Option Levels 1-4

What are the levels of Option Trading Permissions?

IBKR introduced two new, lower levels of option trading permissions, Level 1 and 2, in order to be able to offer option trading to those who currently would not qualify for Limited or Full option trading permissions. Limited permissions are now referred to as Level 3, and Full permissions are considered Level 4.

Please note that clients of IB Canada and IB India are not eligible for option level permissions and remain with Limited or Full option trading permissions.

The type of option strategies available to trade will depend on the level of option permissions approved on the account. The various levels are as follows:

|

Level |

Option Strategies Allowed |

|

Level 1 |

Covered calls, i.e. short call vs long equal quantity of underlying, are allowed. |

|

Level 2 |

Covered Options Positions as defined by FINRA Rule 2360 are allowed with the additional restriction that the expiration date of the long option must be on or after the expiration date of the short option in a spread. |

|

Level 3 |

Option strategies that have limited maximum potential loss are allowed. |

|

Level 4 |

All option strategies are allowed. |

For examples of the types of option combinations allowed in each level, please see the following chart:

|

Strategy |

Level Requirement |

|

Covered Call/Covered Basket Call |

Level 1 |

|

Buy Write |

Level 1 |

|

Long option positions |

Level 2 |

|

Long Call |

Level 2 |

|

Long Put |

Level 2 |

|

Covered Put |

Level 2 |

|

Protective Call |

Level 2 |

|

Protective Put |

Level 2 |

|

Long Straddle |

Level 2 |

|

Long Strangle |

Level 2 |

|

Conversion |

Level 2 |

|

Long call spread |

Level 2 |

|

Long put spread |

Level 2 |

|

Long Iron Condor |

Level 2 |

|

Long Box Spread |

Level 2 |

|

Collar |

Level 2 |

|

Short Collar |

Level 2 |

|

Short Put |

Level 3 |

|

Synthetic |

Level 3 |

|

Reversal |

Level 3 |

|

Short Call Spread |

Level 3 |

|

Short Put Spread |

Level 3 |

|

Short Iron Condor |

Level 3 |

|

Long Butterfly |

Level 3 |

|

Unbalanced Butterfly |

Level 3 |

|

Short Butterfly |

Level 3 |

|

Calendar Spread - Debit |

Level 3 |

|

Diagnol Spread - Short leg expires first |

Level 3 |

|

Short Naked Call |

Level 4 |

|

Short Straddle |

Level 4 |

|

Short Strangle |

Level 4 |

|

Short Synthetic |

Level 4 |

|

Calendar Spread - Credit |

Level 4 |

|

Diagnol Spread - Long leg expires first |

Level 4 |

What account type is needed to trade options?

Option trading permissions are available for Margin, Cash and IRA/Retirement accounts.

A Margin account may request any level of option trading permissions (1-4). A Cash or IRA account may only request levels 1-3, and full payment is required for all call and put purchases.

Please Note

- Clients who maintain either a cash or margin type account must maintain net liquidating equity of at least USD 2,000 (or equivalent in other currencies) in order to establish or increase an existing uncovered options position.

How do I request or update my option trading permissions?

To update your trading permissions for options:

1. Log in to Client Portal

2. Select the User menu (head and shoulders icon in the top right corner) followed by Settings

3. Under Account Settings find the Trading section

4. Click on Trading Permissions

5. Locate Options section, select Add/Edit or Request under Options, select the level of permissions you want to request and click on CONTINUE.

6. Review and sign the disclosures and agreements.

7. Click CONTINUE and follow the prompts on screen.

Trading permission requests may take 24-48 hours to be reviewed. Find more information on trading permissions in the Client Portal Users' Guide.

Please Note

- When only Options permissions are available for a country the permissions will include both Stock and Index Options.

- US legal residents are generally excluded from trading securities options outside of the United States due to SEC restrictions. Securities options are defined as any option on an individual stock, US legal stock, or any cash settled broad based index future.

- Certain option contracts require an additional permission for "Complex or Leveraged Exchange Traded Products".

Is it possible for someone under the age of 21 to trade options?

All clients are eligible for Level 1 options trading permissions. However, IBKR requires that clients be at least 21 years of age to be eligible for level 2-4 option trading.

What are the requirements to qualify for option trading permissions?

IBKR offers various levels of trading permissions to applicants meeting minimum age, liquid net worth, investment objectives, product knowledge and prior experience qualifications. This information is gathered in the account application phase or in Client Portal if a trading permissions upgrade is requested following initial account approval.

If you need to update or review your financial information, investment objectives or experience use the button above or follow this procedure:

1. Log into Client Portal

2. Go to the User menu (head and shoulders icon in the top right corner) followed by Settings

3. Under Account Settings find the Account Profile section

4. Click on Financial Profile, rectify your information and confirm.

¿Qué fórmulas se utilizan para calcular el margen de opciones?

Existe una amplia variedad de fórmulas para calcular el requisito de margen de opciones. La fórmula que se utilice dependerá del tipo de opción o de la estrategia determinada por el sistema. Hay un número considerable de fórmulas detalladas que se aplican a varias estrategias. Para obtener información al respecto, visite la página de inicio de IBKR en el siguiente enlace: www.interactivebrokers.co.uk/es/home.php. Vaya al menú Negociación y haga clic en Margen. Desde la página Requisitos de margen, haga clic en la pestaña Opciones. Esta página muestra una tabla con un listado de todas las estrategias posibles y las diferentes fórmulas utilizadas para calcular el margen en cada una de ellas.

La información anterior se aplica a las opciones sobre acciones y las opciones sobre índices. Las opciones sobre futuros emplean un método totalmente diferente conocido como margen SPAN. Para obtener información sobre el margen SPAN, realice una búsqueda en esta página para los términos “SPAN” o "margen de opciones sobre futuros".

VR(T) time decay and term adjusted Vega columns in Risk Navigator (SM)

Background

Risk Navigator (SM) has two Adjusted Vega columns that you can add to your report pages via menu Metrics → Position Risk...: "Adjusted Vega" and "Vega x T-1/2". A common question is what is our in-house time function that is used in the Adjusted Vega column and what is the aim of these columns. VR(T) is also generally used in our Stress Test or in the Risk Navigator custom scenario calculation of volatility index options (i.e VIX).

Abstract

Implied volatilities of two different options on the same underlying can change independently of each other. Most of the time the changes will have the same sign but not necessarily the same magnitude. In order to realistically aggregate volatility risk across multiple options into a single number, we need an assumption about relationship between implied volatility changes. In Risk Navigator, we always assume that within a single maturity, all implied volatility changes have the same sign and magnitude (i.e. a parallel shift of volatility curve). Across expiration dates, however, it is empirically known that short term volatility exhibits a higher variability than long term volatility, so the parallel shift is a poor assumption. This document outlines our approach based on volatility returns function (VR(T)). We also describe an alternative method developed to accommodate different requests.

VR(T) time decay

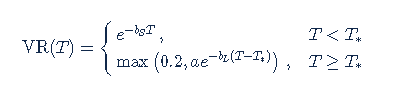

We applied the principal component analysis to study daily percentage changes of volatility as a function of time to maturity. In that study we found that the primary eigen-mode explains approximately 90% of the variance of the system (with second and third components explaining most of the remaining variance being the slope change and twist). The largest amplitude of change for the primary eigenvector occurs at very short maturities, and the amplitude monotonically decreases as time to expiration increase. The following graph shows the main eigenvector as a function of time (measured in calendar days). To smooth the numerically obtained curve, we parameterize it as a piecewise exponential function.

Functional Form: Amplitude vs. Calendar Days

To prevent the parametric function from becoming vanishingly small at long maturities, we apply a floor to the longer term exponential so the final implementation of this function is:

where bS=0.0180611, a=0.365678, bL=0.00482976, and T*=55.7 are obtained by fitting the main eigenvector to the parametric formula.

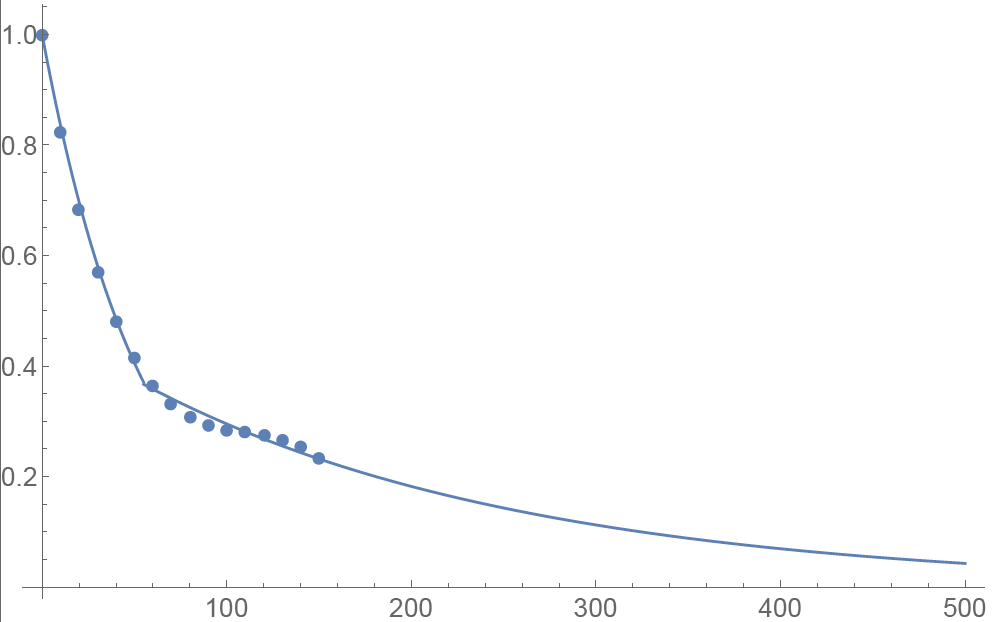

Inverse square root time decay

Another common approach to standardize volatility moves across maturities uses the factor 1/√T. As shown in the graph below, our house VR(T) function has a bigger volatility changes than this simplified model.

Time function comparison: Amplitude vs. Calendar Days

Adjusted Vega columns

Risk Navigator (SM) reports a computed Vega for each position; by convention, this is the p/l change per 1% increase in the volatility used for pricing. Aggregating these Vega values thus provides the portfolio p/l change for a 1% across-the-board increase in all volatilities – a parallel shift of volatility.

However, as described above a change in market volatilities might not take the form of a parallel shift. Empirically, we observe that the implied volatility of short-dated options tends to fluctuate more than that of longer-dated options. This differing sensitivity is similar to the "beta" parameter of the Capital Asset Pricing Model. We refer to this effect as term structure of volatility response.

By multiplying the Vega of an option position with an expiry-dependent quantity, we can compute a term-adjusted Vega intended to allow more accurate comparison of volatility exposures across expiries. Naturally the hoped-for increase in accuracy can only come about if the adjustment we choose turns out to accurately model the change in market implied volatility.

We offer two parametrized functions of expiry which can be used to compute this Vega adjustment to better represent the volatility sensitivity characteristics of the options as a function of time to maturity. Note that these are also referred as 'time weighted' or 'normalized' Vega.

Adjusted Vega

A column titled "Vega Adjusted" multiplies the Vega by our in-house VR(T) term structure function. This is available any option that is not a derivative of a Volatility Product ETP. Examples are SPX, IBM, VIX but not VXX.

Vega x T-1/2

A column for the same set of products as above titled "Vega x T-1/2" multiplies the Vega by the inverse square root of T (i.e. 1/√T) where T is the number of calendar days to expiry.

Aggregations

Cross over underlying aggregations are calculated in the usual fashion given the new values. Based on the selected Vega aggregation method we support None, Straight Add (SA) and Same Percentage Move (SPM). In SPM mode we summarize individual Vega values multiplied by implied volatility. All aggregation methods convert the values into the base currency of the portfolio.

Custom scenario calculation of volatility index options

Implied Volatility Indices are indexes that are computed real-time basis throughout each trading day just as a regular equity index, but they are measuring volatility and not price. Among the most important ones is CBOE's Marker Volatility Index (VIX). It measures the market's expectation of 30-day volatility implied by S&P 500 Index (SPX) option prices. The calculation estimates expected volatility by averaging the weighted prices of SPX puts and calls over a wide range of strike prices.

The pricing for volatility index options have some differences from the pricing for equity and stock index options. The underlying for such options is the expected, or forward, value of the index at expiration, rather than the current, or "spot" index value. Volatility index option prices should reflect the forward value of the volatility index (which is typically not as volatile as the spot index). Forward prices of option volatility exhibit a "term structure", meaning that the prices of options expiring on different dates may imply different, albeit related, volatility estimates.

For volatility index options like VIX the custom scenario editor of Risk Navigator offers custom adjustment of the VIX spot price and it estimates the scenario forward prices based on the current forward and VR(T) adjusted shock of the scenario adjusted index on the following way.

- Let S0 be the current spot index price, and

- S1 be the adjusted scenario index price.

- If F0 is the current real time forward price for the given option expiry, then

- F1 scenario forward price is F1 = F0 + (S1 - S0) x VR(T), where T is the number of calendar days to expiry.

¿Dónde puedo recibir información adicional sobre opciones?

La Options Clearing Corporation (OCC), la cámara de compensación para todas las opciones sobre acciones cotizadas en bolsa en EE. UU., opera un centro de atención telefónica para cumplir con las necesidades de formación de los inversores individuales y los brókeres de valores minoristas. Este recurso responderá a las siguientes cuestiones y asuntos relacionados con los productos de opciones compensados por la OCC:

- Información del Options Industry Council sobre seminarios, vídeos y material educativo;

- Preguntas básicas relacionadas con opciones, como la definición de términos e información sobre productos;

- La respuesta a preguntas estratégicas y operativas, las cuales incluyen posiciones y estrategias de negociación específicas.

Puede comunicarse al centro de atención telefónica a través del 1-800-OPTIONS (solo para EE. UU.). El horario de negociación es de lunes a jueves de 8:00 a 17:00 h y viernes de 8:00 a 16:00 h (hora estándar del centro, CST). El horario para el vencimiento mensual de los viernes se extenderá hasta las 17:00 h (hora estándar del centro, CST).

Complex Position Size

For complex, multi-leg options positions comprising two or more legs, TWS might not track all changes to this position, e.g. a vertical spread where the short leg is assigned and the user re-writes the same leg the next day, or if the user creates a the position over multiple trades, or if the order is not filled as a native combination at the exchange.

Resultados

Las compañías cotizadas en Norteamérica están, normalmente, obligadas a publicar sus resultados de forma trimestral. Estos anuncios, los cuales contienen varias estadísticas relevantes, incluidos ingresos, datos de margen y, a menudo, proyecciones de la rentabilidad futura de la empresa, tienen el potencial de causar movimientos significativos en el precio de mercado de las acciones de la empresa. Desde el punto de vista de la negociación en opciones, cualquier elemento con el potencial de causar volatilidad en las acciones afecta al precio de sus opciones. Las publicaciones sobre resultados no son una excepción.

Los operadores en opciones a menudo intentan anticipar la reacción del mercado a las novedades de los resultados. Saben que las volatilidades implícitas, la clave para los precios de las opciones, subirán de forma estable al tiempo que la distorsión - la diferencia en volatilidad implícita entre las opciones en dinero y fuera de dinero - se agudizarán de forma estable al acercarse la fecha de los resultados. El grado en el que estos ajustes se producen está basado, frecuentemente, en hechos históricos. Las acciones que han hecho movimientos significativos tras el anuncio de resultados a menudo tienen opciones más caras.

El riesgo de los resultados es idosincrático, es decir, que afecta normalmente a acciones específicas y que no pueden cubrirse fácilmente frente a un índice o una compañía similar. Las acciones que están bien correlacionadas pueden reaccionar de diferente forma, lo que lleva a precios de acciones que divergen o a índices con movimientos disminuidos. Por estos motivos, no hay una única estrategia para operar con opciones en estas situaciones. Los operadores deben tener expectativas muy claras sobre el movimiento potencial de una acción y, después, decidir que combinación de opciones proporcionará los resultados más beneficiosos si el operador tenía razón.

Si el mercado parece demasiado optimista sobre las posibilidades de los resultados, es bastante sencillo (aunque a veces costoso) comprar un cono o un put fuera de dinero y esperar un gran movimiento. Disfrutar de la ventaja de la posibilidad opuesta, cuando la volatilidad implícita del mes parece muy elevada, también puede ser rentable, pero puede causar grandes pérdidas tener opciones cortas frente a un gran movimiento ascendente de las acciones. Los operadores pueden aprovecharse de una gran volatilidad del mes al comprar un diferencial temporal; vender un put de mes próximo y comprar el mismo ejercicio al mes siguiente. El potencial de beneficio máximo se alcanza si la acción cotiza al precio de ejercicio, con la opción del mes próximo decayendo más rápidamente que la opción más cara a largo plazo. Las pérdidas se limitan al precio de negociación inicial.

En ocasiones, el exceso de miedo se expresa con una desviación extremadamente aguda, cuando los puts fuera de dinero muestran volatilidades cada vez más altas que las opciones en dinero. Los operadores que utilizan diferenciales verticales pueden capitalizar este fenómeno. Los que sean bajistas pueden comprar el put en dinero, al tiempo que venden un put fuera de dinero. Esto permite al comprador sufragar algunos de los costes de una opción de alto precio, aunque limita los beneficios de la operación si las acciones bajan por debajo del precio de ejercicio más bajo. Por otro lado, aquellos que consideren que el mercado es demasiado bajista pueden vender un put fuera de dinero al tiempo que compran un put con un precio de ejercicio incluso más bajo. Aunque el operador esté comprando la opción con una volatilidad más alta, le permite hacer dinero siempre que la acción permanezca por encima del precio de ejercicio más alto, al tiempo que limita sus pérdidas en la diferencia entre los dos ejercicios.

Este artículo se proporciona como información únicamente y no es una recomendación de comprar o vender valores. La negociación de opciones puede conllevar un riesgo significativo. Antes de operar en opciones, lea las "Características y riesgos de las opciones estandarizadas." Los clientes son los únicos responsables de sus propias decisiones de negociación.

Consideraciones para ejercitar opciones call antes del vencimiento

INTRODUCCIÓN

El ejercicio de una opción call antes del vencimiento no proporciona, normalmente, un beneficio económico, ya que:

- Tiene como resultado la pérdida de cualquier valor temporal de la opción que quede;

- Requiere una mayor inversión de capital para el pago o financiación de la entrega de acciones; y

- Puede exponer al titular de la opción a un mayor riesgo de pérdida sobre la acción en relación con la prima de la opción.

Aún así, para titulares de cuenta que tengan la capacidad de cumplir los requisitos de préstamo o de aumento de capital y de hacer frente a un riesgo potencialmente mayor de caída del mercado, puede ser económicamente beneficioso solicitar un ejercicio temprano de una opción call de tipo americano para capturar un próximo dividendo.

TRASFONDO

Como trasfondo, el titular de una opción call no tiene derecho a recibir un dividendo de la acción subyacente ya que este dividendo solo se devenga para los titulares de acciones en la fecha de cierre de registro de su dividendo. En igualdad de condiciones, el precio de la acción debería decaer en una cantidad igual al dividendo en la fecha ExDividendo. Aunque la teoría del precio de opciones sugiere que el precio call reflejará el valor descontado de los dividendos esperados pagados durante su duración, es posible que decline en la fecha exdividendo. Las condiciones que convierten este escenario en más probable y que hacen más favorable la decisión de un ejercicio temprano son las siguientes:

1. La opción está muy en dinero y tiene una delta de 100;

2. La opción no tiene valor temporal o tiene muy poco;

3. El dividendo es relativamente elevado y su fecha ex precede a la fecha de vencimiento de la opción.

EJEMPLOS

Para ilustrar el impacto de estas condiciones sobre una decisión de ejercicio temprano, consideremos una cuenta que mantenga un saldo en efectivo largo de 9,000 USD y una posición de call larga en un valor hipotético “ABC”, con un precio de ejecución de 90.00 USD y un tiempo hasta vencimiento de 10 días. ABC, que actualmente opera a 100.00 USD, ha declarado un dividendo de 2.00 USD por acción, siendo mañana la fecha exdividendo. También asumiremos que el precio de opción y el precio de acción se comportan de forma similar y declinan según la cantidad de dividendo en la fecha ex.

Aquí, revisaremos la decisión de ejercicio con la intención de mantener la posición de delta de 100 y maximizar la liquidez total mediante dos asunciones de precio de opción; una en la que la opción se vende a la par y otra sobre la par.

ESCENARIO 1: precio de opción a la par - 10.00 USD

En el caso de una opción que opere a la par, el ejercicio temprano servirá para mantener la delta de la posición y evitar la pérdida de valor en la opción larga cuando la acción opere exdividendo. Aquí, el producto en efectivo se aplica en su totalidad a la compra de la acción al precio de ejercicio, la prima de la opción se pierde y la acción, neta de dividendo, y el dividendo pendiente de pago se acreditan en la cuenta. Si busca el mismo resultado al vender la opción antes de la fecha ex dividendo y comprar la acción, recuerde que debe factorizar las comisiones/diferenciales:

| ESCENARIO 1 | ||||

|

Componentes de cuenta |

Saldo inicial |

Ejercicio temprano |

No actuar |

Vender opción y comprar acción |

| Efectivo | $9,000 | $0 | $9,000 | $0 |

| Opción | $1,000 | $0 | $800 | $0 |

| Acción | $0 | $9,800 | $0 | $9,800 |

| Dividendo por cobrar | $0 | $200 | $0 | $200 |

| Liquidez total | $10,000 | $10,000 | $9,800 | $10,000 menos comisiones/diferenciales |

ESCENARIO 2: precio de opción sobre la par - 11.00 USD

En el caso de una opción que opere sobre la par, el ejercicio temprano para capturar el dividendo podría no ser económicamente beneficioso. En este escenario, el ejercicio temprano tendría como resultado una pérdida de 100 USD en valor temporal de la acción, mientras que la venta de la opción y la compra de la acción, después de pagar comisiones, podría ser menos beneficiosa que no realizar ninguna acción. En este escenario, la acción preferible habría sido No actuar.

| ESCENARIO 2 | ||||

|

Componentes de cuenta |

Saldo inicial |

Ejercicio temprano |

No actuar |

Vender opción y comprar acción |

| Efectivo | $9,000 | $0 | $9,000 | $100 |

| Opción | $1,100 | $0 | $1,100 | $0 |

| Acción | $0 | $9,800 | $0 | $9,800 |

| Dividendo pendiente de pago | $0 | $200 | $0 | $200 |

| Liquidez total | $10,100 | $10,000 | $10,100 | $10,100 menos comisiones/diferenciales |

![]() NOTA: los titulares de cuenta que mantengan una posición call larga como parte de un diferencial deberían prestar particular atención al riesgo de no ejercitar el tramo largo dada la posibilidad de que se asigne en el tramo corto. Hay que tener en cuenta que la asignación de una opción call corta tiene como resultado una posición corta en acciones y los titulares de posiciones cortas en acciones en la fecha de registro del dividendo están obligados a pagar el dividendo al prestador de las acciones. Además, el ciclo de procesamiento de la cámara de contratación para notificaciones de ejercicio no acepta entregas de notificaciones de ejercicio como respuesta a la asignación.

NOTA: los titulares de cuenta que mantengan una posición call larga como parte de un diferencial deberían prestar particular atención al riesgo de no ejercitar el tramo largo dada la posibilidad de que se asigne en el tramo corto. Hay que tener en cuenta que la asignación de una opción call corta tiene como resultado una posición corta en acciones y los titulares de posiciones cortas en acciones en la fecha de registro del dividendo están obligados a pagar el dividendo al prestador de las acciones. Además, el ciclo de procesamiento de la cámara de contratación para notificaciones de ejercicio no acepta entregas de notificaciones de ejercicio como respuesta a la asignación.

Como ejemplo, consideremos un diferencial de opción call de crédito (bajista) para SPDR S&P 500 ETF Trust (SPY) que consista en 100 contratos cortos al precio de ejercicio de 146 USD en marzo de 2013 y 100 contratos largos al precio de ejercicio de 147 USD en marzo de 2013. El 14 de marzo de 2013, el SPY Trust declaró un dividendo de 0.69372 USD por acción, pagadero el 30 de abril de 2013 a los accionistas registrados a fecha del 19 de marzo de 2013. Dado el periodo de tres días hábiles para la liquidación para acciones estadounidenses, habría que haber comprado la acción el 14 de marzo de 2013 a más tardar, para recibir el dividendo, ya que al día siguiente la acción empezó a operar exdividendo.

El 14 de marzo de 2013, con un día de negociación previo al vencimiento, los dos contratos de opciones operaron a la par, lo que sugiere el riesgo máximo de 100 USD por contrato o 10,000 USD en la posición de100 contratos. Sin embargo, el no ejercitar el contrato largo para capturar el dividendo y protegerse frente a la probable asignación de los contratos cortos por parte de aquellos que buscaran el dividendo creó un riesgo adicional de 67.372 USD por contrato o 6,737.20 USD en la posición que represente la obligación de dividendo una vez asignadas todas las call cortas. Como se ve en la tabla siguiente, si el tramo de la opción corta no se hubiera asignado, el riesgo máximo cuando se determinaron los precios de liquidación del contrato final el 15 de marzo de 2013 habría permanecido en 100 USD por contrato.

| Fecha | Cierre SPY | Marzo '13, $146 Call | Marzo '13, $147 Call |

| 14 de marzo, 2013 | $156.73 | $10.73 | $9.83 |

| 15 de marzo, 2013 | $155.83 | $9.73 | $8.83 |

Por favor, tenga en cuenta que si su cuenta está sujeta a requisitos de retenciones fiscales bajo la norma 871(m) del Tesoro estadounidense, podría ser beneficioso cerrar una posición larga en opciones antes de la fecha exdividendo y reabrir la posición después de la fecha exdividendo.

Para más información sobre cómo enviar una notificación de ejercicio temprano, por favor haga clic aquí.

El artículo anterior se proporciona solo con propósitos informativos, y no se considera una recomendación, consejos operativos ni constituye una conclusión de que el ejercicio temprano tendrá éxito o será adecuado para todos los cliente so todas las operaciones. Los titulares de cuenta deberían consultar con un especialista fiscal para determinar las consecuencias fiscales, si las hubiere, de un ejercicio temprano y deberían prestar particular atención a los riesgos potenciales de sustituir una posición en opciones larga por una posición en acciones corta.

Earnings

Publicly traded companies in North America generally are required to release earnings on a quarterly basis. These announcements, which contain a host of relevant statistics, including revenue and margin data, and often projections about the company's future profitability, have the potential to cause a significant move in the market price of the company's shares. From an options trading viewpoint, anything with the potential to cause volatility in a stock affects the pricing of its options. Earnings releases are no exceptions.

Options traders often try to anticipate the market's reaction to earnings news. They know implied volatilities, the key to options prices, will steadily rise while skew - the difference in implied volatility between at-money and out-of-the-money options - will steadily steepen as the earnings date approaches. The degree by which those adjustments occur is often based on history. Stocks that have historically made significant post-earnings moves often have more expensive options.

Earnings risk is idiosyncratic, meaning that it is usually stock specific and not easily hedged against an index or a similar company. Stocks that are normally quite well correlated may react quite differently, leading to share prices that diverge or indices with dampened moves. For those reasons, there is no single strategy that works for trading options in these situations. Traders must have very clear expectations for a stock's potential move, and then decide which combination of options will likely lead to the most profitable results if the trader is correct.

If the market seems too sanguine about a company's earnings prospects, it is fairly simple (though often costly) to buy a straddle or an out-of the-money put and hope for a big move. Taking advantage of the opposite prospect, when front month implied volatilities seem too high, can also be profitable but it can also cause serious losses to be short naked options in the face of a big upward stock move. Traders can take advantage of high front month volatility by buying a calendar spread - selling a front month put and buying the same strike in the following month. The maximum profit potential is reached if the stock trades at the strike price, with the front-month option decaying far faster than the more expensive longer-term option. Losses are limited to the initial trade price.

Sometimes excessive fear is expressed by extremely steep skew, when out-of-the-money puts display increasingly higher implied volatilities than at-money options. Traders who use vertical spreads can capitalize on this phenomenon. Those who are bearish can buy an at-money put while selling an out-of-the-money put. This allows the purchaser to defray some of the cost of a high priced option, though it caps the trade's profits if the stock declines below the lower strike. On the other hand, those who believe the market is excessively bearish can sell an out-of-the-money put while buying an even lower strike put. Although the trader is buying the higher volatility option, it allows him to make money as long as the stock stays above the higher strike price, while capping his loss at the difference between the two strikes.

This article is provided for information only and is not intended as a recommendation or a solicitation to buy or sell securities. Option trading can involve significant risk. Before trading options read the "Characteristics and Risks of Standardized Options." Customers are solely responsible for their own trading decisions.

Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

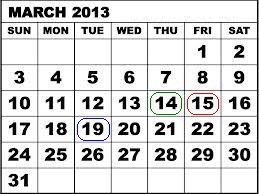

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.