Information Relating to Customer Protection of Assets

The below information applies to trading of non-US index options, OTC CFDs and non-US index futures (when combined with non-US index options)

Interactive Brokers (U.K.) Limited

Customer Assets

Interactive Brokers (U.K.) Limited (“IBUK)’’ is authorised and regulated by the Financial Conduct Authority (“FCA“), register no. 208159. IBUK is a wholly owned subsidiary of Interactive Brokers Group (IBG LLC). IBUK provides client money and client asset services in accordance with FCA Client Assets regulations “CASS”.

Client money is protected as follows:

Client money rules apply to all regulated firms that receive money from a client, or hold money for a client in the course of carrying out MiFID business and/or designated investment business.

Client money is entirely segregated from IBUK’s own money. In the event of a failure of an authorised firm, clients’ monies held in the segregated accounts will be returned to the clients rather than being treated as a recoverable asset by general creditors. If there was a shortfall, the client may be eligible to claim for compensation from the Financial Services Compensation Scheme (“FSCS”).

Client money is ring-fenced in separate bank accounts which are held in trust on behalf of the clients. These accounts are distributed across a number of banks with investment grade ratings to avoid a concentration risk with any single institution. When IBUK makes the selection and appointment of a bank to hold client money, it takes into account the expertise and market reputation of the bank, its financial standing and any legal requirements or market practices related to the holding of client money that could adversely affect clients' rights.

IBUK will allow client money to be held in a client transaction account by an exchange, a clearing house or an intermediate broker but only if the money is transferred to them for the purpose of a transaction or to meet a client’s obligation to provide collateral for a transaction.

Each day, IBUK performs a detailed reconciliation of client money held in client money bank accounts and client transaction accounts and its liabilities to its clients to ensure that client monies are properly segregated and sufficient to meet all liabilities in accordance with the FCA’s CASS rules. All monies credited to such bank accounts are held by the firm as trustee (or if relevant, as agent).

FCA regulations also require IBUK to maintain a CASS Resolution Pack to ensure that in the unlikely event of the firm's liquidation, the Insolvency Practitioner is able to retrieve information with a view to returning client money and assets to the firm's clients on a timely basis.

Financial Services Compensation scheme

Interactive Brokers (U.K.) Limited (“IBUK”) is authorised and regulated by the Financial Conduct Authority (“FCA”) as an investment firm and a participant in the Financial Services Compensation scheme (“FSCS”). Certain eligible clients qualify for

compensation under the FCA Compensation rules.

The main points relating to eligibility are:

- FSCS pays compensation only to eligible claimants when an authorised firm is in default and will carry out an investigation to establish whether or not this is the case.

- FSCS pays compensation only for financial loss and the limits for U.K. Investment firms are covered below.

- The FSCS was set up mainly to assist private individuals, although smaller businesses are also covered.

- Larger businesses are generally excluded.

Investments

FSCS provides protection if an authorised investment firm is unable to pay claims against it e.g. when an authorised investment firm goes out of business and cannot return assets to its clients. Assets classified as investments for authorised investment firms under the FSCS include stocks and shares, futures, options, cfds, other regulated instruments and money deposited by clients.

Compensation Limits

The actual level of compensation you receive will depend on the basis of your claim. The FSCS only pays compensation for financial loss. Compensation limits are per person per authorised firm. Compensation levels are subject to change and for current details please refer to the FSCS website at http://www.fscs.org.uk / .

The below information applies to customers who were or are continuing to trade all products (except metals and OTC CFDs) through IB LLC.

Interactive Brokers LLC (“IBLLC”)

Customer Assets

Customer money is segregated in special bank or custody accounts, which are designated for the exclusive benefit of customers of IBLLC. This protection (the SEC term is “reserve” and the CFTC term is “segregation”) is a core principle of securities and commodities brokerage. By properly segregating the customer's assets, if no money or stock is borrowed and no futures positions are held by the customer, then the customer's assets are available to be returned to the customer in the event of a default by or bankruptcy of the broker.

Securities accounts with no borrowing of cash or securities

Securities customer money is protected as follows:

- A portion is deposited at 14 large U.S. banks in special reserve accounts for the exclusive benefit of IBLLC's customers. These deposits are distributed across a number of banks with investment-grade ratings so that we can avoid a concentration risk with any single institution. No single bank holds more than 5% of total customer funds held by IBLLC.

- A portion may be invested in U.S. Treasury securities, including direct investments in short-term Treasury bills and reverse repurchase agreements, where the collateral received is in the form of U.S. Treasury securities. These transactions are conducted with third parties and guaranteed through a central counterparty clearing house (Fixed Income Clearing Corp., or “FICC”). The collateral remains in the possession of IBLLC and held at a custody bank in a segregated Special Custody Account for the exclusive benefit of customers. U.S. Treasury securities may also be pledged to a clearing house to support customer margin requirements on securities options positions.

- Customer cash is maintained on a net basis in the reserve accounts, which reflects the net credit balances of customers in excess of customer debit balances. To the extent any one customer maintains a margin loan with IBLLC, that loan will be fully secured by stock valued at up to 200% of the loan.

- Current SEC regulations require broker-dealers to perform a detailed reconciliation of customer money and securities (known as the “reserve computation”) at least weekly to ensure that customer monies are properly segregated from the broker-dealer's own funds.

Customer-owned, fully-paid securities are protected in accounts at depositories and custodians that are specifically identified for the exclusive benefit of customers. IBLLC reconciles positions in securities owned by customers daily to ensure that these securities have been received at the depositories and custodians

Commodities accounts

Commodities customer money is protected as follows:

- A portion is pledged to futures clearing houses to support customer margin requirements on futures and options on futures positions or held in custody accounts identified as segregated for the benefit of IB's customers.

- A portion is held at commodities clearing banks/brokers in accounts identified as segregated for the benefit of IBLLC customers to support customer margin requirements.

- Cash in commodities accounts is protected in accordance with US commodities regulations. CFTC rules prohibit an FCM from commingling customer funds with its own money, securities or property. Customer funds must be separately accounted for and segregated as belonging to commodity or option customers. The titles of accounts in which customer funds are deposited must clearly indicate this and show that the funds are segregated as required by the Commodity Exchange Act (“CEA”) and CFTC Rules. Customer funds may not be obligated to anyone except to purchase, margin, guarantee, secure, transfer, adjust or settle trades, contracts or commodity option transactions of commodity or option customers. These requirements also extend to U.S. customers trading on foreign exchanges.

Securities accounts with margin loans

For customers who borrow money from IBLLC to purchase securities, IBLLC is permitted by securities regulations to pledge or borrow stock valued at up to 140% of the value of the loan. Typically, IBLLC lends out a small portion of the total stock it is permitted to lend out.

- As an example, at June 30, 2011, IBLLC lent $800 million value of customers' stock out of the $13.0 billion made available to it by margin customers.

- When IBLLC lends customers' stock, it must put additional money into the special reserve accounts for the exclusive benefit of customers. In the example above, the full value of $800 million of customer stock that was lent was segregated in the special reserve accounts.

Account Protection

Customer securities accounts at IBLLC are protected by the Securities Investor Protection Corporation (“SIPC”) for a maximum coverage of $500,000 (with a cash sublimit of $250,000) and under IBLLC's excess SIPC policy with certain underwriters at Lloyd's of London for up to an additional $30 million (with a cash sublimit of $900,000) subject to an aggregate limit of $150 million. Futures, and options on futures are not covered. As with all securities firms, this coverage provides protection against failure of a broker-dealer, not against loss of market value of securities.

For the purpose of determining a customer account, accounts with like names and titles (e.g. John and Jane Smith and Jane and John Smith) are combined, but accounts with different titles are not (e.g. Individual/John Smith and IRA/John Smith).

SIPC is a non-profit, membership corporation funded by broker-dealers that are members of SIPC. For more information about SIPC and answers to frequently asked questions (such as how SIPC works, what is protected, how to file a claim, etc.), please refer to the following websites:

http://www.finra.org/InvestorInformation/InvestorProtection/SIPCProtecti...

or contact SIPC at:

Securities Investor Protection Corporation

805 15th Street, N.W. - Suite 800

Washington, D.C. 20005-2215

Telephone: (202) 371-8300

Facsimile: (202) 371-6728

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

iOS

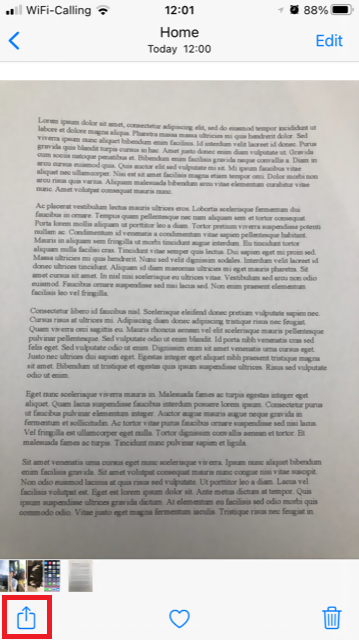

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

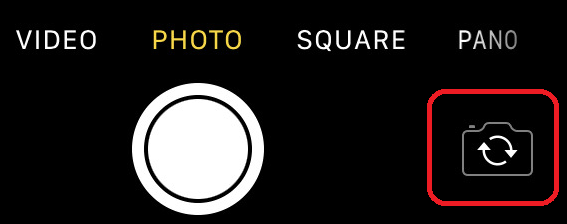

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

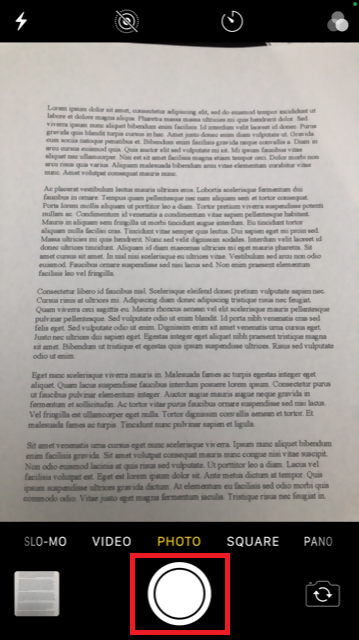

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

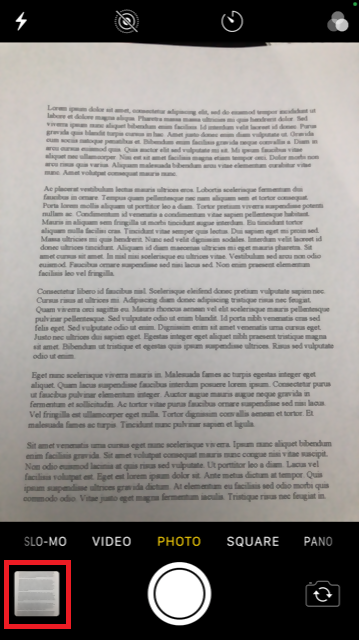

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

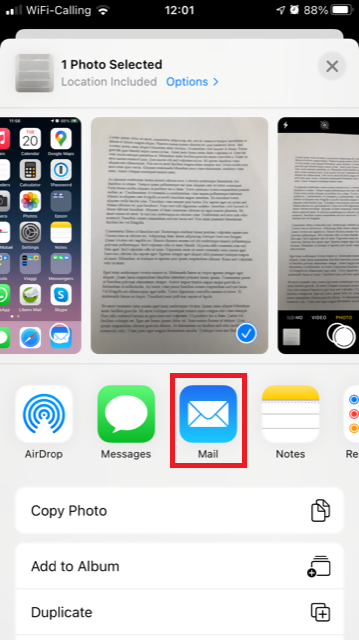

6. Tap the share icon in the lower left-hand corner of the screen.

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

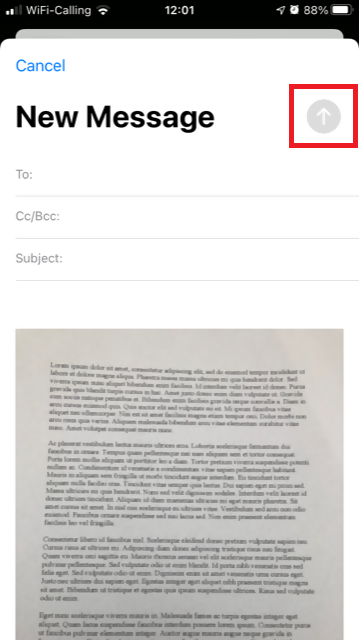

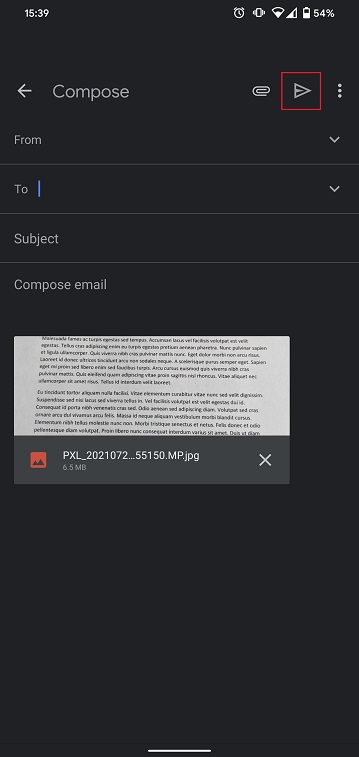

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

Android

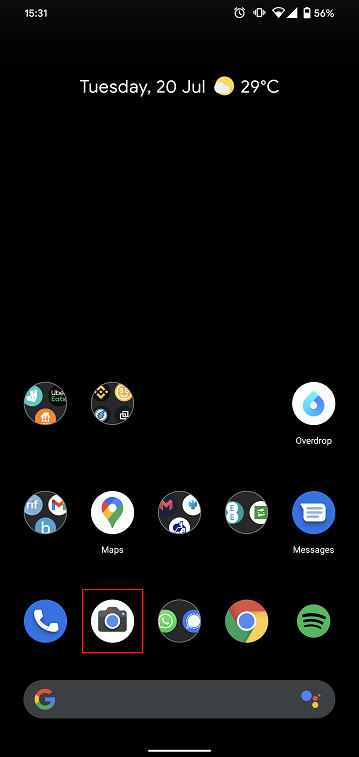

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

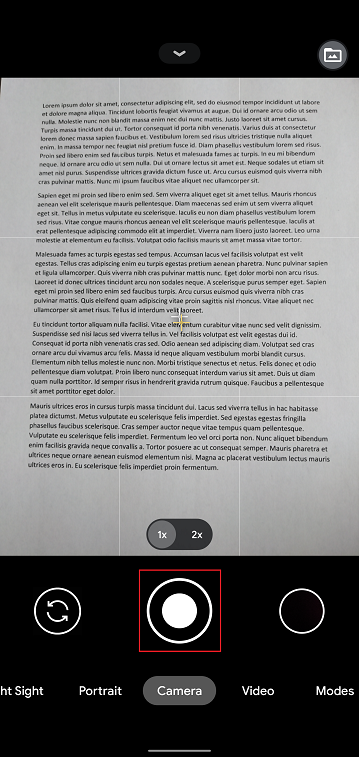

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

5. Tap the empty circle icon in the lower right-hand corner of the screen.

6. Tap the share icon in the lower left-hand corner of the screen.

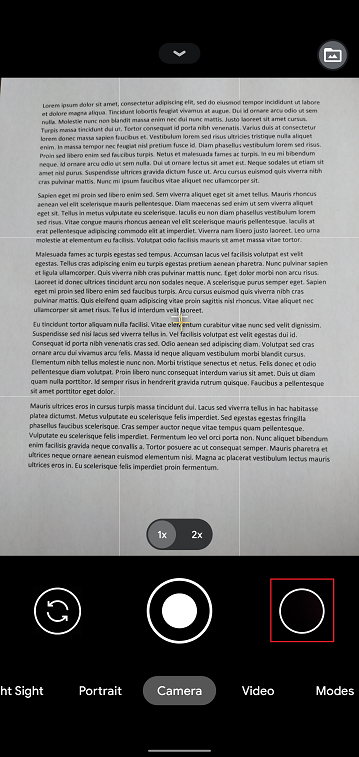

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

How to request a Digital Security Card+ (DSC+) replacement

The below steps are required in order to:

- Replace a Digital Security Card+ which has been lost, stolen or has become inoperable

- Request a Digital Security Card+ alongside your current security device (if you are a new or existing Client with equity above $1,000,000, or equivalent)

1. Notify IBKR Client Services- Contact IBKR Client Services to obtain a temporary account access. This service can only be provided via telephone and requires the identity of the account holder to be verified, as detailed in the IBKR Knowledge Base.

2. Obtain an Online Security Code Card - Activate an Online Security Code Card, which offers enhanced protection and full Client Portal functionality for an extended period of 21 days. Please consult the IBKR Knowledge Base should you need guidance for this specific step.

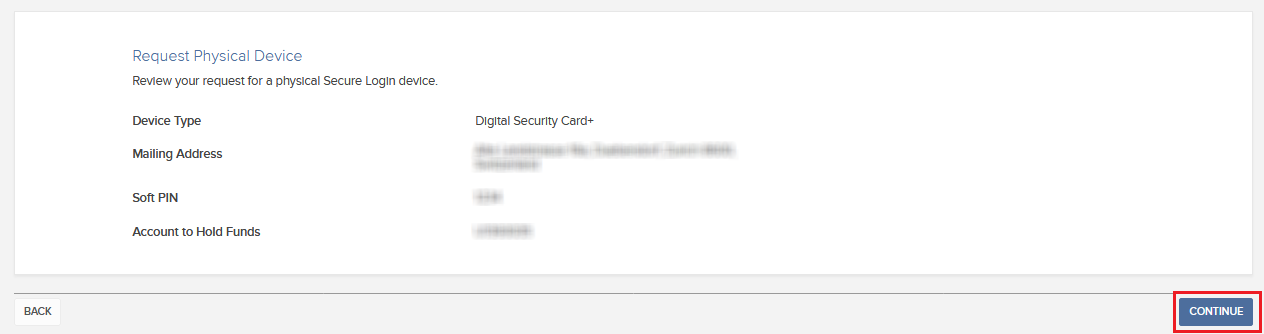

3. Request the DSC+ replacement - Once you have completed the Online Security Code Card activation, please remain in the Secure Login System section of the Client Portal and order your replacement DSC.

Request a DSC+

1. Click on the button Request Physical Device.

.png)

.png)

3. Enter a four-digit Soft PIN1 for your DSC+. Please make sure to remember the PIN you are typing since it will be necessary to activate and to operate your device. When applicable and desired, you may change the account on which the 20 USD deposit will be kept on hold2. Complete this step by clicking on Continue..png)

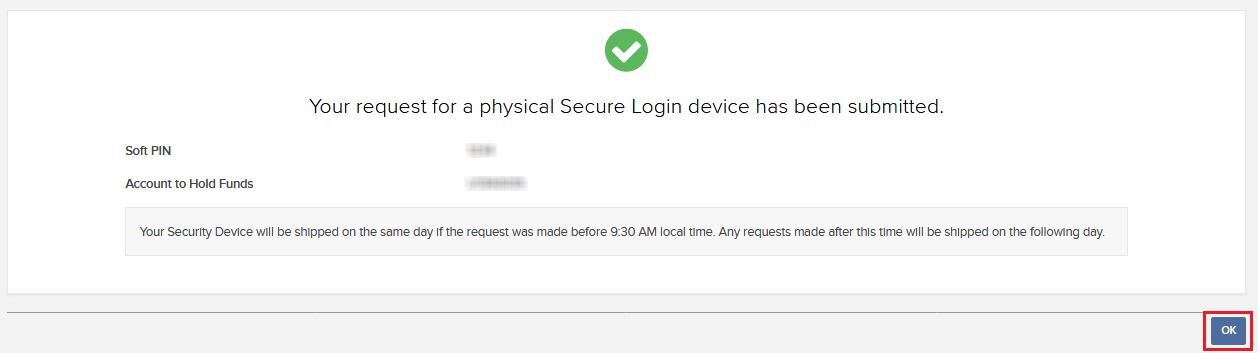

4. The system will show you a summary of your selection. Please make sure the information displayed is correct. Should you need to perform changes, click on the white Back button under the information field (not your browser back button), otherwise submit the request by clicking on Continue.

5. You will receive a final confirmation containing the estimated shipment date3. Click on Ok to finalize the procedure.

1. For PIN guidelines, please consult the IBKR Knowledge Base.

2. The Security token and the shipment are both free of charge. Nevertheless, when you order your device, we will freeze a small amount of your funds (20 USD). If your device is lost, intentionally damaged, stolen or if you close your account without returning it to IBKR, we will use that amount as a compensation for the loss of the hardware. In any other case, the hold will be released once your device has been returned to IBKR. More details on the IBKR Knowledge Base.

3. For security reasons, the replacement device is set to auto-activate within three weeks from the shipment date. IBKR will notify you when the auto-activation is approaching and when it is imminent.

IBKR Knowledge Base References

- See KB1131 for an overview of the Secure Login System

- See KB2636 for information and procedures related to Security Devices

- See KB2481 for instructions about sharing the Security Login Device between two or more users

- See KB2545 for instructions on how to opt back in to the Secure Login System

- See KB975 for instructions on how to return your security device to IBKR

- See KB2260 for instructions on activating the IB Key authentication via IBKR Mobile

- See KB2895 for information about Multiple 2Factor System (M2FS)

- See KB1861 for information about charges or expenses associated with the security devices

- See KB69 for information about Temporary passcode validity

Security Device Replacement Charge

Account holders logging into their account via IBKR's Secure Login System are issued a security device, which provides an additional layer of protection to that afforded by the user name and password, and which is intended to prevent online hackers and other unauthorized individuals from accessing their account. While IBKR does not charge any fee for the use of the device, certain versions require that the account holder return the device upon account closing or incur a replacement fee. Existing account holders are also subject to this replacement fee in the event their device is lost, stolen or damaged (note that there is no fee to replace a device returned as a result of battery failure).

In addition, while IBKR does not assess a replacement fee unless a determination has been made that the device has been lost, stolen, damaged or not returned, a reserve equal to the fee will placed upon the account upon issuance of the device to secure its return. This reserve will have no effect upon the equity of the account available for trading, but will act as limit to full withdrawals or transfers until such time the device is returned (i.e., cannot withdraw the reserve balance).

Outlined below are the replacement fee associated with each device.

| SECURITY DEVICE | REPLACEMENT FEE |

| Security Code Card1 | $0.001 |

| Digital Security Card + | $20.00 |

For instructions regarding the return of security devices, please see KB975

1 The Security Code Card is not required to be returned upon account closing and may be destroyed and discarded once remaining funds have been returned and the account has been fully closed. Access to Client Portal after closure for purposes of viewing and retrieving activity statements and tax documents is maintained using solely the existing user name and password combination. This type of two-factor security is no longer being issued.

Securities Account Protection for Interactive Brokers India Customers

Customer accounts domiciled under Interactive Brokers India Pvt. Limited,(IBI) are awarded different account protection services than our IB-LLC and IB-UK clients. There are two major exchanges, the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE), each one has established their own guidelines for investor grievances against exchange members and/or sub –brokers.

National Stock Exchange of India (NSE)

The NSE has established an Investor Protection Fund with the objective of compensating investors in the event of defaulters' assets not being sufficient to meet the admitted claims of investors, promoting investor education, awareness and research. The Investor Protection Fund is administered by way of registered Trust created for the purpose. The Investor Protection Fund Trust is managed by Trustees comprising of Public representative, investor association representative, Board Members and Senior officials of the Exchange.

The Investor Protection Fund Trust, based on the recommendations of the Defaulters' Committee, compensates the investors to the extent of funds found insufficient in Defaulters' account to meet the admitted value of claim, subject to a maximum limit of Rs. 11 lakhs (1.1 million USD) per investor per defaulter/expelled member.

Bombay Stock Exchange (BSE)

Currently trading is not offered on the BSE by Interactive Brokers.

Tips for selecting your security questions and answers

The security questions represent just one component of the security framework which IB has put into place to protect your account. We offer the following simple tips for selecting your security questions and answers in order to make the most effective use of this security measure:

1. Choose questions having answers that you can remember in the future and answer consistently.

2. Use one-word answers whenever possible.

3. Be careful with spaces. If you use "San Diego" as an answer to one of your security questions, the system will reject "SanDiego."

4. Avoid using quirky or nonsensical answers as they'll likely to be difficult to remember later.

5. Select a question which cannot be easily guessed or researched, has many possible answers and where the probability of guessing the correct answer is low.

6. Select a question for which the answer is unlikely to be known by others such as a family member, close friend, relative, ex-spouse, or significant other.

7. Choose a question having an answer which is stable and not likely to change over time.

What is the purpose of the security questions?

IB requires applicants to select and provide answers to three security questions each selected from a separate pool of questions having varying degrees of complexity. In the event we receive a telephone inquiry involving sensitive information, prior to acknowledging or discussing any account specific information with the caller we will first look to verify that caller's identity. This is accomplished through a multi-tier security process, one tier which requires that the caller answer a randomly selected security question. The caller must provide an answer to the security question which exactly matches the answer we have on file. Otherwise, the request for information will be denied and a potential lock-down placed upon the account.

Troubleshooting Trading Platform Login Failures

Click on the link below which best describes your situation:

a. If operating with a temporary passcode, note that alpha characters are case sensitive and are required to be input in upper case format

b. If operating a security card or electronic device, note that there are no spaces between characters

c. Ports 4000/4001 are being blocked. These ports are often blocked from public connections such as hotels, cafes, etc. and required to be open to accommodate Inbound/Outbound TCP protocol. In addition, if you have a router connected to your computer, these ports must be open on the router.*

*Please click here to check your connectivity status: IBKR Dedicated Connectivity Test Page.

Troubleshooting Client Portal Login Failures

Click on the link below which best describes your situation:

- Receiving “Invalid user name password combination” message

- Receiving “Login Failed” message upon entering security device values

- I’ve forgotten my user name and/or password

- I’m temporarily without possession of my security device

- My security device has been lost or damaged

- I’ve been issued a temporary passcode which has expired

- I’ve been issued an online security card which has expired

- I’m awaiting delivery of my physical security device and can now no longer log into my account

- I am able to log into Client Portal with my temporary passcode but not the trading platform

- I am in possession of my security device and wish to activate it

- Receiving “BAD CHARACTER” message after entering my user name

IMPORTANT NOTE: If you are unable to resolve your account access issue from the information above, please contact your local Client Services Center. Also note that for security purposes, all requests for login assistance must be initiated via telephone as it requires prior verification of the account holder's identity. A listing of Client Services Centers, contact numbers and hours of operations may be found via the following website link: ibkr.com/support

1. Receiving “Invalid user name password combination” message.

Make sure that the Caps Lock key is not on as user name is case sensitive and is required to be input in lower case format.

IMPORTANT SECURITY NOTICE: If an account experiences 10 consecutive failed Client Portal login attempts within any 24-hour period, it will be locked out from login regardless of subsequent attempts using the correct user name and password combination. This lock out, intended as a security measure to prevent hackers from random attempts to guess the password, will remain in force until 24 hours have passed since the last unsuccessful log in attempt.

If you believe that your account has or is about to be been locked due to consecutive failed login attempts, you will need to contact to contact your regional Client Services Center via telephone for assistance. Note that assistance for log in matters is only provided via telephone and after the identity of the account holder has been verified.

2. Receiving “Login failed” message upon entering security device values

a. If operating with a temporary passcode, note that alpha characters are case sensitive and are required to be input in upper case format

b. If operating a security card or electronic device, note that there are no spaces between characters

3. I’ve forgotten my user name and/or password

For security purposes, all requests for assistance with a user name and/or password must be initiated via telephone and require prior verification of the account holder’s identity. Requests are to be directed to one of the regional Client Services Center.

4. I’m temporarily without possession of my security device

If you are temporarily without possession of your security device, interim access may be provided by contacting your regional Client Services Center via telephone where, once your identity has been verified, you will be provided with a temporary passcode.

The temporary passcode is a static alpha-numeric code which replaces the randomly generated code provided through your security device and which will provide full access to Client Portal and the trading platforms for 2 days. Should a lengthier period of interim access be necessary, and to obtain enhanced protection, it is recommended that you use the temporary passcode to log into Client Portal and print out the on-line security card which will operate as a replacement to your security device for up to 3 weeks.

After the expiration of the temporary passcode or on-line security card, or if you regain possession of your security device beforehand, you will need to log into Client Portal and select the menu option to re-activate your security device.

5. My security device has been lost or damaged

In the case of a lost or damaged security device, you will need to contact our Client Services Center to arrange for a replacement and to provide for interim access. As the time frame for shipping a replacement device may range form 3 to 14 days depending upon your country of residence, interim access is provided via an on-line security card. The on-line security card may be retrieved for printing or saving as an image to your desktop once a temporary passcode has been provided for Client Portal access.

6. I’ve been issued a temporary passcode which has expired

The temporary passcode is intended to provide full access to both Client Portal and the trading platforms for a period of 2 days. After 2 days, the temporary passcode may no longer be used to access the trading platforms but may be used to access Client Portal for an additional period of 10 days. The Client Portal access, however, is limited solely for the purpose of printing or saving the on-line security card.

If your window of access to Client Portal using the temporary passcode remains, you may print or save the on-line security card through which full access to both Client Portal and the trading platforms is provided for a period of 21 days. If you are unable to log into Client Portal, you will need to contact your regional Client Services Center for assistance.

7. I’ve been issued an online security card which has expired

The on-line security card is intended to provide full access to both Client Portal and the trading platforms for a period of 21 days. This time frame, while limited, is intended to provide sufficient opportunity for the account holder to either regain possession of a temporarily unavailable security device or request and receive a replacement device.

If you are unable to log in using the on-line security card, you will need to contact your regional Client Services Center for assistance and to provide information as to the status of your permanent security device.

8. I’m awaiting delivery of my physical security device and can now no longer log into my account

Depending upon your location, the physical security device should be delivered to the address of record on your account within 2 days in the case of US residents and within 2 weeks for all other accounts. It’s important to note that the permanent devices are set to automatically activate after a set time frame if not yet manually activated by the account holder. If this is the case and you encounter difficulties logging into your account, please contact our Technical Assistance Department at 1-877-442-2757.

9. I am able to log into Client Portal with my temporary passcode but not the trading platform.

If your window of access to Client Portal using the temporary passcode remains, you may print or save the on-line security card through which full access to both Client Portal and the trading platforms is provided for a period of 21 days.

If you are unable to log into Client Portal, you will need to contact your regional Client Services Center for assistance.

10. I am in possession of my security device and wish to activate it.

To activate either a replacement device or one which was temporarily unavailable and which required issuance of a temporary passcode, you will need to log into Client Portal and select the reactivate security device menu option. Once reactivated, neither the temporary passcode nor on-line security card will remain operable.

11. Receiving “BAD CHARACTER” message after entering my user name.

Re-enter your user name and make sure that you do not include any spaces or characters which are not either alpha or numeric (e.g. !@#$%^&*(.,”:...etc.).

Overview of Secure Login System

Table of contents

- Benefits of Enrollment

- How to enroll

- Lost, Damaged or Temporarily Unavailable Device

- Types of Devices

- Withdrawal Limits

The security of your assets and personal information is of utmost concern to us and we are committed to taking the steps necessary to ensure you are protected from the moment you open your account.

Benefits of Enrollment

- Higher withdrawals thresholds over both single and five day rolling periods.

- Ability to change your banking instructions and email address without contact from a member of our Security Team.

- Ability to effect ACH & EFT funding transactions beyond an initial USD 20,000 account funding transaction.

- The ability to share a single device among multiple usernames registered to the same individual.

How to Enroll

Lost, Damaged or Temporarily Unavailable Device

Types of Devices

- SMS - A quick and easy way to complete the Two-Factor Authentication through text messages (SMS) sent to your mobile phone number.

- IBKR Mobile – An all-in-one mobile app offering a convenient digital solution for your Two-Factor Authentication needs. The IBKR Mobile Authentication (IB Key) module found within the app supports both fingerprint/facial recognition and PIN configuration1 and is available for both Android phones and iPhones.

- Digital Security Card+ - For accounts with an equity of $1M USD or equivalent. It has the same size and shape of a credit card and it is electronic, requiring the user to enter a PIN code as an additional layer of protection.

Note:

For iPhone users you must have either Touch ID, Face ID, or Passcode enabled (refer to: Set up Touch ID or Set up Face ID for directions). Touch ID or Face ID is the recommended choice. PIN/Passcode supports up to 12 hours of trading access while fingerprint/facial recognition allows for 30+ hours as long as you authenticate at least once during this time period. Please see further details mentioned in our User's guide for Extended Trading Access.

Withdrawal Limits

Clients who participate in the Secure Login System enjoy enhanced withdrawal capabilities, while clients who do not participate are subject to daily and weekly withdrawal restrictions. The amount that a participating client may withdraw or transfer over a given one- or five-day period increases commensurate with the protective value of the device and is outlined in the table below.

| Security Device | Maximum Withdrawal per Day | Maximum Withdrawal in 5 Business Days |

|---|---|---|

| None | 50K USD | 100K USD |

| SMS | 200K USD | 600K USD |

| IBKR Mobile Authentication (IB Key) | 1M USD | 1M USD |

| Security Code Card* | 200K USD | 600K USD |

| Digital Security Card* | 1M USD | 1.5M USD |

| Digital Security Card+ | Unlimited | Unlimited |

| Platinum*/Gold* | Unlimited | Unlimited |

Additional Information