Perché le commissioni addebitate sulle opzioni statunitensi sono di tipo variabile?

L'addebito delle commissioni sulle opzioni previsto da IB si divide in due parti:

1. La commissione di esecuzione spettante a IB. Per quanto concerne gli ordini indirizzati tramite il sistema SmartRouting, la tariffa è fissata a 0.70 dollari per contratto, ridotta ad appena 0.15 dollari per contratto in caso di ordini eccedenti i 100,000 contratti in un dato mese (si prega di consultare il sito web per conoscere i costi degli ordini indirizzati direttamente, le tariffe ridotte per le opzioni a basso premio e le tariffe minime addebitabili sugli ordini); e

2. Le tariffe esterne (borsistiche, regolamentari e/o sulle transazioni).

Nel caso delle tariffe esterne, determinate Borse delle opzioni statunitensi mantengono una struttura tariffa/rimborso rispetto alla liquidità che, una volta aggregata alla commissione di esecuzione di IB e alle eventuali altre tariffe regolamentari e/o sulle transazioni, potrebbe comportare l'addebito di una commissione complessiva per contratto variabile in funzione dell'ordine. Ciò è imputabile alla parte del calcolo della Borsa, che dipende da una serie di fattori al di fuori del controllo di IB, inclusi gli attributi d'ordine del cliente e le quotazioni denaro-lettera prevalenti, e il cui risultato potrebbe essere un pagamento in favore del cliente anziché l'addebito di una tariffa.

Le Borse valori che operano secondo questo modello di tariffa/rimborso rispetto alla liquidità prevedono l'addebito di una tariffa per gli ordini di sottrazione della liquidità (cioè, ordini inviabili a mercato) e l'erogazione di un credito per gli ordini di immissione della liquidità (cioè, ordini limite non inviabili a mercato). Le tariffe possono variare a seconda della Borsa valori, del tipo di cliente (es. pubblico, intermediario, società, market-maker, professionale, ecc.) e del sottostante dell'opzione, dove i rimborsi (crediti) per i clienti pubblici sono generalmente compresi tra 0.10 e 0.42 dollari e le tariffe addebitabili ai clienti pubblici tra 0.15 e 0.50 dollari.

IB ha l'obbligo di indirizzare gli ordini di opzioni inviabili a mercato sulla Borsa valori che offre il miglior prezzo di esecuzione. Per determinare la specifica Borsa valori sulla quale indirizzare l'ordine, nel caso in cui il mercato interno sia condiviso da più Borse valori, il sistema SmartRouting terrà in considerazione le tariffe per la sottrazione della liquidità (es. l'ordine sarà indirizzato sulla Borsa valori che offre la tariffa minore o nessuna tariffa). Di conseguenza, il sistema SmartRouting indirizzerà l'ordine a mercato sulla Borsa valori che addebita la tariffa più elevata solamente se consentirà di superare il prezzo di mercato di almeno 0.01 dollari (il che, dato il moltiplicatore standard delle opzioni di 100, mostrerebbe un miglioramento del prezzo di 1.00 dollaro, valore superiore alla tariffa più elevata per la sottrazione di liquidità).

Per maggiori informazioni in merito al concetto di immissione/sottrazione di liquidità, compresi alcuni esempi, si prega di fare riferimento all'articolo KB201.

Priorità degli ordini di clienti professionali

Nel quarto trimestre del 2009 determinate Borse delle opzioni statunitensi (CBOE, ISE) hanno applicato disposizioni volte a contraddistinguere gli ordini provenienti da un gruppo di clienti pubblici ritenuti "professionali" (ovvero, soggetti o entità aventi accesso a informazioni e/o risorse tecnologiche che consentono loro di negoziare con le stesse modalità impiegate dagli operatori indipendenti) da quelli dei clienti retail. Secondo quanto previsto da tali disposizioni, tutti i conti dei clienti che non siano operatori indipendenti, e che in un determinato mese immettano una media giornaliera di oltre 390 ordini di opzioni quotate (eseguiti o meno) tra tutte le Borse delle opzioni a vantaggio del/i proprio/i conto/i, saranno classificati come "professionali". Dal momento dell'attuazione iniziale da parte del CBOE e dell'ISE, la maggior parte delle altre Borse delle opzioni statunitensi ha introdotto disposizioni analoghe per contraddistinguere gli ordini aventi provenienza "professionale".

Ai fini della priorità di esecuzione, gli ordini inviati a tali Borse delle opzioni a nome dei clienti ritenuti "professionali" saranno trattati alla stregua degli ordini degli operatori indipendenti; inoltre, saranno soggetti a una commissione di transazione per contratto compresa tra storni di ($0.65) e una tariffa di $1.12 (a seconda della categoria delle opzioni).

I broker sono tenuti a condurre una verifica trimestrale per identificare i clienti che eccedono la soglia dei 390 ordini in ciascun mese di tale trimestre e devono essere classificati come "professionali" per il trimestre successivo. Si prega di notare che, ai fini di tale disposizione, le singole componenti dello spread non sono considerate ordini singoli, bensì ciascun ordine di spread costituisce in sé un ordine unico. IB provvederà a informare i clienti coinvolti da tali disposizioni. Si ricorda, inoltre, che il sistema di indirizzamento SmartRouting di IB è progettato per tenere in considerazione tali nuove commissioni di Borsa al momento della scelta dell'indirizzamento.

Per maggiori dettagli, si prega di fare riferimento ai seguenti link:

Snapshot Market Data

BACKGROUND

IBKR offers eligible clients the option of receiving a real-time price quote for a single instrument on a request basis. This service, referred to as “Snapshot Quotes” differs from the traditional quote services which offer continuous streaming and updates of real-time prices. Snapshot Quotes are offered as a low-cost alternative to clients who do not trade regularly and require data from specific exchanges1 when submitting an order. Additional details regarding this quote service is provided below.

QUOTE COMPONENTS

The Snapshot quote includes the following data:

- Last price

- Last size

- Last exchange

- Current bid-ask

- Size for each of current bid-ask

- Exchange for each of current bid-ask

AVAILABLE SERVICES

| Service | Restrictions | Price per Quote Request (USD)2 |

|---|---|---|

| AMEX (Network B/CTA) | $0.01 | |

| ASX Total | No access to ASX24. Limited to Non-Professional subscribers |

$0.03 |

| Bolsa de Madrid | $0.03 | |

| Canadian Exchange Group (TSX/TSXV) | Limited to Non-Professional subscribers who are not clients of IB Canada | $0.03 |

| CBOT Real-Time | $0.03 | |

| CME Real-Time | $0.03 | |

| COMEX Real-Time | $0.03 | |

| Eurex Core | Limited to Non-Professional subscribers | $0.03 |

| Euronext Basic | Limited to Non-Professional subscribers Includes Euronext equities, indices, equity derivatives and index derivatives. |

$0.03 |

| German ETF's and Indices | Limited to Non-Professional subscribers | $0.03 |

| Hong Kong (HKFE) Derivatives | $0.03 | |

| Hong Kong Securities Exchange (Stocks, Warrants, Bonds) | $0.03 | |

| Johannesburg Stock Exchange | $0.03 | |

| Montreal Derivatives | Limited to Non-Professional subscribers | $0.03 |

| NASDAQ (Network C/UTP) | $0.01 | |

| Nordic Derivatives | $0.03 | |

| Nordic Equity | $0.03 | |

| NYMEX Real-Time | $0.03 | |

| NYSE (Network A/CTA) | $0.01 | |

| OPRA (US Options Exchanges) | $0.03 | |

| Shanghai Stock Exchange 5 Second Snapshot (via HKEx) | $0.03 | |

| Shenzhen Stock Exchange 3 Second Snapshot (via HKEx) | $0.03 | |

| SIX Swiss Exchange | Limited to Non-Professional subscribers | $0.03 |

| Spot Market Germany (Frankfurt/Xetra) | Limited to Non-Professional subscribers | $0.03 |

| STOXX Index Real-Time Data | Limited to Non-Professional subscribers | $0.03 |

| Toronto Stk Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| TSX Venture Exchange | Limited to Non-Professional subscribers who are clients of IB Canada | $0.03 |

| UK LSE (IOB) Equities | $0.03 | |

| UK LSE Equities | $0.03 |

1In accordance with regulatory requirements, IBKR no longer offers delayed quotation information on U.S. equities to Interactive Brokers LLC clients. All clients (IBKR Lite and Pro) have access to streaming real-time US equity quotes from Cboe One and IEX at no charge. Since this data does not include all markets, IB does not show this quote when entering parameters for an order in a US stock quote. IB customers are able to access a snapshot of real-time quote information for US stocks at the point of order entry.

2Cost is per snapshot quote request and will be assessed in the Base Currency equivalent, if not USD.

ELIGIBILITY

- Accounts must maintain the Market Data Subscription Minimum and Maintenance Equity Balance Requirements in order to qualify for Snapshot quotes.

- The Users must operate TWS Build 976.0 or higher to access Snapshot quote functionality.

PRICING DETAILS

- Clients will receive $1.00 of snapshot quotes free of charge each month. Free snaphots may be applied to either U.S. or non-U.S. quote requests and charges will be applied, without additional notice, once the free allocation has been exhausted. Clients may review their snapshot usage as of the close of each business day via the Client Portal.

- Quote fees are assessed on a lag basis, generally in the first week after the month in which Snapshot services were provided. Accounts which do not have sufficient cash or Equity With Loan Value to cover the monthly fee will be subject to position liquidations.

- The monthly fee for snapshots will be capped at the related streaming real-time monthly service price. At which time the streaming quotes will be provided at no additional cost for the remainder of the month. The switch to streaming quotes will take place at approximately 18:30 EST the following business day after reaching the snapshot threshold. At the close of the month, the streaming service will automatically terminate and the snapshot counter will reset. Each service is capped independently of the others and quote requests for one service cannot be counted towards the cap of another. See table below for sample details.

| Service | Price per Quote Request (USD) | Non-Pro Subscriber Cap (Requests/Total Cost)2 | Pro Subscriber Cap (Requests/Total Cost)3 |

|---|---|---|---|

| AMEX (Network B/CTA) | $0.01 | 150/$1.50 | 2,300/$23.00 |

| NASDAQ (Network C/UTP) | $0.01 | 150/$1.50 | 2,500/$25.00 |

| NYSE (Network A/CTA) | $0.01 | 150/$1.50 | 4,500/$45.00 |

Questionario relativo alla ricezione dei dati di mercato per sottoscrittori Non Professionali

Delucidazioni sulla compilazione del questionario per Non Professionali.

L'NYSE e la maggior parte delle Borse valori statunitensi richiedono ai fornitori la conferma dello status di ciascun cliente per la ricezione dei dati di mercato prima di poter permettere loro di ricevere tali dati. In futuro il questionario per Non Professionali verrà utilizzato per identificare e confermare lo status di tutti i sottoscrittori per la ricezione dei dati di mercato. Secondo i requisiti della Borsa valori, lo status predefinito per la ricezione dei dati di mercato sarà quello di Professionale, a meno che non venga confermato lo status di Non Professionale del cliente. Tale procedura serve a proteggere e mantenere il corretto status di tutti i nuovi sottoscrittori per la ricezione dei dati di mercato. Per una guida rapida in merito alla definizione di Non Professionale, si prega di fare riferimento all'articolo ibkb.interactivebrokers.com/article/2369.

È necessario rispondere a tutte le domande del questionario per essere classificati come Non Professionali. Le Borse valori richiedono la conferma della prova dello status di Non Professionale; di conseguenza, nel caso in cui il questionario per Non Professionali sia incompleto o poco chiaro, verrà assegnata la classificazione di Professionale fino alla conferma del proprio status corretto.

In caso di modifica dello status, si prega di contattare l'helpdesk.

Spiegazione delle domande:

1) Fini commerciali ed economici

a) Riceve informazioni finanziarie (compresi notizie e dati sui prezzi relativi a titoli, commodity e altri strumenti finanziari) per la sua, o qualsiasi altra, entità commerciale?

Spiegazione: la domanda chiede se attualmente si ricevono e utilizzano dati di mercato per l'utilizzo a nome di una società o altra organizzazione a prescindere dall'uso personale dei dati sul proprio conto.

b) Effettua trading su titoli, commodity o forex a beneficio di una società di capitali, società di persone, trust professionale, club d'investimento professionale o altra entità?

Spiegazione: la domanda chiede se attualmente si effettua trading esclusivamente per proprio conto o per conto di un'organizzazione (S.r.l., Ltd., LLC, GmbH, Soc., Co., LLP, Corp.)?

c) Ha siglato un accordo per (a) dividere i profitti della sua attività di trading o (b) ricevere compenso per la sua attività di trading?

Spiegazione: la domanda chiede se attualmente si riceve compenso per effettuare trading o si dividono i profitti derivanti dalla propria attività di trading con terzi (entità o persona fisica).

d) Riceve benefit quali, per esempio, spazi e attrezzature per l'ufficio, o altri tipi di vantaggi, in cambio della sua attività di trading o del suo lavoro in qualità di consulente finanziario per un'altra persona fisica, società o entità commerciale?

Spiegazione: la domanda chiede se attualmente si riceve una qualunque forma di compenso da parte di terzi per la propria attività di trading, non necessariamente sotto forma di pagamento in denaro.

2) Agire in veste di

a) Attualmente agisce in una qualunque veste di consulente o intermediario finanziario?

Spiegazione: la domanda chiede se attualmente si riceve compenso per la gestione di asset di terzi oppure per la consulenza offerta a terzi circa le modalità di gestione dei relativi asset.

b) È impegnato in veste di gestore di fondi per titoli, commodity o forex?

Spiegazione: la domanda chiede se attualmente si riceve compenso per la gestione di titoli, commodity o forex.

c) Sta utilizzando queste informazioni finanziarie in veste professionale o per la gestione degli attivi della/del sua/suo società/datore di lavoro?

Spiegazione: la domanda chiede se attualmente si stanno utilizzando in qualche modo dati a fini commerciali per la specifica gestione degli asset della propria società o del proprio datore di lavoro?

d) Utilizza il capitale di una qualunque altra persona fisica o entità nella conduzione della sua attività di trading?

Spiegazione: la domanda chiede se il proprio conto comprende asset di altre entità oltre ai propri.

3) Distribuzione, ripubblicazione o fornitura di dati a terzi

a) Distribuisce, ridistribuisce, pubblica, rende disponibili o fornisce, in qualunque modo, a terzi un qualunque tipo di informazioni finanziarie relative al servizio?

Spiegazione: la domanda chiede se si inviano dati dai noi ricevuti di qualunque tipo, genere o sorta a terzi.

4) Trader professionale qualificato di titoli/future

a) È attualmente registato o qualificato come trader professionale di titoli presso una qualunque agenzia di sicurezza, o presso un qualunque mercato dei contratti commodity o future, o come consulente di investimento presso una qualunque Borsa valori, autorità di regolamentazione, associazione professionale o ente professionale riconosciuto nazionale o statale? i, ii

SÌ☐ NO☐

i) Di seguito alcuni esempi di enti di regolamentazione:

- La Securities and Exchange Commission (SEC) degli Stati Uniti

- La Commodities Futures Trading Commission (CFTC) degli Stati Uniti

- La Financial Service Authority (FSA) del Regno Unito

- La Japanese Financial Service Agency (JFSA) del Giappone

ii) Di seguito alcuni esempi di organismi di autoregolamentazione:

- Il New York Stock Exchange (NYSE) degli Stati Uniti

- La Financial Industry Regulatory Authority (FINRA) degli Stati Uniti

- La VQF svizzera

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

Commissioni pass-through ADR

Si ricorda ai titolari dei conti in possesso di posizioni in Ricevute di deposito americane (ADR) che tali titoli sono soggetti a commissioni periodiche finalizzate al risarcimento delle banche agenti che forniscono i servizi di custodia per conto delle ADR. Di norma tali servizi comprendono l'inventario dei titoli non americani sottostanti le ADR e l'espletamento delle procedure di registrazione, conformità e conservazione documentale.

Storicamente le banche agenti erano unicamente in grado di riscuotere le commissioni di custodia sottraendole dai dividendi delle ADR. Tuttavia, siccome molte ADR non pagano i dividendi regolarmente, tali banche non sono state più in grado di ricuotere le relative commissioni. Di conseguenza, nel 2009 SEC ha autorizzato la Depository Trust Company (DTC) alla riscossione delle commissioni di custodia delle ADR che non pagavano i dividendi periodici per conto delle banche. La DTC riscuote tali commissioni tramite i propri broker partecipanti (per esempio IB) che detengono ADR per conto dei propri clienti. Tali commissioni sono definite pass-through (di passaggio) in quanto destinate a essere riscosse dai clienti tramite i propri broker di riferimento.

Qualora si detengano posizioni in ADR eroganti dividendi, tali commissioni verranno dedotte dal dividendo stesso, così come accadeva in passato. Nel caso, invece, in cui si detengano posizioni in ADR prive di dividendi, le commissioni pass-through verranno riscosse dal rendiconto mensile alla data di registrazione in cui è stato dichiarato. Così come avviene nel caso della riscossione dei dividendi in contanti, allo stesso modo IB procede alll'allocazione delle commissioni ADR previste tramite la sezione Incrementi e rendiconti. L'addebito delle commissioni è visibile nella sezione Versamenti e prelievi del rendiconto sotto la denominazione "Modifiche - altro" insieme al simbolo della rispettiva ADR cui la commissione è associata.

Se quello delle commissioni pass-through è di norma compreso tra gli 0.01 e gli 0.03 USD per titolo, gli altri importi potrebbero variare in base alle differenti ADR e, per maggiori informazioni, si consiglia di fare riferimento al proprio prospetto di riferimento. È possibile ricercare il prospetto online tramite lo strumento EDGAR Company Search di SEC.

Monitoraggio Commissione di esposizione mediante Finestra conto

La Finestra conto fornisce informazioni generali che permettono il monitoraggio del proprio conto in tempo reale. Tali informazioni comprendono i saldi principali quali, per esempio, l'ammontare del capitale proprio e della liquidità, la composizione del portafoglio e i saldi di margine per la verifica della conformità ai requisiti e del potere d'acquisto disponibile. Da questa schermata si ottengono anche informazioni relative all'ultima commissione di esposizione addebitata e una stima della commissione successiva sulla base delle posizioni esistenti.

È possibile aprire la Finestra conto mediante:

• la postazione TWS classica, cliccando sull'icona Conto o selezionando Finestra conto dalla voce Conto del menu (Figura 1)

Figura 1

.jpg)

• la postazione TWS Mosaic, cliccando sulla voce Conto del menu e poi selezionando Finestra conto (Figura 2)

Figura 2

.jpg)

Dopo l'apertura della schermata è necessario scorrere verso il basso fino alla voce Requisiti di margine e poi cliccare sul segno + nell'angolo in alto a destra per espandere la sezione. Le commissioni di esposizione, denominate rispettivamente "ultima" e "prossima attesa", sono ivi dettagliate per ogni categoria di prodotto cui si applicano (es. azioni, petrolio). Si prega di notare che il saldo indicato alla voce "ultima" rappresenta la commissione aggiornata all'ultima data in cui è stata addebitata (si ricorda che le commissioni sono computerizzate in base alle posizioni in essere alla data di chiusura e addebitate di lì a breve). Il saldo "prossimo atteso" rappresenta la commissione attesa alla data di chiusura in essere sulla base dell'attività della posizione rispetto al calcolo precedente (Figura 3).

Figura 3.jpg)

In caso di sezione nascosta è possibile modificare la visualizzazione predefinita facendo un segno di spunta nella casellina a fianco di un elemento affinché tale elemento sia sempre visualizzato.

Si veda l'articolo KB2275 per informazioni sull'utilizzo di Risk Navigator relative alla gestione e alla stima della Commissione di esposizione e il KB2276 per verificare la Commissione di esposizione attraverso la schermata Anteprima ordine.

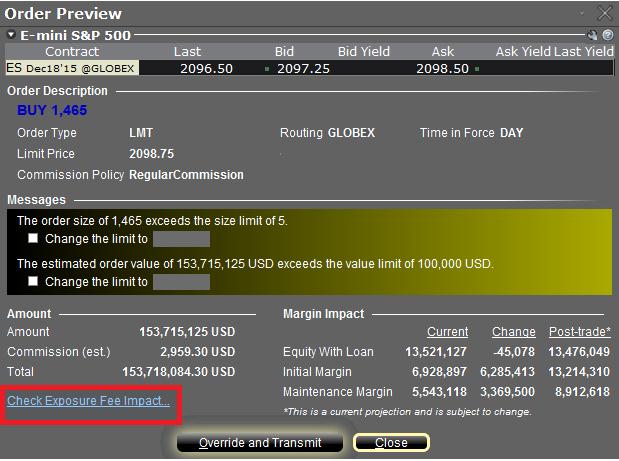

Anteprima ordine - Controllo impatto commissione di esposizione

IB permette ai titolari del conto di verificare l'eventuale impatto di un ordine sulla Commissione di esposizione attesa mediante una funzionalità pensata per un utilizzo prima dell'inoltro dell'ordine. Tale funzionalità fornisce un preavviso di commissione grazie al quale è possibile modificare l'ordine prima della sua trasmissione e diminuire o annullare la commissione stessa.

Per attivare questa funzionalità è necessario cliccare con il pulsante destro del mouse sulla riga dell'ordine, dopodiché si aprirà la finestra Anteprima ordine contenente un link denominato "Controllo impatto commissione di esposizione" (si veda il riquadro evidenziato in rosso nella Figura I qui di seguito).

Figura I

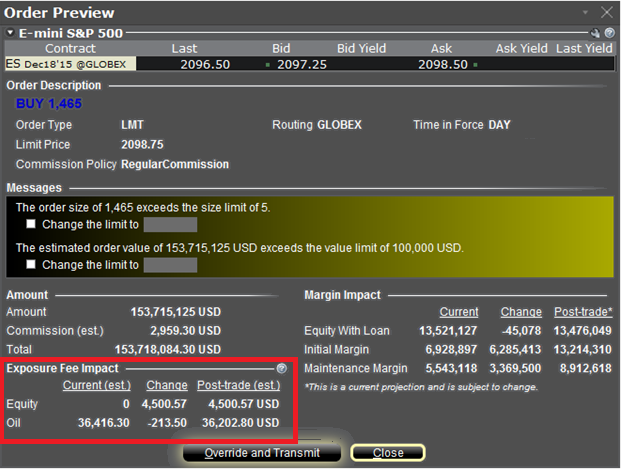

Cliccando sul link si aprirà una finestra raffigurante l'eventuale Commissione di esposizione associata alle posizioni esistenti, la variazione della commissione in caso di ordine processato e la commissione totale risultante una volta processato l'ordine (si veda il riquadro evidenziato in rosso nella Figura II qui di seguito). I saldi sono suddivisi ulteriormente per categoria di prodotto alla quale le commissioni si applicano (es. azioni, petrolio). I titolari del conto possono chiudere la finestra senza inoltrare l'ordine qualora ritengano l'impatto della commissione eccessivo.

Figura II

Si veda l'articolo KB2275 per informazioni sull'utilizzo di Risk Navigator relative alla gestione e alla stima della Commissione di esposizione e il KB2344 per il monitoraggio delle commissioni mediante la Finestra conto

Utilizzo di Risk Navigator per la stima delle commissioni di esposizione

Lo strumento Risk Navigator di IB prevede una funzionalità di scenario personalizzato per poter determinare l'eventuale effetto delle variazioni del proprio portafoglio sulla commissione di esposizione. Di seguito sono elencati i passaggi per creare un portafoglio “What–If”, o mediante variazioni ipotetiche a un portafoglio esistente o tramite un portafoglio completamente nuovo, e calcolarne la commissione. Si ricorda che questa funzionalità è disponibile tramite TWS 951 e versioni successive.

.jpg)

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

Si veda l'articolo KB2344 per informazioni sul monitoraggio della commissione di esposizione mediante la Finestra conto e il KB2276 per verificare la commissione di esposizione attraverso la schermata Anteprima ordine.

Exposure Fee Monitoring via Account Window

The Account Window provides the high-level information suitable for monitoring one's account on a real-time basis. This includes key balances such as total equity and cash, the portfolio composition and margin balances for determining compliance with requirements and available buying power. This window also includes information relating to the most recently assessed exposure fee and a projection of the next fee taking into consideration current positions.

To open the Account Window:

• From TWS classic workspace, click on the Account icon, or from the Account menu select Account Window (Exhibit 1)

Exhibit 1

.jpg)

• From TWS Mosaic workspace, click on Account from the menu, and then select Account Window (Exhibit 2)

Exhibit 2

.jpg)

After opening the window, scroll down to the Margin Requirements section and click on the + sign in the upper-right hand corner to expand the section. There, the "Last" and "Estimated Next" exposure fees will be detailed for each of the product classifications to which the fee applies (e.g., Equity, Oil). Note that the "Last" balance represents the fee as of the date last assessed (note that fees are computed based upon open positions held as of the close of business and assessed shortly thereafter). The "Estimated Next" balance represents the projected fee as of the current day's close taking into account position activity since the prior calculation (Exhibit 3).

Exhibit 3.jpg)

To set the default view when the section is collapsed, click on the checkbox alongside any line item and those line items will remain displayed at all times.

Please see KB2275 for information regarding the use of IB's Risk Navigator for managing and projecting the Exposure Fee and KB2276 for verifying exposure fee through the Order Preview screen.

Important Notes

1. The Estimated Next Exposure Fee is a projection based upon readily available information. As the fee calculation is based upon information (e.g., prices and implied volatility factors) available only after the close, the actual fee may differ from that of the projection.

2. Exposure Fee Monitoring via the Account window is only available for accounts that have been charged an exposure fee in the last 30 days