Warum sehe ich auf meinem Kontoauszug unter „Cash-Bericht“ einen internen Transfer zwischen Wertpapieren und Rohstoffen?

Aus regulatorischen Gründen ist IBKR dazu verpflichtet, in Ihrem Konto Wertpapier- von Rohstoff-Assets zu trennen. Diese Rohstoff-Assets können den Marktwert von Optionen auf Futures-Positionen plus die Barmittel umfassen, die aufgrund der für Rohstoff-Futures und Optionen auf Futures-Positionen erforderlichen Margin benötigt werden. Die Margin-Anforderungen für Ihre Rohstoff-Positionen werden regelmäßig neu berechnet. Sollten sie sinken, werden die Barmittel, die über die erforderliche Rohstoff-Margin hinausgehen, von der Rohstoff- auf die Wertpapierseite Ihres Kontos übertragen. Sollte die Margin-Anforderung dagegen steigen, wird IBKR auf der Wertpapierseite Ihres Kontos verfügbare Barmittel entsprechend auf die Rohstoffseite überweisen. Da nur die Assets auf der Wertpapierseite Ihres Kontos von der SIPC-Versicherung abgedeckt werden, jedoch nicht diejenigen auf der Rohstoffseite, wird diese regelmäßige Übertragung angewendet, damit Ihre Barmittel bestmöglich geschützt sind. Beachten Sie, dass es sich bei diesen Übertragungen um kontointerne Bewegungen handelt, die sich vollständig ausgleichen und somit keine Auswirkungen auf den Gesamtsaldo Ihres Kontos haben (siehe auf dem Kontoauszug die Spalte „Gesamt“ unter Cash-Bericht).

Margin Considerations for Intramarket Futures Spreads

Background

Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation.

Spread Margin Adjustment

This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:

- On the 3rd business day prior to close out, the initial and maintenance margin requirements will be equal to 10% of their respective requirements on each contract month as if there was no spread, plus 90% of the spread requirement;

- On the 2nd business day prior to close out, the initial and maintenance margin requirements will be equal to 20% of their respective requirements on each contract month as if there was no spread, plus 80% of the spread requirement;

- On the business day prior to close out, the initial and maintenance margin requirements will be equal to 30% of their respective requirements on each contract month as if there was no spread, plus 70% of the spread requirement.

Working Example

Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:

| XYZ | Front Month - 1 Short Contract (Uncovered) | Back Month - 1 Long Contract (Uncovered) | Spread - 1 Short Front Month vs. 1 Long Back Month |

| Initial Margin | $1,250 | $1,500 | $500 |

| Maintenance Margin | $1,000 | $1,200 | $400 |

Further assume a position consisting of 1 short front month contract and 1 long back month contract with the front month contract close out date = T. using this hypothetical example, the initial margin requirement over the 3 business day period preceding close out date is outlined in the table below:

| Day | Initial Margin Requirement | Calculation Details |

| T-4 | $500 | Unadjusted |

| T-3 | $725 | .1($1,250 + $1,500) + .9($500) |

| T-2 | $950 | .2($1,250 + $1,500) + .8($500) |

| T-1 | $1,175 | .3($1,250 + $1,500) + .7($500) |

| T | $1,175 | Positions not in compliance with close out requirements are subject to liquidation. |

How to Complete CFTC Form 40

Clients maintaining a U.S. futures or futures option position at a quantity exceeding the CFTC's reportable thresholds may be contacted directly by the CFTC file with a request that they complete a Form 40. Contact will generally be made via email and clients are encouraged to respond to such requests in a timely manner to avoid trading restrictions and/or fines imposed by CFTC upon their account at the FCM.

Completion of the Form requires the following steps:

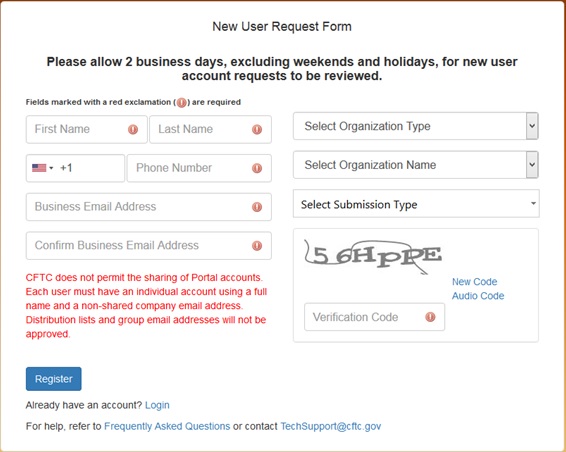

- Register for a CFTC Portal Account - performed online at: https://portal.cftc.gov/Account/Register.aspx Registration will require entry of the 9-digit code that the CFTC provided to you within the email requesting that you register. If you cannot locate your code or receive an invalid entry message, contact TechSupport@cftc.gov. When entering "Organization Type" from the drop-down selector, choose "LTR (Large Traders)".

2. Complete Form 40 - You will receive an email notification from the CFTC once your Portal Account has been approved. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The email will contain a link to the Portal where you will be prompted to log in: https://portal.cftc.gov/

Instructions for completing the form are available at: https://www.ecfr.gov/cgi-bin/text-idx?node=ap17.1.18_106.a

Note that Portal provides the opportunity to save a copy of your submission in XML format, a recommended step, as this allows for uploading the file to the Portal should you need to make modifications at a later date. This will eliminate the need to renter the form in its entirety.

The CFTC will send a confirmation email upon successful completion of your Form 40.

3. Confirm with IBKR - forward your confirmation email, or other evidence that you have submitted the Form 40 to cftc_form40_filing@interactivebrokers.com. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines.

Overview of CFTC Form 40

The CFTC, the primary regulator of U.S. commodity futures markets and Futures Commission Merchants (FCMs), operates a comprehensive system of collecting information on market participants as part of its market surveillance and large trader reporting program.

IBKR, as a registered FCM providing clients with access to those markets, is obligated to report to the CFTC information on clients who hold a position in a quantity that exceeds defined thresholds (i.e., a "reportable position"). In order to report this information, IBKR requires clients trading U.S. futures or futures options to complete an online CFTC Ownership and Control Reporting form at the point the client requests futures trading permissions.

Once a client holds a "reportable position", the CFTC may then contact that client directly and require them to file more detailed information via CFTC Form 40. The information required of this report includes the following:

- Trader's name and address

- Principal business

- Form of ownership (e.g., individual, joint, partnership, corporation, trust, etc.)

- Whether the reporting trader is registered under the Commodity Exchange Act

- Whether the reporting trader controls trading for others

- Whether any other person controls the trading of the reportable trader

- Name and location of all firms through which the reportable trader carries accounts

- Name and location of other persons providing a trading guarantee or having a financial interest in account of 10% or greater

- Name of accounts not in the reporting trader's name in which the trader provides a guarantee or has a financial interest of 10% or more.

Clients who fail to complete this Form in a timely manner may be subject to trading restrictions and/or fines imposed by CFTC upon their account at the FCM. It is therefore imperative that clients immediately respond to these CFTC requests.

To complete the CFTC Form 40, clients must first register for a CFTC Portal Account, an online process which is subject to a review period of 2 business days from the point of initial registration to acknowledgement of approval by the CFTC. For information regarding this registration process and completing the Form 40, see KB3149.

OTC-Futures auf LME-Metalle von IBKR – Fakten & häufig gestellte Fragen

Einleitung

LME-OTC-Futures von IBKR bieten Kunden synthetischen Zugang zur London Metal Exchange, einer Peer-to-peer-Börse, die für Anleger, die keine Mitglieder sind, normalerweise nicht zugänglich ist.

Bei LME-Metall-Futures handelt es sich um OTC-Derivatkontrakte, bei denen IBUK als Gegenpartei fungiert. Die LME-OTC-Futures nehmen Bezug auf den entsprechenden LME-Future hinsichtlich des Kurses, der Lot-Größe, der Art und Kontraktmerkmale, jedoch handelt es sich bei ihnen um keine registrierten Kontrakte. Eine physische Lieferung ist nicht zulässig.

Da LME-OTC-Futures von IBKR über Ihr Marginkonto gehandelt werden, können Sie sowohl Long-Positionen als auch gehebelte Short-Positionen eingehen. Die Marginsätze stimmen mit jenen überein, die von der LME festgelegt wurden. So wie andere Futures sind diese Risiko-basiert (SPAN) und können daher Änderungen unterliegen. Je nach Kontrakt, können aktuelle Margin-Anforderungen zwischen 6 und 9% betragen.

Kontrakte

IBKR bietet für die folgenden Metalle OTC-Futures mit Fälligkeit am dritten Mittwoch jedes Monats an:

| Metall | IB-Symbol | Kurs USD/ | Multiplikator |

| Hochgradiges Primäraluminium | AH | Metrische Tonne | 25 |

| „Grade-A”-Kupfer | CA | Metrische Tonne | 25 |

| Primärnickel | NI | Metrische Tonne | 6 |

| Standardmäßiges Blei | PB | Metrische Tonne | 25 |

| Zinn | SNLME | Metrische Tonne | 5 |

| Special-High-Grade-Zink | ZSLME | Metrische Tonne | 25 |

Fälligkeit zum dritten Mittwoch jedes Monats

Die LME bietet eine Reihe an Kontrakten, die an die jeweiligen Bedürfnisse von physischen Tradern und Absicherern angepasst sind. Den Kern unter ihnen stellen tägliche, 3-monatige Terminkontrakte dar, die von physischen Tradern verwendet werden, um deren Absicherungen genau auf ihre Bedürfnisse abzustimmen.

Bei Kontrakten mit Fälligkeit zum dritten Mittwoch im Monat handelt es sich um monatliche Kontrakte, wie beispielsweise Futures. Daher sind diese besser an die Bedürfnisse von Tradern angepasst. Wie bereits erwähnt, verfallen diese am dritten Mittwoch jedes Monats und obwohl sie physisch an der LME abgewickelt werden, werden Sie bei IBKR ausschließlich bar abgewickelt. Kontrakte mit dem Verfallsdatum an jedem dritten Mittwoch im Monat erfreuen sich immer größerer Beliebtheit und machen 65% aller offenen Positionen an der LME aus.

Kursnotierungen und Marktdaten

IBKR streamt Kursnotierungen von der LME (L2-Marktdaten) und erweitert nicht die Kursnotierung. Jede Kundenorder wird zunächst an der Börse abgesichert und die LME-OTC-Order wird zum Preis der Absicherung ausgeführt.

Cashflows

Der tägliche „Variation Margin” und realisierte G&V für LME-OTC-Futures von IBKR werden wie ein standardmäßiger Future täglich bar verrechnet. Dagegen werden Cashflows für den zugrunde liegenden LME-Kontrakt ausschließlich nach Ablauf des Kontrakts abgewickelt.

Margin-Anforderungen

Für LME-OTC-Futures von IBKR gelten dieselben Margin-Anforderungen wie für den zugrunde liegenden Kontrakt an der LME. Die LME verwendet die „Standard Portfolio Analysis of Risk”-Methode (SPAN), um den Ersteinschuss zu berechnen.

Wie bei anderen Futures werden Marginsätze als absoluter Wert pro Kontrakt festgelegt und normalerweise monatlich aktualisiert.

Handelsberechtigungen

Sie müssen Handelsberechtigungen für Metalle im Vereinigten Königreich in der Kontoverwaltung beantragen.

Marktdaten

Sie benötigen ein Abonnement für die London Metal Exchange (Level II), das derzeit 1.00 GBP beträgt.

Informationsquellen zu LME-OTC-Futures

Produktlisten & Links zu Kontraktdetails

Provisionen

Margin-Anforderungen

Häufig gestellte Fragen

Was wird für den Einstieg in den Handel mit LME-OTC-Futures benötigt?

Sie müssen Handelsberechtigungen für Metalle im Vereinigten Königreich in der Kontoverwaltung beantragen. Falls Sie ein IB-LLC oder ein IB-UK-Konto haben, das von IB LLC verwaltet wird, werden wir ein neues Kontosegment für Sie erstellen (erkennbar durch Ihre bestehende Kontonummer plus dem Suffix „F”). Sobald die Einrichtung des Kontosegments bestätigt wurde, können Sie mit dem Handel beginnen. Sie müssen das F-Segment nicht separat mit Guthaben ausstatten; die Einlagen werden automatisch von Ihrem Hauptkonto übertragen, um die Margin-Anforderungen zu erfüllen.

Wie werden meine LME-OTC-Future-Transaktionen und -Positionen in meinen Auszügen angezeigt?

Ihre Positionen werden in einem separaten Kontosegment gehalten, das durch die Kontonummer Ihres Hauptkontos mit dem angehängten Kennzeichen „F“ ausgezeichnet wird. Sie können sich Umsatzübersichten entweder separat für das F-Segment oder konsolidiert zusammen mit Ihrem Hauptkonto anzeigen lassen. Diese Auswahl können Sie in der Kontoverwaltung im Kontoauszugsfenster treffen.

Welche Kontoschutzmaßnahmen greifen beim Handel mit LME-OTC-Futures?

LME-OTC-Futures sind Kontrakte, bei denen IB UK als Ihre Gegenpartei auftritt. Sie werden nicht über eine regulierte Börse gehandelt und das Clearing erfolgt nicht durch eine zentrale Clearingstelle. Da IB UK als Gegenpartei für Ihre Geschäfte auftritt, gehen Sie die finanziellen und geschäftlichen Risiken - z. B. Kreditrisiken - ein, die mit dem Handel über IB UK einhergehen. Bitte beachten Sie jedoch, dass alle Kundengelder stets vollständig getrennt gehalten werden, auch bei institutionellen Kunden. IB UK ist ein Teilnehmer des britischen „Financial Services Compensation Scheme“ (FSCS). IB UK ist kein Mitglied der „U.S. Securities Investor Protection Corporation“ (SIPC).

Kann man LME-OTC-Futures auch per Telefon handeln?

Nein. In Ausnahmefällen kann es möglicherweise gestattet werden, eine positionsschließende Order per Telefon zu bearbeiten. Für positionseröffnende Orders ist dies jedoch ausgeschlossen.

IBKR OTC Futures on LME Metals – Facts and Q&A

Introduction

IBKR LME OTC Futures provide clients synthetic access to the London Metal Exchange, a peer to peer exchange not generally available to non-member investors.

The LME OTC Futures are OTC derivative contracts with IBUK as the counterparty. The LME OTC Futures reference the corresponding LME future in terms of price, lot size, type and specification but are themselves not registered contracts. Physical delivery is not permitted.

IBKR LME OTC Futures are traded through your margin account, and you can therefore enter long as well as short leveraged positions. Margin rates equal those established by the LME. Like other futures they are risk-based (SPAN), and therefore variable. Current margins range between 6 and 9% depending on the contract.

Contracts

IBKR offers OTC Futures on the 3rd Wednesday expirations for the following metals:

| Metal | IBKR Symbol | Price USD/ | Multiplier |

| High Grade Primary Aluminium | AH | Metric Ton | 25 |

| Copper Grade A | CA | Metric Ton | 25 |

| Primary Nickel | NI | Metric Ton | 6 |

| Standard Lead | PB | Metric Ton | 25 |

| Tin | SNLME | Metric Ton | 5 |

| Special High Grade Zinc | ZSLME | Metric Ton | 25 |

3rd Wednesday Expirations

The LME features a range of contracts adapted to the needs of physical traders and hedgers. The principal among them are daily 3-month forwards used by physical traders to precisely match their hedges to their needs.

The 3rd Wednesday contracts are monthly contracts, like futures, and as such better adapted to the needs of financial traders. As the name suggests, they expire on the 3rd Wednesday of each month and, although physically settled on the LME, are strictly cash-settled at IBKR. The 3rd Wednesday contracts have become increasingly popular and account for 65% of open interest on the LME.

Quotes and Market Data

IBKR streams quotes from the LME (L2 market data) and does not widen the quote. Every client order is first hedged on exchange and the LME OTC order filled at the price of the hedge.

Cash Flows

Daily variation margin and realized P&L for the IBKR LME OTC Futures are cash-settled daily, like a standard future. By contrast, cash flows for the underlying LME contract are only settled after the contract has expired.

Margins

The margin requirements for the IBKR LME OTC Futures equal the requirement for the underlying contract on the LME. LME uses Standard Portfolio Analysis of Risk (SPAN) to calculate Initial Margin.

Like for other futures, the margin rates are established as an absolute value per contract and usually updated monthly.

Trading Permissions

You will need to set up permissions for United Kingdom Metals in Client Portal.

Market Data

You will need a subscription for Level II London Metal Exchange, currently GBP 1.00.

LME OTC Resources

Product Listings & Links to Contract Details

Commissions

Margin Requirements

Frequently asked Questions

What do I need to do to start trading LME OTC Futures?

You need to set up trading permission for United Kingdom Metals in Client Portal. If you have an IB LLC or an IB UK account carried by IB LLC we will set up a new account segment (identified with your existing account number plus the suffix “F”). Once the set-up is confirmed you can begin to trade. You do not need to fund the F segment separately; funds will be automatically transferred from your main account to meet margin requirements.

How are my LME OTC Futures trades and positions reflected in my statements?

Your positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Client Portal.

What account protections apply when trading LME OTC Futures?

LME OTC Futures are contracts with IB UK as your counterparty, and are not traded on a regulated exchange and are not cleared on a central clearinghouse. Since IB UK is the counterparty to your trades, you are exposed to the financial and business risks, including credit risk, associated with dealing with IB UK. Please note however that all client funds are always fully segregated, including for institutional clients. IB UK is a participant in the UK Financial Services Compensation Scheme ("FSCS"). IB UK is not a member of the U.S. Securities Investor Protection Corporation (“SIPC”).

Can I trade LME OTC Futures over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening orders.

MIFID II Commodity Position Limits

Background

On 3 January 2018, a new Directive 2014/65/EC (“MiFID II”) and Regulation (EU) No 600/2014 (“MiFIR”) will become effective, introducing new requirements on position limits and position reporting for commodity derivatives and emission allowances.

National Competent Authorities (“NCAs”) (i.e. regulators) of each European Economic Area (“EEA”) Country will calculate the limits on the size of the net position that a person can hold in commodity derivatives traded on an EU venue or its “economically equivalent contracts” (“EEOTC”).

The European Securities and Markets Authority (“ESMA”) intends to publish approved position limits on its website.

Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities.

Investment firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report

their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well as those of

their clients and the clients of those clients until the end client is reached, to the NCA.

Clients holding positions have to be identified using specified National Identifiers for individuals and LEIs for

organisations under MiFID II.

Interactive Brokers’ Implementation of the Requirements

In order to comply with its reporting obligations, IB will not allow its clients to trade if they have not provided the

specific National Identifier or LEI that is necessary for reporting positions of in scope financial products.

Whenever possible, IB will act to prevent account holders from entering transactions that may result in a position

limit violation. This process will include monitoring account activity, sending a series of notifications intended to

allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit.

Examples of notifications which are sent via email, TWS bulletin and Message Center are as follows:

- Information Level: sent when the position exceeds 50% of the limit. Intended to inform as to the existence of the position limit and its level.

- Warning Level: sent when the position exceeds 70% of the limit. Intended to provide advance warning that account will be subject to trading restrictions should exposure increase to 90%.

- Restriction Level: sent when the position exceeds 90% of the limit. Provides notice that account is restricted to closing transactions until exposure has been reduced to 85%.

Handel mit Bitcoin-Futures bei IBKR

Wie lautet das Handelssymbol?

CME (Bitcoin-Futures): Geben Sie das Symbol des Basiswertes BRR ein, um Futures aufzurufen

CME (Ether-Futures): Geben Sie das Symbol des Basiswertes ETHUSDRR ein, um Futures aufzurufen

ICE (Bakkt® Bitcoin-Futures): Geben Sie das Symbol des Basiswertes BAKKT ein, um Futures aufzurufen

Wie lauten die Handelszeiten?

CME: 17:00 – 16.00 Uhr Ortszeit Chicago, Sonntag – Freitag

CME: 19.00 – 17.00 Uhr Ortszeit Chicago, Sonntag – Freitag

Falls Sie außerhalb regulärer Handelszeiten handeln möchten oder wünschen, dass Ihre Order außerhalb regulärer Handelszeiten ausgeführt wird, sollten Sie diese entsprechend konfigurieren. Folgen Sie dazu den folgenden Anweisungen:

- Über die Ordervoreinstellungen für Futures. Klicken Sie in der klassischen TWS auf „Bearbeiten" und dann auf „Globale Konfiguration". Klicken Sie in Mosaic auf „Datei” und danach auf „Globale Konfiguration”. Klappen Sie den Abschnitt „Voreinstellungen” auf der linken Seite aus und wählen Sie „Futures” aus. Wählen Sie im Abschnitt „Timing” das Feld „Zulassen, dass Orders außerhalb der regulären Handelszeiten aktiviert, ausgelöst oder ausgeführt werden (sofern möglich)” aus. Klicken Sie auf „Anwenden” und danach auf „OK”, wenn Sie fertig sind.

- Über die Orderzeile. Klicken Sie sowohl in der klassischen TWS als auch in Mosaic auf das Feld „Gültigkeitsdauer” und wählen Sie „Außerhalb der reg. HZ auslösen” aus. Wählen Sie im WebTrader das Feld „Ausführung außerhalb der RTH” am Ende der Orderzeile aus.

- Über das Orderticket. Wählen Sie in der Rubrik „Gültigkeitsdauer” das Feld „Zulassen, dass diese Order außerhalb der regulären Handelszeiten ausgeführt werden kann” aus.

Bitte folgen Sie dem nachstehenden Link für weitere Information zum Futures-Handel außerhalb regulärer Handelszeiten:

https://www.interactivebrokers.com/en/index.php?f=719

Wo kann ich Informationen zu Kontraktdetails finden?

CME (Bitcoin Futures): http://www.cmegroup.com/trading/bitcoin-futures.html?itm_source=cmegroup&itm_medium=flyout&itm_campaign=bitcoin&itm_content=tech_flyout

CME (Ether Futures): https://www.cmegroup.com/trading/ether-futures.html

ICE (Bakkt® Bitcoin Futures): https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contact

Wird es etwaige Handelseinschränkungen geben?

Der Handel wird Altersvorsorgekonten (wie z. B. IRA-, SIPP-Konten) oder in Japan wohnhaften Kunden nicht angeboten.

Wie lauten die Marginanforderungen?

Die Marginanforderung für Outright-Long-Positionen beträgt 50% des Abrechnungspreises des Frontmonats vom Vortag. Im Fall von Outright-Short-Positionen liegt der Marginsatz bei 100 % des täglichen Abrechnungspreises.

Spread-Margin: Die Nettodifferenz zwischen der Outright-Kundenmindestmargin für jeden Long- und Short-Kontrakt (wobei 50% sowohl für die Long- als auch Short-Komponente verwendet werden) plus einer Spread-Gebühr von 25% für jeden Spread des täglichen Höchstabrechnungspreises unter allen handelsfähigen XBT-Future-Kontrakten.

Kunden werden daran erinnert, dass IBKR keine Margin-Calls ausgibt und sich vorbehält, jederzeit nach eigenen Ermessen Marginanforderungen zu ändern.

Bitte wechseln Sie zum folgenden Bereich der IBKR-Website, um aktuelle Margin-Anforderungen für alle Produkte einzusehen: https://www.interactivebrokers.com/en/index.php?f=24176

Wie hoch sind die Provisionen?

Die Provisionssätze für Bitcoin-Futures werden 10 USD pro Kontrakt für Produkte an der CME und ICE betragen. IBKR wird die Börsen-, Behörden und Clearingkosten weitergeben.

Weitere Informationen zu Provisionen sowie Börsen-, Behörden und Clearingkosten finden Sie auf der Seite „Provisionen” auf unserer Website:

https://www.interactivebrokers.com/en/index.php?f=commission&p=futures1

Welche Handelsberechtigungen sind erforderlich?

Um Bitcoin-Futures handeln zu können, müssen Sie über Handelsberechtigungen für US-Krypto-Futures verfügen. Sie können eine Handelsberechtigung für US-Krypto-Futures im Client Portal beantragen, indem Sie auf das Benutzermenü klicken (Portraitsymbol oben rechts) und anschließend auf Konto verwalten. Klicken Sie auf das Zahnradsymbol rechts oben im Abschnitt Erfahrung und Handelsberechtigungen. Wechseln Sie zum Abschnitt „Futures" und markieren Sie „Vereinigte Staaten (Krypto)".

Welche Optionen gibt es für Marktdatenabonnements?

Kursnotierungen für Kryptowährung-Futures stehen in Echtzeit über Client Portal auf Basis eines kostenpflichtigen Abonnements zur Verfügung. Die folgenden Abonnements werden angeboten (monatliche Abonnementgebühren werden auf der IBKR-Website veröffentlicht):

CME (Börse = CME. IB-Börse = CME)

Nichtprofessionell

- Stufe 1: CME Echtzeit Nichtprofessionell Stufe 1

- Stufe 1: Vorteilspaket für US-Wertpapier-Momentaufnahmen und Futures (NP, L1)

- Stufe 2: CME Echtzeit Nichtprofessionell Stufe 2 Echtzeit Nichtprofessionell Stufe

- Stufe 2: US-Vorteilspaket PLUS (NP, L2)

- Erfordert das Vorteilspaket für US-Wertpapier-Momentaufnahmen und Futures

- Dies ist nur für Buchtiefe erhältlich

Professionell

- Stufe 2: CME Echtzeit Nichtprofessionell Stufe 2 (Von der CME gibt es Stufe 1 weder für Profis, noch für Nicht-Profis)

ICE (Börse = ICE, IB Börse = ICECRYPTO)

- Stufe 2: ICE Futures US - Digitalprodukt Futures Stufe 2 (Es gibt Stufe 1 weder für Profis, noch für Nicht-Profis)

Zurück zum Inhaltsverzeichnis: Bitcoin und andere Kryptowährungsprodukte @ IBKR

Trading Cryptocurrency Futures with IBKR

What is the trading symbol?

CME (Bitcoin Futures): Enter the underlying symbol BRR in order to bring up the futures

CME (Ether Futures): Enter the underlying symbol ETHUSDRR to bring up the futures

ICE (Bakkt® Bitcoin Futures): Enter the underlying symbol BAKKT to bring up the futures

What are the trading hours?

CME: 17:00 – 16:00 Chicago Time, Sunday – Friday

ICE: 19:00-17:00 Chicago Time, Sunday – Friday

Please note, if you wish to trade outside of regular trading hours or have your order triggered outside of regular trading hours you must configure your order accordingly. You can do so using the following steps:

- Through Futures Order Presets. In Classic TWS, click Edit followed by Global Configuration. In Mosaic, click File followed by Global Configuration. Expand the Presets section on the left side and select Futures. The first section will be Timing, and you will want to check the box that says "Allow order to be activated, triggered, or filled outside of regular trading hours (if available)". Click Apply and OK once finished.

- Through the order line. In both Classic TWS as well as Mosaic, click on the Time in Force field and check the box at the bottom that says "Trigger outside RTH". In WebTrader, check the box at the end of the order line that says "Fill Outside RTH".

- Through the Order Ticket. In the Time in Force section, check the box that says "Allow this order to be filled outside of regular trading hours".

Please see the following link for more information on trading futures outside of regular trading hours:

https://www.interactivebrokers.com/en/index.php?f=719

Where can I find information about the contract specifications?

CME (Bitcoin Futures): http://www.cmegroup.com/trading/bitcoin-futures.html?itm_source=cmegroup&itm_medium=flyout&itm_campaign=bitcoin&itm_content=tech_flyout

CME (Ether Futures): https://www.cmegroup.com/trading/ether-futures.html

ICE (Bakkt® Bitcoin Futures): https://www.theice.com/products/72035464/Bakkt-Bitcoin-USD-Monthly-Futures-Contact

Will there be any restrictions on trading?

Trading will not be offered in retirement accounts (e.g., IRA, SIPP) or for residents of Japan.

What is the Margin Requirement?

The margin requirement for outright long positions will be set at 50% of the prior day's lead month settlement price. In the case of outright short positions, the margin rate will be 100% of the daily settlement price.

Spread Margin: The net difference between the outright customer maintenance margin requirements on each long and short contracts (using 50% for both the long and the short leg) plus, for each spread, a spread charge equal to 25% of the daily settlement price that is the greatest among all XBT futures contracts available for trading.

Clients are reminded that IBKR does not issue margin calls and may modify margin requirements at any time, at IBKR's sole discretion.

Please refer to the following section of the IBKR website for current margin requirements for all products: https://www.interactivebrokers.com/en/index.php?f=24176

What are the commissions?

The commission rate for Crypocurrency futures will be USD 10 per contract for the CME and ICE products. IBKR will pass through exchange, regulatory and clearing fees.

For more information on commission as well as exchange, regulatory and clearing fees, please visit the Commission page of our website:

https://www.interactivebrokers.com/en/index.php?f=commission&p=futures1

What trading permissions are required?

To trade Crypocurrency futures, you must have trading permissions for US Crypto Futures. You can request US Crypto Futures trading permission in Client Portal by clicking the User menu (head and shoulders icon in the top right corner) followed by Manage Account. Click the gear icon in the top right corner of the Trading Experience & Permissions section. Go to the "Futures" section and check off "United States (Crypto)".

What are the market data subscription options?

Live quotes for Crypocurrency futures are available on a paid subscription basis through Client Portal. The following subscriptions are offered (monthly subscription fees are posted to the IBKR website):

CME (Exchange = CME. IB Exchange = CME)

Non-Professional

- Level 1: CME Real-Time Non-Professional Level 1

- Level 1: US Securities Snapshot and Futures Value Bundle (NP,L1)

- Level 2: CME Real-Time Non-Professional Level 2

- Level 2: US Value Bundle PLUS (NP,L2)

- Requires US Securities Snapshot and Futures Value Bundle

- This is only for depth of book

Professional

- Level 2: CME Real-Time Professional Level 2 (There is no CME Pro level 1 product)

ICE (Exchange = ICE, IB Exchange = ICECRYPTO)

- Level 2: ICE Futures US - Digital Asset Futures Level 2 (There is no level 1 available for either professional or professional)

Back to Table of Contents: Bitcoin and Other Cryptocurrency Products @ IBKR

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.