關于盈透證券價格限制通知的披露

監管部門期望經紀公司能采取控制措施防止將具有擾亂市場風險(如突然的價格波動)的委托單提交到市場中心。

爲此,盈透證券對客戶委托單設置了多項價格篩選條件。該等價格篩選條件某些情况下會對客戶委托單施以價格限制以避免對市場造成干擾,而該等價格限制通常是IB計算得出的參考價格基礎上的一個%浮動範圍(價格限制的範圍取决于金融産品的類型及其當前價格)。

儘管價格限制是爲了在追求交易確定性和最小化價格風險之間尋求平衡,但其可能會導致交易延遲或無法成交。更多信息請參見盈透證券的委托單傳遞和定單流收入披露。

如果客戶的委托單被IB的系統施加了價格限制,則客戶會 (i) 在TWS中或通過API或FIX標簽58(對于FIX用戶)收到價格限制的實時通知;幷/或 (ii) 收到每日FYI消息,其中會列出前一日被施加了價格限制的前10筆委托單,包括該等委托單的初步價格限制(如有)和進一步價格限制的限制範圍。

客戶可以點擊FYI消息中的退訂鏈接選擇不再接受此類FYI消息。選擇退訂此類FYI消息即表示客戶:

- 同意不再接收盈透證券發出的任何關于對客戶委托單應用了價格限制的通知;幷且

- 確認客戶已經瞭解,客戶的委托單未來可能會被施加價格限制,但客戶不想再就其委托單被施加了價格限制收到任何通知。

OTC市場(微型市值股票)——美國證監會(SEC)規則15c2-11變更

- 仍然處于OTCQX、OTCQB和Pink Current市場層次的證券不會發生改變。

- 許多股票被移到Pink Limited和Expert層次,幷被OTC市場指定爲“僅限主動提供報價”。客戶可以在綫下單平倉該等倉位。無論是在綫方式還是電話聯繫都不再接受該等倉位的開倉委托單。

- 灰色市場層次的證券不允許非公開報價。

美國微型市值股票限制

簡介

爲遵守非注册證券賣出相關法規、最小化非公開報價證券交易過程中的人工處理,IBKR對美國微型市值股票實施了一定限制。下方列出了該等限制以及與此話題相關的其它常見問題。

微型市值股票限制

- IBKR將只接受來自符合條件之客戶的美國微型市值股票轉帳。符合條件的客戶包括:(1) 資産(轉帳前或轉帳後)不低于500萬美元的賬戶,或資産規模不低于2000萬美元的財務顧問的客戶;幷且(2) 美國微型市值股票投資占比不到其賬戶資産的一半。

- IBKR將只接受符合條件的客戶能够確認股票系從公開市場買入或已在美國證監會(SEC)進行過注册的美國微型市值股票的大宗轉帳1;

- IBKR不接受客戶被OTC標記爲“買者自負”或“灰色市場”的美國微型市值股票轉帳1或開倉委托單。持有該等股票倉位的客戶可以進行平倉;

- IBKR不接受爲了回補在IBKR的空頭倉位而進行的美國微型市值股票轉帳;

- 僅執行客戶(即只通過IBKR執行交易,但在別處清算)不能在其IBKR賬戶中交易美國微型市值股票。(IBKR可對在美國注册的經紀商例外對待);

微型市值股票常見問題

什麽是美國微型市值股票?

“微型市值股票”是指市值介于5000萬美元到3億美元之間幷且價格低于5美元一股的(1) 場外交易股票或(2) Nasdaq和NYSE American挂牌股票。就該政策而言,微型市值股票包括市值等于或低于5000萬美元的美國上市公司股票,這種股票有時也被稱爲納級股或者是在與微型市值股票相關的市場上交易。

爲避免股價短期小幅波動導致股票被反復重新分類,所有被分類爲美國微型市值股的股票只有在其市值和股價連續30天均分別超過5億美元和5美元的情况下才會重新分類。

微型市值股票通常股價很低,常常被稱爲仙股。IBKR也可設置例外,包括對股價低但近期市值上漲的股票。此外,IBKR不會將非美國公司的ADR視作微型市值股票。

微型市值股票在哪裏交易?

微型市值股票通常在OTC市場而非全國性證券交易所交易。其通常由做市商在OTC系統(如OTCBB)和OTC Markets Group管理的市場(如OTCQX、OTCQB和Pink)以電子方式報價。該類別下還包含非公開報價的股票和被指定爲“買者自負”、其它OTC或“灰色市場”的股票。

此外,美國監管部門也將在Nasdaq和NYSE American挂牌、價格等于或低于5美元一股且市值等于或低于3億美元的股票視爲微型市值股票。

如果IBKR收到來自符合條件之客戶的轉倉,其中一個或多個倉位是微型市值股票,會怎麽樣?

如果IBKR收到包含微型市值股票的轉倉,IBKR有權限制其中任何微型市值股票倉位的賣出,除非符合條件的客戶能够提供適當的文件證明該等股票系在公開市場買入(即通過其它經紀商在交易所買入)或者該等股票已經根據S-1或類似股票注册聲明表在美國證監會進行過注册。

符合條件的客戶可以通過提供經紀商給出的能够反映股票買入交易的經紀報表或交易確認來證明股票確實是在公開市場上買入。符合條件的客戶也可以通過提供其股票在美國證監會(Edgar系統)進行注册的備案號(以及任何可證明股票就是注册聲明上所列股票的文件)來證明股票已經過注册。

注意:所有客戶隨時都可轉出我們對其實施了限制的股票。

IBKR對主經紀賬戶有什麽限制?

活動包含主經紀服務的客戶只在IBKR同意接受的來自其執行經紀商的交易方面被視爲符合條件的客戶。然而,儘管主經紀賬戶可以在IBKR清算美國微型市值股票,但在IBKR確認股票根據上述程序可以賣出之前,相關股票將受到限制。

要爲在公開市場上買入的股票移除限制,請讓執行經紀商提供有公司抬頭的簽字函件或正式賬戶報表,證明股票系從公開市場買入。提供的函件或報表必須包含以下信息。如果股票是通過發行取得,則函件必須提供相關注册聲明文件或鏈接幷說明該等股票是發行股票的一部分。

經紀商函件必須包含的信息:

1) IBKR賬戶號碼

2) IBKR賬戶名稱

3) 交易日期

4) 結算日期

5) 代碼

6) 買賣方向

7) 價格

8) 數量

9) 執行時間

10) 交易所

11) 必須有簽字

12) 必須有公司正式抬頭

簡而言之:如果多頭倉位不再受到限制則可以接受賣出多頭交易。賣出空頭交易可以接受。買入多頭交易可以接受,但倉位將被限制,直到向合規部門提供足够資料將限制移除。不接受買入補倉交易和日內軋平交易。

如果您買入的股票被重新分類爲“灰色市場”或“買者自負”股票怎麽辦?

如果您在IBKR賬戶中買入的股票之後被分類爲“買者自負”或“灰色市場”股票,您將可以繼續持有倉位、平倉或轉倉,但無法增加持倉。

我賬戶中微型市值股票交易受到限制的原因是什麽?

您被限制交易微型市值股票的主要原因有兩個:

- 與發行方存在潜在關聯:美國證監會規則144對發行人的關聯方交易股票(包括微型市值股票)有一定限制。如果IBKR發現微型市值股票交易活動或持倉接近規則144規定的交易量閾值(“規則144閾值”),則IBKR會限制客戶交易該微型市值股票,直到完成合規審查。

- 微型市值股票轉倉:如果客戶近期將微型市值股票轉入其IBKR賬戶,IBKR會限制客戶交易該證券,直到完成合規審查。

如果符合其中一種情况,相關證券交易會受到限制,客戶會在賬戶管理的消息中心下收到相應通知。該通知將說明限制的原因以及客戶爲了解除限制必須采取的措施。

爲什麽IBKR將我視爲微型市值股票發行方的潜在關聯方?

“關聯方”是與發行方存在控制關係的人士,如執行官、董事或大股東。

規則144適用于包括微型市值股票在內的所有證券。但是,鑒于交易微型市值股票涉及高風險,如果客戶的微型市值股交易和/或持倉接近規則144閾值,IBKR將限制客戶交易該微型市值股票。 該等限制在合規對客戶的潜在關聯方身份進行審核幷作出决定之前將保持生效。

對于潜在關聯方審核,爲什麽我需要要求每兩周進行一次新的審核?

客戶的關聯方身份可能會在IBKR完成上述潜在關聯方審核後很快發生變化。因此,IBKR認爲如果客戶的的微型市值股交易和/或持倉仍然接近規則144閾值,每兩周刷新一下潜在關聯方審核較爲合適。

哪裏可以查看IBKR指定爲美國微型市值股的股票列表?

請打開以下鏈接:www.ibkr.com/download/us_microcaps.csv

請注意,此列表每日更新。

哪裏可以瞭解更多有關微型市值股票的信息?

有關微型市值股票的更多信息,包括其相關風險,請參見美國證監會網站:https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1包括任何方式的轉帳(如ACATS、DWAC、FOP)、通過“南向(Southbound)”轉帳將加拿大挂牌股票轉成美國股票的轉換、爲回補空頭倉位進行的轉帳、在其它經紀商執行但在IBKR清算的IB主經紀服務客戶等。

小數股交易

小數股交易可供您投資那些您可能沒有足够資金購買一整股股票的公司。從前沒有小數股交易時您可能只能買入一兩家公司的股票,現在却能將資金分散到更多公司,從而更加輕鬆地實現投資組合多元化。

如果您的賬戶啓用了小數股交易功能,我們會根據您指定的現金金額買入或賣出不足整股的股票。例如,如果您想投資500美元,而您想買入的股票當前是1000美元一股,那麽您最後會買到0.5股。

誰可以申請小數股交易許可?

所有個人、獨立賬戶(但居住在以色列的人士、加拿大RRSP/TFSA賬戶和盈透證券日本有限公司實體賬戶除外)均可以申請小數股交易許可。

財務顧問、資金經理和介紹經紀商可以選擇給所有客戶啓用,或者所有客戶均不啓用。

如何啓用小數股交易?

如果符合條件,則您可以在客戶端中啓用小數股交易。依次點擊“使用者”菜單(右上角的小人圖標)和“設置”。在“賬戶設置”下找到“交易”部分,點擊“交易許可”。下拉到“股票”,點擊“+添加”然後勾選“全球(小股數交易)”旁的複選框,點擊“保存”。然後點擊“繼續”,按屏幕提示操作。 之後您便可以就您已有相關交易許可的符合條件的股票進行小數股交易了。要就符合條件的美國股票進行小數股交易,您需要有美國股票交易許可;要就符合條件的歐洲股票進行小數股交易,您需要有歐洲股票交易許可。

請注意,交易小數股需要TWS 979或以上版本。該功能目前支持大多數委托單類型。

什麽産品可支持小數股交易?

我們現在針對符合條件的美國和歐洲股票與ETF支持小數股交易。*

您可點擊下方鏈接查看支持小數股交易的股票列表。請注意,該列表可能會在無事先通知的情况下發生調整:

http://www.ibkr.com/download/fracshare_stk.csv

*根據歐盟法規,歐盟零售客戶一般不能就美國ETF進行小數股交易。

可以賣空小數股嗎?

只要您有保證金幷且有美國或歐洲挂牌股票的小數股交易許可,IBKR便可支持您對符合條件的股票進行小數股賣空。

小數股交易有什麽費用?

使用小數股交易沒有額外費用。只收取標準傭金(IBKR Lite版和IBKR Pro版)。

小數股交易可以使用哪些委托單類型?

對于小數股交易,IBKR只接受部分委托單類型(如市價單、限價單、止損單、止損限價單等)。如果您選擇下達一個含小數股的非適銷(當前無法成交)限價單,小數股部分只有在整個委托單都適銷(可以成交)的情况下才會執行(因此可能完全不會執行),儘管如果股數是整數,委托單可能會更早執行。

IBKR如何處理歐洲股票的小數股委托單?

取决于委托單的交易數量和屬性,IBKR會將含小數股的歐洲股票委托單傳遞至由多個執行目的地組成的池子,這與其它委托單類型使用的有所不同。您應查看適用的委托單執行政策瞭解更多詳細信息。

我可以向IBKR轉帳小數股嗎?

IBKR不接受通過轉倉轉入小數股。

小數股可以參加股息再投資項目(DRIP)嗎?

目前通過DRIP再投資的股息無法接收小數股。希望未來可以實現。

請注意,上方表述不適用于共同基金股息,共同基金的股息再投資之後可能會産生小數份額。

我會從公司行動中收到小數股倉位嗎?

如果您的賬戶獲批可以進行小數股交易幷且美國或歐洲公司行動發行了小數股,則小數股會留在您的賬戶中。但是,如果您的賬戶沒有小數股交易許可或者公司行動發行的是不符合小數股條件的股票,則小數股會被平掉。

我賬戶中持有的小數股有投票權嗎?

您賬戶中持有的小數股沒有投票權,您也無法就該等小數股的任何公司行動(包括但不限于要約收購或認股權配售)進行自主選擇,幷且我們也無法就小于一股的持倉爲您提供任何其它股東文件。

小數股有股息嗎?

您的小數股倉位與整股倉位一樣有股息。

通過API可以進行小數股交易嗎?

目前FIX/CTCI支持小數股交易,但API尚不支持。

IBKR股票收益提升計劃

計劃概覽

股票收益提升計劃(Stock Yield Enhancement Program)讓客戶有機會用賬戶中全額支付的股票賺取額外收益。該計劃允許IBKR通過抵押(美國國債或現金)從您那裡借入股票,然後將股票借給希望做空股票並願意支付借券利息的交易者。有關股票收益提升計劃的更多信息,請參見此處或查看常見問題頁面。

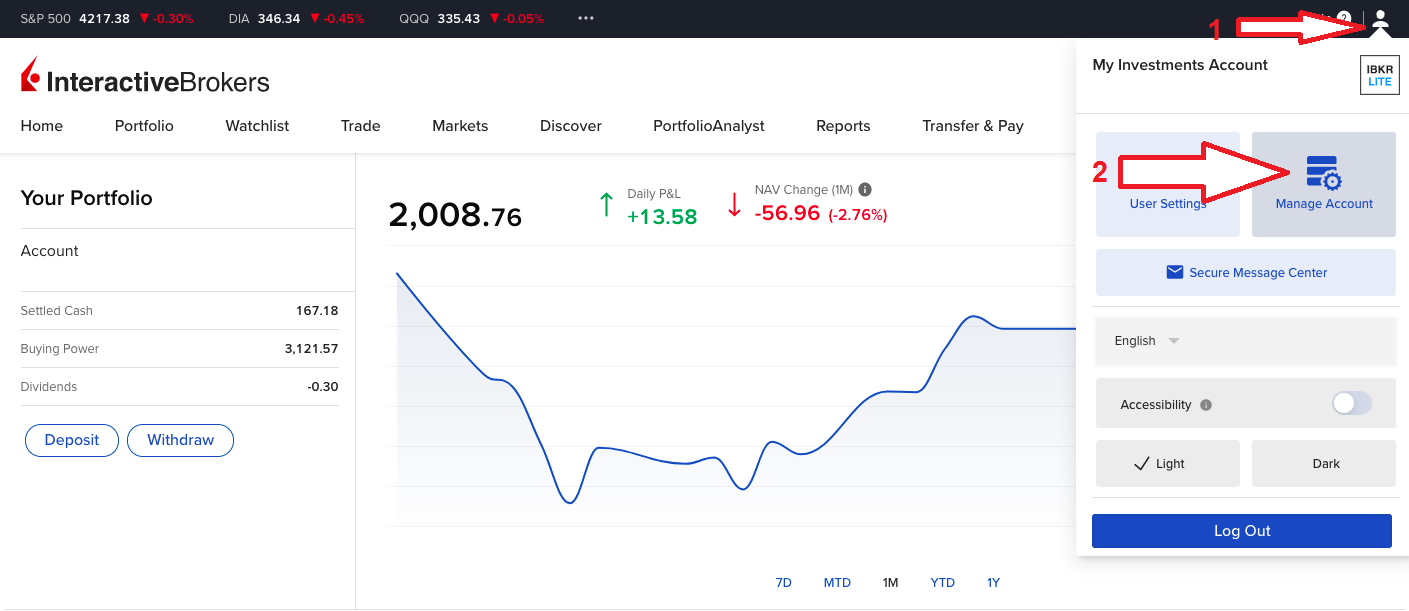

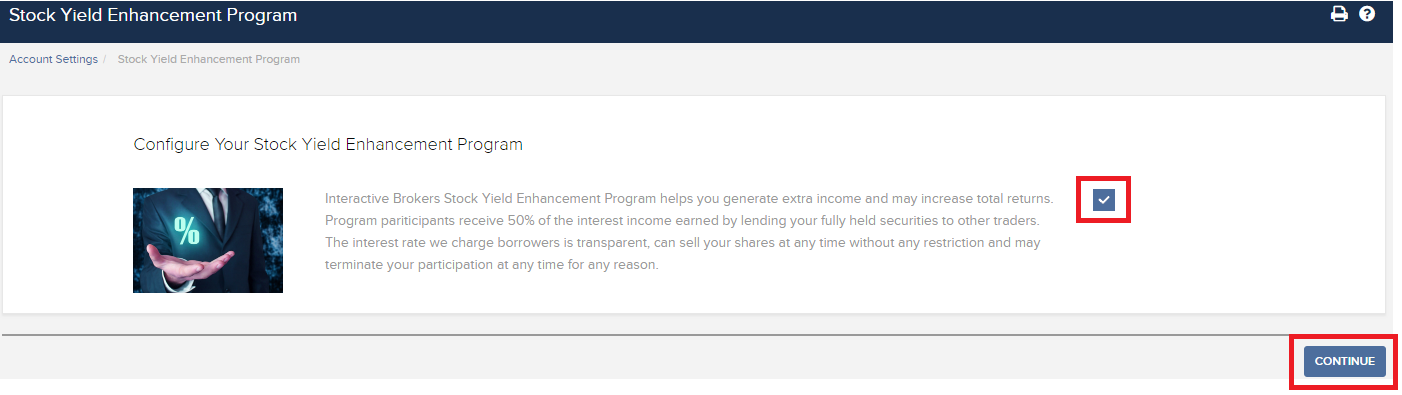

要參加計劃,請登錄客戶端。登錄後,點擊使用者菜單(右上角的頭像圖標),然後點擊管理賬戶。在配置部分,點擊股票收益提升計劃旁邊的配置(齒輪)圖標。在下一個界面勾選複選框然後點擊繼續。您將會看到參加計劃必需的表格和披露。查看並簽署表格後,您的申請便會提交處理。需要24到48小時才會激活生效。

.png)

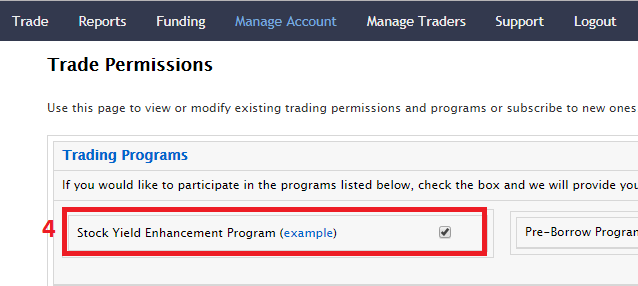

For enrollment via Classic Account Management, please click on the below buttons in the order specified.

OTC Market (Microcap Stock) – Changes to SEC Rule 15c2-11

- No change is anticipated for securities that remain classified in the OTCQX, OTCQB, or Pink Current market tiers.

- Many stocks are being moved to the Pink Limited and Expert Tier and designated by OTC Markets as “unsolicited quotes only.” Clients can close these positions by placing orders online. Opening orders in these positions cannot be accepted online or by phone.

- No public quotations are permitted for securities classified in the Grey market tier.

什麼是特殊備忘錄賬(SMA)?如何使用?

特殊備忘錄賬(SMA)表示的不是賬戶資金或現金,而是在Reg. T保證金賬戶內證券市場價值上升時產生的信用額度。其目的是為了維護未實現盈利對於後續交易所能提供的購買力,如果沒有這種處理,購買力只有通過取出多餘資金然後在要進行後續買入時再存入賬戶才能確定。從這個角度來說,SMA有助於維持賬戶價值穩定、盡可能減少非必要的資金轉帳。

SMA會隨著證券價值上升而增加,但如果證券價值下跌,SMA並不會減少。SMA只有在買入證券和取款時才會減少,使用SMA唯一的限制是證券買入和取款不能讓賬戶資產低於維持保證金要求。可增加SMA的項目包括現金存款、收到利息或股息(等額方式)和證券賣出(淨收入的50%)。請注意,SMA餘額表示的是開戶以來每條會造成SMA水平變化的歷史帳目的總和。考慮到時間跨度和其中包含的帳目數量,從每日活動報表中總結出當前的SMA水平雖然可行,但卻不太現實。

要說明SMA是如何運作的,我們先假設賬戶持有人存入了$5,000美元,然後買了$10,000美元的證券,貸款50%(保證金要求等於1 – 貸款比例,也就是50%)。前後的賬戶相關數值如下:

|

項目

|

描述

|

事件1 - 首次存款

|

事件2 - 買入股票

|

|

A.

|

現金

|

$5,000

|

($5,000)

|

|

B.

|

多頭股票市場價值

|

$0

|

$10,000

|

|

C.

|

淨清算價值/含貸款價值* (A + B)

|

$5,000

|

$5,000

|

|

D.

|

初始保證金要求 (B * 50%)

|

$0

|

$5,000

|

|

E

|

可用資金 (C - D)

|

$5,000

|

$0

|

|

F.

|

SMA

|

$5,000

|

$0

|

|

G.

|

購買力

|

$10,000

|

$0

|

接下來,假設多頭股票市場價值上漲至$12,000美元。$2,000美元的漲幅可產生$1,000美元的SMA,可供賬戶持有人:1) 在無需額外存入資金的情況下再買價值$2,000美元的證券,保證金貸款比率50%;或 2) 取出$1,000美元現金,如果賬戶沒有現金,這$1,000美元將記入賬戶的貸款餘額。見下表:

|

項目

|

描述

|

事件2 – 買入股票

|

事件3 - 股票升值

|

|

A.

|

現金

|

($5,000)

|

($5,000)

|

|

B.

|

多頭股票市場價值

|

$10,000

|

$12,000

|

|

C.

|

淨清算價值/含貸款價值* (A + B)

|

$5,000

|

$7,000

|

|

D.

|

初始保證金要求 (B * 50%)

|

$5,000

|

$6,000

|

|

E

|

可用資金 (C - D)

|

$0

|

$1,000

|

|

F.

|

SMA

|

$0

|

$1,000

|

|

G.

|

購買力

|

$0

|

$2,000

|

*含貸款價值英文縮寫為EWL,在此例中,等於淨清算價值。

最後,請注意,SMA只是一個用以衡量IB LLC下證券賬戶是否符合隔夜初始保證金要求的Reg. T概念,我們並不會用SMA來決定賬戶是否符合日內或隔夜維持保證金要求,也不會用它來決定商品賬戶是否符合保證金要求。同樣,如果賬戶在隔夜或Reg.T初始保證金要求開始實施生效時(美國東部時間15:50)SMA為負值,則會面臨強制平倉清算以滿足保證金要求。

股票收益提升計劃(SYEP)常見問題

股票收益提升計劃推出的目的是什麽?

股票收益提升計劃可供客戶通過允許IBKR將其賬戶內原本閑置的證券頭寸(即全額支付和超額保證金證券)出借給第三方來賺取額外收益。參與此計劃的客戶會收到用以確保股票在借貸終止時順利歸還的抵押(美國國債或現金)。

什麽是全額支付和超額保證金證券?

全額支付證券是客戶賬戶中全款付清的證券。超額保證金證券是雖然沒有全款付清但本身市場價值已超過保證金貸款餘額的140%的證券。

客戶股票收益提升計劃的借出交易收益如何計算?

客戶借出股票的收益取决于場外證券借貸市場的借貸利率。借出的股票不同,出借的日期不同,都會對借貸利率造成很大差异。通常,IBKR會按自己借出股票所得金額的大約50%向參與計劃的客戶支付利息。

借貸交易的抵押金額如何確定?

證券借貸的抵押(美國國債或現金)金額採用行業慣例確定,即用股票的收盤價乘以特定百分比(通常爲102-105%),然後向上取整到最近的美元/分。每個幣種的行業慣例不同。例如,借出100股收盤價爲$59.24美元的美元計價股票,現金抵押應爲$6,100 ($59.24 * 1.02 = $60.4248;取整到$61,再乘以100)。下表爲各個幣種的行業慣例:

| 美元 | 102%;向上取整到最近的元 |

| 加元 | 102%;向上取整到最近的元 |

| 歐元 | 105%;向上取整到最近的分 |

| 瑞士法郎 | 105%;向上取整到最近的生丁 |

| 英鎊 | 105%;向上取整到最近的便士 |

| 港幣 | 105%;向上取整到最近的分 |

更多信息,請參見KB1146。

股票收益提升計劃下的抵押如何保管以及保管在何處?

對於IBLLC的客戶,抵押將採用現金或美國國債的形式,並將轉入IBLLC的聯營公司IBKR Securities Services LLC (“IBKRSS”)進行保管。您在該計劃下借出股票的抵押會由IBKRSS以您爲受益人保管在一個賬戶中,您將享有第一優先級擔保權益。如果IBLLC違約,您將可以直接從IBKRSS取得抵押,無需經過IBLLC。請參見 此處的《證券賬戶控制協議》瞭解更多信息。對于非IBLLC的客戶,抵押將由賬戶所在實體保管。例如,IBIE的賬戶其抵押將由IBIE保管。

退出IBKR股票收益提升計劃或賣出/轉帳通過此計劃借出的股票會對利息造成什麽影響?

交易日的下一個工作日(T+1)停止計息。對於轉帳或退出計劃,利息也會在發起轉帳或退出計劃的下一個工作日停止計算。

參加IBKR股票收益提升計劃有什麽資格要求?

| 可參加股票收益提升計劃的實體* |

| 盈透證券有限公司(IB LLC) |

| 盈透證券英國有限公司(IB UK)(SIPP賬戶除外) |

| 盈透證券愛爾蘭有限公司(IB IE) |

| 盈透證券中歐有限公司(IB CE) |

| 盈透證券香港有限公司(IB HK) |

| 盈透證券加拿大有限公司(IB Canada)(RRSP/TFSA賬戶除外) |

| 盈透證券新加坡有限公司(IB Singapore) |

| 可參加股票收益提升計劃的賬戶類型 |

| 現金帳戶(申請參加時賬戶資産超過$50,000美元) |

| 保證金賬戶 |

| 財務顧問客戶賬戶* |

| 介紹經紀商客戶賬戶:全披露和非披露* |

| 介紹經紀商綜合賬戶 |

| 獨立交易限制賬戶(STL) |

*參加的賬戶必須是保證金賬戶或滿足上述現金帳戶最低資産要求的現金帳戶。

盈透證券日本、盈透證券盧森堡、盈透證券澳大利亞和盈透證券印度公司的客戶不能參加此計劃。賬戶開在IB LLC下的日本和印度客戶可以參加。

此外,滿足上方條件的財務顧問客戶賬戶、全披露介紹經紀商客戶和綜合經紀商可以參加此計劃。如果是財務顧問和全披露介紹經紀商,必須由客戶自己簽署協議。綜合經紀商由經紀商簽署協議。

IRA賬戶可以參加股票收益提升計劃嗎?

可以。

IRA賬戶由盈透證券資産管理公司(Interactive Brokers Asset Management)管理的賬戶分區可以參加股票收益提升計劃嗎??

不是。

英國SIPP賬戶可以參加股票收益提升計劃嗎?

不是。

如果參加計劃的現金帳戶資産跌破最低資産要求$50,000美元會怎麽樣?

現金帳戶只有在申請參加計劃當時必須滿足這一最低資産要求。之後資産跌破此要求並不會對現有借貸造成任何影響,也不影響您繼續借出股票。

如何申請參加IBKR股票收益提升計劃?

要參加股票收益提升計劃,請登錄客戶端。登錄後,點擊 使用者菜單(右上角的小人圖標),然後點擊設置。然後,在賬戶設置內,尋找交易板塊並點擊股票收益提升計劃 以申請參加。您將會看到參加該計劃所需填寫的表格和披露。閱讀並簽署表格後,您的申請便會提交處理。可能需要24到48小時才能完成激活。

如何終止股票收益提升計劃?

要退出股票收益提升計劃,請登錄客戶端。登錄後,點擊使用者菜單 (右上角的小人圖標),然後點擊 設置。在賬戶 設置板塊內會找到交易,然後點擊股票 收益 提升 計劃,然後依照所需步驟。您的申請便會提交處理。 中止參加的請求通常會在當日結束時進行處理。

如果一個賬戶參加了計劃然後又退出,那麽該賬戶多久可以重新參加計劃?

退出計劃後,賬戶需要等待90天才能重新參加。

哪些證券頭寸可以出借?

| 美國市場 | 歐洲市場 | 香港市場 | 加拿大市場 |

| 普通股(交易所掛牌、粉單和OTCBB) | 普通股(交易所掛牌) | 普通股(交易所掛牌) | 普通股(交易所掛牌) |

| ETF | ETF | ETF | ETF |

| 優先股 | 優先股 | 優先股 | 優先股 |

| 公司債券* |

*市政債券不適用。

借出IPO後在二級市場交易的股票有什麽限制嗎?

沒有,只要賬戶本身沒有就相應的證券受到限制就可以。

IBKR如何確定可以借出的股票數量?

第一步是確定IBKR有保證金扣押權從而可以在沒有客戶參與的情况下通過股票收益提升計劃借出的證券的價值(如有)。根據規定,通過保證金貸款借錢給客戶購買證券的經紀商可以將該客戶的證券借出或用作抵押,金額最高不超過貸款金額的140%。例如,如果客戶現金餘額爲$50,000美元,買入市場價值爲$100,000美元的證券,則貸款金額爲$50,000美元,那麽經紀商對$70,000美元($50,000的140%)的證券享有扣押權。客戶持有的證券超出這一金額的部分被稱爲超額保證金證券(此例子中爲$30,000),需要記在隔離賬戶,除非客戶授權IBKR通過股票收益提升計劃將其借出。

計算貸款金額首先要將所有非美元計價的現金餘額轉換成美元,然後减去股票賣空所得(轉換成美元)。如果結果爲負數,則我們最高可抵押此數目的140%。此外,商品賬戶段中持有的現金餘額和現貨金屬和差價合約相關現金不納入考慮範圍。 詳細說明請參見此處。

例1: 客戶在基礎貨幣爲美元的賬戶內持有100,000歐元,歐元兌美元匯率爲1.40。客戶買入價值$112,000美元(相當於80,000歐元)的美元計價股票。由於轉換成美元後現金餘額爲正數,所有證券被視爲全額支付。

| 項目 | 歐元 | 美元 | 基礎貨幣(美元) |

| 現金 | 100,000 | (112,000) | $28,000 |

| 多頭股票 | $112,000 | $112,000 | |

| 淨清算價值 | $140,000 |

例2: 客戶持有80,000美元、多頭持有價值$100,000美元的美元計價股票並且做空了價值$100,000美元的美元計價股票。總計$28,000美元的多頭證券被視爲保證金證券,剩餘的$72,000美元爲超額保證金證券。計算方法是用現金餘額减去賣空所得($80,000 - $100,000),所得貸款金額再乘以140% ($20,000 * 1.4 = $28,000)

| 項目 | 基礎貨幣(美元) |

| 現金 | $80,000 |

| 多頭股票 | $100,000 |

| 空頭股票 | ($100,000) |

| 淨清算價值 | $80,000 |

IBKR會把所有符合條件的股票都借出去嗎?

不保證賬戶內所有符合條件的股票都能通過股票收益提升計劃借出去,因爲某些證券可能沒有利率有利的市場,或者IBKR無法接入有意願的借用方所在的市場,也有可能IBKR不想借出您的股票。

通過股票收益提升計劃借出股票是否都要以100爲單位?

不是。只要是整股都可以,但是借給第三方的時候我們只以100爲倍數借出。這樣,如果有第三方需要借用100股,就可能發生我們從一個客戶那裏借出75股、從另一個客戶那裏借出25股的情况。

如果可供借出的股票超過借用需求,如何在多個客戶之間分配借出份額?

如果我們股票收益提升計劃的參與者可用以借出的股票數量大於借用需求,則借出份額將按比例分配。例如,可供借出XYZ數量爲20,000股,而對於XYZ的需求只有10,000股的情况下,每個客戶可以借出其所持股數的一半。

股票是只借給其它IBKR客戶還是也會借給其它第三方?

股票可以借給IBKR客戶和第三方。

股票收益提升計劃的參與者可以自行决定哪些股票IBKR可以借出嗎?

不是。此計劃完全由IBKR管理,IBKR在確定了自己因保證金貸款扣押權可以借出的證券後,可自行决定哪些全額支付或超額保證金證券可以借出,並發起借貸。

通過股票收益提升計劃借出去的證券其賣出是否會受到限制?

借出去的股票可隨時賣出,沒有任何限制。賣出交易的結算並不需要股票及時歸還,賣出收益會按正常結算日記入客戶的賬戶。此外,借貸會於證券賣出的下一個工作日開盤終止。

客戶就通過股票收益提升計劃借出去的股票沽出持保看張期權還能享受持保看漲期權保證金待遇嗎?

可以。由於借出去的股票其盈虧風險仍然在借出方身上,借出股票不會對相關保證金要求造成任何影響。

借出去的股票由於看漲期權被行權或看跌期權行權被交付會怎麽樣?

借貸將於平倉或减倉操作(交易、被行權、行權)的T+1日終止。

借出去的股票被暫停交易會怎麽樣?

暫停交易對股票借出沒有直接影響,只要IBKR能繼續借出該等股票,則無論股票是否被暫停交易,借貸都可以繼續進行。

借貸股票的抵押可以劃至商品賬戶段沖抵保證金和/或應付行情變化嗎?

不是。股票借貸的抵押不會對保證金或融資造成任何影響。

計劃參與者發起保證金貸款或提高現有貸款金額會怎麽樣?

如果客戶有全額支付的證券通過股票收益提升計劃借出,之後又發起保證金貸款,則不屬於超額保證金證券的部分將被終止借貸。同樣,如果客戶有超額保證金證券通過此計劃借出,之後又要增加現有保證金貸款,則不屬於超額保證金證券的部分也將被終止借貸。

什麽情况下股票借貸會被終止?

發生以下情况(但不限于以下情况),股票借貸將被自動終止:

- 客戶選擇退出計劃

- 轉帳股票

- 以股票作抵押借款

- 賣出股票

- 看漲期權被行權/看跌期權行權

- 賬戶關閉

股票收益提升計劃的參與者是否會收到被借出股票的股息?

通過股票收益提升計劃借出的股票通常會在除息日前召回以獲取股息、避免股息替代支付。但是仍然有可能獲得股息替代支付。

股票收益提升計劃的參與者是否對被借出的股票保有投票權?

不是。如果登記日或投票、給予同意或採取其它行動的截止日期在貸款期內,則證券的借用者有權就證券相關事項進行投票或决斷。

股票收益提升計劃的參與者是否能就被借出的股票獲得權利、權證和分拆股份?

可以。被借出股票分配的任何權利、權證和分拆股份都將屬於證券的借出方。

股票借貸在活動報表中如何呈現?

借貸抵押、借出在外的股數、活動和收益在以下6個報表區域中反映:

1. 現金詳情 – 詳細列出了期初抵押(美國國債或現金)餘額、借貸活動導致的淨變化(如果發起新的借貸則爲正;如果股票歸還則爲負)和期末現金抵押餘額。

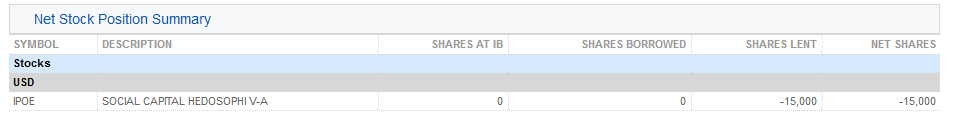

2. 淨股票頭寸總結 – 按股票詳細列出了在IBKR持有的總股數、借入的股數、借出的股數和淨股數(=在IBKR持有的總股數 + 借入的股數 - 借出的股數)。

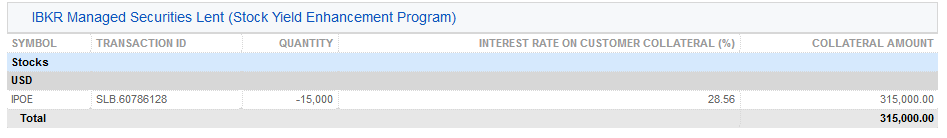

3. 借出的IBKR管理證券(股票收益提升計劃) – 對通過股票收益提升計劃借出的股票按股票列出了借出的股數以及利率(%)。

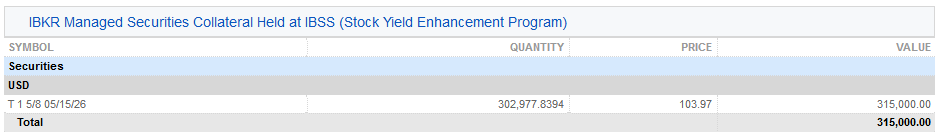

3a. 在IBSS保管的IBKR管理證券的抵押(股票收益提升計劃) – IBLLC的客戶會看到其報表中多出來一欄,顯示作爲抵押的美國國債以及抵押的數量、價格和總價值。

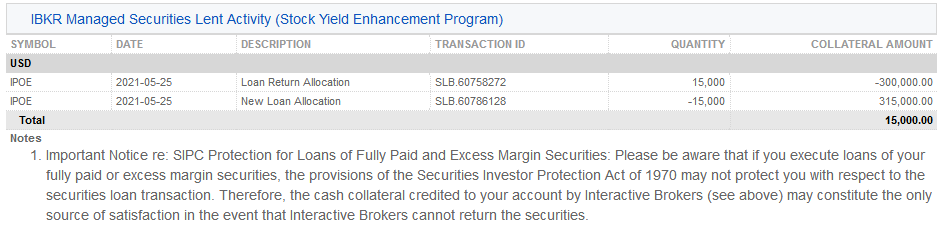

4. IBKR管理證券借出活動 (股票收益提升計劃)– 詳細列出了各證券的借貸活動,包括歸還份額分配(即終止的借貸);新借出份額分配(即新發起的借貸);股數;淨利率(%);客戶抵押金額及其利率(%)。

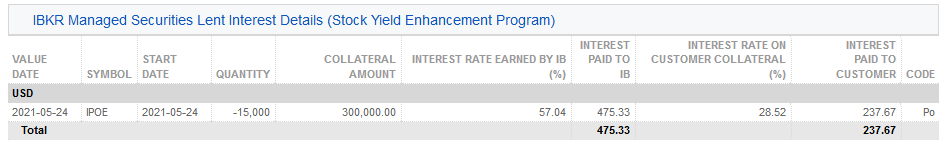

5. IBKR管理的證券借出活動利息詳情 (股票收益提升計劃)– 按每筆借出活動詳細列出了IBKR賺取的利率(%);IBKR賺取的收益(爲IBKR從該筆借出活動賺取的總收益,等于{抵押金額 * 利率}/360);客戶抵押的利率(爲IBKR從該筆借出活動賺取的收益的一半)以及支付給客戶的利息(爲客戶的現金抵押賺取的利息收入)

注:此部分只有在報表期內客戶賺取的應計利息超過1美元的情况下才會顯示。

6. 應計利息 – 此處利息收入列爲應計利息,與任何其它應計利息一樣處理(累積計算,但只有超過$1美元才會顯示並按月過帳到現金)。年末申報時,該筆利息收入將上報表格1099(美國納稅人)。

常見問題解答:有特殊要求的證券

近期,GME、AMC、BB、EXPR、KOSS和一小部分美國證券表現出了極端波動,使我們不得不降低了向該等證券提供的杠杆,有時甚至只允許可降低風險的交易。以下是關于近期措施的常見問題解答。

問:目前交易GME及其它近期波動率上升的美國證券是否有限制?

答: IBKR目前不限制客戶交易AMC、GME、BB、EXPR、KOSS或其它表現出極端市場波動的股票。這包括開倉或平倉。

和許多經紀商一樣,IBKR有段時間曾對上述部分證券的開倉交易設有限制。這些限制現已解除。

IBKR沒有限制客戶平倉現有倉位,也不打算這麽做。

問:我能否在IBKR使用保證金交易這些産品的股票、期權或其它衍生品?

答: IBKR已提高了交易GME及其它近期波動率巨大的美國證券的保證金要求,多頭倉位保證金要求高達100%,空頭倉位保證金要求高達300%。您在交易平臺中提交委托單前可以查看相應保證金要求。

問:爲什麽對于某些證券IBKR要限制我開倉?

答: IBKR采取這些措施是出于風險管理的考慮,目的是爲了保護公司和客戶在極端波動的市場環境下不因價格的大幅變動而蒙受巨額損失。

IBKR對此次非自然波動給清算所、經紀商和市場參與者帶來的影響保持謹慎擔憂。

問:IBKR或其關聯公司在此次被限制交易的産品中有持倉嗎?

答:否。IBKR在這些證券中均沒有自營交易持倉。

問:IBKR實施這些交易限制的依據是什麽?

答: 根據客戶協議,IBKR有權自行决定拒絕接受任何客戶委托單。

IBKR還有權自行决定修改任何已開倉倉位或新倉位的保證金要求。畢竟,IBKR是保證金交易的資金貸出方。

問:這些限制是針對所有IBKR客戶的,還是僅針對部分客戶?

答: 所有限制,包括限制開倉及提高保證金,都是針對所有IBKR客戶的。限制是基于證券而非客戶實施的。

問:我在IBKR的資金有風險嗎?IBKR有無蒙受實質性損失?

答: IBKR未蒙受任何實質性的損失。得益于其審慎的風控措施,IBKR很好地應對了本次市場波動。實際上,盈透集團的合幷總股本逾90億美元,超過監管要求60億美元以上。

問:未來IBKR會怎麽做?我怎麽才能知道?

答: IBKR會繼續監控市場動態,且會根據市場情况采取行動。如需瞭解最新的信息,請持續訪問我們的網站。

FAQs: Securities subject to Special Requirements

We are seeing unprecedented volatility in GME, AMC, BB, EXPR, KOSS and a small number of other U.S. securities that has forced us reduce the leverage previously offered to these securities and, at times, limit trading to risk reducing transactions. Outlined below are a series of FAQs relating to these actions.

Q: Are there any current restrictions on my ability to trade GME and the other US securities that have been subject to the recent heightened volatility?

A: IBKR is currently not restricting customers from trading shares of AMC, GME, BB, EXPR, KOSS or the other stocks that have been the subject of extreme market volatility. That includes orders to open new positions or close existing ones.

Like many brokers, IBKR placed limits on opening new positions in certain of these securities for a period of time. Those restrictions have since been lifted.

IBKR has not restricted customers’ ability to close existing positions and does not plan to do so.

Q: Can I use margin in trading stocks, options or other derivatives on these products through IBKR?

A: IBKR has increased its margin requirements for securities in GME and the other US securities subject to the recent volatility, including up to 100% margin required for long positions and 300% margin on the short side. You can see these margin requirements in your trading platform prior to submitting an order.

Q: Why did IBKR place these restrictions on my ability to open new positions in certain securities?

A: IBKR took these actions for risk management purposes, to protect the firm and its customers from incurring outsized losses due to wild swings in prices in a volatile and unstable marketplace.

IBKR remains concerned about the effect of this unnatural volatility on the clearinghouses, brokers and market participants.

Q: Does IBKR or its affiliates have positions in these products that it was protecting by placing these restrictions?

A: No. IBKR itself has no proprietary positions in any of the securities.

Q: What allowed IBKR to place those restrictions?

A: Pursuant to its customer agreement, IBKR may decline to accept any customer’s order at IBKR’s discretion.

IBKR also has the right to modify margin requirements for any open or new positions at any time, in its sole discretion. After all, IBKR is the one whose money is being loaned in a margin trade.

Q: Did those restrictions apply to all or just some of IBKR’s customers?

A: All restrictions – all limits on opening new positions and margin increases – applied to all IBKR customers. They were placed based on the security, not based on the customer.

Q: Is my money at IBKR at risk? Has IBKR suffered material losses?

A: IBKR did not incur substantial losses. Through its prudent risk management, IBKR has navigated this market volatility well. In any event, on a consolidated basis, IBG LLC exceeds $9 billion in equity capital, over $6 billion in excess of regulatory requirements.

Q: What will IBKR do going forward? How will I know?

A: IBKR will continue to monitor developments in the market, and will make decisions based on market conditions. For current information, please continue to visit our website.