“EMIR”:交易报告库报告义务和盈透证券的委托报告服务

如果我交易的产品是以我账户中没有的币种计价的会怎么样?

买卖给定的产品所需的特定币种是交易所决定的,不是IBKR决定的。例如,当您下单买入某种以您的账户中没有的币种计价的证券,假设您使用的是保证金账户且在满足了保证金要求后有多余的资产,则IBKR会借入该币种的资金。请注意,IBKR有义务以指定的计价币种和清算所结算该交易。如您不希望我们借入资金进而产生利息成本,则您需先向您的账户存入所需的币种及金额的资金,或通过IdealPro或各种零数(odd lot)交易场所将账户中的资金兑换为所需的币种及金额——对于超过25,000美元或等值的金额,通过IdealPro兑换;对于小于25,000美元或等值的金额,通过零数交易场所兑换,这两种渠道都可在TWS中找到。

需注意的还有,当您平仓了以特定币种计价的证券,所获资金将始终以该币种保留在您的账户中,不论该币种是否是您为账户选择的基础货币。相应地,这部分资金相对于您的基础货币将存在汇率风险,直至您完成换汇或用这些资金交易其它以该币种计价的产品。

关于使用止损单的更多信息

美股市场偶尔会发生极端波动和价格混乱。 有时这类情况持续时间很长,有时又很短。止损单可能会对价格施加下行压力、加剧市场波动,且可能使委托单在大幅偏离触发价格的位置上成交。

为什么活动报表的现金报告部分反映的是证券和商品之间的内部转账?

根据监管要求,IBKR须将您账户中的证券资产和商品资产分隔开来。 这些商品资产可能包含期货期权仓位的市场价值加上用作商品期货和期货期权仓位保证金的现金。 您商品仓位的保证金要求会定期重新计算,如果保证金降低,则多出来的现金便会从账户的商品分区转到证券分区。 同样,如果商品保证金要求提高,IBKR也会将资金从证券分区转到商品分区。 由于美国证券投资者保护公司(SIPC)的保险覆盖的是您账户证券分区(而非商品分区)的资产,这种定期转账也是为了确保您的现金能得到最大程度的保护。 请注意,这种现金移动表示的是您账户中的日记账分录,是用来互相抵消的,因此对账户的总现金余额并没有影响(参考活动报表现金报告的总计栏)。

SPAN保证金系统概述

“标准投资组合风险分析(SPAN)”是芝加哥商品交易所(CME)创建的一种计算保证金要求的方法。全球多家清算所和交易所都使用该方法来计算期货及期货期权的“履约保证”(即保证金要求)。清算所会从期货经纪商(FCM)处收取履约保证,期权经纪商则从其客户处收取。

SPAN会使用16种假设的市场情境来评估投资组合在给定期限内(通常设为一天)在最差的情况下可能遭受的损失,进而得出保证金金额。这16种假设情境会反映期货或期权合约底层价格的变动,对于期权,还会反映时间衰减和隐含波动率的变动。

计算SPAN要求的第一步是将所有底层产品相同的持仓合并为一个 “商品组合”。下一步,SPAN会计算和加总某一种情境下“商品组合”内每一个持仓的风险,并将理论损失最大的情境下的风险定义为“扫描风险”。16种情境是基于“商品组合”价格扫描范围(给定期限内底层产品的最大价格波动)和波动率扫描范围(期权最大隐含波动率变动)得出的。

假设一个投资组合由股票指数ABC的一张多头期货合约和一张多头看跌期权合约组成,底层价格为1000美元,乘数为100,价格扫描范围为6%。对于该给定的投资组合,“扫描风险”为情境14下的1125美元。

|

# |

1 张多头期货 |

1 张多头看跌期权 |

合计 |

情境描述 |

|

1 |

$0 |

$20 |

$20 |

价格不变;波动率在扫描范围内上升 |

|

2 |

$0 |

($18) |

($18) |

价格不变;波动率在扫描范围内下降 |

|

3 |

$2,000 |

($1,290) |

$710 |

价格上涨价格扫描范围的1/3;波动率在扫描范围内上升 |

|

4 |

$2,000 |

($1,155) |

$845 |

价格上涨价格扫描范围的1/3;波动率在扫描范围内下降 |

|

5 |

($2,000) |

$1,600 |

($400) |

价格下跌价格扫描范围的1/3;波动率在扫描范围内上升 |

|

6 |

($2,000) |

$1,375 |

($625) |

价格下跌价格扫描范围的1/3;波动率在扫描范围内下降 |

|

7 |

$4,000 |

($2,100) |

$1,900 |

价格上涨价格扫描范围的2/3;波动率在扫描范围内上升 |

|

8 |

$4,000 |

($2,330) |

$1,670 |

价格上涨价格扫描范围的2/3;波动率在扫描范围内下降 |

|

9 |

($4,000) |

$3,350 |

($650) |

价格下跌价格扫描范围的2/3;波动率在扫描范围内上升 |

|

10 |

($4,000) |

$3,100 |

($900) |

价格下跌价格扫描范围的2/3;波动率在扫描范围内下降 |

|

11 |

$6,000 |

($3,100) |

$2,900 |

价格上涨价格扫描范围的3/3;波动率在扫描范围内上升 Range |

|

12 |

$6,000 |

($3,375) |

$2,625 |

价格上涨价格扫描范围的3/3;波动率在扫描范围内下降 |

|

13 |

($6,000) |

$5,150 |

($850) |

价格下跌价格扫描范围的3/3;波动率在扫描范围内上升 |

|

14 |

($6,000) |

$4,875 |

($1,125) |

价格下跌价格扫描范围的3/3;波动率在扫描范围内下降 |

|

15 |

$5,760 |

($3,680) |

$2,080 |

极端价格上涨(价格扫描范围的3倍)* 32% |

|

16 |

($5,760) |

$5,400 |

($360) |

极端价格下跌(价格扫描范围的3倍)* 32% |

然后,用“扫描风险”加上同商品跨月价差风险值(衡量期货日历价差基础风险的值)和交割风险值(衡量可交割的持仓由于临近到期日而上升的风险),再减去跨商品价差折抵值(由于有相关性的产品互相分散了风险而降低的保证金要求)。 将该合计值与做空期权的最低保证金要求比较(做空期权的最低保证金要求能确保对包含深度价外期权的投资组合收取了最低的保证金),取两者中较大的值作为“商品组合”的风险。系统会用前述方法逐一计算所有“商品组合”的风险。投资组合的总保证金风险等于所有“商品组合”风险的总和减去由于不同“商品组合”间风险分散而折抵的保证金。

计算SPAN保证金要求的软件叫作“PC-SPAN”,可在芝商所的网站上找到。

如何计算期货和期货期权的保证金要求?

期货期权和期货的保证金是由交易所根据SPAN保证金计算方法确定的。有关SPAN保证金系统及其计算逻辑,请参见芝商所(CME)网站www.cmegroup.com。在芝商所网站搜索SPAN,您会看到很多包括其计算逻辑在内的相关信息。SPAN保证金系统是一个通过分析几乎所有市场情境下的假设情况来计算保证金要求的保证金计算系统。

SPAN的运行逻辑大致如下:

SPAN会通过计算由衍生品和实物产品所构成的投资组合在给定时间区间(通常为一个交易日)内的最坏情况损失来评估投资组合的整体风险。最坏情况损失通常是通过计算投资组合在不同市场行情下的盈亏情况来完成。该计算方法的核心是SPAN风险阵列,即一系列可显示某特定合约在不同行情下的盈亏情况的数据。每种行情算作一种风险情境。每种风险情境的数值代表该特定合约在对应价格(底层证券价格)变化、波动率变化和时间衰减的特定组合下会产生的盈亏。

交易所会以特定频率向IBKR发送SPAN保证金文件,接着,该等文件会被导入到SPAN保证金计算器当中。所有期货期权,除非已经过期或是平仓,否则始终都需要计算风险损失情况,哪怕处于价外也没有关系。所有情境都必须考虑极端市场波动情况下的变化,因此,只要仓位还在,该等期货期权的保证金影响就还要被纳入考量。 我们会将SPAN保证金要求与IBKR预定义的极端市场波动情境进行比较,取较大者作为保证金要求。

Margin Considerations for Intramarket Futures Spreads

Background

Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation.

Spread Margin Adjustment

This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:

- On the 3rd business day prior to close out, the initial and maintenance margin requirements will be equal to 10% of their respective requirements on each contract month as if there was no spread, plus 90% of the spread requirement;

- On the 2nd business day prior to close out, the initial and maintenance margin requirements will be equal to 20% of their respective requirements on each contract month as if there was no spread, plus 80% of the spread requirement;

- On the business day prior to close out, the initial and maintenance margin requirements will be equal to 30% of their respective requirements on each contract month as if there was no spread, plus 70% of the spread requirement.

Working Example

Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:

| XYZ | Front Month - 1 Short Contract (Uncovered) | Back Month - 1 Long Contract (Uncovered) | Spread - 1 Short Front Month vs. 1 Long Back Month |

| Initial Margin | $1,250 | $1,500 | $500 |

| Maintenance Margin | $1,000 | $1,200 | $400 |

Further assume a position consisting of 1 short front month contract and 1 long back month contract with the front month contract close out date = T. using this hypothetical example, the initial margin requirement over the 3 business day period preceding close out date is outlined in the table below:

| Day | Initial Margin Requirement | Calculation Details |

| T-4 | $500 | Unadjusted |

| T-3 | $725 | .1($1,250 + $1,500) + .9($500) |

| T-2 | $950 | .2($1,250 + $1,500) + .8($500) |

| T-1 | $1,175 | .3($1,250 + $1,500) + .7($500) |

| T | $1,175 | Positions not in compliance with close out requirements are subject to liquidation. |

How to Complete CFTC Form 40

Clients maintaining a U.S. futures or futures option position at a quantity exceeding the CFTC's reportable thresholds may be contacted directly by the CFTC file with a request that they complete a Form 40. Contact will generally be made via email and clients are encouraged to respond to such requests in a timely manner to avoid trading restrictions and/or fines imposed by CFTC upon their account at the FCM.

Completion of the Form requires the following steps:

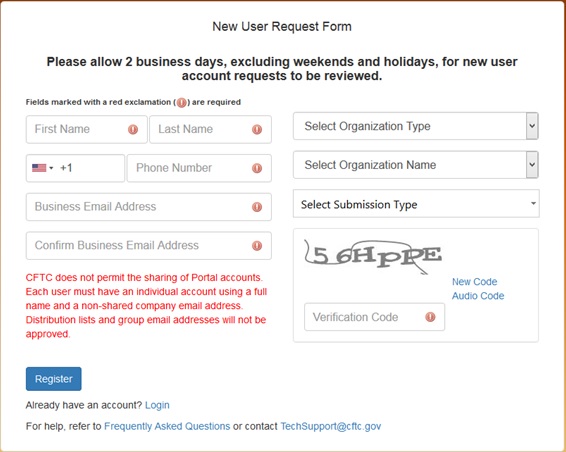

- Register for a CFTC Portal Account - performed online at: https://portal.cftc.gov/Account/Register.aspx Registration will require entry of the 9-digit code that the CFTC provided to you within the email requesting that you register. If you cannot locate your code or receive an invalid entry message, contact TechSupport@cftc.gov. When entering "Organization Type" from the drop-down selector, choose "LTR (Large Traders)".

2. Complete Form 40 - You will receive an email notification from the CFTC once your Portal Account has been approved. Note that this approval may take up to 2 business days from the date you complete the New User Request Form. The email will contain a link to the Portal where you will be prompted to log in: https://portal.cftc.gov/

Instructions for completing the form are available at: https://www.ecfr.gov/cgi-bin/text-idx?node=ap17.1.18_106.a

Note that Portal provides the opportunity to save a copy of your submission in XML format, a recommended step, as this allows for uploading the file to the Portal should you need to make modifications at a later date. This will eliminate the need to renter the form in its entirety.

The CFTC will send a confirmation email upon successful completion of your Form 40.

3. Confirm with IBKR - forward your confirmation email, or other evidence that you have submitted the Form 40 to cftc_form40_filing@interactivebrokers.com. This will assist to ensure that your account is not subject to CFTC directed restrictions or fines.

Overview of CFTC Form 40

The CFTC, the primary regulator of U.S. commodity futures markets and Futures Commission Merchants (FCMs), operates a comprehensive system of collecting information on market participants as part of its market surveillance and large trader reporting program.

IBKR, as a registered FCM providing clients with access to those markets, is obligated to report to the CFTC information on clients who hold a position in a quantity that exceeds defined thresholds (i.e., a "reportable position"). In order to report this information, IBKR requires clients trading U.S. futures or futures options to complete an online CFTC Ownership and Control Reporting form at the point the client requests futures trading permissions.

Once a client holds a "reportable position", the CFTC may then contact that client directly and require them to file more detailed information via CFTC Form 40. The information required of this report includes the following:

- Trader's name and address

- Principal business

- Form of ownership (e.g., individual, joint, partnership, corporation, trust, etc.)

- Whether the reporting trader is registered under the Commodity Exchange Act

- Whether the reporting trader controls trading for others

- Whether any other person controls the trading of the reportable trader

- Name and location of all firms through which the reportable trader carries accounts

- Name and location of other persons providing a trading guarantee or having a financial interest in account of 10% or greater

- Name of accounts not in the reporting trader's name in which the trader provides a guarantee or has a financial interest of 10% or more.

Clients who fail to complete this Form in a timely manner may be subject to trading restrictions and/or fines imposed by CFTC upon their account at the FCM. It is therefore imperative that clients immediately respond to these CFTC requests.

To complete the CFTC Form 40, clients must first register for a CFTC Portal Account, an online process which is subject to a review period of 2 business days from the point of initial registration to acknowledgement of approval by the CFTC. For information regarding this registration process and completing the Form 40, see KB3149.

IBKR发行的伦敦金属交易所(LME)场外期货 – 事实和常见问题

简介

IBKR LME场外期货使客户得以用合成的方式交易伦敦金属交易所的产品——伦敦金属交易所是一家端对端(peer to peer)的交易所,通常不对非成员投资者开放。

LME场外期货是以IB英国(IBUK)作为对手方的场外衍生品合约。LME场外期货在价格、交易单位、类型和合约参数方面均参照对应的LME期货,但该产品自身不是注册的合约。不允许实物交割。

IBKR LME场外期货需通过您的保证金账户交易,因此您既可提交多头头寸,也可提交带杠杆的空头头寸。保证金率与LME设置的比例相同。与其他期货一样,LME场外期货的保证金率基于风险(SPAN),因此比例可变。视合约不同,当前保证金率在6到9%之间。

合约

IBKR就以下金属提供以第三个星期三为到期日的场外期货:

| 金属 | IB代码 | 价格 美元/ | 倍数 |

| 高级原铝 | AH | 公吨 | 25 |

| A级铜 | CA | 公吨 | 25 |

| 初级镍 | NI | 公吨 | 6 |

| 标准铅 | PB | 公吨 | 25 |

| 锡 | SNLME | 公吨 | 5 |

| 特等锌 | ZSLME | 公吨 | 25 |

第三个星期三到期

LME提供一系列能满足实物交易者和对冲者需求的合约。其中比较主要的有每日发行的3个月远期期货,实物交易者通过此类期货可精确地满足对冲需求。

第三个星期三到期的合约是以月为单位的合约,也能很好地满足金融交易者的需求。正如其名称所表明的,此类合约在每月的第三个星期三到期,尽管在LME以实物交割,但在IBKR严格以现金交割。第三个星期三到期的合约越来越受欢迎,占LME未平仓合约的65%。

报价及市场数据

IBKR从LME(二级市场数据)获取实时报价,且不会扩大报价价差。每个客户定单会先在交易所被对冲,然后LME场外定单将以对冲时的价格成交。

现金流

IBKR LME场外期货的每日保证金波动及已实现盈亏每天以现金结算,与标准期货一样。相反,底层LME合约的现金流仅当合约到期后才结算。

保证金

IBKR LME场外期货的保证金要求与LME底层合约的保证金要求相同。LME使用标准投资组合风险分析法(SPAN)计算初始保证金。

与其它期货合约一样,保证金率对于每份合约均为一个绝对值,且通常每月更新一次。

交易许可

您需要在账户管理中设置“英国金属”的交易许可。

市场数据

您需要订阅伦敦金属交易所二级数据,目前定价为1.00英镑。

LME场外产品相关资源

常见问题

开始交易LME场外期货前需要做什么?

您需要在账户管理中设置“英国金属”的交易许可。如果您的账户在IB LLC开立,或是由IB LLC提供服务的IB UK账户,则我们将设置一个新的账户板块(即您当前的账户号码加上后缀“F”)。设置确认后您便可以开始交易了。您无需单独为F账户注资,资金会从您的主账户自动转入以满足保证金要求。

LME场外期货交易与头寸在报表中如何反映?

您的头寸持有在单独的账户板块中,该账户板块以您的主账户号码加上后缀“F”加以区分。您可以选择单独查看F板块的活动报表,也可以选择与主账户合并查看。您可在账户管理的报表窗口进行选择。

交易LME场外期货适用哪些账户保护条款?

LME场外期货以IB英国作为您的交易对方,不是在受监管的交易所进行交易,也不是在中央结算所进行结算。因IB英国是您交易的对手方,您会面临与IB英国交易相关的财务和商业风险,包括信用风险。但请注意,所有客户资金永远都是完全隔离的,包括对机构客户。IB英国是英国金融服务补偿计划(“FSCS”)参与者。IB英国不是美国证券投资者保护公司(“SIPC”)成员。

我能否通过电话交易LME场外期货? 不能。在极端情况下我们可能同意通过电话处理平仓定单,但绝不会通过电话处理开仓定单。