Introduction

This Users Guide is intended to assist introducing brokers with answering questions your clients may have when completing the online IB Tax Form. Individual and joint accounts having tax information requiring update will be presented with the form immediately upon login to Account Management. For joint accounts, each account holder needs to provide his or her personal information and complete an appropriate tax form. Organization and trust accounts will complete the form through an updated online account application made available through your Account Management Dashboard. Applicable sections of the form will be pre-populated with information on record and the form should therefore only take a few minutes to complete. Completion of the form in a timely manner is critical to ensuring that both U.S. and non-U.S. taxpayers are not subject to any exceptional U.S. tax withholding and non-U.S. taxpayers receive the most favorable rate on dividend withholding as defined by U.S. treaties. As a result, the form cannot be by-passed upon client login and no other Account Management functions will be accessible until completed.

To notify your clients about this online Tax Form and request that they log into Account Management to complete it, sample communication templates suitable for sending to each of your U.S. (

Exhibit I) and Non-U.S. (

Exhibit II) clients have been included in the Exhibit section of this document. Note that once the Tax Form has been completed, it will be reviewed by IB for purposes of verifying the client’s stated tax residency which, depending upon the information submitted, may require the client to complete additional tasks (e.g., explain responses or send supporting identity and/or address documentation). As IB will have no direct communication with your clients as part of this process, you will need contact the client to complete these additional tasks and forward required documentation to

fatca@interactivebrokers.com. To assist you with managing communications and tracking status, IB will be sending periodic reports to your Message Center listing any clients having tasks pending completion and the nature of those tasks.

IB Tax Form Screen Overview

Screen 1

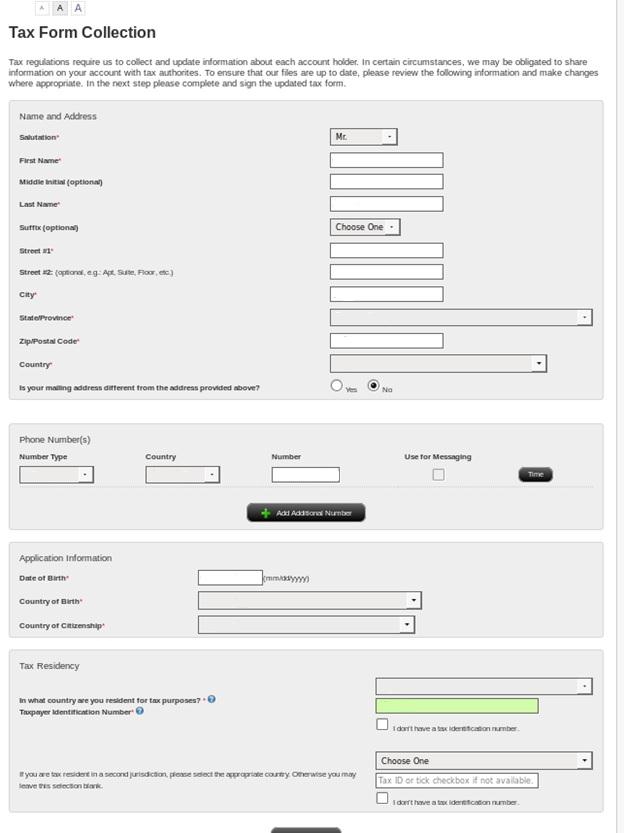

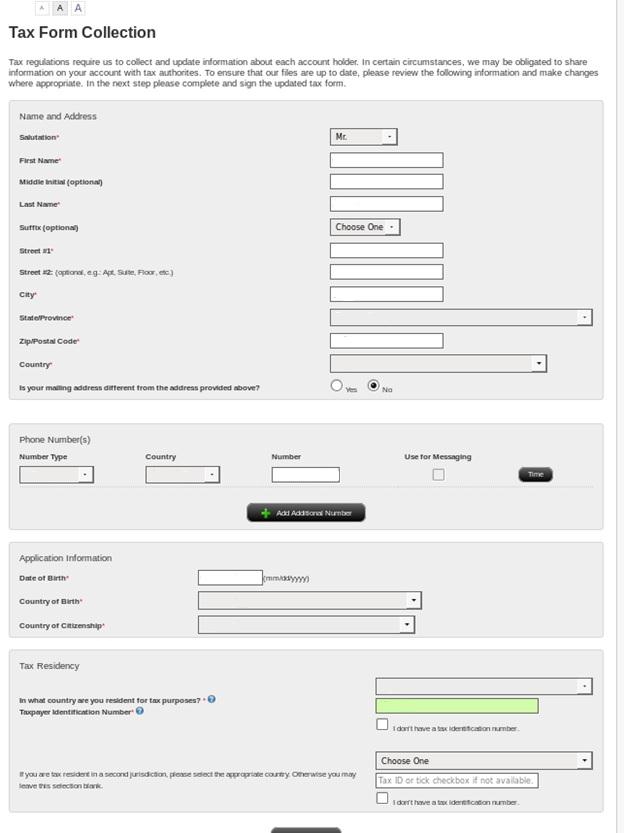

The first screen which the client will be presented upon login to Account Management contains basic account identifying information provided by the client at the point of application or updated through Account Management thereafter. The information presented is as follows:

Section 1: Name and Address – the Salutation, First Name, Middle Initial, Last Name and Suffix fields are pre-populated and cannot be changed on this form. If any of this information has changed, please continue with form and when complete navigate to the Settings, Account Settings and Profile sections to make changes. Changes to permanent and mailing address and telephone number are allowed.

Warning! Certain changes will require verification documents from the client.

Note: The presence of (i) U.S. telephone number and no non-U.S. number, (ii) a U.S. address (mailing or permanent), or (iii) U.S. place of birth are considered U.S. tax connections. Explanations and further follow up documentation from the client are required when these connections are found.

The presence of an address in Jersey, Isle of Mann, Guernsey and Gibraltar is UK indicia flag if the client does not indicate tax residency in the corresponding country. Explanation and further follow up documentation may be required from the client.

Section 2: Phone Number(s) – allows update and addition of phone numbers by type (home, work, mobile fax). For each number entered, specify country of issuance and number. If phone type is mobile and you which to receive test messages check “Use for Messaging” box. An optional entry for preferred times of contact may be specified by clicking on the Time button.

Note: We understand that many clients us a U.S. mobile number for simplicity and ease of communication. While understandable, failure by the client to provide a secondary, non-U.S. telephone number will result in the account being flagged for further review.

Section 3: Application Information - Date of birth, country of citizenship and country of birth will be prepopulated if IB has this information on file. These are required fields which require client entry to proceed.

Note: U.S. citizenship is considered a U.S. tax connection and requires disclosure of U.S. tax residency and a social security number.

U.S. place of birth is considered a U.S. connection if the client does not indicate U.S. citizenship. Explanation and further follow up documentation from the client is required when this connection is found.

Section 4: Tax Residency - The client must disclose the jurisdictions where the client is tax resident and the tax id associated with that residency if applicable. The second tax jurisdiction is an optional field although entries which are clearly erroneous will not be accepted. Additionally, we have programmed rules for the collection of tax ids in certain countries. For example a U.S. social security number has 9 digits and all are numbers. If a client fails the logic, the system will not accept the tax id. If the client is having a problem inserting tax ids, this could be the reason.

Client should hit “Submit” button after all personal information is completed. Assuming no entry errors have been made, the client will be directed to Page 2 (tax form).

Screen 1

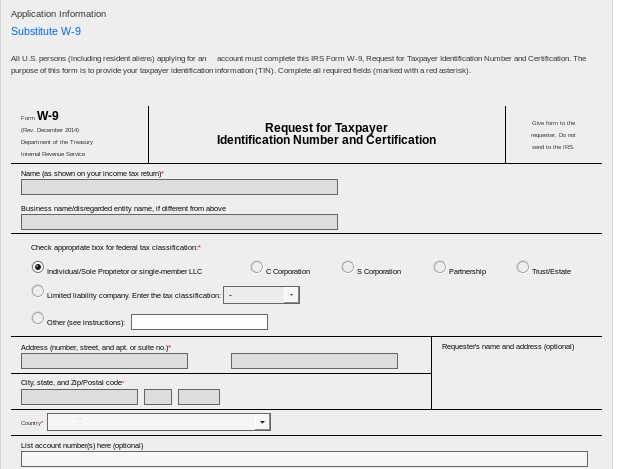

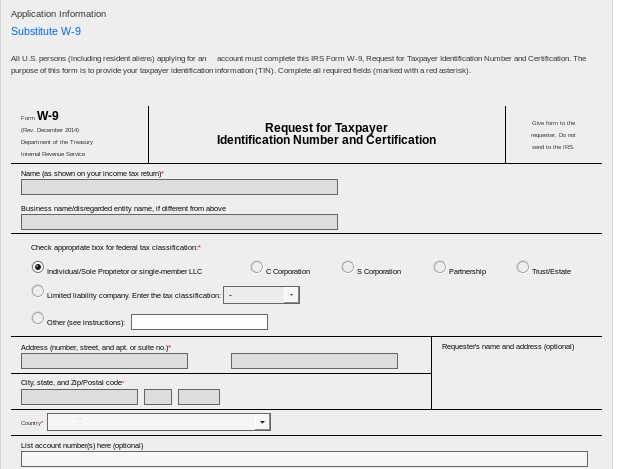

Screen 2 (W-9)

The second screen which the client will be presented will be the W-9 or W-8BEN tax form, whichever is applicable, based upon information provided on the prior screen. For example, a W-9 will be shown if the client selects U.S. tax residency (even if another tax residency was disclosed). Note that information on the W-9 will be pre-populated and cannot be edited.

Important: To change the pre-populated information on the W-9, the client MUST hit the back button and change the relevant information on the prior page for the tax form to be updated.

In the Part II Certification section of this screen, the client will need to review and check the boxes that apply.

Important: The first 3 boxes on the W-9 under certification must be checked to avoid having the client subject to back up withholding.

.jpg)

Next, the client will need to provide an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen and select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

.jpg)

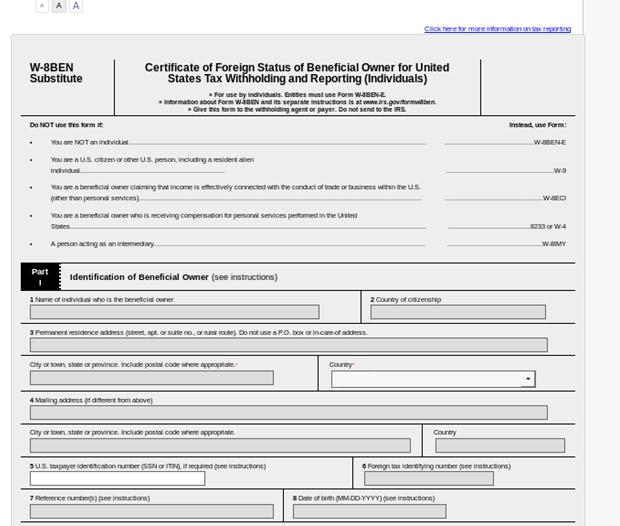

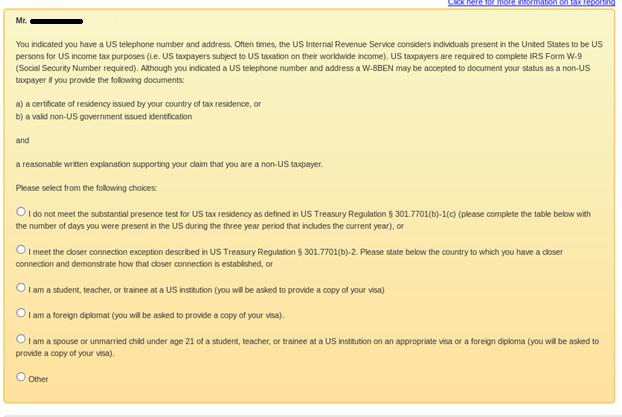

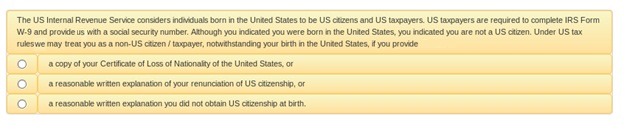

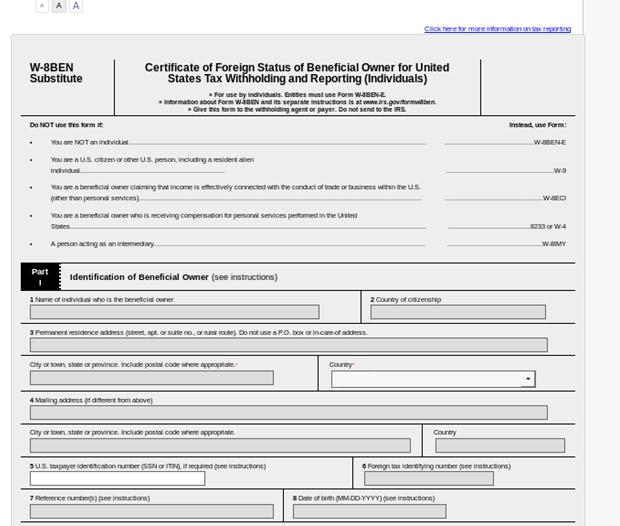

A W-8BEN will be show if the client selected any tax residency other than U.S. At the top of the tax form will be shown any U.S. or U.K. connections (e.g., U.S. address, telephone number, place of birth or crown dependency address) identified and tasks necessary to resolve it.

Example of U.S. address / telephone number problem

Example of U.S. place of birth.

The client must answer the questions by selecting the appropriate radio button. Many of these require document submissions to resolve the connection and the condition is not resolved until the appropriate documentation is provided. If a document is required, the client will be notified of this information once the form has been completed.

Information on Part I of the W-8BEN will be pre-populated based on the information provided on the prior page. Generally, the information cannot be edited with the exception of U.S. taxpayer identification number. This may be updated by the client.

Important: The client MUST hit the back button and change the relevant information on the prior page for the tax form to be updated.

On Part II of the W-8BEN the client will be prompted to specify whether they are a resident of a country which maintains a tax treaty with the U.S. Only those countries with which the U.S. maintains a treaty will be shown on the drop-down list and if the client does not see his or her treaty country, the client should select “N/A” or “I am not resident in a treaty country.”

Important: The system will flag a problem if the client’s mailing or permanent address is outside the treaty country which they have specified. In this case, the client will need to explain the reason for the non-treaty country address on the form

and will be prompted afterwards to submit a proof of address and proof of identity from the treaty country for the claim to be valid. Client who cannot comply will not be afforded treaty benefits per IRS rules.

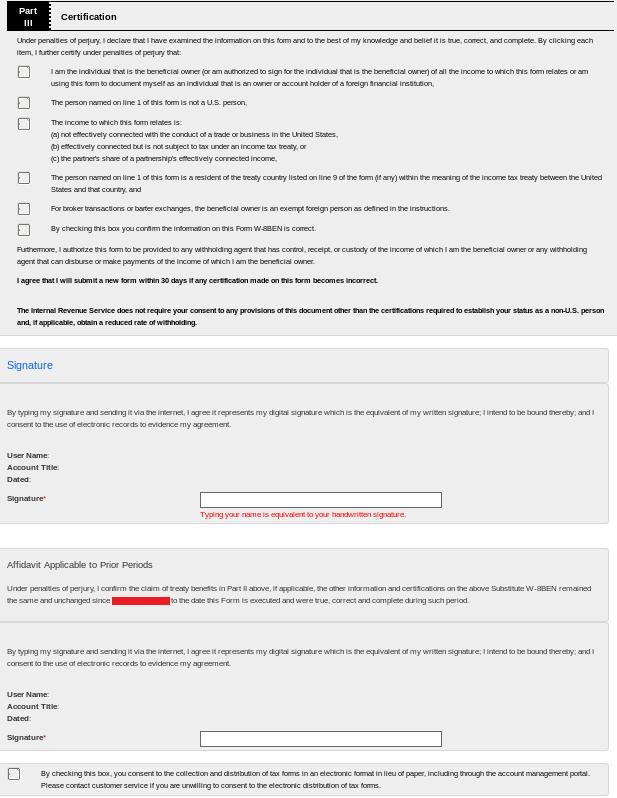

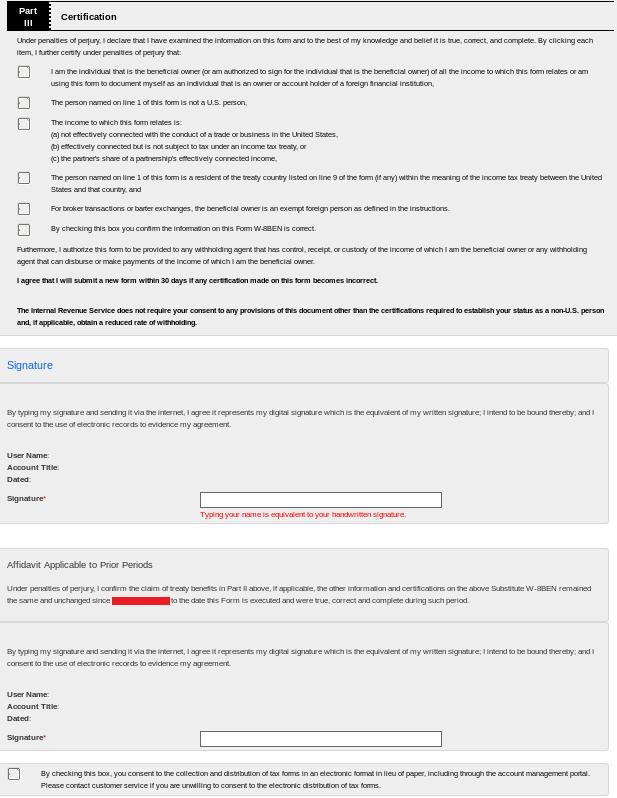

.jpg)

On Part III of the W-8BEN the client will be prompted to certify that the information provided on the form is accurate by checking the boxes and providing an electronic signature by typing their name (i.e., account title) exactly as it appears on the screen.

The client will also be prompted to acknowledge that the treaty benefits being claimed have remained unchanged since the date of their last tax form certification. This affidavit also requires entry of an electronic signature.

The client will then be prompted to check the box through which they consent to electronic collection and delivery of tax forms and then select the “Save and Continue” button. The client will then be taken to the confirmation screen which will list any documents that they need to send to the broker.

Final Review & Document Request

Once the form has been completed, it is subject to review by IB for purposes of verifying the client’s stated tax residency. This review may generate discrepancies in one of the following three areas: U.S. Connection, Treaty Claim or U.K. Crown Connection. If a client account is flagged for any discrepancy, you will need to contact them and request documents to resolve. The steps for resolving each of these is as follows:

1. U.S. Connection – Clients who complete the Form W-8BEN and have indication of a U.S. connection either from entries provided on the form or through a review by IB of the client’s records, will need submit proof that they are not a U.S. taxpayer. The proof varies by connection type and are as follows:

a. U.S. Person – if there is indication of U.S. citizenship or place of birth, the client must provide a copy of:

- Valid non-U.S. passport, AND

- Certificate of Loss of Nationality of the United States (Form DS-4083) or

- Reasonable written explanation of your renunciation of U.S. citizenship, or

- Reasonable written explanation that you did not obtain U.S. citizenship at birth.

b. U.S. Address – if there is an indication of a U.S. mailing address, permanent address or telephone number, the client must provide a copy of:

- Proof of non-U.S. identity document, AND

- Proof of non-U.S. address (less than 12 months old), AND

c. Explanation for U.S. address. One of:

- I do not meet the substantial presence test for U.S. residency as defined in U.S. Treasury Regulation § 301.7701(b)-1(c). In your response, please provide IB with the total number of days you are (intend to be) present in the United States in the current calendar year and the total number of days you were present in the United States in each of the 2 preceding calendar years. This computation is subject to verification by IB.

- I meet the closer connection exception described in U.S. Treasury Regulation § 301.7701(b)-2. In your response, please state the country to which you have a closer connection and demonstrate how that closer connection is established. This claim must be verified for reasonableness by IB.

- I am present in the United States as a student, teacher or trainee at a U.S. institution. Copy of F, J, M or Q visa from U.S. Immigration and Customs Enforcement is required.

- I am present in the United States as a foreign diplomat. Copy of your A or G visa (other than A-3 or G-3 visa) from U.S. Immigration and Customs Enforcement is required.

- I am present in the United States and am a spouse or unmarried child under the age of 21 of a person described in 2 prior bullets. Copy of visa required.

Important: If a U.S. Green Card is found, then W-8 tax status will only be allowed with IB’s consent.

If a U.S. passport is found, then W-8 status not allowed. The account will be considered a U.S. person and required to submit a W-9.

2. Treaty Claim - Clients who complete the Form W-8BEN containing a mailing address or permanent address outside of their stated country of tax residency will need submit proof of tax residency as follows:

a. Proof of treaty country identity document; AND

b. Proof of treaty country address (less than 12 months old): AND

c. Written explanation of non-treaty country address

3. U.K. Crown Connection - Clients who complete the Form W-8BEN containing a mailing address or permanent address located in either Guernsey, Jersey, Gibraltar or Isle of Man but did not indicate they are a tax resident of one of those regions will need to provide a reasonable written explanation for why they maintain such address.

IB will send a periodic report listing clients who have tasks which need to be completed so that you may contact them to act. This will include those accounts who have not logged into Account Management to complete the Tax Form or who have completed the form but need to send in documentation.

EXHIBIT 1 – Tax Form Prompt – U.S.

Immediate Response Requested

Dear Client,

A review of your account (Insert account ID) shows your tax information is out-of-date.Please immediately log into Account Management. You will be presented with information we already have on file as well as a tax form you should check, make corrections as needed, and then sign. This form will only be presented to the primary account owner, and should only take a few minutes to complete.

Confirming your information is essential to ensure that you will not become subject to backup withholding, including withholding on trade proceeds.

We appreciate your prompt attention to this matter.

Immediate Response Requested

Dear Client,

A review of your account (Insert account ID) shows your tax information is out-of-date.

Please immediately log into Account Management. You will be presented with information we already have on file as well as a tax form you should check, make corrections as needed, and then sign. This form will only be presented to the primary account owner, and should only take a few minutes to complete.

Confirming your information is essential to ensure that (a) we can give you the most favorable rate on normal dividend and interest withholding as defined by standard international tax treaties; and (b) you will not become subject to any exceptional U.S. tax withholding.

We appreciate your prompt attention to this matter.

.jpg)

.jpg)

.jpg)