市场数据交易所接入费用

作为市场数据供应商,IBKR须遵守多个交易所协议,该等协议指定并控制着市场数据分销的方式。此外,某些交易所还会对分销实时或延时数据的供应商征收月费(也称“交易所接入费用”)。

“交易所接入费用”通常用来描述机构(如经纪商)的客户通过我们的供应商协议(而非机构和交易所之间的直接协议)获取数据的情况。

如果存在交易所接入费用,我们会允许机构通过限制其客户订阅交易所市场数据来退出此费用项目。但是,机构可以收费方式允许客户进行市场数据订阅。

下表为Nasdaq、CBOE Global Markets和Deutsche Borse收取的交易所接入费用。请注意,Deutsche Borse的交易所接入费自2021年2月1日起免收,直至另行通知。Nasdaq和CBOE Global Markets的交易所接入费用已于2016年12月1日实施生效。

| 交易所接入产品 | 交易所接入费用 | 客户订阅选择 |

| BATS EU Exchange Access Fee | 950英镑 |

· European (BATS/Chi-X) Equities (P, L2)

· European (BATS/Chi-X) Equities (NP, L2)

|

| Nasdaq MFDS Exchange Access Fee | 150美元 |

· US Mutual Funds (P,L1)

· US Mutual Funds (NP, L1)

|

| Nasdaq GIDS Exchange Access Fee | 800美元 |

· Nasdaq Global Index Data Service (P)

· Nasdaq Global Index Data Service (NP)

|

| Nordic Equity Exchange Access Fee for Nonprofessional | 800欧元 |

· Nordic Equities (NP, L1)

· Nordic Equities (NP, L2)

|

| Nordic Equity Exchange Access Fee for Professional | 2,140欧元 |

· Nordic Equities (P, L1)

· Nordic Equities (P, L2)

|

| Deutsche Borse Indices and Xetra ETF & Volatility Indices Exchange Access Fee | 免收 |

· German ETFs and Indices (P, L1)

· German ETFs and Indices (NP, L1)

|

| Eurex Core Exchange Access Fee | 免收 |

· Eurex Core (P, L2)

· Eurex Retail Europe (NP, L1)

· Eurex Core (NP, L1)

· Eurex Core (NP, L2)

|

| STOXX Indices Exchange Access Fee | 免收 |

· STOXX Index Real-Time Data (P)

· STOXX Index Real-Time Data (NP)

|

| Xetra Core Exchange Access Fee | 免收 | · Spot Market Germany (Frankfurt/Xetra) (P, L1)

· Spot Market Germany(Frankfurt/Xetra) (P, L2)

· Spot Market Germany(Frankfurt/Xetra) (NP, L1)

· Spot Market Germany(Frankfurt/Xetra) (NP, L2)

|

| Tradegate Exchange Access Fees | 免收 | Tradegate (L1) |

上表可理解如下:机构为产品Nordic Equity Exchange Access Fee for Non-professional支付800欧元,机构的客户就可以选择订阅Nordic Equities (NP, L1)或Nordic Equities (NP, L2)。

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

IBIS Statements

All IBIS subscribers, whether brokerage clients or not, receive a monthly statement detailing the subscriptions elected and their fees. In the case of brokerage clients, this information is included within the activity statements with billing taking place generally within the first week following the month in which service was received. In the case of non-brokerage clients, this information is provided on a monthly billing statement.

Regardless of client type, all statements (current and historic) are accessible via log in to Account Management.

Free Trial Considerations

IB currently offers a free 30 trial of each of the IBIS Basic Platform (regularly $69 per month), Research Bundle (regularly $39 per month) and various premium newswire and analyst report subscriptions (priced ala carte from $10 - $325 per month). This free trial is made available to both brokerage and non-brokerage clients, although brokerage clients receive the Basic Platform at no cost.

While there is no charge for subscriptions during the free trial period, if you do not cancel your subscription prior to the trial end you will automatically receive and be billed for the subscriptions originally selected each month thereafter. If you do not wish to be billed for these subscriptions, you would need to log into your account at any time prior to the end of the free trial and cancel the subscription.

Should you require any assistance logging into your account or managing your subscriptions, please contact your local Customer Service Center or the IBIS hotline at 1-203-618-7709.

Terminating Service (non-brokerage clients)

IBIS subscriptions renew monthly on a continuous basis until terminated either by client election or for non-payment. Clients may cancel the service by logging into Account Management and selecting the 'Cancel' menu option. As long as service is canceled prior to the billing date, no service fees will be incurred for the following month. If service is canceled on or after the billing date, no refund or proration of fees is provided. Regardless of whether cancellation takes place before or after the billing date, access to billed services will continue until the end of the month for which they have been paid.

Service will also be terminated if the billing charge is not honored by the credit card issuer due to invalid instructions, insufficient credit limit or an expired card. In each of these situations, IB will attempt to send an email notification of the matter prior to the initiation of the upcoming service period in an attempt to ensure continuity of service.

IBIS Billing Considerations

IBIS subscribers who are brokerage customers will have any monthly IBIS fees deducted directly from their account in a manner similar to and simultaneous with the fees assessed for any other (non-IBIS) market data subscriptions. For these accounts, subscriptions are offered on a monthly calendar basis, will billings performed in arrears and generally within the first week of the month following that in which the services were provided. In addition, fees for any IBIS subscriptions initiated mid-month will be prorated based upon the actual term of service provided.

IBIS subscribers who are not brokerage customers are billed on a monthly basis in advance of the month in which services are provided. Payment is made via the credit card provided at the point of registration or as updated via Account Management thereafter with the subscription cycle beginning on the same day each month as that at which service was initiated. Accepted credit cards include: Visa, Master Card, Discover & JCB

Market Data Exchange Access Fees

As a vendor of market data, IBKR is subject to various exchange agreements that specify and control the manner in which such data may be disseminated. In addition, some exchanges impose a monthly fee (also known as an Exchange Access Fee) on the vendor when real-time or delayed data is distributed.

The term Exchange Access Fee is generally used to describe an arrangement where the clients of an organization, such as a broker, obtain market data through our vendor agreement rather than through a direct agreement between the organization and exchange.

When an Exchange Access Fee exists, we allow an organization to opt out of the fee by restricting the ability of the organization's clients to subscribe to the exchange market data. However, the organization may enable client access to the market data subscriptions for a fee.

The table below illustrates existing Exchange Access Fees levied by Nasdaq, CBOE Global Markets and Deutsche Borse. Please note that the Exchange Access Fee for Deutsche Borse has been waived from February 1, 2021 until further notice. Exchange Access Fees for Nasdaq and CBOE Global Markets has been in effect since December 1, 2016.

|

Exchange Access Product

|

Exchange Access Fee

|

Client Enabled Subscription

|

|

BATS EU Exchange Access Fee

|

GBP 950

|

· European (BATS/Chi-X) Equities (P, L2)

· European (BATS/Chi-X) Equities (NP, L2)

|

|

Nasdaq MFDS Exchange Access Fee

|

USD 150

|

· US Mutual Funds (P,L1)

· US Mutual Funds (NP, L1)

|

|

Nasdaq GIDS Exchange Access Fee

|

USD 800

|

· Nasdaq Global Index Data Service (P)

· Nasdaq Global Index Data Service (NP)

|

|

Nordic Equity Exchange Access Fee for Nonprofessional

|

EUR 800

|

· Nordic Equities (NP, L1)

· Nordic Equities (NP, L2)

|

|

Nordic Equity Exchange Access Fee for Professional

|

EUR 2,140

|

· Nordic Equities (P, L1)

· Nordic Equities (P, L2)

|

|

Deutsche Borse Indices and Xetra ETF & Volatility Indices Exchange Access Fee

|

Fee Waived

|

· German ETFs and Indices (P, L1)

· German ETFs and Indices (NP, L1)

|

|

Eurex Core Exchange Access Fee

|

Fee Waived

|

· Eurex Core (P, L2)

· Eurex Retail Europe (NP, L1)

· Eurex Core (NP, L1)

· Eurex Core (NP, L2)

|

|

STOXX Indices Exchange Access Fee

|

Fee Waived

|

· STOXX Index Real-Time Data (P)

· STOXX Index Real-Time Data (NP)

|

|

Xetra Core Exchange Access Fee

|

Fee Waived

|

· Spot Market Germany (Frankfurt/Xetra) (P, L1)

· Spot Market Germany (Frankfurt/Xetra) (P, L2)

· Spot Market Germany (Frankfurt/Xetra) (NP, L1)

· Spot Market Germany (Frankfurt/Xetra) (NP, L2)

|

| Tradegate Exchange Access Fees | Fee Waived | Tradegate (L1) |

The table reads as follows: An organization pays EUR 800 for the Nordic Equity Exchange Access Fee for Non-professional product, which gives the organization’s clients the option to subscribe to Nordic Equities (NP, L1) or Nordic Equities (NP, L2).

Market Data Considerations for the Paper Trading Account

As a licensed distributor of exchange market data, IBKR is obligated to respect constraints imposed by the exchanges which serve to govern the dissemination and/or retransmission of this data.

As a general rule, within a given account, the real user can activate and maintain its own set of market data subscriptions. The paper user, by design, does not have a set of market data subscription on its own but can be configured in one of the following ways:

-

The paper user can be set to share2 the live market data subscriptions of the real user:

In this scenario, if the real and paper trading sessions are running simultaneously, they must reside on the same device in order for the paper to receive live market data. If this is not the case, the real trading session will be still afforded the real-time market data but the paper trading session will not receive any data3 . Please see the section CASE 1 below for details.

-

The paper user can be set NOT to share2 the live market data subscriptions of the real user:

In this scenario, the real and paper trading sessions are independent, in respect of market data flows. Hence, they can run simultaneously on the same or on different devices and the paper user will receive delayed data, as available. Please see the section CASE 1 below for details.

-

In case the account possess multiple real users, the paper user can be set to share2 the live market data subscriptions of a chosen one.

Clients who wish to run real and paper sessions simultaneously and on different devices (e.g., stand-alone PC, smart phone, tablet), may create an additional real user for their account, as explained here: Adding a second user for an individual account holder. While this approach will result in additional fees for any paid market data subscriptions elected, it will allow maintaining different subscription sets. In this scenario, the client will be able to select2 which real user will share his subscriptions with the paper user, allowing the other real user and the paper trading sessions to run simultaneously on different devices. Please see the section CASE 2 below for details.

Example Cases:

| Location of real_user session | Location of paper_user session | Sharing of live market data between real_user and paper_user is active? | Type of market data received by real_user | Type of market data received by paper_user |

| DEVICE1 | DEVICE2 | YES | LIVE | NO DATA3 |

| DEVICE1 | DEVICE1 | YES | LIVE | LIVE |

| DEVICE1 | DEVICE2 | NO | LIVE | DELAYED |

| DEVICE1 | DEVICE1 | NO | LIVE | DELAYED |

| USER NOT LOGGED IN | DEVICE1 | YES | N/A | LIVE |

| USER NOT LOGGED IN | DEVICE1 | NO | N/A | DELAYED |

| Location of real_user1 session | Location of real_user2 session | Location of paper_user session | paper_user is mirroring the subscriptions of | Type of market data received by real_user1 | Type of market data received by real_user2 | Type of market data received by paper_user |

| USER NOT LOGGED IN | DEVICE1 | DEVICE2 | real_user1 | N/A | LIVE | LIVE |

| USER NOT LOGGED IN | DEVICE1 | DEVICE1 | real_user1 | N/A | LIVE | LIVE |

| DEVICE1 | USER NOT LOGGED IN | DEVICE2 | real_user1 | LIVE | N/A | NO DATA3 |

| DEVICE1 | USER NOT LOGGED IN | DEVICE1 | real_user1 | LIVE | N/A | LIVE |

| USER NOT LOGGED IN | DEVICE1 | DEVICE2 | real_user2 | N/A | LIVE | NO DATA3 |

| USER NOT LOGGED IN | DEVICE1 | DEVICE1 | real_user2 | N/A | LIVE | LIVE |

| DEVICE1 | USER NOT LOGGED IN | DEVICE2 | real_user2 | LIVE | N/A | LIVE |

| DEVICE1 | USER NOT LOGGED IN | DEVICE1 | real_user2 | LIVE | N/A | LIVE |

| DEVICE1 | DEVICE1 | DEVICE2 | real_user1 | LIVE | LIVE | NO DATA3 |

| DEVICE1 | DEVICE1 | DEVICE1 | real_user1 | LIVE | LIVE | LIVE |

| DEVICE1 | DEVICE2 | DEVICE2 | real_user2 | LIVE | LIVE | LIVE |

| DEVICE1 | DEVICE1 | DEVICE2 | real_user1 | LIVE | LIVE | NO DATA3 |

| DEVICE1 | DEVICE1 | DEVICE2 | Set NOT to mirror | LIVE | LIVE | DELAYED |

| DEVICE1 | DEVICE1 | DEVICE1 | Set NOT to mirror | LIVE | LIVE | DELAYED |

| DEVICE1 | DEVICE2 | DEVICE1 | Set NOT to mirror | LIVE | LIVE | DELAYED |

| DEVICE1 | DEVICE2 | DEVICE2 | Set NOT to mirror | LIVE | LIVE | DELAYED |

Notes

-

Trader Workstation (TWS)

-

IBKR Mobile

-

Web Trader

-

Client Portal

3. No Data: On the paper session, the trading platform will display a warning message containing: “...production username associated with this paper-trading username is also running on...”

Change Your Billable Account

If you have additional linked, duplicate or consolidated accounts, the Billable Account section appears on the Market Data Subscriptions screen. Use the Billable Accounts panel to change the account that is currently being billed for market data.

To change your billable account

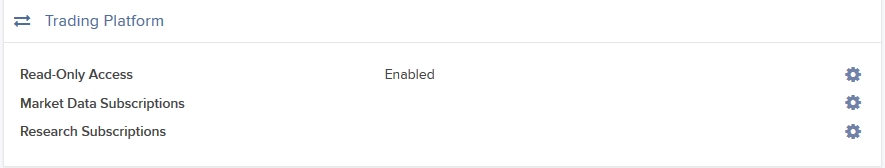

1. Click Settings > User Settings

2. In the Trading Platform panel, click the Configure (gear) icon for Market Data Subscriptions.

The Market Data Subscription screen opens.

3. Click the Configure (gear) icon in the Billable Account panel.

4. Select the account you want to be billed for market data, then click Save.

Beginning with the next billing cycle, your market data subscriptions will be billed to the account you selected.