Information Regarding Physical Delivery Rules

IBKR does not have the facilities necessary to accommodate physical delivery for most products. For futures contracts that are settled by actual physical delivery of the underlying commodity (physical delivery futures), account holders may not make or receive delivery of the underlying commodity.

It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. If an account holder has not closed out a position in a physical delivery futures contract by the close-out deadline, IBKR may, without additional prior notification, liquidate the account holder’s position in the expiring contract. Please note that liquidations will not otherwise impact working orders; account holders must ensure that open orders to close positions are adjusted for the actual real-time position.

To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline.

Below provides an overview of the relevant close-out deadlines of futures and futures options contracts. The relevant First Notice Date, First Position Date and Last Trading Date information may be obtained through the IBKR website by navigating to the IBKR Support page and selecting Contract Search. Any date information provided is on a best-efforts basis and should be verified by reviewing the contract specifications available on the exchange's website.

Summary of Physical Delivery Futures Policies

|

Contract |

Delivery Permitted |

Close-Out Deadline |

|

ZB, ZN, ZF (CBOT) |

No |

2 hours before the end of open outcry trading on the business day prior to First Notice Day (longs) or Last Trading Day (shorts) |

|

ZT (CBOT) futures, Japanese Govt Bond Futures (JGB) |

No |

End of second business day prior to the First Position Day (longs) or end of second business day prior to Last Trading Day (shorts) |

|

EUREXUS futures |

No |

End of business day prior to the First Position Day (longs) or Last Trading Day (shorts) |

|

EUREXUS 2 yr Jumbo bond (FTN2) and 3 yr bond (FTN3) futures |

No |

End of the second business day prior to the First Position Day (longs) or Last Trading Day (shorts) |

|

IPE contracts (GAS, NGS) |

No |

End of the second business day prior to the First Position Day (longs) or day prior to Last Trading Day (shorts) |

|

CME LIVE CATTLE (LE) |

No |

End of the second business day prior to the First Intent Day (longs) or Last Trading Day (shorts) |

|

CME NOK, SEK, PLZ, CZK, ILS, KRW and HUF, and correspondent Euro rates |

No |

End of the fifth business day prior to the Last Trading Day for both longs and shorts |

|

GBL, GBM, GBS, GBX (Eurex), CONF (Eurex) |

No |

2 hours before the end of trading on the last trading day |

|

CME currency futures (EUR, GBP, CHF, AUD, CAD, JPY, HKD) |

Yes* |

Not applicable* |

|

CME Ethanol futures (ET) |

No |

End of the fifth business day prior to the First Position Day (longs) or Last Trading Day (shorts) |

| NG futures (NYMEX) | No | End of the business day prior to the First Position Day or last trading day (whichever comes first) (longs) or end of business day prior to Last Trading Day (shorts) |

|

All other contracts |

No |

End of the second business day prior to the sooner of First Position Day or Last Trading Day (longs) or end of the second business day prior to the Last Trading Day (shorts) |

*As Cash and IRA accounts are restricted from holding foreign currencies, the liquidation schedule outlined above for All other contracts will also apply to Cash and IRA accounts for these foreign currency products.

Summary of Physical Delivery Future Options Policies

| Contract | Delivery Permitted | Close-Out Deadline |

| All contracts | Yes | Options will be allowed to expire into futures (or, if out-of-the-money, expire worthless), if the options expiration date is prior to the underlying futures’ First Position Day. If there is a resulting futures position, it will then be subject to the respective Close-Out Deadlines, as detailed above. |

What happens to US security options if the underlying becomes the subject of a full cash merger?

In the case of any stock option associated with a merger in which the underlying security has been converted to 100% cash after December 31, 2007, the OCC will accelerate its expiration. The new expiration date for such options will be accelerated to the nearest standard equity expiration, unless the cash conversion takes place after the Tuesday within an expiration week, in which case the expiration date for all contracts not already expiring that week will be deferred until the following month’s expiration.

Note that this acceleration does not impact the automatic exercise threshold, through which all options having a strike price that is in-the-money by at least $0.01 will be automatically exercised by OCC. Nor does it impact the date of the cash settlement attributable to the exercise which remains at T+2.

Also note that this acceleration does not affect options which were converted to cash on or before December 31, 2007 which will remain valid series until their original expiration date has been reached.

Can I take delivery on my futures contract?

With the exception of certain currency futures contracts carried in an account eligible to hold foreign currency cash balances, IB does not allow customers to make or receive delivery of the commodity underlying a futures contract.

IB does not have the facilities necessary to accommodate physical delivery. For futures contracts that are settled by actual physical delivery of the underlying commodity (physical delivery futures), account holders may not make or receive delivery of the underlying commodity.

It is the responsibility of the account holder to make themselves aware of the close-out deadline of each product. If an account holder has not closed out a position in a physical delivery futures contract by the close-out deadline, IB may, without additional prior notification, liquidate the account holder’s position in the expiring contract. Please note that liquidations will not otherwise impact working orders; account holders must ensure that open orders to close positions are adjusted for the actual real-time position.

To avoid deliveries in expiring futures contracts, account holders must roll forward or close out positions prior to the Close-Out Deadline indicated on www.interactivebrokers.com. From the home page, choose the Trading menu, and then select Delivery, Exercise & Actions. From the Delivery, Exercise and Corporate Actions page, read the information governing Futures and Future Options Physical Delivery Liquidation Rules. Also listed are the few futures in which delivery can be taken, such as currency futures.

Will open futures contracts roll over automatically at expiration?

Please note that futures contracts, by default, do not roll over at expiration. The TWS trading platform, however, does provide a feature to "Auto Roll Data for Expiring Futures Contracts". When specified in Global Configuration, the system automatically rolls soon-to-expire futures data lines to the next lead month. Approximately three days prior to expiration, the new lead month contract will be added to quote monitor. Approximately one day after the contract expires it will automatically be removed from the display.

Additionally, you can instruct TWS to cancel open orders on expiring contracts. If you have the auto-roll option selected, anytime there are open orders on expiring futures contracts you will receive a pop-up message asking if you want TWSto cancel the listed open orders in anticipation of expiration. Once the contracts expire the orders will be canceled automatically.

The following steps are to be performed in order to activate this feature:

1. Click the Configure wrench icon in the trading window

2. In the left pane of Global Configuration, select General;

3. In the right pane, check Auto Roll Date for Expiring Futures Contracts

Also note that with the exception of certain currency futures contracts, IBKR does not allow for the actual physical delivery of underlying commodities. Contracts which settle by physical delivery must be rolled over or closed out prior to a close-out deadline or face forced liquidation by IBKR. Please refer to the website under Delivery, Exercise & Corporate Actions for additional details as this deadline will vary by product.

Options Assignment Prior to Expiration

An American-Style option seller (writer) may be assigned an exercise at any time until the option expires. This means that the option writer is subject to being assigned at any time after he or she has written the option until the option expires or until the option contract writer closes out his or her position by buying it back to close. Early exercise happens when the owner of a call or put invokes his or her rights before expiration. As the option seller, you have no control over assignment, and it is impossible to know exactly when this could happen. Generally, assignment risk becomes greater closer to expiration, however even with that being said, assignment can still happen at any time when trading American-Style Options.

Short Put

When selling a put, the seller has the obligation to buy the underlying stock or asset at a given price (Strike Price) within a specified window of time (Expiration date). If the strike price of the option is below the current market price of the stock, the option holder does not gain value putting the stock to the seller because the market value is greater than the strike price. Conversely, If the strike price of the option is above the current market price of the stock, the option seller will be at assignment risk.

Short Call

Selling a call gives the right to the call owner to buy or “call” stock away from the seller within a given time frame. If the market price of the stock is below the strike price of the option, the call holder has no advantage to call stock away at higher than market value. If the market value of the stock is greater than the strike price, the option holder can call away the stock at a lower than market value price. Short calls are at assignment risk when they are in the money or if there is a dividend coming up and the extrinsic value of the short call is less than the dividend.

What happens to these options?

If a short call is assigned, the short call holder will be assigned short shares of stock. For example, if the stock of ABC company is trading at $55 and a short call at the $50 strike is assigned, the short call would be converted to short shares of stock at $50. The account holder could then decide to close the short position by purchasing the stock back at the market price of $55. The net loss would be $500 for the 100 shares, less credit received from selling the call initially.

If a short put is assigned, the short put holder would now be long shares of stock at the put strike price. For example, with the stock of XYZ trading at $90, the short put seller is assigned shares of stock at the strike of $96. The put seller is responsible for buying shares of stock above the market price at their strike of $96. Assuming, the account holder closes the long stock position at $90, the net loss would be $600 for 100 shares, less credit received from selling the put originally.

Margin Deficit from the option assignment

If the assignment takes place prior to expiration and the stock position results in a margin deficit, then consistent with our margin policy accounts are subject to automated liquidation in order to bring the account into margin compliance. Liquidations are not confined to only shares that resulted from the option position.

Additionally, for accounts that are assigned on the short leg of an option spread, IBKR will NOT act to exercise a long option held in the account. IBKR cannot presume the intentions of the long option holder, and the exercise of the long option prior to expiration will forfeit the time value of the option, which could be realized via the sale of the option.

Post Expiration Exposure, Corporate Action and Ex-Dividend Events

Interactive Brokers has proactive steps to mitigate risk, based upon certain expiration or corporate action related events. For more information about our expiration policy, please review the Knowledge Base Article "Expiration & Corporate Action Related Liquidations".

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at the OCC's web site.

What happens to the USD equity option that I am long at expiration?

There are two scenarios which could occur if a long option is taken to expiration. If the option is out-of-the-money at expiration and you do not choose to exercise it, the option will expire worthless, and your losses will consist of the premium that was paid to acquire the option. If the option is in-the-money at expiration by 0.01 or more, it will be automatically exercised on your behalf (unless you previously chose to lapse the option) by the Options Clearing Corporation (OCC). The OCC processes monthly expiration options on the third Saturday of the month, or the day after Friday expiration. The resulting long or short position will be put into the account, effective on the Friday trade date. If the account has sufficient margin to satisfy the requirement on the resulting position, it will then be up to the account holder to decide what they want to do with the position. If the resulting position causes a margin deficit, the account will be subject to liquidation at a time which is defined by the holdings within the account. Please be aware that any positions could be liquidated as a result of the account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. For example, if the account holds currency, futures, future options positions or and non-USD product, the account may begin to liquidate to meet the margin deficit as soon as a corresponding market opens.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.

How can I exercise long options?

Account holders have the ability to exercise equity options they hold long in their account.

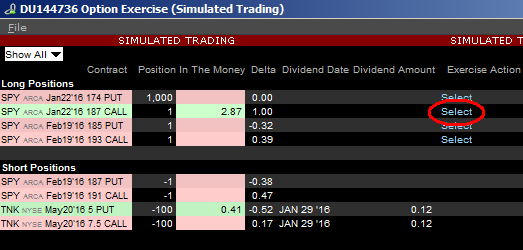

From Trader Workstation, go to the Trade menu and select Option Exercise.

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To exercise one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

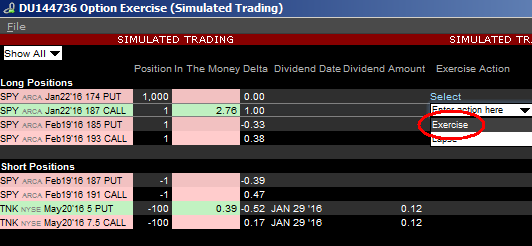

Select "Exercise" from the drop down menu.

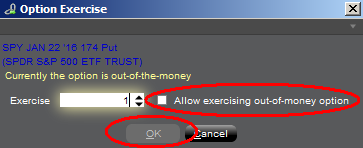

Your Exercise request will now show as an order line on your Trader Workstation until the clearinghouse processes the request. If the option is out-of-the-money, a warning message will appear. To submit the Exercise request, check the box to “Allow exercising out-of-money option” and click OK.

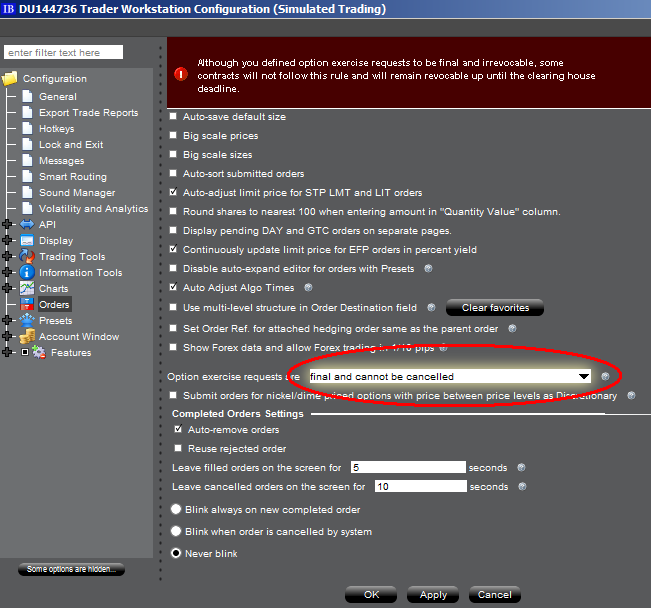

Please note, you have the option of selecting whether you would like your option exercise request to be final and unable to be cancelled, or editable until cutoff time (varies by clearing house). If you select "final and cannot be cancelled", some contracts will not follow this rule and will remain revocable up until the clearing house deadline. You can make this selection in Trader Workstation by going to Edit followed by Global Configuration and selecting Orders from the configuration tree on the left side.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Client Portal window. In the Client Portal window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Option Exercise Requests (whether received through the TWS Option Exercise window or by a ticket sent via Client Portal / Message Center) must be submitted as follows:

| For Equity Option Contracts Traded Upon: | IBKR must receive an Exercise Request by: | ||||||

| North America | US Options Exchanges | 17:25 EST | |||||

| Montreal Exchange | 16:30 EST | ||||||

| Europe | Euronext | 17h50 CET | |||||

| Eurex (German and Swiss) | 17h50 CET | ||||||

| IDEM | 17h50 CET | ||||||

| LIFFE | 17h50 CET | ||||||

| MEFF | 17h50 CET | ||||||

| Sweden | 17h50 CET | ||||||

| Asia Pacific | Australia | 16:25 Australia/NSW | |||||

| Japan | 15:30 JST | ||||||

| (Send a ticket and call Client Services) | |||||||

If I am assigned on the short leg of an option spread, will the long option leg be automatically exercised so as to offset the resulting stock position from the assignment?

The answer depends upon whether the assignment occurred at expiration or prior to expiration (i.e., an American Style option). At expiration, many clearinghouses employ an exercise by exception process intended to ease the operational overhead associated with the provision of exercise instructions by clearing members. In the case of US securities options, for example, the OCC will automatically exercise any equity or index option which is in-the-money by at least $0.01 unless contrary exercise instructions are provided by the client to the clearing member. Accordingly, if the long option has the same expiration date as the short and at expiration is in-the-money by a minimum of the stated exercise by exception threshold, the clearinghouse it will be automatically exercised, effectively offsetting the stock obligation on the assignment. Depending upon the option strike prices, this may result in a net cash debit or credit to the account.

If the assignment takes place prior to expiration neither IBKR nor the clearinghouse will act to exercise a long option held in the account as neither party can presume the intentions of the long option holder and the exercise of the long option prior to expiration is likely result in the forfeiture of time value which could be realized via the sale of the option.

Are there commissions associated with option exercise or assignment?

The answer depends upon the option type and its region of listing. There is no IBKR commission associated with an exercise or assignment of US stock and index security options and out-of-the-money non-US index options. A commission is charged for an exercise or assignment of an in-the-money non-US index option and for options on futures. Please refer to the Other Fees section of the IBKR website for details.

Why am I not informed of the assignment on my US securities option position until the following day?

The processing of exercise notices for American style options on days other than the expiration date is not performed on a real-time basis, but rather as part of a nightly batch process by the Options Clearing Corporation (OCC). The processing sequence, which by definition results in a notification lag of at least one day to the assigned client, is as follows:

- OCC generally allows its clearing members to submit exercise notices on behalf of the clients holding a long position electronically throughout the day, but generally no later than the start of their critical processing in the evening (Day E).

- As part of its evening position processing sequence, OCC randomly assigns the exercise notices it has received to the open interest of its clearing members. That information is then made available by OCC to its clearing members early in the morning on the following day (Day E+1).

- At the point in which that information has been made available, clearing firms such as IBKR have already completed their processing of that day’s trade activity in order to provide timely statements, margin and settlement information to their clients. Also, since OCC carries the client positions of its clearing members in an omnibus manner (i.e., they do not know the identity of the clients, only the clearing firm), the clearing member must, in turn, execute a random process to assign those exercise notices to clients holding a short position in that particular option series.

- Once IBKR receives notice of the assignment from OCC and completes its random assignment process, the assignments will be readily posted to the Trader Workstation of the impacted accounts and reflected on the Daily Activity Statement as of that day’s close (E+1).

In addition, due to this processing sequence and the fact that a long option may have remaining time value, IBKR cannot automatically provide an exercise notice to OCC for any long option spread against the assigned short option as a means of offsetting the ensuing delivery obligation.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.