Совместимость TWS с MacOS 12 (Monterey)

Статья посвящена проблемам при работе Trader Workstation (TWS) на MacOS Monterey (версия: 12), отмеченным некоторыми клиентами. На MacOS 12 программа может зависать или неожиданно прекращать работу. Сбои могут возникнуть при запуске TWS или при дальнейшей работе с программой (спустя несколько минут или даже часов).

Устранение проблемы

Ошибка была устранена в бета-версии TWS, скачать которую можно здесь.

Для внедрения нового решения требовалось провести тщательное тестирование, чтобы определить, какая платформа на Java лучше всего подходит для работы с Trader Workstation, и избежать новых ошибок.

Благодарим за Ваше терпение.

Информация об оповещениях от Interactive Brokers относительно ограничений цены

Регулирующие органы требуют, чтобы в брокерских фирмах действовали механизмы предотвращения отправки ордеров, несущих риск дестабилизации рынка (напр., риск резких скачков цены).

Для выполнения этих требований компания Interactive Brokers применяет к клиентским ордерам ряд ценовых фильтров. В некоторых случаях такие фильтры могут ограничить цену клиентского ордера с целью избежания дестабилизации рынка; как правило предел цены выражается в виде процента от рассчитанного IB справочного ценового диапазона (диапазон зависит от типа и текущей цены инструмента).

Несмотря на то, что пределы цен призваны повысить определенность на рынке и снизить ценовой риск, в результате ограничений сделка может быть отложена или не состояться. Дополнительная информация доступна на сайте Interactive Brokers: Уведомление о маршрутизации и плате за поток ордеров.

При ограничении клиентского(-их) ордера(-ов) нашей системой клиент IB получает: (i) оповещения в реальном времени в Trader Workstation, через API или FIX; и/или (ii) ежедневные информационные сообщения FYI (For Your Information) с резюме первых 10 ордеров, цена которых была ограничена в предыдущий день, исходные пределы цен для этих ордеров (если применимо) и диапазоны дальнейших ограничений.

Клиент может отказаться от получения будущих информационных сообщений FYI, щелкнув по соответствующей ссылке в одном из них. Делая это, клиент:

- Освобождает Interactive Brokers от обязанности уведомлять клиента о применении ограничений к ценам клиентских ордеров; и

- Осознает, что в будущем на его ордера могут быть наложены ограничения цены, и подтверждает свое нежелание получать оповещения об этом.

Interaction between TWS and MacOS 12 (Monterey)

The present article addresses performance on the Trader Workstation (TWS) under MacOS Monterey (version: 12), as experienced by several clients. The TWS may experience freezes or may shut down unexpectedly (crash) when running on MacOS 12. This can happen immediately during the TWS start up phase or may occur at a later time point, after some minutes or even hours.

Fix Implementation

A fix has been released in the TWS Beta, available for download here

This process included an extensive amount of testing, in order to see which of the alternative Java platforms was the best fit for the Trader Workstation and as well to avoid introducing new issues while solving the current one.

We sincerely thank you for your patience.

TWS Account Window for Retail Clients of IBKR Ireland and Central Europe

This article describes the information provided in the TWS account window for IBKRs EU based entities.

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Retail clients who are residents of the EEA and therefore maintain an account with one of IBKR’s European brokers, IBIE or IBCE, are subject to EU regulations which introduce leverage and other restrictions applicable to CFD transactions.

Notably the regulations require the use of free cash to satisfy CFD margin requirements and prohibit retail clients from using securities in the account as collateral to borrow funds to initiate or maintain a CFD position. Please see Overview of ESMA CFD Rules Implementation for Retail Clients at IBIE and IBCE for full details.

The accounts of IBKRs EU entities are universal accounts in which clients can trade all asset classes available on IBKRs platform, but unlike IBKRs US and UK entities, there are no separately funded segments.

Working examples of how this restriction is applied, along with details as to how clients can monitor free cash available for CFD transactions, are outlined below.

Account Window

IBKR enforces the restriction relating to free cash by calculating the funds available for CFD trading on a real-time basis, rejecting new orders and liquidating existing positions when the available free cash is insufficient to cover CFD initial and maintenance margin requirements.

IBKR offers clients the ability to monitor free cash available for CFD transactions via an enhancement to the TWS Account Window which displays the level of free cash in the account. Importantly, the funds shown as available for CFD trading do not imply that cash is held in a separate segment. It simply indicates what proportion of total account balances is available for CFD trading.

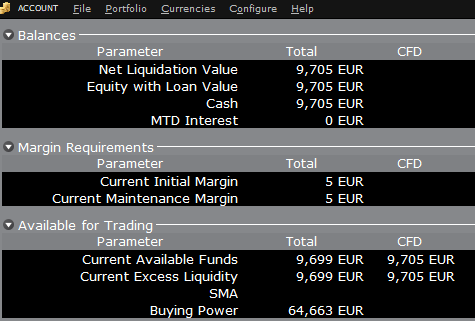

For example, assume that an account has EUR 9,705 in cash and no positions. All the cash is available to open CFD positions, or positions in any other asset class:

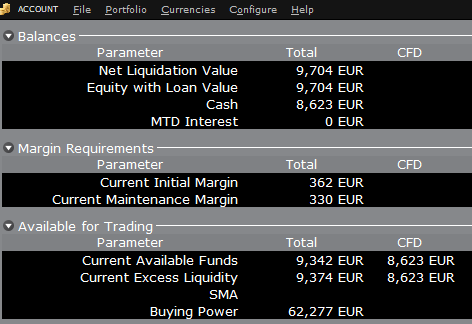

If the account now purchases 10 shares of AAPL stock for an aggregate value of USD 1,383 the cash in the account is reduced by a corresponding amount in EUR, and the funds available for CFD trading are reduced by the

same amount:

Note that Total available funds are reduced by a smaller amount, corresponding to the stock margin requirement.

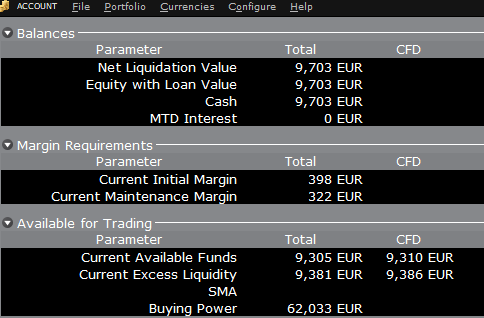

If, instead of buying AAPL stock, the account buys 10 AAPL CFDs the impact will be different. As the transaction involves a derivative contract rather than the purchase of the underlying asset itself, there’s no reduction in cash but the funds available for CFDs are reduced by the CFD margin requirement to secure performance on the contract:

In this case Total available funds and CFD available funds are reduced by an equal amount; the CFD margin requirement.

Funding

As noted above, EU-based accounts do not have segments and therefore there is no need for internal transfers. Funds are available for trades in all asset classes in the amounts indicated in the account window, without the need for sweeps or transfers.

Note also that should an account have a margin loan, i.e. negative cash, it will not be possible to open CFD positions since the CFD margin requirement must be satisfied by free, positive cash. Should you have a margin loan and wish to trade CFDs you must first either close margin positions to eliminate the loan, or add cash to the account in an amount that covers the margin loan and creates a cash buffer sufficient for the necessary CFD margin.

Ограничения портфеля

Жители Люксембурга (LU): IB Luxembourg (“IB-LUX”) не поддерживает сырьевые металлы (сертификаты на золото "London Gold").

Жители Центральной и Западной Европы (HU, CZ, PO, BG, RO, HR, SK, EE, LV, LT, CY, MT): IB Central Europe (“IB-CE”) не поддерживает сырьевые металлы. На данный момент IBCE работает только со следующими валютами: EUR, USD, CZK, HUF, PLN. GBP и CHF будут добавлены в ближайшее время.

Если в Вашем портфеле имеются такие позиции, то их необходимо закрыть как можно скорее, чтобы мы могли осуществить перенос Вашего счета. Это касается только длинных позиций. Короткие денежные позиции (заем) не требуют срочного закрытия.

Portfolio Restrictions

Residents of Luxembourg (LU): IB Luxembourg (“IB-LUX”) cannot support Commodity-Metals (London Gold Certificates).

Residents of Central-Eastern Europe (HU, CZ, PO, BG, RO, HR, SK, EE, LV, LT, CY, MT): IB Central Europe (“IB-CE”) cannot support commodity metals. Furthermore, IBCE currently only supports for the following currencies: EUR, USD, CZK, HUF, PLN. GBP and CHF are expected in the near future.

If you hold any of these currencies in your portfolio, you must close the positions as soon as possible in order to facilitate transfer of your account. Short cash positions (borrowing) do not have to be close immediately, just long positions.

Навигатор риска – калькулятор альтернативной маржи

IB регулярно анализирует уровень маржи и вводит изменения, которые увеличивают требования выше минимума, установленного законодательством, в соответствии с условиями рынка. Чтобы помочь клиентам оценить последствия таких изменений для своего портфеля, в "Навигатор риска" добавлена функция "Калькулятор альтернативной маржи". Ниже приведены шаги по созданию портфеля "что, если", который позволяет определить, к чему могут привести такие изменения маржи.

Шаг 1. Откройте новый портфель "что, если"

На экране торговой платформы Classic TWS выберите Аналитические инструменты, Навигатор риска и затем Открыть новый "что, если" (Рис. 1: Analytical Tools -> Risk Navigator -> Open New What-If).

Рис. 1

.png)

При работе в Mosaic TWS выберите Новое окно, Навигатор риска и затем Открыть новый "что, если".

Шаг 2. Настройте исходный портфель

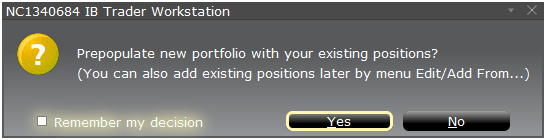

Появится всплывающее окно (Рис. 2), где Вам предложат создать гипотетический портфель на основе своего текущего портфеля или создать новый. Если нажать "Да", в новый портфель "что, если" будут загружены Ваши текущие позиции.

Рис. 2

Если нажать "Нет", откроется новый портфель "что, если" без позиций.

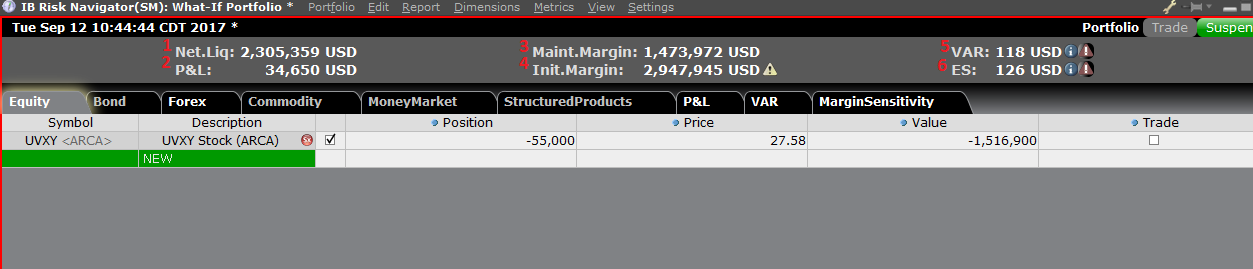

Панель управления рисками

Панель управления рисками находится над вкладками с продуктами и доступна для работы с портфелями "что, если" и активными портфелями. Для портфелей "что, если" значения рассчитываются по запросу. На панели отображается основная информация счета, в том числе:

1) Чистая ликвидационная стоимость – общая чистая ликвидационная стоимость счета

2) ПиУ – общие дневные ПиУ для всего портфеля

3) Минимальная маржа – текущие требования общей минимальной маржи

4) Начальная маржа – общие требования начальной маржи

5) VAR – стоимость под риском (Value at risk) всего портфеля

6) ES – ожидаемый дефицит (Expected Shortfall), т.е. средняя стоимость под риском – ожидаемая доходность портфеля в худшем случае

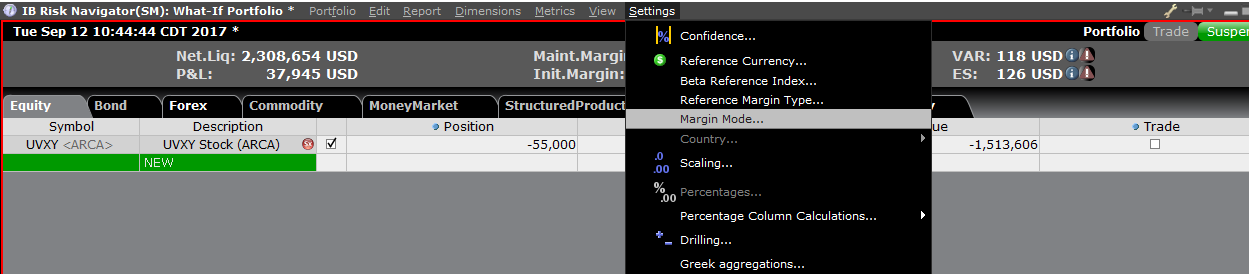

Калькулятор альтернативной маржи

Чтобы открыть "Калькулятор альтернативной маржи", в меню "Настройки" выберите "Режим маржи" (Рис. 3: Settings -> Margin Mode). Калькулятор отображает, как изменения маржи повлияют на общие маржинальные требования после вступления в силу.

Рис. 3

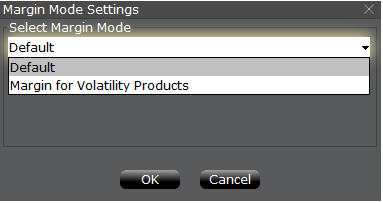

Шаг 3. Настройте режим маржи

Появится всплывающее окно (Рис. 4) с заголовком "Настройки режима маржи" (Margin Mode Settings). С помощью выпадающего меню на экране Вы можете изменить расчет маржи с опции по умолчанию (нынешниие регуляции) на новые настройки маржи (т.е. новые правила маржи). Выберите желаемый вариант и нажмите "ОК".

Рис. 4

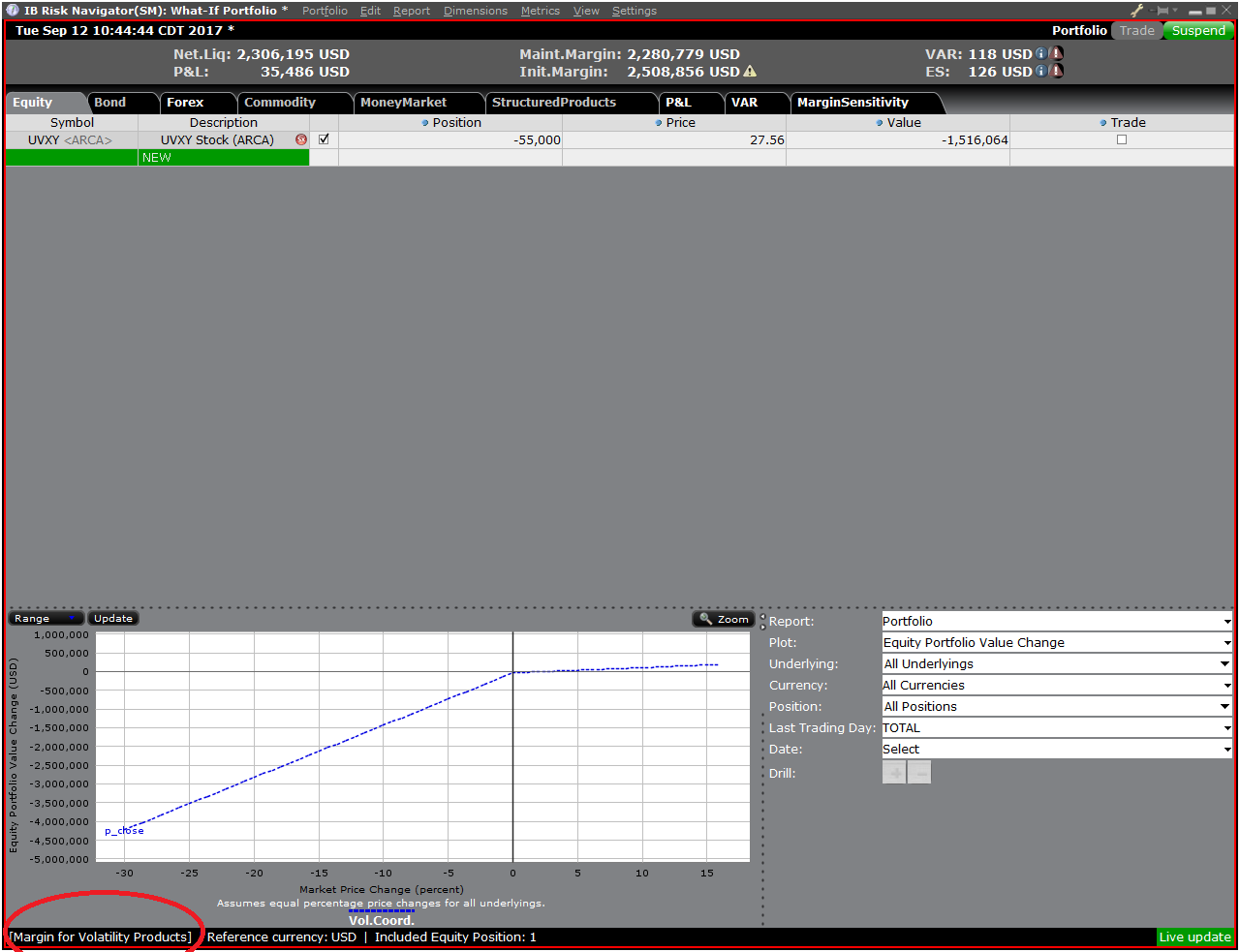

После изменения режима маржи панель "Навигатора риска" автоматически обновится. Вы можете переключать и сравнивать режимы маржи. Выбранный режим маржи будет указан в левом нижнем углу "Навигатора риска" (Рис. 5).

Рис. 5

Шаг 4. Добавьте позиции

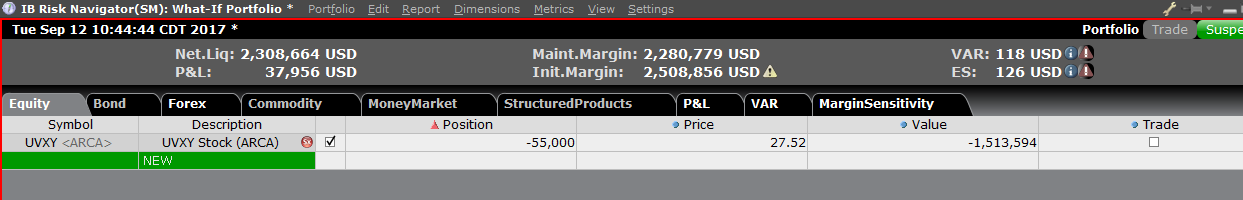

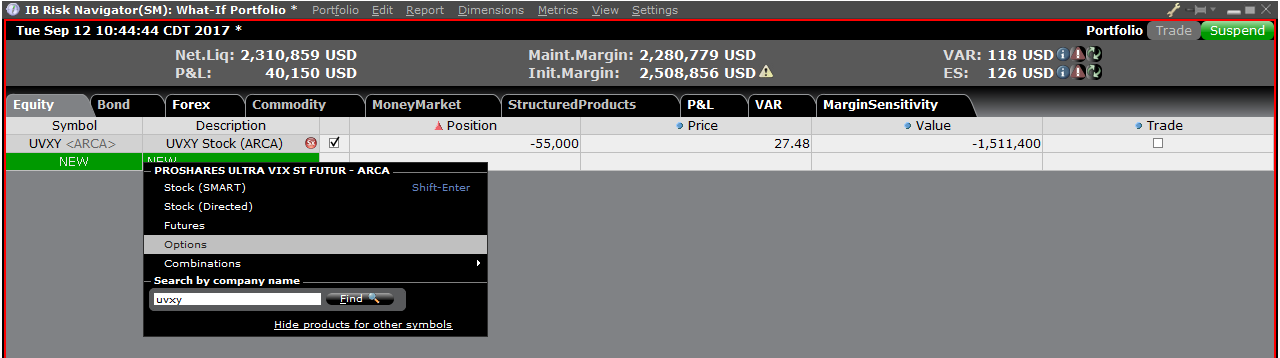

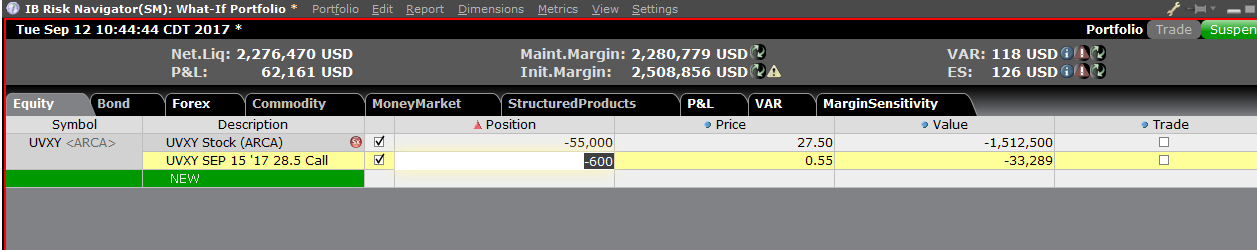

Чтобы добавить позиции в портфель "что, если", нажмите на зеленую строку с названием "Новый" и введите символ андерлаинга (Рис. 6), укажите тип продукта (Рис. 7) и введите размер позиции (Рис. 8)

Рис. 6

Рис. 7

Рис. 8

Вы можете изменить позиции и посмотреть, как это влияет на маржу. Измените позиции и нажмите на иконку пересчета (![]() ) справа от значений маржи, чтобы их обновить. Если рядом со значением маржи отображена эта иконка, значит величина не отражает актуальные данные портфеля "что, если".

) справа от значений маржи, чтобы их обновить. Если рядом со значением маржи отображена эта иконка, значит величина не отражает актуальные данные портфеля "что, если".

Disclosure Regarding Interactive Brokers Price Cap Notices

Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading (e.g., the risk of sudden, transient price moves).

To comply with these expectations, Interactive Brokers implements various price filters on customer orders. Those price filters may, in certain circumstances, price cap customer orders in order to avoid market disruption, and those Price Caps will generally be in a % range from a reference price range calculated by IB. (The range of the Price Cap varies depending on the type of instrument and the current price.)

Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. More information is available in Interactive Broker’s Order Routing and Payment for Order Flow Disclosure.

If a customer’s order(s) are price capped by IB’s systems, that customer will either receive (i) real-time notification of those price cap(s) in Trader Workstation or via the API or FIX tag 58 (for FIX users); and/or (ii) a daily FYI message containing a digest of the first 10 order(s) that were price capped the prior day, the initial price cap(s) for those order(s) (if applicable), and the Price Cap Range(s) for further Price Cap(s) of those order(s).

Customers may opt out from receiving future FYI Messages by clicking the relevant opt-out link within an FYI Message. By opting out from receiving these future FYI Messages, a customer:

- Agrees to waive any further notifications from Interactive Brokers about the application of the firm’s Price Caps to that customer’s order(s); and

- Acknowledges that he or she understands that his or her orders may be price-capped in the future, but that the customer does not wish to be notified again about the application of any Price Caps to any of his or her orders.

Possible Alerts during the TWS installation or update

IBKR's Trader Workstation (TWS) is a global trading system enabling clients to use a suite of online trading tools. The TWS can be installed on Windows, Mac OS X and Linux, and it requires the presence of a Java Runtime Environment (JRE). Therefore, when you install the TWS, it also downloads the necessary Java files in order to run using a Java Virtual Machine (JVM).

Sometimes, during the installation or update process of the TWS, software such as Antivirus applications will show an alert and prevent the process to complete. The warning and other messages in this case can safely be ignored, and you can complete the installation of the trading platform.

Table of content

Downloading the TWS installer and update patches

The TWS installers available in the download areas of ibkr.com or IBKR regional web sites are sealed and digitally signed using all the safety procedures required by the industry standards and do not contain any malicious code or process. The same industry standard practices have been used for the TWS update patches, which are automatically downloaded and installed when launching the TWS (if and only if there is an update available). Nevertheless, if you have received an alert, we recommend you to be cautious. Should you intend to keep the TWS installation file on your machine for future use, you should make sure that the same precautions for the protection of data from viruses and malware are applied to it.

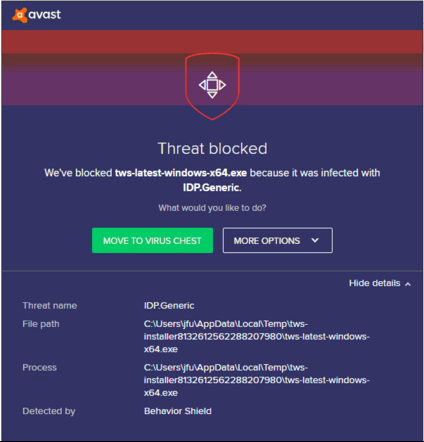

Why do I receive a warning when I install the TWS or when the TWS automatic update runs?

You might see an alert (similar to Figure 1 but not limited to) and your security system would wait for your input on how to process the suspicious file. You usually have the option to quarantine the file, delete it, ignore it once or create a permanent exception for it.

Please note that your antivirus might autonomously quarantine or delete the TWS installer file or some of his components without asking for your confirmation and without showing you any warning. Nevertheless, this should only happen if you have preset your antivirus to specifically react in this way.

Figure 1.

What should I do when I receive a warning?

In case you receive a warning during the TWS installation or update, we recommend the following steps:

1. Delete the TWS installer and download it again from the IBKR main or regional web site

a) Delete the TWS installer file already present on your computer and then delete it as well from your Trash (empty your Trash)

b) From the table below, click on the TWS download area correspondent to your location

| Location | TWS download area |

| US | https://www.ibkr.com |

| Asia / Oceania | https://www.interactivebrokers.com.hk |

| India | https://www.interactivebrokers.co.in |

| Europe | https://www.interactivebrokers.co.uk https://www.interactivebrokers.eu |

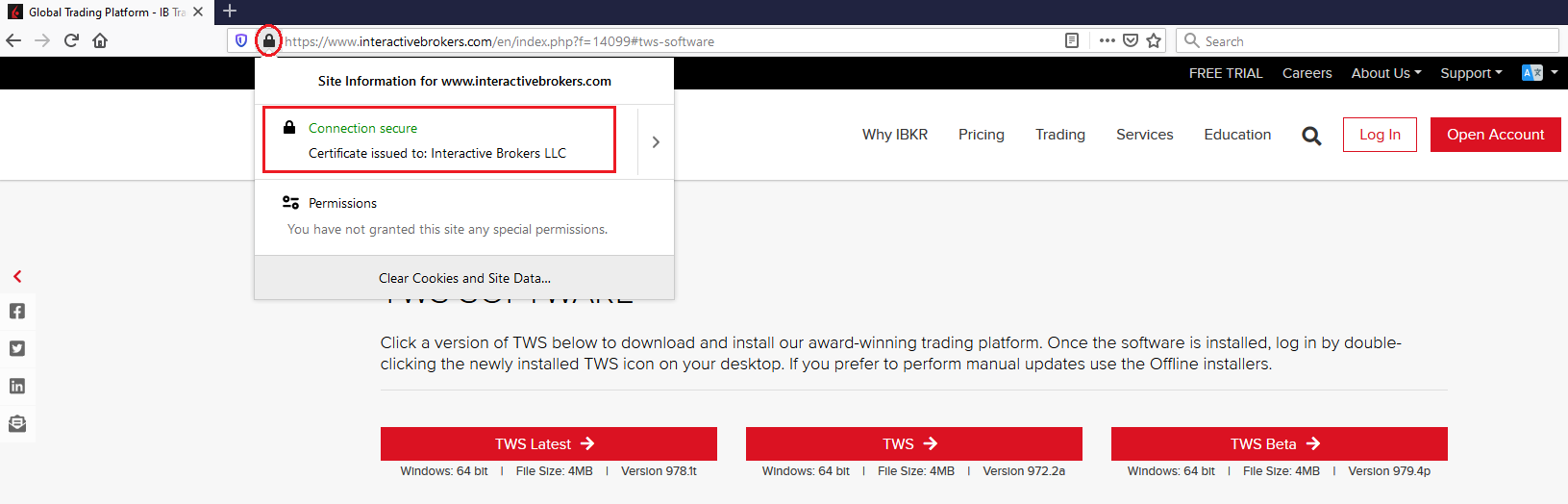

c) Check the website certificate. Most Internet browsers will immediately alert you in case the site certificate is invalid, compromised or expired. Nevertheless, if you want to check manually the validity of the site certificate, click on the padlock close to the address (URL) and make sure the Connection is reported as secure and no security warning are present (see Figure 2 below).

Figure 2.

d) Click on the button labeled with the TWS version you wish to use and download again the TWS installer

2. Check the digital signature of the TWS installer file you have downloaded

Normally you will immediately receive a security warning in case the digital signature of a file is compromised. Nevertheless, if you wish to perform a manual check, proceed as follows, according to your Operating System:

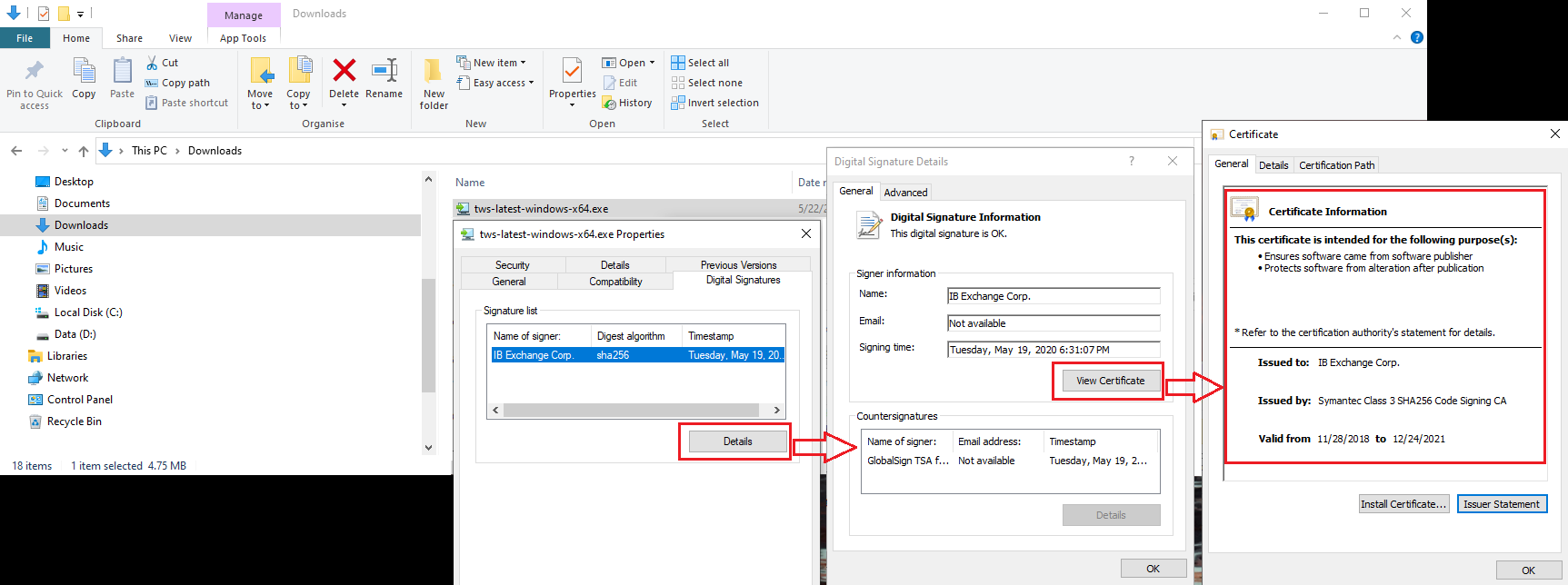

For Windows

a) From the Windows file explorer, access your Downloads folder or the folder where you placed the TWS installer

b) Right click on the TWS installer file, select Properties and then click on the tab "Digital Signatures"

c) Click on "Details" and on "View Certificate" to check the certificate status and signer. The legitimate signer is "IB Exchange Corp." (See Figure 3 below)

Figure 3.

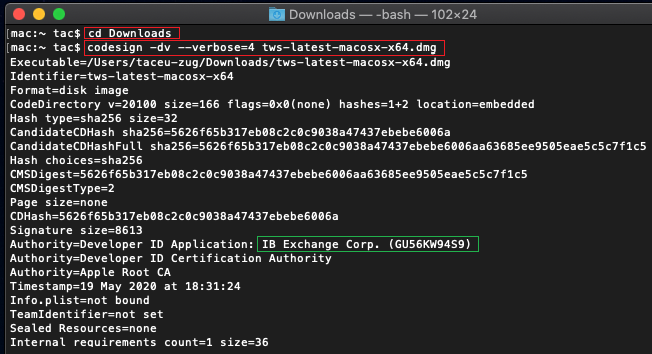

For Mac OS X

a) Click on the magnifier glass (Spotlight Search) on the top right of your screen and type Terminal. From the search results, launch the Terminal app

b) Type cd Downloads and press Enter

c) Type codesign -dv --verbose=4 tws-latest-macosx-x64.dmg and press Enter. Please notice that the name of the file (tws-latest-macosx-x64.dmg) may differ according to the TWS version you decided to download. If needed, replace the file name in the command with the appropriate one

d) Check the command output and make sure the "Developer ID Application" is "IB Exchange Corp." (see Figure 4 below)

Figure 4.

3. Run the TWS installer file you have downloaded

Once you have downloaded again the TWS installer and after you made sure the file is original (points 1. and 2. above), you can proceed with the installation. Should you still receive a warning from your antivirus, you can reasonably consider it as a false positive and ignore it. Should you need guidance on this step, please proceed directly to the next section.

How can I signal an Alert as false positive?

All modern security systems allow the creation of exceptions, precisely in order to address false positive cases. An exception is a rule forcing the antivirus engine not to scan a specific file or process. That specific file or process will hence be deemed safe and no further alerts will be raised for it.

The procedure for creating an exception may vary, according to the security software you are using. You may be able to create a temporary or permanent exception directly from the alert pop-up or you may have to create one manually from a specific section in the main configuration panel.

If you are unsure of the procedure, we recommend you to consult your antivirus documentation.

Once you have set an exception for the TWS installer file or for the TWS updater process, those will be no longer blocked and will be able to complete their respective tasks successfully.

What else can I do if I have doubts or if my system behaves abnormally?

If you have reasons to believe your machine may be compromised or infected, we recommend performing a full system scan. Usually you can right click on the antivirus icon present on the bottom taskbar (for Windows) or on the upper menu bar (for MacOS) and you will find the option to launch a full system scan. Alternatively, you may start that task from the main antivirus window. If you are unsure of the procedure, we recommend you to consult your antivirus documentation.

Technical Background

How does my security system scan the files I download from the Internet?

Modern antivirus and anti-malware engines base their threats recognition on:

Signature-based scanning: the antivirus scanner searches for a specific pattern of bytes that was previously catalogued as malicious or at least suspicious. The antivirus may check as well file signatures (called hash) against a database of known threats (called virus definitions).

Analysis of behavior: the antivirus engine detects specific actions which individually may not represent a threat but, when correlated together, resemble the usual activity of a malicious software (e.g. the ability of a code to replicate or hide itself, download additional files from the Internet, contact external hosts over the Internet, modify the Operating System registry) This type of scan is designed to detect previously unknown computer threats.

Heuristic detection: the scanner de-compiles the code or runs it within a virtual, restricted environment. It then classifies and weights the actions performed by the code against a predefined, behavior based, rule set.

Cloud-based protection and machine learning: those are relatively new techniques. The file that needs to be analyzed is sent to the antivirus / security system vendor cloud where sophisticated algorithms perform a deep analysis of the code authenticity and behavior.

Are those scan methods infallible?

Modern threats are very sophisticated and, like biological viruses, can mutate their code and their signatures. Moreover, new malwares and exploits are created every day and spread rapidly over the Internet. The threat recognition methods mentioned above are therefore not infallible but can guarantee a high percentage of malware recognition when combined together.

While signature based techniques are very successful in recognizing known threats and less prone to false positives, they are not so efficient in recognizing unknown malware or mutations of existing ones. In this area, the behavioral and heuristic methods perform much better although they are more prone to false positives since their detection is not based on bare code matching but on a certain degree of interpretation and hence uncertainty.

The term "false positive" is used when a security system classifies an innocuous file or process as malware.

Reference: