Wieso stimmt der „Kurs“ von Hard-to-Borrow-Aktien nicht mit dem Schlusskurs der Aktie überein?

Bei der Bestimmung der Bareinlage, die zur Besicherung einer Aktienleiheposition erforderlich ist, verlangt der Verleiher nach allgemeiner Branchenkonvention eine Einlage in Höhe von 102% des Abrechnungskurses des vorherigen Geschäftstages**, aufgerundet auf den nächsten ganzen Dollar und dann multipliziert mit der Anzahl der geliehenen Aktien. Da die Kreditzinsen auf der Grundlage des Wertes der Darlehensicherheiten festgelegt werden, wirkt sich diese Konvention auf die Kosten für die Aufrechterhaltung der Short-Position aus, wobei die Auswirkungen bei niedrigpreisigen und schwer zu leihenden Aktien am größten sind. Bitte beachten Sie, dass die Berechnung für Aktien, die nicht in USD denominiert sind, anders ausfällt. Nachstehend finden Sie eine Tabelle mit einer Zusammenfassung der Berechnungen pro Währung:

| Währung | Berechnungsmethode |

| USD | 102%; auf den nächsten Dollar gerundet |

| CAD | 102%; auf den nächsten Dollar gerundet |

| EUR | 105%; auf den nächsten Cent gerundet |

| CHF | 105%; auf den nächsten Rappen gerundet |

| GBP | 105%; auf den nächsten Penny gerundet |

| HKD | 105%; auf den nächsten Cent gerundet |

Kontoinhaber können diesen angepassten Preis für eine bestimmte Transaktion im Abschnitt "Details zu Non-Direct-Hard-to-Borrow-Gebühren" auf ihrem Tageskontoauszug einsehen. Nachstehend finden Sie zwei Beispiele für die Berechnung der Sicherheiten und deren Auswirkungen auf die Darlehensgebühren.

Beispiel 1

Leerverkauf von 100,000 Aktien von ABC zu einem Kurs von $1.50

Erhaltene Leerverkaufserlöse = $150,000.00

Angenommen, der Kurs von ABC fällt auf $0.25 und die Aktie hat einen Leihgebührensatz von 50%

Berechnung des Sicherheitenwerts für Leerverkäufe

Kurs = 0.25 x 102% = 0.255; aufrunden auf $1.00

Wert = 100,000 Aktien x $1.00 = $100,000.00

Leihgebühr = $100,000 x 50% / 360 Tage im Jahr = $138.89 pro Tag

Angenommen, dass der Kontostand des Kontoinhabers keine Erlöse aus anderen Leerverkaufstransaktionen enthält, wird diese Leihgebühr nicht durch Guthabenzinsen auf die Leerverkaufserlöse ausgeglichen, da der Kontostand nicht die Mindestschwelle von $100,000 Tier 1 überschreitet, die für das Anfallen von Zinsen erforderlich ist.

Beispiel 2 (auf EUR lautende Aktien)

Leerverkauf von 100,000 Aktien von ABC zu einem Kurs von 1.50 EUR

Angenommen, der Schlusskurs des vorherigen Geschäftstages beträgt 1.55 EUR und der Leihgebührensatz liegt bei 50%

Berechnung des Sicherheitenwerts für Leerverkäufe

Kurs = 1.55 EUR x 105% = 1.6275; aufrunden auf 1.63 EUR

Wert = 100,000 Aktien x 1.63 = $163,000.00

Leihgebühr = 163,000 EUR x 50% / 360 Tage im Jahr = 226.38 EUR pro Tag

** Bitte beachten Sie, dass Samstage und Sonntage als Freitag behandelt werden und der Abrechnungskurs vom Donnerstag zur Berechnung der erforderlichen Einlage verwendet wird.

FAQs zum Aktienrendite-Optimierungsprogramm

Was ist der Zweck des Aktienrendite-Optimierungsprogramms?

Das Aktienrendite-Optimierungsprogramm bietet Kunden die Möglichkeit, zusätzliche Erträge aus Wertpapierpositionen zu erzielen, die ansonsten ausgesondert würden (d. h. voll bezahlte und überschüssige Margin-Wertpapiere), indem IBKR diese Wertpapiere an Dritte ausleihen darf. Kunden, die an dem Programm teilnehmen, erhalten eine Barsicherheit, um die Rückgabe des Wertpapierdarlehens bei dessen Beendigung zu sichern, sowie Zinsen auf die vom Darlehensnehmer gestellte Barsicherheit für jeden Tag, an dem das Darlehen besteht.

Was sind voll eingezahlte und überschüssige Margin-Wertpapiere?

Voll eingezahlte Wertpapiere sind Wertpapiere auf dem Konto eines Kunden, die vollständig bezahlt wurden. Überschuss-Margin-Wertpapiere sind Wertpapiere, die nicht vollständig bezahlt wurden, deren Marktwert jedoch 140% des Margin-Sollsaldos des Kunden übersteigt.

Wie wird der Ertrag ermittelt, den ein Kunde für eine Darlehenstransaktion aus dem Aktienrendite-Optimierungsprogramm erhält?

Der Ertrag, den ein Kunde im Austausch für verliehene Aktien erhält, hängt von den Leihsätzen ab, die auf dem außerbörslichen Wertpapierleihmarkt festgelegt werden. Diese Zinssätze können nicht nur je nach dem verliehenen Wertpapier, sondern auch je nach dem Ausleihdatum erheblich variieren. Im Allgemeinen zahlt IBKR den Teilnehmern Zinsen auf ihre Barsicherheiten zu einem Satz, der ungefähr 50% der Beträge entspricht, die IBKR für das Verleihen der Aktien verdient. . Nehmen wir zum Beispiel an, IBKR verdient 15% auf das Jahr gerechnet mit dem Verleihen von Aktien im Wert von $10,000 und es werden Barsicherheiten im Wert von $10,000 auf das Konto eines Teilnehmers gebucht. Der normale tägliche Zinssatz, den IB an einen Teilnehmer auf die Barsicherheit zahlen würde, wäre $2.08

Wie wird die Höhe der Barsicherheiten für ein bestimmtes Darlehen ermittelt?

Die Barsicherheit, die dem Wertpapierdarlehen zugrunde liegt und für die Bestimmung der Zinszahlungen verwendet wird, wird nach einer Branchenkonvention bestimmt, wobei der Schlusskurs der Aktie mit einem bestimmten Prozentsatz multipliziert wird (im Allgemeinen 102-105%) und dann auf den nächsten Dollar/Cent/Pence etc. aufgerundet wird. Je nach Währung gibt es unterschiedliche Branchenkonventionen. Zum Beispiel würde eine Leihe von 100 Aktien einer USD-Aktie, die bei $59.24 schließt, $6,100 entsprechen ($59.24 * 1.02 = $60.4248; auf $61 runden, mit 100 multiplizieren). Nachstehend finden Sie eine Tabelle mit den verschiedenen Branchenkonventionen pro Währung:

| USD | 102%; auf den nächsten Dollar gerundet |

| CAD | 102%; auf den nächsten Dollar gerundet |

| EUR | 105%; auf den nächsten Cent gerundet |

| CHF | 105%; auf den nächsten Rappen gerundet |

| GBP | 105%; auf den nächsten Penny gerundet |

| HKD | 105%; auf den nächsten Cent gerundet |

Weitere Informationen erhalten Sie unter KB1146.

Wie wirken sich Long-Verkäufe, Übertragungen von Wertpapieren, die über das Aktienrendite-Optimierungsprogramm von IBKR ausgeliehen wurden, oder eine Abmeldung auf die Zinsen aus?

Die Verzinsung endet am nächsten Geschäftstag nach dem Handelsdatum (T+1). Die Verzinsung endet ebenfalls am nächsten Geschäftstag nach dem Datum des Transfereingangs oder der Abmeldung.

Was sind die Voraussetzungen für die Teilnahme am IBKR-Aktienrendite-Optimierungsprogramm?

| BERECHTIGTE UNTERNEHMEN |

| IB LLC |

| IB UK (ausgenommen SIPP-Konten) |

| IB IE |

| IB CE |

| IB HK |

| IB Canada (ausgenommen RRSP/TFSA-Konten) |

| BERECHTIGTE KONTOTYPEN |

| Cash (Mindestkapital über $50,000 zum Zeitpunkt der Anmeldung) |

| Margin |

| Finanzberater-Kundenkonten* |

| Kundenkonten von einführenden Brokern: Offengelegt und nicht offengelegt* |

| Einführende Omnibus-Konten für Broker |

| Konten mit getrennten Handelslimiten (STL) |

*Das angemeldete Konto muss die Anforderungen in Bezug auf das Mindestkapital für das Margin-Konto oder das Cash-Konto erfüllen.

Kunden bei IB Japan, IB Europe SARL, IBKR Australia und IB India sind nicht berechtigt. Japanische und indische Kunden, die Konten bei IB LLC haben, sind jedoch teilnahmeberechtigt.

Darüber hinaus können Kundenkonten von Finanzberatern, vollständig offengelegten IBroker-Kunden und Omnibus-Broker, die die oben genannten Anforderungen erfüllen, teilnehmen. Im Falle von Finanzberatern und vollständig offengelegten IBrokern müssen die Kunden die Vereinbarungen selbst unterschreiben. Bei Omnibus-Brokern unterschreibt der Broker die Vereinbarung.

Sind IRA-Konten berechtigt, am Aktienrendite-Optimierungsprogramm teilzunehmen?

Ja.

Sind Partitionen von IRA-Konten, die von Interactive Brokers Asset Management verwaltet werden, berechtigt, am Aktienrendite-Optimierungsprogramm teilzunehmen?

Nein.

Sind UK-SIPP-Konten berechtigt, am Aktienrendite-Optimierungsprogramm teilzunehmen?

Nein.

Wie melde man sich zum Aktienrendite-Optimierungsprogramm von IBKR an?

Kunden, die berechtigt sind und sich für das Aktienrendite-Optimierungsprogramm anmelden möchten, können dies tun, indem sie "Einstellungen" und anschließend "Kontoeinstellungen" auswählen. Klicken Sie auf das Schraubenschlüsselsymbol neben "Handelsberechtigungen". Wählen Sie das Feld oben auf der Seite unter "Handelsprogramme" aus, bei dem "Aktienrendite-Optimierungsprogramm" steht. Klicken Sie auf "WEITER" und füllen Sie alle erforderlichen Vereinbarungen/Offenlegungen aus.

Was geschieht, wenn das Eigenkapital eines teilnehmenden Barkontos unter den qualifizierenden Schwellenwert von $50,000 fällt?

Das Cash-Konto muss diese Mindestkapitalanforderung nur zum Zeitpunkt der Anmeldung zum Programm erfüllen. Wenn das Eigenkapital danach unter diesen Wert fällt, hat dies keine Auswirkungen auf bestehende Kredite oder die Möglichkeit, neue Darlehen zu veranlassen.

Wie kündigt man die Teilnahme am Aktienrendite-Optimierungsprogramm?

Kunden, die die Teilnahme am Aktienrendite-Optimierungsprogramm beenden möchten, können dies tun, indem sie sich in die Kontoverwaltung einloggen und "Einstellungen" und danach "Kontoeinstellungen" auswählen. Klicken Sie auf das Schraubenschlüsselsymbol neben "Handelsberechtigungen". Entfernen Sie das Häkchen aus dem Kästchen im Abschnitt Handelsprogramme mit der Überschrift "Aktienrendite-Optimierungsprogramm". Klicken Sie auf "WEITER" und füllen Sie alle erforderlichen Vereinbarungen/Offenlegungen aus. Anträge auf Beendigung werden normalerweise am Ende des Tages bearbeitet.

Wenn sich ein Kontoinhaber anmeldet und zu einem späteren Zeitpunkt wieder abmeldet, wann kann er/sie wieder in das Programm aufgenommen werden?

Nach der Abmeldung kann ein Konto 90 Kalendertage lang nicht wieder angemeldet werden.

Welche Arten von Wertpapierpositionen sind für die Ausleihe geeignet?

| US-Markt | EU-Markt | HK-Markt | CAD-Markt |

| Stammaktien (börsennotiert, PINK und OTCBB) | Stammaktien (börsennotiert) | Stammaktien (börsennotiert) | Stammaktien (börsennotiert) |

| ETF | ETF | ETF | ETF |

| Vorzugsaktien | Vorzugsaktien | Vorzugsaktien | Vorzugsaktien |

| Unternehmensanleihen* |

*Kommunalanleihen sind nicht zulässig.

Gibt es eine Beschränkung für das Ausleihen von Aktien, die nach einem IPO auf dem Sekundärmarkt gehandelt werden?

Nein, solange IBKR nicht Teil der verkaufenden Gruppe ist.

Wie ermittelt IBKR die Anzahl der Aktien, die für eine Beleihung in Frage kommen?

Der erste Schritt ist die Bestimmung des Wertes von Wertpapieren, falls vorhanden, auf die IBKR ein Margin-Pfandrecht hat und die ohne die Teilnahme des Kunden am Aktienrendite-Optimierungsprogramm verliehen werden können. Ein Broker, der Kundenkäufe von Wertpapieren über ein Margin-Darlehen finanziert, darf laut Vorschrift die Wertpapiere dieses Kunden in einer Höhe von bis zu 140% des Cash-Debit-Saldos beleihen oder als Sicherheit verpfänden. Wenn zum Beispiel ein Kunde mit einem Barguthaben von $50,000 Wertpapiere mit einem Marktwert von $100,000 kauft, beträgt der Soll- oder Darlehenssaldo $50,000 und der Broker hat ein Pfandrecht auf 140% dieses Saldos oder $70,000 an Wertpapieren. Alle Wertpapiere, die der Kunde über diesen Betrag hinaus hält, werden als überschüssige Margin-Wertpapiere bezeichnet ($30,000 in diesem Beispiel) und müssen abgesondert werden, es sei denn, der Kunde erteilt IB die Genehmigung, über das Aktienrendite-Optimierungsprogramm zu verleihen.

Der Sollsaldo wird ermittelt, indem zuerst alle nicht auf USD lautenden Barguthaben in USD konvertiert werden und dann alle Erlöse aus Leerverkäufen von Aktien abgezogen werden (falls nötig in USD konvertiert). Wenn das Ergebnis negativ ist, geben wir 140% dieser negativen Zahl frei. Darüber hinaus werden Cash-Salden, die im Rohstoffsegment oder für Spot-Metalle und CFDs gehalten werden, nicht berücksichtigt.

BEISPIEL 1: Der Kunde hält eine Long-Position in Höhe von 100,000 EUR in einem USD-Basiswährungskonto mit einem EUR.USD-Kurs von 1.40. Der Kunde kauft auf USD lautende Aktien im Wert von $112,000 (Gegenwert 80,000 EUR). Alle Wertpapiere gelten als voll bezahlt, da der in USD umgerechnete Bargeldsaldo ein Guthaben ist.

| Komponente | EUR | USD | Basis (USD) |

| Barbetrag | 100,000 | (112,000) | $28,000 |

| Long-Aktie | $112,000 | $112,000 | |

| NLV | $140,000 |

BEISPIEL 2: Der Kunde hält eine Long-Position im Wert von 80,000 USD, eine Long-USD-Aktienposition in Höhe von $100,000 sowie eine Short-USD-Aktienposition im Wert von $100,000. Die Long-Wertpapiere im Gesamtwert von $28,000 werden als Margin-Wertpapiere angesehen, während die übrigen $72,000 als überschüssige Margin-Wertpapiere behandelt werden. Dies wird ermittelt, indem die Short-Aktienerträge vom Barsaldo subtrahiert werden ($80,000 - $100,000) und das Ergebnis mit 140% ($20,000 * 1.4 = $28,000)multipliziert wird.

| Komponente | Basis (USD) |

| Barbetrag | $80,000 |

| Long-Aktie | $100,000 |

| Short-Aktien | ($100,000) |

| NLV | $80,000 |

Wird IBKR alle zulässigen Aktien ausleihen?

Es gibt keine Garantie, dass alle zulässigen Aktien in einem bestimmten Konto durch das Aktienrendite-Optimierungsprogramm verliehen werden, da es möglicherweise keinen Markt zu einem vorteilhaften Kurs für bestimmte Wertpapiere gibt, IBKR möglicherweise keinen Zugang zu einem Markt mit bereitwilligen Darlehensnehmern hat oder IBKR Ihre Aktien nicht verleihen möchten.

Werden Darlehen im Rahmen des Aktienrendite-Optimierungsprogramms nur in 100er-Schritten vergeben?

Nein. Darlehen können in jeder ganzen Aktienmenge vergeben werden, obwohl wir extern nur in Vielfachen von 100 Aktien verleihen. Es besteht also die Möglichkeit, dass wir 75 Aktien von einem Kunden und 25 von einem anderen ausleihen, wenn es eine externe Nachfrage nach 100 Aktien gibt.

Wie werden die Darlehen unter den Kunden aufgeteilt, wenn das Angebot an zu verleihenden Aktien die Leihnachfrage übersteigt?

Für den Fall, dass die Nachfrage nach dem Ausleihen eines bestimmten Wertpapiers geringer ist als das Angebot an Aktien, die von den Teilnehmern unseres Aktienrendite-Optimierungsprogramms ausgeliehen werden können, werden die Kredite anteilig zugeteilt (z. B. wenn das Gesamtangebot 20,000 und die Nachfrage 10,000 beträgt, hat jeder Kunde Anspruch auf 50% seiner Aktien, die er ausleihen kann).

Werden Aktien nur an andere IBKR-Kunden oder auch an andere Dritte verliehen?

Aktien können an jede beliebige Gegenpartei ausgeliehen werden und sind nicht nur auf andere IBKR-Kunden beschränkt.

Kann der Teilnehmer des Aktienrendite-Optimierungsprogramms bestimmen, welche Aktien IBKR verliehen kann?

Nein. Das Programm wird vollständig von IBKR verwaltet, die nach der Bestimmung derjenigen Wertpapiere, die IBKR aufgrund eines Margin-Darlehenspfandrechts verleihen darf, nach eigenem Ermessen entscheiden kann, ob irgendwelche der voll bezahlten oder überschüssigen Margin-Wertpapiere verliehen werden können, und die Darlehen veranlassen kann.

Gibt es irgendwelche Beschränkungen für den Verkauf von Wertpapieren, die über das Aktienrendite-Optimierungsprogramm verliehen wurden?

Ausgeliehene Aktien können jederzeit und ohne Einschränkungen verkauft werden. Die Aktien müssen nicht rechtzeitig zurückgegeben werden, um den Verkauf der Aktie abzuwickeln, und der Erlös aus dem Verkauf wird dem Konto des Kunden zum normalen Abrechnungstermin gutgeschrieben. Darüber hinaus wird die Leihgabe am Eröffnungstag des auf den Wertpapierverkauf folgenden Geschäftstages beendet.

Kann ein Kunde gedeckte Calls gegen Aktien schreiben, die über das Aktienrendite-Optimierungsprogramm ausgeliehen wurden und als gedeckte Call-Marginposition behandelt werden?

Ja. Das Ausleihen von Aktien hat keinen Einfluss auf die Margin-Anforderung auf ungedeckter oder abgesicherter Basis, da der Verleiher das Risiko von Gewinnen oder Verlusten im Zusammenhang mit der ausgeliehenen Position behält.

Was geschieht mit Aktien, die Gegenstand eines Darlehens sind und die anschließend gegen eine Call-Zuweisung oder Put-Ausübung geliefert werden?

Das Darlehen wird am T+1 der Maßnahme (Handel, Abtretung, Ausübung) beendet, durch die die Position geschlossen oder verringert wurde.

Was passiert mit Aktien, die Gegenstand einer Leihe sind und die anschließend vom Handel ausgesetzt werden?

Ein Handelsstopp hat keine direkte Auswirkung auf die Fähigkeit, die Aktie zu verleihen. Solange IBKR die Aktie weiterhin verleihen kann, bleibt das Darlehen bestehen, unabhängig davon, ob die Aktie einem Handelsstopp ausgesetzt wird.

Können die Barsicherheiten aus einem Darlehen in das Rohstoffsegment zur Deckung der Marge und/oder der Schwankungen übertragen werden?

Nein. Die Barsicherheiten, die den Kredit besichern, wirken sich niemals auf die Margin-Anforderungen oder die Finanzierung aus.

Was passiert, wenn ein Programmteilnehmer ein Margin-Darlehen veranlasst oder einen bestehenden Darlehenssaldo erhöht?

Wenn ein Kunde voll bezahlte Wertpapiere unterhält, die über das Aktienrendite-Optimierungsprogramm verliehen wurden, und anschließend ein Margin-Darlehen veranlasst wird, wird das Darlehen in dem Maße beendet, in dem die Wertpapiere nicht als Überschuss-Margin-Wertpapiere qualifiziert sind. Ähnlich verhält es sich, wenn ein Kunde, der Wertpapiere mit Überschussmargen unterhält, die über das Programm verliehen wurden, den bestehenden Marginkredit erhöht, kann das Darlehen wiederum in dem Maße gekündigt werden, dass die Wertpapiere nicht mehr als Überschussmargen-Wertpapiere qualifiziert werden.

Unter welchen Umständen wird ein bestimmtes Wertpapierdarlehen gekündigt?

In einem der folgenden Fälle wird ein Aktiendarlehen automatisch gekündigt:

- Wenn der Kunde sich entscheidet, die Programmteilnahme zu beenden

- Übertragung von Aktien

- Beleihung der Aktien mit einem bestimmten Betrag

- Verkauf von Aktien

- Call-Zuweisung/Put-Ausübung

- Schließung des Kontos

Erhalten Teilnehmer beim Aktienrendite-Optimierungsprogramm Dividenden für verliehene Aktien?

Aktien aus dem Aktienrendite-Optimierungsprogramm, die verliehen werden, werden in der Regel vor dem ex-Datum vom Entleiher zurückgefordert, um die Dividende zu erfassen und Zahlungen anstelle von Dividenden (Payments in Lieu, PIL) zu vermeiden.

Behalten Teilnehmer am Aktienrendite-Optimierungsprogramm Stimmrechte für verliehene Aktien?

Nein. Der Entleiher der Wertpapiere hat das Recht, in Bezug auf die Wertpapiere abzustimmen oder eine Zustimmung zu erteilen, wenn der Stichtag oder die Frist für die Abstimmung, die Erteilung der Zustimmung oder die Vornahme sonstiger Handlungen in die Leihfrist fällt.

Erhalten Teilnehmer am Aktienrendite-Optimierungsprogramm Rechte, Optionsscheine und Spin-Off-Aktien auf verliehene Aktien?

Ja. Der Verleiher der Wertpapiere erhält alle Rechte, Optionsscheine, Spin-Off-Aktien und Ausschüttungen, die auf verliehene Wertpapiere erfolgen.

Wie werden Darlehen in der Aktivitätsübersicht angezeigt?

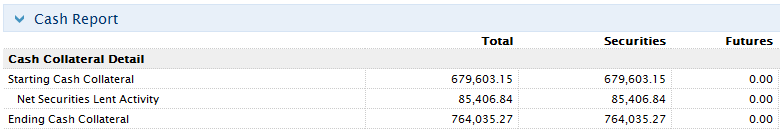

Kreditsicherheiten, ausstehende Aktien, Aktivitäten und Erträge werden in den folgenden 6 Abschnitten des Kontoauszugs angezeigt:

1. Details zum Barsaldo - zeigt den Anfangsbestand der Barsicherheiten, die Nettoveränderung aufgrund der Kreditaktivität (positiv, wenn neue Darlehen veranlasst wurden; negativ bei Netto-Rückgaben) und den Endbestand der Barsicherheiten.

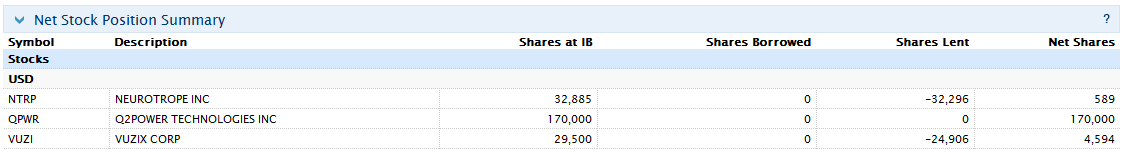

2. Netto-Aktienpositionsübersicht – für jede Aktie werden die Gesamtzahl der Aktien bei IBKR, die Anzahl der geliehenen Aktien, die Anzahl der verliehenen Aktien und die Netto-Aktien (= Aktien bei IBKR + geliehene Aktien - verliehene Aktien) angegeben.

3. Von IBKR verwaltete und verliehene Wertpapiere – listet für jede Aktie, die über das Aktienrendite-Optimierungsprogramm ausgeliehen wurde, die Anzahl der ausgeliehenen Aktien und den Zinssatz (%) auf.

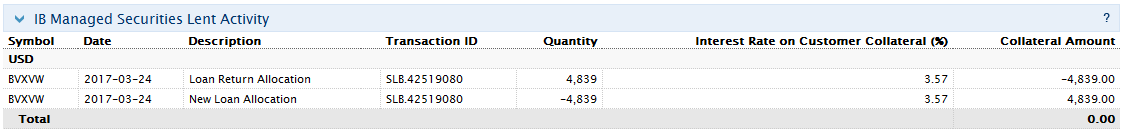

4. Umsätze zu von IBKR verwalteten und verliehenen Wertpapieren – listet für jedes Wertpapier die Darlehensaktivität auf, einschließlich Darlehensertragszuteilungen (d. h. beendete Darlehen), neue Darlehenszuteilungen (d. h. veranlasste Darlehen); die Aktienmenge; den Nettozinssatz (%); Zinssatz auf Kundensicherheiten (%) und den Sicherheitenbetrag.

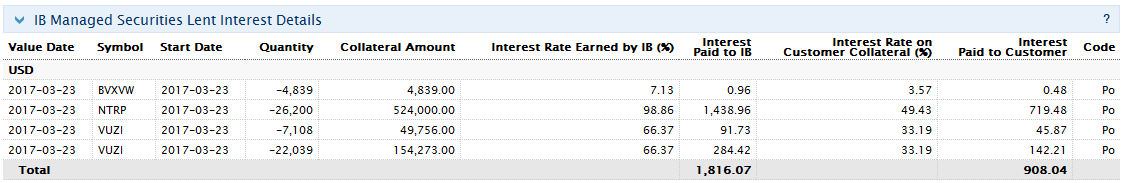

5. Zinsdetails zu von IBKR verwalteten und verliehenen Wertpapieren – Details auf Einzeldarlehensbasis, einschließlich des von IBKR erzielten Zinssatzes (%); des von IBKR erzielten Einkommens (stellt das Gesamteinkommen dar, das IBKR aus dem Darlehen erzielt, das gleich {Sicherheitsbetrag * Zinssatz)/360} ist); des Zinssatzes auf Kundensicherheiten (stellt etwa die Hälfte des Einkommens dar, das IB aus dem Darlehen erzielt) und des an den Kunden gezahlten Zinses (stellt das Zinseinkommen dar, das aus den Sicherheiten eines Kunden erzielt wird).

Hinweis: Dieser Abschnitt wird nur angezeigt, wenn die vom Kunden verdienten Zinsen für den Abrechnungszeitraum 1 USD übersteigen.

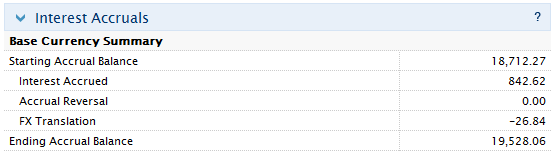

6. Aufgelaufene Zinsen – die Zinserträge werden hier als Zinsabgrenzung verbucht und wie alle anderen aufgelaufenen Zinsen behandelt (aggregiert, aber nur als Abgrenzung angezeigt, wenn sie 1 USD übersteigen und monatlich in Barmittel umgewandelt werden). Für die Jahresendberichterstattung wurden diese Zinserträge auf dem an US-Steuerzahler ausgegebenen Formular 1099 ausgewiesen.

Shorting US Treasuries

Interactive Brokers clients have the ability to gain direct exposure to US Treasuries on both the short and long side of the market.

Order Entry

Orders can be entered via TWS.

Cost to Borrow

The borrow fee to short US Treasuries is based on IBKR’s borrow cost and is subject to daily change. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee.

Interest Income

Customers earn Short Credit Interest on their short US Treasury positions based on IBKR’s standard tiered rates.

.png)

Margin Requirements

Margin1 requirements on Short US Treasury positions are the same as Long US Treasury positions. The requirement is between 1% and 9%, depending on time to maturity. The proceeds of the short sale are not available for withdrawal. The amount available for withdrawal is generally Equity with Loan Value – Initial Margin.

Additional information on fixed income margin requirements can be found here.

Commissions

Selling short US Treasuries incurs the same commission cost as buying US Treasuries. IBKR’s commission schedule can be found here.

Trading Policy

Minimum short position size is $250,000 face value per CUSIP due to limitations of the US Treasury borrow market. Once the minimum position size is met, the minimum order increment is $250,000 for both short sales and buy to covers (as long as the resulting short position remains higher than the $250,000 face value minimum).

Short Sale Order Examples

| Existing US Treasury Short Position Face Value in Account (per CUSIP) | Face Value of Short Sale Order | Face Value of Resulting Position | Order Accepted? | Reason |

| Flat | $250,000 | $250,000 | Yes | Face Value of resulting position is => $250,000 |

| Flat | $100,000 | $100,000 | No | Face Value of resulting position is < $250,000 |

| $250,000 | $50,000 | $300,000 | No | Order increment < $250,000 |

| $250,000 | $250,000 | $500,000 | Yes | Order increment =>$250,000 |

Buy-to-cover orders that will result in a short US Treasury position of less than $250,000 face value will not be accepted.

Buy to Cover Order Examples

| Existing US Treasury Short Position Face Value in Account (per CUSIP) | Face Value of Buy to Cover Order | Face Value of Resulting Position | Order Accepted? | Reason |

| $500,000 | $250,000 | $250,000 | Yes | Face Value of resulting position is => $250,000 |

| $500,000 | $300,000 | $200,000 | No | Face Value of resulting position is < $250,000 |

| $500,000 | $500,000 | Flat | Yes | Order increment => $250,000 |

Payment in Lieu

When a short US Treasury position is held over the record date of an interest payment, the borrower’s account will be debited a payment-in-lieu of interest equal to the interest payment owed to the lender.

Eligible US Treasuries for Shorting

Only accounts carried under Interactive Brokers LLC and Interactive Brokers UK are eligible to short sell US Treasuries.

US Treasury Notes and Bonds with an outstanding value greater than $14 Billion can be sold short.

US Treasury Bills, TIPs, STRIPs, TF (Floating Rate Notes) and WITFs (When-Issued Floating Rate Notes) are not available for shorting.

Non-US sovereign debt is also not available for shorting.

1Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment.

For more information regarding margin loan rates, see ibkr.com/interest

Regulation SHO Rule 204, Closeouts, and Introducing Brokers

As a US registered broker-dealer, Interactive Brokers LLC (“IBKR”) is subject to Regulation SHO, a collection of US Securities & Exchange Commission rules relating to short-selling of equity securities. Rule 204 of Regulation SHO places certain requirements on clearing brokers in the event that they fail to deliver securities on settlement date in connection with a sale of those securities. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. In certain circumstances, Rule 204 may require a clearing broker to not permit shorting a security for a certain period of time (unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale).

Rule 204(a) requires that a clearing broker, if it fails to deliver on a sale trade on the settlement date, must closeout its fail by buying or borrowing the relevant security a specified number of trading days later (depending on whether the sale was long or short), prior to the opening of the regular trading session on that day.

Rule 204(b) provides that if the clearing broker does not closeout its fail in accordance with Rule 204(a), the broker may not accept short sale orders from its customers in the relevant stock (the stock in which the unclosed-out fail has occurred), or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. This is colloquially known in the securities industry as being in the “penalty box” for the relevant security. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled.

Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule 204(b) restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker.

Rule 204(c) requires clearing brokers to notify brokers from whom they receive trades for clearance and settlement of when they become subject to a short-sale restriction under Rule 204(b), and when that restriction ends. This is so that the notified brokers can avoid executing trades away from the clearing broker that are not permitted under the clearing broker’s short-sale restriction. If you have received a notice from IBKR regarding Rule 204(c), it generally means that IBKR's books and records show that you are an introducing broker or dealer that clears and settles trades through IBKR, and that also has the capability (or your client has such capability) of executing trades at away brokers or dealers for settlement through IBKR. You should not execute any short-sale order at an away broker-dealer in a security which we have notified you is shortsale restricted, unless you have first arranged to pre-borrow sufficient shares of that security through IBKR. For more information on pre-borrowing, please click here or contact us.

The above is a general description of Rule 204 of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. It is not legal advice and should not be used as such.

Operational Risks of Short Selling

Rate Risk

Holders of short call options can be assigned before option expiration. When the long holder of an option enters an early exercise request, the Options Clearing Corporation (OCC) allocates assignments to its members (including Interactive Brokers) at random. The OCC reports assignments to IBKR on the day of the long call exercise (T) but after US market hours. As such, option assignments are reflected in IBKR client accounts on the next business day (T+1), which is also the settlement date. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held beforehand. Settled short position holders are subject to borrow fees, which can be high. Additionally, if IBKR cannot fulfil the short sale delivery obligation due to a lack of securities lending inventory on settlement date, the short position can be subject to a closeout buy-in.

Due to T+1 settlement mechanics described previously, traditional purchases to cover a short position on T+1 will leave the account with a settled short stock position for at least 1 night (or longer in case of a weekend or holiday).

Long in-the-money Puts are automatically exercised on expiration date. A short position as a result of the exercise carries the same risks as assigned short calls.

| Day | Short Sale | Buy to Cover | Settled Short Position | Borrow Fee Charged? | |

| Monday | OCC reports short call assignment to IBKR after market hours. | -100 XYZ stock Trade Date (T) |

Flat | No | |

| Tuesday | Call assignment and stock sale are reflected in the account | T+1 Settlement Date | +100 XYZ stock Trade Date (T) |

Yes | Yes |

| Wednesday | T+1 Settlement Date | Flat | No |

Special Risks Associated with ETN & Leveraged ETF Short Sales

Introduction

While account holders are always at risk of having a short security position closed out if IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics which may increase the likelihood of these events occurring. Two examples are leveraged Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN), where the supply of shares available to borrow can be influenced by a number of factors not found with shares of common stock. An overview of these securities and these factors is provided below.

Overview

As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants (typically large broker-dealers) to create and redeem ETF shares in large blocks, typically 50,000 to 100,000 shares. While many ETFs invest solely in securities, others use debt or derivatives to track and/or magnify exposure to an index. The ProShares Ultra VIX Short-Term Futures ETF ( symbol: UVXY) is one example of a widely traded leveraged ETF.

ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. They do not pay interest like traditional debit instruments, but rather a promise to pay a specific return that typically corresponds to an index or benchmark. The Barclays iPath® S&P 500 VIX Short-Term Futures™ ETN (symbol: VXX) is one example of a widely traded ETN.

The supply of shares available to borrow in order to initiate or maintain a short sale position may be less stable for certain leveraged ETFs and ETNs, including UVXY and VXX, due to the following factors:

- Limited Authorized Participants: The number of Authorized Participants willing to issue ETFs, particularly those that invest in derivatives (e.g., futures contracts, swap agreements and forward contracts) rather than securities and seek performance equal to a multiple (i.e., 2x) or an inverse multiple (i.e., -2x) of a benchmark may be limited. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer.

- No Authorized Participants: As ETN shares represent credit instruments, the supply of such shares is determined solely by the issuing financial institution and Authorized Participants are not involved with the creation or redemption of shares. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time.

- Limited Holding Period: Certain leveraged ETFs and ETNs seek to match the performance of a benchmark index for a single day rather than an extended period. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales.

- Margin Considerations: Shares made available for lending to short sellers often originate from brokers who maintain a lien on the shares as they’ve financed the purchase of the shares on behalf of clients via margin loans. Clients purchasing shares using borrowed funds are subject to regulatory margin requirements, compliance to which depends in part upon the value of the shares supporting the loan. As certain leveraged ETFs/ETNs are designed to provide returns in multiples of their benchmark, the inherent volatility of these products may diminish clients’ ability to maintain the position and, in turn, the broker’s ability to lend the shares.

Überblick über Buy-Ins und Close-Outs bei Aktienleerverkäufen

Einleitung

Kunden, die Short-Positionen in Aktien halten, gehen das Risiko ein, dass IB für diese Positionen eine Zwangsliquidierung oder Zwangseindeckung (Close-Out bzw. Buy-In) durchführt. Dies geschieht häufig mit wenig oder keiner Vorwarnung. Dieses Risiko ist ein inhärentes Risiko von Leerverkäufen und entzieht sich weitgehend der Kontrolle des Kunden. Zudem werden die Zeitrahmen, binnen derer die Broker bestimmte Maßnahmen ergreifen müssen, durch aufsichtsrechtliche Vorschriften diktiert.

Buy-Ins und Close-Outs erzielen eine ähnliche Wirkung. Jedoch erfolgt ein Buy-In durch einen Dritten, während ein Close-Out durch IB ausgeführt wird. Diese Maßnahmen resultieren üblicherweise aus einem der drei nachstehenden Ereignisse:

1. Die Aktien, die zur Lieferung benötigt werden, wenn ein Leerverkauf zur Abwicklung kommt, können nicht geliehen werden.

2. Die Aktien, die ausgeliehen und zur Abwicklung geliefert wurden, werden später zurückgefordert.

3. Die Lieferung bei der Clearingstelle schlägt fehl.

Im Folgenden erhalten Sie einen Überblick über diese drei möglichen Ereignisse und ihre Implikationen.

Überblick über Buy-In-/Close-Out-Ereignisse

1. Leerverkauf kommt zur Abwicklung: Wenn Aktien leer verkauft werden, muss der Broker dafür sorgen, dass die Aktien rechtzeitig zum Zeitpunkt der Abwicklung der Transaktion ausgeliehen werden. Im Falle von US-amerikanischen Wertpapieren ist dieser Zeitpunkt der dritte Geschäftstag nach Abschluss der Transaktion (T+3). Vor der Ausführung des Leerverkaufs muss der Broker in gutem Glauben eine Einschätzung treffen, ob die entsprechenden Aktien wahrscheinlich zur Leihe verfügbar sind, wenn sie benötigt werden. Diese Einschätzung wird auf Basis der Verfügbarkeit der Aktien zum Zeitpunkt der Entscheidung getroffen. Bitte beachten Sie: Sofern keine Pre-Borrow-Vereinbarung getroffen wurde, besteht keine Gewähr, dass die Aktien, die am Tag der Transaktionsausführung zur Leihe zur Verfügung stehen, auch drei Tage später noch verfügbar sind. Falls dies nicht der Fall ist, erfolgt eine Zwangsauflösung des Leerverkaufs. Für die Entscheidung über die Durchführung einer Zwangsauflösung gelten folgende Fristen:

T+3 (alle Zeitangaben basieren auf der Zeitzone US Eastern Time)

14:30 - Falls es IB bis zu diesem Zeitpunkt noch nicht möglich war, die Aktien für die Abwicklung auszuleihen, und mit hoher Wahrscheinlichkeit zu erwarten ist, dass dies auch bis zur Abwicklung nicht möglich sein wird, wird nach bestem Vermögen eine Mitteilung gesendet, um den Kunden über das mögliche Close-Out zu informieren. Der Kunde hat nun bis zum Ende der verlängerten Handelszeiten an diesem Tag Zeit, die betreffende(n) Short-Position(en) selbst zu schließen, um eine Zwangsauflösung zu vermeiden. Falls es IB innerhalb dieses Zeitraums gelingt, die Aktien auszuleihen, bemüht sich IB, den Kunden entsprechend in Kenntnis zu setzen.

15:15 – Es wird nach bestem Vermögen eine weitere Benachrichtigung an den Kunden versendet, falls dieser die Short-Position(en) noch nicht geschlossen und IB die Aktien noch nicht erfolgreich ausgeliehen hat. Der Kunde hat weiterhin bis zum Ende der erweiterten Handelszeiten dieses Tages die Möglichkeit, die Short-Position(en) selbst zu schließen, um eine Zwangsauflösung zu vermeiden.

16:50 – Falls es IB nicht gelungen ist, die Aktien für die Abwicklung auszuleihen, wird der Kunde nach bestem Vermögen von IB benachrichtigt, dass ein letzter Versuch bis 09:00 Uhr T+4 unternommen wird, falls es IB nicht möglich sein sollte, die Aktien bis Handelsschluss T+3 auszuleihen.

T+4

09:00 – Falls es IB bis 09:00 Uhr weiterhin nicht möglich ist, die Aktien auszuleihen, wird das Close-Out bei Handelseröffnung um 09:30 Uhr US Eastern Time eingeleitet. Das Close-Out wird in der TWS-Transaktionsanzeige mit einem indikativen Kurs angezeigt.

09:30 – IB gibt das Close-Out unter Verwendung einer volumengewichteten Durchschnittskurs-Order (VWAP) ein, die für den gesamten Handelstag aktiv ist. Der indikative Kurs, der in der TWS-Transaktionsanzeige angezeigt wird, wird bei Ausführung des Close-Outs auf den tatsächlich erzielten Kurs aktualisiert.

2. Rückruf geliehener Aktien: Sobald ein Leerverkauf abgewickelt wurde (d. h. wenn die Aktien ausgeliehen und für die Leerverkaufslieferung an den Käufer verwendet wurden), hat der Verleiher der Aktien das Recht, diese jederzeit zurückzufordern. Im Falle eines Rückrufs versucht IB, die zuvor ausgeliehenen Aktien durch Aktien eines anderen Verleihers zu ersetzen. Falls keine Aktien ausgeliehen werden können, ist der Verleiher berechtigt, einen formellen Rückruf auszugeben. In diesem Fall erfolgt 3 Geschäftstage nach Ausgabe des Rückrufs ein Buy-In, sofern IB die zurückgeforderten Aktien nicht in der Zwischenzeit an den Verleiher zurückgibt. Der formelle Rückruf ermöglicht dem Verleiher die Option eines Buy-Ins, doch der Anteil an Rückruf-Benachrichtigungen, in deren Folge tatsächlich ein Buy-In erfolgt, ist (in der Regel aufgrund einer günstigen Entwicklung der Leihmöglichkeiten während der folgenden 3 Tage) gering. Angesichts der Menge an formellen Rückrufen, die wir erhalten, die sich aber letztlich nicht entsprechend auswirken, spricht IB keine Vorwarnung an Kunden in Bezug auf solche Rückruf-Benachrichtigungen aus.

Sobald eine Gegenpartei eine Buy-In-Warnung an IB übermittelt, ist diese Gegenpartei berechtigt, jederzeit ein Buy-In der von IB ausgeliehenen Aktien für dieses Handelsdatum durchzuführen. Falls der Rückruf zu einem Buy-In führt, führt der Verleiher die Buy-In-Transaktion aus und benachrichtigt dann IB über den Ausführungskurs. IB überprüft die Angemessenheit der Buy-In-Kurse von Gegenparteien gemessen an der Handelsaktivität des Tages.

IB führt anschließend eine Zuteilung des Buy-Ins auf die betroffenen Kunden durch, basierend auf deren abgewickelten Aktien-Short-Positionen. Nicht abgewickelte Transaktionen werden bei der Ermittlung der Verbindlichkeiten nicht berücksichtigt. Zwangseindeckungen infolge eines Rückrufs werden in der Transaktionsanzeige der TWS sichtbar, sobald sie im Konto verbucht wurden. Eine Intraday-Benachrichtigung wird nach bestem Vermögen bis ca. 17:30 Uhr US Eastern Time versendet.

3. Lieferung schlägt fehl: Eine fehlgeschlagene Lieferung ereignet sich, wenn ein Broker eine Netto-Short-Abwicklungsverpflichtung bei einer Clearingstelle hat und die entsprechenden Aktien weder im eigenen Bestand führt noch diese von einem anderen Broker leihen kann, um seine Lieferverpflichtung zu erfüllen. Die fehlgeschlagene Lieferung resultiert aus Verkaufstransaktionen und ist nicht auf Leerverkäufe beschränkt, sondern kann durch Transaktionen zur Schließung einer auf Margin gehaltenen Long-Position resultieren, die zur Beleihung zugunsten anderer Kunden verfügbar war.

Bei US-amerikanischen Aktien sind Broker verpflichtet, sich um fehlgeschlagene Positionen spätestens zu Beginn der regulären Handelszeiten am nächsten Abwicklungstag zu kümmern. Sie können hierzu beispielsweise Wertpapiere kaufen oder leihen. Falls sich jedoch die verfügbaren Aktien-Leih-Transaktionen als unzureichend zur Erfüllung der Lieferverpflichtung erweisen, schließt IB die Positionen von Kunden, die Short-Positionen der Aktie halten, unter Verwendung einer volumengewichteten Durchschnittskurs-Order (VWAP), die für den gesamten Handelstag aktiv ist.

Wichtige Hinweise:

* Kunden sollten folgendes beachten: An einem Tag, an dem ein Close-Out für Positionen eines Kunden erfolgt ist, muss dieser Kunde bei Handelsschluss - über all seine Konten bei der Gesellschaft hinweg - netto mindestens die Anzahl an Aktien erworben haben, für die das Close-Out erfolgt ist (und es muss das Wertpapier gekauft werden, für das das Close-Out erfolgt ist). Für den verbleibenden Handelstag, an dem das Close-Out erfolgt, ist es dem betroffenen Kunden nicht gestattet, (i) Leerverkäufe über Aktien des Wertpapiers auszuführen, das von dem Close-Out betroffen war, (ii) im Geld liegende Call-Optionen auf die Aktie zu zeichnen, für die das Close-Out erfolgt ist, oder (iii) Put-Optionen auf die Aktie auszuüben, für die das Close-Out erfolgt ist (die „Handelsbeschränkungen“). Falls ein Kunde am Ende des Tages - über alle Konten des Kunden bei der Gesellschaft zusammengenommen - nicht mit einer Netto-Kaufposition über die erforderliche Anzahl an Aktien des Wertpapiers aus dem Handel geht, für das das Close-Out erfolgt ist (zum Beispiel infolge einer Zuteilung für zuvor gezeichnete Call-Optionen), führt die Gesellschaft am nächsten Handelstag für dieses Konto ein weiteres Close-Out über die Anzahl an Aktien durch, die zusammen mit den gesamten Netto-Handelsaktivitäten des vorherigen Close-Out-Datums für dieses Wertpapier die Zahl an Aktien ergibt, die erforderlich gewesen wäre, damit der Kunde die geforderte Netto-Kaufposition erreicht. Es gilt anschließend wiederum die Auflage, dass der Kunde über alle Konten hinweg mit einer Netto-Kaufposition über die entsprechende Anzahl an Aktien aus dem Handel gehen muss und es gelten wiederum die genannten Handelsbeschränkungen für den Rest des Handelstages.

* Kunden sollten beachten, dass es aufgrund der Art und Weise, in der IB Close-Outs durchführen muss und der Art und Weise, in der Drittparteien Buy-Ins durchführen können, zu erheblichen Unterschieden zwischen dem Ausführungskurs der Transaktion und dem Schlusskurs des Vortags kommen kann. Bei illiquiden Wertpapieren können diese Unterschiede besonders ausgeprägt sein. Kunden sollten sich dieser Risiken bewusst sein und ihr Portfolio entsprechend verwalten.

Kunden, die Short-Positionen in Aktien halten, gehen das Risiko ein, dass IB für diese Positionen eine Zwangsliquidierung oder Zwangseindeckung (Close-Out bzw. Buy-In) durchführt. Dies geschieht häufig mit wenig oder keiner Vorwarnung. Dieses Risiko ist ein inhärentes Risiko von Leerverkäufen und entzieht sich weitgehend der Kontrolle des Kunden. Zudem werden die Zeitrahmen, binnen derer die Broker bestimmte Maßnahmen ergreifen müssen, durch aufsichtsrechtliche Vorschriften diktiert.

Buy-Ins und Close-Outs erzielen eine ähnliche Wirkung. Jedoch erfolgt ein Buy-In durch einen Dritten, während ein Close-Out durch IB ausgeführt wird. Diese Maßnahmen resultieren üblicherweise aus einem der drei nachstehenden Ereignisse:

1. Die Aktien, die zur Lieferung benötigt werden, wenn ein Leerverkauf zur Abwicklung kommt, können nicht geliehen werden.

2. Die Aktien, die ausgeliehen und zur Abwicklung geliefert wurden, werden später zurückgefordert.

3. Die Lieferung bei der Clearingstelle schlägt fehl.

Im Folgenden erhalten Sie einen Überblick über diese drei möglichen Ereignisse und ihre Implikationen.

Überblick über Buy-In-/Close-Out-Ereignisse

1. Leerverkauf kommt zur Abwicklung: Wenn Aktien leer verkauft werden, muss der Broker dafür sorgen, dass die Aktien rechtzeitig zum Zeitpunkt der Abwicklung der Transaktion ausgeliehen werden. Im Falle von US-amerikanischen Wertpapieren ist dieser Zeitpunkt der dritte Geschäftstag nach Abschluss der Transaktion (T+3). Vor der Ausführung des Leerverkaufs muss der Broker in gutem Glauben eine Einschätzung treffen, ob die entsprechenden Aktien wahrscheinlich zur Leihe verfügbar sind, wenn sie benötigt werden. Diese Einschätzung wird auf Basis der Verfügbarkeit der Aktien zum Zeitpunkt der Entscheidung getroffen. Bitte beachten Sie: Sofern keine Pre-Borrow-Vereinbarung getroffen wurde, besteht keine Gewähr, dass die Aktien, die am Tag der Transaktionsausführung zur Leihe zur Verfügung stehen, auch drei Tage später noch verfügbar sind. Falls dies nicht der Fall ist, erfolgt eine Zwangsauflösung des Leerverkaufs. Für die Entscheidung über die Durchführung einer Zwangsauflösung gelten folgende Fristen:

T+3 (alle Zeitangaben basieren auf der Zeitzone US Eastern Time)

14:30 - Falls es IB bis zu diesem Zeitpunkt noch nicht möglich war, die Aktien für die Abwicklung auszuleihen, und mit hoher Wahrscheinlichkeit zu erwarten ist, dass dies auch bis zur Abwicklung nicht möglich sein wird, wird nach bestem Vermögen eine Mitteilung gesendet, um den Kunden über das mögliche Close-Out zu informieren. Der Kunde hat nun bis zum Ende der verlängerten Handelszeiten an diesem Tag Zeit, die betreffende(n) Short-Position(en) selbst zu schließen, um eine Zwangsauflösung zu vermeiden. Falls es IB innerhalb dieses Zeitraums gelingt, die Aktien auszuleihen, bemüht sich IB, den Kunden entsprechend in Kenntnis zu setzen.

15:15 – Es wird nach bestem Vermögen eine weitere Benachrichtigung an den Kunden versendet, falls dieser die Short-Position(en) noch nicht geschlossen und IB die Aktien noch nicht erfolgreich ausgeliehen hat. Der Kunde hat weiterhin bis zum Ende der erweiterten Handelszeiten dieses Tages die Möglichkeit, die Short-Position(en) selbst zu schließen, um eine Zwangsauflösung zu vermeiden.

16:50 – Falls es IB nicht gelungen ist, die Aktien für die Abwicklung auszuleihen, wird der Kunde nach bestem Vermögen von IB benachrichtigt, dass ein letzter Versuch bis 09:00 Uhr T+4 unternommen wird, falls es IB nicht möglich sein sollte, die Aktien bis Handelsschluss T+3 auszuleihen.

T+4

09:00 – Falls es IB bis 09:00 Uhr weiterhin nicht möglich ist, die Aktien auszuleihen, wird das Close-Out bei Handelseröffnung um 09:30 Uhr US Eastern Time eingeleitet. Das Close-Out wird in der TWS-Transaktionsanzeige mit einem indikativen Kurs angezeigt.

09:30 – IB gibt das Close-Out unter Verwendung einer volumengewichteten Durchschnittskurs-Order (VWAP) ein, die für den gesamten Handelstag aktiv ist. Der indikative Kurs, der in der TWS-Transaktionsanzeige angezeigt wird, wird bei Ausführung des Close-Outs auf den tatsächlich erzielten Kurs aktualisiert.

2. Rückruf geliehener Aktien: Sobald ein Leerverkauf abgewickelt wurde (d. h. wenn die Aktien ausgeliehen und für die Leerverkaufslieferung an den Käufer verwendet wurden), hat der Verleiher der Aktien das Recht, diese jederzeit zurückzufordern. Im Falle eines Rückrufs versucht IB, die zuvor ausgeliehenen Aktien durch Aktien eines anderen Verleihers zu ersetzen. Falls keine Aktien ausgeliehen werden können, ist der Verleiher berechtigt, einen formellen Rückruf auszugeben. In diesem Fall erfolgt 3 Geschäftstage nach Ausgabe des Rückrufs ein Buy-In, sofern IB die zurückgeforderten Aktien nicht in der Zwischenzeit an den Verleiher zurückgibt. Der formelle Rückruf ermöglicht dem Verleiher die Option eines Buy-Ins, doch der Anteil an Rückruf-Benachrichtigungen, in deren Folge tatsächlich ein Buy-In erfolgt, ist (in der Regel aufgrund einer günstigen Entwicklung der Leihmöglichkeiten während der folgenden 3 Tage) gering. Angesichts der Menge an formellen Rückrufen, die wir erhalten, die sich aber letztlich nicht entsprechend auswirken, spricht IB keine Vorwarnung an Kunden in Bezug auf solche Rückruf-Benachrichtigungen aus.

Sobald eine Gegenpartei eine Buy-In-Warnung an IB übermittelt, ist diese Gegenpartei berechtigt, jederzeit ein Buy-In der von IB ausgeliehenen Aktien für dieses Handelsdatum durchzuführen. Falls der Rückruf zu einem Buy-In führt, führt der Verleiher die Buy-In-Transaktion aus und benachrichtigt dann IB über den Ausführungskurs. IB überprüft die Angemessenheit der Buy-In-Kurse von Gegenparteien gemessen an der Handelsaktivität des Tages.

3. Lieferung schlägt fehl: Eine fehlgeschlagene Lieferung ereignet sich, wenn ein Broker eine Netto-Short-Abwicklungsverpflichtung bei einer Clearingstelle hat und die entsprechenden Aktien weder im eigenen Bestand führt noch diese von einem anderen Broker leihen kann, um seine Lieferverpflichtung zu erfüllen. Die fehlgeschlagene Lieferung resultiert aus Verkaufstransaktionen und ist nicht auf Leerverkäufe beschränkt, sondern kann durch Transaktionen zur Schließung einer auf Margin gehaltenen Long-Position resultieren, die zur Beleihung zugunsten anderer Kunden verfügbar war.

Bei US-amerikanischen Aktien sind Broker verpflichtet, sich um fehlgeschlagene Positionen spätestens zu Beginn der regulären Handelszeiten am nächsten Abwicklungstag zu kümmern. Sie können hierzu beispielsweise Wertpapiere kaufen oder leihen. Falls sich jedoch die verfügbaren Aktien-Leih-Transaktionen als unzureichend zur Erfüllung der Lieferverpflichtung erweisen, schließt IB die Positionen von Kunden, die Short-Positionen der Aktie halten, unter Verwendung einer volumengewichteten Durchschnittskurs-Order (VWAP), die für den gesamten Handelstag aktiv ist.

Wichtige Hinweise:

* Kunden sollten folgendes beachten: An einem Tag, an dem ein Close-Out für Positionen eines Kunden erfolgt ist, muss dieser Kunde bei Handelsschluss - über all seine Konten bei der Gesellschaft hinweg - netto mindestens die Anzahl an Aktien erworben haben, für die das Close-Out erfolgt ist (und es muss das Wertpapier gekauft werden, für das das Close-Out erfolgt ist). Für den verbleibenden Handelstag, an dem das Close-Out erfolgt, ist es dem betroffenen Kunden nicht gestattet, (i) Leerverkäufe über Aktien des Wertpapiers auszuführen, das von dem Close-Out betroffen war, (ii) im Geld liegende Call-Optionen auf die Aktie zu zeichnen, für die das Close-Out erfolgt ist, oder (iii) Put-Optionen auf die Aktie auszuüben, für die das Close-Out erfolgt ist (die „Handelsbeschränkungen“). Falls ein Kunde am Ende des Tages - über alle Konten des Kunden bei der Gesellschaft zusammengenommen - nicht mit einer Netto-Kaufposition über die erforderliche Anzahl an Aktien des Wertpapiers aus dem Handel geht, für das das Close-Out erfolgt ist (zum Beispiel infolge einer Zuteilung für zuvor gezeichnete Call-Optionen), führt die Gesellschaft am nächsten Handelstag für dieses Konto ein weiteres Close-Out über die Anzahl an Aktien durch, die zusammen mit den gesamten Netto-Handelsaktivitäten des vorherigen Close-Out-Datums für dieses Wertpapier die Zahl an Aktien ergibt, die erforderlich gewesen wäre, damit der Kunde die geforderte Netto-Kaufposition erreicht. Es gilt anschließend wiederum die Auflage, dass der Kunde über alle Konten hinweg mit einer Netto-Kaufposition über die entsprechende Anzahl an Aktien aus dem Handel gehen muss und es gelten wiederum die genannten Handelsbeschränkungen für den Rest des Handelstages.

* Kunden sollten beachten, dass es aufgrund der Art und Weise, in der IB Close-Outs durchführen muss und der Art und Weise, in der Drittparteien Buy-Ins durchführen können, zu erheblichen Unterschieden zwischen dem Ausführungskurs der Transaktion und dem Schlusskurs des Vortags kommen kann. Bei illiquiden Wertpapieren können diese Unterschiede besonders ausgeprägt sein. Kunden sollten sich dieser Risiken bewusst sein und ihr Portfolio entsprechend verwalten.

Monitoring Stock Loan Availability

IBKR provides a variety of methods to assist account holders engaged in short selling with monitoring inventory levels and borrow costs/rebates. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below.

Public Website

Interested parties may query the IBKR website for stock loan data. To start, click here and scroll down to the section titled "Stocks Available". Click the section to expand it and select the country in which the stock is listed. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. A quick search box allowing direct query for a given symbol is also provided. Query results include the product description, currency of denomination and a link titled “Check Availability” which displays the quantity of shares available to borrow upon entering your login credentials.

Public FTP

Windows

Windows Explorer

- Open windows explorer (Start > Computer)

- With "Computer" selected on the left, right click an empty space on the right side of the window and choose “Add a network location”

- When the wizard prompts for a network address, enter “ftp://shortstock: @ftp2.interactivebrokers.com” and press next

- Give the connection a name of your choosing and press next

- File explorer should now open and display all of the files in the ftp location.

Command Prompt

- Go to Start > Windows System > Command Prompt

- Type "ftp" and press enter (the prompt will change to an ftp> prompt)

- Type “open ftp2.interactivebrokers.com”

- When prompted, enter the username “shortstock” and leave the password empty.

- Use the “dir” command to show the files in the directory

- Use the “get filename.txt” to retrieve the desired file

MacOS

- Open Finder

- From the “Go” menu choose “Connect to Server”

- Enter “ftp://shortstock: @ftp2.interactivebrokers.com” and press the + button to add to your favorites.

- Click “Connect”

- If prompted, the username should be “shortstock” and the password should be left empty.

- Click "Connect"

- If all steps were done correctly the finder window should display all of the files in the ftp location.

Linux

Terminal

- Open a Terminal window

- Type “ftp shortstock@ftp2.interactivebrokers.com”

- When prompted for a password, press enter

- Type “ls” to list the contents of the ftp location

- Type “get filename.txt” to get the desired file.

- Type “bye” to end the ftp session

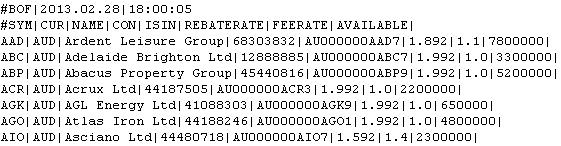

Outlined below is a snapshot of the sample file output which includes the stock symbol, currency of denomination, name, contract identifiers (IBKR’s and the ISIN), fee rates and shares available. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes.

Short Stock Availability (SLB) Tool

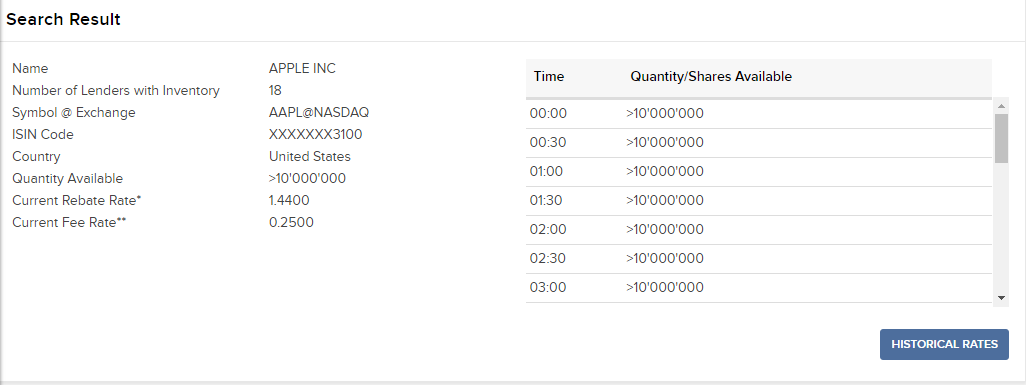

The SLB tool is available to IBKR account holders through Client Portal. Log in and select the Support section and then select Short Stock (SLB) Availability. This tool allows one to query information on a single stock as well as at a bulk level. Single stock searches can be performed by symbol/exchange, ISIN or CUSIP numbers. At the single security level, query results include the quantity available and number of lenders (note that a negative rebate rate infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold). Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available.

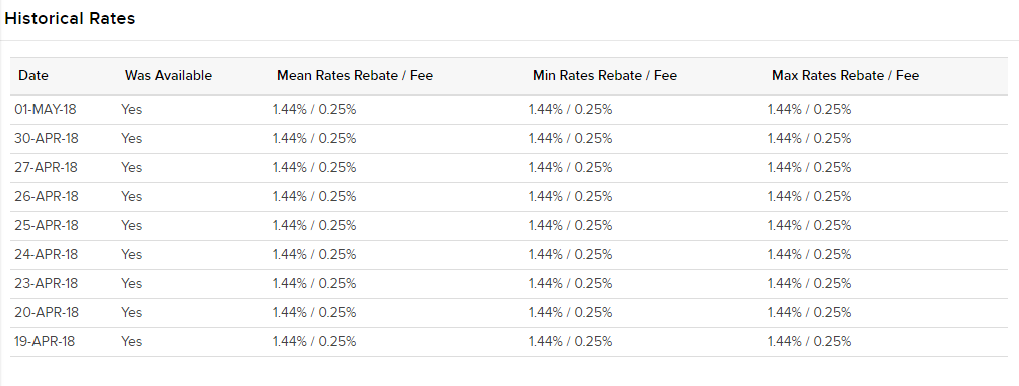

In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day.

This tool also allows one to upload a text file (with symbol/exchange or ISIN detail) and search for availability of multiple stocks in bulk within a single query. These bulk requests will then generate a .CSV file similar to the sample file output made available through the public FTP site.

Hong Kong Short Reporting Obligations

Overview

- Hong Kong regulations now require beneficial owners of shares in selected HK listed stocks to report each week short positions that exceed the threshold of HKD 30 million or 0.02% of market capitalization on the constituent stocks of the Hang Seng Index, the Hang Seng China Enterprises Index and other financial companies specified by the SFC. A list of affected of stocks can be found here:

http://www.sfc.hk/sfc/html/EN/research/short-position-reporting/specified-shares.html

- Investors with applicable positions should register directly with the SFC. Registration and guidance on the registration process can be found here.

- Reporting is expected on a weekly basis, but the second business day of the following week.

- Links for the registering and reporting can be found here:

https://portal.sfc.hk/dsp/gateway/welcome?locale=en

Guidelines, Instructions and FAQ's:

SFC announcement with links to legislation

Short position forms, guidelines, reference material and list of specified shares

Link to subscribe to SFC alert service (choose Short Position Reporting Related Matters)

For further details, please refer to the SFC website: www.sfc.hk and/or contact them via email with specific questions at shortpositions@sfc.hk

IBKR Stock Yield Enhancement Program

PROGRAM OVERVIEW

The Stock Yield Enhancement Program provides the opportunity to earn extra income on the fully-paid shares of stock held in your account by allowing IBKR to borrow shares from you in exchange for collateral (either U.S. Treasuries or cash), and then lend the shares to traders who want to sell them short and are willing to pay interest to borrow them. For additional information on the Stock Yield Enhancement Program please see here or review the Frequently Asked Questions page.

HOW TO ENROLL IN THE STOCK YIELD ENHANCEMENT PROGRAM

To enroll, please login to the Client Portal. Once logged in, click the User menu (head and shoulders icon in the top right corner) followed by Settings.

In the Trading section of the Settings page, click the link for the Stock Yield Enhancement Program. Select the checkbox on the next screen and click Continue. You will then be presented with the requisite forms and disclosures needed to enroll in the program. Once you have reviewed and signed the forms, your request will be submitted for processing. Please allow 24-48 hours for enrollment to become active.

.png)

.png)