現金劃轉

該等法規還要求所有證券交易和相關保證金交易均在全能賬戶的證券賬戶段進行,而商品交易則在商品賬戶段進行。1 雖然法規允許將全額支付的證券持倉以保證金抵押品的形成存放在商品賬戶段進行托管,但IB幷不允許這種操作,從而對抵押權應用了更爲嚴格的SEC限制性規則。鑒于相關法規和政策已對持倉應歸于哪個賬戶段作出了規定,現金是唯一可由客戶自行决定在兩個賬戶段之間來回轉帳的資産。

下方爲現金劃轉選項、選擇步驟和注意事項相關的說明。

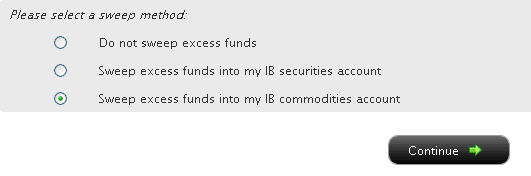

然後,您可點擊您想要的劃轉方式對應的單選按鈕,然後選擇〝繼續〞按鈕。您的選擇將從下一個工作日起生效,幷將一直有效,直到選擇其它選項爲止。請注意,只要滿足上文中提到的交易許可設置,您可隨時更改劃轉方式,沒有次數限制。

通過Wise進行注資

通過與Wise進行合作,IBKR能够在您登錄IBKR平臺期間,爲您提供以下的服務:

- 把您的IBKR賬戶與WISE賬戶關聯進行注資

- 把IBKR不直接支持的貨幣(例如羅馬尼亞列伊(RON)、保加利亞列弗(BGN)、馬來西亞令吉(MYR)、印度尼西亞盧比(IDR))從您的本地銀行轉帳至Wise,然後在Wise將其兌換成IBKR支持的貨幣(例如歐元(EUR)、美元(USD)等)存入您的IBKR賬戶。

- 從現有的Wise餘額向您的IBKR賬戶轉帳以及從IBKR賬戶轉回Wise

Wise與IBKR賬戶只需要建立一次關聯。您只能與您名下的Wise賬戶進行關聯。

如這是您首次使用Wise注資方式,您將會收到與Wise賬戶關聯的提示。

所需時間方面,從您的本地銀行轉帳資金至Wise可能需要幾個小時至幾個工作日,然後需要最多一整個工作日把資金從Wise轉至您的IBKB賬戶,具體時間視乎不同貨幣而定。

資金從您的Wise賬戶轉出之後,需要幾個小時至一整個工作日才會到達您的IBKR賬戶,具體時間視乎幣種而定。

您可從IBKR賬戶提取支持的幣種(例如歐元(EUR)、美元(USD))轉帳至您的Wise賬戶。

How To Transfer an Existing IRA from Interactive Brokers

If the other broker participates in the Automated Customer Account Transfer Service (ACATS) program, then contact your other broker to submit the transfer out electronically.

If the other broker is not ACAT eligible, they must provide outgoing trustee to trustee transfer paperwork or outgoing Direct Rollover paperwork. They can give you the completed documents which can be uploaded online. Please note this is only for cash transfers, and information submitted is only instructions, not the actual withdrawal. After paperwork is reviewed and approved, you’ll be advised when to submit the withdrawal of funds.

To submit a withdrawal request:

- Log into Client Portal

- Select Transfer & Pay followed by Transfer Funds

- Click Make a Withdrawal

- Select Use a new withdrawal method and next to Bank Wire, click Use this Method

- Select Financial Institution when asked “Where will funds be deposited?”

- Answer the prompts that follow, then click in the box when asked if you’ll be sending a trustee-to-trustee transfer or Direct Rollover to this destination

- Confirm in the pop up box you have the signed custodian transfer paperwork

- Complete remaining banking prompts and click Save Bank Information

- Confirm the instructions on the next page and click Continue

- Click on Upload your form

- Click Reply to upload the document and add a comment.

- Click Submit and close the window

You will be provided updates of your transfer request through the Message Center.

If a wire transfer is not accepted by your new custodian, you may submit a check withdrawal request. Please note check requests require review by Compliance and will take longer to process if approved.

- Log into Client Portal

- Select Transfer & Pay followed by Transfer Funds

- Click Make a Withdrawal

- Select Use a new withdrawal method and next to Check, click Use this Method

- Select “Send to another person/entity” from the first drop down box

- Answer the prompts that follow and click Save Destination

- Complete remaining banking prompts and click Save Bank Information

- Confirm the information and click Continue

- Read the instructions and click Finish

- Finally, click on Help on the top right and select Secure Message Center to create a new ticket

- Click Compose and then New Ticket>Funds & Banking>Cash Withdrawals

- Complete the prompts and upload the completed paperwork from your broker/custodian

You will be provided updates via this ticket.

Contra firms and Custodians (only) may forward paperwork to the following:

Interactive Brokers LLC

Attn: IRA Services, Transfers

209 South LaSalle Street, 10th Floor

Chicago, IL 60604

- Email — iraservices@ibkr.com

- Fax — 312-542-7345

Additional Information

- IRA Transfer Methods in the Client Portal Users' Guide

從已關的賬戶中提取資金

簡介

客戶如選擇關戶,則應在關戶前取走或轉走賬戶中的全部現金及證券餘額。賬戶一旦被關閉,就無法再進行交易。然而,在少數情况下,可能會有資産被存入已關的賬戶。正如在關戶時向客戶披露的,鑒于已關賬戶不再能使用交易平臺兌換貨幣,被存入已關賬戶的現金餘額不論金額大小,都將自動被兌換爲基礎貨幣。

下文將介紹前述情况發生的背景以及客戶應如何提取相關資産。

關戶後産生餘額

儘管關戶後通常不會再有資産存入,但在以下情况下仍可能導致賬戶産生餘額:

- 關戶時選擇通過支票提取賬戶餘額,而客戶未在90天內兌現該支票,進而導致支票交易被IBKR取消;或者,由于支票遺失、被盜或未送達,客戶要求止付。

- 關戶時選擇通過電子渠道(如電匯、ACH、EFT)提取賬戶餘額,但資産後被接收銀行退回了IBKR。這可能是由于客戶在接收銀行處的賬戶已關閉或IBKR的賬戶名稱和銀行的賬戶名稱不一致(如第三方轉帳的情况),導致接收銀行拒收幷退回資金。

- 賬戶被關後收到了之前多扣的股息稅退還的稅款。

- 開戶人在賬戶未成功開立前向賬戶存入了資金,而該賬戶一直未被IBKR批准或被開戶人遺弃。

- 關戶時選擇將資産轉至其它經紀商,但資産在關戶後被經紀商退回。

提取資産

要提取現金,請登錄客戶端,依次選擇轉帳與支付和轉帳資金菜單,然後系統會顯示可用的取款方式及您在賬戶開立狀態時創建的銀行存取款指令列表。選擇一個適用于要提取的幣種的可用存取款指令。

如您的賬戶內有持倉,請聯繫退回持倉的經紀商,請求將該筆持倉重新轉回。請注意,您無法通過已關閉的賬戶提交委托單平倉。

常見問題解答

問:如果我不記得我的登錄驗證信息、無法登錄客戶端怎麽辦?

答:如您需要登錄賬戶方面的幫助,請致電您當地的客服中心。爲防止無授權的用戶登錄您的賬戶,此類請求需要口頭驗證您的身份。聯繫信息請見我們的網站。

問:我如何確定我賬戶中的餘額?

答:您可通過賬戶活動報表瞭解賬戶餘額及其組成。每日、每月及年度報表可通過客戶端的報告/稅務報告菜單在綫查看。

問:我可否重開已關閉的賬戶?

答:已關閉很長時間且只是爲了提取資産而申請重開的賬戶通常不能重開。如您希望重開賬戶幷長期使用我們的經紀服務,請聯繫您當地的客服中心獲取幫助。

問:如果我希望通過支票提取資金而我的地址變了會怎麽樣?

答:如果您的賬戶可通過支票提取資金(只支持美元取款且要求客戶有美國的郵寄地址)而您記錄在我們這裏的地址不再準確,則您將無法在綫更改您的地址。在這種情况下,請聯繫客服告知我們您的最新地址,客服人員將指導您如何上傳駕照或其它可被接受的文件副本。

問:如果我想通過電子渠道取款而我的賬戶沒有有效的銀行存取款指令,這種情况下怎麽辦?

答:如果您目前沒有可用的銀行存取款指令,請登錄客戶端幷使用“轉帳與支付”菜單添加新的指令。請注意,IBKR有權通過口頭驗證及/或要求客戶提交文件的方式來驗證新的存取款指令。該驗證步驟旨在防止客戶因無授權的第三方轉帳而蒙受損失。

問:開戶實體的銀行賬戶被注銷了或實體不再存在了。這種情况下如何取款?

答:如果無法以關戶時的賬戶持有人的名義取款,則IBKR將嘗試按實體所有人的所有權比例來向所有人分配資金。請注意,這通常要求所有人提交文件來證明其身份及其所有權權益,幷提交有所有人簽字的保證和補償書,承諾其提供的信息是準確的,且除他們以外,沒有其它所有人或債權人對賬戶資金有索取權。IBKR也有權要求由律師提供獨立意見,證明所有人提供的信息的準確性。

問:如果我不采取行動來提取已關賬戶內的資産會怎麽樣?

答:IBKR會嘗試通過客戶留在我司處的郵箱來通知已關賬戶的持有人賬戶內有餘額。如果賬戶持有人在通知發出後30天內不采取行動取款,則將被收取20美元/月的已關賬戶費用。另外,還請注意,根據法規要求,IBKR有義務將“被遺弃賬戶”內的資産上交給客戶居住的州政府(如果客戶居住在美國以外,則上交給康涅狄格州)。對于賬戶多久無活動會被歸爲“不活躍”,各州的規定不同,但最短可爲3年。關于如何從州政府出取回無主財産的詳細信息,請見知識庫文章2599。

費用概覽

我們鼓勵客戶和潛在客戶訪問我們的網站瞭解詳細費用信息。

最常見的幾項費用有:

1. 傭金——取決於產品類型和掛牌交易所,以及您選擇的是打包式(一價全含)還是非打包式收費。例如,美國股票傭金為每股0.005美元,每筆交易最低傭金為1.00美元。

2. 利息——保證金貸款需繳納利息,IBKR採用國際公認的隔夜存款基準利率作為基礎來確定自己的利率。然後我們將分等級在基準利率基礎上應用一個浮動值(這樣餘額越大對應的利率就越有利)來確定實際利率。例如,對於美元計價的貸款,基準利率是聯邦基金利率,而10萬美元以內的餘額利率會在基準利率的基礎上加1.5%。此外,賣空股票的個人應注意,借用“難以借到”的股票還會有一筆特殊費用,以日息表示。

3. 交易所費用——取決於產品類型和交易所。例如,對於美國證券期權,某些交易所會對消耗流動性的委託單(市價委託單或適銷的限價委託單)收取費用、對添加流動性的委託單(限價委託單)給與補貼。此外,許多交易所還會對取消或修改的委託單收取費用。

4. 市場數據——您並非一定要訂閱市場數據,但是如果不訂閱市場數據,您可以會產生月費用,具體取決於供應交易所及其訂閱服務。我們提供市場數據助手工具,可根據您想交易的產品幫助您選擇適當的市場數據訂閱服務。要訪問該工具,請登錄客戶端,點擊支持然後打開市場數據助手鏈接。

5. 最低月活動費用——為迎合活躍客戶的需求,我們規定如果賬戶產生的月傭金能達到最低月傭金要求,則可免交月活動費用;而如果產生的月傭金未能達到最低月傭金要求,則需繳納差額作為活動費用。最低月傭金要求為10美元。

6. 雜費 - IBKR允許每月一次免費取款,後續取款將收取費用。此外,還會代收交易取消請求費用、期權和期貨行權&被行權費用以及ADR保管費用。

更多信息,請訪問我們的網站,從定價菜單中選擇查看。

資金轉賬限制

簡介

作爲反洗錢工作的一部分,IBKR會對某些客戶存款和取款實施限制。該等限制針對的是具有較高反洗錢風險之國家相關的轉帳,同時會考慮客戶的居住地、取款目的地和轉帳資金的計價幣種等因素。1下方對該等限制進行了簡要介紹。

限制概述

- 在被認定爲具有較高反洗錢風險之國家居住或擁有聯繫地址的客戶不得將資金取到位于另一具有較高反洗錢風險之國家的賬戶,除非其在該國也有聯繫地址。

- 在被認定爲具有較高反洗錢風險之國家居住或擁有聯繫地址的客戶不得從位于另一具有較高反洗錢風險之國家的賬戶發起存款,除非其在該國也有聯繫地址。

- 在被認定爲具有較高反洗錢風險之國家居住或擁有聯繫地址的客戶只能將資金取到其曾從中收到過存款的自己名下的賬戶。

- 客戶只能以基礎貨幣、其本國貨幣或通用貨幣(如USD、EUR、HKD、AUD、GBP、CHF、CAD、JPY和SGD)取款。

- IBSG的客戶只能以SGD、USD、CNH、HKD和GBP取款。

- IBKR會對客戶取款的目標銀行數目進行限制,不論客戶或銀行的所在國家或地區。

請注意,客戶如果要創建被限制的在綫銀行指令或發起被限制的存款或取款,系統會阻止其操作幷報錯。

1在决定一個國家是否存在較高反洗錢風險時,我們會參考金融行動特別工作組(FATF)提供的信息,金融行動特別工作組是爲打擊洗錢、恐怖主義融資和其它威脅國際金融體系及其它反洗錢指數完整的行爲而成立的政府間組織。

Notification Regarding Third-Party Wire Withdrawals

Certain Interactive Brokers (“IBKR”) accounts are eligible to request withdrawal of funds to third parties by bank wire. These requests are subject to review and approval at IBKR’s sole discretion. This program is described on the IBKR website here.

After a due diligence review, IBKR may allow withdrawals to a third party for purposes like:

• Withdrawal for purchase of a home or mortgage payoff

• Withdrawal to a spouse, parent, sibling, or child of source account holder

• Withdrawal to an account held by one of the accountholders of a joint account or vice versa.

• Withdrawal from trust account to a beneficiary

• Payment of certain account expenses

• Tax payments

• IRA qualified charitable distributions

IBKR will generally not approve the following types of third-party withdrawals:

• Private investments

• Repayment of loans

• Withdrawals to companies owned by the accountholder

• Payment for purchase of goods or services

• Withdrawals to individuals other than spouse, parent, sibling or child of account holder

Withdrawing Funds from a Closed Account

Introduction

Clients who elect to close their account must first ensure that all balances (e.g., cash and positions) have been withdrawn or transferred before the account can be closed. Once closed, the account is then restricted from further transactions, however, there are situations where assets may be credited to the account despite it being closed. As disclosed at the point of account closing, cash balances credited to an account after it has been closed are automatically converted to the base currency, regardless of amount, since the trading platform is no longer available to facilitate conversions.

The following article provides background as to how such situations may occur and the steps clients can take to withdraw the assets.

Post-Closure Balances

While it is uncommon for credits to be applied to an account once closed, the events which cause this to happen generally arise from the following:

- The account was closed via disbursement issued in in the form of a check which the client does not present for payment for 90 days and is therefore cancelled by IBKR; or, where the client requests a stop payment due to loss, theft or non-delivery of the check.

- The account was closed via an electronic disbursement (e.g., wire, ACH, EFT) later returned to IBKR by the receiving bank. This can occur if the receiving bank decides to reject and return the funds because the client’s bank account is closed or if the title of the account at IBKR differs from the bank account to which it is being deposited (i.e., a 3rd party transfer).

- A credit adjustment is applied to the account after it has closed to correct an over-withholding of taxes on a prior period dividend.

- An applicant deposited funds prior to the account being opened and the application was never approved by IBKR or was abandoned by the applicant.

- The account was closed via transfer to another broker who later returns the assets after the account has closed.

Withdrawing Assets

To withdraw cash, log into the Client Portal, select the Transfer & Pay and then Transfer Funds menu options and you will be presented with the option to make a withdrawal and a list of available banking instructions which you created while the account was open. Select an instruction that is active and applicable to the denomination of the currency to be withdrawn.

If your account has positions, please contact the broker who returned the positions to request that they be transferred back. Note that you will not be able to submit orders to close positions in a closed account.

FAQs

Q. What do I do if I don't recall my login credentials and am unable to log into the Client Portal?

A. If you require assistance logging into your account, you will need to contact your local Client Service Center via telephone. Such requests require verbal verification of your identity as a protection from unauthorized users. Contact information is available on our website.

Q. How do I determine the credit balance in my account?

A. The account balance and its composition can be found in your activity statement. Daily, monthly and annual statements are available online via the Client Portal through the Reports/Tax Reports menu option.

Q. Am I able to reopen an account that has been closed?

A. Accounts that have been closed for an extended period or are attempting to reopen solely for the purpose of withdrawing assets are generally not eligible to be reopened. If you intend to reopen the account to establish an ongoing brokerage relationship, please contact your local Client Service Center for assistance.

Q. What happens if I want to withdraw the funds via check and my address has changed?

A. If your account is eligible to withdraw funds via check (only available for US currency withdrawals by customers with a US mailing address) and your mailing address on record is no longer accurate, you will not be able to change your address online. In this instance, please contact Client Services to inform us of your new address and receive instructions on how to upload a copy of a driver's license or other acceptable document.

Q. What happens if I want to withdraw the funds electronically and my account does not already have a valid banking instruction on file?

A. If you currently do not have an active banking instruction on file, please log into the Client Portal and add a new instruction using the Transfer & Pay menu option. Note that IBKR reserves the right to verify new instructions via verbal confirmation and/or submission of qualifying documentation. This verification step is intended to protect against unauthorized transfers to a 3rd party.

Q. The entity which owned the account no longer has a bank account or is no longer in existence. How can the funds be withdrawn?

A. In the event the funds are unable to be withdrawn and distributed in the name of account holder at the point of account closure, IBKR will seek to distribute the funds to the entity owners based on their pro rata share of ownership. Note that this will generally require submission of documentation evidencing the owners and their ownership interests as well as a warranty and indemnification letter executed by the owners that the information they provide is accurate and there aren’t any other owners or creditors to whom the funds are owned. IBKR also reserves the right to request an independent opinion of counsel verifying the accuracy of the information provided.

Q. What happens if I do not act to withdraw assets in a closed account?

A. IBKR will attempt to notify closed accounts of a credit balance using the email address of record. Account holders who do not act to withdraw balances within 30 days after notice has been sent are subject to a monthly closed account fee of $20. Also note that IBKR is subject to statutes which require that assets in accounts deemed "abandoned" be turned over to the state in which the client resides (or Connecticut if the client resides outside the U.S.). The period of inactivity by which an account is considered "inactive" varies by state, but can be as low as 3 years. See Knowledge Base Article 2599 for details regarding retrieving unclaimed property from the state.

IB LLC大宗商品賬戶保證金要求

引言

作為一家在19個國家或地區提供期貨交易的全球性經紀商,IB受多種監管要求的約束,某些監管要求仍保留了在日末計算一次保證金的概念,而IB的保證金是連續、實時計算的。為滿足大宗商品監管要求并以務實的方式控制經濟風險,我們會在收槃時應用兩種保證金計算方式,兩種方式計算得出的保證金要求須同時滿足。兩種方式的概述如下。

概述

所有定單在執行前均須滿足初始保證金要求,執行后則須始終滿足維持保證金要求。由於某些產品的日中保證金可能會低於交易所要求的最低保證金比例,為確保日末能滿足保證金要求,IB通常會在休市前清算頭寸,而不是要求客戶追加保證金。然而,如果賬戶在休市時仍不滿足保證金要求,我們會通知客戶追加保證金,同時僅允許客戶做減少占用保證金的交易,如在之后的第三個工作日休時仍不能滿足最初的要求,則頭寸將被清算。

在確定是否需追加保證金時,IB會應用實時計算和監管計算這兩種方式,而某些情況下,這兩種方法得出的結果可能不同:

實時:在本方法下,初始保證金是用同一個時間點收集的頭寸和價格計算的,不考慮產品所在的交易所及正式的休市時間;鑒於大部分交易所的交易時間均接近連續,我們認為本方法有其適用性。

監管:在本方法下,初始保證金是用各家交易所常規交易時間終止時收集的頭寸和價格計算的。比如,對於交易香港交易所、EUREX和CME期貨產品的客戶,保證金要求將根據各家交易所休市時的信息計算。

影響

交易單一時段、單一國家或地區的期貨的客戶不受影響。在某個交易所的常規交易時段及槃后交易時段交易、或在不同國家或地區的交易所(這些交易所的休市時間不同)交易的客戶更可能受影響。比如,一個客戶在香港常規交易時段開倉期貨合約并在美國交易時段平倉,則保證金要求只取決於開倉時的頭寸。在新的計算方式下,這種交易將適用不同的保證金要求,甚至產生在當前方法下不存在的追加保證金。下表舉例說明了該情況。

舉例

本例試圖說明,如果一個同時在亞洲和美國兩個時區交易期貨的客戶在延長的交易時段(即在常規交易時段以外、該日已正式休市時)交易時會如何受影響。本例中,客戶在香港常規交易時段開倉,并在延長的交易時段內平倉,進而騰出資金在美國常規交易時段開倉。為說明起見,假設交易損失了1,000美元。本例說明,監管的日末保證金計算方法可能不能識別在正式休市后進行的會占用保證金的交易,因此產生了追加初始保證金的要求。

| 天數 | 時間(美東) | 事件 |

初始頭寸 |

結束頭寸 | IB保證金 | 監管保證金 | |||

| 含貸款的淨資產 | 維持 | 初始 | 隔夜 | 追加保證金 | |||||

| 1 | 22:00 | 買1份 HHI.HK | 無 | 1份HHI.HK多頭 | $10,000 | $3,594 | $4,493 | 不適用 | 不適用 |

| 2 | 04:30 | 香港交易所正式休市 | 1份HHI.HK多頭 | 1份HHI.HK多頭 | $10,000 | $7,942 | $9,927 | $4,493 | 不適用 |

| 2 | 08:00 | 賣1份HHI.HK | 1份HHI.HK多頭 | 無 | $9,000 | $0 | $0 | $0 | 不適用 |

| 2 | 10:00 | 買1份ES | 無 | 1份ES多頭 | $9,000 | $2,942 | $3,677 | 不適用 | 不適用 |

| 2 | 17:00 | 美國交易所正式休市 | 1份ES多頭 | 1份ES多頭 | $9,000 | $5,884 | $7,355 | $9,993 | 是 |

| 3 | 17:00 | 美國交易所正式休市 | 1份ES多頭 | 1份ES多頭 | $9,000 | $5,884 | $7,355 | $5,500 | 否 |

Funds Transfer Restrictions

INTRODUCTION

As part of its anti-money laundering efforts, IBKR implements restrictions on certain client deposits and withdrawals. These restrictions apply to transfers associated with countries considered to have elevated AML risk and consider factors such as the client’s residency, the withdrawal destination and the denomination of the currency being transferred.1 An outline of these restrictions is provided below.

OVERVIEW OF RESTRICTIONS

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not withdraw funds to an account located in another country that has elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may not deposit funds from an account located in another country having elevated AML risk unless they also maintain an address in that country.

- Clients residing or maintaining an address in a country designated as having elevated AML risk may only withdraw funds to an account from which that client received a first-party deposit.

- Clients may only withdraw funds in their base currency, their home country’s currency or common currencies (e.g. USD, EUR, HKD, AUD, GBP, CHF, CAD, JPY and SGD).

- IBSG clients may only withdraw in SGD, USD, CNH, EUR, GBP and HKD.

- IBKR may restrict the number of banks that a client may send money to, regardless of the domicile of the client or the bank.

- A change to your base currency requires a minimum of 5 days before withdrawal instructions can be entered and a withdrawal request can be processed.

Note that clients who attempt to create an online banking instruction or initiate a deposit or withdrawal which is restricted will be blocked from creating that instruction or initiating that transaction and will be presented with an online error message.

1In determining whether a country is associated with elevated AML risk, consideration is given to information provided by the Financial Action Task Force (FATF), an intergovernmental organization which promotes measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system and other public AML indices.