Warrant Tutorial

Introduction

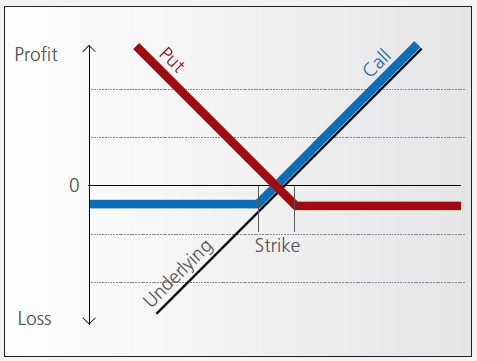

A warrant confers the right to buy (call-warrant) or sell (put-warrant) a specific quantity of a specific underlying instrument at a specific price over a specific period of time.

Pay-out Profile

With some warrants, the option right can only be exercised on the expiration date. These are referred to as “European-style” warrants. With “American-style” warrants, the option right can be exercised at any time prior to expiration. The vast majority of listed warrants are cash-exercised, meaning that you cannot exercise the warrant to obtain the underlying physical share. The exception to this rule is Switzerland, where physically settled warrants are widely available.

Factors that influence pricing

Not only do changes in the price of the underlying instrument influence the value of a warrant, a number of other factors are also involved. Of particular importance to investors in this regard are changes in volatility, i.e. the degree to which the price of the underlying instrument fluctuates. In addition, changes in interest rates and the anticipated dividend payments on the underlying instrument also play a role.

However, changes in implied volatility - as well as interest rates and dividends - only affect the time value of a warrant. The primary driver - intrinsic value - is solely determined by the difference between the price of the underlying instrument and the specified exercise price.

Historical and implied volatility

In addressing this topic, a differentiation has to be made between historical and implied volatility. Implied volatility reflects the volatility market participants expect to see in the financial instrument in the days and months ahead. If implied volatility for the underlying instrument increases, so does the price of the warrant.

This is because the probability of profiting from a warrant during a particular time-frame increases if the price of the underlying instrument is highly volatile. The warrant is therefore more valuable.

Conversely, if implied volatility decreases, that leads to a decline in the value of warrants and hence occasionally to nasty surprises for warrant investors who aren’t familiar with the concept and influence of volatility.

Interest rates and dividends

Issuers hedge themselves against price changes in the warrant through purchases and sales of the underlying instrument. Due to the leverage afforded by warrants, the issuer needs considerably more capital to hedge its exposure than you require to buy the warrants. The issuer’s interest expense associated with that capital is included in the price of the warrant. The amount of embedded interest reduces over time and at expiration is zero.

In the case of puts, the situation is exactly the opposite. Here, the issuer sells the underlying instrument

short to establish the necessary hedge, and in so doing receives capital that can earn interest. Thus interest reduces the price of the warrant by an amount that decreases over time.

As the issuer owns shares as a part of its hedging operations, it is entitled to receive the related dividend

payments. That additional income reduces the price of call warrants and increases the price for puts. But if the dividend expectations change, that will have an influence on the price of the warrants. Unanticipated special dividends on the underlying instrument can lead to a price decline in the related warrants.

Key valuation factors

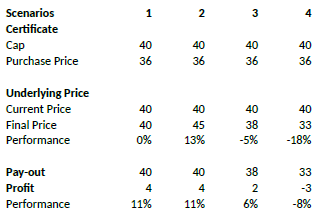

Let’s assume the following warrant:

Warrant Type: Call

Term to expiration: 2 years

Underlying : ABC Share

Share price: EUR 30.00

Strike: EUR 30.00

Exercise ratio: 0.1

Warrant’s price: EUR 0.30

Intrinsic value

Intrinsic value represents the amount you could receive if you exercised the warrant immediately and then bought (in the case of a call) or sold (put) the underlying instrument in the open market.

It’s very easy to calculate the intrinsic value of a warrant. In our example the intrinsic value is EUR 00.00

and is calculated as follows:

(price of underlying instrument – strike price) x exercise ratio

= (EUR 30.00 – EUR 30.00) x 0.1

= EUR 00.00

If the price of the ABC share increases by EUR 1, the intrinsic value becomes

= (EUR 31.00 – EUR 30.00) x 0.1

= EUR 00.10

The intrinsic value of a put warrant is calculated with this formula:

(strike price – price of underlying instrument) x exercise ratio

It’s important to note that the intrinsic value of a warrant can never be negative. By way of explanation:

if the price of the underlying instrument is at or below the exercise price, the intrinsic value of a call equals zero. In this instance, the price of the warrant consists only of “time value”. On the flipside, the intrinsic value of a put is equal to zero if the price of the underlying instrument is at or above the exercise price.

Time value

Once you’ve calculated the intrinsic value of a warrant, it’s also easy to figure out what the time value of that warrant is. You simply deduct the intrinsic value from the current market price of the warrant. In our example, the time value is equal to EUR 1.30 as you can see from the following calculation:

(warrant price – intrinsic value)

= (EUR 0.30 EUR – EUR 0.00)

= EUR 0.30

Time value gradually erodes during the term of a warrant and ultimately ends up at zero upon expiration. At that point, warrants with no intrinsic value expire worthless. Otherwise you can expect to receive payment of the intrinsic value. Take note, though: a warrant’s loss of time value accelerates during the final months of its term.

Premium

The premium indicates how much more expensive a purchase/sale of the underlying instrument would be via the purchase of a warrant and the immediate exercise of the option right as opposed to simply buying/selling the underlying instrument in the open market.

Hence the premium is a measure of how expensive a warrant actually is. It follows that, when given a choice between warrants with similar features, you should always buy the one with the lowest premium. By calculating the premium as an annualized percentage, warrants with different terms to expiry can be compared with each other.

The percentage premium for the call warrant in our example can be calculated as follows:

(strike price + warrant price / exercise ratio – share price) / share price * 100

= (EUR 30.00 + EUR 0.30 / 0.1 – EUR 30.00) / EUR 30.00 x 100

= 10 percent

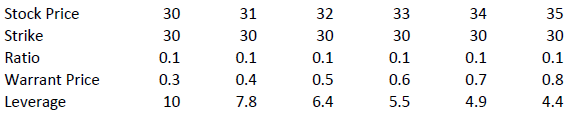

Leverage

The amount of leverage is the price of the share * ratio divided by the price of the warrant. In our example 30.00*0.1/0.3 = 10. So when the price of ABC increases by 1% the value of the warrant increases by 10%.

The amount of leverage is not constant however; it varies as intrinsic and time value changes, and is particularly sensitive to changes in intrinsic value. As a rule of thumb, the higher the intrinsic value of the warrant, the lower the leverage. For example (assuming constant time value):

Knock-out (Turbo) Tutorial

Introduction

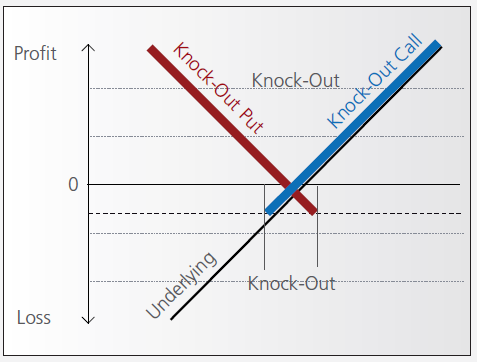

Knock-out warrants (turbos), like vanilla warrants, derive their value from the difference between the price of the underlying and the strike. They differ significantly however from vanilla warrants in many important respects:

- They can expire (knock-out) prematurely if the price of the underlying instrument touches or falls below (in the case of knock-out calls) or exceeds (in the case of knockout puts) a predetermined barrier-level. It expires worthless if the barrier equals the strike, or it may have a residual stop-loss value if the barrier is set higher than the strike (in the case of a call).

- Changes in implied volatility have little or no impact on knock-out products, therefore their pricing is easier for investors to comprehend than that of warrants.

- They have little or no time value (because of the presence of the knock-out barrier), and therefore have a higher degree of leverage than a warrant with the same strike. This is because the absence of time value makes the instrument “cheaper”.

Pay-out Profile

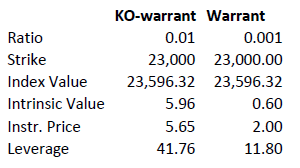

Leverage

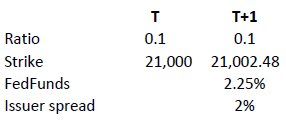

As discussed above, knock-out warrants exhibit high degrees of leverage, particularly as the price of the underlying nears the strike/barrier. Consider the following example of a long turbo on the Dow Jones Index, compared to a vanilla warrant:

Intrinsic value = (index value – strike) x ratio

Leverage = Index Value x Ratio / Instrument Price

A vanilla warrant retains significant time value even as the underlying price approaches the strike, sharply reducing its leverage compared to a knock-out warrant.

Product types

As discussed above, the barrier may either equal the strike, or be set above (calls) or below (puts). In the latter cases a small residual value remains after knock-out, corresponding to the difference between the barrier (the stop-loss level) and the strike.

Moreover, knock-out products may either have an expiration date or may be open-ended. This makes a difference in the way interest is accounted for. If the contract has an expiration date interest is included in the premium, the amount of which reduces over time and is zero on expiration. This is analogous to a standard vanilla warrant.

in relation to an expiration date. The price of the contract therefore corresponds exactly to its intrinsic value. Interest however must be accounted for. This is done by a daily adjustment of the barrier and strike. The following example shows the daily adjustment for a long open-end turbo on the Dow Jones Index:

The adjustment = Strike T x (1+ FedFunds/360 + Issuer Spread/360).

The intrinsic value of the instrument is correspondingly reduced as follows, assuming no change in the value of the DJ Index):

Intrinsic value = (index value – strike) x ratio

Discount Certificates Tutorial

Introduction

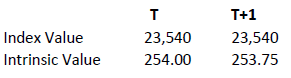

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

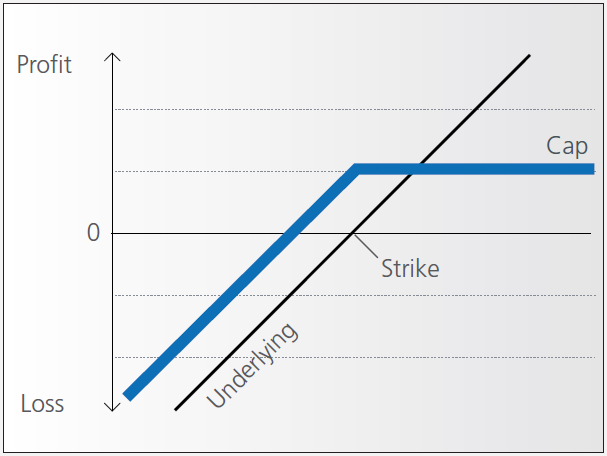

Example

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

Daily Leverage

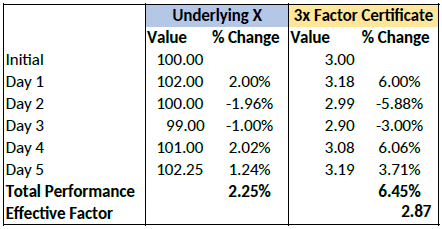

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

Intraday Reset

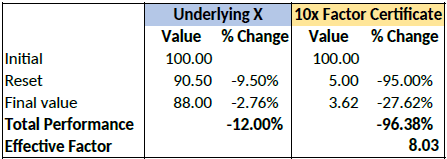

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows:

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

Añadir eliminar liquidez

El objetivo de este artículo es proporcionar un mejor entendimiento de tarifas de mercado, tarifas por adición/eliminación de liquidez, para una estructura de comisiones no agrupada.

El concepto de añadir o eliminar liquidez es aplicable tanto a acciones como a opciones sobre índices/acciones. El que una orden añada o elimine liquidez dependerá de que esa orden sea negociable o no negociable.

Las órdenes negociables ELIMINAN liquidez.

Las órdenes negociables son órdenes de mercado U órdenes limitadas de compra/venta cuyo límite esté por encima/debajo del mercado actual.

1. Para una orden negociable limitada de compra, el precio límite es igual o superior al ask.

2. Para una orden negociable limitada de venta, el precio límite es igual o inferior al bid.

Ejemplo:

El tamaño/precio actual del ASK (oferta) de XYZ es de 400 participaciones a 46.00. Usted introduce una orden limitada de compra de 100 acciones de XYZ a 46.01. La orden se considerará negociable porque se producirá una ejecución inmediata. Si hay un cargo del mercado por eliminar liquidez, dicha tarifa se le cargará al cliente.

Las órdenes no negociables son órdenes limitadas de compra/Venta en las que el precio límite está por debajo/encima del mercado actual.

1. Para una orden limitada de compra no negociable, el precio límite está por debajo del ask.

2. Para una orden limitada de venta no negociable, el precio límite está por encima del bid.

Ejemplo:

El tamaño/precio actual del ASK (oferta) de XYZ es de 400 participaciones a 46.00. Usted introduce una orden limitada de compra para 100 acciones de XYZ a 45.99. Esta orden se considerará no negociable, porque se registrará en el mercado como el mejor bid, en lugar de ejecutarse inmediatamente.

En caso de que alguien más envíe una orden de venta negociable que haga que su orden limitada de compra se ejecute, usted debería recibir un reembolso(crédito) si hay crédito disponible por añadir liquidez.

POR FAVOR, TENGA EN CUENTA:

1. Todas las cuentas que operen en opciones estarán sujetas a las tarifas o créditos por eliminar/añadir liquidez de los mercados de opciones.

2. Según la página web de IB, solo los números negativos bajo las estructuras de eliminar añadir liquidez son reembolsos (créditos).

http://interactivebrokers.com/es/index.php?f=3706

¿Por qué varían las comisiones de opciones estadounidenses?

El cargo de las comisiones de opciones de IB tiene dos partes:

1. La tarifa de ejecución que corresponde a IB. Para órdenes con enrutado smart, esta tarifa está establecida en $0.70 por contrato, y se puede reducir hasta $0.15 por contrato para órdenes en exceso de 100,000 contratos en un mes concreto (consulte la página web para costes de órdenes con enrutado directo, tasas reducidas para opciones con primas bajas y cargos mínimos de órdenes).

2. Tarifas de mercados terceros, normativas o de transacción.

En el caso de tarifas de terceros, ciertos mercados de opciones estadounidenses mantienen una estructura de reembolsos/tarifa de liquidez que, cuando se agrega a la tarifa de ejecución de IB y a otras tarifas normativas o de transacción podrían tener como resultado un cargo general de comisiones que varíe de una orden a otra. Esto es atribuible a la porción de mercado de los cálculos, cuyo resultado podría ser un pago al cliente, en lugar de una tarifa, y que depende de un número de factores fuera del control de IB, incluidos los atributos de órdenes del cliente y las cotizaciones de oferta-demanda predominantes.

Los mercados que operan bajo este modelo de reembolso/tarifa de liquidez cargan una tarifa para las órdenes que sirven para eliminar liquidez (es decir, órdenes negociables) y proporcionan un crédito para órdenes que añaden liquidez (es decir, órdenes limitadas que no son negociables). Las tarifas pueden varias según mercado, tipo de cliente (público, bróker-díler, empresa, creador de mercado, profesional) y subyacente de opción, con reembolsos de clientes públicos (créditos) que generalmente varían entre $0.10 - $0.42 y tarifas de clientes públicos que varían entre $0.15 - $0.50.

IB tiene la obligación de enrutar las órdenes de opciones negociables al mercado que proporcione el mejor precio de ejecución y el enrutado smart tiene en cuenta tarifas de eliminación de liquidez al determinar a qué mercado dirigir la orden cuando el mercado interior es compartido por múltiples (es decir, enrutará la orden al mercado con la tarifa más baja o sin tarifa). Por lo tanto, el enrutado smart solo enrutará una orden de mercado a un mercado que cargue una tarifa más elevada si puede mejorar el precio de mercado en, al menos, $0.01 (lo que, dado el multiplicador estándar de opciones de 100 tendría como resultado una mejora de precio de $1.00, que es superior a la mayor tarifa por eliminación de liquidez).

Si desea información adicional sobre el concepto de añadir/eliminar liquidez, con ejemplos incluidos, consulte el artículo KB201.

Risks of Volatility Products

Trading and investing in volatility-related Exchange-Traded Products (ETPs) is not appropriate for all investors and presents different risks than other types of products. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities (such as futures and swaps) and risks associated with the effects of leveraged investing in geared funds. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. We have summarized several risk factors (as identified in prospectuses for ETPs and in other sources) and included links so you can conduct further research. Please keep in mind that this is not a complete list of the risks associated with these products and investors are responsible for understanding and familiarizing themselves completely before entering into risk-taking activities. By providing this information, Interactive Brokers (IB) is not offering investment or trading advice regarding ETPs to any customer. Customers (and/or their independent financial advisors) must decide for themselves whether ETPs are an appropriate investment for their portfolios.

Prioridad de órdenes de clientes profesionales

En el cuarto trimestre de 2009, ciertos mercados de opciones estadounidenses (CBOE, ISE) implementaron normas que sirven para distinguir órdenes que se originen de un grupo de clientes públicos considerados "profesionales" (es decir, personas físicas o jurídicas que tengan acceso a información o tecnología que les permita operar como un bróker-díler), en contraste con minoristas. De acuerdo con estas reglas, cualquier cuenta de cliente que no sea de bróker- díler y que introduzca más de 390 órdenes de opciones cotizadas (tanto si se ejecutan como si no) en un promedio diario entre todos los mercados de opciones en un mes dado para beneficio de sus propias cuentas serán clasificadas como Profesional. Desde la implementación original por parte de CBOE y ISE, la mayoría de los mercados de opciones estadounidenses han implementado de forma similar normas para distinguir órdenes "profesionales" en su origen.

Las órdenes enviadas en nombre de clientes profesionales a estos mercados de opciones se tratarán de la misma forma que las órdenes de brókeres-díleres a efectos de prioridad de ejecución y estarán sujetas a una tarifa de transacción por contrato que podrá variar entre reducciones de ($0.65) hasta un cargo de $1.12 (dependiendo de la clase de opciones).

Los brókeres deben realizar una revisión de forma trimestral para identificar a aquellos clientes que hayan excedido el umbral de las 390 órdenes para cualquier mes de dicho trimestre y que deban ser considerados profesionales para el siguiente trimestre natural. Tenga en cuenta que, a efectos de esta norma, las órdenes de diferencial se consideran una sola orden, en lugar de considerar cada tramo del diferencial como una orden separada. Los clientes afectados por estas normas serán notificados por IB. Además, el enrutado Smart de IB está diseñado para tomar estas tarifas de mercado en consideración al realizar las decisiones de enrutado.

Para ver detalles adicionales, consulte los siguientes enlaces: