Information regarding the transfer of accounts from IB LLC to IB Australia

Introduction

Following the establishment of Interactive Brokers Australia Pty Ltd (IB Australia), who holds an Australian Financial Services License, number 453554, Australian residents maintaining an account with Interactive Brokers LLC (IB LLC) will have their account transferred to IB Australia as IB LLC intends to cease business in Australia. Outlined below are the steps required to initiate the transfer and information regarding the account holder's relationship with IB Australia following the transfer.

How To Transfer Your Account To IB Australia

Moving your account to IB Australia is easy. The process is simple because we will use the information and documents we already have on file for you. The transfer process is initiated once you sign the online authorisation form. This form will be presented to you immediately upon log in to Account Management. Once the form has been signed your account will be scheduled for transfer, with the transfer typically taking effect over a weekend (with consideration given to weekends which coincide with option expiration processing).

Click Here to Authorise the Transfer of Your Account

We encourage you to complete the application to transfer to IB Australia as soon as possible.

Products offered by IB Australia

As a client of IB Australia, you will continue to be able to trade all of the exchange traded products you currently have access to (including local and global stocks, bonds, options, futures, etc.) through Interactive Brokers’ award winning trading platform and software. For further information on IB Australia's products and services, please see our website.

Australian regulatory status

Upon transfer of your account to IB Australia, you will automatically be designated as a retail client. However, if it appears that you may qualify as a wholesale investor or as a professional investor, or if you believe that you would qualify for either, you will have the option to complete and submit the required documentation for IB Australia to consider.

Offering margin under IB Australia

IB Australia have decided that they will not be offering margin accounts to a corporate entity which is designated as a retail client. As a result, if you currently have a margin account and you have not submitted the required documentation to allow IB Australia to categorize you as either a wholesale client or a professional investor, upon transfer of your account to IB Australia, you will not be able to use your margin account for any new purchases. If you think that you might qualify as either a wholesale client or a professional investor, and you would like to retain the benefits of a margin account with IB Australia, please ensure that you complete and submit the required documentation as soon as possible.

You should also note that IB Australia only offers risk based margin accounts, similar to our Portfolio Margin accounts under IB LLC. If you currently have a Reg T margin account and would like to simulate and review the margin changes after the migration, please login to our TWS trading platform, go to the Account window and select Margin Requirements then Portfolio Margin.

Client Money Considerations

Transfer Of Money From IB LLC To IB Australia: IB LLC and IB Australia are separate legal companies. When you complete the application to transfer your account to IB Australia, you will be directing IB LLC to close your account, transfer your positions, and pay to IB Australia all of the cash currently in your account. Upon receiving these funds, IB Australia will pay the funds into an IB Australia Client Money Account (discussed in more detail below). The actual transfer will occur as soon as practicable following the opening of your account with IB Australia.

Money To Be Held On Trust By IB Australia: IB Australia is required to handle all money that it receives from you or on your behalf in accordance with Part 7.8 of the Corporations Act. In other words, IB Australia is required to maintain one or more trust/segregated client money accounts (Client Money Accounts) with a bank for the holding of monies it receives for or from its clients. This money is held on trust for IB Australia's clients. IB Australia will initially only hold client money in Australian dollars (AUD), U.S. dollars (USD), British Pounds (GBP), or Euros (EUR).

For the purposes of this article, these currencies will be referred to as IBA supported currencies.

Conversion Or Withdrawal Of Non IBA supported currency Balances Before Transfer: You will be given a choice in the IB Australia application process as to which of these supported currencies you would like as your base currency. If you have cash balances in currencies other than IBA supported currencies (AUD, USD, GBP or EUR) these will to be converted into your nominated base currency upon the transfer of your account to IB Australia. The exchange rate that will apply to such a conversion will be the best rate that is reasonably available to IB LLC through its existing liquidity providers when it performs the conversion.

Client Assets And Positions – Transition

When you transfer your account to IB Australia, IB Australia will be your service provider, not IB LLC. When you trade through your IB Australia account, IB Australia will execute Australian market transactions for you, and will arrange for offshore brokers to execute transactions in offshore markets, including IB LLC and other Interactive Broker Group affiliates, as appropriate. In those markets, the offshore brokers will treat IB Australia as their client (and IB Australia will operate omnibus client accounts with those brokers to cover transactions for IB Australia's clients).

IB Australia will replace IB LLC as your custodian. IB Australia will hold all assets that you purchase through IB Australia on your behalf subject to IB Australia’s General Terms, which are available here.

Please refer to IB Australia’s Financial Services Guide, which provides important information about the custody services that IB Australia provides and the sub-custodians that IB Australia uses.

The following is a brief summary of the asset and position holding arrangements going forward:

| Assets/Positions | Past IB LLC Arrangement | Future IB Australia Arrangement |

| Australian securities | IB LLC as custodian (and IB Australia as sub-custodian and executing broker) |

IB Australia as custodian and BNP Paribas Securities Services (as sub-custodian and clearing participant) |

| Foreign securities | Foreign sub-custodian (including IB LLC affiliates) | IB Australia as custodian and IB LLC as sub-custodian. |

| Australian exchange traded derivatives |

IB Australia (clearing participant) | IB Australia (clearing participant) |

| International exchange traded derivatives |

Foreign broker/clearing participant in relevant market |

Foreign broker/clearing participant in relevant market |

| FX positions | Contract with IB LLC | Contract with IB Australia |

When you agree to transfer your account to IB Australia, you will be instructing and authorising IB Australia and IB LLC to do all things reasonably required to facilitate the transfer of all assets and positions from your IB LLC account to your new IB Australia account, including to amend their books and records to reflect the transition, and to give appropriate instructions and directions to sub-custodians, clearing participants and other external providers.

Please note that if you hold positions in products that IBA does not support, such as OTC Metals, these positions will be closed out prior to transfer by IBA at the prevailing price. It is recommended that you close these out prior to completing the transfer form.

In addition, if you participate in the Stock Yield Enhancement Program (SYEP), IB Australia does not as yet support this service. You will not be able to participate in this once your account is transferred to IB Australia.

In order to ensure continued compliance with our regulatory obligations, Interactive Brokers Australia has decided that we will NOT accept any other form of collateral except cash for the purposes of determining whether you can trade or hold ASX24 products. If the margin requirements of ASX24 products cannot be met using cash, an account will be subject to automated liquidation.

A new IB account number will be assigned and our deposit Instructions may change. Prior to making any new deposits, we ask that you obtain the new deposit instructions through Account Management.

The Insured Bank Deposit Sweep Program is available to only those non-U.S. residents whose account is carried with IBLLC, the U.S. broker, or IB-UK, the introducing broker. If your account was previously carried by IBLLC, but is now carried by IB Australia, your account is no longer eligible for the Insured Bank Deposit Sweep Program. Further information is available at this link:

What If I Choose Not To Transfer My Account To IB Australia or Don't Act?

You are not required to transfer your account to IB Australia but you will need to close or transfer you account ASAP as IB LLC intends to cease providing financial services in Australia very soon. This means IB LLC will cease offering financial services and products to Australian residents, including you. This will impact you as follows:

If your account remains open and you have not opened a new account with IB Australia before a

nominated date of which we will be informed, then IB LLC (U.S.) will, under the terms of its Customer

Agreement with you, impose trading restrictions on your account, including prohibiting you from

opening new positions and may transfer your account to IB Australia.

What Happens When IB LLC (U.S.) Transfers My Account To IB Australia?

Please note the following information is only relevant if you do not apply to transfer your Account(s) to IB Australia prior to a date we will inform you of.

If you have NOT applied to transfer your account(s) to IB Australia, then IB LLC (U.S.) will be forced to assign your account(s) to IB Australia. When this happens, IB Australia will be holding your account under the same agreement that you held the account with IB LLC (U.S.).

You will be prohibited from opening new positions until you accept the legal terms that govern and the disclosures that relate to IB Australia’s account offering; you can, however, apply to withdraw your funds and transfer positions to 3rd party brokers.

Please also note the following:

- If the base currency of your IB LLC (U.S.) is other than AUD, USD, GBP or EUR (IBA supported currencies), you will be provided the option to nominate one of these currencies as your base currency when you complete the transfer, otherwise we will default the base currency of the account prior to the transfer to IB Australia to AUD;

- Any currency balances currently held that are not denominated in either of the IBA supported currencies will be converted into your Base Currency at the prevailing exchange rate; and,

- If you close any open positions after the transfer and the settlement proceeds (if any) are in a currency other than the IBA supported currencies, IB Australia will convert the proceeds into the base currency of your account. If, at a later date, you still have not accepted IB Australia’s new legal terms and disclosures, then IB Australia may transfer out positions into issuer sponsored holdings (where it deems reasonable to do so) and liquidate any other open positions that you hold in the account and return the resulting funds to you. IB Australia will provide you notice should we decide to take this action.

Other

- For a full list of the disclosure documents and legal terms which govern the services IB Australia will make available please refer to the IB website.

- For further information on IB Australia, click on our Financial Services Guide.

- For more information or assistance, please contact IB Client Services.

Mobile Phone Verification during the account application

Introduction

IB requires that clients verify their mobile phone in order to receive account and trade related communication directly via SMS. Clients who fail to verify their phone will be subject to trade restrictions pending completion of this process. Verification is performed online and the steps for doing so are outlined below.

In case your account has been already opened but your mobile number has not been yet verified, please jump directly to KB2552 to complete the verification process.

Phone Verification

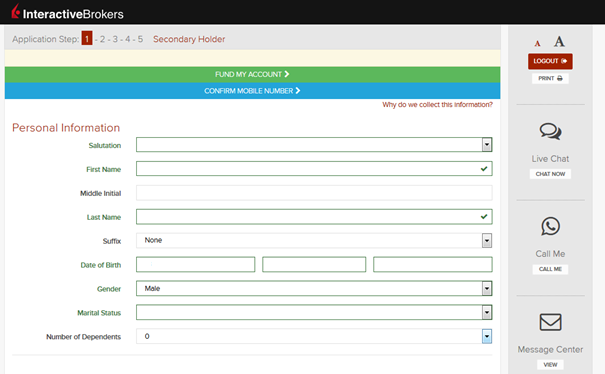

When completing your Interactive Brokers Account Application, you will see a blue bar at the top of the page that says "CONFIRM MOBILE NUMBER."

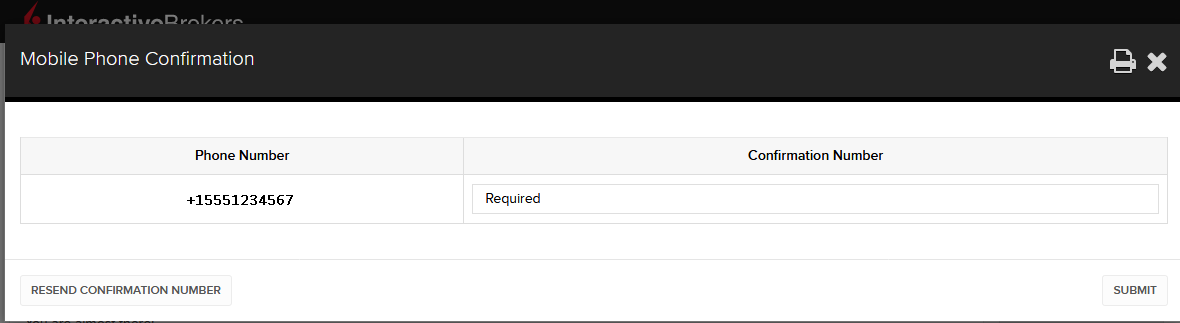

You can click on that bar any time during steps 1-4. Once you do, you will see this window:

Once you have entered your full number, it will be recognized and a confirmation message is sent immediately. Validate your phone number by entering the SMS Code received in the Confirmation Code field and click Submit.

If you are unable to do this during the application process, you can always confirm it on the Application Status page

.png)

Please consider the following as certain restrictions may apply:

- SMS messages may be blocked if you participate in your Countries NDNC (National Do Not Call) registry.

- Due to fraud prevention measures, virtual number providers may be blocked.

- Some carriers may restrict the Hours of delivery for SMS messages.

Document Certification for Australian Residents

OVERVIEW

IB is required by regulation to verify the identity and address of each applicant and, where copies of physical documents are required, is often subject to local rules as to the type and form of documents which may be accepted. In the case of Australian residents, documents can only be accepted if certified as a true copy of the original by an approved individual. A list of such individuals along with other requirements and document submission instructions is outlined below.

LIST OF APPROVED CERTIFIERS

- Authorized/licensed/registered notary public

- Justice of the Peace with a registration number1

- A person who is enrolled on the roll of the Supreme Court of a State or Territory, or the High Court of Australia, as a legal practitioner (however described) (e.g. a solicitor or barrister)

- Manager of an Australian bank or credit union1

- A member of the Institute of Chartered Accountants in Australia, CPA Australia or the National Institute of Accountants with two or more years of continuous membership (e.g. an accountant)

- Officer of a company which holds an Australian financial services license or authorized representative of an Australian financial services licensee, having two or more continuous years of service with one or more licensees

- Dentist1

- Judges or masters of an Australian Federal, State or Territory court

- Medical Practitioners1

- Police officer in charge of police stations or of the rank of Sergeant or above1

- Agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public1

- Australian consular officer or an Australian diplomatic officer (within the meaning of the Consular Fees Act 1955) in Australia or overseas

1Person must be authorized/licensed/registered under Australian law.

OTHER REQUIREMENTS

Each page of the document being certified must contain the certifiers signature plus the following statement: "I certify this document to be a true and accurate copy of the original as sighted by me". Have the certifying party complete the Certified Copy Certificate Form for fastest processing. If you do not use the above form, ensure to include the following information on the first page of the document being certified:

- Full name of the certifier

- Signature of the certifier

- Date of certification

- Capacity of the certifier (e.g., Practicing solicitor, Justice of Peace, etc.)

- Registration number (if any) of the certifier's profession

- Number of pages if more than one

DOCUMENT SUBMISSION

Documents cannot be sent electronically and must be delivered to IB by mail or courier.

New Accounts Department

Interactive Brokers Australia Pty Ltd

P.O. Box R229

Royal Exchange, NSW 1225

Australia

Courier

New Accounts Department

Interactive Brokers Australia Pty Ltd

Level 40 Grosvenor Place

225 George Street, Sydney, NSW 2000

Australia

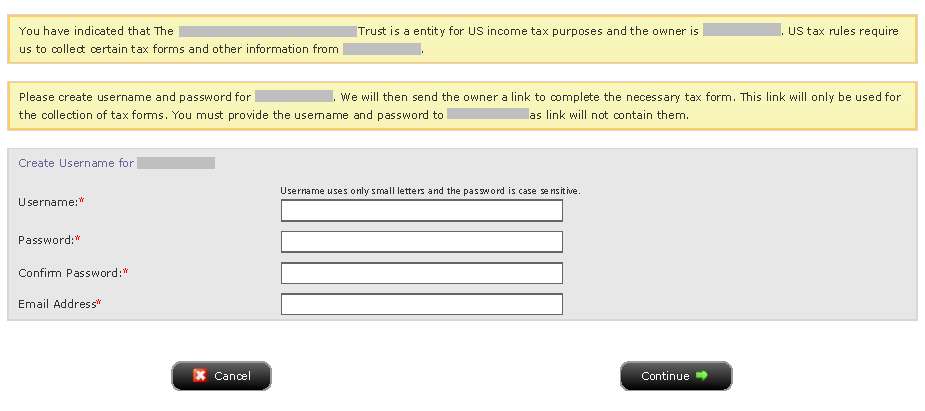

FATCA Procedures - Grantor Trust Tax Information Submission

Interactive Brokers is required to collect certain documentation from clients to comply with U.S. Foreign Account Tax Compliance Act (“FATCA”) and other international exchange of information agreements.

This guide contains instructions for a Trust to complete the online tax information and to electronically submit a W-9 or W-8BEN.

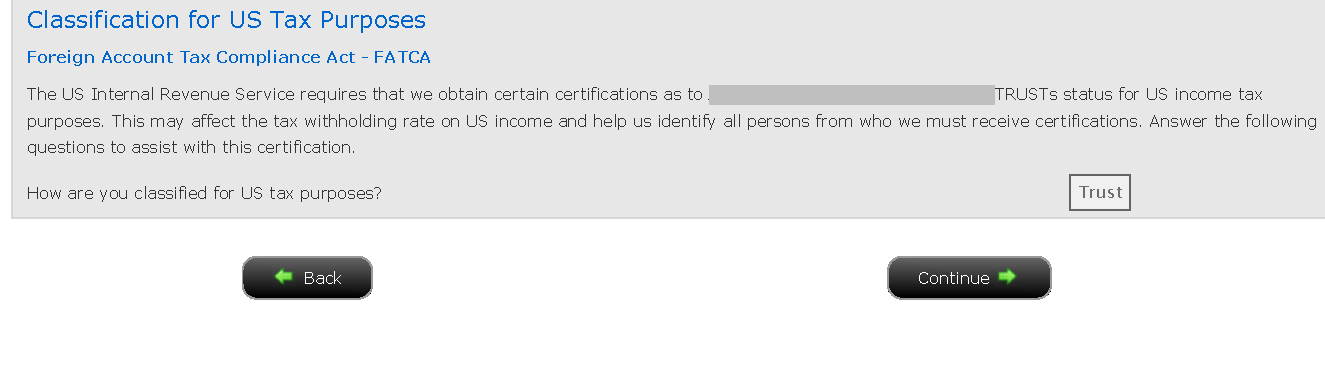

U.S. Tax Classification

Your U.S. income tax classification determines the tax form(s) required to document the account.

You must login to Account Management with the trust's primary username to access the Tax Form Collection page.

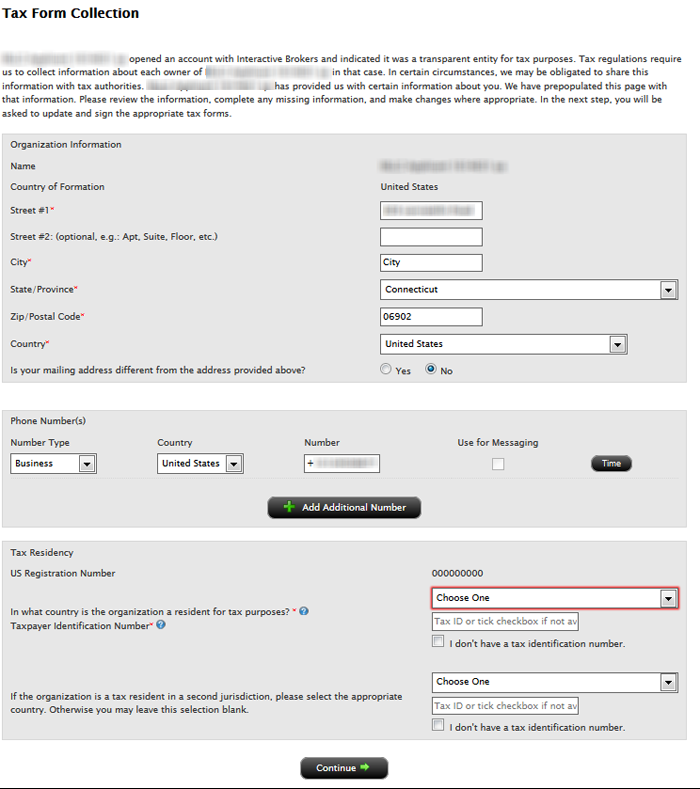

1. Tax Form Collection

2. Classification for US Tax Purposes

3. Identify Grantors

a. Click Manage Account > Account Information > Tax Information > Tax Forms.

.png)

Can I have more than two individuals on a joint account?

IBKR offers three types of joint accounts: Tenants with Rights of Survivorship, Tenancy in Common and Community Property. Each of these joint account types is limited to two account holders.

Applicants interested in opening an account with multiple owners in excess of two may consider the corporate, partnership, limited liability company or unincorporated legal structure account types offered by IBKR. Note that documentation establishing proof of formation and address are generally required at the point of application.

Converting From a Single to Joint Account

The process of adding a second owner to an existing single account for purposes of converting to a joint account is outlined below:

市场数据非专业客户问卷

如何完成最新的非专业客户问卷。

纽约证券交易所(NYSE)及大多数美国的交易所均要求供应商在允许客户接收市场数据前确认每个客户接收市场数据的身份。未来,我们将使用非专业客户问卷来识别及确认所有订阅用户的市场数据身份。根据交易所的要求,在未明确客户为非专业人士之前,将默认客户的市场数据接收身份为专业人士。该流程能够保证所有新订阅用户的数据订阅身份是准确的。若要获取有关非专业人士定义的简要指南,请见ibkb.interactivebrokers.com/article/2369。

您必须回答问卷上的所有问题,方可被定义为非专业人士。鉴于交易所要求供应商明确获得客户为非专业人士的证明,若问卷回答不完整或不清晰,客户将被界定为专业投资者,直至其身份得到确认。

如您的身份有所变更,请联系帮助台。

问题解释:

1) 商业及业务用途

a) 您是否出于业务需要、或代表其他商业实体接收财经信息(包括关于证券、商品及其他金融产品的新闻或价格数据)?

解释:除个人用途外,您是否代表公司或其他组织接收及使用本账户中的市场数据?

b) 您是否代表公司、合伙企业、专业信托机构、专业投资俱乐部或其他实体开展证券、商品或外汇交易?

解释:您只代表个人交易,还是也代表机构(如,有限责任公司、有限责任企业、股份有限公司、公司、有限责任合伙企业等)交易?

c) 您是否就以下事项与其他实体或个人达成过协议:(a) 分享交易活动的盈利,或 (b)获取交易酬劳?

解释:您是否通过交易获得酬劳,或与第三方实体或个人分享交易活动的盈利?

d) 您是否通过交易换取办公场所、设备或其他福利?或者,您是否担任任意个人、企业或商业实体的财务顾问?

解释:您是否以任意形式从第三方获得交易的酬劳,该酬劳不一定以货币的形式支付。

2) 担任职务

a) 目前您是否担任任何投资顾问或经纪交易商的职务?

解释:您是否通过管理第三方的资产或指导他人如何管理资产获得酬劳?

b) 您是否担任证券、商品或外汇方面的资产管理人?

解释:您是否通过管理证券、商品或外汇资产获得酬劳?

c) 目前您是否在工作中使用此类财经信息,或将其用于管理您的雇主或公司的资产?

解释:您使用数据是否单纯出于商业目的,即,用于管理您的雇主及/或公司的资产?

d) 您交易时是否使用了其他个人或实体的资金?

解释:您的账户中除了您个人的资产,是否有其他实体的资产?

3) 向其他任意实体传播、再发布或提供数据

a) 您是否以任意方式向任意第三方传播、再传播、发布或提供任何从服务中获得的财经信息?

解释:您是否以任意形式向其他实体发送您从我方获得的任何数据?

4) 合资格的专业证券/期货交易商

a) 目前,您是否为任意证券机构、商品或期货市场的注册或合资格的专业证券交易员,或为任意国家交易所、监管机构、专业协会或公认专业机构的投资顾问?i, ii

是☐ 否☐

i) 监管机构的例子包括但不限于:

- 美国证券交易委员会(SEC)

- 美国商品期货交易委员会(CFTC)

- 英国金融服务局(FSA)

- 日本金融服务局(JFSA)

ii) 自律组织(SROs)的例子包括但不限于:

- 美国纽约证券交易所(NYSE)

- 美国金融业监管局(FINRA)

- 瑞士联邦金融局(VQF)

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

安全登录系统概述

目录

我们高度重视您的资产与个人信息安全,并致力于采取必要措施确保您的账户自开立起便受到保护。

参与安全登录系统的益处

- 单日及五日内的取款限额更高。

- 无需联系我司安全部门即可更改银行指令和电子邮件地址。

- 能够在初次向账户注资2万美元后,发起ACH和EFT资金转账。

- 同一个人注册的多个用户名可共享一个安全设备。

如何参与

设备丢失、损坏或暂不可用

设备类型

- 手机短信 - 通过向您手机发送短信完成双因素验证,快速、简便。

- 移动IBKR – 此移动应用程序提供了一种便捷的数字解决方案来满足您的双因素验证需求。程序中集成的移动IBKR验证程序(IB Key)支持指纹/人脸识别和PIN码1,安卓手机和iPhone均可使用。

- 数码安全卡+ - 适用于资产不低于100万美元的账户。其外形与信用卡相同,为电子卡片,需要使用者输入PIN码作为额外保护。

注意:

iPhone用户必须启用Touch ID、 Face ID或锁屏密码(参见设置Touch ID或设置Face ID)。推荐使用Touch ID和Face ID。PIN码/锁屏密码最长可支持12小时的交易访问,而指纹/人脸识别最长支持超过30个小时。更多详细信息请参见我们的用户指南延长交易访问。

取款限制

参与安全登录系统的客户取款更为自由,而为参加的客户则与每日和每周取款限制。参与安全登录系统的客户单日和五日可取款或转账的金额随设备的保护性能变化,详情如下。

| 安全设备 | 单日最高取款限额 | 5个工作日内最高取款限额 |

|---|---|---|

| 无 | 50K USD | 100K USD |

| 手机短信 | 200K USD | 600K USD |

| 移动IBKR验证程序(IB Key) | 1M USD | 1M USD |

| 安全代码卡* | 200K USD | 600K USD |

| 数码安全卡* | 1M USD | 1.5M USD |

| 数码安全卡+ | 无限制 | 无限制 |

| 铂金卡*/金卡* | 无限制 | 无限制 |

CFTC所有权及控制权报告

美国商品期货交易委员会(The Commodities Futures Trading Commission,简称“CFTC”)曾恪守的法规要求期货佣金商(FCM)上报所持仓位等于或超过既定限制的客户其信息(如大型交易者信息报告)。2013年11月份,CFTC采用了新的法规,该法规扩展了此前的报告法规,它要求收集并上报有关交易美国商品期货产品的账户其持有人和监控人更多且更全面的信息。这一新法规被称为所有权及控制权报告(Ownership and Control Reporting,以下简称“OCR”),下方列出的是有关此规定的常见问题解答。

CFTC法规要求期货佣金商在账户达到仓位限制或成交量限制的次日于美国东部时间09:00之前向CFTC进行报告。故此,IB要求所有交易美国商品期货产品的账户提供相关信息。

账户所有的持有人和监控人必须提供以下信息:

• 姓名

• 街道地址

• 邮箱地址

• 包含国家代码的直拨电话号码

• 如果适用,提供法律实体标识(Legal Entity Identifier,以下简称“LEI”)

• 联系人详细信息:

o 姓名

o 职务

o 与法律实体的关系

o 包含国家代码的直拨电话号码

• 与账户持有人的关系

• 职务

• 雇佣单位

• 如果适用,提供雇佣单位的LEI

账户持有人是指直接持有交易账户所有者权益的个人或法律实体。

4. 出于OCR目的,何人为账户监控人?

CFTC对“账户监控人”的定义是:受委托或直接控制账户进行交易的自然人。一个交易账户可以具备多个监控人。此定义可于条例17 C.F.R. § 15.00(bb)中寻得。

美国联邦监管机构要求包括盈透在内的所有期货佣金商从其客户处获取这些信息。此规定具有普遍性且适用于所有个人或实体,无论其经纪商为谁。

是的,如果您希望交易美国商品期货产品,那么您必须向我公司提供这些信息。

我们会根据盈透证券集团隐私声明对数据进行保密。详情请见:https://individuals.interactivebrokers.com/en/index.php?f=ibgStrength&p=priv

您可以从CFTC网站获取完整版的条例变更: