Verification of Mobile Telephone Numbers

Clients who have completed the steps of verifying their mobile telephone numbers with IB will be able to receive account related communications directly to their phones in the form of a text message (SMS). This will help to reduce the need to access the Account Management Message Center for information on items such as Funding. In addition, a verified mobile number is a prerequisite for using the IB Key Authentication via IBKR Mobile or the SMS as second factor authentication.

Verification of a mobile number may be done through one of the following methods:

- Set up messaging for your mobile telephone number. Please see KB2552 for details

- Activate the IB Key Authentication via IBKR Mobile on your smartphone. Please see KB2260 for details

How to verify your mobile phone number

This article explains how to verify your mobile phone number.

If the verification of your phone number was not completed during the account application, you can complete it at any time by following these steps:

- Log in to Account Management.

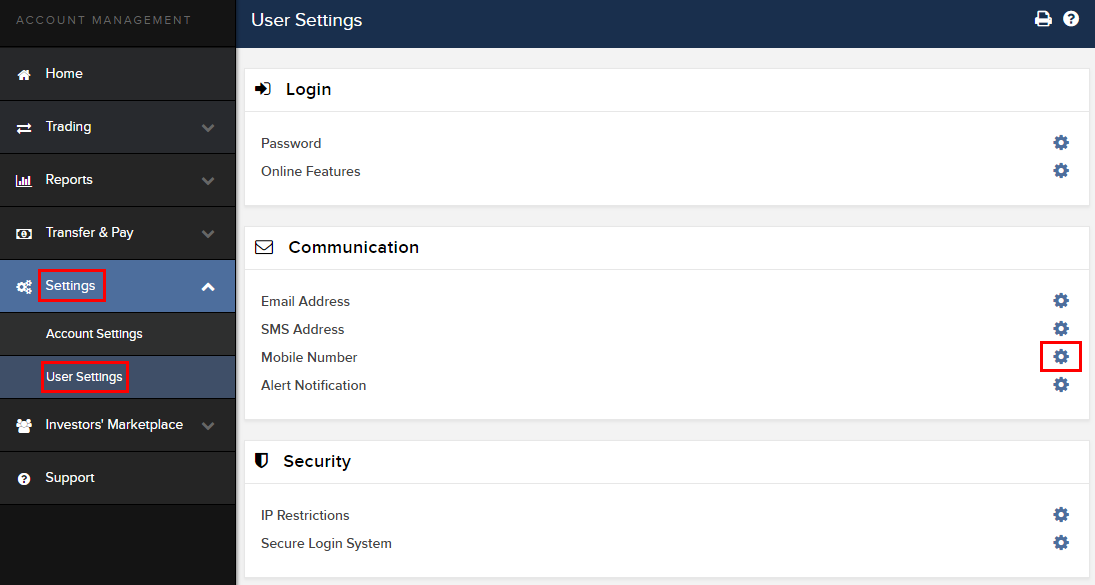

- From the side menu, click on Settings and then on User Settings. Click on the configuration gear correspondent to Mobile Number. If you are using the Classic Account Management, this section can be reached from the top menu Manage Account -> Account Information -> Details -> Profile, by clicking on the link "Modify"

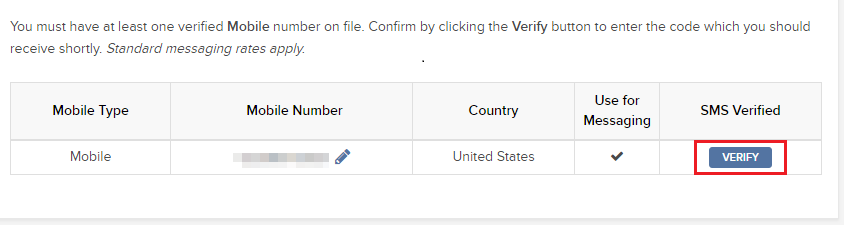

- Click on VERIFY

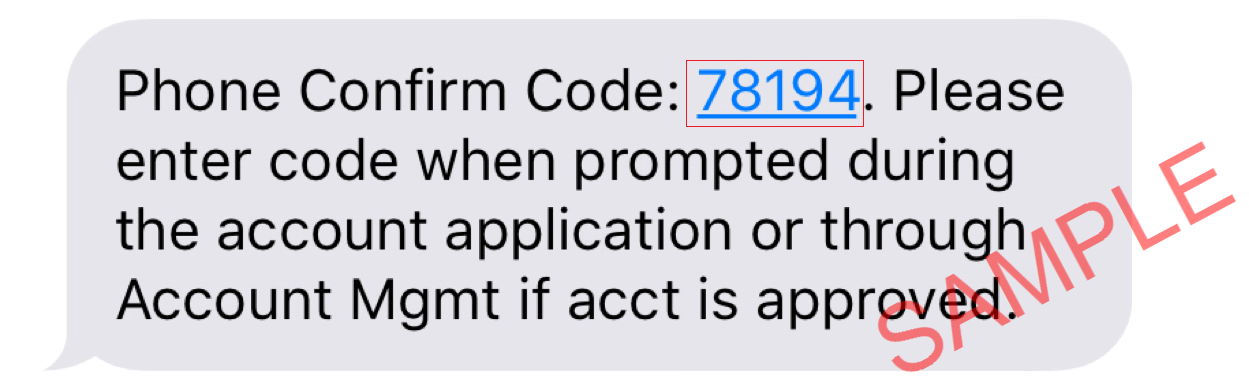

- Open your phone's messages app and you will find the SMS with the Confirm Code we sent to you.

NOTE: message delivery time may vary and in some circumstances it can take few minutes.

- Enter the Confirm Code you have received into the Confirmation Number field, then click CONTINUE.

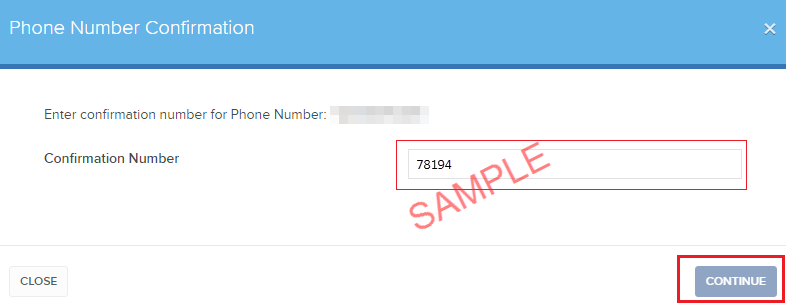

- If the code has been accepted, a green check mark will appear under the column SMS Verified. Click CONTINUE to finalize the procedure.

- If your user does not have an active SLS device, it will be automatically enrolled in SMS for Two-Factor Authentication shortly afterwards. For instructions about login authentication via SMS, please see KB3196.

Client Portal Login Failure using Safari as Browser

Background

Most recent versions of web browsers contain a feature which prompts users to save their user name and password when logging into various sites on the Internet. While convenient in practice, this feature introduces a significant security risk in that it allows anyone with access to the computer to log into those sites where the password has been saved.

Many sites that deal with highly sensitive information, including the Client Portal, have controls which do not allow this feature to be utilized. While most browsers such as Mozilla Firefox, Internet Explorer and Google Chrome allow for such controls, others such as Apple's Safari do not.

As a result, Safari users who attempt to use the password save feature may experience log in failures on future log in attempts.

Solution

Should this log in failure occur, you will need to remove the saved login credentials. To remove the login credentials, follow these steps:

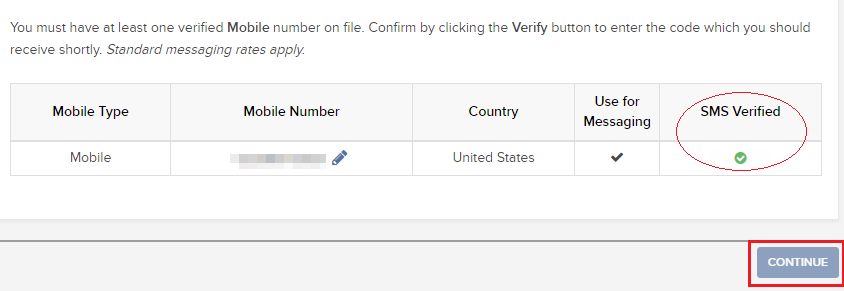

1) When Safari is in the foreground, click on the menu Safari --> Preferences

2) Click on the icon AutoFill on the toolbar

3) Click on the button Edit... next to "User names and passwords" (see Figure 1.)

Figure 1.

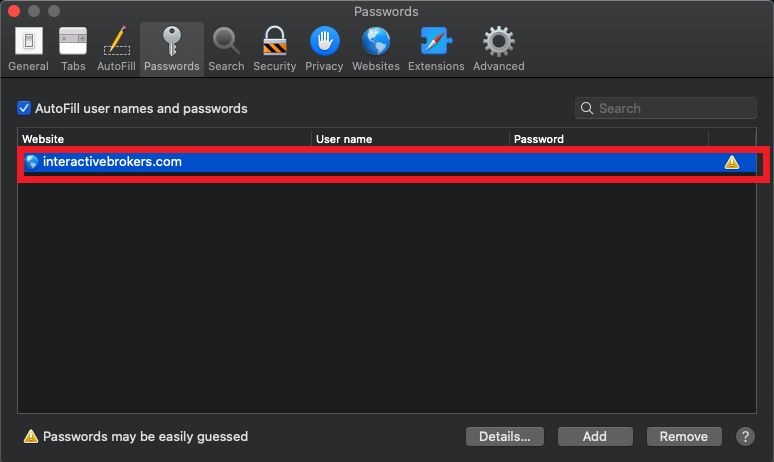

4) Locate the line related to the Client Portal web site and select it (see Figure 2.)

Figure 2.

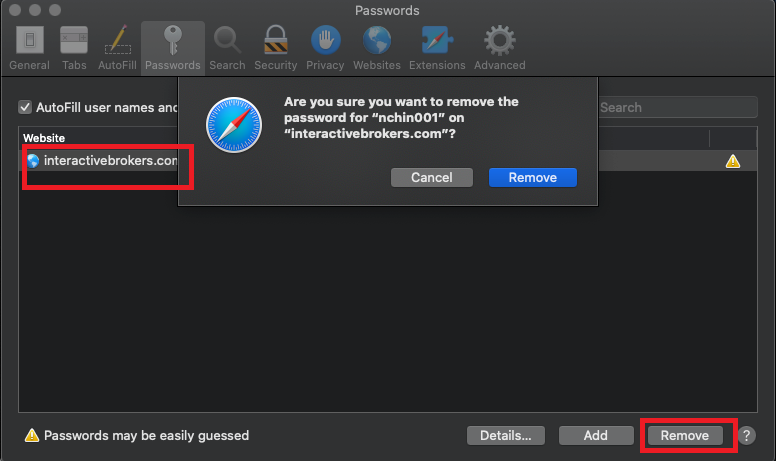

5) Click on the button Remove (see Figure 3.)

Figure 3.

6) Close and reopen Safari. You should now be able to log in . Upon log in you will be prompted whether to save user/pass again for the website. Please answer “Never for this website” or "Not now".

Financial Advisor How To: Linking Related Client Accounts

Account linkage provides account holders who maintain multiple accounts under a single advisor, the ability to group the accounts together under a single user name. The benefits of account linking include the following:

- The ability to log into all accounts via a single user name and password;

- Account accessed using a common security device;

- Activity fee minimums, when applicable, are determined based on commissions consolidated across the linked accounts;

- Consolidated reporting of accounts.

While linking may be performed by the client, this article outlines the steps by which an advisor may link accounts on behalf of the client

Steps:

1. Linkage begins by logging into Account Management at the master account level and selecting the Manage Clients, Accounts and then Link Client Accounts menu options.

.jpg)

2. You will then be provided with a drop down list of client which are eligible to be linked. While multiple clients may be linked in a given session, the linkage steps must be completed for a given client before proceeding to another.

.jpg)

3. After selecting the client to be linked, a list of all of the client's accounts that are eligible to be linked will be presented. Here, you will be prompted to specify which of the user names is to be retained for future account access. Once the linkage process has been completed, all other user names will be deactivated.

.jpg)

4. Next you will be presented with the Account Information page where confirmation of the client's personal information will be performed. In the event the client maintains information which differs among accounts (e.g., residential address), you will be prompted to select that which is accurate and is to be retained following completion of linkage.

.jpg)

5. Next, select any or all of the standing banking instructions which will be retained.

.jpg)

6. Confirmation of the linkage request is then provided.

.jpg)

IMPORTANT NOTES:

- You must select the client account with the highest level security device.

- Once the accounts are linked, the unique usernames and passwords for the accounts to be linked with this account will no longer function. The surviving username and password associated with the account will function for all linked accounts.

- Interactive Brokers will link these accounts on Fridays.

- Once the accounts are linked, the security devices for the accounts to be linked with this account will no longer function and the device associated with this account will function for all linked accounts. Those device do not need to be returned to IB, as per KB975

Welcome to Interactive Brokers

Now that your account is funded and approved you can start trading. The information below will help you getting

started as a new customer of Interactive Brokers.

- Your Money

- Configure your account to trade

- How to trade

- Trade all over the World

- Five points to enrich your IB experience

1. Your Money

Deposits & Withdrawals General Info. All transactions are administered through your secure Account Management

Deposits

First, you create a deposit notification through your Account Management > Funding > Fund Transfers > Transaction Type: “Deposit” How to create a deposit notification. The second step is to instruct your Bank to do the wire transfer with the bank details provided in your Deposit Notification.

Withdrawals

Create a withdrawal instruction via your secure Account Management > Funding > Fund Transfers > Transaction Type: "Withdrawals" How to create a withdrawal instruction

If you instruct a withdrawal over the Withdrawal limits, it will be considered an exceptional withdrawal and we will therefore need to match bank account holder and IB account. If destination bank account has been used for a deposit, withdrawal will be processed; otherwise, you must contact customer service and provide the documents needed.

Troubleshooting

Deposits: My bank sent the money but I do not see it credited into my IB account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) A Deposit Notification is missing. You have to create it via your Account Management and send a ticket to Customer Service

c) Amending details are missing. Your name or IB account number is missing in the transfer details. You have to contact your bank and ask for the full amending details.

d) ACH initiated by IB is limited to 100k USD in a 7 business period. If you opened a Portfolio Margin account where the initial requirement is 110k, a wire deposit might be the better deposit option to reduce wait time for your first trade. If selecting ACH a wait time of almost 2 weeks or a temporary downgrade to RegT can be possible solutions.

Withdrawals: I have requested a withdrawal but I do not see the money credited to my bank account. Possible reasons:

a) A fund transfer takes 1-4 business days

b) Rejected. Over the max it can be withdrawn. Please check your account cash balance. Note that for regulatory requirements, when the funds are deposited, there is a 3 day holding period before they can be withdrawn.

c) Your bank returned the funds. Probably because receiving bank account and remitting bank account names do not match.

2. Configure your account to trade

Difference between Cash and Margin accounts: If you have chosen the FastTrack application, by default your account type is a cash account with US stock permission. If you would like to get leverage and trade on margin, here how to upgrade to a RegT Margin account

Trading Permissions

In order to be able to trade a particular asset class in a particular country, you need to get the trading permission for it via your Account Management. Please note that trading permissions are free. You might however be asked to sign risk

disclosures required by local regulatory authorities. How to Request Trading Permissions

Market Data

If you want to have market data in real-time for a particular product/exchange, you need to subscribe to a market data package charged by the exchange. How to subscribe to Market data

The Market data assistant will help you choose the right package. Please watch this Video explaining how it works.

Customers have the option to receive delayed market data for free by clicking the Free Delayed Data button from a non-subscribed ticker row.

Advisor Accounts

Have a look at the user guide getting started as advisors. Here you see how to create additional users to your advisor account and grant them access and much more.

3. How to trade

The Trader's University is the place to go when you want to learn how to use our Platforms. Here you will find our webinars, live and recorded in 10 languages and tours and documentation about our various Trading Platforms.

Trader Workstation (TWS)

Traders who require more sophisticated trading tools can use our market maker-designed Trader Workstation (TWS), which optimizes your trading speed and efficiency with an easy-to-use spreadsheet interface, support for more than 60 order types, task-specific trading tools for all trading styles, and real-time account balance and activity monitoring. Try the two models

TWS Mosaic: for intuitive usability, easy trading access, order management, watchlist, charts all in one window or

TWS Classic: the Advanced Order Management for traders who need more advanced tools and algos.

General Description and Information / Quick start guide / Usersguide

Interactive Tours: TWS Basics / TWS configuration / TWS Mosaic

How to place a trade: Video Classic TWS / Video Mosaic

Trading tools: General Description and Information / Users guide

Requirements: How to install Java for Windows / How to install Java for MAC / Port 4000 and 4001 needs to be open

Login TWS / Download TWS

WebTrader

Traders who prefer a clean and simple interface can use our HTML-based WebTrader, which makes it easy to view market data, submit orders, and monitor your account and executions. Use the latest WebTrader from every browser

Quick Start Guide / WebTrader User's Guide

Introduction: Video WebTrader

How to place a Trade: Video WebTrader

Login WebTrader

MobileTrader

Our mobile solutions allow you to trade your IB account on the go. The mobileTWS for iOS and the mobileTWS for BlackBerry are custom-designed for these popular models, while the generic MobileTrader supports most other Smart phones.

General Description and Information

Order Types Order Types available and Description / Videos / Tour / Users guide

Paper Trading General Description and Information / How to get a Paper Trading Account

Once your paper account is created, you can share the market data of your real account with your paper trading account: Account Management > Manage Account > Settings > Paper trading

4. Trade all over the World

IB accounts are multi-currency accounts. Your account can hold different currencies at the same time, this allows you to trade multiple products around the world from a single account.

Base Currency

Your base currency determines the currency of translation for your statements and the currency used for determining margin requirements. Base currency is determined when you open an account. Customers may change their base currency at any time through Account Management.

We do not automatically convert currencies into your Base currency

Currency conversions must be done manually by the customer. In this video you can learn how to do a currency conversion.

In order to open a position denominated in a currency that you do not have in your account, you have two possibilities:

A) Currency conversion.

B) IB Margin Loan. (Not available for Cash Accounts)

Please see this course explaining the mechanics of a foreign transaction.

5. Five points to enrich your IB experience

1. Contract Search

Here you will find all our products, symbols and specifications.

2. IB Knowledge Base

The Knowledge Base is a repository of glossary terms, how-to articles, troubleshooting tips and guidelines designed to assist IB customers with the management of their IB accounts. Just enter in the search button what you are looking for and you will get the answer.

3. Account Management

As our trading platforms give you access to the markets, the Account Management grants you access to your IB account. Use Account Management to manage account-related tasks such as depositing or withdrawing funds, viewing your statements, modifying market data and news subscriptions, changing your trading permissions, and verifying or changing your personal information.

Log In Account Management / AM Quick Start Guide / AM Users Guide

4. Secure Login System

To provide you with the highest level of online security, Interactive Brokers has implemented a Secure Login System (SLS) through which access to your account is subject to two-factor authentication. Two-factor authentication serves to confirm your identity at the point of login using two security factors: 1) Something you know (your username and password combination); and 2) Something you have (an IB issued security device which generates a random, single-use security code). As both knowledge of your username/password and physical possession of the security device are required to login to your account, participation in the Secure Login System virtually eliminates the possibility of anyone other than you accessing your account.

How to Activate your Security Device / How to Obtain a Security Code Card / How to return Security device

In case you forgot your password or lost your security code card, please call us for immediate assistance.

5. Statements and Reports

Easy to view and customize, our statements and reports cover all aspects of your Interactive Brokers account. How to view an Activity Statement

Steps for Importing Worksheet for Form 8949 to TurboTax

As a matter of operational convenience and to assist with the preparation of IRS Form 8949 (Sales and Other Dispositions of Capital Assets) IB Prepares a Form 8949 worksheet in each of a PDF, CSV and TXF format on an annual basis. The TXF format allows you to import the information into Turbo Tax Standalone(CD/Download Version) but not the online version. Please click here for to visit our Turbo Tax FAQ's.

How to Import Form 8949 into TurboTax

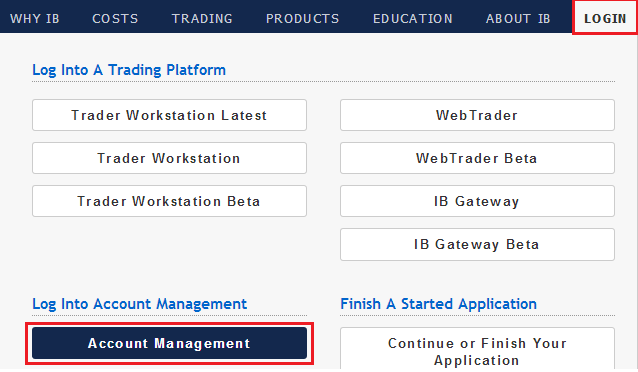

1. Log into Account Management by going to https://www.interactivebrokers.com and select Login and then Account Management from the upper right hand section and enter username/password to log in.

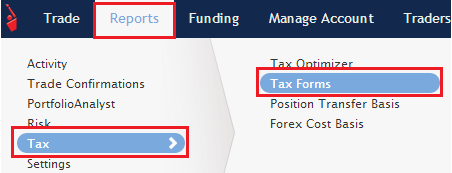

2. Navigate to Reports, Tax and then select Tax Forms

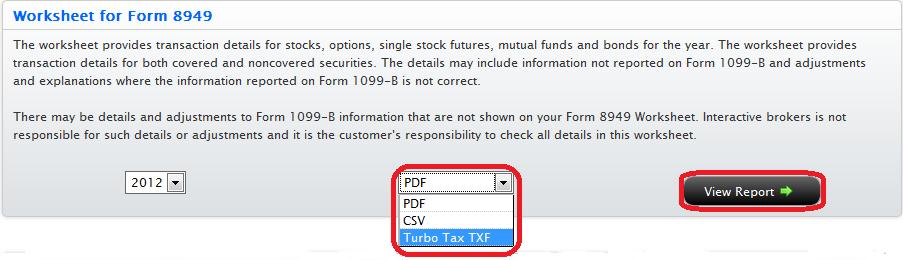

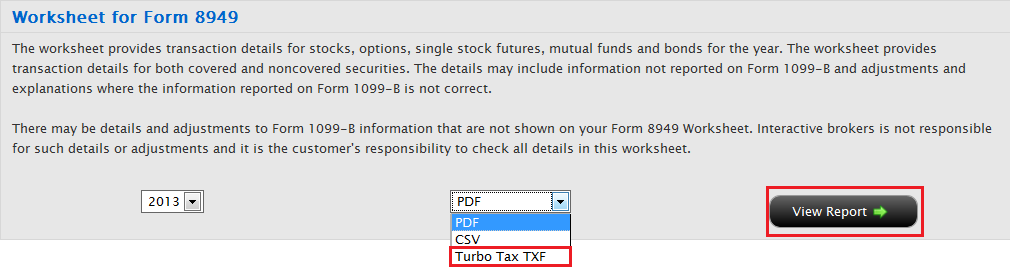

3. Under Worksheet for Form 8949 section, select TurboTax TXF from the drop down menu and select View Report

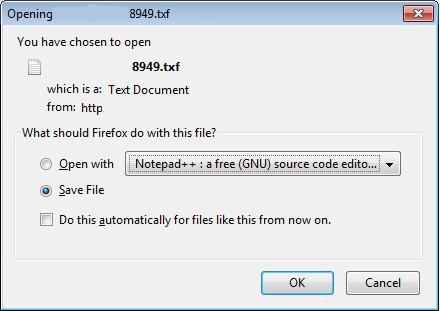

4. A save dialog box will appear. Please select Save File and then OK.

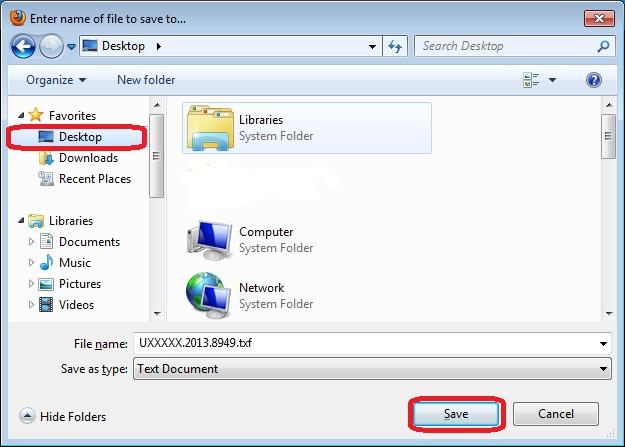

5. Another dialog box will appear. Please select Desktop on the left and then Save. This will save your downloaded file to your desktop

6. Now that the file is downloaded please follow the directions below in Section C to import into TurboTax

Section B (Vertical menu on the left)

1. Log into Account Management by going to www.interactivebrokers.com and select Login and then Account Management from the upper right hand section and enter username/password to log in.

.jpg)

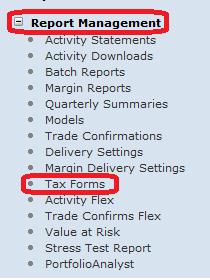

2. On the left please select Report Management and then Tax Forms

3. On the right under Worksheet for Form 8949 section, select TurboTax TXF from the drop down menu and select View Report

4. A save dialog box will appear. Please select Save File and then OK

5. Another dialog box will appear. Please select Desktop on the left and then Save. This will save your download file to your desktop

6. Now that the file is downloaded please follow the directions below in Section C to import TurboTax

Section C (Importing downloaded file into TurboTax)

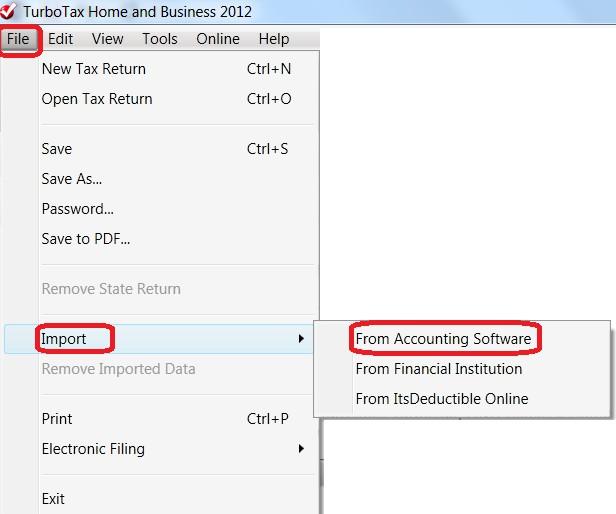

1. Open TurboTax and navigate to File and select “From Accounting Software” under the Import option.

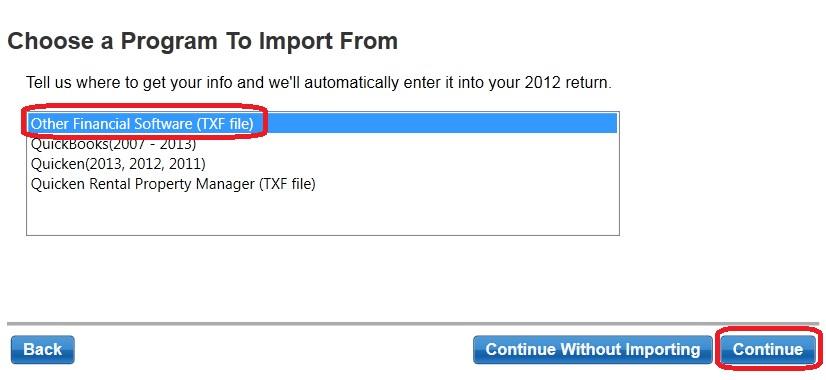

2. A new window will appear with a few options. Please select Other Financial Software (TXF file) and then Continue

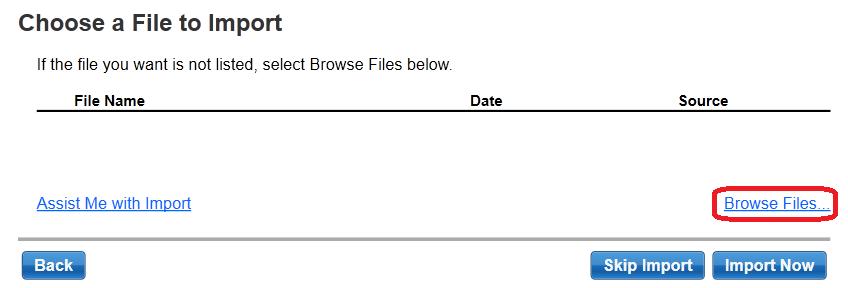

3. On the next screen select Browse Files

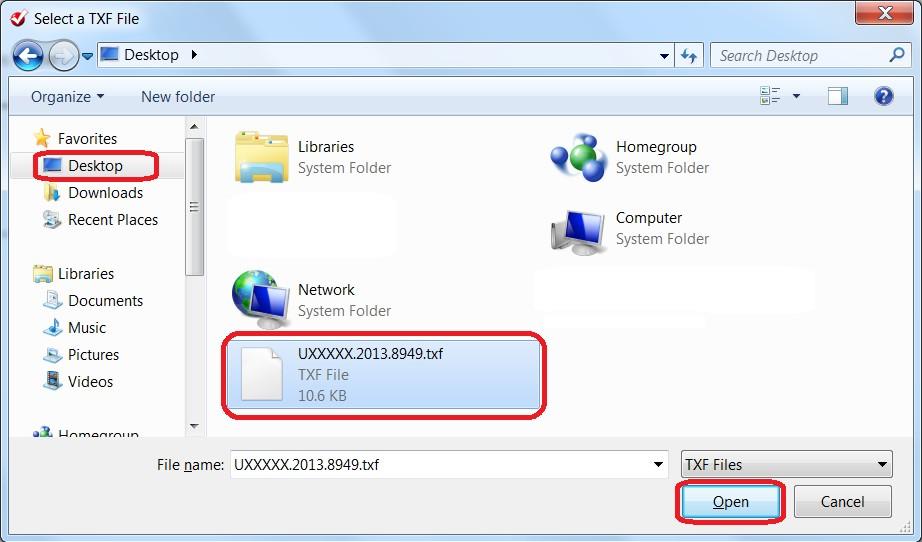

4. A new window will appear. Please select Desktop on the left and then select the file you just saved on your desktop and then select Open.

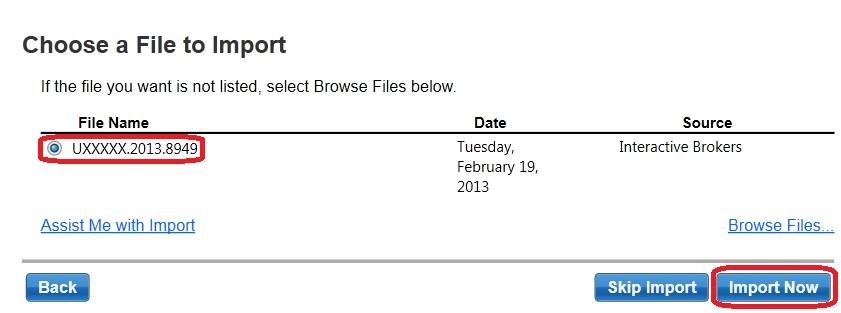

5. A new window will appear with the name of the file. Select Import Now

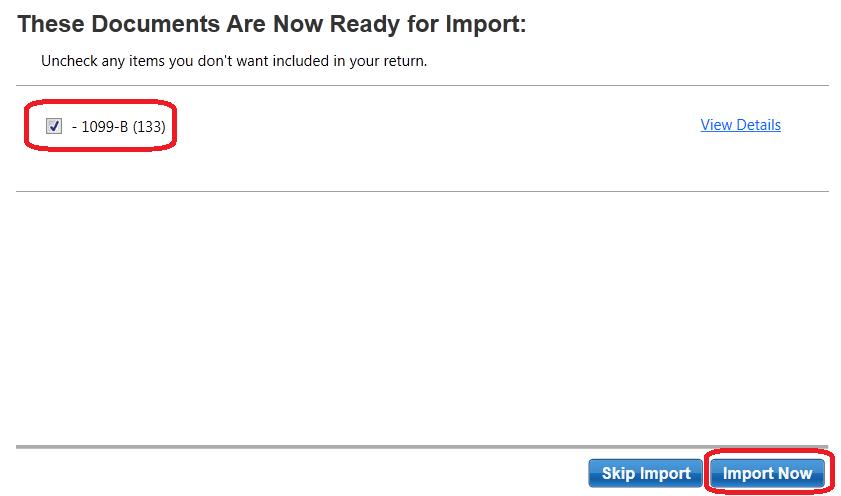

6. On the next page you will see 1099-B (133). Make sure the box next to it is checked and then select Import Now

7. On the last page select Done and all your transactions will now be imported into TurboTax. If you need any additional help navigating TurboTax please contact them directly at http://turbotax.intuit.com/

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

iOS

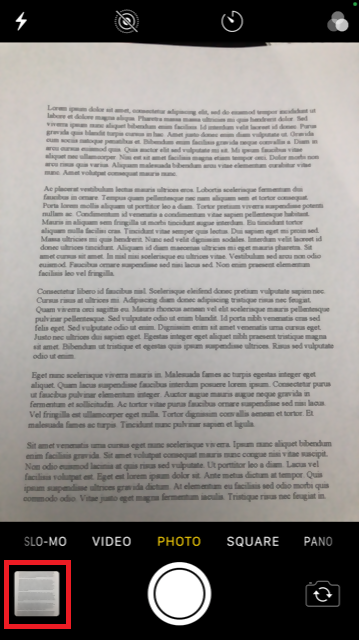

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

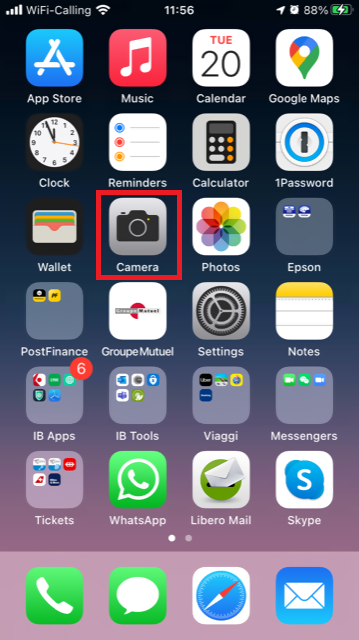

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

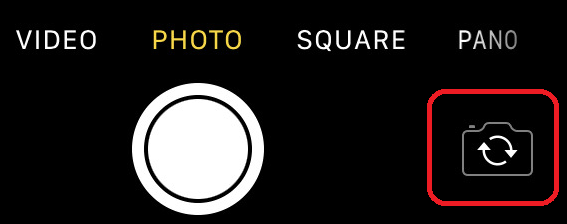

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

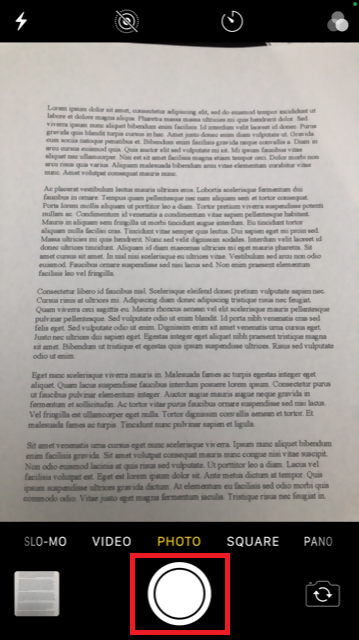

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

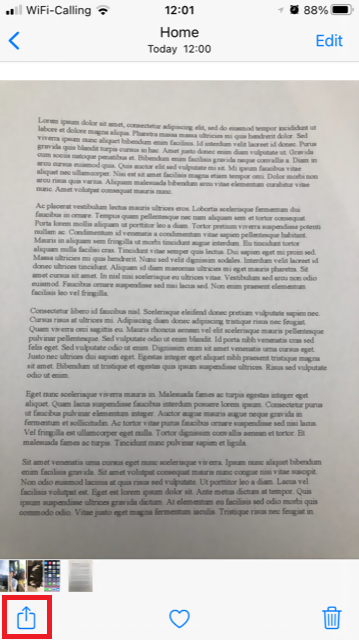

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

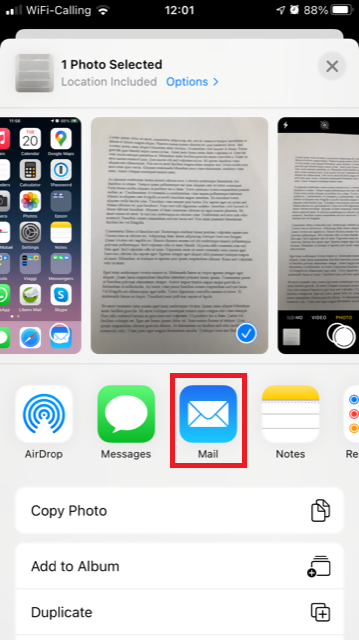

6. Tap the share icon in the lower left-hand corner of the screen.

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

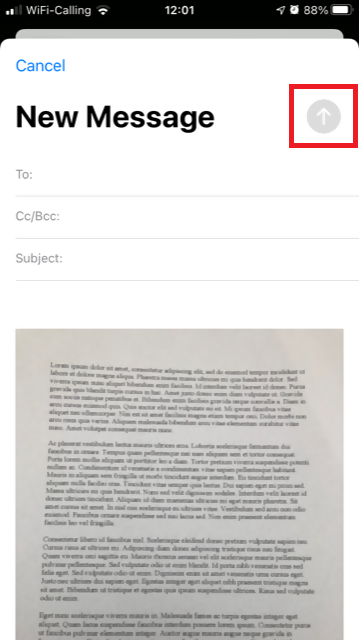

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

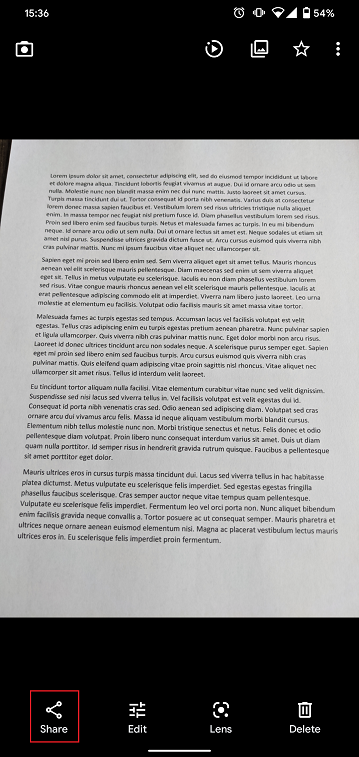

Android

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

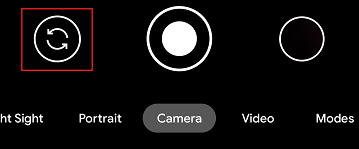

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

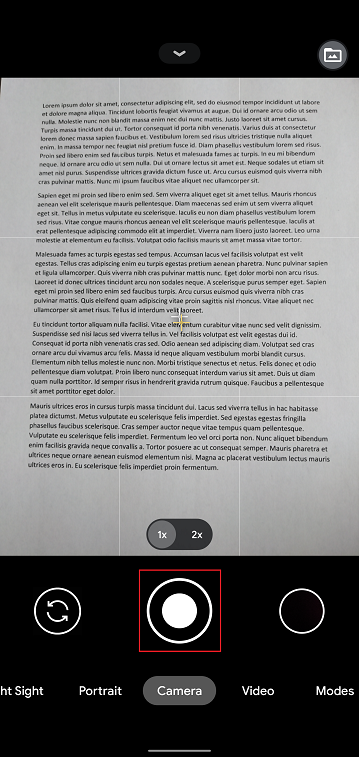

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

5. Tap the empty circle icon in the lower right-hand corner of the screen.

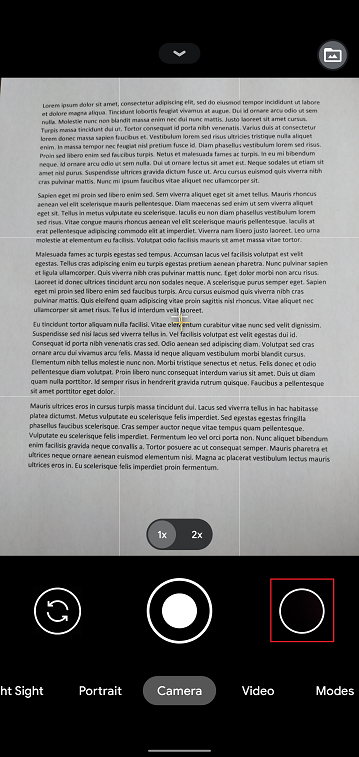

6. Tap the share icon in the lower left-hand corner of the screen.

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

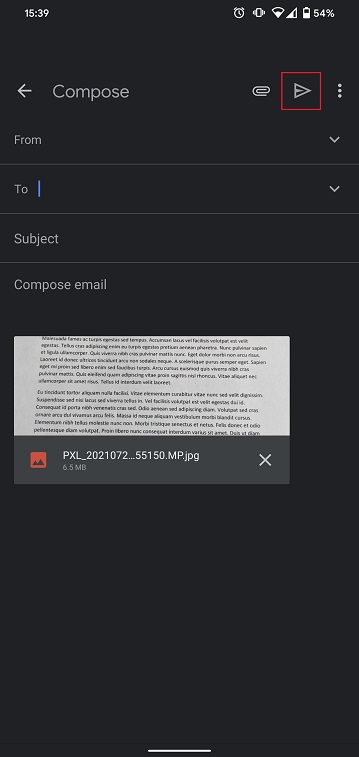

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

Comparison of U.S. Segregation Models

INTRODUCTION

The regulation of securities and commodities products and brokers1 in the U.S. is administered by two distinct federal agencies, the Securities and Exchange Commission (SEC) for securities including stocks, ETFs, bonds, options and mutual funds and the Commodities Futures Trading Commission (CFTC) for commodities including futures and options on futures.2 While both agencies seek to safeguard customer assets by restricting their use and “segregating” them from assets of the broker, the regulations and manner in which they accomplish this differs. The following article provides a basic overview of two segregation models and additional considerations relating to IB accounts.

OVERVIEW

Differences between the CFTC and SEC segregation models originate largely from the products themselves, whose characteristics are fundamentally unique. Commodity products, by nature, do not involve an extension of credit by the broker to the customer as a futures contract is not an asset but rather a contingent liability which is marked-to-market and a long futures option, while an asset, must be paid for in-full. Consequently, non-option assets in a commodities account are generally comprised of funds deposited as margin to secure performance on the contracts therein. Since the broker may not use the funds of one customer to margin or guarantee the transactions of another, the commodities segregation requirement (CFTC Rules 1.20 – 1.30) is equal to the gross assets of all customers and the broker needs to add its own funds to segregation to cover customers whose net equity is in deficit.

A securities margin account, in contrast, can facilitate the extension of credit for the purpose of long securities (e.g., stocks, bonds) purchases or short securities sales on a secured basis. The segregation or reserve requirement rules recognize this through special provisions for the protection of each of the cash and securities components, further distinguishing fully-paid securities from those whose purchase the broker has financed and maintains a lien upon. Here, the broker must deposit into a separate bank account the net amount of customer cash balances3, in accordance with a formula set forth in SEC Rule 15c3-3. In addition, the broker must identify and segregate in a good control location (e.g., depository, bank) customer securities which meet the definition of “fully paid” or “excess margin”.

The table below provides a comparison of the main principals of each model.

| COMPARISON OF CFTC & SEC SEGREGATION MODELS | ||

| PRINCIPAL | CFTC | SEC |

|

Separation of Customer Balances

|

Commodity customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts.

Funds used for trading on non-US commodity exchanges must be kept separate from those used for trading on U.S. exchanges (even for the same customer). Commodity customer balances must also be maintained separate from securities customer balances (even for the same customer). |

Securities customer balances must be maintained separate from firm assets and cannot be used to finance proprietary business activities or to satisfy firm debts. Securities customer balances must also be maintained separate from commodity customer balances (even for the same customer).

|

|

Priority in the Event of Broker Default

|

Commodity customers maintain priority and equal claim over assets in each of their respective U.S. segregated and non-U.S. secured pools.

No claim on assets in a commodity pool in which one is not a participant and no claim on securities customer assets. If commodity segregated assets are insufficient to meet claims and broker is insolvent, customers share equally in shortfall and become general creditors for residual claims. |

Securities customers maintain priority and equal claim over assets.4

No claim on commodity segregated assets. If securities segregated assets are insufficient to meet claims, broker is insolvent and claims exceed SPIC coverage, customers share equally in shortfall and become general creditors for residual claims.

|

| Segregation Style |

Gross – the broker may not use the funds of one customer to margin or guarantee the transactions of another and must segregate assets in an amount at least equal to the sum of all customer credit balances. |

Net – broker may use customer cash credit balances to finance, on a secured basis, margin loans to other customers and may lend or pledge a portion of customer securities purchased on margin to other customers selling short.

|

| Investment of Cash Balances |

Broker is allowed to reinvest commodity customer’s cash balances and retain an interest in the income generated. Permissible investments include: U.S. government securities, municipal securities, government sponsored enterprise securities, bank CDs, corporate obligations (commercial paper, notes and bonds) fully guaranteed as to principal and interest by the U.S. under the Temporary Liquidity Guarantee Program and money market mutual funds. Securities which are the subject of reinvestment must be maintained in a segregated account. |

Broker is allowed to reinvest securities customer’s cash balances and retain an interest in the income generated. Permissible investments limited to “qualified securities” defined as securities which are guaranteed as to both interest and principal by the U.S. government. Securities which are the subject of reinvestment must be held in Special Reserve Bank Account (i.e., segregated). |

| Computation Frequency | Daily | Weekly |

| Insurance | None | Securities Investor Protection Corporation (SIPC) provides insurance of up to USD 500,000 with a cash sublimit of USD 250,000. |

ADDITIONAL CONSIDERATIONS

In addition to the safeguards afforded through segregation, IB employs a number of policies and practices which serve to enhance the safety and security of accounts beyond that outlined above. These include the following:

- IB computes its securities segregation or reserve requirement on a daily rather than weekly basis as allowed by regulation, thereby ensuring timely determination as to the amount required to be reserved and the deposit of funds necessary to satisfy the requirement.

- IB’s does not avail itself of the generally more permissive rules with respect to the investment of commodity customer cash balances. These balances are instead invested in a manner similar to that of securities cash balances (i.e., U.S. government securities) with the exception of an occasional investment in money market funds.

- All customer securities positions are held in the securities segment of the Universal Account as opposed to the commodities (commodities margin met with cash and/or futures options), thereby limiting their hypothecation to the more restrictive rules of the SEC.

- In addition to SIPC coverage, IB maintains an excess SIPC policy with Lloyd's of London which, in aggregate with SIPC, offers insurance totaling $30 million (with a cash sublimit of $900,000), subject to an aggregate firm limit of $150 million.

- IB offers account holders the ability to sweep cash balances in excess of that required for margin purposes in either the securities or commodities segment to the other segment. Details as to this feature may be found in KB1851.

- For additional information regarding IB strength and security, please review the following website page.

Other Relevant Knowledge Base Articles:

Information Regarding SIPC Coverage

Footnotes:

1The term broker as used in this article is intended to refer to an organization registered with both the SEC as a Broker-Dealer and the CFTC as a Futures Commission Merchant for the purpose of conducting customer transactions

2Single stock futures are a hybrid product jointly regulated by the SEC and CFTC and allowed to be carried in either account type.

3Including cash obtained through the use of customer securities such bank pledges or stock loans less cash required to finance customer transactions (e.g., stock borrows, customer fails to deliver of securities, or margin deposited for short option positions with OCC).

4Assets, or customer property, which securities customers share in proportion to their net equity claim, include cash, margin securities and fully-paid securities held in “street name”. IB does not hold securities in the customer’s name which are not considered bulk customer property.

W8 Re-certification

If you are not a U.S. citizen or entity formed within the U.S. and have an account with Interactive Brokers, you are requested to declare your citizenship or country of formation with the US tax authority (IRS). This declaration can be done online by correctly filling out the W-8BEN form. Filling out this form is an easy process that only takes a few minutes. In the short movie below, we show you where to find the W-8BEN in your IB account management and how to fill it out.

If you fail to declare your foreign citizenship or country of formation, and IB does not have a valid W-8BEN form on file, you are presumed to be a US person/entity without a proper tax certification. As a US person/entity, you will be subject to backup withholding at a rate of 28% on interest, dividends, and substitute payments in lieu; as well as gross proceeds.

Every 3 years the IRS requires a re-certification of the W-8BEN form. IB will ask the beneficial account owner to re-certify their foreign status by re-signing the W8-BEN in order to continue their status as a foreign person and claim the tax treaty benefits. If you experience any problems or have questions regarding the W-8BEN form or how IB handles Non-US persons and entities, select this Tax Information and Reporting link and choose the tab Non-US Persons and Entities or consult the following IRS information page for more details: www.irs.gov/instructions/iw8/ch02.html