Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

Handhabung von Markt-Orders

Kundinnen und Kunden wird empfohlen, bei Orders, die große Auftragsmengen oder illiquide Produkte umfassen, die Verwendung von Limit-Orders anstelle von Market-Orders zu erwägen. Denn bei Market-Orders kann es insbesondere unter volatilen Marktbedingungen dazu kommen, dass sie zu Preisen weit unter bzw. über dem aktuell angezeigten Geld-/Briefkurs ausgeführt werden.

Um sowohl unsere Kundinnen und Kunden als auch IB selbst vor Verlusten zu schützen, die durch erhebliche, plötzliche Kursschwankung entstehen können, wird IB Market-Orders gegebenenfalls als Market-with-Protection-Orders simulieren und eine Ausführungsgrenze in Prozentpunkten über dem internen Geld-/Briefkurs festlegen. Diese Grenze wird zwar so gewählt, dass das Verhältnis zwischen Ausführungssicherheit und Kursrisiko ausgewogen ist, aber es besteht dennoch ein geringes Risiko, dass die Ausführung verzögert wird oder nicht stattfindet.

Darüber hinaus ist zu beachten, dass manche Börsen als Schutzmaßnahme eigene Preisgrenzen oder -bandbreiten für Market-Orders festlegen. Diese können strengere oder lockerer Beschränkungen darstellen als die von IB angewendeten. Außerdem können sie sich ebenfalls darauf auswirken, wie schnell und mit welcher Sicherheit eine Order ausgeführt werden kann.

Zuführen/Entziehen von Liquidität

Das Ziel dieses Artikels ist es, ein eingehendes Verständnis zu Börsengebühren und Gebühren für das Zuführen/Entziehen von Liquiditätsgebühren im Rahmen einer gestaffelten Provisionsstruktur zu liefern.

Sowohl bei Aktien als auch Aktien-/Indexoptionen kann Liquidität zugeführt oder entzogen werden. Ob eine Order Liquidität zuführt oder beseitigt hängt davon ab, ob diese Order marktfähig ist oder nicht.

Marktfähige Orders ENTZIEHEN Liquidität.

Marktfähige Orders sind entweder Markt-Orders ODER Kauf-/Verkaufs-Limit-Orders, deren Limitkurs entweder gleich viel oder mehr/weniger als der derzeitige Marktkurs beträgt.

1. Bei einer marktfähigen Kauf-Limit-Order befindet sich der Limitkurs entweder beim Briefkurs oder darüber.

2. Bei einer marktfähigen Verkaufs-Limit-Order liegt der Limitkurs entweder beim Geldkurs oder darunter.

Beispiel:

Der/die derzeitige BRIEFKURS/-MENGE der Aktie XYZ (Angebot) liegt bei 400 Aktien zu 46.00. Sie gehen eine Kauf-Limit-Order für 100 XYZ-Aktien zu 46.01 ein. Diese Order wird als marktfähig angesehen, da eine sofortige Ausführung stattfinden wird. Falls eine Börsengebühr für das Entziehen von Liquidität wirksam ist, wird die Gebühr dem Kunden berechnet.

Bei nicht marktfähigen Orders handelt es sich um Kauf-/Verkaufs-Limit-Orders, deren Limitkurs sich entweder über oder unter dem derzeitigen Marktkurs befindet.

1. Bei einer nicht marktfähigen Kauf-Limit-Order liegt der Limitkurs unter dem Briefkurs.

2. Bei einer nicht marktfähigen Verkaufs-Limit-Order liegt der Limitkurs über dem Geldkurs.

Beispiel:

Der/die derzeitige BRIEFKURS/-MENGE der Aktie XYZ (Angebot) liegt bei 400 Aktien zu 46.00. Sie gehen eine Kauf-Limit-Order für 100 XYZ-Aktien zu 45.99 ein. Diese Order wird als nicht marktfähig angesehen, da sie auf dem Markt als der beste Geldkurs ausgewiesen wird, anstelle sofort ausgeführt zu werden.

Falls und wenn jemand anderes eine marktfähige Verkaufsorder übermittelt, die dazu führt, dass Ihre Kauf-Limit-Order ausgeführt wird, erhalten Sie einen Rabatt (Gutschrift), sofern eine Gutschrift für das Zuführen von Liquidität verfügbar ist.

BITTE BEACHTEN SIE FOLGENDES:

1. Alle Konten, die Optionen handeln, unterliegen jeglichen Gebühren oder Gutschriften von Optionsbörsen für das Zuführen/Entziehen von Liquidität.

2. Gemäß der IB-Website gelten ausschließlich negative Zahlen im Rahmen der Gebührenstrukturen für das Entziehen/Zuführen von Liquidität als Rabatte (Gutschriften).

https://www.interactivebrokers.com/de/index.php?f=3581

IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

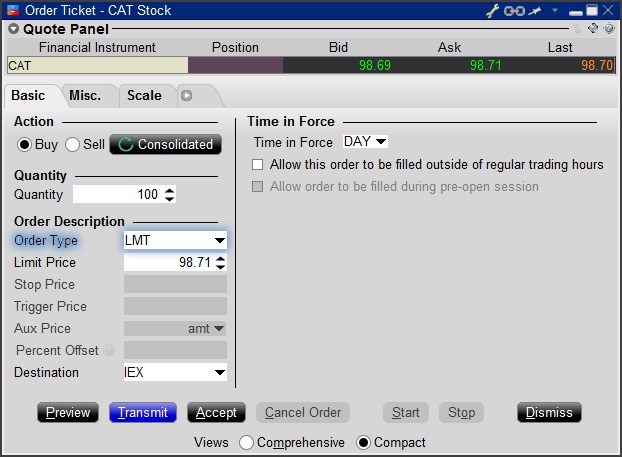

Step 1

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

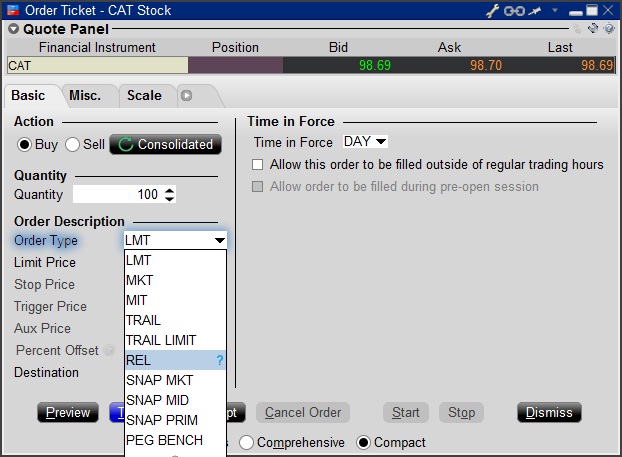

Step 2

Select the REL order type from the Order Type drop down menu.

Step 3

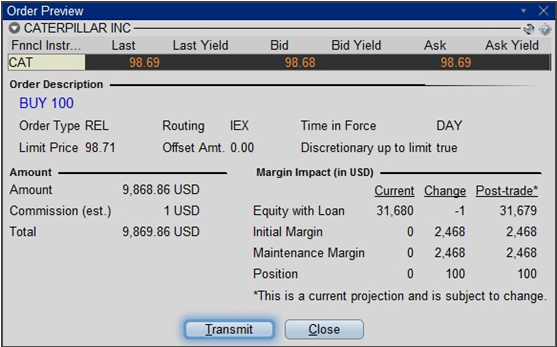

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

Hong Kong - China Stock Connect

Hong Kong – China Stock Connect (“China Connect”) is a mutual market access program through which Hong Kong and international investors can trade shares listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) via the Stock Exchange of Hong Kong (SEHK) and their existing clearinghouse. As a member of SEHK, IBKR provides you with direct access to trade with eligible listed products on the Shanghai and Shenzhen Stock Exchange. IBKR clients with China Connect trading permissions will be eligible to trade SSE/SZSE securities through Shanghai and Shenzhen - Stock Connect.

Among the different types of SSE/SZSE-listed securities, only A shares (shares in mainland China-based companies that trade on Chinese stock exchange) are included in the Shanghai and Shenzhen Stock Connect.

Shanghai Connect includes all the constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that have corresponding H shares listed on the SEHK.

Product List and Stock Codes for SSE

Shenzhen Connect includes all the constituent stocks of the SZSE Component Index, the SZSE Small/Mid Cap Innovation Index that have a market capitalization of not less than RMB 6 billion and all the SZSE-listed A shares that have corresponding H shares listed on SEHK.

Product List and Stock Codes for SZSE

IBKR Commission for Trading SSE/SZSE Securities

Same as trading Hong Kong stocks, IBKR charges only 0.08% of trade value as a commission with a minimum CNH 15 per order. Detailed fee rates can be found in the Hong Kong – China Stock Connect Northbound fee table.

Daily Quota

Trading under Shanghai Connect and Shenzhen Connect is subject to a Daily Quota. The Daily Quota is applied on a “net buy” basis. The Daily Quota limits the maximum net buy value of cross-boundary trades under Shanghai Connect and Shenzhen Connect each day.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Or if it happens during a continuous auction session or closing call auction session, no further buy orders will be accepted for the remainder of the day. SEHK will resume the Northbound buying service on the following trading day.

SEHK will also publish the remaining balance of the Aggregate Quota and Daily Quota.

For details, please refer to HKEX Stock Connect FAQ or HKEX Stock Connect Rule 1407

Trading Information of Shanghai and Shenzhen Connect

|

Trading currency |

RMB |

|

Order Type |

IBKR offers various order types but will stimulate the order into limit order for execution. More information can be referred to our website.

|

|

Tick Size / Spread |

Uniform at RMB 0.01 |

|

Board Lot |

100 shares (applicable for buyers only) |

|

Odd Lot |

Sell orders only (odd lot should be made in one single order) |

|

Max Order Size |

1 million shares |

|

Price Limit |

±10% on previous closing price (±5% for stocks under special treatment under risk alert, i.e. ST and *ST stocks) |

|

Day (Turnaround) Trading |

Not allowed |

|

Block Trade |

Not available |

|

Manual Trade |

Not available |

|

Order Modification |

IBKR will cancel and replace the order for any order modification |

|

Settlement cycle |

Securities: Settlement on T day Cash from China Connect trades: Settlement on T+1 day Forex*: Settlement on T+2 day |

*Due to the unsynchronized settlement cycle, clients who exchange CNH themselves should execute the Forex trade one day prior to the stock trade (T-1) to avoid the extra day’s interest payment (considering normal settlement without involving holidays).

Trading Hours

|

SSE/SZSE Trading Sessions |

SSE/SZSE Trading Hours |

|

Opening Call Auction |

09:15 - 09:25 |

|

Continuous Auction (Morning) |

09:30 – 11:30 |

|

Continuous Auction (Afternoon) |

13:00 – 14:57 |

|

Closing Call Auction |

14:57 – 15:00 |

Half-day Trading

If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed. Refer to the exchange website for holiday trading arrangements and additional information.

Disclosure Obligation

If client holds or controls up to 5% of the issued shares of China Connect, the client is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

The client is not allowed to continue purchasing or selling shares in that Mainland listed company during the three days notification period. Visit the IBKR Knowledge Base for more information.

Shareholding Restriction

A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares. Visit the IBKR Knowledge Base for more information.

Forced-sale Arrangement

Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:

|

Situation |

Shareholding (in a listed company) |

|

A single foreign investor |

> = 10% of the company’s total issued shares |

|

All foreign investors |

> = 30% of the company’s total issued shares |

Margin Financing

Margin trading in China Connect securities will subject to restrictions and only certain A shares will be eligible for margin trading. Eligible Securities, as determined by SSE and SZSE from time to time, are listed on the HKEX website.

According to the relevant rules of SSE and SZSE, either market may suspend margin trading activities in specific A shares when the volume of margin trading activities for a specific A share exceeds the prescribed threshold. The market will resume margin trading activities in the affected A share when its volume drops below a prescribed threshold.

Stock Borrowing and Lending (SBL)

SBL in China Stock Connect Securities is subject to restrictions set by the SSE or SZSE and stated in the Rules of the Exchange.

IBHK does not offer this service at the moment.

Eligible Short Selling Securities

SBL for the purpose of short selling will be limited to those China Stock Connect Securities that are eligible for both buy orders and sell orders through Shanghai and Shenzhen Connect (i.e., excluding Connect Securities that are only eligible for sell orders).

IBHK does not offer this service at the moment.

Trading Shenzhen ChiNext and Shanghai Star shares

Trading Shenzhen ChiNext and Shanghai Star shares are limited to institutional professional investors.

Holidays

Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

|

|

Mainland |

Hong Kong |

Open for Northbound Trading |

|

Day 1 |

Business Day |

Business Day |

Yes |

|

Day 2 |

Business Day |

Business Day |

No, HK market closes on money settlement day |

|

Day 3 |

Business Day |

Public Holiday |

No, HK market closes on trading day |

|

Day 4 |

Public Holiday |

Business Day |

No, Mainland market closes |

Severe Weather Conditions

Information on the trading arrangement available under severe weather conditions can found on the HKEx website.

Where to Learn More?

Please refer to the following exchange website links for additional information regarding Hong Kong China Stock Connect:

If you have any questions regarding Hong Kong-China Stock Connect, please contact IBKR Client Services for further information.

IPO Considerations

An Initial Public Offering, or IPO, is defined as the first sale of stock by a company to the public. As IB generally does not operate as an underwriter or selling agent of IPO shares, the first opportunity customers have to transact in such shares does not take place until the issue begins trading in the secondary market. Outlined below are key issues which customers should consider when transacting in shares on their first day of listing:

1. Margin

As IPOs are inherently subject to a high degree of uncertainty as to price and liquidity once secondary market trading begins, each new issue is subject to a review to determine whether initial and maintenance margin requirements above the minimum which is required by regulation is warranted. Current margin information is made available through the "Check Margin" feature on the trading platform. Customers should also note that IB reserves the right to change margin on an intraday basis and without advance notice when warranted.

2. Order Entry

IB monitors for upcoming IPOs and makes every effort to provide customers the ability to enter orders in advance of the day at which trading begins in the secondary market. In certain circumstances, either IB and/or the exchange may impose restrictions on the type of orders which may be accepted as well as the time in force conditions associated with such orders. It should also be noted that orders not direct-routed to the primary exchange may be subject to special auction handling and therefore may receive a different opening print from that of the primary exchange. In addition, as the price at which the issue trades once available in the secondary market may differ significantly from the IPO price, customers are strongly encouraged to use limit orders when.

3. Short Availability

Customers should assume that IPO issues will not be available for shorting immediately upon trading in the secondary market. This limitation is a function of regulations which require the broker to locate and make a good faith determination that shares are available to borrow at settlement coupled with the likelihood that such shares will not be available (due to underwriter lending restrictions and the fact that secondary market transactions have not yet settled).

How to Place a CFD Trade on the Trader Workstation

How to place trades in U.K. CFDs on the Trader Workstation

Understanding Guaranteed vs. Non-guaranteed Combination Orders

Provides information about multi-leg orders specifically relating to guaranteed vs non-guaranteed orders.

Multi-Leg Orders

A multi-leg order, also known as combination order, is a special order type comprising two or more components or legs that execute as a single transaction. Each leg of a multi-leg order is defined with an asset, a leg side, and a ratio relative to other legs. IB currently supports multi-leg orders with legs that belong to the following asset types: stocks, options, futures, future options and US CFDs.

Guaranteed and Non-Guaranteed Multi-Leg Orders

A guaranteed multi-leg order is an order in which executions are guaranteed to be delivered simultaneously for each leg and in proportion to the leg ratio. This guarantee is fulfilled by IB or the exchange depending on the way the guaranteed multi-leg order is routed and executed.

Non-guaranteed multi-leg orders are not guaranteed to be executed proportionally to the required leg ratio although every effort is made to execute the order that way.

Guaranteed multi-leg orders can be SMART routed or directed to a specific exchange, while non-guaranteed multi-leg orders can only be SMART routed. See the table below.

Guaranteed Multi-Leg Order Support by Routing Type

|

Routing Type |

Guaranteed |

Non-Guaranteed |

|

SMART Routed |

Yes |

Yes |

|

Exchange Directed |

Yes |

No |

Directed Multi-Leg Orders

A directed multi-leg order is an order that is routed to a specific exchange that has native support for such an order. Directed multi-leg orders follow the exchange’s rules in terms of allowed number of legs, permitted asset types, and allowed combinations of leg ratios and leg sides. IB never attempts to execute individual legs of a directed multi-leg order separately.

Directed multi-leg orders are guaranteed by the exchange to be executed following the specified leg ratio. IB does not accept non-guaranteed directed orders.

SMART Guaranteed Multi-Leg Orders

IB supports SMART routed guaranteed multi-leg orders of up to 6 legs. Based on the order marketability, these orders can be routed by the IB system to one of the competing exchanges that support them natively. In addition, 2-legged SMART routed guaranteed US stock/option and US option/option orders can be executed by IB on different exchanges, where each leg is routed separately. Any risk of resulting execution that does not satisfy the required order ratio is taken over by IB.

SMART Non-Guaranteed Multi-Leg Orders

IB supports SMART routed non-guaranteed multi-leg orders of up to 2 legs. Legs must trade in the same currency and must be stocks, options, futures, or futures options. Supported currencies are: USD, EUR, AUD, CAD, CHF, GBP, HKD, and JPY.

Non-guaranteed multi-leg orders can only be SMART routed. These orders may be executed natively on an exchange if supported there or executed by IB on one or more exchanges with each leg routed separately. The IB system makes every effort to execute the order according to the specified order ratio, but does not guarantee such an execution. Clients must acknowledge the inherent risk of non-guaranteed multi-leg orders upon order entry.