Key Information Documents (KID)

IBKR is required to provide EEA and UK retail customers with Key Information Documents (KID) for certain financial instruments.

Relevant products include ETFs, Futures, Options, Warrants, Structured Products, CFDs and other OTC products. Funds include both UCITS and non-UCITS funds available to retail investors.

Generally KIDs must be provided in an official language of the country in which a client is resident.

However, clients of IBKR have agreed to receive communications in English, and therefore if a KID is available in English all EEA and UK clients can trade the product regardless of their country of residence.

In cases where a KID is not available in English, IBKR additionally supports other languages as follows:

| Language | Can be traded by residents or citizens* of |

| German | Germany, Austria, Belgium, Luxembourg and Liechtenstein |

| French | France, Belgium and Luxembourg |

| Dutch | the Netherlands and Belgium |

| Italian | Italy |

| Spanish | Spain |

*regardless of country of residence

Panoramica dell'introduzione delle norme dell'ESMA sui CFD per i clienti al dettaglio presso IBIE e IBCE

|

I CFD sono strumenti complessi e implicano un alto rischio di perdita rapida di denaro per via della leva finanziaria. Il 68,7% dei conti detenuti dagli investitori al dettaglio perde denaro nell'ambito delle attività di trading di CFD svolte tramite IBKR. È bene considerare se si comprende il funzionamento dei CFD e se ci si può permettere di assumersi l'alto rischio di perdita di denaro. |

L'Autorità europea degli strumenti finanziari e dei mercati (ESMA) ha emanato delle nuove norme applicabili ai clienti al dettaglio impegnati nel trading di CFD, in vigore a partire dal 1 agosto 2018. I clienti professionali non ne sono soggetti.

Gli enti regolatori nazionali hanno adottato le norme dell'ESMA in maniera permanente.

Queste norme consistono in: 1) dei limiti della leva finanziaria; 2) una norma sulla liquidazione del margine a seconda dello specifico conto; e 3) una tutela del saldo negativo a seconda dello specifico conto; 4) una restrizione sugli incentivi offerti per la negoziazione di CFD; e 5) un'avvertenza sui rischi standard.

La maggior parte dei clienti (eccetto le persone giuridiche regolamentate), è inizialmente classificata quale "cliente al dettaglio". In alcune circostanze IBKR potrà acconsentire a riclassificare un "Cliente al dettaglio" come "Cliente professionale" e viceversa. Per maggiori informazioni, consulta l'articolo sulla Classificazione della clientela ai sensi della normativa MiFID.

I seguenti paragrafi illustrano in che modo IBKR ha deciso di implementare la decisione dell'ESMA.

1 Limiti della leva

1.1 Margini fissati dall'ESMA

L'ESMA ha fissato i limiti della leva a diversi livelli in base al sottostante:

- Il 3.33% per le principali coppie valutarie; per principali coppie valutarie si intende una combinazione di qualunque tra USD; CAD; EUR; GBP; CHF; JPY

- Il 5% per le coppie valutarie non principali e gli indici principali;

- Per coppie valutarie non principali si intende una combinazione qualunque che comprenda una valuta non indicata sopra, per esempio USD.CNH

- I principali indici sono i seguenti: IBUS500; IBUS30; IBUST100; IBGB100; IBDE40; IBEU50; IBFR40; IBJP225; IBAU200

- Il 10% per gli indici non principali; IBES35; IBCH20; IBNL25; IBHK50

- Il 20% per i singoli titoli

1.2 Margini applicati - Requisiti standard

Oltre ai margini previsti dall'ESMA, IBKR stabilisce i propri requisiti di margine (margini IB) basati sulla volatilità storica del sottostante e altri fattori. Applicheremo i margini IB se superiori a quelli previsti dall'ESMA.

I dettagli dei margini IB ed ESMA applicabili sono disponibili qui.

1.2.1 Margini applicati - Margini basati sulla concentrazione

Qualora il tuo portafoglio sia costituito esclusivamente da un numero ridotto di posizioni su CFD e/o azioni, oppure qualora le due posizioni di dimensioni maggiori abbiano un peso predominante, ti verrà addebitata una tariffa di concentrazione. Sottoporremo il tuo portafoglio a uno stress test simulando una variazione avversa del 30% sulle due posizioni di dimensioni maggiori e una del 5% sulle posizioni rimanenti. Nel caso in cui risulti essere maggiore del requisito standard per le posizioni combinate su titoli e su CFD, la perdita totale verrà applicata come requisito di margine di mantenimento. Ti ricordiamo che la tariffa di concentrazione è l'unico caso nel quale le posizioni CFD e quelle azionarie hanno un margine congiunto.

1.3 Finanziamento dei requisiti di margine iniziali

È possibile utilizzare solamente liquidità per pubblicare il margine per l'apertura di posizioni su CFD.

All'inizio tutta la liquidità utilizzata per finanziare il conto è disponibile per il trading su CFD. Qualunque requisito di margine iniziale per altri strumenti e la liquidità usata per acquistare titoli riduce la liquidità disponibile. Sei tuoi acquisti di titoli azionari hanno generato un prestito a margine, non vi saranno fondi disponibili per le operazioni su CFD anche se il tuo conto dispone di un capitale di entità significativa. In base alle regole fissate dall'ESMA, non possiamo aumentare il prestito a margine per finanziare il margine per CFD.

I profitti su CFD realizzati sono compresi nella liquidità e disponibili immediatamente; la liquidità non deve essere prima regolata. Tuttavia, i profitti non realizzati non possono essere impiegati per soddisfare i requisiti di margine iniziali.

2 Norma di liquidazione del margine

2.1 Calcolo del margine di mantenimento e liquidazioni

L'ESMA richiede a IBKR di liquidare le posizioni su CFD quando il capitale proprio necessario scende al di sotto del 50% del margine iniziale registrato per l'apertura delle posizioni. IBKR potrà decidere di liquidare in anticipo delle posizioni se decideremo di assumere una valutazione del rischio più conservatrice. Il capitale proprio necessario per soddisfare questo obiettivo include la liquidità per CFD e il P&L non realizzato su CFD (positivo e negativo). Ti ricordiamo che la liquidità per CFD non include la liquidità per supportare i requisiti di margine relativi ad altri strumenti.

La base del calcolo è il margine iniziale registrato al momento dell'apertura della posizione. In altre parole, e a differenza dei calcoli del margine applicabili alle posizioni su strumenti diversi dai CFD, l'ammontare del margine iniziale non cambia al variare della posizione aperta.

2.1.1 Esempio

Disponi di 2000 EUR in liquidità nel tuo conto e non hai posizioni aperte. Si desidera acquistare 100 CFD di XYZ al prezzo limite di 100 EUR. Si ottiene, innanzitutto, l'esecuzione di 50 CFD e poi dei restanti 50. La liquidità disponibile si riduce durante l'esecuzione delle transazioni:

|

|

Liquidità |

Capitale proprio* |

Posizione |

Prezzi |

Valore |

P&L non realizzato |

MI |

MM |

Liquidità disponibile |

Violazione del MM |

|

Pre-transazione |

2000 |

2000 |

|

|

|

|

|

|

2000 |

|

|

Post-transazione 1 |

2000 |

2000 |

50 |

100 |

5000 |

0 |

1000 |

500 |

1000 |

No |

|

Post-transazione 2 |

2000 |

2000 |

100 |

100 |

10000 |

0 |

2000 |

1000 |

0 |

No |

*Capitale proprio equivalente alla liquidità più il P&L non realizzato

Il prezzo aumenta fino a 110. Il capitale proprio è ora pari a 3000, ma non è possibile aprire posizioni aggiuntive, perché la liquidità a propria disposizione è pari a 0, e, secondo le norme dell'ESMA, il MI (margine iniziale) e il MM (margine di mantenimento) restano immutati:

|

|

Liquidità |

Liquidità |

Posizione |

Prezzi |

Valore |

P&L non realizzato |

MI |

MM |

Liquidità disponibile |

Violazione del MM |

|

Variazione |

2000 |

3000 |

100 |

110 |

11000 |

1000 |

2000 |

1000 |

0 |

No |

Il prezzo, quindi, scende fino a 95. Il capitale proprio si riduce a 1500, ma non vi è violazione del margine dato che è comunque maggiore del requisito di 1000:

|

|

Liquidità |

Liquidità |

Posizione |

Prezzi |

Valore |

P&L non realizzato |

MI |

MM |

Liquidità disponibile |

Violazione del MM |

|

Variazione |

2000 |

1500 |

100 |

95 |

9500 |

(500) |

2000 |

1000 |

0 |

No |

Il prezzo scende ulteriormente fino ad arrivare a 85, causando una violazione del margine e innescando una liquidazione:

|

|

Liquidità |

Liquidità |

Posizione |

Prezzi |

Valore |

P&L non realizzato |

MI |

MM |

Liquidità disponibile |

Violazione del MM |

|

Variazione |

2000 |

500 |

100 |

85 |

8500 |

(1500) |

2000 |

1000 |

0 |

Sì |

3 Protezione del capitale proprio negativo

L'ordinanza dell'ESMA limita la propria responsabilità dei CFD ai fondi dedicati al trading di CFD. Gli altri strumenti finanziari (es., azioni o future) non possono essere liquidati per soddisfare il disavanzo di margine dei CFD.*

Di conseguenza gli asset diversi dai CFD non fanno parte del tuo capitale a rischio per il trading di CFD.

Nel caso in cui tu perda una somma superiore a quella dedicata al trading CFD, IB avrà l'obbligo di cancellare la perdita.

Dato che la protezione del capitale proprio negativo rappresenta un rischio aggiuntivo per IBKR, addebiteremo agli investitori al dettaglio uno spread finanziario aggiuntivo del 1% per le posizioni su CFD mantenute alla giornata. Per informazioni dettagliate sui tassi di finanziamento dei CFD, clicca qui.

*Sebbene non possiamo liquidare le posizioni su strumenti diversi dai CFD per coprire il disavanzo dei CFD, possiamo liquidare le posizioni su CFD per coprire il disavanzo non CFD.

Finestra del Conto di TWS per i clienti al dettaglio di IBKR Ireland e dell'Europa centrale

Questo articolo descrive le informazioni fornite nella finestra del conto in TWS per le entità di IBKR con sede nell'Unione Europea.

|

I CFD sono strumenti complessi e implicano un alto rischio di perdita rapida di denaro per via della leva finanziaria. Il 63.7% dei conti detenuti dagli investitori al dettaglio perde denaro nell'ambito delle attività di trading di CFD svolte tramite IBKR. È bene considerare se hai compreso il funzionamento dei CFD e sei in grado di assumerti l'elevato rischio di perdita di denaro. |

I clienti al dettaglio che risiedono nella SEE e che pertanto mantengono un conto con uno dei broker europei di IBKR, ovvero IBIE oppure IBCE, sono soggetti alle regole della UE che introducono restrizioni circa la leva finanziaria e altre norme applicabili alle transazioni sui contratti per differenze (CFD).

Nello specifico i regolamenti richiedono l’utilizzo di liquidità disponibile per soddisfare i requisiti di margine dei CFD e vietano ai clienti al dettaglio l’utilizzo di titoli nel conto come garanzia per ottenere fondi in prestito per aprire o mantenere posizioni su CFD. Per maggiori informazioni ti invitiamo a leggere la Panoramica delle Regole di Implementazione dell’ESMA relative ai CFD per i Clienti al dettaglio presso IBIE e IBCE.

I conti delle entità di IBKR presenti in Europa sono conti universali nei quali i clienti possono negoziare tutte le classi di asset disponibili sulla piattaforma di IBKR. Tuttavia, al contrario di quanto è possibile per le entità negli USA e nel Regno Unito, non sono presenti segmenti finanziati separatamente.

Qui di seguito troverai alcuni esempi relativi all'applicazione di questa restrizione e maggiori dettagli su cosa possono fare i clienti per controllare la liquidità disponibile per le transazioni su CFD.

Finestra del Conto

IBKR applica delle restrizioni relative alla liquidità disponibile calcolando i fondi disponibili per il trading su CFD in tempo reale, respingendo nuovi ordini e liquidando le posizioni esistenti nel caso in cui la liquidità disponibile non sia sufficiente a coprire i requisiti di margine iniziali e di mantenimento per i CFD.

IBKR offre ai clienti la possibilità di monitorare la liquidità disponibile per le transazioni CFD attraverso una nuova funzione introdotta nella Finestra Conto di TWS che mostra il livello di liquidità nel conto. È importante sottolineare che i fondi mostrati come disponibili per il trading di CFD non implicano che la liquidità è mantenuta in un segmento distinto. A essere indicata è solo la proporzione dei saldi totali del conto che viene considerata disponibile per il trading di CFD.

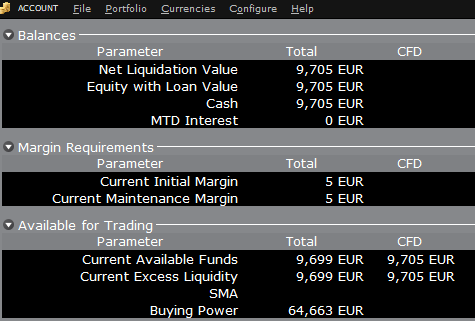

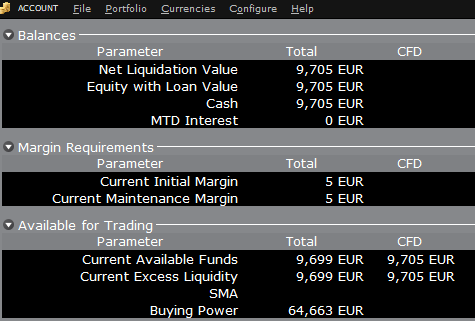

Per esempio, prendiamo in considerazione un conto che abbia 9.705 EUR in liquidità e zero posizioni. Tutta la liquidità è disponibile per aprire posizioni su CFD oppure per posizioni in qualunque altro tipo di asset:

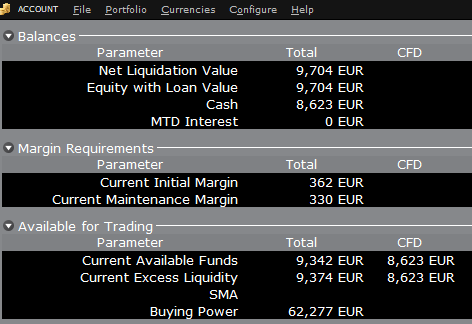

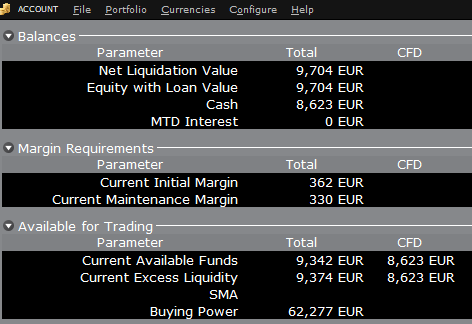

Se il conto ora acquista 10 azioni del titolo AAPL per un valore aggregato di 1.383 USD, la liquidità presente nel conto verrà

ridotta dell’importo corrispondente in EUR, e di conseguenza i fondi disponibili per il trading di CFD si ridurranno dello

stesso importo:

Ti ricordiamo che il Totale dei fondi disponibili viene ridotto di un importo più piccolo che corrisponde al requisito di margine del titolo.

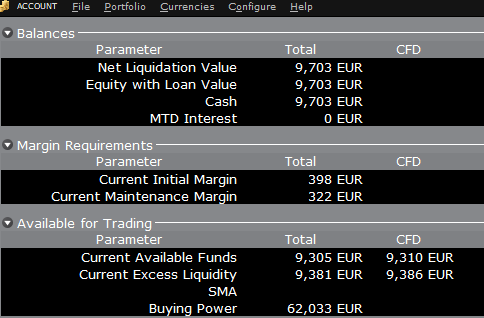

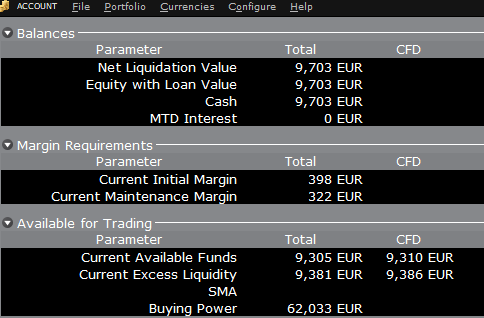

Se invece di acquistare le azioni di AAPL, vengono acquistati 10 CFD del titolo AAPL, l’impatto è differente. In questo caso infatti la transazione non è legata all’acquisto dell’asset sottostante, ma riguarda un contratto derivato. Per questo non vi sarà una riduzione della liquidità ma i fondi disponibili per i CFD saranno ridotti il base al requisito di margine per CFD in modo da garantire la performance sul contratto:

In questo caso il Totale dei fondi disponibili e il totale fondi disponibili per CFD verranno diminuiti di un importo identico, ossia il requisito di margine per i CFD.

Finanziamento

Come indicato poc’anzi, i conti con base nell’Unione Europea non hanno segmenti e non vi è quindi alcuna necessità di trasferimenti interni. I fondi sono disponibili per transazioni in tutti i tipi di asset negli importi indicati nella finestra del conto, senza bisogno di eseguire sweep o trasferimenti.

Ti ricordiamo inoltre che nel caso in cui un conto presenti un prestito di margine, ossia della liquidità negativa, non sarà possibile aprire posizioni su CFD. Il motivo di tale regola è che il requisito di margine per CFD deve essere rispettato avendo a disposizione una situazione di cassa positiva. Nel caso in cui tu abbia un prestito di margine e voglia negoziare CFD, dovrai per prima cosa chiudere le posizioni con margine per eliminare il prestito, oppure aggiungere liquidità al conto per un importo che possa coprire il prestito a margine e che rappresenti un “cuscinetto di liquidità” sufficiente per bilanciare il margine CFD richiesto.

TWS Account Window for Retail Clients of IBKR Ireland and Central Europe

This article describes the information provided in the TWS account window for IBKRs EU based entities.

|

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61% of retail investor accounts lose money when trading CFDs with IBKR. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. |

Retail clients who are residents of the EEA and therefore maintain an account with one of IBKR’s European brokers, IBIE or IBCE, are subject to EU regulations which introduce leverage and other restrictions applicable to CFD transactions.

Notably the regulations require the use of free cash to satisfy CFD margin requirements and prohibit retail clients from using securities in the account as collateral to borrow funds to initiate or maintain a CFD position. Please see Overview of ESMA CFD Rules Implementation for Retail Clients at IBIE and IBCE for full details.

The accounts of IBKRs EU entities are universal accounts in which clients can trade all asset classes available on IBKRs platform, but unlike IBKRs US and UK entities, there are no separately funded segments.

Working examples of how this restriction is applied, along with details as to how clients can monitor free cash available for CFD transactions, are outlined below.

Account Window

IBKR enforces the restriction relating to free cash by calculating the funds available for CFD trading on a real-time basis, rejecting new orders and liquidating existing positions when the available free cash is insufficient to cover CFD initial and maintenance margin requirements.

IBKR offers clients the ability to monitor free cash available for CFD transactions via an enhancement to the TWS Account Window which displays the level of free cash in the account. Importantly, the funds shown as available for CFD trading do not imply that cash is held in a separate segment. It simply indicates what proportion of total account balances is available for CFD trading.

For example, assume that an account has EUR 9,705 in cash and no positions. All the cash is available to open CFD positions, or positions in any other asset class:

If the account now purchases 10 shares of AAPL stock for an aggregate value of USD 1,383 the cash in the account is reduced by a corresponding amount in EUR, and the funds available for CFD trading are reduced by the

same amount:

Note that Total available funds are reduced by a smaller amount, corresponding to the stock margin requirement.

If, instead of buying AAPL stock, the account buys 10 AAPL CFDs the impact will be different. As the transaction involves a derivative contract rather than the purchase of the underlying asset itself, there’s no reduction in cash but the funds available for CFDs are reduced by the CFD margin requirement to secure performance on the contract:

In this case Total available funds and CFD available funds are reduced by an equal amount; the CFD margin requirement.

Funding

As noted above, EU-based accounts do not have segments and therefore there is no need for internal transfers. Funds are available for trades in all asset classes in the amounts indicated in the account window, without the need for sweeps or transfers.

Note also that should an account have a margin loan, i.e. negative cash, it will not be possible to open CFD positions since the CFD margin requirement must be satisfied by free, positive cash. Should you have a margin loan and wish to trade CFDs you must first either close margin positions to eliminate the loan, or add cash to the account in an amount that covers the margin loan and creates a cash buffer sufficient for the necessary CFD margin.

IBKR Metals CFDs – Facts and Q&A

The following article is intended to provide a general introduction to London Gold and Silver Contracts for Differences (CFDs) issued by IBKR.

Please follow these links for information on IBKR Share CFDs, Index CFDs and Forex CFDs.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

61% of retail investor accounts lose money when trading CFDs with IBKR.

You should consider whether you understand how CFDs work and whether you can afford to take the

high risk of losing your money.

ESMA Rules for CFDs (Retail Clients only)

The European Securities and Markets Authority (ESMA) has enacted new CFD rules effective 1st August

2018.

The rules include: 1) leverage limits on the opening of a CFD position; 2) a margin close out rule on a per

account basis; and 3) negative balance protection on a per account basis.

The ESMA Decision is only applicable to retail clients. Professional clients are unaffected.

Please refer to the following articles for more detail:

ESMA CFD Rules Implementation at IBKR (UK) and IBKR LLC

ESMA CFD Rules Implementation at IBIE and IBCE

Introduction

A London Gold CFD enables you to have exposure to price movements of physical Gold without actually owning it. A London Gold CFD is an agreement between you and IBKR to exchange the difference in price of the underlying over a period of time. The difference to be exchanged is determined by the change in the reference price of the underlying. Thus, if the price of physical Gold traded on the London bullion market rises and you are long the CFD, you receive cash from IBKR and vice versa. A London Gold CFD can be bought long or sold short to suit your view of market direction in the future.

Contract Specifications

| Contract | IBKR Symbol | Per Trade Fee | Minimum per Order | Multiplier |

| London Gold | XAUUSD | 0.015% | USD 2.00 | 1 |

| London Silver | XAGUSD | 0.03% | USD 2.00 | 1 |

Price Determination

The IBKR London Gold and Silver CFDs reference physical Gold and Silver traded on the London bullion market. The London bullion market is a wholesale over-the-counter market for the trading of precious metals. Trading is conducted among members of the London Bullion Market Association (LBMA). Most of the members are major international banks.

IBKR receives quote streams from approximately 10 such major banks, in much the same way it does for cash forex. IBKR Smart routes between the banks, and the best available price at any given time becomes the reference price for the CFDs. IBKR does not add a spread to the banks’ quotes.

Low Commissions and Financing Rates: Unlike other CFD providers IBKR charges a transparent

commission, rather than widening the spread. Commission rates are only 0.015% for London Gold and 0.03% for London Silver. Overnight financing rates are just benchmark +/- 1.5% (an additional 1% surcharge is added for retail accounts).

Transparent Quotes: Because IBKR does not widen the spread, the Metals CFD quotes accurately

represent the spreads and price movements of the related cash metal, as described above.

Margin Efficiency: IBKR establishes house-margin requirements based on historic volatility of the

underlying and other factors. Retail clients are subject to regulatory minimum initial margins of 5% for

London Gold or 10% for London Silver.

Trading Permissions: Same as for Share and Index CFDs.

Market Data Permissions: Metals CFD market data is free, but a permission is required for system

reasons.

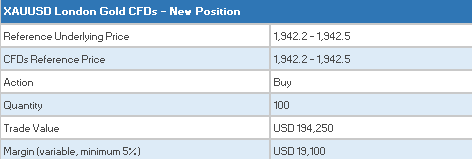

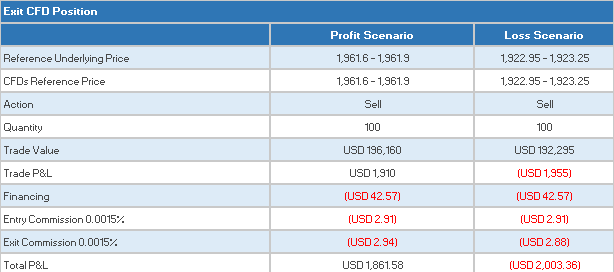

Worked Trade Example (Professional Clients):

You purchase 100 XAUUSD CFDs at $1,942.5 for USD 194,250 which you then hold for 5 days.

![]()

Closing the Position

CFD Resources

Below are some useful links with more detailed information on IB’s CFD offering:

Frequently asked Questions

Are short Metals CFDs subject to forced buy-in?

No.

Can I take delivery of the underlying metal?

No, IBKR does not support physical delivery for Metals CFDs.

Are there any market data requirements?

The market data for Metal CFDs is free, and is included the market data for Index CFDs. However, you need to subscribe to the permission for system reasons. To do this, log into Account Management, and click through the following tabs: Settings/User Settings/Trading Platform/Market Data Subscriptions. Alternatively you can set up an Index or Metals CFD in your TWS quote monitor and click the “Market Data Subscription Manager” button that appears on the quote line.

How are my CFD trades and positions reflected in my statements?

If you are a client of IBKR (U.K.) or IBKR LLC, your CFD positions are held in a separate account segment identified by your primary account number with the suffix “F”. You can choose to view Activity Statements for the F-segment either separately or consolidated with your main account. You can make the choice in the statement window in Account Management.

If you are a client of other IBKR entities, there is no separate segment. You can view your positions normally alongside your non-CFD positions.

In what type of IB accounts can I trade CFDs e.g., Individual, Friends and Family,

Institutional, etc.?

All margin and cash accounts are eligible for CFD trading.

Can I trade CFDs over the phone?

No. In exceptional cases we may agree to process closing orders over the phone, but never opening

orders.

Can anyone trade IB CFDs?

All clients can trade IB CFDs, except residents of the USA, Canada, Hong Kong, New Zealand and

Israel. There are no exemptions based on investor type to the residency-based exclusions.

Bonus Certificates Tutorial

Introduction

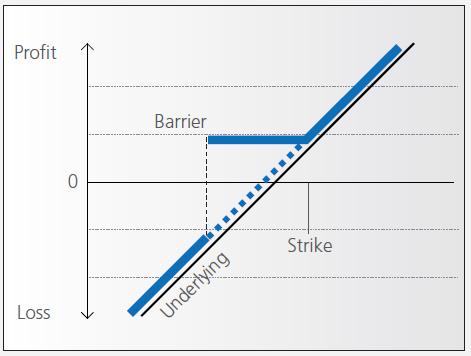

Bonus certificates are designed to provide a predictable return in sideways markets, and market returns in rising markets.

At the time they’re issued, bonus certificates normally have a term to maturity of two to four years. You will receive a specified cash pay-out (“bonus level” or “Strike”) if at maturity the price of the underlying is below or at the strike, as long as the underlying instrument has not touched or fallen below an established price level (“safety threshold” or “barrier”) during the term of the certificate.

Unless the certificate has a cap, you continue to participate in the price gains if the underlying instrument rises above the bonus level. In this case you either receive the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

However, if the barrier is breached, you will no longer be entitled to the bonus payment. The value of the certificate then corresponds to the value of the underlying (times the ratio). In other words, once the barrier has been touched the certificate effectively converts to an index certificate. You will receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Although there is no structured leverage, the presence of the barrier creates effective leverage. When the price of the underlying instrument approaches the barrier the probability of a breach increases, affecting the price of the certificate disproportionately.

Pay-out Profile

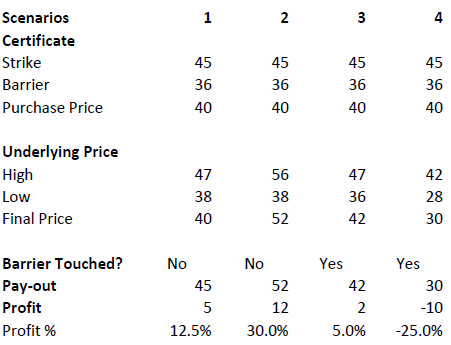

Example

Assume a bonus certificate on ABC share. The certificate has a strike of EUR 45.00 and a barrier set at EUR 36.00. The table below shows scenarios depending on the trading range of the underlying, the final price of the underlying and whether the barrier has been touched or not.

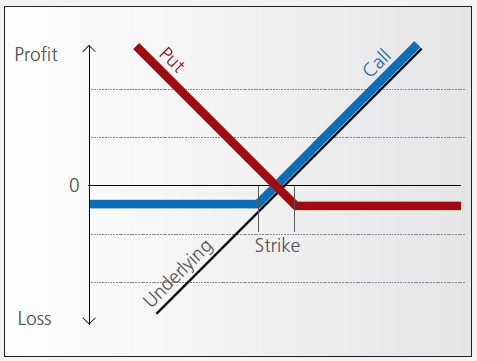

Warrant Tutorial

Introduction

A warrant confers the right to buy (call-warrant) or sell (put-warrant) a specific quantity of a specific underlying instrument at a specific price over a specific period of time.

Pay-out Profile

With some warrants, the option right can only be exercised on the expiration date. These are referred to as “European-style” warrants. With “American-style” warrants, the option right can be exercised at any time prior to expiration. The vast majority of listed warrants are cash-exercised, meaning that you cannot exercise the warrant to obtain the underlying physical share. The exception to this rule is Switzerland, where physically settled warrants are widely available.

Factors that influence pricing

Not only do changes in the price of the underlying instrument influence the value of a warrant, a number of other factors are also involved. Of particular importance to investors in this regard are changes in volatility, i.e. the degree to which the price of the underlying instrument fluctuates. In addition, changes in interest rates and the anticipated dividend payments on the underlying instrument also play a role.

However, changes in implied volatility - as well as interest rates and dividends - only affect the time value of a warrant. The primary driver - intrinsic value - is solely determined by the difference between the price of the underlying instrument and the specified exercise price.

Historical and implied volatility

In addressing this topic, a differentiation has to be made between historical and implied volatility. Implied volatility reflects the volatility market participants expect to see in the financial instrument in the days and months ahead. If implied volatility for the underlying instrument increases, so does the price of the warrant.

This is because the probability of profiting from a warrant during a particular time-frame increases if the price of the underlying instrument is highly volatile. The warrant is therefore more valuable.

Conversely, if implied volatility decreases, that leads to a decline in the value of warrants and hence occasionally to nasty surprises for warrant investors who aren’t familiar with the concept and influence of volatility.

Interest rates and dividends

Issuers hedge themselves against price changes in the warrant through purchases and sales of the underlying instrument. Due to the leverage afforded by warrants, the issuer needs considerably more capital to hedge its exposure than you require to buy the warrants. The issuer’s interest expense associated with that capital is included in the price of the warrant. The amount of embedded interest reduces over time and at expiration is zero.

In the case of puts, the situation is exactly the opposite. Here, the issuer sells the underlying instrument

short to establish the necessary hedge, and in so doing receives capital that can earn interest. Thus interest reduces the price of the warrant by an amount that decreases over time.

As the issuer owns shares as a part of its hedging operations, it is entitled to receive the related dividend

payments. That additional income reduces the price of call warrants and increases the price for puts. But if the dividend expectations change, that will have an influence on the price of the warrants. Unanticipated special dividends on the underlying instrument can lead to a price decline in the related warrants.

Key valuation factors

Let’s assume the following warrant:

Warrant Type: Call

Term to expiration: 2 years

Underlying : ABC Share

Share price: EUR 30.00

Strike: EUR 30.00

Exercise ratio: 0.1

Warrant’s price: EUR 0.30

Intrinsic value

Intrinsic value represents the amount you could receive if you exercised the warrant immediately and then bought (in the case of a call) or sold (put) the underlying instrument in the open market.

It’s very easy to calculate the intrinsic value of a warrant. In our example the intrinsic value is EUR 00.00

and is calculated as follows:

(price of underlying instrument – strike price) x exercise ratio

= (EUR 30.00 – EUR 30.00) x 0.1

= EUR 00.00

If the price of the ABC share increases by EUR 1, the intrinsic value becomes

= (EUR 31.00 – EUR 30.00) x 0.1

= EUR 00.10

The intrinsic value of a put warrant is calculated with this formula:

(strike price – price of underlying instrument) x exercise ratio

It’s important to note that the intrinsic value of a warrant can never be negative. By way of explanation:

if the price of the underlying instrument is at or below the exercise price, the intrinsic value of a call equals zero. In this instance, the price of the warrant consists only of “time value”. On the flipside, the intrinsic value of a put is equal to zero if the price of the underlying instrument is at or above the exercise price.

Time value

Once you’ve calculated the intrinsic value of a warrant, it’s also easy to figure out what the time value of that warrant is. You simply deduct the intrinsic value from the current market price of the warrant. In our example, the time value is equal to EUR 1.30 as you can see from the following calculation:

(warrant price – intrinsic value)

= (EUR 0.30 EUR – EUR 0.00)

= EUR 0.30

Time value gradually erodes during the term of a warrant and ultimately ends up at zero upon expiration. At that point, warrants with no intrinsic value expire worthless. Otherwise you can expect to receive payment of the intrinsic value. Take note, though: a warrant’s loss of time value accelerates during the final months of its term.

Premium

The premium indicates how much more expensive a purchase/sale of the underlying instrument would be via the purchase of a warrant and the immediate exercise of the option right as opposed to simply buying/selling the underlying instrument in the open market.

Hence the premium is a measure of how expensive a warrant actually is. It follows that, when given a choice between warrants with similar features, you should always buy the one with the lowest premium. By calculating the premium as an annualized percentage, warrants with different terms to expiry can be compared with each other.

The percentage premium for the call warrant in our example can be calculated as follows:

(strike price + warrant price / exercise ratio – share price) / share price * 100

= (EUR 30.00 + EUR 0.30 / 0.1 – EUR 30.00) / EUR 30.00 x 100

= 10 percent

Leverage

The amount of leverage is the price of the share * ratio divided by the price of the warrant. In our example 30.00*0.1/0.3 = 10. So when the price of ABC increases by 1% the value of the warrant increases by 10%.

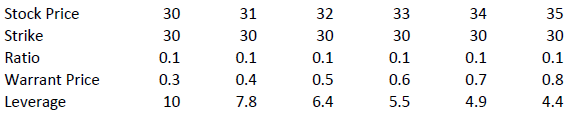

The amount of leverage is not constant however; it varies as intrinsic and time value changes, and is particularly sensitive to changes in intrinsic value. As a rule of thumb, the higher the intrinsic value of the warrant, the lower the leverage. For example (assuming constant time value):

Knock-out (Turbo) Tutorial

Introduction

Knock-out warrants (turbos), like vanilla warrants, derive their value from the difference between the price of the underlying and the strike. They differ significantly however from vanilla warrants in many important respects:

- They can expire (knock-out) prematurely if the price of the underlying instrument touches or falls below (in the case of knock-out calls) or exceeds (in the case of knockout puts) a predetermined barrier-level. It expires worthless if the barrier equals the strike, or it may have a residual stop-loss value if the barrier is set higher than the strike (in the case of a call).

- Changes in implied volatility have little or no impact on knock-out products, therefore their pricing is easier for investors to comprehend than that of warrants.

- They have little or no time value (because of the presence of the knock-out barrier), and therefore have a higher degree of leverage than a warrant with the same strike. This is because the absence of time value makes the instrument “cheaper”.

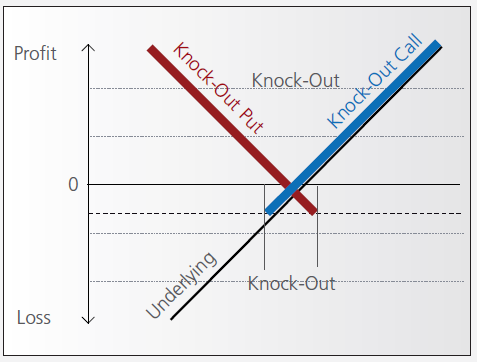

Pay-out Profile

Leverage

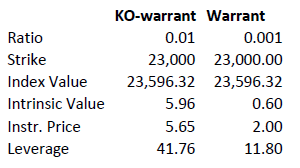

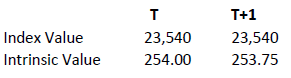

As discussed above, knock-out warrants exhibit high degrees of leverage, particularly as the price of the underlying nears the strike/barrier. Consider the following example of a long turbo on the Dow Jones Index, compared to a vanilla warrant:

Intrinsic value = (index value – strike) x ratio

Leverage = Index Value x Ratio / Instrument Price

A vanilla warrant retains significant time value even as the underlying price approaches the strike, sharply reducing its leverage compared to a knock-out warrant.

Product types

As discussed above, the barrier may either equal the strike, or be set above (calls) or below (puts). In the latter cases a small residual value remains after knock-out, corresponding to the difference between the barrier (the stop-loss level) and the strike.

Moreover, knock-out products may either have an expiration date or may be open-ended. This makes a difference in the way interest is accounted for. If the contract has an expiration date interest is included in the premium, the amount of which reduces over time and is zero on expiration. This is analogous to a standard vanilla warrant.

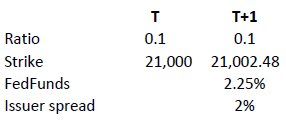

in relation to an expiration date. The price of the contract therefore corresponds exactly to its intrinsic value. Interest however must be accounted for. This is done by a daily adjustment of the barrier and strike. The following example shows the daily adjustment for a long open-end turbo on the Dow Jones Index:

The adjustment = Strike T x (1+ FedFunds/360 + Issuer Spread/360).

The intrinsic value of the instrument is correspondingly reduced as follows, assuming no change in the value of the DJ Index):

Intrinsic value = (index value – strike) x ratio

Discount Certificates Tutorial

Introduction

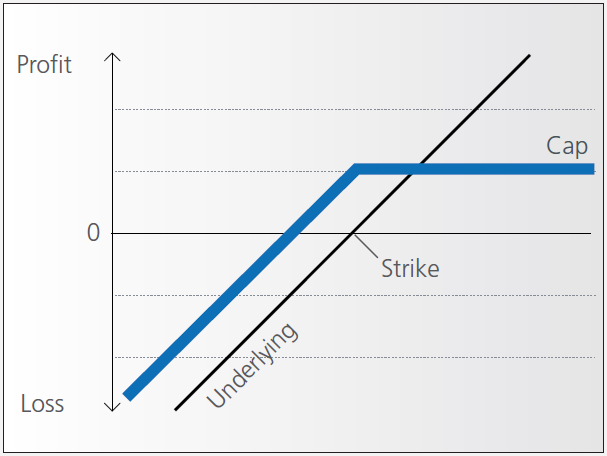

Discount certificates are designed to provide an enhanced return in sideways markets, compared to a direct investment in the underlying.

Discount certificates make it possible for you to buy an underlying instrument for less than its current market price. However, the maximum payback on a discount certificate is limited to a predetermined amount (cap).

Discount certificates normally have a term to maturity of one to three years. At maturity, a determination is made of where the price of the underlying instrument stands.

If it is at or above the cap, you’ll earn the maximum return and receive payment of the amount reflected by the cap.

If the price of the underlying instrument is below the cap on the maturity date, you’ll receive either the corresponding number of shares or a cash settlement reflecting the value of the underlying instrument on the maturity date.

Pay-out Profile

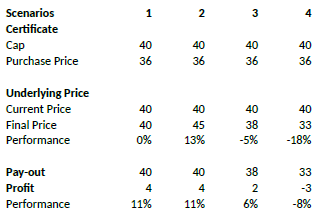

Example

Assume a discount certificate on ABC share. The certificate has a cap of EUR 40.00, and a purchase price of EUR 36.00. The table below shows scenarios depending on the final price of the underlying.

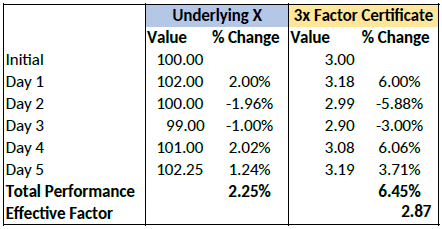

Factor Certificates Tutorial

Introduction

Factor certificates employ a daily leverage factor that multiplies the daily performance of the underlying instrument. Unlike knock-out warrants and mini-futures, factor certificates do not have a knock-out barrier. To avoid a loss greater than the investment, the calculation resets intraday if the performance of the underlying threatens to render the certificate worthless.

Daily Leverage

The performance of the certificate is calculated daily, without reference to previous days’ values. If the underlying returns 1% on the day, the value of 3x certificate increases by 3%, a 5x by 5%. The next day the process is repeated, referencing the prior day’s underlying close.

As such, factor certificates are particularly suitable for day-traders.

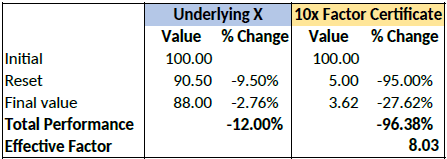

However, for a period of more than one day, the cumulative performance of the underlying cannot be simply multiplied by a factor of 3 as the previous day’s price always forms the new basis of calculating each day’s performance for the certificate. To illustrate with an example:

Cumulatively, the factor certificate has returned less than 3x the performance of the underlying.

Intraday Reset

If an underlying for a factor certificate loses more than a certain percentage of its value intraday, the calculation is reset by simulating a new day. The reset threshold varies depending on the leverage factor.

Let’s assume a long factor certificate with a 10x leverage factor. According to the terms of the certificate, a reset will be triggered if the underlying loses more than 9.5% during the calculation day.

Let’s now assume that the underlying loses 12% of its value during a particular day. The reset

and final performance will be as follows: