South African Rand (ZAR) - Onshore/Offshore

Explanation of Onshore/Offshore South African Rand (ZAR)

Background

The South African Reserve Bank (SARB) has currency exchange control rules in place for South African residents. A South African resident is a person (i.e. a natural person, body corporate, foundation, trust or partnership) whether of South African or any other nationality who has taken up residence, is domiciled or registered in the Republic of South Africa (RSA). A resident account is also the account of persons resident, domiciled or registered in the Common Monetary Area (CMA). The CMA comprises of the Republic of South Africa, Lesotho, Namibia and Swaziland. There are no exchange control restrictions between the members of the CMA and they form a single exchange control territory.

The rules stipulate that there is a yearly limit placed on the amount of ZAR that can be taken out of the country by South African residents – i.e. taken "Offshore". ZAR that remain in South Africa are deemed “Onshore”.

Each resident can take the following amounts offshore per calendar year:

- ZAR 1 million can be taken offshore as a “Single Discretionary Allowance”

- ZAR 10 million can be taken offshore as an “Foreign Capital Allowance”

Only institutions licensed as “Authorised Dealers” (AD) are able to send ZAR outside of South Africa and so offshore. An AD is responsible for reporting the offshoring of any ZAR to the SARB. As a result, residents sending ZAR offshore must accurately state the purpose for which the ZAR is being sent. Residents must receive approval from an AD before they are able to send any ZAR offshore. Prior to taking ZAR offshore as part of the Foreign Capital Allowance, residents must also have additional clearance from the SA tax authorities.

The full exchange control rulebook from the SARB can be found here: https://www.resbank.co.za/RegulationAndSupervision/FinancialSurveillanceAndExchangeControl/EXCMan/Pages/default.aspx

Current Situation

Our cashiering account is a non-resident account. Therefore, we are permitted to:

- Receive deposits in ZAR from other non-resident accounts.

- Disburse ZAR from our cashiering account to non-resident accounts.

- Receive deposits from accounts of South African residents.

- Disburse ZAR to accounts of South African residents.

Margin Considerations for IB LLC Commodities Accounts

Introduction

As a global broker offering futures trading in 19 countries, IB is subject to various regulations, some of which retain the concept of margin as a single, end of day computation as opposed to the continuous, real-time computations IB performs. To satisfy commodity regulatory requirements and manage economic exposure in a pragmatic fashion, two margin computations are performed at the market close, both which must be met to remain fully margin compliant. An overview of these computations is outlined below.

Overview

All orders are subject to an initial margin check prior to execution and continuous maintenance margin checks thereafter. As certain products may be offered intraday margin at rates less than the exchange minimum and to ensure end of day margin compliance overall, IB will generally liquidate positions prior to the close rather than issue a margin call. If, however, an account remains non-compliant at the close, our practice is to issue a margin call, restrict the account to margin reducing transactions and liquidate positions by the close of the 3rd business day if the initial requirement has not then been satisfied.

In determining whether a margin call is required, IB performs both a real-time and regulatory computation, which in certain circumstances, can generate different results:

Real-Time: under this method, initial margin is computed using positions and prices collected at a common point in time, regardless of a product’s listing exchange and official closing time; an approach we believe appropriate given the near continuous trading offered by most exchanges.

Regulatory: under this method, initial margin is computed using positions and prices collected at the official close of regular trading hours for each individual exchange. So, for example, a client trading futures listed on each of the Hong Kong, EUREX and CME exchanges would have a requirement calculated based upon information collected at the close of each respective exchange.

Impact

Clients trading futures listed within a single country and session are not expected to be impacted. Clients trading both the daytime and after hours sessions of a given exchange or on exchanges located in different countries where the closing times don’t align are more likely to be impacted. For example, a client opening a futures contract during the Hong Kong daytime session and closing it during U.S. hours, would have only the opening position considered for purposes of determining the margin requirement. This implies a different margin requirement and a possible margin call under the revised computation that may not have existed under the current. An example of this is provided in the chart below.

Example

This example attempts to demonstrate how a client trading futures in both the Asia and U.S. timezones would be impacted were that client to trade in an extended hours trading session (i.e., outside of the regular trading hours after which the day's official close had been determined). Here, the client opens a position during the Hong Kong regular hours trading session, closes it during the extended hours session, thereby freeing up equity to open a position in the U.S. regular hours session. For purposes of illustration, a $1,000 trading loss is assumed. This example illustrates that the regulatory end of day computation may not recognize margin reducing trades conducted after the official close, thereby generating an initial margin call.

| Day | Time (ET) | Event |

Start Position |

End Position | IB Margin | Regulatory Margin | |||

| Equity With Loan | Maintenance | Initial | Overnight | Margin Call | |||||

| 1 | 22:00 | Buy 1 HHI.HK | None | Long 1 HHI.HK | $10,000 | $3,594 | $4,493 | N/A | N/A |

| 2 | 04:30 | Official HK Close | Long 1 HHI.HK | Long 1 HHI.HK | $10,000 | $7,942 | $9,927 | $4,493 | N/A |

| 2 | 08:00 | Sell 1 HHI.HK | Long 1 HHI.HK | None | $9,000 | $0 | $0 | $0 | N/A |

| 2 | 10:00 | Buy 1 ES | None | Long 1 ES | $9,000 | $2,942 | $3,677 | N/A | N/A |

| 2 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $9,993 | Yes |

| 3 | 17:00 | Official U.S. Close | Long 1 ES | Long 1 ES | $9,000 | $5,884 | $7,355 | $5,500 | No |

Bienvenue chez Interactive Brokers

Maintenant que votre compte est approvisionné et approuvé, vous pouvez commencer à trader. Les informations ci-dessous vous aideront à démarrer en tant que nouveau client d'Interactive Brokers.

- Votre argent

- Configurer votre compte pour le trading

- Comment trader

- Trader à travers le monde

- Cinq rappels pour tirer pleinement parti de nos services

1. Votre argent

Dépôts et retraits Informations générales. Toutes les transactions sont gérées par le biais de votre Gestion de compte sécurisée.

Dépôts

Tout d'abord, vous créez une notification de dépôt depuis Gestion de compte> Approvisionnement > Transferts de fonds > Type de transactions : “Dépôt” Comment créer une notification de dépôt. La seconde étape consiste à demander à votre banque d'effectuer un virement en utilisant les coordonnées bancaires fournies dans votre Notification de dépôt.

Retraits

Créez une instruction de dépôt via Gestion de compte > Approvisionnement > Transfert de fonds > Type de transaction : "Retraits" Comment créer des instructions de retrait

Si vous demandez un retrait dépassant les limites de retrait, il sera considéré comme un retrait exceptionnel et par conséquent, le détenteur du compte et le compte IB devront être les mêmes. Si le compte bancaire du destinataire a été utilisé pour un dépôt, le retrait sera traité. Dans le cas contraire, vous devez contacter le service clientèle et fournir les documents requis.

Résolution de problèmes

Dépôts : ma banque m'a envoyé de l'argent mais je ne vois pas ce montant crédité sur mon compte IB.

Raisons possibles :

a) Un transfert d'argent prend entre 1 et 4 jours ouvrés

b) La notification de dépôt est manquante. Vous devez la créer via votre Gestion de compte et envoyer un ticket au service clientèle

c) Les informations de modification sont manquantes. Votre nom ou le numéro de compte IB ne sont pas indiqués dans les informations de transfert. Vous devez contacter votre banque et demander les informations complètes.

d) La compensation par ACH initiée par IB est limitée à 100k USD par périodes de 7 jours. Si vous avez ouvert un compte Portfolio Margin avec une exigence de dépôt minimum de 110k, un virement est sans doute la meilleure option pour réduire le temps d'attente avant votre première transaction. Si vous avez opté pour une compensation par ACH, un temps d'attente de presque 2 semaines est à prévoir. Une autre solution est d'utiliser temporairement un compte RegT.

Retraits : J'ai demandé un retrait mais je ne vois pas cet argent crédité sur mon compte bancaire.

Raisons possibles :

a) Un transfert de fonds prend entre 1 à 4 jours ouvrés

b) Rejet. Le montant demandé excède le montant maximum disponible. Veuillez vérifier le solde de votre compte. Veuillez noter que conformément aux exigences réglementaires, lorsque les fonds sont déposés, ils doivent être détenus pendant une période de 3 jours avant qu'ils ne soient disponibles.

c) Votre banque a retourné les fonds. La raison en est sans doute que les noms du compte bancaire destinataire et émetteur ne correspondent pas.

2. Configurez votre compte pour le trading

Différence entre un compte de marge et un compte au comptant : si vous avez choisi de faire une demande d'ouverture de compte FastTrack, le type de compte par défaut est un compte au comptant avec autorisations de trading d'actions américaines. Si vous souhaitez trader avec un effet de levier et réaliser des opérations sur marge, voici comment faire une demande de compte de marge Reg T.

Autorisations de trading

Afin de trader une classe d'actifs particulière dans un pays donné, vous devez obtenir les autorisations de trading via votre Gestion de compte. Veuillez noter que les autorisations de trading sont obtenues gratuitement. Il vous sera par contre demandé de signer des clauses d'informations du risque conformément à la réglementation imposée par les organismes régulateurs du pays. Comment demander des autorisations de trading

Données de marché

Si vous voulez recevoir des données de marché en temps réel pour un produit ou une Bourse en particulier, vous devez vous abonner à une des liasses de données de marché qui sont facturées par la Bourse. Comment s'abonner aux données de marché

L'assistant de données de marché vous aidera à choisir la bonne liasse. Consultez la vidéo vous expliquant leur fonctionnement.

Les clients ont la possibilité de recevoir gratuitement des données de marché en différé en cliquant sur le bouton correspondant aux données gratuites en différé sur une ligne de symbole pour laquelle ils n'ont pas de souscription.

Comptes gérants indépendants

Jetez un oeil à notre guide "Comment commencer en tant que gérant indépendant". Vous trouverez ici des informations sur la manière de créer des utilisateurs supplémentaires sur votre compte de gérant et comment leur conférer des droits d'accès.

3. Comment trader

L'Academie du trading est le lieu où vous apprendrez comment utiliser nos plateformes. Vous y trouverez nos webinaires, live ou enregistrés dans 10 langues différentes, ainsi que de la documentation sur nos différentes plateformes de trading.

Trader Workstation (TWS)

Les traders qui ont besoin d'outils de trading plus sophistiqués peuvent utiliser notre Trader Workstation (TWS). Élaborée pour les teneurs de marché, cette plateforme vous propose une interface tableur qui prend en charge plus de soixante types d'ordres, des outils de trading adaptés à toutes les stratégies et un aperçu de votre solde et de vos activités en temps réel, pour trader plus rapidement et plus efficacement.

Essayez nos deux versions :

TWS Mosaic : intuitive, accès simple au trading, gestion des ordres, listes de suivi, graphiques, disponibles dans une fenêtre unique

TWS Classic : une gestion des ordres avancée pour les traders ayant besoin d'outils plus sophistiqués et d'algorithmes.

Description et informations générales / Guide de prise en main rapide / Manuel utilisateur

Visites guidées interactives : Les bases de TWS / Configuration de TWS / TWS Mosaic

Comment passer un ordre : Vidéo Classic TWS / Vidéo Mosaic

Outils de trading : Description et informations générales / Guide utilisateurs

Conditions préalables : Comment installer Java pour Windows / Comment installer Java pour MAC / Les ports 4000 et 4001 doivent être ouverts

Se connecter à TWS / Télécharger TWS

WebTrader

Les traders qui préfèrent une interface simplifiée peuvent utiliser notre plateforme HTML WebTrader, qui offre une présentation claire et simplifiée des données de marché et vous permet d'envoyer des ordres, de suivre l'évolution de vos comptes et de vos exécutions. Utilisez la dernière version du WebTrader pour votre navigateur

Guide de prise en main rapide / Manuel d'utilisation de WebTrader

Introduction : Vidéo WebTrader

Comment passer un ordre : Vidéo WebTrader

Connexion WebTrader

MobileTrader

Nos solutions mobiles vous permettent de trader sur votre compte IB durant vos déplacements. MobileTWS pour iOS et mobileTWS pour Blackberry sont conçus spécialement pour ces appareils tandis que la version plus générique MobileTrader prend en charge la plupart des autre smartphones.

Description et informations générales

Types d'ordres Types d'ordres disponibles et descriptions / Vidéos / Visites guidées / Manuel d'utilisation

Trading simulé Description générale et informations / Comment obtenir un compte de trading simulé

Une fois votre compte de trading simulé créé, les données de marché de votre compte simulé et de votre compte réel seront mises en commun : Gestion de compte > Gérer un compte > Paramètres > Trading simulé

4. Tradez dans le monde entier

Les comptes IB sont des comptes multi-devises. Votre compte peut contenir différentes devises au même moment. Cela vous permet de trader de multiples produits dans le monde à partir d'un seul compte.

Devise de base

Votre devise de base détermine la devise utilisée sur vos relevés de compte et celle utilisée pour déterminer les exigences de marge. La devise de base est déterminée lorsque vous ouvrez un compte. Les clients peuvent modifier la devise de base à tout moment sur leur Gestion de compte.

Nous ne convertissons pas automatiquement les devises dans votre devise de base

Les conversions de devises doivent être réalisées manuellement par le client. Sur cette vidéo, vous apprendrez comment effectuer une conversion de devise. Afin d'ouvrir une position libellée dans une devise différente de celle utilisée sur votre compte, vous avez deux possibilités :

A) Conversion de la devise

B) Prêt sur marge IB. (Non disponible pour les comptes au comptant)

Ce cours vous explique les mécanismes des transactions Forex.

5. Rappels utiles

1. Recherche de contrats

Vous trouverez ici tous nos produits, symboles et spécifications.

2. Base de connaissance IB

La base de connaissance est composée d'un glossaire terminologique, de guides pratiques ainsi que de conseils et recommandations en cas de problèmes. Elle vise à aider les clients IB à gérer leurs comptes. Saisissez votre requête dans la fenêtre de recherche et vous obtiendrez une réponse à votre question.

De la même manière que votre plateforme de trading vous donne accès aux marchés, la Gestion de compte vous permet d'accéder à votre compte IB. Utilisez la Gestion de compte pour gérer les tâches liées à votre compte telles que le retrait ou dépôt de fonds, la consultation de vos relevés, la souscription aux données de marché ou leur modification, les autorisations de trading et la vérification ou modification de vos informations personnelles.

Connexion Gestion de compte / Guide d'utilisation rapide de la Gestion de compte / Guide d'utilisation de la Gestion de compte

Afin de vous garantir le plus haut niveau de sécurité en ligne, Interactive Brokers a mis en place une système d'accès sécurisé

(Secure Login System - SLS) par lequel l'accès à votre compte se fait par un processus d'authentification en deux temps. Cette double authentification permet de confirmer votre identité au moment de la connexion de deux manières : 1) Par une information dont vous avez connaissance (votre nom d'utilisateur et mot de passe ); et 2) Par quelque chose que vous possédez (un appareil de sécurité fourni par IB qui génère un code de sécurité aléatoire, valable une seule fois). Votre nom d'utilisateur et mot de passe ainsi que la possession physique de l'appareil étant requis, participer au système d'accès sécurisé élimine la possibilité pour quiconque d'accéder à votre compte.

Comment activer votre appareil de sécurité / Comment obtenir une carte de sécurité / Comment retourner un appareil de sécurité

Si vous oubliez votre mot de passe ou perdez votre carte de sécurité, veuillez nous contacter pour une assistance immédiate.

Facile à consulter et à personnaliser, nos relevés et rapports recouvrent tous les aspects de votre compte Interactive Brokers. Comment consulter un relevé d'activités

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Overview of Dodd-Frank

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd-Frank, is a U.S. law enacted in July of 2010, the purpose of which is to prevent the recurrence of events which lead to the 2008 financial crisis. Its principal goals are to:

- Promote U.S. financial stability by improving accountability and transparency within the financial system;

- Protect taxpayers from future bailouts of institutions deemed “too big to fail”; and

- Protect consumers from financial services practices considered abusive.

For additional information, please review the following sections:

- Dodd-Frank reforms

- Dodd-Frank and your IB Account

Dodd-Frank Reforms

To accomplish its goals, Dodd-Frank proposed the following reforms:

- Enhanced oversight and supervision of financial institutions through the creation of Financial Stability Oversight Council

- Creation of a new agency responsible for implementing and enforcing compliance with consumer financial laws (Bureau of Consumer Financial Protection)

- Implementation of more stringent regulatory capital requirements

- Changes in the regulation of over the counter derivatives including restrictions upon access to Federal credit by swaps entities, establishment of regulatory oversight and mandatory trading and clearing requirements

- Enhanced regulation of credit rating agencies intended to eliminate exemptions from liability, enhance rating agency disclosure, establish prohibited activities and impose standards for independent Board governance

- Changes to corporate governance and executive compensation practices

- Incorporation of the Volcker Rule which imposes restrictions upon the speculative proprietary trading activities of banking entities

- Mandating studies intended to reform investor protection rules

- Changes to the securitization market including requirements that mortgage bankers retain a % of risky loans.

Dodd-Frank and Your IB Account

Perhaps most visible to IB account holders of all the Dodd-Frank regulations are those relating to money transfers. Here, Section 1073 of the Act introduces consumer protections designed to increase transparency with respect to the costs, timing and the right to repudiate cross-border transactions.

For purpose of Section 1073, a cross-border transaction is defined as an electronic transfer of money from a consumer in the United States to a person or business in a foreign country. As IB LLC is a U.S. based broker, all its account holders regardless of whether they are domiciled in the U.S. or not, benefit from this protection and it covers withdrawals denominated in a currency other than the U.S. dollar as well as USD denominated withdrawals sent to a non-U.S. bank. Account holders submitting a withdrawal which is covered by this regulation will be provided with a disclosure after confirming the request within Account Management. This disclosure will include the following information:

- The name and address of the sender and recipient

- The amount to be deducted from the sender’s IB account

- The amount projected to be credited to the recipient’s bank account including an estimate of fees which the receiving bank's correspondent bank(s) may charge. Note that these correspondent bank fees are not set by nor is any part of them earned by IB.

- A disclaimer that additional fees and foreign taxes may apply.

- Notice of the sender’s right to cancel the transfer request for a full refund within 30 minutes of it being authorized.

- Regulatory contact information in the event of questions or complaints.

When estimating correspondent bank transfer fees, IB takes into consideration information collected from past customer transactions in addition to data made available by our agent banks. We encourage our customers to review and consider this information when making decisions regarding cross-border transactions.

IRA: Required Minimum Distributions

IRA owners may be required to to withdraw funds beginning at age 73, and every year thereafter. Determining your Required Minimum Distribution (RMD) is significant while retaining an IRA, considering both your life expectancy and the IRA's fair market value.

The required amount for each eligible person is based on the December 31 IRA account value of the previous year and the IRA owners date of birth. Your spouse's date of birth may also be a factor if your spouse is at least 10 years younger than you. Interactive Brokers LLC provides several information resources to understand and calculate your RMD, including access to the online FINRA RMD Calculator.

Requesting Your RMD Withdrawal

The Internal Revenue Service (IRS) requires the IRA plan custodian to notify IRA owners about the RMD requirements by January 31 each year. If you turn 73 this year, you are required to begin taking RMDs before April 1 of the following year.

Eligible IRA owners must begin receiving withdrawals by December 31 of the year they reach age 73. The first RMD withdrawal, however, may be delayed until April 1 of the following year.

If you elect to delay the withdrawal, then please observe the following considerations:

(1) Two RMD withdrawals will be required the following year, the undistributed initial RMD and the new RMD.

(2) The new RMD will be slightly larger due to the December 31 market value's inclusion of the undistributed initial RMD.

Subsequent RMD withdrawals from your IRA must be distributed by December 31 to avoid a penalty tax.

Note: Roth IRAs are exempt from the RMD rules during the IRA owner's lifetime.

Requesting Your RMD Withdrawal

You may request a withdrawal of funds through the Transfer & Pay and then Transfer Funds menu options within Client Portal. The IRS deadline for taking RMDs is December 31 each year. Keep in mind that the year end withdrawal cut off for processing withdrawals from your Interactive Brokers account may occur before December 31.

Please note that you can elect to transfer your funds to your bank account or to an Interactive Brokers non-IRA account. To transfer funds to an Interactive Brokers non-IRA account, log into Client Portal, select Transfer & Pay, Transfer Funds then select Transfer Funds Between Accounts.

Your RMD is determined by dividing the account balance on December 31 of last year by your life expectancy factor. Your life expectancy factor is taken from the Life Expectancy Tables contained in IRS Publication 590. Your IRA beneficiary election may play an important role in determining your RMD, as well.

You must calculate your RMD separately for each qualifying IRA custodied at Interactive Brokers and any other financial institution. The RMD, however, may be satisfied from any single one or combination of your IRAs. The IRA Required Minimum Distribution Worksheets may provide additional assistance with the calculation of your RMD.

Click here to return to the Retirement Account Resource page.

Disclaimer: IB does not provide tax advice. These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any international, federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor. We recommend that you consult a qualified tax adviser or refer to the U.S. Internal Revenue Service.

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Security Device Replacement Charge

Account holders logging into their account via IBKR's Secure Login System are issued a security device, which provides an additional layer of protection to that afforded by the user name and password, and which is intended to prevent online hackers and other unauthorized individuals from accessing their account. While IBKR does not charge any fee for the use of the device, certain versions require that the account holder return the device upon account closing or incur a replacement fee. Existing account holders are also subject to this replacement fee in the event their device is lost, stolen or damaged (note that there is no fee to replace a device returned as a result of battery failure).

In addition, while IBKR does not assess a replacement fee unless a determination has been made that the device has been lost, stolen, damaged or not returned, a reserve equal to the fee will placed upon the account upon issuance of the device to secure its return. This reserve will have no effect upon the equity of the account available for trading, but will act as limit to full withdrawals or transfers until such time the device is returned (i.e., cannot withdraw the reserve balance).

Outlined below are the replacement fee associated with each device.

| SECURITY DEVICE | REPLACEMENT FEE |

| Security Code Card1 | $0.001 |

| Digital Security Card + | $20.00 |

For instructions regarding the return of security devices, please see KB975

1 The Security Code Card is not required to be returned upon account closing and may be destroyed and discarded once remaining funds have been returned and the account has been fully closed. Access to Client Portal after closure for purposes of viewing and retrieving activity statements and tax documents is maintained using solely the existing user name and password combination. This type of two-factor security is no longer being issued.

Cash Sweeps

These regulations further require that all securities transactions be effected and margined in the securities segment of the Universal account and commodities transactions in the commodities segment.1 While the regulations allow for the custody of fully-paid securities positions in the commodities segment as margin collateral, IB does not do so, thereby limiting their hypothecation to the more restrictive rules of the SEC. Given the regulations and policies which direct the decision to hold positions in one segment vs. the other, cash remains the only asset eligible to be transferred between the two and for which customer discretion is provided.

Outlined below is a discussion as to the cash sweep options offered, the process for selecting an option as well as selection considerations.

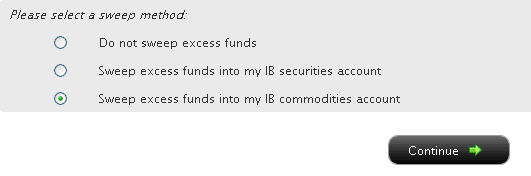

You may then select the radio button alongside the option of your choice and select the Continue button. Your choice will take effect as of the next business day and will remain in effect until a different option has been selected. Note that subject to the trading permission settings noted above, there is no restriction upon when or how often you may change your sweep method.

A Comparison of U.S. Segregation Models

銀行送金による出金方法

ご出金いただく場合は、アカウントマネジメントより出金指示をご入力ください。

<アカウントマネジメントのメニューが左側に表示されている場合>

アカウントマネジメントへログインし、Funds Management(資金管理)、Fund Transfers(入金・出金)を選択してください。

※画面上部に表示されております国旗を選択することでメニューの言語切替が可能です。

<アカウントマネジメントのメニューが上部に表示されている場合>

アカウントマネジメントへログインし、Funding(入金・出金)、Fund Transfers(入金・出金)を選択してください。

※画面右上に表示されております世界地図をクリックすることでメニューの言語切替が可能です。

1. 表示される画面上でTransaction(入金・出金)より「Withdraw Funds(出金)」、Method(方法)より「Zengin Wire(国内送金)」、Instruction(指示)より「Add New Instruction(出金先の新規登録)」を選択します。

※ IBSJ口座(国内商品取引口座)をお持ちのお客様は、上部にございます日本の国旗をクリックすることでメニューを日本語に変換できます。

※ IBLLC口座(海外商品取引口座)をお持ちのお客様は、Transactionより「Withdrawal Funds(出金)」、Methodより「Wire(電子送金)」、Instructionより「Add New Instruction(出金先の新規登録)」を選択してください。

2. 次にCurrency(通貨)、Bank Location(銀行所在地)、Bank Account Number(銀行口座番号)、Account Type(口座種別)、Bank/Branch code(銀行および支店コードをスペースなしで続けて入力)等の情報を入力する画面が表示されます。これらの情報をご入力後、「Continue(次に進む)」をクリックしてAmount(金額)をご入力ください。出金確認ページを完了しますと、お客様の出金リクエストは担当部署にてレビュー後、処理されます。

※ IBLLC口座(海外商品取引口座)をお持ちのお客様には、Currency(通貨)、Bank Location(銀行所在地)、Bank Account Number(銀行口座番号)、SWIFT code(SWIFTコード)等の情報を入力する画面が表示されます。

※ マネーロンダリング防止の取り組みとして、弊社からの出金は全てお客様のIB口座名義にて出金処理されますのでご了承ください。

この他ご不明な点がございましたら、カスタマーサービスまでお問い合わせください。

www.interactivebrokers.com/en/p.php?f=customerService&ib_entity=llc

How to withdraw funds via bank wire transfer

To make a wire withdrawal to your bank account you will first need to register a new withdrawal instruction through Account Management.

<If your Account Management has menus on left side>

Once logged into Account Management, select the Funds Management and then Funds Transfers menu options. ※ You may change languages by clicking a flag shown on the top.

<If your Account Management has menus on top>

Once logged into Account Management, select the Funding and then Funds Transfers menu options.

※ You may change languages by clicking a gray global map on the right top of the screen.

1. From there you will select the Transaction Type of "Withdrawal", the Method of " Zengin Wire ", the Instruction of "Add New Instruction".

※ If you are IBLLC customers, you will select the Transaction Type of "Withdraw Funds", the Method of "Wire", and Instruction of "Add New Instruction".

2. You will then be prompted to input Currency of denomination, Bank Location, Bank Account Number, Account Type, and Bank/Branch code (no space between bank and branch codes). Once that information has been input, click "Continue" button to enter withdrawal amount. After confirmation page, your withdrawal request will be reviewed and processed.

※ IBLLC customers will be prompted to input your receiving bank details including Currency of denomination, Bank Location, Bank Account Number and SWIFT code of your bank.

※ Please note that all withdrawals will be sent in the name of IB account holder in accordance with anti-money laundering regulations.

Should you have further questions, please contact one of our Customer Service Centers.

www.interactivebrokers.com/en/p.php?f=customerService&ib_entity=llc