阅两种方式,同时还有实时数据、快照数据和延时数据这三种类型可供客户自行选择。请注意,根据监管要求,IBKR不再向Interactive Brokers LLC的客户提供美国股票的延时报价信息。

您交易什么美国产品?

您需要查看实时报价的频率如何?

您每月一般会产生多少佣金?

您交易哪些交易所的产品?

- 美国股票和期权扩展实时更新数据组(US Equity and Options Add-On Streaming Bundle)1:包括NYSE (Network A)、AMEX (Network B)、NASDAQ(Network C)和OPRA(美国期权)。适合交易所有四家交易所的证券并且交易频率较高的用户。将取代美国证券快照和期货数据组订阅中提供的快照报价。

延时市场数据的延迟时间

市场数据供应商提供的交易所数据通常分为两类,即实时数据和延时数据。实时市场数据是只要信息一公开便会立刻发布。而延时市场数据则相对于实时报价会有一定延迟,通常会晚10到20分钟。

某些交易所允许免费显示延时数据,不收取任何市场数据订阅费用。下方表格列出了我们可以无需正式请求(即在交易平台输入产品代码便会显示相应的延时数据)、免费提供延时数据的交易所。该表格还包含的对应的实时数据订阅信息,详细费用请参见IBKR的网站。

请注意:

- 根据监管要求,IBKR不再向Interactive Brokers LLC的客户提供美国股票的延时报价信息。

- 延时报价应作为指示参考使用,不一定可用于交易。延迟的时间可能会在无事先通知的情况下进一步延长。

美洲

| 外部交易所名称 | IB交易所名称 | 延迟时间 | 实时订阅 |

| CBOT | CBOT | 10分钟 | CBOT Real-Time |

| CBOE Futures Exchange | CFE | 10分钟 | CFE Enhanced |

| Market Data Express (MDX) | CBOE | 10分钟 | CBOE Market Data Express Indices |

| CME | CME | 10分钟 | CME Real-Time |

| COMEX | COMEX | 10分钟 | COMEX Real-Time |

| ICE US | NYBOT | 10分钟 | ICE Futures U.S. (NYBOT) |

| Mexican Derivatives Exchange | MEXDER | 15分钟 | Mexican Derivatives Exchange |

| Mexican Stock Exchange | MEXI | 20分钟 | Mexican Stock Exchange |

| Montreal Exchange | CDE | 15分钟 | Montreal Exchange |

| NYMEX | NYMEX | 10分钟 | NYMEX Real-Time |

| NYSE GIF | NYSE | 15分钟 | NYSE Global Index Feed |

| One Chicago | ONE | 10分钟 | OneChicago |

| OPRA | OPRA | 15分钟 | OPRA Top of Book (L1) (US Option Exchanges) |

| OTC Markets | PINK | 15分钟 | OTC Markets |

| Toronto Stock Exchange | TSE | 15分钟 | Toronto Stock Exchange |

| Venture Exchange | VENTURE | 15分钟 | TSX Venture Exchange |

欧洲

| 外部交易所名称 | IB交易所名称 | 延迟时间 | 实时订阅 |

| BATS Europe | BATE/CHIX | 15分钟 | European (BATS/Chi-X) Equities |

| Boerse Stuttgart | SWB | 15分钟 | Stuttgart Boerse incl. Euwax (SWB) |

| Bolsa de Madrid | BM | 15分钟 | Bolsa de Madrid |

| Borsa Italiana | BVME/IDEM | 15分钟 | Borsa Italiana (BVME stock / SEDEX / IDEM deriv) |

| Budapest Stock Exchange | BUX | 15分钟 | Budapest Stock Exchange |

| Eurex | EUREX | 15分钟 | Eurex Real-Time Information |

| Euronext | AEB/SBF/MATIF/BELFOX | 15分钟 | Euronext Cash |

| Euronext | AEB/SBF/MATIF/BELFOX | 15分钟 | Euronext Data Bundle |

| Frankfurt Stock Exchange and XETRA | FWB/IBIS/XETRA | 15分钟 | Spot Market Germany (Frankfurt/Xetra) |

| ICE Futures Europe (Commodities) | IPE | 10分钟 | ICE Futures E.U. - Commodities (IPE) |

| ICE Futures Europe (Financials) | ICEEU | 10分钟 | ICE Futures E.U. – Financials (LIFFE) |

| LSE | LSE | 15分钟 | LSE UK |

| LSEIOB | LSEIOB | 15分钟 | LSE International |

| MEFF | MEFF | 15分钟 | BME (MEFF) |

| NASDAQ OMX Nordic Derivatives | OMS | 15分钟 | Nordic Derivatives |

| Prague Stock Exchange | PRA | 15分钟 | Prague Stock Exchange Cash Market |

| SWISS Exchange | EBS/VIRTX | 15分钟 | SIX Swiss Exchange |

| Tel Aviv Stock Exchange | TASE | 15分钟 | Tel Aviv Stock Exchange |

| Turquoise ECN | TRQXCH/TRQXDE/TRQXEN | 15分钟 | Turquoise ECNs |

| Warsaw Stock Exchange | WSE | 15分钟 | Warsaw Stock Exchange |

亚洲

| 外部交易所名称 | IB交易所名称 | 延迟时间 | 实时订阅 |

| Australian Stock Exchange | ASX | 20分钟 | ASX Total |

| 恒生指数 | HKFE-IND | 15分钟 | 恒生指数 |

| 香港期货交易所 | HKFE | 15分钟 | 香港衍生品(期货&期权) |

| 香港联合交易所 | SEHK | 15分钟 | 香港证券交易所(股票、权证&债券) |

| Korea Stock Exchange | KSE | 20分钟 | Korea Stock Exchange |

| National Stock Exchange of India | NSE | 15分钟 | National Stock Exchange of India, Capital Market Segment |

| Osaka Securities Exchange | OSE.JPN | 20分钟 | Osaka Exchange |

| SGX Derivatives | SGX | 10分钟 | Singapore Exchange (SGX) - Derivatives |

| 上海证券交易所 | SEHKNTL | 15分钟 | 上海证券交易所 |

| 上海证券交易所科创板 | SEHKSTAR | 15分钟 | 上海证券交易所 |

| 深圳证券交易所 | SEHKSZSE | 15分钟 | 深圳证券交易所 |

| Singapore Stock Exchange | SGX | 10分钟 | Singapore Exchange (SGX) - Stocks |

| Sydney Futures Exchange | SNFE | 10分钟 | ASX24 Commodities and Futures |

| Tokyo Stock Exchange | TSEJ | 20分钟 | Tokyo Stock Exchange |

费用概览

我们鼓励客户和潜在客户访问我们的网站了解详细费用信息。

最常见的几项费用有:

1. 佣金——取决于产品类型和挂牌交易所,以及您选择的是打包式(一价全含)还是非打包式收费。例如,美国股票佣金为每股0.005美元,每笔交易最低佣金为1.00美元。

2. 利息——保证金贷款需缴纳利息,IBKR采用国际公认的隔夜存款基准利率作为基础来确定自己的利率。然后我们将分等级在基准利率基础上应用一个浮动值(这样余额越大对应的利率就越有利)来确定实际利率。例如,对于美元计价的贷款,基准利率是联邦基金利率,而10万美元以内的余额利率会在基准利率的基础上加1.5%。此外,卖空股票的个人应注意,借用“难以借到”的股票还会有一笔特殊费用,以日息表示。

3. 交易所费用——取决于产品类型和交易所。例如,对于美国证券期权,某些交易所会对消耗流动性的委托单(市价委托单或适销的限价委托单)收取费用、对添加流动性的委托单(限价委托单)给与补贴。此外,许多交易所还会对取消或修改的委托单收取费用。

4. 市场数据——您并非一定要订阅市场数据,但是如果不订阅市场数据,您可以会产生月费用,具体取决于供应交易所及其订阅服务。我们提供市场数据助手工具,可根据您想交易的产品帮助您选择适当的市场数据订阅服务。要访问该工具,请登录客户端,点击支持然后打开市场数据助手链接。

5. 最低月活动费用——为迎合活跃客户的需求,我们规定如果账户产生的月佣金能达到最低月佣金要求,则可免交月活动费用;而如果产生的月佣金未能达到最低月佣金要求,则需缴纳差额作为活动费用。最低月佣金要求为10美元。

6. 杂费 - IBKR允许每月一次免费取款,后续取款将收取费用。此外,还会代收交易取消请求费用、期权和期货行权&被行权费用以及ADR保管费用。

更多信息,请访问我们的网站,从定价菜单中选择查看。

VR(T) time decay and term adjusted Vega columns in Risk Navigator (SM)

Background

Risk Navigator (SM) has two Adjusted Vega columns that you can add to your report pages via menu Metrics → Position Risk...: "Adjusted Vega" and "Vega x T-1/2". A common question is what is our in-house time function that is used in the Adjusted Vega column and what is the aim of these columns. VR(T) is also generally used in our Stress Test or in the Risk Navigator custom scenario calculation of volatility index options (i.e VIX).

Abstract

Implied volatilities of two different options on the same underlying can change independently of each other. Most of the time the changes will have the same sign but not necessarily the same magnitude. In order to realistically aggregate volatility risk across multiple options into a single number, we need an assumption about relationship between implied volatility changes. In Risk Navigator, we always assume that within a single maturity, all implied volatility changes have the same sign and magnitude (i.e. a parallel shift of volatility curve). Across expiration dates, however, it is empirically known that short term volatility exhibits a higher variability than long term volatility, so the parallel shift is a poor assumption. This document outlines our approach based on volatility returns function (VR(T)). We also describe an alternative method developed to accommodate different requests.

VR(T) time decay

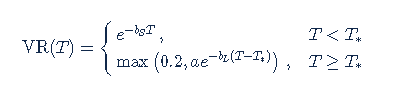

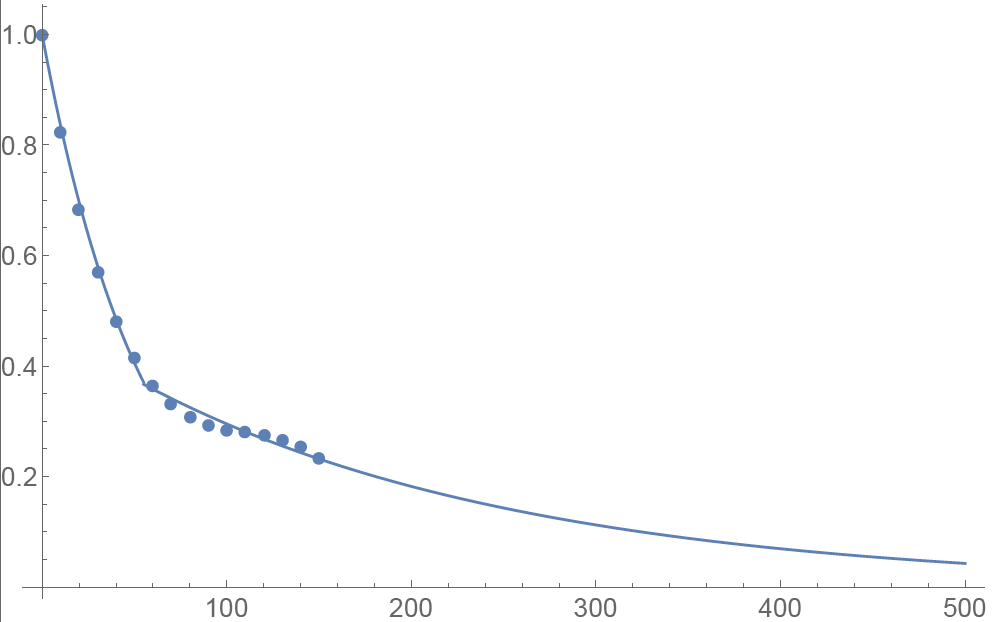

We applied the principal component analysis to study daily percentage changes of volatility as a function of time to maturity. In that study we found that the primary eigen-mode explains approximately 90% of the variance of the system (with second and third components explaining most of the remaining variance being the slope change and twist). The largest amplitude of change for the primary eigenvector occurs at very short maturities, and the amplitude monotonically decreases as time to expiration increase. The following graph shows the main eigenvector as a function of time (measured in calendar days). To smooth the numerically obtained curve, we parameterize it as a piecewise exponential function.

Functional Form: Amplitude vs. Calendar Days

To prevent the parametric function from becoming vanishingly small at long maturities, we apply a floor to the longer term exponential so the final implementation of this function is:

where bS=0.0180611, a=0.365678, bL=0.00482976, and T*=55.7 are obtained by fitting the main eigenvector to the parametric formula.

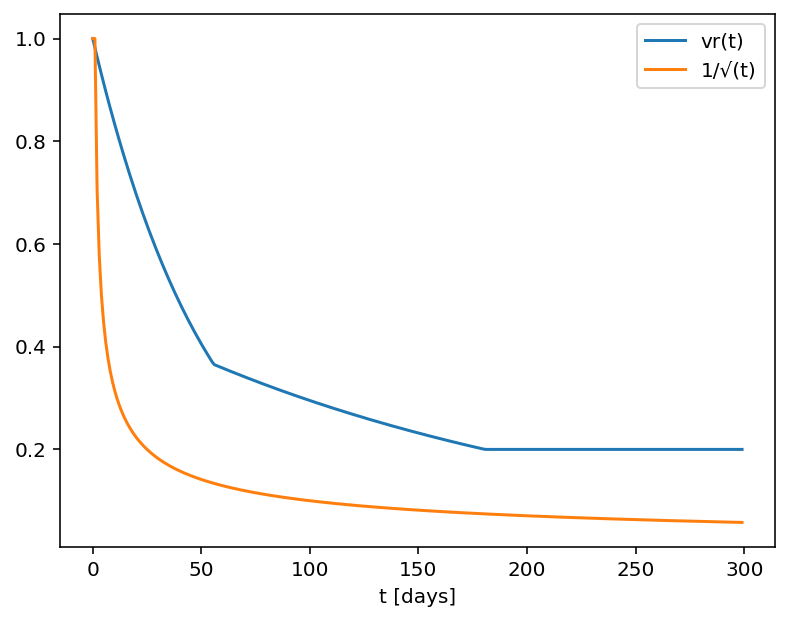

Inverse square root time decay

Another common approach to standardize volatility moves across maturities uses the factor 1/√T. As shown in the graph below, our house VR(T) function has a bigger volatility changes than this simplified model.

Time function comparison: Amplitude vs. Calendar Days

Adjusted Vega columns

Risk Navigator (SM) reports a computed Vega for each position; by convention, this is the p/l change per 1% increase in the volatility used for pricing. Aggregating these Vega values thus provides the portfolio p/l change for a 1% across-the-board increase in all volatilities – a parallel shift of volatility.

However, as described above a change in market volatilities might not take the form of a parallel shift. Empirically, we observe that the implied volatility of short-dated options tends to fluctuate more than that of longer-dated options. This differing sensitivity is similar to the "beta" parameter of the Capital Asset Pricing Model. We refer to this effect as term structure of volatility response.

By multiplying the Vega of an option position with an expiry-dependent quantity, we can compute a term-adjusted Vega intended to allow more accurate comparison of volatility exposures across expiries. Naturally the hoped-for increase in accuracy can only come about if the adjustment we choose turns out to accurately model the change in market implied volatility.

We offer two parametrized functions of expiry which can be used to compute this Vega adjustment to better represent the volatility sensitivity characteristics of the options as a function of time to maturity. Note that these are also referred as 'time weighted' or 'normalized' Vega.

Adjusted Vega

A column titled "Vega Adjusted" multiplies the Vega by our in-house VR(T) term structure function. This is available any option that is not a derivative of a Volatility Product ETP. Examples are SPX, IBM, VIX but not VXX.

Vega x T-1/2

A column for the same set of products as above titled "Vega x T-1/2" multiplies the Vega by the inverse square root of T (i.e. 1/√T) where T is the number of calendar days to expiry.

Aggregations

Cross over underlying aggregations are calculated in the usual fashion given the new values. Based on the selected Vega aggregation method we support None, Straight Add (SA) and Same Percentage Move (SPM). In SPM mode we summarize individual Vega values multiplied by implied volatility. All aggregation methods convert the values into the base currency of the portfolio.

Custom scenario calculation of volatility index options

Implied Volatility Indices are indexes that are computed real-time basis throughout each trading day just as a regular equity index, but they are measuring volatility and not price. Among the most important ones is CBOE's Marker Volatility Index (VIX). It measures the market's expectation of 30-day volatility implied by S&P 500 Index (SPX) option prices. The calculation estimates expected volatility by averaging the weighted prices of SPX puts and calls over a wide range of strike prices.

The pricing for volatility index options have some differences from the pricing for equity and stock index options. The underlying for such options is the expected, or forward, value of the index at expiration, rather than the current, or "spot" index value. Volatility index option prices should reflect the forward value of the volatility index (which is typically not as volatile as the spot index). Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different, albeit related, volatility estimates.

For volatility index options like VIX the custom scenario editor of Risk Navigator offers custom adjustment of the VIX spot price and it estimates the scenario forward prices based on the current forward and VR(T) adjusted shock of the scenario adjusted index on the following way.

- Let S0 be the current spot index price, and

- S1 be the adjusted scenario index price.

- If F0 is the current real time forward price for the given option expiry, then

- F1 scenario forward price is F1 = F0 + (S1 - S0) x VR(T), where T is the number of calendar days to expiry.

VOLUME – Calculation of Shares Traded

At first glance, the number of shares executed in a given time period would seem to be a straightforward calculation. The simplest definition of volume is the number of shares traded from one point in time to another point in time. However, several variables affect the calculation.

Market conditions may cause a calculation of volume to differ among data providers. For example, the two plans that manage the US Consolidated equities market have different number of, and definition for, trade reporting codes. In addition, data distributors often include variables such as odd lots, corrections, cash trades, or pre-/post-market trades in the volume calculation.

Numbers can become more visible in light volume or over time. For example, what was volume as of 09:37?

| Time | Symbol | Quantity | Price |

| 9:35 | XYZ | 1000 | 19.90 |

| 9:36 | XYZ | -1000 | 19.90 |

| 9:37 | XYZ | 1000 | 19.80 |

Depending on the distributor, the volume at 09:37 could be:

- 1000 shares if the distributor corrects the volume for corrections

- 2000 shares if the distributor only counts positive numbers

- 3000 shares if the distributor reflects the total of all prints expressed as a positive number

This may be a simplified example, but understanding how a distributor calculates volume will help the volume calculation serve as an indicator of market direction.

Alternative Streaming Quotes for US Equities

The SEC Vendor Display Rule requires that brokers give clients access to the NBBO at the point of order entry. In order to provide users with free live streaming market data, we cannot display this free stream when entering an order without the client subscribing to the paid NBBO. Please note, this does not apply to non-IBLLC clients.

Under the Rule 603(c) of Regulation NMS (Vendor Display Rule), when a broker is providing quotation information to clients that can be used to assess the current market or the quality of trade execution, reliance on non-consolidated market information as the source of that quotation would not be consistent with the Vendor Display Rule.

All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, we cannot show this quote when entering parameters for a US stock quote. Therefore and according to FINRA's enforcement of the SEC rule, IBKR provides IBLLC US clients a free default snapshot service, “US Snapshots VDR Required”. If clients do not sign up for an NBBO US equity data service and they are an IBLLC client, they will have access to free real-time snapshots when making trading decisions on US stocks. Order routing will not change based on what is shown on the screen. If one is subscribed to NBBO quotes or not, by default the trade will still take place with the assistance of the SMART order router designed to provide the best price for the order.

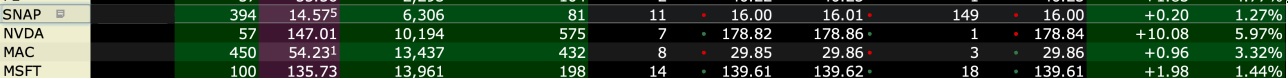

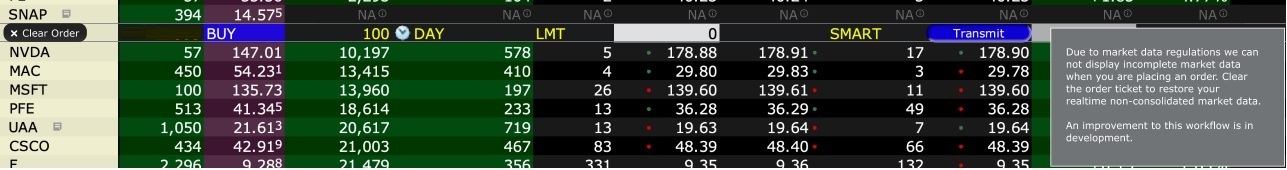

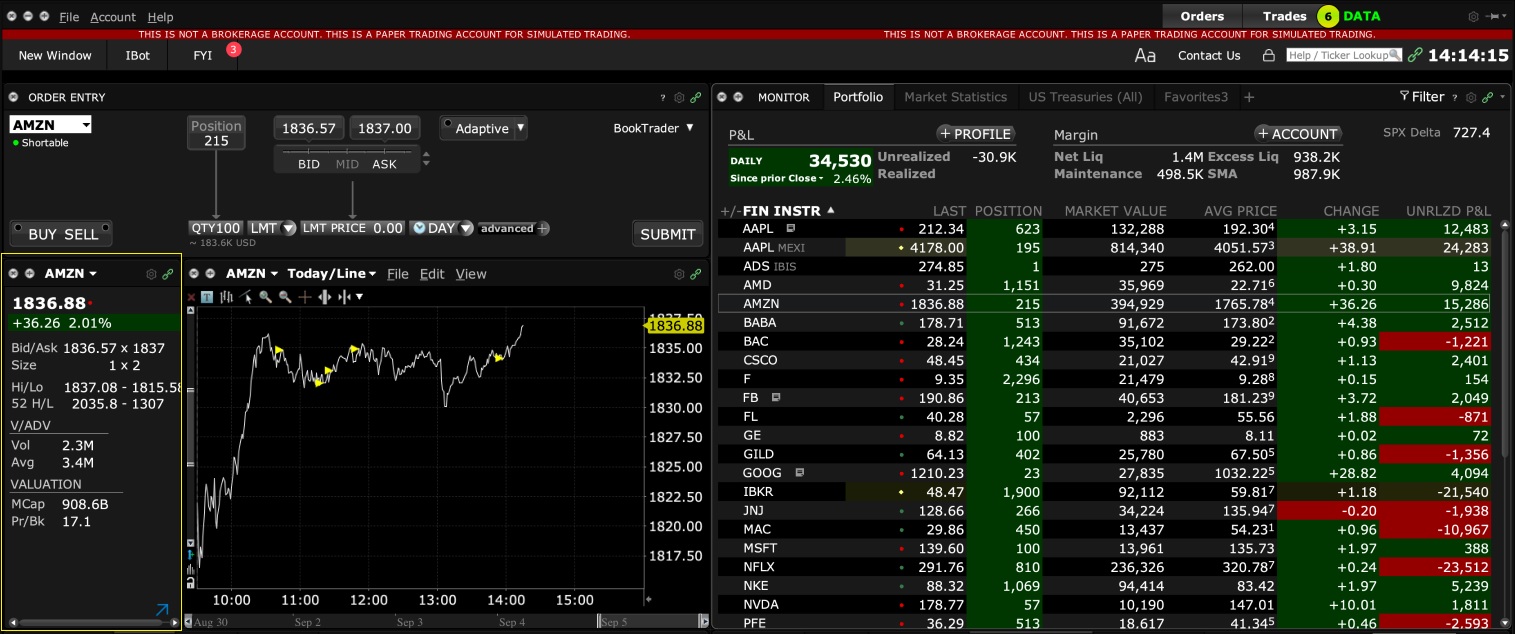

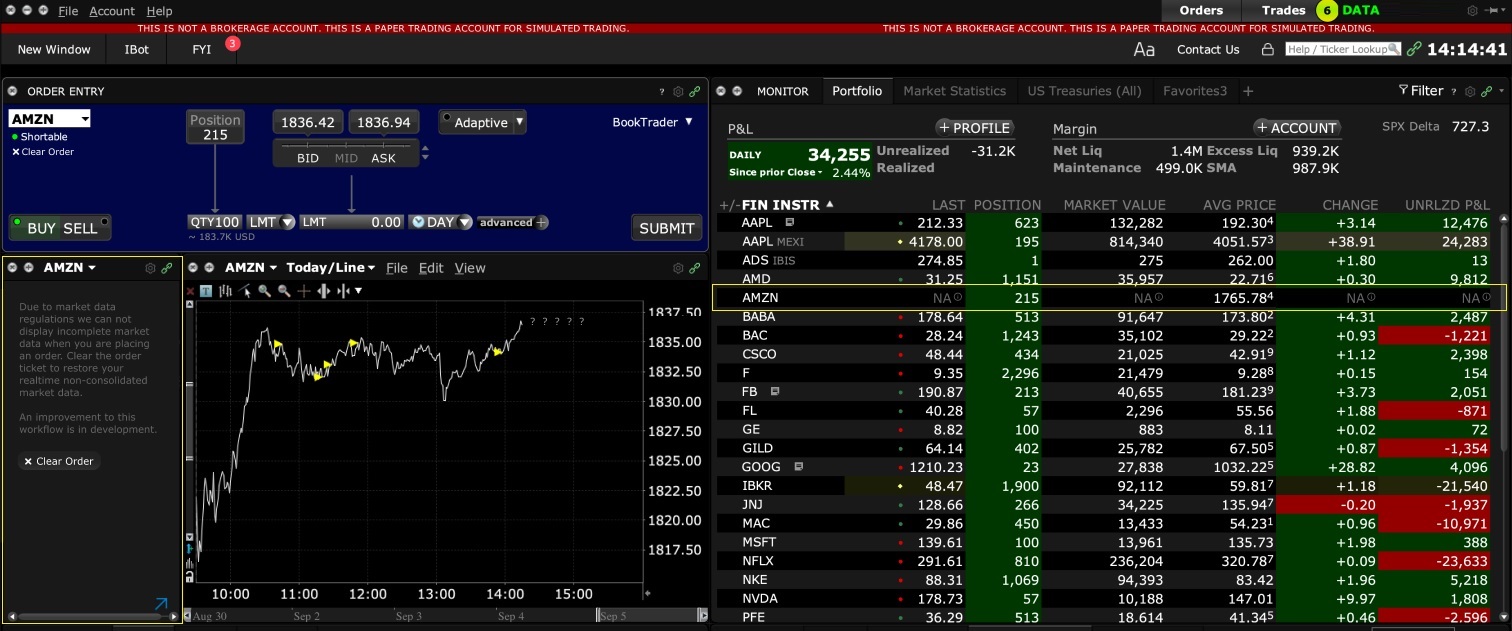

Please see the sample screenshots below from TWS Classic and TWS Mosaic for what occurs when placing an order without the NBBO streaming subscription for US equities.

TWS Classic:

1. Screenshot of quotes showing without order entry line item

2. Screenshot of quote going blank when putting in the order entry line item

TWS Mosaic:

1. Screenshot of quotes showing without order entry line item

2. Screenshot of quote going blank when putting in the order entry line item

快照市场数据

背景

符合一定要求的IBKR客户可选择提交单次请求,要求接收某个金融产品的实时报价。该服务被称为“快照报价”。传统报价服务会持续更新实时报价,而快照报价不会,这是它与传统报价服务的不同之处。对于不经常交易且不希望根据延时报价1下单的客户,快照报价的价格更有竞争力。有关该报价服务的更多信息如下。

报价项目

快照报价包括以下数据:

- 最后价

- 最后价交易数量

- 最后价交易所

- 当前买价-卖价

- 当前买价-卖价的交易数量

- 当前买价-卖价的交易所

可用服务

| 服务 | 限制 | 每条报价请求的价格(美元)2 |

|---|---|---|

| AMEX(B/CTA网络) | $0.01 | |

| ASX Total | 不支持ASX24 仅限非专业订阅用户 |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| 加拿大交易所集团(TSX/TSXV) | 仅限不是IB加拿大客户的非专业订阅用户 | $0.03 |

| CBOT实时 | $0.03 | |

| CME实时 | $0.03 | |

| COMEX实时 | $0.03 | |

| Eurex Core | 仅限非专业订阅用户 | $0.03 |

| Euronext基础版 | 仅限非专业订阅用户 包括Euronext股票、指数、股票衍生品及指数衍生品 |

$0.03 |

| 德国ETF和指数 | 仅限非专业订阅用户 | $0.03 |

| 香港(HKFE)衍生品 | $0.03 | |

| 香港证券交易所(股票、权证、债券) | $0.03 | |

| 约翰内斯堡证券交易所 | $0.03 | |

| 蒙特利尔衍生品 | 仅限非专业订阅用户 | $0.03 |

| NASDAQ(C/UTP网络) | $0.01 | |

| Nordic衍生品 | $0.03 | |

| Nordic股票 | $0.03 | |

| NYMEX实时 | $0.03 | |

| NYSE(A/CTA网络) | $0.01 | |

| OPRA(美国期权交易所) | $0.03 | |

| 上交所5秒快照(通过HKEx) | $0.03 | |

| 深交所5秒快照(通过HKEx) | $0.03 | |

| SIX瑞士交易所 | 仅限非专业订阅用户 | $0.03 |

| 即期市场德国(Frankfurt/Xetra) | 仅限非专业订阅用户 | $0.03 |

| STOXX指数实时数据 | 仅限非专业订阅用户 | $0.03 |

| 多伦多证券交易所 | 仅限IB加拿大客户中的非专业订阅用户 | $0.03 |

| 多伦多证券交易所创业板 | 仅限IB加拿大客户中的非专业订阅用户 | $0.03 |

| 英国伦敦证券交易所(IOB)股票 | $0.03 | |

| 英国伦敦证券交易所股票 | $0.03 |

1根据监管要求,IBKR不再向Interactive Brokers LLC的客户提供美国股票的延时报价信息。

2费用按每笔快照报价请求计算,如果不是美元计费,则将按账户基础货币收取。

资格要求

- 账户必须达到市场数据订阅的最低和维持资产要求才能使用快照报价服务。

- 用户必须运行TWS 976.0或以上版本才能使用快照报价功能。

定价详情

- 每月客户可免费接收$1.00美元的快照报价。免费快照可能会用于美国或非美国报价请求,而一旦免费额度用完,便会直接开始收费,不再另行通知。客户可在客户端中查看其每日的快照使用情况。

- 报价采用后付费模式,通常在提供快照服务次月的第一周收取。账户现金或含贷款价值的净资产如不足以支付月费的,账户持仓将面临清算。

- 快照数据的月费用不得超过相关实时数据的月费。如果当月快照报价合计费用达到了相关实时数据的价格,则该月剩余时间用户无需支付额外费用便可使用实时数据服务。系统将在用户达到快照数据费用上限下一个工作日的美东时间18:30左右切换为实时报价。月末,实时报价服务会自动终止,次月快照费用则重新开始累计。每项服务的费用均单独累计,一项服务的报价请求不得与另一项服务合并来应用上限。详情请见以下表格。

| 服务 | 每条报价请求的价格(美元) | 非专业订阅用户上限(请求次数/总费用)2 | 专业订阅用户上限(请求次数/总费用)3 |

|---|---|---|---|

| AMEX(B/CTA网络) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ(C/UTP网络) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE(A/CTA网络) | $0.01 | 150/$1.50 | 4,500/$45.00 |

请求快照报价

桌面版交易——标准模式TWS:

如您已能看到延时数据且启用了快照报价,则您可在“代码行动”栏下看到“快照”按钮:

点击“快照”按钮后会出现报价详情窗口。一旦系统收到了该产品的NBBO(全国最佳买卖价)报价,报价详情窗口会即刻生成一个时间戳并显示NBBO信息:

在报价详情窗口中点击刷新链接会更新NBBO报价。

举例:

在上例中,GOOG是一家在纳斯达克(C/UTP 网络)上市的公司。每请求一次报价(一次快照)的费用为0.01美元。

- 非专业用户最多可再请求149条GOOG或任意其它在纳斯达克(C/UTP 网络)挂牌的股票的快照数据,超过149条将切换为实时报价。

- 专业用户最多可再请求2449条GOOG或任意其它在纳斯达克(C/UTP 网络)上市的股票的快照数据,超过2449条将切换为实时报价。

您请求快照数据产生的费用不会超过上限。一旦达到上限,该月剩余时间将不会产生新的费用,且您将收到该产品的实时数据。

桌面版交易——TWS魔方:

如您已能看到延时数据且启用了快照报价,选择监控标签下的某一行后,“定单输入”窗口会显示请求快照数据的选项。

点击+快照链接后会出现报价详情窗口。一旦系统收到了该产品的NBBO报价,报价详情窗口会即刻生成一个时间戳并显示NBBO信息:

在报价详情窗口中点击刷新链接会更新NBBO报价。

客户端:

如您已能看到延时数据且启用了快照报价,在买价/卖价下的“定单委托单”窗口内,您将看到快照链接:

点击快照链接后会出现报价详情窗口。一旦系统收到了该产品的NBBO报价,报价详情窗口会即刻生成一个时间戳:

在报价详情窗口中点击刷新链接会更新NBBO报价。

网络交易——网络交易者(WebTrader):

如您已能看到延时数据且启用了快照报价,在“市场”标签下的“其它数据”栏上您将看到“快照”数据:

点击“快照”按钮后会出现报价详情窗口。一旦系统收到了该产品的NBBO报价,报价详情窗口会即刻生成一个时间戳:

移动交易——移动IBKR应用:

在报价界面点击任意产品代码会扩展报价框。如您已能看到延时数据且启用了快照报价,您将看到“快照”链接:

点击“快照”链接后会出现报价详情窗口。一旦系统收到了该产品的NBBO(全国最佳买卖价)报价,报价详情窗口会即刻生成一个时间戳并显示NBBO信息: