How is my IB Canada account protected?

The Canadian Investor Protection Fund (CIPF) is sponsored by the Canadian regulator (IIROC) to ensure client assets held by a Canadian investment dealer are protected if a member firm becomes insolvent. IB Canada is a member of the CIPF which offers insurance against member default for amounts up to CAD 1,000,000. Covered assets include cash, securities and commodities and will depend on the account type:

Non-registered accounts (Cash, Margin, TFSA)

1,000,000 CAD for any combination of cash, securities and commodities under all non-registered account types.

For assets held in a joint account or under a corporation, the percentage interest is added towards the same total.

Registered account (RSP)

RSP accounts are treated as "Separate Account" and are eligible for an additional 1,000,000 CAD coverage. Additional details can be found on www.cipf.ca.

Please note, IB Canada accounts receive CIPF protection in lieu of SIPC protection.

How to use Voice callback for receiving login authentication codes

If you have SMS enabled as two-factor authentication method, you may use Voice callback to receive your login authentication codes. This article will provide you steps on how to select voice callback when logging in to our platforms.

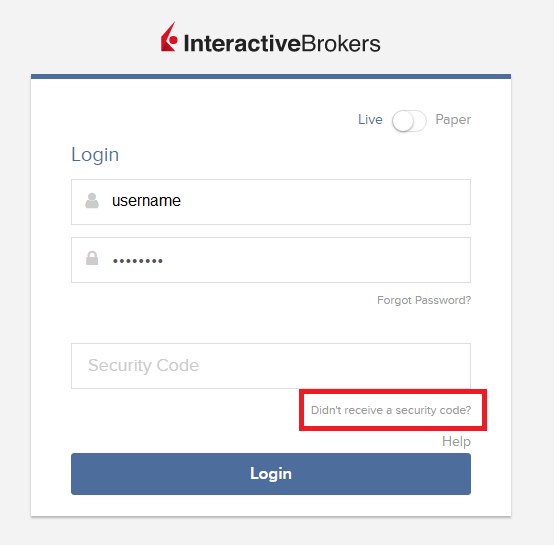

Client Portal

1. Click on "Didn't receive a security code?"

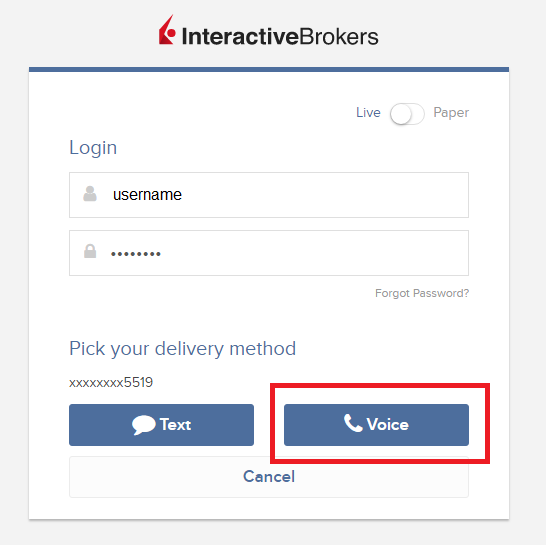

2. From the two options, select "Voice" and wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

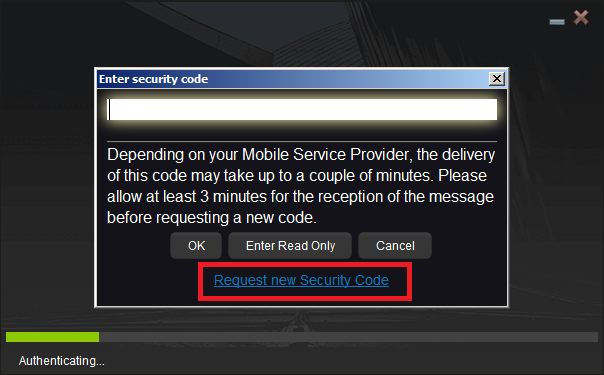

TWS

1. Click on "Request new Security Code"

2. From the two options, select "Voice" and click on OK. Then wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

Note: Voice callback for the TWS is only available in the LATEST and BETA version.

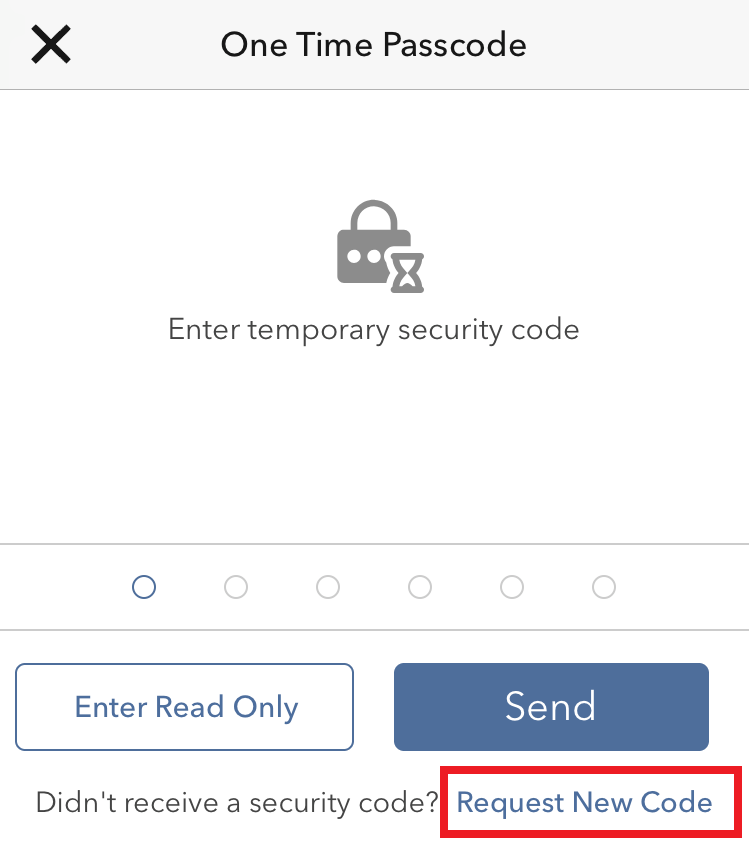

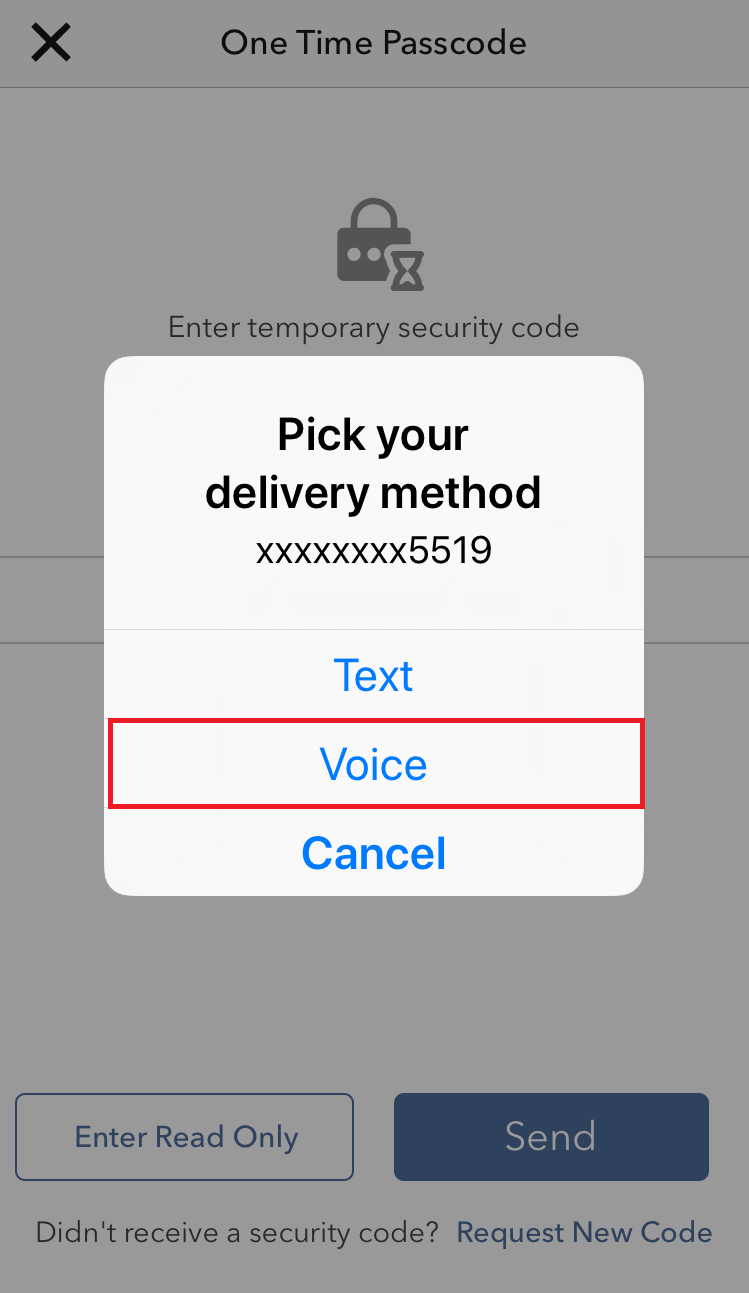

IBKR Mobile - iOS

1. Click on "Request New Code"

2. From the two options, select "Voice" and wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

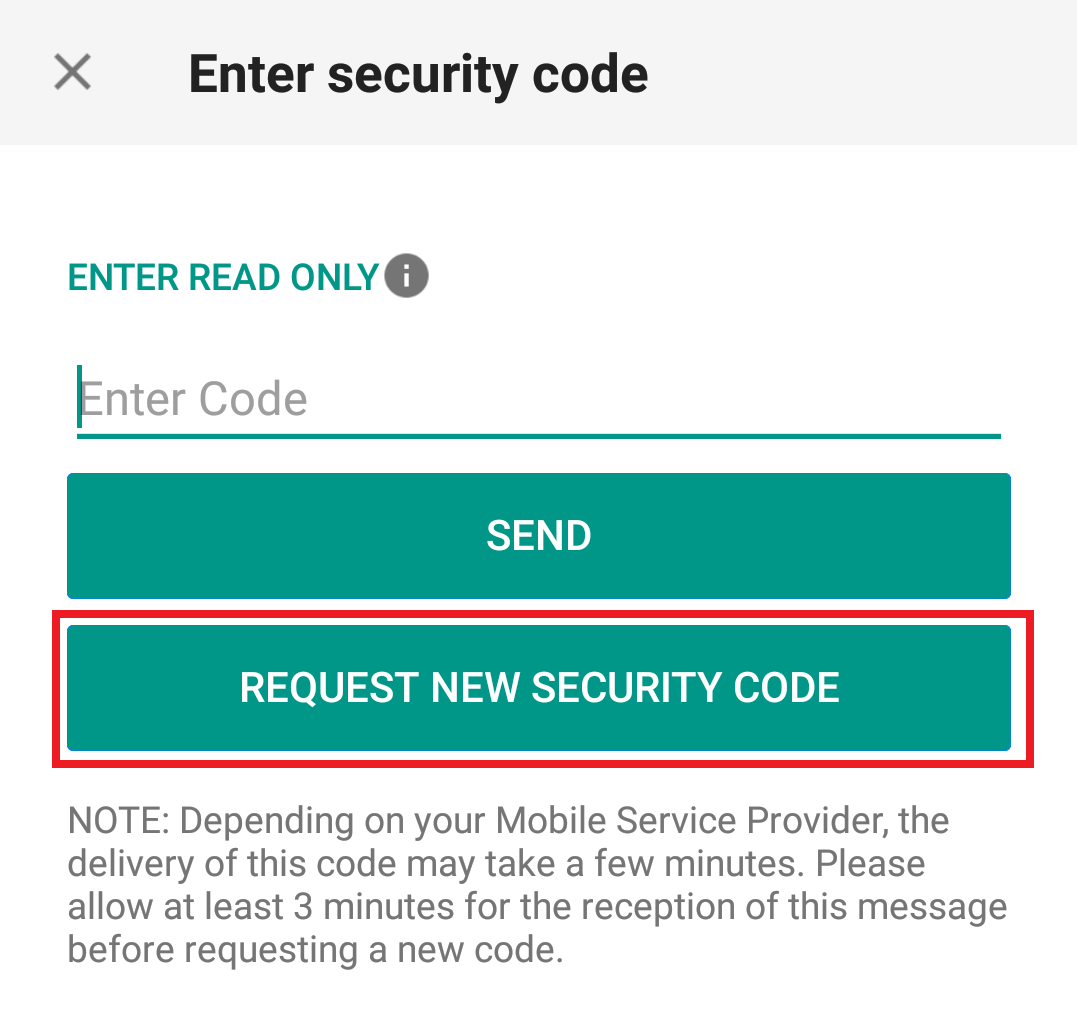

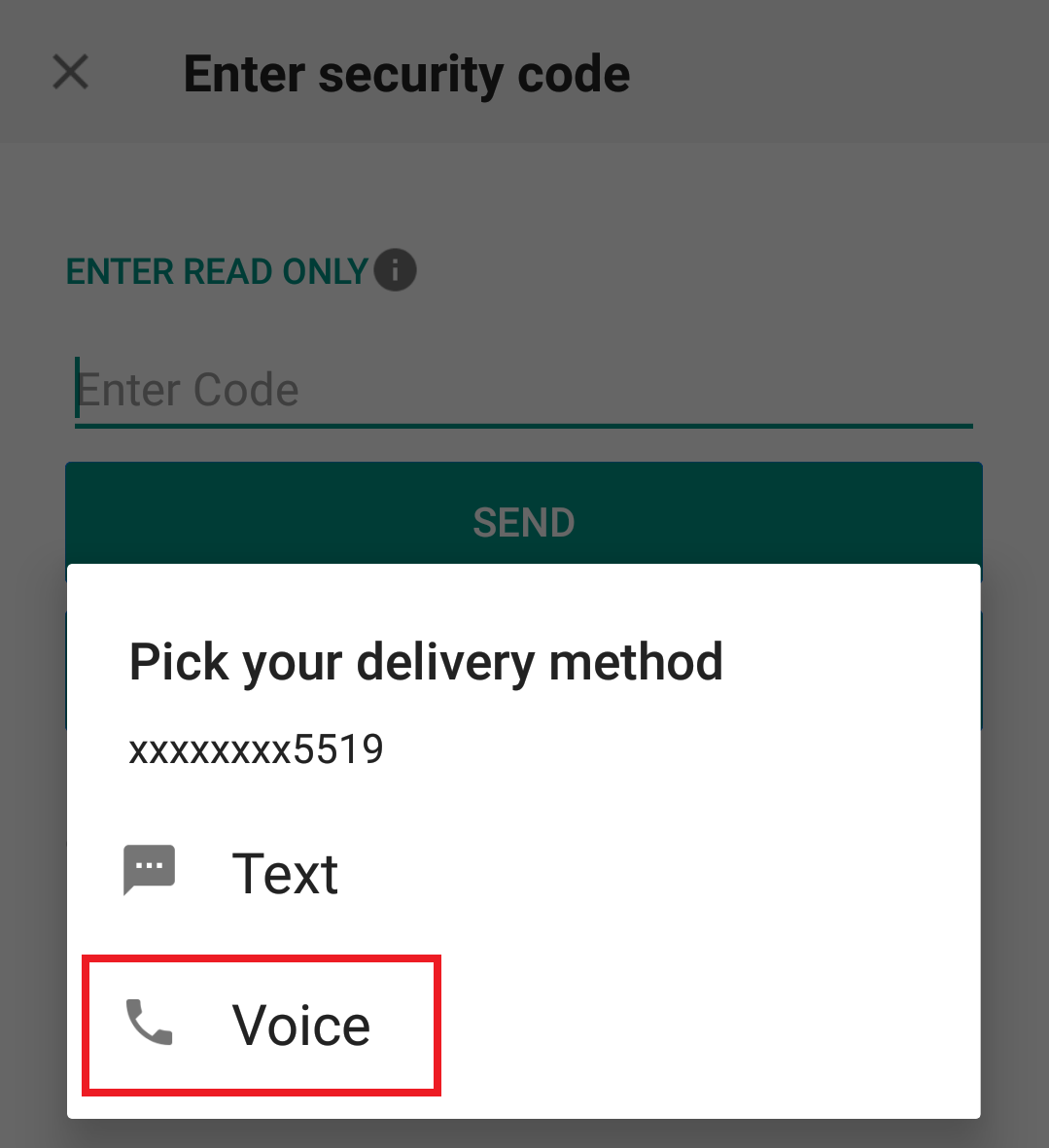

IBKR Mobile - Android

1. Click on "Request New Security Code"

2. From the two options, select "Voice" and wait for the callback.

3. After selecting Voice, you should receive the callback within a minute. Please wait for the callback and be ready to write down the code that will be provided over the callback.

References:

- How to login using SMS authentication

- Overview of Secure Login System

- Information and procedures related to Security Devices

- IBKR Mobile Authentication

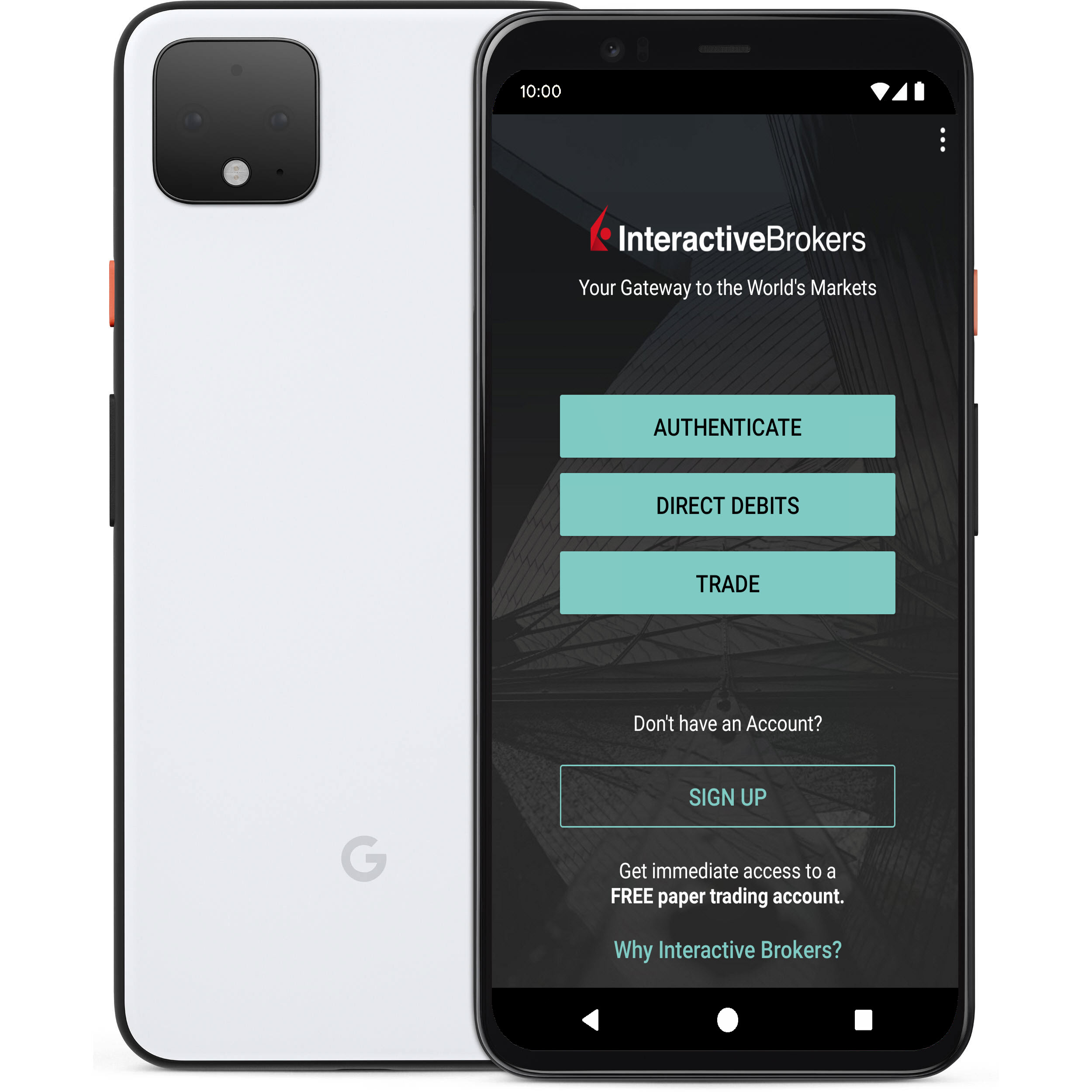

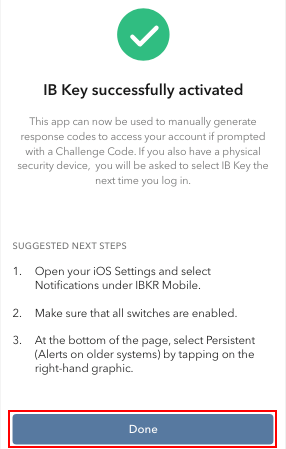

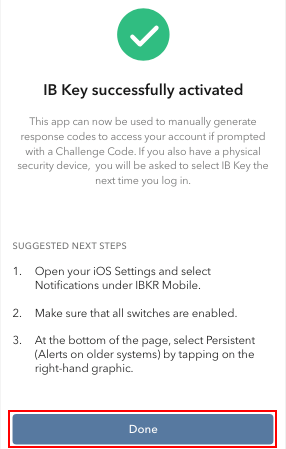

IBKR Mobile Authentication (IB Key) Use Without Notifications

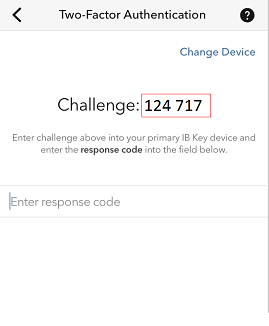

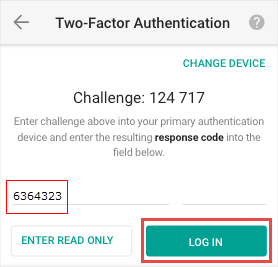

In case your smartphone is unable to receive IBKR Mobile notifications, you can still complete the login process using the IBKR Mobile Authentication (IB Key) Challenge/Response method, described on the following pages (according to your device operating system):

The same information applies to you if your phone has no Internet connectivity (you are in roaming, out of coverage, without an active mobile data plan, etc.)

If your smartphone is unable to receive IBKR Mobile notifications despite having Internet connectivity, we recommend you to perform the steps outlined in the IBKR Knowledge Base.

双因素保护—移动IBKR验证

在IBKR,我们致力于通过双因素验证登录保护您的账户。在双因素验证模式下,只有通过使用两项安全因素才能访问账户,即“您已知的”(用户名和密码)和“您已有的”(工具生成的随机密码,将在用户名和密码后输入)。 双因素保护旨在降低网络黑客(其可通过恶意软件或社会工程陷阱取得您的密码)访问您账户的风险。

尽管IBKR提供多种双因素选择,但移动IBKR验证被普遍认为是最便于访问和操作的方式。下方列出了该应用程序的一些便利性因素。

1. 始终可用:

您总是会随身携带手机,这也就是能让您安全访问IBKR账户的工具

2. 便利:

无需携带、跟踪和注意其它设备。如果丢失或更换手机,IBKR客服也随时能帮助您恢复该应用程序,让其正常运行。

3. 快速激活:

程序下载后几分钟内,您便可用其进行验证登录。

4. 无需邮寄、运输或退还:

不会有寄送延迟,也不会因为电池耗尽而要退回设备。只需一次快速下载便可使用。

5. 用我们的无缝验证实现安全且快速通畅的登录:

登录交易平台或客户端时,您只需输入用户名和密码 - IBKR会向您发送通知,您再通过IB Key协议用生物特征识别或PIN码(具体取决于您的配置)完成验证。

6. 允许多个使用者用同一个应用程序进行验证:

如果您个人的IBKR账户有一个安全设备、您与配偶的联名账户有一个安全设备、您的公司账户也有一个安全设备,那么知道所有这些使用者(还可以有更多)现在都可以用同一个应用程序,您一定会非常高兴。

7. 所有智能手机都可使用:

如果您用的是iPhone,可直接从苹果应用商店下载移动IBKR。安卓手机用户可从谷歌电子市场获取该应用程序。中国客户可以从百度手机助手或360手机助手上下载。

8. 可离线运行:

即使手机离线(如正在休假或信号不好),您仍然可以使用移动IBKR验证。尽管无法使用无缝验证,但该程序仍可以生成您访问账户和进行交易必须用到的验证代码。

9. 重置密码安全传输:

安装了移动IBKR并激活了IB Key验证后,您便可让IBKR客服将临时密码以一种安全的方式发送到您的手机,而无需通过短信或其它方式。

10. 内存占用量小:

即使是限制最严格的数据套餐也可以下载移动IBKR,其安装在手机上不会占用系统资源。该程序的大小及其运行时的资源占用量都已在不影响安全性能的前提下降到了最小。

有关移动IBKR验证的安装、激活与运行,请参见KB2260。

如何将移动IBKR验证程序(IB Key)迁移到新手机

您可以将移动IBKR应用程序同时安装在多个设备上,但集成的验证模块——移动IBKR验证程序(IB Key)——只能在一个手机上激活,您将在这台手机上完成任何其它设备触发的双因素验证任务。

- iOS

- 安卓

阅读完上述要求后,请根据您手机的操作系统点击下方对应链接:

iOS

2. 选择迁移IB Key(图 2),然后点击迁移IB Key确认您的选择(图 3)

.png)

.png)

.png)

.png)

安卓

2. 选择迁移IB Key(图 2),然后点击迁移IB Key确认您的选择(图 3)

.png)

.png)

.png)

.png)

参考:

- 参见KB2879和KB2260了解有关移动IBKR验证程序(IB Key)的基本信息

- 参见KB2260了解移动IBKR应用程序的安装/激活/操作说明

-

参见KB2278了解在苹果手机上操作移动IBKR验证程序(IB Key)的说明

-

参见KB2277了解在安卓手机上操作移动IBKR验证程序(IB Key)的说明

- 参见KB3279了解在另一手机上启用了移动IBKR验证程序(IB Key)的情况下如何登录移动IBKR

- 参见KB3073了解如何重新激活或迁移移动IBKR验证程序(IB Key)

在其它手机上启用了移动IBKR验证程序(IB Key)的情况下如何登录移动IBKR

验证设备:这是您激活了移动IBKR验证程序(IB Key)的智能手机

交易设备:这是您想使用移动IBKR程序进行交易的设备。

程序

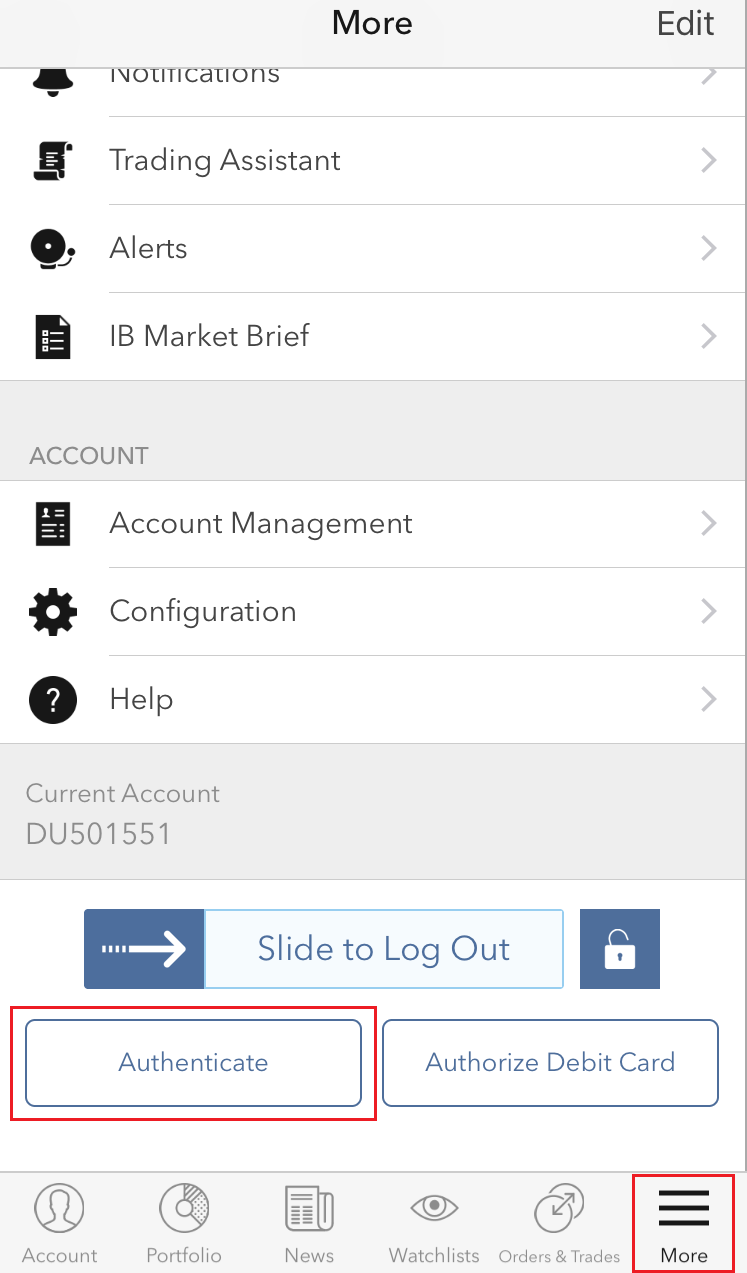

iOS

.png)

.png)

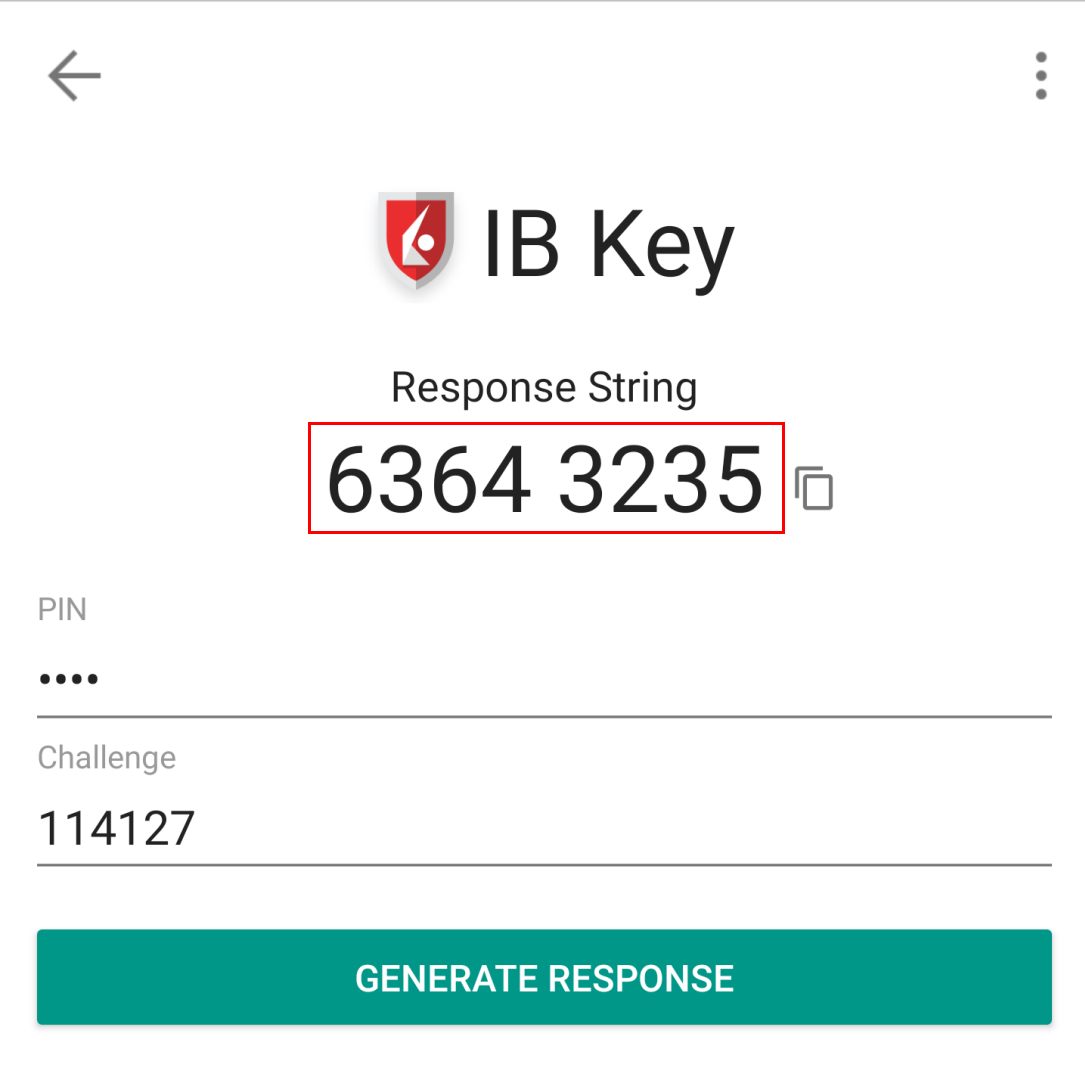

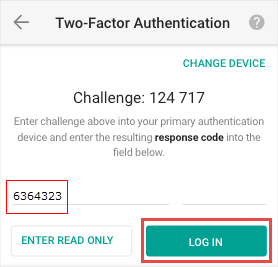

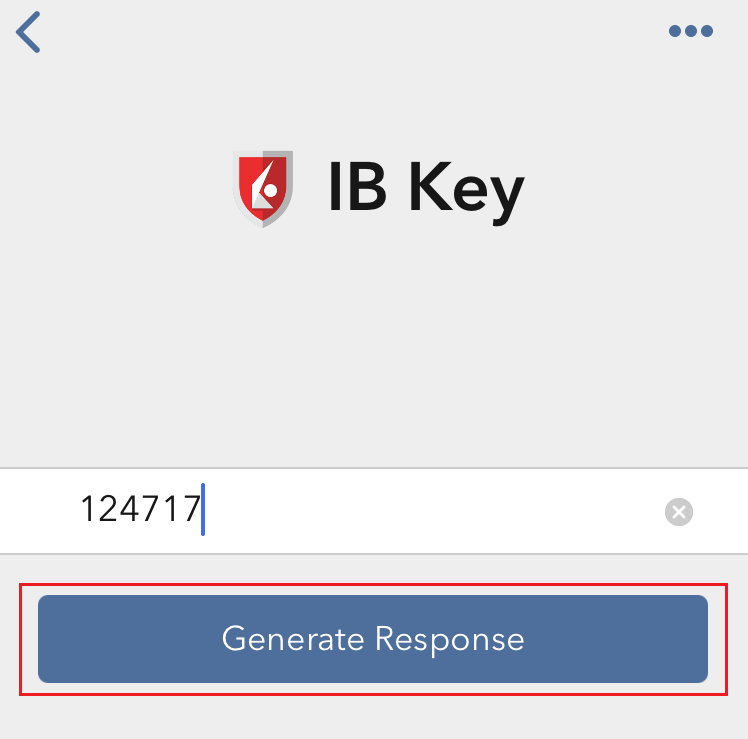

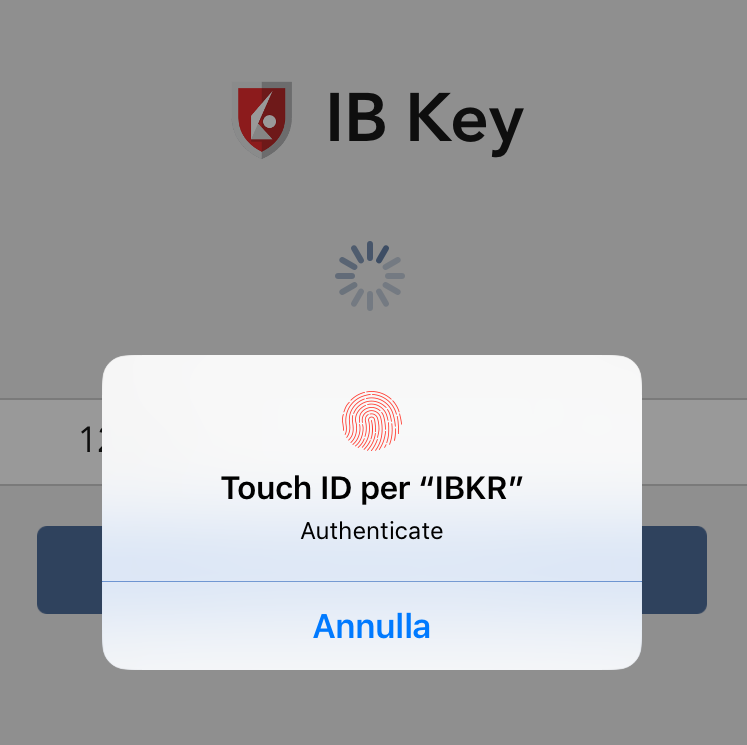

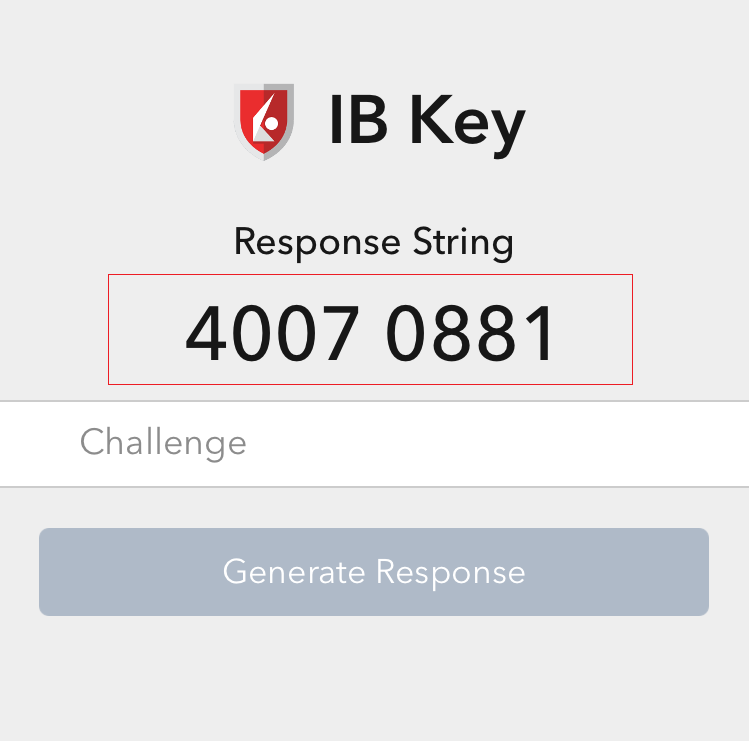

5.输入在第2步中获得的挑战码。然后点击生成响应码 (图 8)。提供安全验证要素后(图 9),您便会收到一条响应字符串(图 10)。

图 8 图 9 图 10

6. 在交易设备上,将响应字符串输入到“输入响应码“区域,然后点击发送以最终完成验证程序。

.png)

安卓

(1).png)

.png)

图 7 图 8

.png)

.png)

图 9 图 10

.png)

I am not receiving text messages (SMS) from IBKR on my mobile phone

Once your mobile phone number has been verified in the Client Portal, you should immediately be able to receive text messages (SMS) from IBKR directly to your mobile phone. This article will provide you with basic troubleshooting steps in case you are unable to receive such messages.

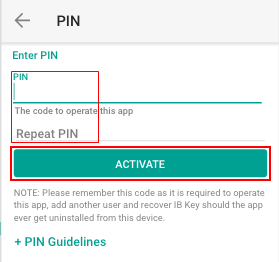

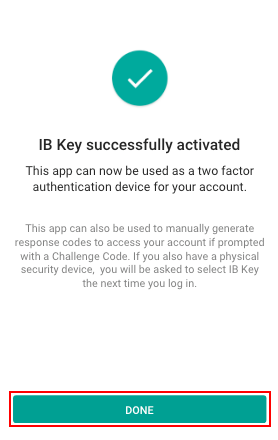

1. Activate the IBKR Mobile Authentication (IB Key) as 2-Factor security device

In order to be independent of wireless/phone carrier-related issues and have a steady delivery of all IBKR messages we recommend to activate the IBKR Mobile Authentication (IB Key) on your smartphone.

The smartphone authentication with IB Key provided by our IBKR Mobile app serves as a 2-Factor security device, thereby eliminating the need to receive authentication codes via SMS when logging in to your IBKR account.

Our IBKR Mobile app is currently supported on smartphones running either Android or iOS operating system. The installation, activation, and operating instructions can be found here:

2. Restart your phone:

Power your device down completely and turn it back on. Usually this should be sufficient for text messages to start coming through.

Please note that in some cases, such as roaming outside of your carrier's coverage (when abroad) you might not receive all messages.

3. Use Voice callback

If you do not receive your login authentication code after restarting your phone, you may select 'Voice' instead. You will then receive your login authentication code via an automated callback. Further instructions on how to use Voice callback can be found in IBKB 3396.

4. Check whether your phone carrier is blocking the SMS from IBKR

Some phone carriers automatically block IBKR text messages, as they are wrongly recognized as spam or undesirable content. According to your region, those are the services you can contact to check if a SMS filter is in place for your phone number:

In the US:

- All carriers: Federal Trade Commission Registry

- T-Mobile: Message Blocking settings are available on T-Mobile web site or directly on the T-Mobile app

In India:

- All carriers: Telecom Regulatory Authority of India

In China:

- Call your phone carrier directly to check whether they are blocking IBKR messages

References:

- How to login using SMS authentication

- Overview of Secure Login System

- Information and procedures related to Security Devices

- IBKR Mobile Authentication

How to Migrate IBKR Mobile Authentication (IB Key) to a New Smartphone

You may have the IBKR Mobile app installed simultaneously on multiple devices but the integrated authentication module IBKR Mobile Authentication (IB Key) can only be active on a single smartphone, on which you will complete the Two-Factor authentication tasks triggered from any other device.

- Apple iOS

- Android

Once you have reviewed the above requirements, please click one of the below links, according to the operating system of your secondary smartphone

Apple iOS

2. Select the Migrate IB Key option (Figure 2), then tap Migrate IB Key to confirm your choice (Figure 3)

.png)

.png)

.png)

.png)

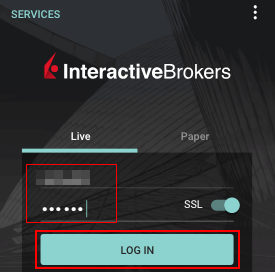

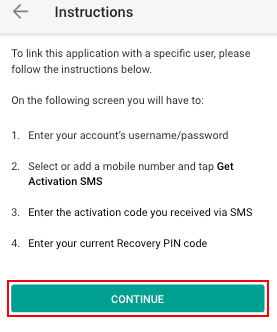

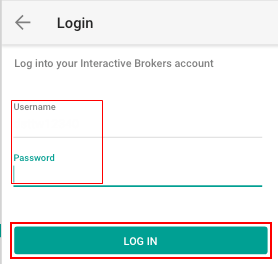

Android

2. Select the Migrate IB Key option (Figure 2), then tap Migrate IB Key to confirm your choice (Figure 3)

.png)

.png)

.png)

.png)

References:

- See KB2879, KB2260 for General information about IBKR Mobile Authentication (IB Key)

- See KB2260 for instructions on how to install/activate/operate the IBKR Mobile app

-

See KB2278 for instructions on how to operate your IBKR Mobile Authentication (IB Key) on an Apple iPhone

-

See KB2277 for instructions on how to operate your IBKR Mobile Authentication (IB Key) on an Android smartphone:

- See KB3279 for instructions on how to log in to IBKR Mobile when IBKR Mobile Authentication (IB Key) is enabled on another phone

- See KB3073 for instructions on how to reactivate or transfer the IBKR Mobile Authentication (IB Key)

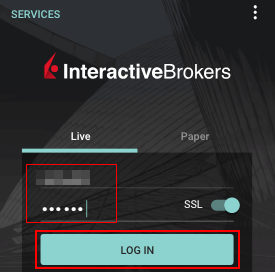

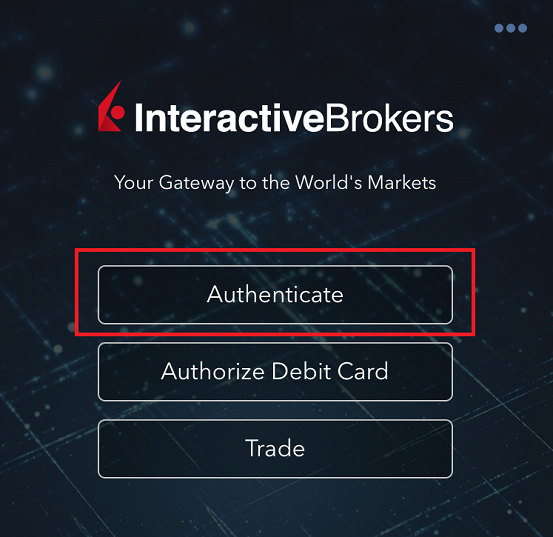

How to Log in to IBKR Mobile when IBKR Mobile Authentication (IB Key) is Enabled on Another Phone

Authentication device: this is the smartphone on which you activated the IBKR Mobile Authentication (IB Key)

Trading device: this is where you want to use IBKR Mobile app for trading.

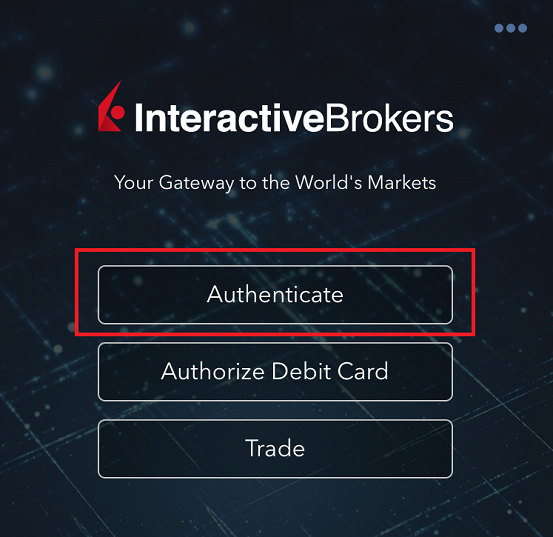

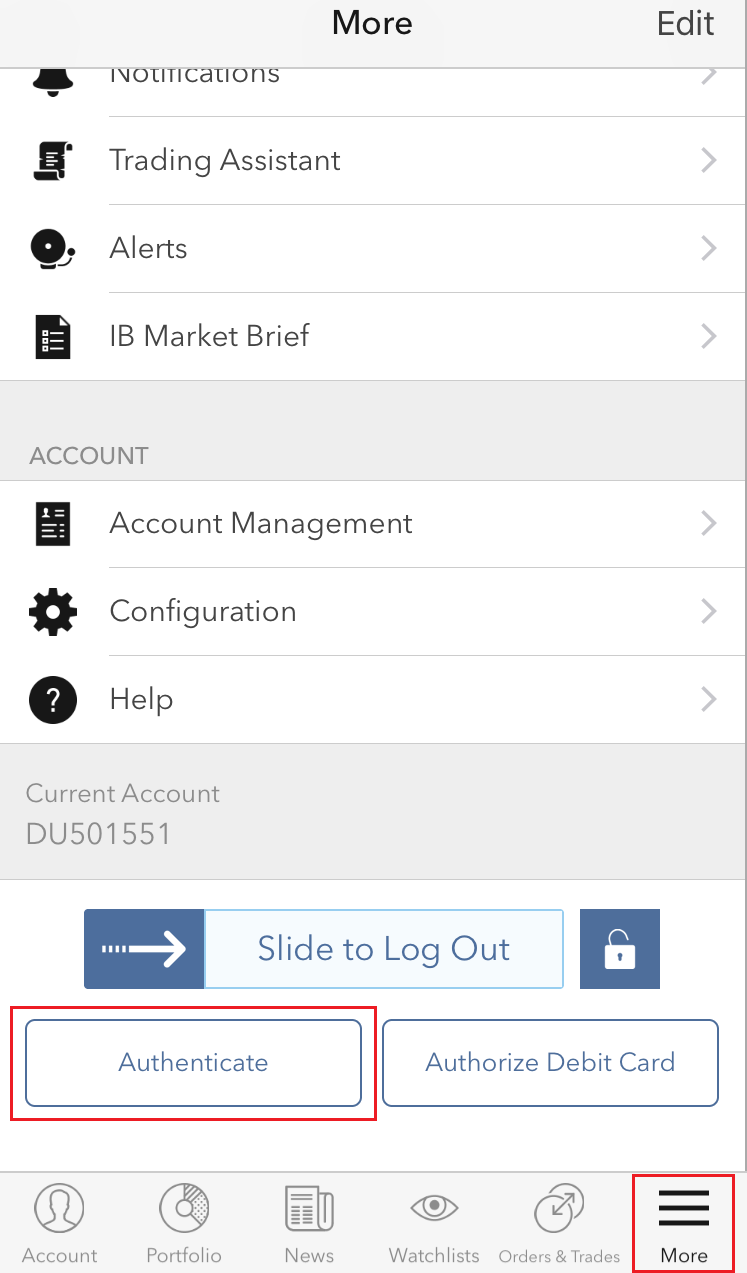

Procedure

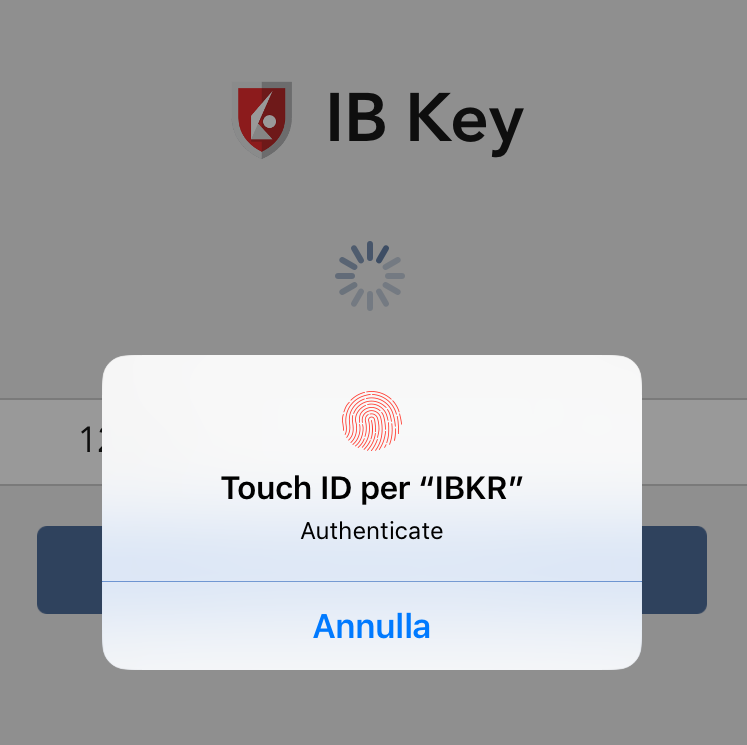

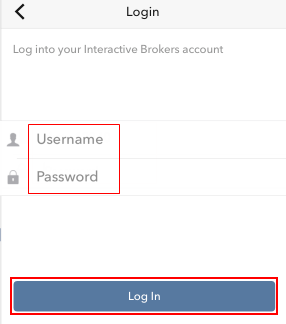

Apple iOS

.png)

.png)

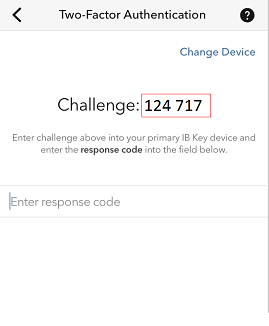

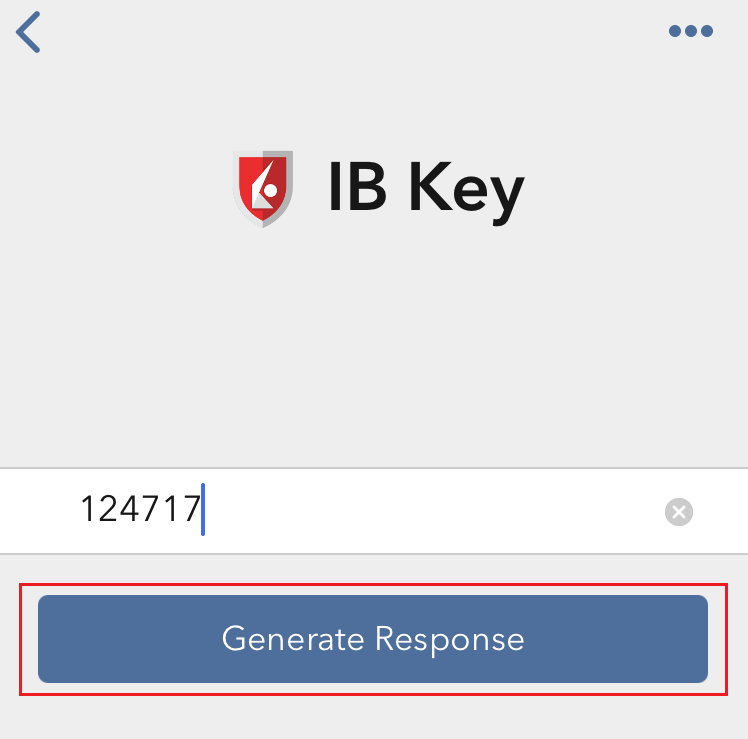

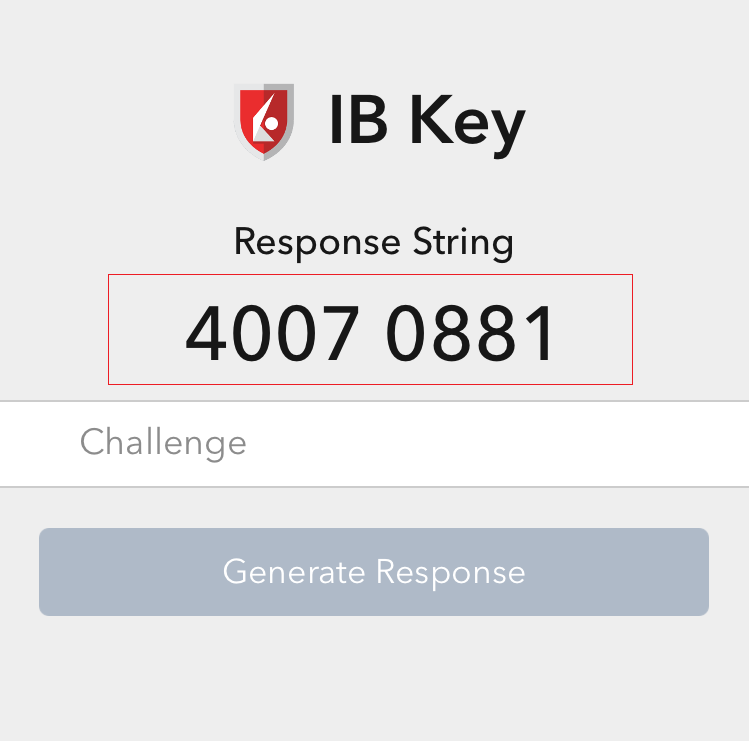

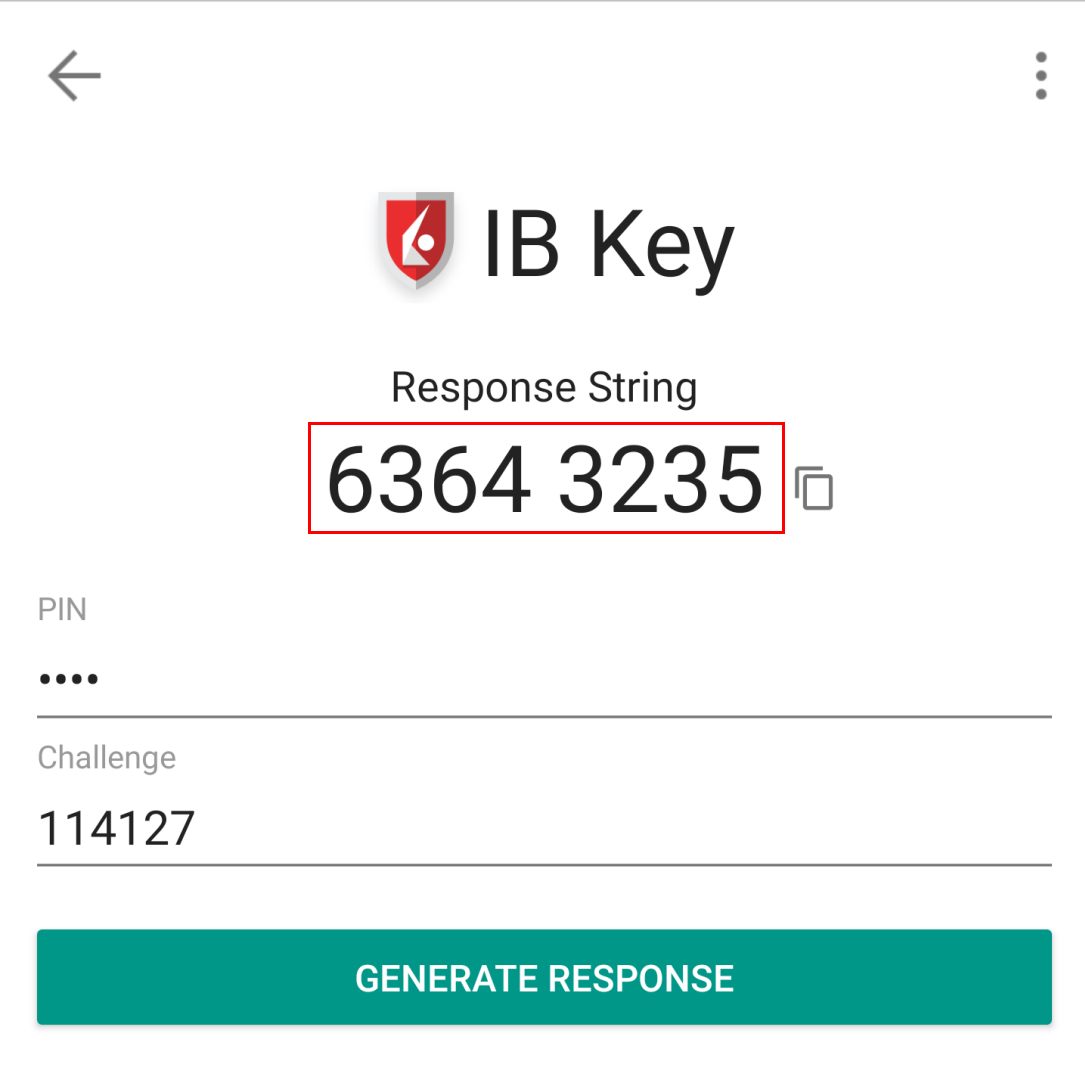

5. Enter the Challenge code you obtained at point 2. Then tap Generate Response (Figure 8). Once you have provided your security element (Figure 9), you will receive a Response String (Figure 10).

Figure 8 Figure 9 Figure 10

6. On your Trading device, enter the Response String into the "Enter response code" field and tap Send to finalize the authentication process.

.png)

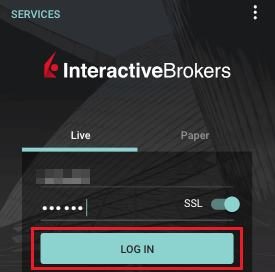

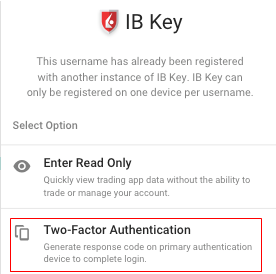

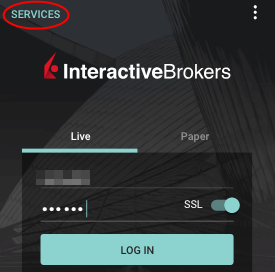

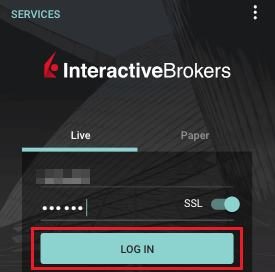

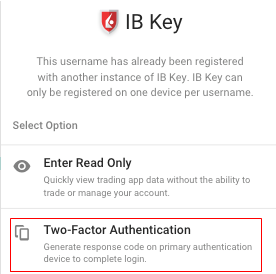

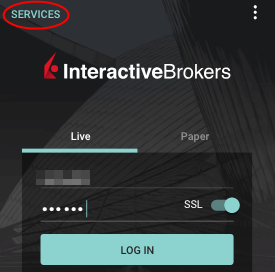

Android

(1).png)

.png)

Figure 7 Figure 8

.png)

.png)

Figure 9 Figure 10

.png)

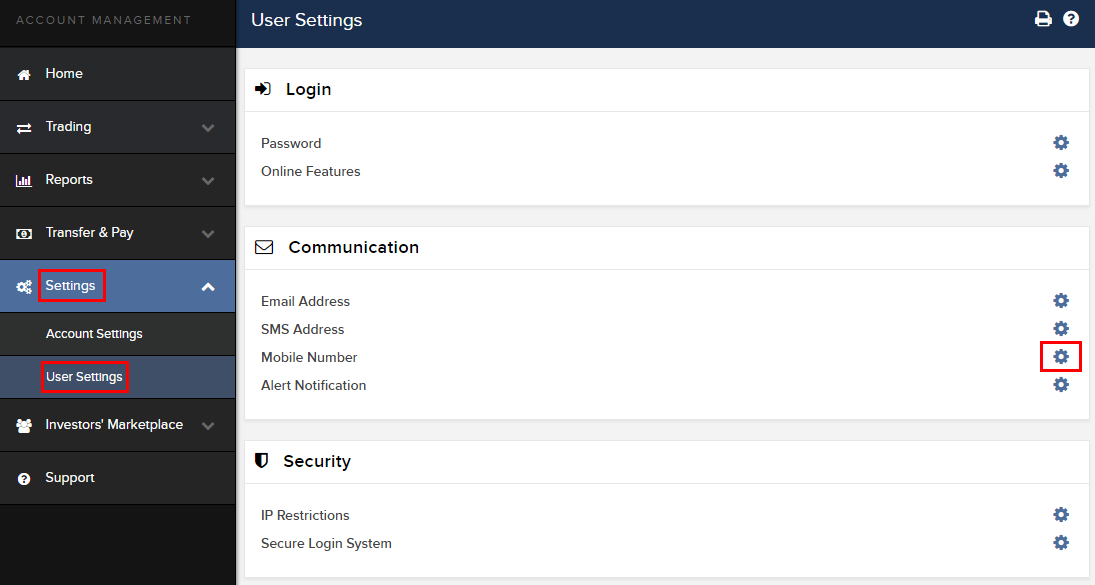

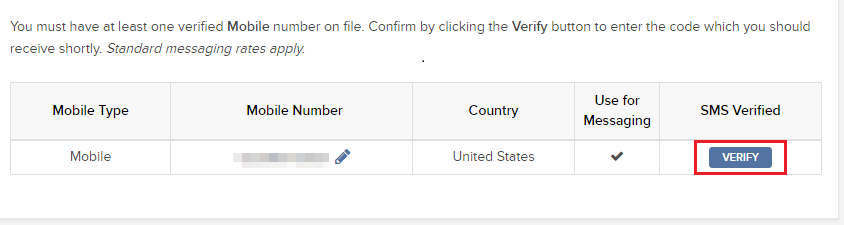

如何启用和使用SMS作为双因素验证方式

SMS(短信)作为一种双因素验证方式,可快速简便地执行验证任务。本文将向您说明如何设置手机号码通过短信接收验证码。

如何启用短信验证

要启用短信双因素验证,您需要有一个经验证的手机号码。如您在申请账户时未验证过您的手机号码,您可随时通过以下步骤完成验证:

- 登录客户端。

- 在侧边栏菜单中,依次点击设置 和使用者设置。点击手机号码对应的配置齿轮图标。

- 点击验证

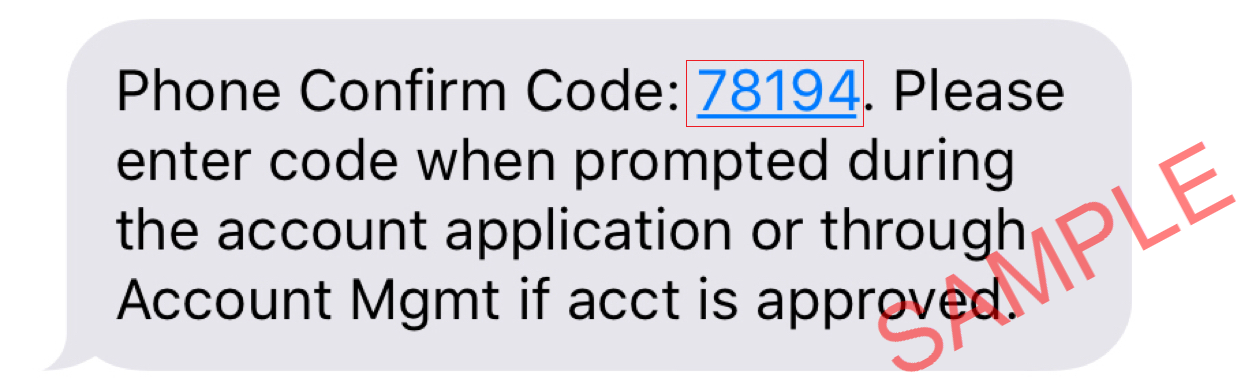

- 打开您手机的短信,您将看到我们发送给您的带有确认码的短信。

注意:短信发送时间有长有短,在某些情况下可能需要几分钟。需等待2分钟之后才能请求重发短信。

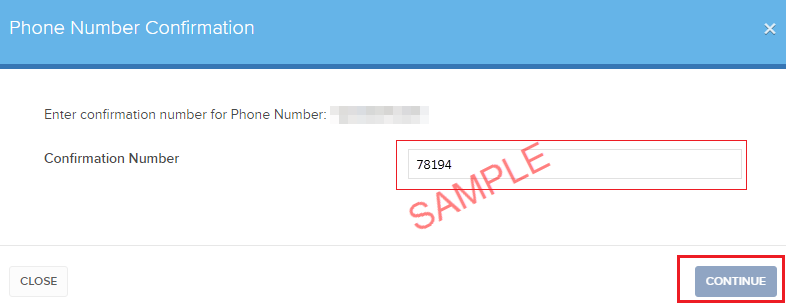

- 在确认码区域输入您收到的确认码,然后点击继续。

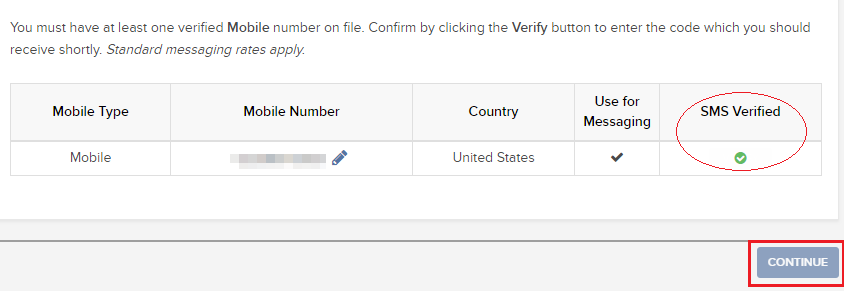

- 如果确认码被接受,则“已短信验证”栏会出现一个绿色的勾。点击继续完成操作。

- 如您的使用者没有活跃的SLS设备,系统将自动启用短信作为双因素验证方式。

回到顶部

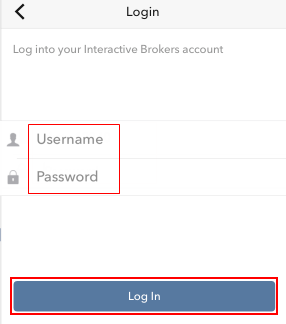

如何使用短信验证登录

一旦启用短信作为双因素验证方式,您便可按以下方法进行使用:

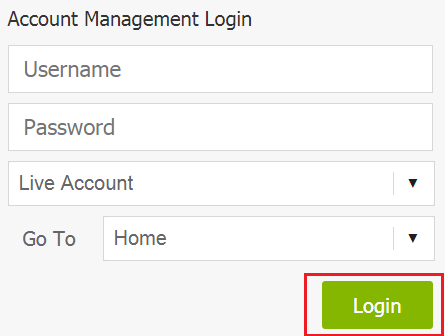

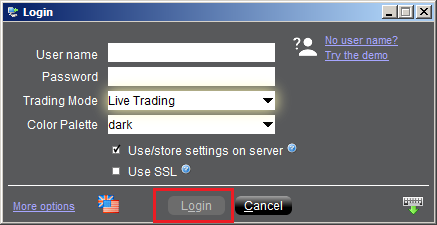

- 启动TWS或打开客户端

- 在相应区域输入用户名和密码,点击登录

- 系统会提示您输入通过短信发送给您的验证码。请打开您手机的短信应,找到含有验证码的短信。

.png)

- 在登录页面的安全代码区域输入验证码,然后点击登录或确定

.png)

.png)