How to Place a CFD Trade on the Trader Workstation

How to place trades in U.K. CFDs on the Trader Workstation

Accessing the WebTrader Language Selection Menu

IB's Webtrader allows the user set the system display in a variety of languages including English, German, French, Italian, Spanish, Japanese and Chinese.

Account holders who need to reset the global language setting in the WebTrader may no longer be presented with the selection menu at the point of login as the setting has been saved by their browser. Outlined below are the steps which are required to be taken in order to again display this selection menu using Internet Explorer as the sample browser.

![]() IMPORTANT NOTE: Please note that these steps require that you delete temporary internet files and cookies in order to reset your WebTrader layout to the default settings. By taking this step you will also remove any customized settings or layout establsihed in prior WebTrader sessions and will also clear all private data stored in your browser.

IMPORTANT NOTE: Please note that these steps require that you delete temporary internet files and cookies in order to reset your WebTrader layout to the default settings. By taking this step you will also remove any customized settings or layout establsihed in prior WebTrader sessions and will also clear all private data stored in your browser.

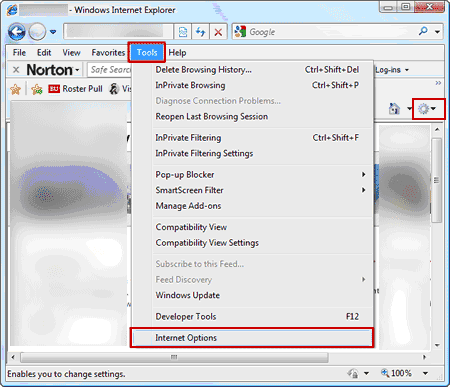

Step 1

From the browser main menu, select Tools and then Internet Options

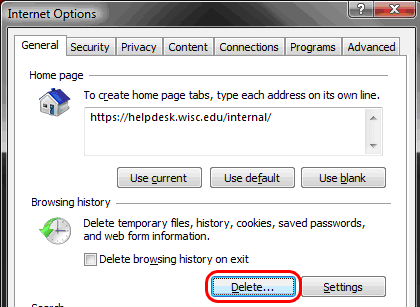

Step 2

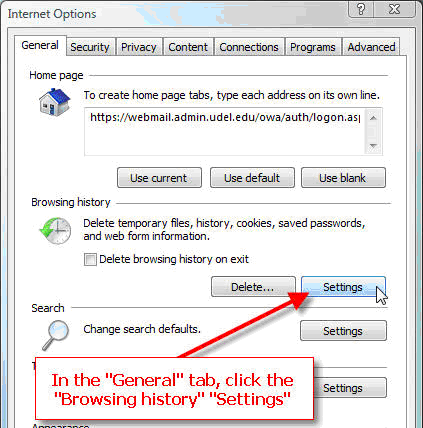

Select the tab titled General and click on the Delete button

Step 3

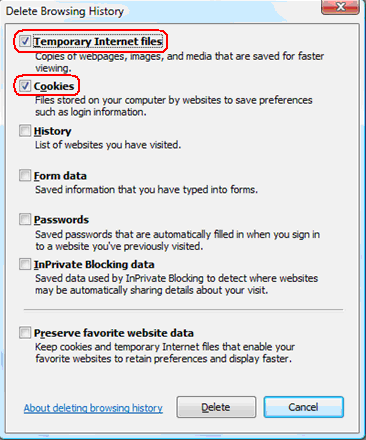

Check the boxes marked Temporary Internet files and Cookies and click on the Delete button

Step 4

Close and then reopen your Internet Explorer browser and login to the WebTrader. The login screen should now display the language preferences.

Step 5

If the language preferences are not displayed, you will then need to manually delete your cookies. To do so, return to the Tools and then Internet Options menu options and select the Settings button.

Step 6

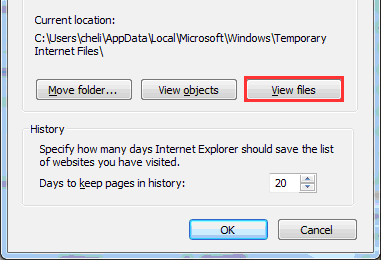

From the Temporary Internet Files section, click on the View Files button. Then highlight ALL files and delete. Close and then reopen your Internet Explorer browser and login to the WebTrader. The login screen should now display the language preferences.

IdealPro - Large-Size Order Facility

The IdealPro Forex market center provides a Large-Size Order facility specifically intended for accounts which regularly submit orders in quantities greater than standard order maximums and are willing to trade outside the NBBO associated with the standard order minimum/maximum bands in an attempt to obtain faster fills.

Standard orders submitted through IdealPro are subject to minimum and maximum size restrictions which, when expressed in USD equivalents, generally range from $25,000 to $7,000,000 but vary by currency (see Forex Min/Max Order Sizes Chart). These size restrictions serve to provide for the most optimal combination of liquidity and spreads, minimize the impact of erroneous or “fat finger” entries, and are intended to minimize any distortion which the submission of a large-size order may have upon supply or demand.

Orders submitted at a quantity below the standard order minimums are considered odd lot orders and are subject to special handling and price quoting considerations (see Odd Lot FX Transactions). Account holders who wish to submit orders at quantities above the standard order maximum must first request to be qualified for the Large-Size Order facility. Unlike standard orders for which the quote covers any quantity within the stated minimum and maximum size restrictions, the quote associated with a Large-Sized Order is specific to the order quantity entered. In an effort to obtain the best execution possible and also to limit any market impact, Large-Sized Order quotes are

generated based upon an aggregation of quotes provided by interbank dealers along with

and internalized orders of other IB clients.

Outlined below are a series of FAQs addressing the features and considerations of the Large-Size Order

facility.

How do I become eligible to submit Large-Size Orders?

In order to become eligible to submit large-size orders through the Large-Size Order facility, you would need to first submit a request to Customer Service. Requests will be reviewed and considered based upon a number of factors including the applicant's prior trade history and account equity. Please allow up to 7 business days for completion of this review to take place.

What spreads are expected for Large-Size Orders?

In general, spreads for Large-Size Orders on IdealPro are expected to be greater than those for standard orders, however, other factors such as liquidity of the currency pair, time of the day and release of economic numbers or other data can also influence bid ask spreads and should also be taken into consideration.

What is the maximum available order size?

In general sizes up to 50 million of the base currency are available. As with bid-ask spreads, this may vary depending on a number of factors. The Large-Size Order facility will return the lower of the size requested and size available at the time of the request.

What order types are supported?

Account holders are strongly encouraged to use limit order types with the Large Size Order facility as market orders are susceptible to being filled at prices far lower/higher than the current displayed bid/ask particularly under volatile market conditions or where the order involves illiquid products. In addition, to protect from losses associated with significant and rapidly changing prices, IB will simulate client market orders as market with protection orders, establishing an execution cap seven basis points (0.07%) beyond the quoted bid/ask. While this cap is set at a level that is intended to balance the objectives of execution certainty and minimizing price risk, there exists a remote possibility that the execution of a market order will be delayed or may not take place.

How will prices be displayed?

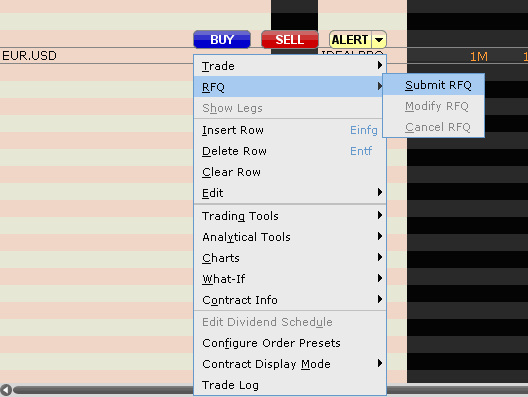

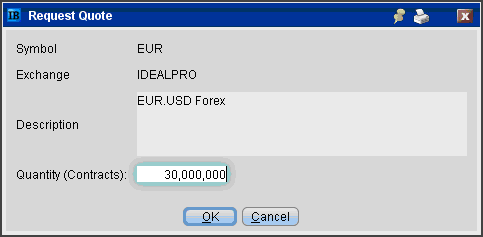

The TWS quote line will display dealable prices for a predefined amount once access to the Large-Size Order facility has been provided. To display prices, right-click on a given currency pair and then select the Choose RFQ and Submit RFQ menu options (Exhibit 1). You will then be prompted to provide the currency amount and then hit enter (Exhibit 2). The prices displayed (Exhibit 3) will time out after a certain time and you would have to repeat the request process to get another price again. We do not publish prices through other channels at the moment. The handling of the orders remains the same, regardless whether sent using the Large-Size Order facility, the quote screen, FX Trader or sent using an API.

Exhibit 1

Exhibit 2

Exhibit 3

.bmp)

Order Management Overview

BACKGROUND

TWS Messages - Your account is restricted from placing orders at this time

Account holders receiving the following message 'Your account is restricted from placing orders at this time' are not allowed to place any opening or closing orders without prior assistance from the IB Trade Desk. Questions regarding this restriction should be addressed to the Trade Desk via Customer Service (see contact information link below).

TWS Messages - Your account has been restricted to closing orders only

Account holders receiving the following message 'Your account has been restricted to placing closing orders only' are limited to placing orders which serve to close or reduce existing positions (i.e., sell orders which close out or reduce existing long positions or buy orders which which close out or reduce existing short positions). The basis for this restriction varies and often involves pending documentation, compliance and/or risk issues. Regardless of its basis, the restriction affords account holders the ability to manage and reduce the market exposure of their positions while in effect. Questions regarding this restriction should be addressed to Customer Service (see contact information link below).

TWS Messages - Order quantity must be fully displayed for this instrument

Order types which provide privacy by either hiding the entire order quantity (i.e., Hidden Orders) or allowing the display of only a specified portion of the submitted order quantity (i.e., Iceberg/Reserves) are not supported for all product types and venues.

Examples of venues for which Hidden and Iceberg/Reserve stock orders are not supported are Pink Sheet and OTCBB. Hidden or Iceberg/Reserve orders submitted to these venues will be rejected and will generate the following message: "Order quantity must be fully displayed for this instrument". Orders receiving this rejection message will require the removal of any hidden or display size attribute prior to resubmission.

Additional information regarding product types and venues for which these order types are supported is available through the links below:

Iceberg/Reserve:

http://individuals.interactivebrokers.com/en/trading/orders/iceberg.php?ib_entity=llc

Hidden :

http://individuals.interactivebrokers.com/en/trading/orders/hidden.php?ib_entity=llc

How to reset the TWS to the default settings on a Windows computer

Should you need to strip the TWS of any customization you did and revert to the default settings, use the instructions in this video.

Applicable to any TWS version under any operating system.

How to Customize the Order Management Page

How to customize the order management page

If you would like to see how to enable additional features on your Trader Workstation, please click here

If you would like to see a brief description of basic order entry concepts on the Trader Workstation, please click here

Preview Order / Check Margin

The Preview Order/Check Margin feature offers the ability to review the projected cost, commission and margin impact of an order prior to its transmission. This feature is made available in both the TWS and WebTrader, with the TWS version providing greater detail.

Trader Workstation (TWS)

The TWS Check Margin feature provides the ability to isolate the margin impact of the proposed order from one's existing positions and also displays the new margin requirement on the assumption the order is executed. Key margin balances including the Initial and Maintenance Requirements are reported as is the Equity With Loan Value. To use this feature, place your cursor on the order line, right-click on the mouse button and select Check Margin from the drop-down menu.

Example: Buy 1 ES June 2012 Future @ 1387.25

The first section of the Order Preview displays the bid, ask, and last trade price for the security.

The second section displays the basic order details

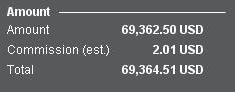

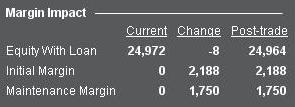

The Amount section shows the value of the order as well as the applicable commission estimate.

The Margin Impact section displays a breakdown of the following;

Current = The current account values, excluding the order being transmitted.

Change = The effect of the order being submitted ignoring any positions in the account.

Post-Trade = The anticipated account values when the order being transmitted has been executed and incorporated into the account portfolio.

WebTrader

The WebTrader order preview displays the equivalent of the TWS Post-Trade values only.