IEX Discretionary Peg Order

IEX offers a Discretionary Peg™ (D-Peg™) order type which is a non-displayed order that is priced at either the National Best Bid (NBB for buys) or National Best Offer (NBO for sells). D-Peg™ orders passively rest on the book while seeking to access liquidity at a more aggressive price up to Midpoint of the NBBO, except when IEX determines that the quote is transitioning to less aggressive price

How to Place a D-Peg Order

Please note, the IEX D-Peg order type is only available via the TWS version 961 and above. Instructions for entering this order type are outlined below:

Step 1

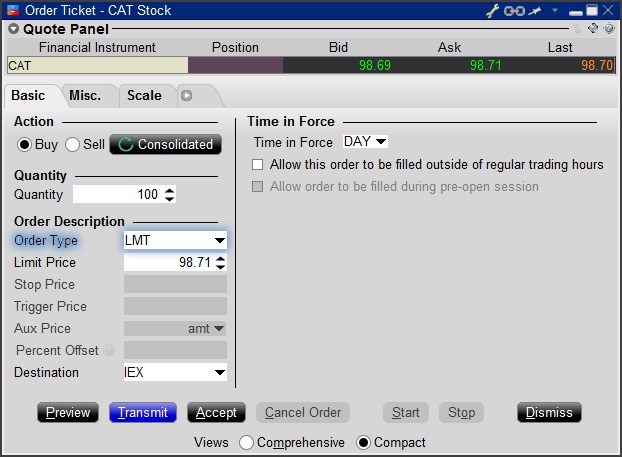

Enter a symbol and choose a directed quote, selecting IEX as the destination. Right click on the data line and select Trade followed by Order Ticket to open the Order Ticket window.

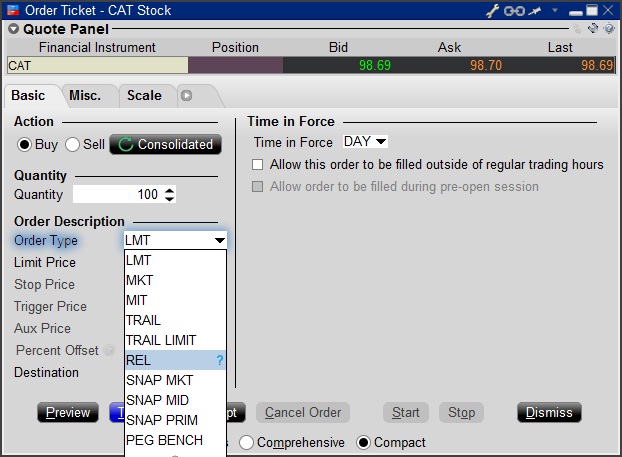

Step 2

Select the REL order type from the Order Type drop down menu.

Step 3

Click on the Miscellaneous tab (Misc.) and at the bottom there will be a checkbox for "Discretionary up to limit". Check this box. The price that you set in the Limit Price field will be used at the discretionary price on the order.

.jpg)

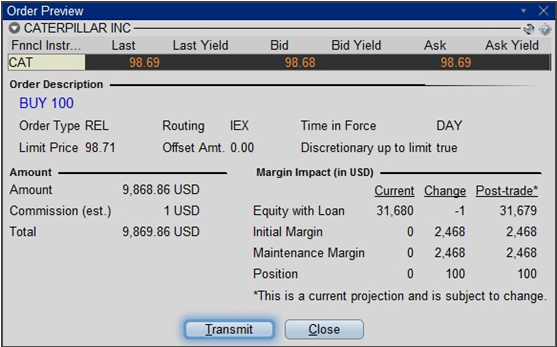

Step 4

Hit Preview to view the Order Preview window.

For additional information concerning this order type, please review the following exchange website link: https://www.iextrading.com/trading/dpeg/

SEC Tick Size Pilot Program

Background

Effective October 3, 2016, securities exchanges registered with the SEC will operate a Tick Size Pilot Program ("Pilot") intended to determine what impact, if any, widening of the minimum price change (i.e., tick size) will have on the trading, liquidity, and market quality of small cap stocks. The Pilot will last for 2 years and it will include approximately 1,200 securities having a market capitalization of $3 billion or less, average daily trading volume of 1 million shares or less, and a volume weighted average price of at least $2.00.

For purposes of the Pilot, these securities will be organized into groups that will determine a minimum tick size for both quote display and trading purposes. For example, Test Group 1 will consist of securities to be quoted in $0.05 increments and traded in $0.01 increments and Test Group 2 will include securities both quoted and traded in $0.05 increments. Test Group 3 will include also include securities both quoted and traded in $0.05 increments, but subject to Trade-at rules (more fully explained in the Rule). In addition, there will be a Control Group of securities that will continue to be quoted and traded in increments of $0.01. Details as to the Pilot and securities groupings are available on the FINRA website.

Impact to IB Account Holders

In order to comply with the SEC Rules associated with this Pilot, IB will change the way that it accepts orders in stocks included in the Pilot. Specifically, starting October 3, 2016 and in accordance with the phase-in schedule, IB will reject the following orders associated with Pilot Securities assigned to Test Groups:

- Limit orders having an explicit limit that is not entered in an increment of $0.05;

- Stop or Stop Limit orders having an explicit limit that is not entered in an increment of $0.05; and

- Orders having a price offset that is not entered in an increment of $0.05. Note that this does not apply to offsets which are percentage based and which therefore allow IB to calculate the permissible nickel increment

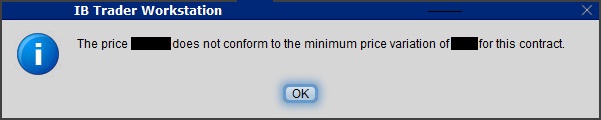

Clients submitting orders via the trading platform that are subject to rejection will receive the following pop-up message:

The following order types will continue to be accepted for Pilot Program Securities:

- Market orders;

- Benchmark orders having no impermissible offsets (e.g., VWAP, TVWAP);

- Pegged orders having no impermissible offsets ;

- Retail Price Improvement Orders routed to the NASDAQ-BX and NYSE as follows:

- Test Group 1 in .001

- Test Group 2 and 3 in .005

Other Items of Note

- GTC limit and stop orders entered prior to the start of the Pilot will be adjusted as allowed (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

- Clients generating orders via third-party software (e.g., signal provider), order management system, computer to computer interfaces (CTCI) or through the API, should contact their vendor or review their systems to ensure that all systems recognize the Pilot restrictions.

- Incoming orders to IB that are marked with TSP exception codes from other Broker Dealers will not be acted upon by IB. For example, IB will not accept incoming orders marked with the Retail Investor Order or Trade-At ISO exception codes.

- The SEC order associated with this Pilot is available via the following link: https://www.sec.gov/rules/sro/nms/2015/34-74892-exa.pdf

- For a list of Pilot Program related FAQs, please see KB2750

Please note that the contents of this article are subject to revision as further regulatory guidance or changes to the Pilot Program are issued.

Allocation of Partial Fills

How are executions allocated when an order receives a partial fill because an insufficient quantity is available to complete the allocation of shares/contracts to sub-accounts?

Overview:

From time-to-time, one may experience an allocation order which is partially executed and is canceled prior to being completed (i.e. market closes, contract expires, halts due to news, prices move in an unfavorable direction, etc.). In such cases, IB determines which customers (who were originally included in the order group and/or profile) will receive the executed shares/contracts. The methodology used by IB to impartially determine who receives the shares/contacts in the event of a partial fill is described in this article.

Background:

Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. They can do so by first creating a group (i.e. ratio/percentage) or profile (i.e. specific amount) wherein a distinct number of shares/contracts are specified per client account (i.e. pre-trade allocation). These amounts can be prearranged based on certain account values including the clients’ Net Liquidation Total, Available Equity, etc., or indicated prior to the order execution using Ratios, Percentages, etc. Each group and/or profile is generally created with the assumption that the order will be executed in full. However, as we will see, this is not always the case. Therefore, we are providing examples that describe and demonstrate the process used to allocate partial executions with pre-defined groups and/or profiles and how the allocations are determined.

Here is the list of allocation methods with brief descriptions about how they work.

· AvailableEquity

Use sub account’ available equality value as ratio.

· NetLiq

Use subaccount’ net liquidation value as ratio

· EqualQuantity

Same ratio for each account

· PctChange1:Portion of the allocation logic is in Trader Workstation (the initial calculation of the desired quantities per account).

· Profile

The ratio is prescribed by the user

· Inline Profile

The ratio is prescribed by the user.

· Model1:

Roughly speaking, we use each account NLV in the model as the desired ratio. It is possible to dynamically add (invest) or remove (divest) accounts to/from a model, which can change allocation of the existing orders.

Basic Examples:

Details:

CTA/FA has 3-clients with a predefined profile titled “XYZ commodities” for orders of 50 contracts which (upon execution) are allocated as follows:

Account (A) = 25 contracts

Account (B) = 15 contracts

Account (C) = 10 contracts

Example #1:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 10 am (ET) the order begins to execute2but in very small portions and over a very long period of time. At 2 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 7 of the 50 contracts are filled or 14%). For each account the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 14% of 25 = 3.5 rounded down to 3

Account (B) = 14% of 15 = 2.1 rounded down to 2

Account (C) = 14% of 10 = 1.4 rounded down to 1

To Summarize:

A: initially receives 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: initially receives 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. Account C which currently has a ratio of 0.10).

A: final allocation of 3 contracts, which is 3/25 of desired (fill ratio = 0.12)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 2 contract, which is 2/10 of desired (fill ratio = 0.20)

The execution(s) received have now been allocated in full.

Example #2:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be filled3 but in very small portions and over a very long period of time. At 1 pm (ET) the order is canceled prior being executed in full. As a result, only a portion of the order is executed (i.e., 5 of the 50 contracts are filled or 10%).For each account, the system initially allocates by rounding fractional amounts down to whole numbers:

Account (A) = 10% of 25 = 2.5 rounded down to 2

Account (B) = 10% of 15 = 1.5 rounded down to 1

Account (C) = 10% of 10 = 1 (no rounding necessary)

To Summarize:

A: initially receives 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: initially receives 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: initially receives 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The system then allocates the next (and final) contract to an account with the smallest ratio (i.e. to Account B which currently has a ratio of 0.067).

A: final allocation of 2 contracts, which is 2/25 of desired (fill ratio = 0.08)

B: final allocation of 2 contracts, which is 2/15 of desired (fill ratio = 0.134)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Example #3:

CTA/FA creates a DAY order to buy 50 Sept 2016 XYZ future contracts and specifies “XYZ commodities” as the predefined allocation profile. Upon transmission at 11 am (ET) the order begins to be executed2 but in very small portions and over a very long period of time. At 12 pm (ET) the order is canceled prior to being executed in full. As a result, only a portion of the order is filled (i.e., 3 of the 50 contracts are filled or 6%). Normally the system initially allocates by rounding fractional amounts down to whole numbers, however for a fill size of less than 4 shares/contracts, IB first allocates based on the following random allocation methodology.

In this case, since the fill size is 3, we skip the rounding fractional amounts down.

For the first share/contract, all A, B and C have the same initial fill ratio and fill quantity, so we randomly pick an account and allocate this share/contract. The system randomly chose account A for allocation of the first share/contract.

To Summarize3:

A: initially receives 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: initially receives 0 contracts, which is 0/15 of desired (fill ratio = 0.00)

C: initially receives 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

Next, the system will perform a random allocation amongst the remaining accounts (in this case accounts B & C, each with an equal probability) to determine who will receive the next share/contract.

The system randomly chose account B for allocation of the second share/contract.

A: 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: 0 contracts, which is 0/10 of desired (fill ratio = 0.00)

The system then allocates the final [3] share/contract to an account(s) with the smallest ratio (i.e. Account C which currently has a ratio of 0.00).

A: final allocation of 1 contract, which is 1/25 of desired (fill ratio = 0.04)

B: final allocation of 1 contract, which is 1/15 of desired (fill ratio = 0.067)

C: final allocation of 1 contract, which is 1/10 of desired (fill ratio = 0.10)

The execution(s) received have now been allocated in full.

Available allocation Flags

Besides the allocation methods above, user can choose the following flags, which also influence the allocation:

· Strict per-account allocation.

For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order.

· “Close positions first”1.This is the default handling mode for all orders which close a position (whether or not they are also opening position on the other side or not). The calculation are slightly different and ensure that we do not start opening position for one account if another account still has a position to close, except in few more complex cases.

Other factor affects allocations:

1) Mutual Fund: the allocation has two steps. The first execution report is received before market open. We allocate based onMonetaryValue for buy order and MonetaryValueShares for sell order. Later, when second execution report which has the NetAssetValue comes, we do the final allocation based on first allocation report.

2) Allocate in Lot Size: if a user chooses (thru account config) to prefer whole-lot allocations for stocks, the calculations are more complex and will be described in the next version of this document.

3) Combo allocation1: we allocate combo trades as a unit, resulting in slightly different calculations.

4) Long/short split1: applied to orders for stocks, warrants or structured products. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex.

5) For non-guaranteed smart combo: we do allocation by each leg instead of combo.

6) In case of trade bust or correction1: the allocations are adjusted using more complex logic.

7) Account exclusion1: Some subaccounts could be excluded from allocation for the following reasons, no trading permission, employee restriction, broker restriction, RejectIfOpening, prop account restrictions, dynamic size violation, MoneyMarketRules restriction for mutual fund. We do not allocate to excluded accountsand we cancel the order after other accounts are filled. In case of partial restriction (e.g. account is permitted to close but not to open, or account has enough excess liquidity only for a portion of the desired position).

Footnotes:

SEC Tick Size Pilot Program FAQs

Tick Size Pilot ("TSP" or "Pilot") Program:

Under the TSP Program, if IBKR receives any order in a Pilot Security that does not conform to the designated pricing increment (e.g., a limit price in a $0.01 increment for a security designated as trading $0.05 increments), IBKR will REJECT that order, subject to limited exceptions. IBKR strongly encourages a thorough review of your software or your vendor’s software to understand the criteria for what causes an order in a Pilot Security to be rejected to permit you or your vendor to make changes to correctly handle orders in Test Group Pilot Securities.

FREQUENTLY ASKED QUESTIONS:

Q: What is the Tick Size Pilot?

A: On May 6, 2015, the SEC approved an amended TSP NMS Plan. The Pilot will be two years in length. Data collection for the Pilot began on April 4, 2016, 6 months prior to the implementation of the trading and quoting rules for the Pilot. Implementation of the trading and quoting rules for the Pilot will begin on October 3, 2016.

The Pilot will be conducted using a Control Group and three Test Groups where variations in quoting and trading rules exist between each group. Please see the TSP NMS Plan for additional information.

Q: Will the Pilot quoting and trading rules apply during regular market hours, pre-market hours and post market hours?

A: The Pilot rules apply during all operational hours (pre-market, regular hours, and post market hours trading).

Q: Will the Pilot quoting and trading rules apply to odd-lot and mixed-lot sizes?

A: Yes, the Pilot rules to all order sizes.

Q: Will orders in Control Group Securities be accepted in price increments of less than $0.05?

A: Yes, orders submitted in price increments of less than $0.05 will continue to be accepted in Control Group securities.

Q: Will orders in a Test Group 1, 2 or 3 Pilot Securities be accepted in price increments of less than $0.05?

A: No, unless covered by an exception, orders submitted in price increments of less than $0.05 will be rejected.

Q: Which Pilot Security Orders in Test Groups will Interactive Brokers accept at other than $0.05 increments?

![]() Midpoint orders with no explicitly stated limit price or impermissible offsets will be accepted

Midpoint orders with no explicitly stated limit price or impermissible offsets will be accepted

![]() VWAP orders that do not have an explicitly stated limit price or impermissible offsets will be accepted.

VWAP orders that do not have an explicitly stated limit price or impermissible offsets will be accepted.

![]() Interactive Brokers will accept Exchange operated Retail Price Improvement orders as follows:

Interactive Brokers will accept Exchange operated Retail Price Improvement orders as follows:

![]() Test Group 1 in $0.001 price increments

Test Group 1 in $0.001 price increments

![]() Test Groups 2 and 3 in $0.005 price increments.

Test Groups 2 and 3 in $0.005 price increments.

Q: Will there be any changes to the Opening / Closing processes on Exchanges?

A: Please refer to each of the exchange rules for details but in general, there will be no changes to the Opening / Closing process. All orders entered and eligible to participate in Exchange Opening / Closing Cross will be accepted in increments of $0.05. The Exchanges will begin publishing all quotes in increments of $0.05; however, Net Order Imbalance Indicator prices may be published in increments of $0.025.

Q: What will happen to my GTC order that was placed prior to October 3rd in a Pilot Stock that was priced in impermissible tick increments?

A: Interactive Brokers will adjust outstanding limit and stop GTC orders in Pilot stocks in Test Groups that are not in permissible tick increments (e.g., a buy limit order at $5.01 will be adjusted to $5.00 and a sell limit at $5.01 adjusted to $5.05).

Q: What will happen to my GTC order placed after October 3rd that was placed and accepted in a nickel tick increment but the Pilot Stock moves from a Test Group to the Control Group that permits non-nickel increments?

A: The GTC order will automatically be able to be revised by the user in non-nickel increments on the date the Pilot stock moves from the Test Group to the Control Group. Similarly, if a stock is added to Test Group due to a corporate action, IBKR will cancel the GTC order if it is priced in impermissible increments.

Q: Where can I find out more information?

A: See KB2752 or the FINRA website for additional details regarding the Pilot Program: http://www.finra.org/industry/tick-size-pilot-program

Additional Information Regarding the Use of Stop Orders

U.S. equity markets occasionally experience periods of extraordinary volatility and price dislocation. Sometimes these occurrences are prolonged and at other times they are of very short duration. Stop orders may play a role in contributing to downward price pressure and market volatility and may result in executions at prices very far from the trigger price.

Delivery Settings for Shareholder Materials

IBKR’s default setting for distributing shareholder communications (e.g., proxy materials and annual reports) from U.S. and Canadian issuers is electronic delivery. Under this method the account holder will receive an email notice when information becomes available for a security they hold from our processing agent, Mediant Communications. This notification will provide the necessary links for accessing the information and voting through the Internet in lieu of receiving these documents via postal service. The technology which you will need to secure the information includes access to the Internet and a web browser supporting secure connections. In addition, you will need to be able to read the documents online and print a copy provided your system supports documents in a PDF format.

Other items of note:

- The information above applies solely to shareholder communications associated with U.S. and Canadian issuers. The delivery of communications for securities issued outside of these two countries is typically electronic, but managed directly by the issuer or its agent (i.e., not Mediant).

See also: Non-Objecting Beneficial Owner (NOBO)

Commissioni pass-through ADR

Si ricorda ai titolari dei conti in possesso di posizioni in Ricevute di deposito americane (ADR) che tali titoli sono soggetti a commissioni periodiche finalizzate al risarcimento delle banche agenti che forniscono i servizi di custodia per conto delle ADR. Di norma tali servizi comprendono l'inventario dei titoli non americani sottostanti le ADR e l'espletamento delle procedure di registrazione, conformità e conservazione documentale.

Storicamente le banche agenti erano unicamente in grado di riscuotere le commissioni di custodia sottraendole dai dividendi delle ADR. Tuttavia, siccome molte ADR non pagano i dividendi regolarmente, tali banche non sono state più in grado di ricuotere le relative commissioni. Di conseguenza, nel 2009 SEC ha autorizzato la Depository Trust Company (DTC) alla riscossione delle commissioni di custodia delle ADR che non pagavano i dividendi periodici per conto delle banche. La DTC riscuote tali commissioni tramite i propri broker partecipanti (per esempio IB) che detengono ADR per conto dei propri clienti. Tali commissioni sono definite pass-through (di passaggio) in quanto destinate a essere riscosse dai clienti tramite i propri broker di riferimento.

Qualora si detengano posizioni in ADR eroganti dividendi, tali commissioni verranno dedotte dal dividendo stesso, così come accadeva in passato. Nel caso, invece, in cui si detengano posizioni in ADR prive di dividendi, le commissioni pass-through verranno riscosse dal rendiconto mensile alla data di registrazione in cui è stato dichiarato. Così come avviene nel caso della riscossione dei dividendi in contanti, allo stesso modo IB procede alll'allocazione delle commissioni ADR previste tramite la sezione Incrementi e rendiconti. L'addebito delle commissioni è visibile nella sezione Versamenti e prelievi del rendiconto sotto la denominazione "Modifiche - altro" insieme al simbolo della rispettiva ADR cui la commissione è associata.

Se quello delle commissioni pass-through è di norma compreso tra gli 0.01 e gli 0.03 USD per titolo, gli altri importi potrebbero variare in base alle differenti ADR e, per maggiori informazioni, si consiglia di fare riferimento al proprio prospetto di riferimento. È possibile ricercare il prospetto online tramite lo strumento EDGAR Company Search di SEC.

Date fondamentali relative ai dividendi azionari

Di seguito vengono illustrate le date fondamentali relative ai dividendi azionari:

1. Data di dichiarazione dei dividendi: la data in cui il Consiglio di amministrazione della società approva il pagamento dei dividendi e stabilisce la Data di pagamento e la Data di registrazione.

2. Data di registrazione: la data in cui vengono individuati gli azionisti legittimati al pagamento del dividendo. Si ha diritto al pagamento del dividendo solo se si è in possesso delle azioni alla chiusura della Data di registrazione.

3. Data di stacco cedola: la data in cui, o a seguito della quale, le azioni vengono negoziate senza il diritto al dividendo. Siccome la maggior parte delle operazioni finanziarie negli Stati Uniti vengono regolate in modo regolare, ovvero, tre giorni lavorativi dopo la transazione, è necessario acquistare le azioni tre giorni lavorativi prima della Data di registrazione per poter essere legittimati al pagamento del dividendo. La Data di stacco cedola precede di due giorni quella di registrazione.

4. Data di pagamento: la data in cui i dividendi dichiarati vengono pagati a tutti gli azionisti in possesso di quote alla Data di registrazione.

Qualified Investments in RSP & TFSA Accounts

Canadian Revenue Agency (“CRA”) regulations place restrictions upon the types of positions that may be held in RSP and TFSA accounts with eligibility limited to those meeting the definition of a “Qualified Investment”. Positions held in such accounts that do not meet this definition are referred to as “Non-Qualified Investments” and are subject to a CRA tax equal to 50% of the fair market value of the property at the time it was acquired or it became Non-Qualified.

Qualified Investments include the following instruments: an investment in properties, including money, guaranteed investment certificates (GICs), government and corporate bonds, mutual funds, and securities listed on a designated stock exchange. Note that certain investments, while Qualified, may not be offered by IB due to the product type itself or its designated exchange not being supported.1

Non-Qualified investments include any property that is not is not classified as a Qualified Investment. Examples include stocks trading on NEX in Canada, as well as on PINK and OTCBB shares in the US.

For additional information, please refer to the CRA website links below:

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/rrsp-reer/glssry-eng.html

http://www.cra-arc.gc.ca/tx/ndvdls/tpcs/ntvdnc/nnqlfdnvst-eng.html

Determining Buying Power

Buying power serves as a measurement of the dollar value of securities that one may purchase in a securities account without depositing additional funds. In the case of a cash account where, by definition, securities may not be purchased using funds borrowed from the broker and must be paid for in full, buying power is equal to the amount of settled cash on hand. Here, for example, an account holding $10,000 in cash may purchase up to $10,000 in stock.

In a margin account, buying power is increased through the use of leverage provided by the broker using cash as well as the value of stocks already held in the account as collateral. The amount of leverage depends upon whether the account is approved for Reg. T margin or Portfolio Margin. Here, a Reg. T account holding $10,000 in cash may purchase and hold overnight $20,000 in securities as Reg. T imposes an initial margin requirement of 50%, which translates to buying power of 2:1 (i.e., 1/.50). Similarly, a Reg. T account holding $10,000 in cash may purchase and hold on an intra-day basis $40,000 in securities given IB’s default intra-day maintenance margin requirement of 25%, which translates to buying power of 4:1 (i.e., 1/.25).

In the case of a Portfolio Margin account, greater leverage is available although, as the name suggests, the amount is highly dependent upon the make-up of the portfolio. Here, the requirement on individual stocks (initial = maintenance) generally ranges from 15% - 30%, translating to buying power of between 6.67 – 3.33:1. As the margin rate under this methodology can change daily as it considers risk factors such as the observed volatility of each stock and concentration, portfolios comprised of low-volatility stocks and which are diversified in nature tend to receive the most favorable margin treatment (e.g., higher buying power).

In addition to the cash examples above, buying power may be provided to securities held in the margin account, with the leverage dependent upon the loan value of the securities and the amount of funds, if any, borrowed to purchase them. Take, for example, an account which holds $10,000 in securities which are fully paid (i.e., no margin loan). Using the Reg. T initial margin requirement of 50%, these securities would have a loan value of $5,000 (= $10,000 * (1 - 0.50)) which, using that same initial requirement providing buying power of 2:1, could be applied to purchase and hold overnight an additional $10,000 of securities. Similarly, an account holding $10,000 in securities and a $1,000 margin loan (i.e., net liquidating equity of $9,000), has a remaining equity loan value of $4,000 which could be applied to purchase and hold overnight an additional $8,000 of securities. The same principles would hold true in a Portfolio Margin account, albeit with a potentially different level of buying power.

Finally, while the concept of buying power applies to the purchase of assets such as stocks, bonds, funds and forex, it does not translate in the same manner to derivatives. Most securities derivatives (e.g., short options and single stock futures) are not assets but rather contingent liabilities and long options, while an asset, are short-term in nature, considered a wasting asset and therefore generally have no loan value. The margin requirement on short options, therefore, is not based upon a percentage of the option premium value, but rather determined on the underlying stock as if the option were assigned (under Reg. T) or by estimating the cost to repurchase the option given adverse market changes (under Portfolio Margining).