Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

Exchange name change

Overview:

Interactive Brokers is completing an effort to update and consolidate exchange names where appropriate. When this effort is complete, the following updates will be in effect:

- GLOBEX and CMECRYPTO will be consolidated to a single exchange, ‘CME’

- ECBOT will be updated to ‘CBOT’

- COMEX listed metals (previously reflected as NYMEX) will be updated to exchange ‘COMEX’

- NYMEX, no change

Given the breadth of products involved, we are migrating in four waves based on underlying products:

| Key | Effective Trade Date | Products |

| Wave 1 | October 30, 2022 | GLOBEX: ZAR, LB, DA, IXE |

| Wave 2 | November 6, 2022 | GLOBEX: EMD, BRE, CHF, SOFR3, E7, NKD CMECRYPTO: BTCEURRR, ETHEURRR, MET |

| Wave 3 | November 13, 2022 | GLOBEX: All remaining products CMECRYPTO: All remaining products ECBOT: ZO, ZR, 2YY, 30Y NYMEX: ALI, QI, QC |

| Wave 4 | December 4, 2022 | ECBOT: All remaining products NYMEX: All remaining "Metal" products |

I am trading via API, how does this impact me?

For API clients the only requirement would be to provide a new exchange name, for example: exchange=”CME”, for existing contracts for the affected exchanges.

Old exchanges names will no longer be available after the change.

More details can be found within our FAQs through the following link: Upcoming Exchange name Changes

Note: If you are using a third party software connected to TWS or IB Gateway and that software does not recognize the new contract definitions, please contact the third party vendor directly.

Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

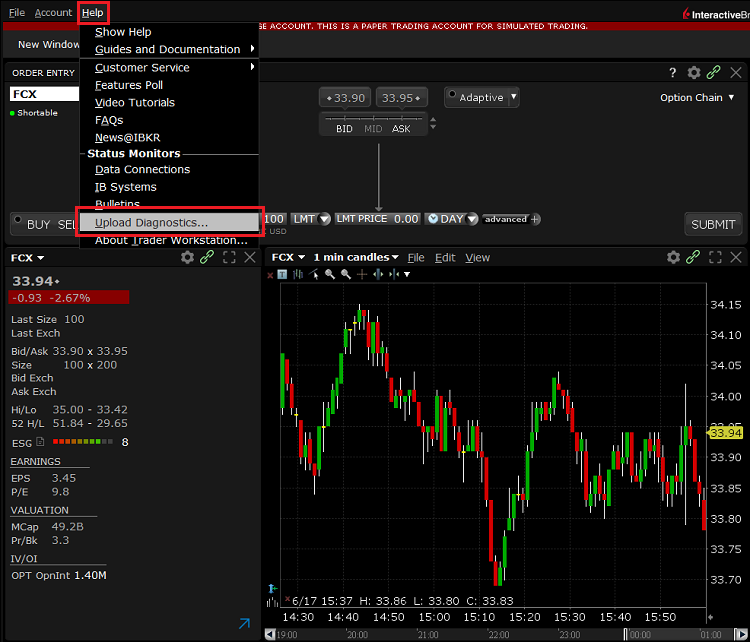

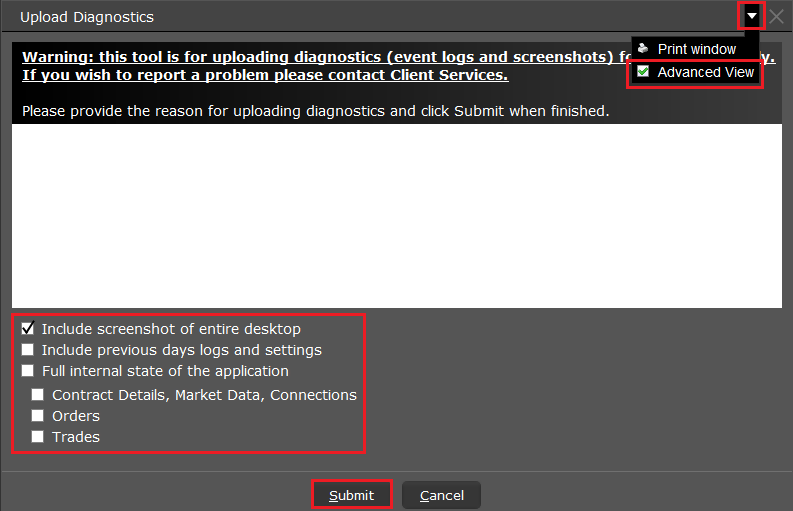

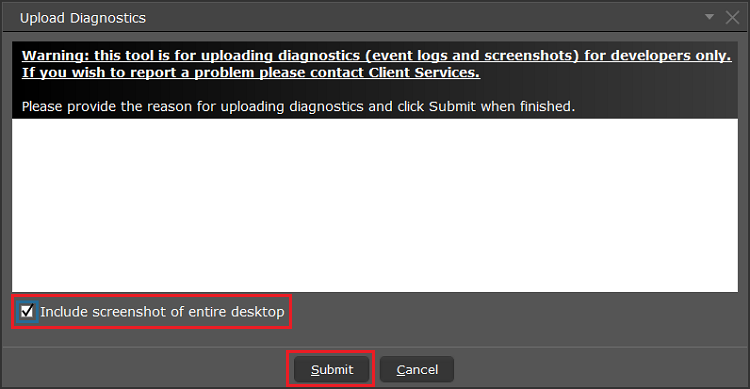

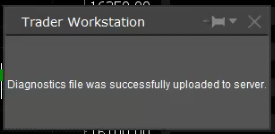

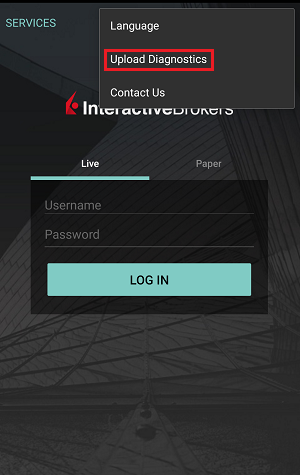

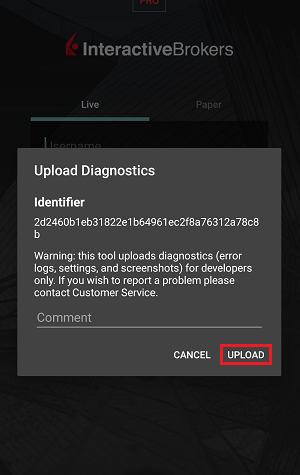

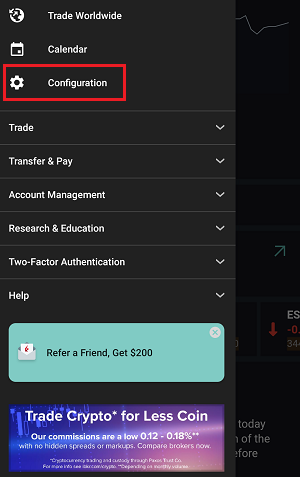

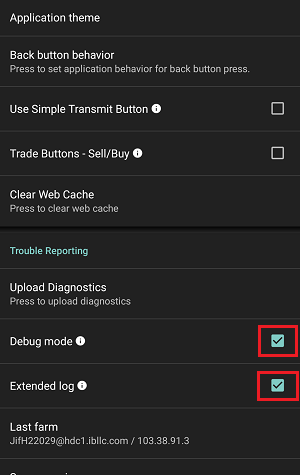

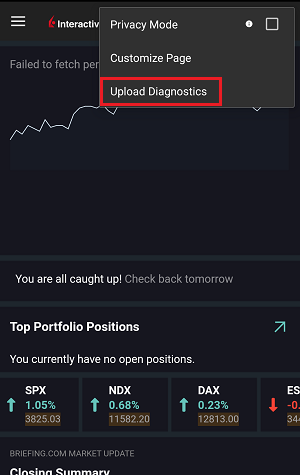

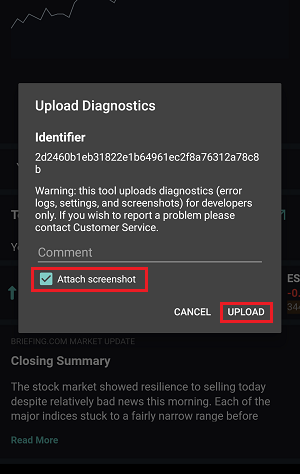

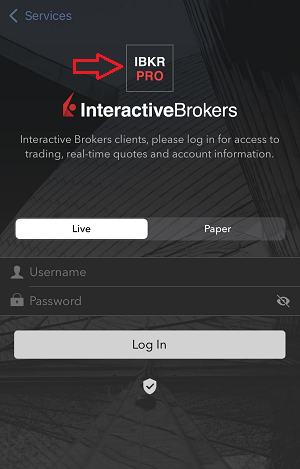

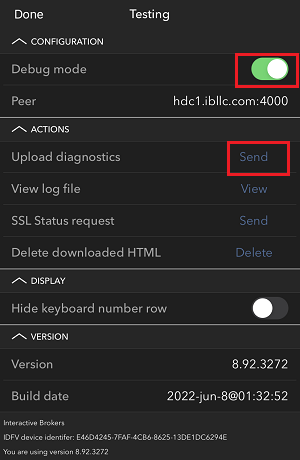

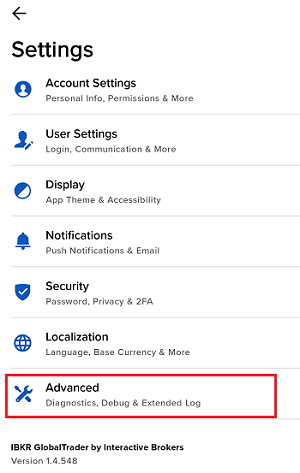

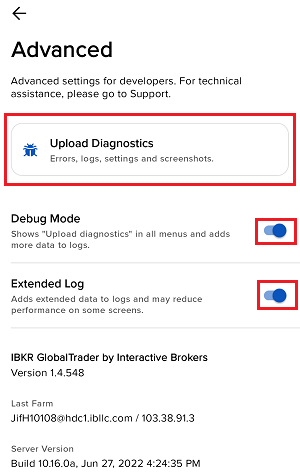

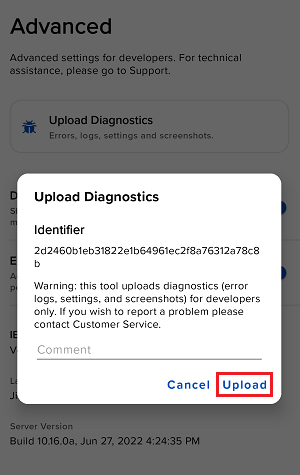

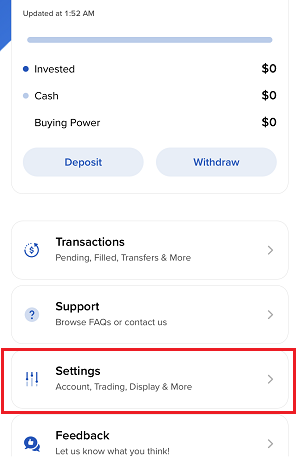

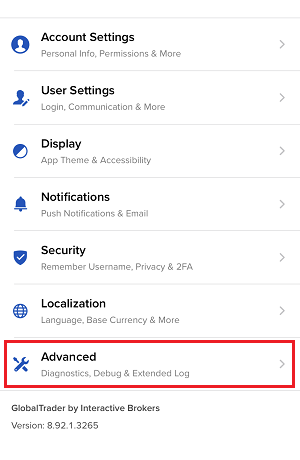

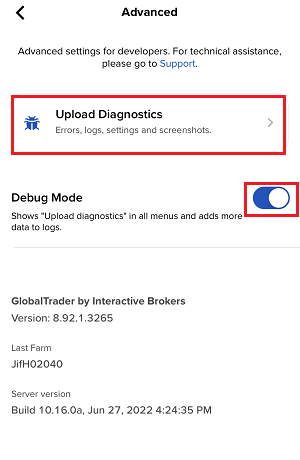

How to Upload a Diagnostic Bundle from an IBKR Platform

Some support related issues require diagnostics files and logs to be uploaded along with screenshots. The information will help our team to investigate and resolve the issue that you are experiencing.

This article will help you with detailed steps on how to upload diagnostics files and logs from various Interactive Brokers’ trading platforms.

Note: IBKR does not monitor the diagnostic bundle repository throughout the day. Should you spontaneously decide to upload a diagnostic bundle, without being instructed by Interactive Brokers, please inform our Client Services via Message Center ticket or phone call otherwise your error report will go unnoticed.

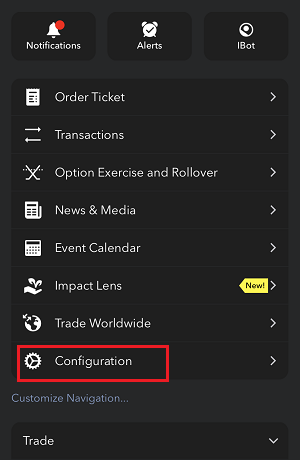

Please click on one of the links below, according to the platform you are using:

-

IBKR Mobile (Android)

-

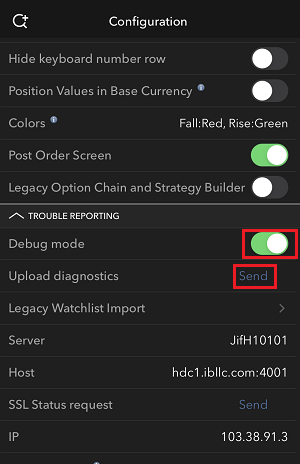

IBKR Mobile (iOS)

- For Windows and Linux Operating system: Press Ctrl+Alt+Q

- For Mac: Press Cmd+Option+H

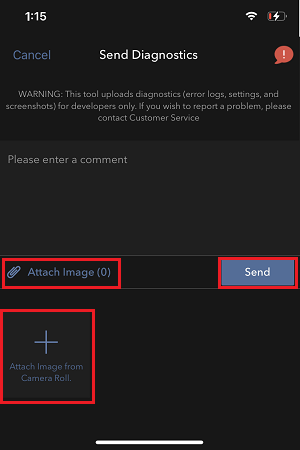

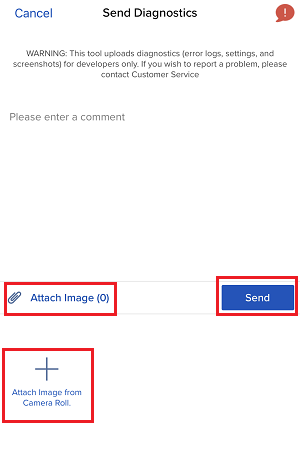

7. Enter your comments in the field and tap ‘Attach Image’ to attach the screenshot/s you previously saved in your camera roll

A diagnostic trace for Client Portal can be captured following the steps on IBKB3512

Please Upgrade TraderWorkstation (TWS)

On December 9, 2021, a critical security vulnerability in Apache's Log4j software library was disclosed, (now commonly referred to as “Log4Shell”). Log4j is very broadly used in a wide variety of consumer and enterprise services, websites, applications, and devices to log security and performance information. The vulnerability allows an unauthenticated remote actor to take control of an affected system and execute arbitrary code on it. The ubiquitous nature of Log4j and the ease of exploitation of the vulnerability makes this threat not only critical but also nearly universal.

WHAT IS IBKR DOING TO PROTECT ITS CLIENTS?

We are actively working, with high priority, to mitigate the threat on several levels:

- We have patched all our servers accessible externally (from the Internet) with a version of Log4j that is not susceptible to this vulnerability.

- We have upgraded our Trader Workstation (TWS) software and our TWS installers with a version of Log4j that is not susceptible to this vulnerability.

- We have updated our security infrastructure (including network firewalls, application firewalls, intrusion detection tools, etc.) with the latest protection measures that help detect and block cyber-attacks that attempt to exploit the Log4j vulnerability.

- We continue our ongoing efforts to fully identify and patch any impacted internal systems (those that are not accessible from the Internet).

- We continue monitoring the evolving industry threats and adopt additional mitigation measures as needed.

ACTION REQUIRED

We are committed to providing a secure environment for your assets and trading activities. To that end, we request that our clients give priority to the use of the LATEST TWS version, which will auto-update. Should you have the STABLE or any OFFLINE version, which does not auto-update, please ensure that you take the necessary steps to keep your TWS in line with the latest security fixes.

Interaction between TWS and MacOS 12 (Monterey)

The present article addresses performance on the Trader Workstation (TWS) under MacOS Monterey (version: 12), as experienced by several clients. The TWS may experience freezes or may shut down unexpectedly (crash) when running on MacOS 12. This can happen immediately during the TWS start up phase or may occur at a later time point, after some minutes or even hours.

Fix Implementation

A fix has been released in the TWS Beta, available for download here

This process included an extensive amount of testing, in order to see which of the alternative Java platforms was the best fit for the Trader Workstation and as well to avoid introducing new issues while solving the current one.

We sincerely thank you for your patience.

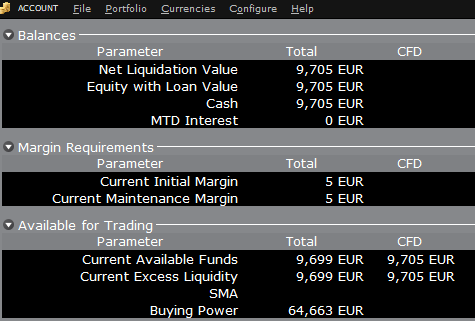

TWS Account Window for Retail Clients of IBKR Ireland and Central Europe

This article describes the information provided in the TWS account window for IBKRs EU based entities.

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Retail clients who are residents of the EEA and therefore maintain an account with one of IBKR’s European brokers, IBIE or IBCE, are subject to EU regulations which introduce leverage and other restrictions applicable to CFD transactions.

Notably the regulations require the use of free cash to satisfy CFD margin requirements and prohibit retail clients from using securities in the account as collateral to borrow funds to initiate or maintain a CFD position. Please see Overview of ESMA CFD Rules Implementation for Retail Clients at IBIE and IBCE for full details.

The accounts of IBKRs EU entities are universal accounts in which clients can trade all asset classes available on IBKRs platform, but unlike IBKRs US and UK entities, there are no separately funded segments.

Working examples of how this restriction is applied, along with details as to how clients can monitor free cash available for CFD transactions, are outlined below.

Account Window

IBKR enforces the restriction relating to free cash by calculating the funds available for CFD trading on a real-time basis, rejecting new orders and liquidating existing positions when the available free cash is insufficient to cover CFD initial and maintenance margin requirements.

IBKR offers clients the ability to monitor free cash available for CFD transactions via an enhancement to the TWS Account Window which displays the level of free cash in the account. Importantly, the funds shown as available for CFD trading do not imply that cash is held in a separate segment. It simply indicates what proportion of total account balances is available for CFD trading.

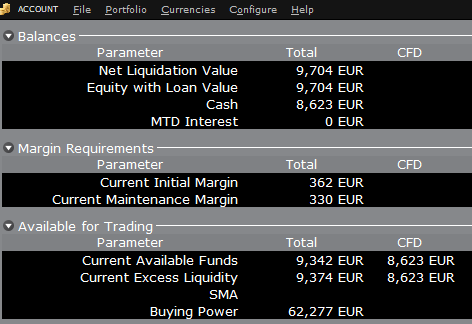

For example, assume that an account has EUR 9,705 in cash and no positions. All the cash is available to open CFD positions, or positions in any other asset class:

If the account now purchases 10 shares of AAPL stock for an aggregate value of USD 1,383 the cash in the account is reduced by a corresponding amount in EUR, and the funds available for CFD trading are reduced by the

same amount:

Note that Total available funds are reduced by a smaller amount, corresponding to the stock margin requirement.

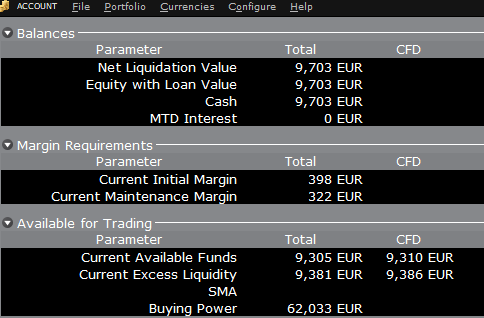

If, instead of buying AAPL stock, the account buys 10 AAPL CFDs the impact will be different. As the transaction involves a derivative contract rather than the purchase of the underlying asset itself, there’s no reduction in cash but the funds available for CFDs are reduced by the CFD margin requirement to secure performance on the contract:

In this case Total available funds and CFD available funds are reduced by an equal amount; the CFD margin requirement.

Funding

As noted above, EU-based accounts do not have segments and therefore there is no need for internal transfers. Funds are available for trades in all asset classes in the amounts indicated in the account window, without the need for sweeps or transfers.

Note also that should an account have a margin loan, i.e. negative cash, it will not be possible to open CFD positions since the CFD margin requirement must be satisfied by free, positive cash. Should you have a margin loan and wish to trade CFDs you must first either close margin positions to eliminate the loan, or add cash to the account in an amount that covers the margin loan and creates a cash buffer sufficient for the necessary CFD margin.

Portfolio Restrictions

Residents of Luxembourg (LU): IB Luxembourg (“IB-LUX”) cannot support Commodity-Metals (London Gold Certificates).

Residents of Central-Eastern Europe (HU, CZ, PO, BG, RO, HR, SK, EE, LV, LT, CY, MT): IB Central Europe (“IB-CE”) cannot support commodity metals. Furthermore, IBCE currently only supports for the following currencies: EUR, USD, CZK, HUF, PLN. GBP and CHF are expected in the near future.

If you hold any of these currencies in your portfolio, you must close the positions as soon as possible in order to facilitate transfer of your account. Short cash positions (borrowing) do not have to be close immediately, just long positions.

Disclosure Regarding Interactive Brokers Price Cap Notices

Regulators expect brokerage firms to maintain controls designed to prevent the firm from submitting orders to market centers that create a risk of disruptive trading (e.g., the risk of sudden, transient price moves).

To comply with these expectations, Interactive Brokers implements various price filters on customer orders. Those price filters may, in certain circumstances, price cap customer orders in order to avoid market disruption, and those Price Caps will generally be in a % range from a reference price range calculated by IB. (The range of the Price Cap varies depending on the type of instrument and the current price.)

Although the price caps are intended to balance the objectives of trade certainty and minimized price risk, a trade may be delayed or may not take place as a result of price capping. More information is available in Interactive Broker’s Order Routing and Payment for Order Flow Disclosure.

If a customer’s order(s) are price capped by IB’s systems, that customer will either receive (i) real-time notification of those price cap(s) in Trader Workstation or via the API or FIX tag 58 (for FIX users); and/or (ii) a daily FYI message containing a digest of the first 10 order(s) that were price capped the prior day, the initial price cap(s) for those order(s) (if applicable), and the Price Cap Range(s) for further Price Cap(s) of those order(s).

Customers may opt out from receiving future FYI Messages by clicking the relevant opt-out link within an FYI Message. By opting out from receiving these future FYI Messages, a customer:

- Agrees to waive any further notifications from Interactive Brokers about the application of the firm’s Price Caps to that customer’s order(s); and

- Acknowledges that he or she understands that his or her orders may be price-capped in the future, but that the customer does not wish to be notified again about the application of any Price Caps to any of his or her orders.