IdealPro - Large-Size Order Facility

The IdealPro Forex market center provides a Large-Size Order facility specifically intended for accounts which regularly submit orders in quantities greater than standard order maximums and are willing to trade outside the NBBO associated with the standard order minimum/maximum bands in an attempt to obtain faster fills.

Standard orders submitted through IdealPro are subject to minimum and maximum size restrictions which, when expressed in USD equivalents, generally range from $25,000 to $7,000,000 but vary by currency (see Forex Min/Max Order Sizes Chart). These size restrictions serve to provide for the most optimal combination of liquidity and spreads, minimize the impact of erroneous or “fat finger” entries, and are intended to minimize any distortion which the submission of a large-size order may have upon supply or demand.

Orders submitted at a quantity below the standard order minimums are considered odd lot orders and are subject to special handling and price quoting considerations (see Odd Lot FX Transactions). Account holders who wish to submit orders at quantities above the standard order maximum must first request to be qualified for the Large-Size Order facility. Unlike standard orders for which the quote covers any quantity within the stated minimum and maximum size restrictions, the quote associated with a Large-Sized Order is specific to the order quantity entered. In an effort to obtain the best execution possible and also to limit any market impact, Large-Sized Order quotes are

generated based upon an aggregation of quotes provided by interbank dealers along with

and internalized orders of other IB clients.

Outlined below are a series of FAQs addressing the features and considerations of the Large-Size Order

facility.

How do I become eligible to submit Large-Size Orders?

In order to become eligible to submit large-size orders through the Large-Size Order facility, you would need to first submit a request to Customer Service. Requests will be reviewed and considered based upon a number of factors including the applicant's prior trade history and account equity. Please allow up to 7 business days for completion of this review to take place.

What spreads are expected for Large-Size Orders?

In general, spreads for Large-Size Orders on IdealPro are expected to be greater than those for standard orders, however, other factors such as liquidity of the currency pair, time of the day and release of economic numbers or other data can also influence bid ask spreads and should also be taken into consideration.

What is the maximum available order size?

In general sizes up to 50 million of the base currency are available. As with bid-ask spreads, this may vary depending on a number of factors. The Large-Size Order facility will return the lower of the size requested and size available at the time of the request.

What order types are supported?

Account holders are strongly encouraged to use limit order types with the Large Size Order facility as market orders are susceptible to being filled at prices far lower/higher than the current displayed bid/ask particularly under volatile market conditions or where the order involves illiquid products. In addition, to protect from losses associated with significant and rapidly changing prices, IB will simulate client market orders as market with protection orders, establishing an execution cap seven basis points (0.07%) beyond the quoted bid/ask. While this cap is set at a level that is intended to balance the objectives of execution certainty and minimizing price risk, there exists a remote possibility that the execution of a market order will be delayed or may not take place.

How will prices be displayed?

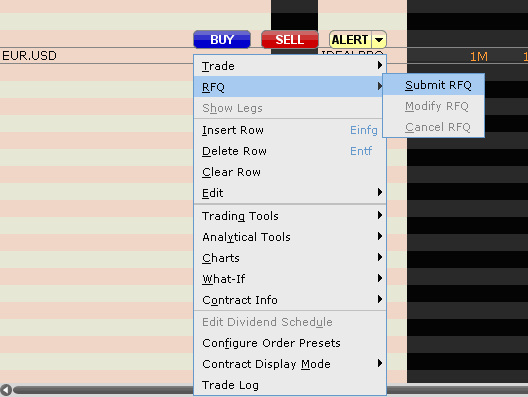

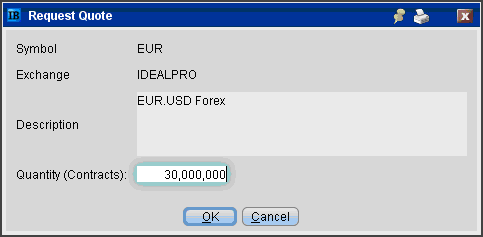

The TWS quote line will display dealable prices for a predefined amount once access to the Large-Size Order facility has been provided. To display prices, right-click on a given currency pair and then select the Choose RFQ and Submit RFQ menu options (Exhibit 1). You will then be prompted to provide the currency amount and then hit enter (Exhibit 2). The prices displayed (Exhibit 3) will time out after a certain time and you would have to repeat the request process to get another price again. We do not publish prices through other channels at the moment. The handling of the orders remains the same, regardless whether sent using the Large-Size Order facility, the quote screen, FX Trader or sent using an API.

Exhibit 1

Exhibit 2

Exhibit 3

.bmp)