Considerations for Exercising Call Options Prior to Expiration

INTRODUCTION

Exercising an equity call option prior to expiration ordinarily provides no economic benefit as:

- It results in a forfeiture of any remaining option time value;

- Requires a greater commitment of capital for the payment or financing of the stock delivery; and

- May expose the option holder to greater risk of loss on the stock relative to the option premium.

Nonetheless, for account holders who have the capacity to meet an increased capital or borrowing requirement and potentially greater downside market risk, it can be economically beneficial to request early exercise of an American Style call option in order to capture an upcoming dividend.

BACKGROUND

As background, the owner of a call option is not entitled to receive a dividend on the underlying stock as this dividend only accrues to the holders of stock as of its dividend Record Date. All other things being equal, the price of the stock should decline by an amount equal to the dividend on the Ex-Dividend date. While option pricing theory suggests that the call price will reflect the discounted value of expected dividends paid throughout its duration, it may decline as well on the Ex-Dividend date. The conditions which make this scenario most likely and the early exercise decision favorable are as follows:

1. The option is deep-in-the-money and has a delta of 100;

2. The option has little or no time value;

3. The dividend is relatively high and its Ex-Date precedes the option expiration date.

EXAMPLES

To illustrate the impact of these conditions upon the early exercise decision, consider an account maintaining a long cash balance of $9,000 and a long call position in hypothetical stock “ABC” having a strike price of $90.00 and time to expiration of 10 days. ABC, currently trading at $100.00, has declared a dividend of $2.00 per share with tomorrow being the Ex-Dividend date. Also assume that the option price and stock price behave similarly and decline by the dividend amount on the Ex-Date.

Here, we will review the exercise decision with the intent of maintaining the 100 share delta position and maximizing total equity using two option price assumptions, one in which the option is selling at parity and another above parity.

SCENARIO 1: Option Price At Parity - $10.00

In the case of an option trading at parity, early exercise will serve to maintain the position delta and avoid the loss of value in long option when the stock trades ex-dividend, to preserve equity. Here the cash proceeds are applied in their entirety to buy the stock at the strike, the option premium is forfeited and the stock (net of dividend) and dividend receivable are credited to the account. If you aim for the same end result by selling the option prior to the Ex-Dividend date and purchasing the stock, remember to factor in commissions/spreads:

| SCENARIO 1 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $0 |

| Option | $1,000 | $0 | $800 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,000 | $10,000 | $9,800 | $10,000 less commissions/spreads |

SCENARIO 2: Option Price Above Parity - $11.00

In the case of an option trading above parity, early exercise to capture the dividend may not be economically beneficial. In this scenario, early exercise would result in a loss of $100 in option time value, while selling the option and buying the stock, after commissions, may be less beneficial than taking no action. In this scenario, the preferable action would be No Action.

| SCENARIO 2 | ||||

|

Account Components |

Beginning Balance |

Early Exercise |

No Action |

Sell Option & Buy Stock |

| Cash | $9,000 | $0 | $9,000 | $100 |

| Option | $1,100 | $0 | $1,100 | $0 |

| Stock | $0 | $9,800 | $0 | $9,800 |

| Dividend Receivable | $0 | $200 | $0 | $200 |

| Total Equity | $10,100 | $10,000 | $10,100 | $10,100 less commissions/spreads |

![]() NOTE:

NOTE:

Options have two components that make up their total premium value - intrinsic value and time value. The intrinsic value is the amount by which the option is in-the-money, while the time value represents the possibility that the option could become even more profitable before expiration as the underlying asset price fluctuates while providing protection against adverse moves.

Many options are American-style, which means they can be exercised early, ahead of their expiration date. Early exercise of an option eliminates the remaining time value component from the option's premium, since the option holder loses protection against unfavorable movements in the underlying asset’s price.

This makes early exercise suboptimal in most situations, as the option holder is willingly forfeiting a portion of the option's value.

There are a few specific circumstances where early exercise could make sense, such as:

- For call options on a stock that will pay dividends soon, where the dividend amount exceeds the remaining time value (and only if the exercise will settle on or prior to the record date for the dividend).

- For deep in-the-money options where the time value is negligible compared to the intrinsic value, and the option is expected to drop in value due to interest rate effects (PUTS), or expected stock loan benefits (CALLS).

The first case, exercising an in the money call immediately ahead of a dividend payment, is the most common economically-sensible early exercise. In most cases, it is advisable to hold or sell the option instead of exercising it early, in order to capture the remaining time value. An option should only be exercised early after carefully considering all factors and determining that the benefits of early exercise outweigh the time value being surrendered.

Account holders holding a long call position as part of a spread should pay particular attention to the risks of not exercising the long leg given the likelihood of being assigned on the short leg. Note that the assignment of a short call results in a short stock position and holders of short stock positions as of a dividend Record Date are obligated to pay the dividend to the lender of the shares. In addition, the clearinghouse processing cycle for exercise notices does not accommodate submission of exercise notices in response to assignment.

As example, consider a credit call (bear) spread on the SPDR S&P 500 ETF Trust (SPY) consisting of 100 short contracts in the March '13 $146 strike and 100 long contracts in the March '13 $147 strike. On 3/14/13, with the SPY Trust declared a dividend of $0.69372 per share, payable 4/30/13 to shareholders of record as of 3/19/13. Given the 3 business day settlement time frame for U.S. stocks, one would have had to buy the stock or exercise the call no later than 3/14/13 in order receive the dividend, as the next day the stock began trading Ex-Dividend.

On 3/14/13, with one trading day left prior to expiration, the two option contracts traded at parity, suggesting maximum risk of $100 per contract or $10,000 on the 100 contract position. However, the failure to exercise the long contract in order to capture the dividend and protect against the likely assignment on the short contracts by others seeking the dividend created an additional risk of $67.372 per contract or $6,737.20 on the position representing the dividend obligation were all short calls assigned. As reflected on the table below, had the short option leg not been assigned, the maximum risk when the final contract settlement prices were determined on 3/15/13 would have remained at $100 per contract.

| Date | SPY Close | March '13 $146 Call | March '13 $147 Call |

| March 14, 2013 | $156.73 | $10.73 | $9.83 |

| March 15, 2013 | $155.83 | $9.73 | $8.83 |

Please note that if your account is subject to tax withholding requirements of the US Treasure rule 871(m), it may be beneficial to close a long option position before the ex-dividend date and re-open the position after ex-dividend.

For information regarding how to submit an early exercise notice please click here.

The above article is provided for information purposes only as is not intended as a recommendation, trading advice nor does it constitute a conclusion that early exercise will be successful or appropriate for all customers or trades. Account holders should consult with a tax specialist to determine what, if any, tax consequences may result from early exercise and should pay particular attention to the potential risks of substituting a long option position with a long stock position.

Equity & Index Option Position Limits

Equity option exchanges define position limits for designated equity options classes. These limits define position quantity limitations in terms of the equivalent number of underlying shares (described below) which cannot be exceeded at any time on either the bullish or bearish side of the market. Account positions in excess of defined position limits may be subject to trade restriction or liquidation at any time without prior notification.

Position limits are defined on regulatory websites and may change periodically. Some contracts also have near-term limit requirements (near-term position limits are applied to the side of the market for those contracts that are in the closest expiring month issued). Traders are responsible for monitoring their positions as well as the defined limit quantities to ensure compliance. The following information defines how position limits are calculated;

Option position limits are determined as follows:

- Bullish market direction -- long call & short put positions are aggregated and quantified in terms of equivalent shares of stock.

- Bearish market direction -- long put & short call positions are aggregated and quantified in terms of equivalent shares of stock.

The following examples, using the 25,000 option contract limit, illustrate the operation of position limits:

- Customer A, who is long 25,000 XYZ calls, may at the same time be short 25,000 XYZ calls, since long and short positions in the same class of options (i.e., in calls only or in puts only) are on opposite sides of the market and are not aggregated

- Customer B, who is long 25,000 XYZ calls, may at the same time be long 25,000 XYZ puts. Rule 4.11 does not require the aggregation of long call and long put (or short call and short put) positions, since they are on opposite sides of the market.

- Customer C, who is long 20,000 XYZ calls, may not at the same time be short more than 5,000 XYZ puts, since the 25,000 contract limit applies to the aggregate position of long calls and short puts in options covering the same underlying security. Similarly, if Customer C is also short 20,000 XYZ calls, he may not at the same time have a long position of more than 5,000 XYZ puts, since the 25,000 contract limit applies separately to the aggregation of short call and long put positions in options covering the same underlying security.

Notifications and restrictions:

IB will send notifications to customers regarding the option position limits at the following times:

- When a client exceeds 85% of the allowed limit IB will send a notification indicating this threshold has been exceeded

- When a client exceeds 95% of the allowed limit IB will place the account in closing only. This state will be maintained until the account falls below 85% of the allowed limit. New orders placed that would increase the position will be rejected.

Notes:

Position limits are set on the long and short side of the market separately (and not netted out).

Traders can use an underlying stock position as a "hedge" if they are over the limit on the long or short side (index options are reviewed on a case by case basis for purposes of determining which securities constitute a hedge).

Position information is aggregated across related accounts and accounts under common control.

Definition of related accounts:

IB considers related accounts to be any account in which an individual may be viewed as having influence over trading decisions. This includes, but is not limited to, aggregating an advisor sub-account with the advisor's account (and accounts under common control), joint accounts with individual accounts for the joint parties and organization accounts (where an individual is listed as an officer or trader) with other accounts for that individual.

Position limit exceptions:

Regulations permit clients to exceed a position limit if the positions under common control are hedged positions as specified by the relevant exchange. In general the hedges permitted by the US regulators that are recognized in the IB system include outright stock position hedges, conversions, reverse conversions and box spreads. Currently collar and reverse collar strategies are not supported hedges in the IB system. For more detail about the permissible hedge exemptions refer to the rules of the self regulatory organization for the relevant product.

OCC posts position limits defined by the option exchanges. They can be found here.

http://www.optionsclearing.com/webapps/position-limits

How to create option spread strategies using Stategy Builder

How to create option spread strategies using OptionTrader

Where can I receive additional information on options?

The Options Clearing Corporation (OCC), the central clearinghouse for all US exchange traded securities option, operates a call center to serve the educational needs of individual investors and retail securities brokers. The resource will address the following questions and issues related to OCC cleared options products:

- Options Industry Council information regarding seminars, video and educational materials;

- Basic options-related questions such as definition of terms and product information;

- Responses to strategic and operational questions including specific trade positions and strategies.

The call center can be reached by dialing 1-800-OPTIONS. The hours of operation are Monday through Thursday from 8 a.m. to 5 p.m. (CST) and Friday from 8 a.m. to 4 p.m. (CST). Hours for the monthly expiration Friday will be extended to 5 p.m. (CST).

What is the margin on a Butterfly option strategy?

In order for the software utilized by IB to recognize a position as a Butterfly, it must match the definition of a Butterfly exactly. These are the 3 different types of Butterfly spreads recognized by IBKR, and the margin calculation on each:

Long Butterfly:

Two short options of the same series (class, multiplier, strike price, expiration) offset by one long option of the same type (put or call) with a higher strike price, and one long option of the same type with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

There is no margin requirement on this position. The long option cost is subtracted from cash and the short option proceeds are applied to cash.

Short Butterfly Put:

Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

The margin requirement for this position is (Aggregate put option highest exercise price - aggregate put option second highest exercise price). Long put cost is subtracted from cash and short put proceeds are applied to cash.

Short Butterfly Call:

Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal.

The margin requirement for this position is (Aggregate call option second lowest exercise price - aggregate call option lowest exercise price). Long option cost is subtracted from cash and short option proceeds are applied to cash.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. Other option positions in the account could cause the software to create a strategy you didn't originally intend, and therefore would be subject to a different margin equation.

What is the margin on an Iron Condor option strategy?

If an iron condor strategy exists in the account, the margin requirement will be the short put strike - the long put strike.

Example:

10 SPY Dec19 160P

-10 SPY Dec19 170P

-10 SPY Dec19 180C

10 SPY Dec19 190C

The margin requirement is determined by taking the strike of the short put (170) and subtracting the strike of the long put (160)

170-160 = 10

Take the difference and multiply by the number of contracts (10) and the multiplier (100)

10*10*100 = 10,000

In order for an iron condor to be recognized under exchange rules, the options must all be on the same underlying instrument and have the same expiration date, have different strike prices and the strike distance between the puts and the calls must be equal. If the distance between the puts and calls is different the position will be margined as two separate spreads with two separate margin requirements.

*Please note that Interactive Brokers utilizes option margin optimization software to try to create the minimum margin requirement. However, due to the system requirements required to determine the optimal solution, we cannot always guarantee the optimal combination in all cases. It is possible that given the option positions in the account, the iron condor you are trying to create will not be recognized as such.

What formulas do you use to calculate the margin on options?

There are many different formulas used to calculate the margin requirement on options. Which formula is used will depend on the option type or strategy determined by the system. There are a significant number of detailed formulas that are applied to various strategies. To find this information go to the IBKR home page at www.interactivebrokers.com. Go to the Trading menu and click on Margin. From the Margin Requirements page, click on the Options tab. There is a table on this page which will list all possible strategies, and the various formulas used to calculate margin on each.

The information above applies to equity options and index options. Options on futures employ an entirely different method known as SPAN margining. For information on SPAN margining, conduct a search on this page for “SPAN” or “Futures options margin”.

What happens to the USD equity option that I am long at expiration?

There are two scenarios which could occur if a long option is taken to expiration. If the option is out-of-the-money at expiration and you do not choose to exercise it, the option will expire worthless, and your losses will consist of the premium that was paid to acquire the option. If the option is in-the-money at expiration by 0.01 or more, it will be automatically exercised on your behalf (unless you previously chose to lapse the option) by the Options Clearing Corporation (OCC). The OCC processes monthly expiration options on the third Saturday of the month, or the day after Friday expiration. The resulting long or short position will be put into the account, effective on the Friday trade date. If the account has sufficient margin to satisfy the requirement on the resulting position, it will then be up to the account holder to decide what they want to do with the position. If the resulting position causes a margin deficit, the account will be subject to liquidation at a time which is defined by the holdings within the account. Please be aware that any positions could be liquidated as a result of the account being in margin violation—the liquidation is not confined to only the shares that resulted from the option position. For example, if the account holds currency, futures, future options positions or and non-USD product, the account may begin to liquidate to meet the margin deficit as soon as a corresponding market opens.

Account holders should refer to the Characteristics and Risks of Standardized Options disclosure document which is provided by IBKR to every option eligible client at the point of application and which clearly spells out the risks of assignment. This document is also available online at OCC's web site.

How can I exercise long options?

Account holders have the ability to exercise equity options they hold long in their account.

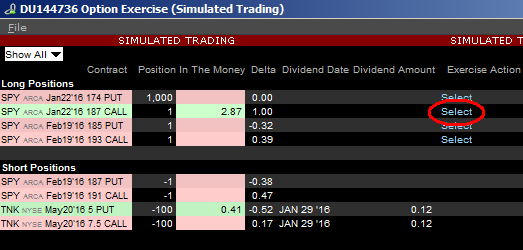

From Trader Workstation, go to the Trade menu and select Option Exercise.

The Option Exercise window will appear and any long options you are holding will populate under the Long Positions column header. To exercise one of them, left-click on the light blue “Select” link under the Exercise Option column header for that particular option.

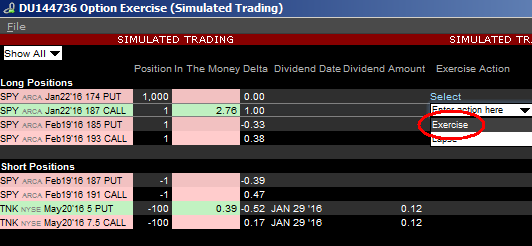

Select "Exercise" from the drop down menu.

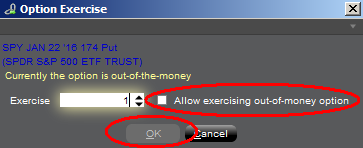

Your Exercise request will now show as an order line on your Trader Workstation until the clearinghouse processes the request. If the option is out-of-the-money, a warning message will appear. To submit the Exercise request, check the box to “Allow exercising out-of-money option” and click OK.

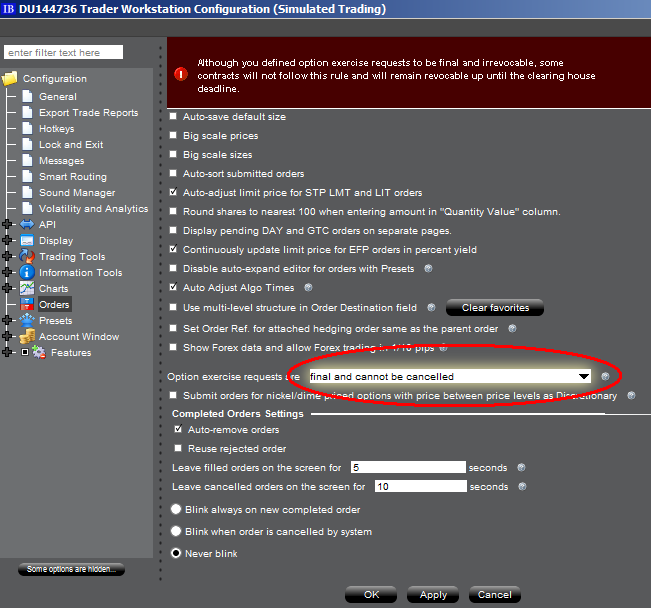

Please note, you have the option of selecting whether you would like your option exercise request to be final and unable to be cancelled, or editable until cutoff time (varies by clearing house). If you select "final and cannot be cancelled", some contracts will not follow this rule and will remain revocable up until the clearing house deadline. You can make this selection in Trader Workstation by going to Edit followed by Global Configuration and selecting Orders from the configuration tree on the left side.

In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Client Portal window. In the Client Portal window, click on "Inquiry/Problem Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Option Exercise Requests (whether received through the TWS Option Exercise window or by a ticket sent via Client Portal / Message Center) must be submitted as follows:

| For Equity Option Contracts Traded Upon: | IBKR must receive an Exercise Request by: | ||||||

| North America | US Options Exchanges | 17:25 EST | |||||

| Montreal Exchange | 16:30 EST | ||||||

| Europe | Euronext | 17h50 CET | |||||

| Eurex (German and Swiss) | 17h50 CET | ||||||

| IDEM | 17h50 CET | ||||||

| LIFFE | 17h50 CET | ||||||

| MEFF | 17h50 CET | ||||||

| Sweden | 17h50 CET | ||||||

| Asia Pacific | Australia | 16:25 Australia/NSW | |||||

| Japan | 15:30 JST | ||||||

| (Send a ticket and call Client Services) | |||||||

Trading permissions in an IRA account

IBKR offers Traditional, Roth and SEP IRAs any of which may be designated as a 'Cash' or 'Margin' type. The following article outlines the trading permissions provided under each type as well as restrictions which account holders should familiarize themselves with.

CASH TYPE PERMISSIONS

- Long stock, bond, mutual fund

- Long call and put options

- Short calls if covered by underlying stock (which is then restricted)

- Short puts if strike price is fully covered by cash (which is then restricted)

- Option spreads where exercise style is European and long leg expires simultaneously or after short leg

- Long or short futures contracts (subject to a margin requirement which is generally 2x that of the requirement for non-retirement accounts)

Restrictions:

- Must have sufficient (unrestricted) cash available to support all outstanding orders

- Cash proceeds from sales not available for withdrawal or trading until settlement (generally 2 business days for stocks and Forex and 1 for options)

- No short stock

- No negative or debit cash balance (subject to immediate position liquidation in an amount sufficient to restore cash to non-negative balance)

- Not allowed to hold a cash balance or position denominated in a currency different from the Base Currency of the account.

- If the exercise or assignment of an option results in the delivery of either a long stock position for which the account does not have sufficient cash to purchase (e.g., call exercise) or any short stock position (e.g. put exercise) the account will be subject to liquidation.

- IBKR does not allow trading or holdings of securities such as Master Limited Partnerships (MLPs) in retirement accounts that have the potential to generate UBTI (Unrelated Business Taxable Income) as this type of income has the potential to trigger taxes and tax reporting in an otherwise tax-deferred account type.

MARGIN TYPE ACCOUNT

- Long stock, bond, mutual fund

- Long call and put options

- Short calls if covered by underlying stock (which is then restricted)

- Short puts if strike price is fully covered by cash (which is then restricted)

- Option spreads where long leg expires simultaneously or after short leg (no exercise style restriction)

- Long balance in non-Base Currency

- Long or short futures contracts (subject to a margin requirement which is generally 2x that of the requirement for non-retirement accounts)

Restrictions:

- Reg T margin rules enforced (including Pattern day Trading rules)

- Cash proceeds from sales not available for withdrawal until settlement (generally 2 business days for stocks and Forex and 1 for options). Unsettled funds may be used for trading

- Cash proceeds from unsettled sales are available for trading as long as the subsequent purchase order does not settle prior to the sale order

- No short stock

- No negative or debit cash balance (subject to immediate position liquidation in an amount sufficient to restore cash to non-negative balance)

- If purchasing a security or trading a product denominated in a currency different from the Base Currency of the account, a currency conversion must first be executed

- If the exercise or assignment of an option results in the delivery of either a long stock position for which the account does not have sufficient cash to purchase (e.g., call exercise) or any short stock position (e.g. put exercise) the account will be subject to liquidation

- IBKR does not allow trading or holdings of securities such as Master Limited Partnerships (MLPs) in retirement accounts that have the potential to generate UBTI (Unrelated Business Taxable Income) as this type of income has the potential to trigger taxes and tax reporting in an otherwise tax-deferred account type.

- Not eligible for Portfolio Margining

- Not allowed for clients of IBKR Canada

See KB280 or click here for instructions on upgrading an account from Cash to Margin type.