満期前のコールオプション権利行使について

概要

満期前の株式コールオプションの権利行使は、以下の点により通常は経済的利点がありません:

- オプション・タイムバリューの喪失;

- 株式受け渡しへの支払い、借入にかかる費用の増加;

- オプションプレミアムに関連する株式損失リスクの増加

しかしながら、支払や借入、ダウンサイドのマーケットリスク増加に対応できる口座保有者にとって、アメリカンスタイルのコールオプションの早期権利行使は支払予定の配当金の受け取りが可能なため、経済的利点が発生する可能性があります。

背景

配当金は割り当て日の株式保有者に対して支払われるため、コールオプションの保有者への支払はありません。その他の条件が同じ場合、株価は配当落ち日に配当金分、下落します。オプション価格理論上、コールオプションの価格は限月中、配当金支払い見込みが反映されたものとなりますが、配当落ち日に下落することがあります。この様なシナリオで早期権利行使が好まれる条件は以下のような場合です:

1. オプションがディープ・イン・ザ・マネーでデルタが100

2. オプションのタイムバリューが少額、もしくはゼロ

3. 配当金が比較的高く、配当落ち日がオプション満期日の前にある

例

早期権利行使の影響を例にして見てみます。口座の現金残高が$9,000であり、架空の株式ABCのロング・コール(権利行使価格$90.00)が10日後に満期を迎えると仮定します。ABCの株価は$100.00、配当金額は1株あたり$2.00、権利落ち日は明日であるとします。また、オプション価格と株価の動向は類似しており、権利落ち後に配当金額分下落すると仮定します。

100株のデルタポジションを、パリティ価格でのオプションの売却とパリティ価格以上でのオプションの売却の二つのオプション価格をを想定し、資産の最大化を査定します。

シナリオ1:オプション価格がパリティの時 - $10.00

パリティ価格でオプションが取引されている場合、株式が配当落ち後に資金に変わる際、早期権利行使でポジションデルタを維持し、ロングオプションの損失を避けます。現金は権利行使価格で株式を購入するために使用され、オプションプレミアムは喪失し、株式および配当金受取は口座に反映されます。これは配当落ち日の前にオプションを売却し、株式を購入することで達成できますが、手数用およびスプレッドも考慮してください:

| シナリオ1 | ||||

|

口座 バランス |

当初 バランス |

早期 権利行使 |

アクション 無し |

オプション売 &株式買 |

| 現金 | $9,000 | $0 | $9,000 | $0 |

| オプション | $1,000 | $0 | $800 | $0 |

| 株式 | $0 | $9,800 | $0 | $9,800 |

| 配当金受取 | $0 | $200 | $0 | $200 |

| 資産合計 | $10,000 | $10,000 | $9,800 | $10,000 |

シナリオ2:オプション価格がパリティ価格より上の時 - $11.00

パリティ価格以上でオプションが取り引きされる場合、配当金確保のための早期権利行使には経済的利点がない場合があります。このシナリオでは早期権利行使によりオプション・タイムバリューに$100の損失が発生しますが、オプションを売却して株式を購入した場合、手数料を差し引いた結果、アクションを取らない方がかえって良い可能性もあります。この場合、最も好まれるアクションはオプションを取らないことです。

| シナリオ2 | ||||

|

口座 バランス |

当初 バランス |

早期 権利行使 |

アクション 無し |

オプション売 |

| 現金 | $9,000 | $0 | $9,000 | $100 |

| オプション | $1,100 | $0 | $900 | $0 |

| 株式 | $0 | $9,800 | $0 | $9,800 |

| 配当金受取 | $0 | $200 | $0 | $200 |

| 資産合計 | $10,100 | $10,000 | $9,900 | $10,100 |

![]() 注意: ロングコール・ポジションをスプレッド取引の一部として保有している場合には、ショートポジションの割り当てが発生した際に、ロングポジションの権利行使を行わないリスクに特に注意を払う必要があります。割り当て日に株式ショートポジションを保有していて、ショートコールの割り当てが発生した場合、株式の貸し手に配当金を支払う義務が発生しますのでご注意ください。また、権利行使処理を行うクリアリング機関は、割り当ての対応として権利行使処理を行いません。

注意: ロングコール・ポジションをスプレッド取引の一部として保有している場合には、ショートポジションの割り当てが発生した際に、ロングポジションの権利行使を行わないリスクに特に注意を払う必要があります。割り当て日に株式ショートポジションを保有していて、ショートコールの割り当てが発生した場合、株式の貸し手に配当金を支払う義務が発生しますのでご注意ください。また、権利行使処理を行うクリアリング機関は、割り当ての対応として権利行使処理を行いません。

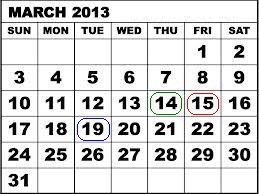

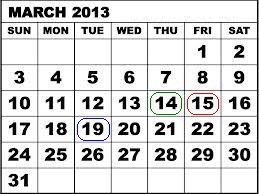

例:SPDR S&P 500 ETF Trust(SPY)のショート100枚(March '13 権利行使$146)とロング100枚(March '13 権利行使$147)を含むクレジットコール(ベア)スプレッドを例にとって考えて見ます。2013年3月14日に1株あたり$0.69372の配当金が発表されたとします。2013年3月19日付で、20134月30日支払の配当金支払見込みが株主の口座に反映されました。米国株式の3営業日決済により、配当金を受け取るには2013年3月14日までに株式の購入、もしくはコールオプションの権利行使を行わなければなりません。それ以降は配当落ち株式となります。

2013年3月14日には満期まで取引日が1日しか残されていません。二つのオプションはパリティ価格で取引され、1枚当たり$100、または100枚のポジションに$10,00の最大リスクが伴います。しかし、配当金の受け取りと、配当金受取を見込んだ、相手方の割り当てからの保護としてのロングコールの権利行使に失敗するとショートコール割り当てに対する配当金支払い義務が発生し、1枚当たり$67.372、または100枚のポジションに$6,737.20の追加のリスクが発生します。以下の表の通り、ショートコール・オプションの割り当てが発生しなかった場合、ポジションの最終決済価格が2013年3月15日に決定し、最大損失リスクは1枚あたり$100に留まります。

| 期日 | SPY 終値 | March '13 $146 コール | March '13 $147 コール |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

お持ちのお口座が米国債ルール871(m)により米国源泉徴収税の対象となっている場合、権利落ち日前に一度ロングポジションをクローズし、権利落ち日後に再度オープンされることにより、効果的に作用する可能性があります。

早期権利行使通知の提出方法については弊社ウェブサイトをご確認ください。

このページは情報提供のみを目的とするものであり、推奨や取引アドバイスではなく、早期権利行使がすべてのお客様やトレーダーに適していることを結論付けるものではありません。口座を保有されるお客様は専門の税理士にご相談の上、早期権利行使による課税への影響をご確認ください。また、ロングポジションの変わりに株式ポジションを保有するにあたって発生する可能性のあるリスクにご注意ください。

Dividend Tax Withholding on Depository Receipts

In the event an account holds a dividend paying depository receipt, at the time of the dividend payment taxes will be withheld. In several jurisdictions, IB is unable to efficiently comply in an electronic, straight-through manner with the required beneficial owner disclosure requirements. As such, dividends on depository receipts where full beneficial owner disclosure is required in order to receive beneficial tax treatment will be withheld at the maximum tax rate applicable.

Shareholders will not be eligible for reduced tax treatment on the allocation of cash through IB. All shareholders should consult their tax advisor for information on how to obtain a tax refund or tax credit for such activity.

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

SPY - Dividend Recognition

Unlike the case of a stock, in which a dividend is taxable in the year in which it is paid, the SPDR S&P 500 ETF Trust (Symbol: SPY) represents itself as a Regulated Investment Company and its dividend is deemed taxable in the year in which the record date is determined. As such, SPY dividends declared in either October, November or December and payable to shareholders of record on a specified date in one of those months will be considered taxable income income in that year despite the fact that such dividend will generally be paid in January of the following year.

Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

Overview of IBKR issued Share CFDs

The following article is intended to provide a general introduction to share-based Contracts for Differences (CFDs) issued by IBKR.

For Information on IBKR Index CFDs click here. For Forex CFDs click here. For Precious Metals click here.

Topics covered are as follows:

I. CFD Definition

II. Comparison Between CFDs and Underlying Shares

III. CFD Tax and Margin Advantage

IV. US ETFs

V. CFD Resources

VI. Frequently Asked Questions

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ESMA Rules for CFDs (Retail Clients of IBKRs European entities, including so-called F segments)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August 2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

I. Overview

IBKR CFDs are OTC contracts which deliver the return of the underlying stock, including dividends and corporate actions (read more about CFD corporate actions).

Said differently, it is an agreement between the buyer (you) and IBKR to exchange the difference in the current value of a share, and its value at a future time. If you hold a long position and the difference is positive, IBKR pays you. If it is negative, you pay IBKR.

Our Share CFDs offer Direct Market Access (DMA). Our Share CFD quotes are identical to the Smart-routed quotes for shares that you can observe in the Trader Workstation. Similar to shares, your non-marketable (i.e. limit) orders have the underlying hedge directly represented on the deep book of those exchanges at which it trades. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer.

To compare IBKR’s transparent CFD model to others available in the market please see our Overview of CFD Market Models.

We currently offer approximately 8500 Share CFDs covering the principal markets in the US, Europe and Asia. Eligible shares have minimum market capitalization of USD 500 million and median daily trading value of at least USD 600 thousand. Please see CFD Product Listings for more detail.

Most order types are available for CFDs, including auction orders and IBKR Algos.

CFDs on US share can also be traded during extended exchange hours and overnight. Other CFDs are traded during regular hours.

II. Comparison Between CFDs and Underlying Shares

| BENEFITS of IBKR CFDs | DRAWBACKS of IBKR CFDs |

|---|---|

| No stamp duty or financial transaction tax (UK, France, Belgium, Spain) | No ownership rights |

| Generally lower margin rates than shares* | Complex corporate actions may not always be exactly replicable |

| Tax treaty rates for dividends without need for reclaim | Taxation of gains may differ from shares (please consult your tax advisor) |

| Exemption from day trading rules | |

| US ETFs tradable as CFDs** |

*IB LLC and IB-UK accounts.

**EEA area clients cannot trade US ETFs directly, as they do not publish KIDs.

III. CFD Tax and Margin Advantage

Where stamp duty or financial transaction tax is applied, currently in the UK (0.5%), France (0.3%), Belgium (0.35%) and Spain (0.2%), it has a substantially detrimental impact on returns, particular in an active trading strategy. The taxes are levied on buy-trades, so each time you open a long, or close a short position, you will incur tax at the rates described above.

The amount of available leverage also significantly impacts returns. For European IBKR entities, margin requirements are risk-based for both stocks and CFDs, and therefore generally the same. IB-UK and IB LLC accounts however are subject to Reg T requirements, which limit available leverage to 2:1 for positions held overnight.

To illustrate, let's assume that you have 20,000 to invest and wish to leverage your investment fully. Let's also assume that you hold your positions overnight and that you trade in and out of positions 5 times in a month.

Let's finally assume that your strategy is successful and that you have earned a 5% return on your gross (fully leveraged) investment.

The table below shows the calculation in detail for a UK security. The calculations for France, Belgium and Spain are identical, except for the tax rates applied.

| UK CFD | UK Stock | UK Stock | |

|---|---|---|---|

| All Entities |

EU Account

|

IB LLC or IBUK Acct

|

|

| Tax Rate | 0% | 0.50% | 0.50% |

| Tax Basis | N/A | Buy Orders | Buy Orders |

| # of Round trips | 5 | 5 | 5 |

| Commission rate | 0.05% | 0.05% | 0.05% |

| Overnight Margin | 20% | 20% | 50% |

| Financing Rate | 1.508% | 1.508% | 1.508% |

| Days Held | 30 | 30 | 30 |

| Gross Rate of Return | 5% | 5% | 5% |

| Investment | 100,000 | 100,000 | 40,000 |

| Amount Financed | 100,000 | 80,000 | 20,000 |

| Own Capital | 20,000 | 20,000 | 20,000 |

| Tax on Purchase | 0.00 | 2,500.00 | 1,000.00 |

| Round-trip Commissions | 500.00 | 500.00 | 200.00 |

| Financing | 123.95 | 99.16 | 24.79 |

| Total Costs | 623.95 | 3099.16 | 1224.79 |

| Gross Return | 5,000 | 5,000 | 2,000 |

| Return after Costs | 4,376.05 | 1,900.84 | 775.21 |

| Difference | -57% | -82% |

The following table summarizes the reduction in return for a stock investment, by country where tax is applied, compared to a CFD investment, given the above assumptions.

| Stock Return vs cfD | Tax Rate | EU Account | IB LLC or IBUK Acct |

|---|---|---|---|

| UK | 0.50% | -57% | -82% |

| France | 0.30% | -34% | -73% |

| Belgium | 0.35% | -39% | -75% |

| Spain | 0.20% | -22% | -69% |

IV. US ETFs

EEA area residents who are retail investors must be provided with a key information document (KID) for all investment products. US ETF issuers do not generally provide KIDs, and US ETFs are therefore not available to EEA retail investors.

CFDs on such ETFs are permitted however, as they are derivatives for which KIDs are available.

Like for all share CFDs, the reference price for CFDs on ETFs is the exchange-quoted, SMART-routed price of the underlying ETF, ensuring economics that are identical to trading the underlying ETF.

V. Extended and Overnight Hours

US CFDs can be traded from 04:00 to 20:00EST, and the again overnight from 20:00 to 03:30 the following day. Trades in the overnight session are attributed to the day when the session ends, even if a trade is entered before midnight the previous day. This has implications for corporate actions and financing.

Trades entered before midnight on the day before ex-date will not have a dividend entitlement. Trades before midnight will settle as if they had been traded the following day, delaying the start of financing.

VI. CFD Resources

Below are some useful links with more detailed information on IBKR’s CFD offering:

The following video tutorial is also available:

How to Place a CFD Trade on the Trader Workstation

VII. Frequently Asked Questions

What Stocks are available as CFDs?

Large and Mid-Cap stocks in the US, Western Europe, Nordic and Japan. Liquid Small Cap stocks are also available in many markets. Please see CFD Product Listings for more detail. More countries will be added in the near future.

Do you have CFDs on other asset classes?

Yes. Please see IBKR Index CFDs - Facts and Q&A, Forex CFDs - Facts and Q&A and Metals CFDs - Facts and Q&A.

How do you determine your Share CFD quotes?

IBKR CFD quotes are identical to the Smart routed quotes for the underlying share. IBKR does not widen the spread or hold positions against you. To learn more please go to Overview of CFD Market Models.

Can I see my limit orders reflected on the exchange?

Yes. IBKR offers Direct market Access (DMA) whereby your non-marketable (i.e. limit) orders have the underlying hedges directly represented on the deep books of the exchanges on which they trade. This also means that you can place orders to buy the CFD at the underlying bid and sell at the offer. In addition, you may also receive price improvement if another client's order crosses yours at a better price than is available on public markets.

How do you determine margins for Share CFDs?

IBKR establishes risk-based margin requirements based on the historical volatility of each underlying share. The minimum margin is 10%, making CFDs more margin-efficient than trading the underlying share in many cases. Retail investors are subject to additional margin requirements mandated by the European regulators. There are no portfolio off-sets between individual CFD positions or between CFDs and exposures to the underlying share. Concentrated positions and very large positions may be subject to additional margin. Please refer to CFD Margin Requirements for more detail.

Are short Share CFDs subject to forced buy-in?

Yes. In the event the underlying stock becomes difficult or impossible to borrow, the holder of the short CFD position may become subject to buy-in.

How do you handle dividends and corporate actions?

IBKR will generally reflect the economic effect of the corporate action for CFD holders as if they had been holding the underlying security. Dividends are reflected as cash adjustments, while other actions may be reflected through either cash or position adjustments, or both. For example, where the corporate action results in a change of the number of shares (e.g. stock-split, reverse stock split), the number of CFDs will be adjusted accordingly. Where the action results in a new entity with listed shares, and IBKR decides to offer these as CFDs, then new long or short positions will be created in the appropriate amount. For an overview please CFD Corporate Actions.

*Please note that in some cases it may not be possible to accurately adjust the CFD for a complex corporate action such as some mergers. In these cases IBKR may terminate the CFD prior to the ex-date.

Can anyone trade IBKR CFDs?

All clients can trade IBKR CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and Israel. There are no exemptions based on investor type to the residency based exclusions.

What do I need to do to start trading CFDs with IBKR?

You need to set up trading permission for CFDs in Client Portal, and agree to the relevant disclosures. If your account is with IBKR (UK) or with IBKR LLC, IBKR will then set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F-account separately, funds will be automatically transferred to meet CFD initial margin requirements from your main account.

If your account is with another IBKR entity, only the permission is required; an additional account segment is not necessary.

Are there any market data requirements?

The market data for IBKR Share CFDs is the market data for the underlying shares. It is therefore necessary to have market data permissions for the relevant exchanges. If you already have market data permissions for an exchange for trading the shares, you do not need to do anything. If you want to trade CFDs on an exchange for which you do not currently have market data permissions, you can set up the permissions in the same way as you would if you planned to trade the underlying shares.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

Can I transfer in CFD positions from another broker?

IBKR does not facilitate the transfer of CFD positions at this time.

Are charts available for Share CFDs?

Yes.

In what type of IBKR accounts can I trade CFDs e.g., Individual, Friends and Family, Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

What are the maximum a positions I can have in a specific CFD?

There is no pre-set limit. Bear in mind however that very large positions may be subject to increased margin requirements. Please refer to CFD Margin Requirements for more detail.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

Overview of the OneChicago NoDiv Contract

The OneChicago NoDiv single stock futures contract (OCX.NoDivRisk) differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions (e.g., dividends, capital gains, etc.). Whereas the traditional contract is not adjusted for such ordinary distributions (the discounted expectations are reflected in the price), the NoDiv contract is intended to remove the risk of dividend expectations through a price adjustment made by the clearinghouse. The adjustment is made on the morning of the ex-date to ensure that the effect of the distribution is removed from the daily mark-to-market or cash variation pay/collect.

For example, assume a NoDiv contract which closes at $50.00 on the business day prior the ex-date at which stockholders of a $1.00 dividend are to be determined. On the ex-date OCC will adjust that prior day's final settlement price from $50.00 downward by the amount of the dividend to $49.00. The effect of this adjustment will be to ensure that the dividend has no impact upon the cash variation pay/collect as of ex-date close (i.e., short position holder does not receive the $1.00 variation collect and the long holder incur the $1.00 payment).

Dividend withholding procedures for foreign stocks traded in Japan

Foreign stocks listed for trading in Japan which issue dividends will have the cash dividend allocation subject to an increased withholding tax rate. The tax will vary based on the domicile of the stock issuing the dividend; however in general the withholding rate will be the highest withholding rate applicable and will not incorporate a reduction based on prevailing tax treaties.

This treatment is due to the tax reporting status of Interactive Brokers's clearing agent. As our clearing agent is unable to process the relevant tax declaration documentation which would allow for the application of tax withholding at a reduced rate, shareholders will be subject to the highest rate.

In order to avoid the application of the tax withholding on the dividends of foreign stocks, positions in such dividend paying stocks should be closed prior to the ex-dividend date.

We recommend that customers consult with their tax advisor for assistance in determining the eligibility, if any, for a tax credit on this withholding.

A list of foreign stocks and their applicable rates is provided below. Please be aware that the below is for informational purposes only and may not include all stocks which may be subject to the higher withholding rates.

| Stock Code | Stock Name | DividendTax Rate |

| 9399 | Xinhua Finance Limited | N/A |

Dividend withholding procedures for entities issuing dual-sourced income

U.S. persons holding securities issued by entities that are domiciled outside of the U.S., but which invest within the U.S. should pay particular attention to IB's tax withholding obligation in the event of a distribution by the issuer. These entities, which may include Canadian unit trusts, REITS, limited partnerships or other common shares, often distribute dividends and/or interest based on both the U.S. and non-U.S. sourced income. While U.S. persons reporting a valid taxpayer ID number on their Form W-9 are generally exempt from backup withholding on U.S. sourced income, the nature of the custodial arrangement for these particular securities is such that U.S persons may be subject to a withholding tax calculated at a fixed rate of 30% on that portion of the distribution associated with the US-sourced income. This is in addition to any withholding required to be applied to the non-U.S. sourced portion of the distribution as required by the relevant foreign taxing body.

It's important to note that these taxes will be withheld by the depository prior to remittance of the distribution to IB and the subsequent credit of the net distribution to the accounts of any U.S. persons. Accordingly, IB has no ability to reverse or reclaim the withholding on behalf of its clients. In addition, as IB does not remit the withholdings to the tax authority, we do not report such withholdings to either the tax authority or clients on their year-end tax forms.

As IB does not provide tax advice or guidance, we recommend that you consult with your tax advisor for assistance in determining the eligibility, if any, for a tax credit on this withholding.

Below lists securities where this type of withholding has been applied previously. This list is for informational purposes only and may not include all securities.

| Symbol | Security Name |

| CHE.UN | Chemtrade Logistics Income Fund |

| CSH.UN | Chartwell Seniors Housing Real Estate Investment Trust |

| DR.UN | Medical Facilities Corp |

| EXE.UN | Extendicare real Estate Investment Trust |

| FCE.UN | Fort Chicago Energy Partnerships LP |

| HR.UN | H&R Real Estate Investment Trust |

| NFI.UN | New Flyer Industries Inc |

| UFS | Domtar Corp |

| UVI | Unilens Vision Inc |

Tax Treaty Benefits

Income payments (dividends and payment in lieu) from U.S. sources into your IB account may have U.S. tax withheld. Generally, a 30% rate is applied to non-U.S. accounts. Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the U.S. Complete the applicable Form W-8 to find out your status.

Tax Treaties*

U.S. tax treaties with some countries have different benefits. Legal tax residents of the following countries may be eligible for the treaty benefits. Below is a list of the tax treaty countries. Benefits vary by country.

| Australia | Czech Republic | India | Lithuania | Sweden |

| Austria | Denmark | Indonesia | Poland | Switzerland |

| Bangladesh | Egypt | Ireland | Portugal | Thailand |

| Barbados | Estonia | Israel | Romania | Trinidad & Tobago |

| Belgium | Finland | Italy | Russia | Tunisia |

| Bulgaria | France | Jamaica | Slovak Republic | Turkey |

| Canada | Germany | Japan | Slovenia | Ukraine |

| China, People's Rep. Of | Greece | Kazakhstan | South Africa | United Kingdom |

| Commonwealth of Ind. States | Hungary | Korea, Rep. of | Spain | Venezuela |

| Cyprus | Iceland | Latvia | Sri Lanka |

*Country list as of April 2009

Refer to IRS Publication 901 for details on withholding rates for your tax residence country and your eligible benefits.

What corporate action services does Interactive Brokers provide?

Interactive Brokers services relating to corporate actions are as follows:

1. The processing of mandatory corporate actions (e.g. prompt dividend recovery, spin-offs, stock splits, effective mergers and etc.) at no extra cost; and

2. Providing, on a best efforts basis, details of corporate action announcements associated with stock and option positions held in your account. These details are provided in the form of a web ticket posted to the Corporate Actions tab of your Message Center. Account holders may also elect to set their preferences so as to receive a copy of such details via email. Information provided includes

- Mandatory offers - general information regarding mandatory offers

- Voluntary offers - eligible account holders may submit elections directly through Account Management

IMPORTANT NOTE:

Interactive Brokers does not provide any guidance, consultation or advice regarding corporate actions to its customers. IB customers are solely responsible for the monitoring of the existence of a corporate action, understanding the rights and terms of any corporate action and providing timely and accurate instructions regarding the handling for any voluntary corporate action.