Using GPG/RSA Encryption Keys to Guarantee the Privacy and Security of Your Reports

In order to ensure the privacy and security of your Reports and Statements, IBKR offers the following file delivery options:

A. sFTP (Secure FTP) - Recommended solution

- We can send you Reports using the sFTP (Secure FTP) protocol on non-standard TCP port 32.

- sFTP is a network protocol that utilizes SSH (Secure Shell) for the transfer, management, and access of files through an encrypted data stream.

- Key based authentication is required. You will authenticate against our sFTP server through a unique RSA - 2048-bit public/private key pair, generated directly by you. We will use only your public key as authentication method for our sFTP server. Since the two keys are mathematically linked, only the private key holder (you) will be able to access the data.

- PGP encryption1 is optional.

B. Email with PGP (Pretty Good Privacy) Encryption

- We can encrypt your Reports using PGP (Pretty Good Privacy) certificates and send you those reports via email.

- PGP encryption1 is optional but recommended. If you opt to receive your Reports via email without encryption, any account sensitive data will be masked.

C. Plain FTP with PGP (Pretty Good Privacy) Encryption

- We can send you Reports using the regular FTP protocol on standard TCP port 21.

- PGP encryption1 is required. We can encrypt your Reports using PGP (Pretty Good Privacy) certificates.

Note 1: PGP encryption is based on a private/public key pair, which is unique and generated directly by you. We will use only your public key to encrypt your Reports. Since the two keys are mathematically linked, only the private key holder (you) will be able to decrypt the files.

To start the process, please select one of the options below according to the way you wish to access your Reports:

A. I Want to Receive my Reports via Secure FTP (sFTP)

When electing to receive your Reports through the IBKR hosted sFTP, please follow the steps below:

1) Install a FTP application. There are many free FTP application suites that can be used, like FileZilla or WinSCP.

2) Generate a public/private RSA key pair. Please follow the procedure below according to the Operating System you use:

3) Open a Web Ticket (via Client Portal -> Help -> Support Center) as follows:

-

Write "Attn. Reporting Integration Team" in the subject.

-

Write a short request for a IBKR hosted plain FTP in the message body

-

Write the IP Address(es) your connection will originate from in the message body

-

Paste the content (the alphanumeric string) of your RSA public key file in the message body

Alternatively, you can provide these same elements listed above via email to the Reporting Integration Team. Include the last 4 digits of your IBKR Account number in the email subject.

Note: We will not accept your public key if you have included as well your private key. Please be sure to send us only the public part of the key pair.

4) IBKR will notify you within 1-2 business days, once your sFTP site has been set up.

5) Set your RSA key pair as authentication method for your sFTP client. Please follow the procedure below according to the Operating System you use:

B. I Want to Receive my Reports via Email with PGP Encryption

When electing to receive emails that contain encrypted data from IBKR, please follow the steps below:

1) Generate a PGP key pair in order to decrypt the files. Please follow the procedure below according to the Operating System you use:

-

Write "Attn. Reporting Integration Team" in the subject

-

Paste the content (the alphanumeric string) of your PGP public key file in the message body

Note: We will not accept your public key if you have included as well your private key. Please be sure to send us only the public part of the key pair.

3) IBKR will notify you once your public key was imported on our systems. You will then enable the encryption for email file delivery from your Client Portal.

4) Use your key pair to decrypt the emails with the encrypted attachment/s. Please follow the procedure below according to the Operating System you use:

C. I Want to Receive my Reports via FTP with PGP Encryption

When electing to receive your Reports through the IBKR hosted sFTP, please follow the steps below:

1) Generate a PGP key pair in order to decrypt the files. Please follow the procedure below according to the Operating System you use:

-

Write "Attn. Reporting Integration Team" in the subject

-

Write a short request for a IBKR hosted plain FTP in the message body

-

Paste the content (the alphanumeric string) of your PGP public key file in the message body

Alternatively, you can provide these same elements listed above via email to the Reporting Integration Team. Include the last 4 digits of your IBKR Account number in the email subject.

Note: We will not accept your public key if you have included as well your private key. Please be sure to send us only the public part of the key pair.

3) IBKR will notify you once your public key has been imported on our systems. You will then enable the encryption for FTP file delivery from your Client Portal.

4) Access our FTP site and use your PGP key pair to decrypt the files you receive. Please follow the procedure below according to the Operating System you use:

Additional procedures

- How to back up your public/private key pair

- How to transfer your public/private key pair from one computer to another

KB3968 - Generate a key pair using GPG for Windows

KB4205 - Generate a key pair using GPG Suite on macOS

KB4108 - Decrypt your Reports using GPG for Windows

KB4210 - Decrypting Reports using your PGP Key pair on macOS

KB4407 - Generate RSA Key Pair on Windows

KB4410 - How to set up sFTP for using Certificate Authentication on macOS

KB4411 - How to backup your public/private Key pair

KB4323 - How to transfer your public/private key pair from one computer to another

株式利回り向上プログラムに関連してよくあるご質問

株式利回り向上プログラムの目的

株式利回り向上プログラムは、分離管理されている証券ポジション(全額支払い済みや超過証拠金となる株式)をIBKRがサードパーティに貸付することを許可することによって副収入につなげるプログラムです。ご参加されるお客様は、貸付されている株式が終了時に確実に返却されるための担保(米国国債または現金)をお受取りされます。

全額支払済みおよび超過証拠金となる株式とは

全額支払済みの株式とは、口座に保有されている有価証券で完全に支払いの済んでいるものを指します。超過証拠金となる株式とは、支払いの済んでいない株式で、市場価格が証拠金バランスの140%を超えているものを指します。

株式利回り向上プログラムの貸付による取引から発生する収入はどのように計算されますか?

株式の貸付によってお客様に発生する収入は、店頭株式貸付市場の金利によって変わります。金利は貸付される株式の種類だけでなく、貸付日にも大きく左右されます。弊社では通常、参加者のお客様に対し、株式の貸付によって弊社に発生した金額の約50%の利息を担保にお支払い致します。

貸付の担保額はどのように計算されるのですか?

株式の貸付に必要となる金利を決定する担保(米国国債または現金)は、株式の終値に一定の割合(通常102-105%)掛けた上で一番近いドル/セント/ペンス等に切り上げられる、業界協定による方法で設定されます。通貨によって業界協定が異なります。例えば終値がUSD 59.24の株式100株貸付は$6,100に値します($59.24 * 1.02 = $60.4248。これが$61に切り上げられた上で100を掛けたもの)。下記は通貨ごとの業界協定のチャートになります:

| USD | 102%: 一番近いドルに切り上げ |

| CAD | 102%: 一番近いドルに切り上げ |

| EUR | 105%: 一番近いセントに切り上げ |

| CHF | 105%: 一番近いラッペンに切り上げ |

| GBP | 105%: 一番近いペンスに切り上げ |

| HKD | 105%: 一番近いセントに切り上げ |

詳細はKB1146をご確認ください。

株式利回り向上プログラム用の担保はどこにどうやって保有されるのですか?

IBLLCのお客様の担保は米国国債または現金として、IBLLCの関連会社であるIBKR Securities Services LLC(「IBKRSS」)に移管の上で保有されます。本プログラムによる担保はIBKRSSがお客様用の口座に保有し、担保に対する権利は完全にお客様が優先となります。万が一、IBLLCが債務不履行を起こした場合でも、IBLLCを経由せずにIBKRSSを通して直接、担保にアクセスすることができます。詳細はこちらより、証券口座の管理に関する同意書をご参照ください。IBLLCのお客様ではない方の担保は、口座を管理する事業体による保有および保管となります。例えば、IBIE口座の場合、担保はIBIEによる保有および保管となります。

IBKRの株式利回り向上プログラムによって貸付されている株式が売却や移管された場合や、プログラムへの参加をやめた場合にはどのような影響がありますか?

金利は取引が行われた日の翌日(T+1)より発生しなくなります。また、移管やプログラム参加の解約があった場合には、翌営業日より金利が発生しなくなります。

株式利回り向上プログラムへの参加資格はどのようになっていますか?

| 参加資格のある事業体* |

| IB LLC |

| IB UK(SIPP口座は対象外) |

| IB IE |

| IB CE |

| IB HK |

| IB Canada(RRSP/TFSA口座は対象外) |

| IB Singapore |

| 参加対象となる口座 |

| キャッシュ(登録日の時点で資産が最低$50,000であること) |

| マージン |

| ファイナンシャルアドバイザー管理のクライアント口座* |

| 証券会社管理のクライアント口座: Fully DisclosedおよびNon-Disclosed* |

| 証券会社管理のオムニバス口座 |

| セパレート・トレーディング・リミット口座(STL) |

*お申込みされる口座は、マージン口座やキャッシュ口座の必要最低額を達成している必要があります。

こちらのプログラムは、IBジャパン、IBヨーロッパSARL、IBKRオーストラリア、ならびにIBインドのお客様にはご利用いただけません。IB LLCにおける口座をお持ちの日本およびインドのお客様はプログラムにご参加いただくことができます。

また、ファイナンシャルアドバイザー管理のクライアント口座、fully disclosedタイプの証券会社管理のクライアント口座、ならびにオムニバス・ブローカー口座をお持ちのお客様で上記の条件を達成されている方にはご利用いただくことができます。ファイナンシャルアドバイザーおよびfully disclosedタイプの証券会社管理のクライアント口座の場合には、クライアントによる同意書へのサインが必要となります。オムニバス・ブローカー口座の場合には、ブローカーによる同意書へのサインが必要となります。

IRA口座は株式利回り向上プログラムに参加できますか?

できます。

Interactive Brokers Asset Managementの管理によるIRA口座のパーティションは、株式利回り向上プログラムに参加できますか?

いいえ。

UK SIPP口座は株式利回り向上プログラムに参加できますか?

いいえ。

プログラムに参加しているキャッシュ口座の資産が必要額である$50,000を下回った場合にはどうなりますか?

キャッシュ口座に必要となる最低資金額は、プログラムへの参加時点のみに必要となります。それ以降に資金額が下がったとしても、既存の貸付および新規の貸付に対する影響はありません。

株式利回り向上プログラムへはどうやって申込みできますか?

お申込みはクライアント・ポータルからできます。ログインしたら、ユーザーメニュー(右上にある人型のアイコン)をクリックし、設定を選択します。この後、口座設定にある取引の項目の株式利回り向上プログラムをクリックしてお申込みください。プログラムへのお申込みにあたって必要となる書類とディスクロージャーが表示されます。フォームをご確認のうえ、ご署名ください。リクエストがお手続きのために送信されます。お申込みの完了には24-48時間かかります。

株式利回り向上プログラムはどのように解約できますか?

ご解約はクライアント・ポータルからできます。ログインしたら、ユーザーメニュー(右上にある人型のアイコン)をクリックし、設定を選択します。この後、口座設定にある取引の項目の株式利回り向上プログラムをクリックして必要手続きを行ってください。リクエストがお手続きのために送信されます。 解約リクエストは通常、同日の終了時に処理されます。

プログラム参加後に解約した場合、いつからまたプログラムへの参加ができるようになりますか?

プログラム解約後、暦日で90日間はお申込みいただくことができません。

貸付対象となる有価証券ポジションのタイプ

| 米国マーケット | ヨーロッパマーケット | 香港マーケット | カナダマーケット |

| 普通株(上場株式、PINKおよびOTCBB) | 普通株(上場株式) | 普通株(上場株式) | 普通株(上場株式) |

| ETF | ETF | ETF | ETF |

| 優先株 | 優先株 | 優先株 | 優先株 |

| 社債* |

*地方債は対象外です。

IPOに続いて流通市場で取引されている株式を貸付するにあたって何か規制はありますか?

口座に保有される対象証券に規制がない限りありません。

貸付対象となる株数はどうやって割り出されますか?

株式がある場合には先ずこの価値を割り出します。IBKRではこれに対する担保権を保有し、お客様が株式利回り向上プログラムにご参加されていない場合でも貸し出すことができます。お客様が株式を購入する際に証拠金貸付によって融資を行うブローカーは、お客様の株式を現金負債額の140%まで担保として貸出できるよう、規制によって許可されています。$50,000の現金残高を保有するお客様が、市場価格が$100,000の株式を購入するケースを例として見てみます。この場合の貸付高は$50,000となり、ブローカーはこの残高の140%に値する金額または$70,000の株式を担保権として保有します。この金額を超えてお客様が保有する株式は超過証拠金証株式(この例では$30,000となります)とみなされ、株式利回り向上プログラムの一環として弊社がこれの貸付を行うことを許可されない場合には分別管理が必要になります。

負債額はまずUSD建てでない残高をすべてUSDに変換し、この後ショート株式からの収益がある場合にはこれを差し引いて(必要な場合にはUSDに変換し)割り出されます。結果としてマイナスの数値が出る場合には、これの140%までを弊社が確保します。またコモディティのセグメントやスポットメタル、およびCFD用に保有される残高は計算に入りません。 詳細は、こちらをご参照ください。

例 1: USDを基準通貨とする口座において、EUR.USDが1.40の換算レートでEUR 100,000保有しています。USD建てで株価が$112,000(EUR 80,000同等額)の株式を購入します。USDに変換された現金額がプラス残高であるため、株式は全額支払い済みとみなされます。

| 要素 | EUR | USD | 基準(USD) |

| 現金 | 100,000 | (112,000) | $28,000 |

| ロング株式 | $112,000 | $112,000 | |

| 流動性資産価値(NLV) | $140,000 |

例 2: USDで$80,000、USD建てで$100,000のロング株式、そしてUSD建てで$100,000のショート株式を保有しています。合計$28,000のロング株式は証拠金証券、また残りの$72,000は超過証拠金証券とみなされます。これはショート株式の収益を現金残高から差し引き($80,000 - $100,000)この結果となるマイナス残高に140%をかけて算出されます($20,000 * 1.4 = $28,000)。

| 要素 | 基準(USD) |

| 現金 | $80,000 |

| ロング株式 | $100,000 |

| ショート株式 | ($100,000) |

| 流動性資産価値(NLV) | $80,000 |

IBKRでは利用可能な株式すべてを貸付するのですか?

貸付対象となる株式に対する有利なレートを提供するマーケットがない、借手のいるマーケットに弊社がアクセスできない、または弊社が貸付を希望しないなどの理由により、口座内の貸付可能な株式すべてが株式利回り向上プログラムを通して貸付される保証はありません。

株式利回り向上プログラムの貸付は100株単位で行われますか?

いいえ。弊社から外部への貸付は100株単位のみで行っていますが、お客様からの貸付には決まった単位はなく、外部へ100株の貸付が必要となる場合には、1人のお客様からの75株、また別のお客様からの25株をあわせて100株しにて貸付を行う可能性があります。

貸付することのできる株数が必要な株数を上回る場合、貸付は顧客に対してどのように振り分けられるのですか?

プログラムによって貸付可能な株数が借手が必要とする株数を超える場合、貸付は比例計算で割当られます。例えば、プログラムによるXYZ株の合計数が20,000株で、10,000株が必要とされている場合、それぞれのお客様より対象となる株式の50%が貸付されます。

株式の貸付はIBKRの顧客のみにされますか?それともサードパーティにもされるのでしょうか?

株式は、IBKRおよびサードパーティの顧客に貸付されることがあります。

株式利回り向上プログラムの参加者は、IBKRが貸付する株式を指定することができますか?

いいえ。こちらのプログラムは弊社が完全に管理を行うものであり、証拠金ローンの抵当権により弊社が貸付許可を有する貸付可能な証券がある場合、全額支払い済みまたは超過証拠金の株式の貸付が可能かどうか、またこれの開始は弊社の裁量により決定されます。

株式利回り向上プログラムで貸付に出されている株式の売却には何か規制がありますか?

貸付されている株式に規制はなく、いつでも売却することができます。株式は売却にあたって返還の必要はなく、売却からの収益は通常の決済日にお客様の口座に入金されます。貸付は売却日の翌営業日開始時に終了します。

株式利回り向上プログラムで貸付されている株式に対してカバード・コールを売却し、証拠金信用力を受けることはできますか?

できます。貸付されているポジションに関連する損益は株式所有者のものとなるため、株式の貸付によってアンカバードやヘッジベースの必要証拠金に影響はありません。

貸付対象の株式で実際に引渡しが行われたものに対してコールの割当やプットの権利行使が発生した場合にはどうなりますか?

ポジションのクローズまたは減少となるアクションからT+1(取引、割当、権利行使)の時点で貸付停止となります。

貸付の対象となった後で取引が中止された株式はどうなりますか?

取引中止によって株式の貸付機能への直接的な影響はなく、対象株式の貸付が可能である限り、中止に関わらず株式の状態は変わりません。

証拠金や変動をカバーするために貸付による担保をコモディティ口座にスイープすることはできますか?

いいえ。貸付保証のための担保が証拠金などに関わることはありません。

プログラム参加者が証拠金ローンを始める、または既存のローン残高を増やすとどうなりますか?

全額支払い済みの株式をお持ちのお客様がプログラムを利用してこれを貸付された後で証拠金ローンを行う場合、超過証拠金証券の対象とならなくなるため貸付は停止されます。同様に、超過証拠金証券をお持ちのお客様がプログラムを利用してこれを貸付された後で証拠金ローンを上げる場合には、これも超過証拠金証券の対象とならなくなるため貸付は停止されます。

貸付されている株式はどのような状況で解約されますか?

以下のいずれかの状況(これに限らず)が発生した場合、株式の貸付は解約となります:

- プログラムの解約

- 株式の移管

- 株式を元にした借入

- 株式の売却

- コール割当/プット権利行使

- 口座の解約

株式利回り向上プログラムの参加者は、貸付されている株式の配当を受け取ることができますか?

貸出された株式利回り向上プログラムの株式は、 配当金を獲得し、配当金相当額(PIL)による受け取りを回避するため、通常、配当の権利落日前日までにリコールを試みます。ただし、PILとしての受け取りとなる場合もあります。

株式利回り向上プログラムの参加者には、貸付されている株式への議決権がありますか?

いいえ。承諾やアクションを行う選択日や基準日が貸付期間内の場合、選択や承諾を行う権利は証券の借手のものとなります。

株式利回り向上プログラムの参加者は、貸付されている株式のライツやワラント、またをスピンオフによる株式を受け取ることができますか?

できます。貸付されている株式のライツ、ワラント、スピンオフ株式や分配はすべて株式所有者が受け取ります。

貸付されている株式はアクティビティ・ステートメント上にどのように表示されますか?

貸付担保、発行済み株式、アクティビティおよび収入は、以下の6項目に表示されます:

1. 現金詳細 – 開始時の担保(米国国債または現金)残高、貸付アクティビティによる純変化(新しい貸付の場合にはプラス、純利益の場合にはマイナス)および終了時の現金担保残高が記載されます。

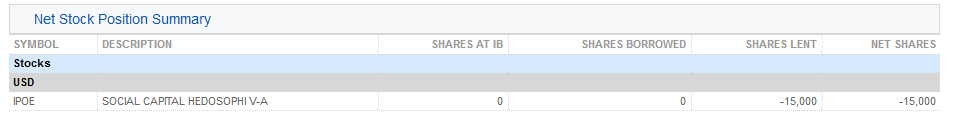

2. 純株式ポジションのサマリー – 株式ごとにIBKRにおける合計株数、借入られている株数、貸付られている株数および純株数(IBKRでの株数+借入株数+貸付株数)が記載されます。

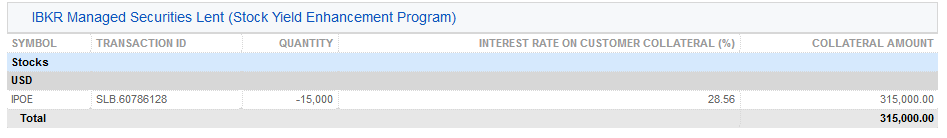

3. IBKR管理の貸付証券(株式利回り向上プログラム) – 株式利回り向上プログラムで貸付された株式ごとに、貸付株数および金利(%)が記載されます。

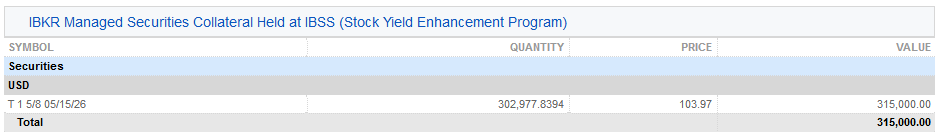

3a. IBSSに保管されるIBKR管理の証券担保(株式利回り向上プログラム) – 証券の貸付用担保として保有される米国国債とその数量、価格、合計価値がIBLLCのお客様のステートメントに表示されます。

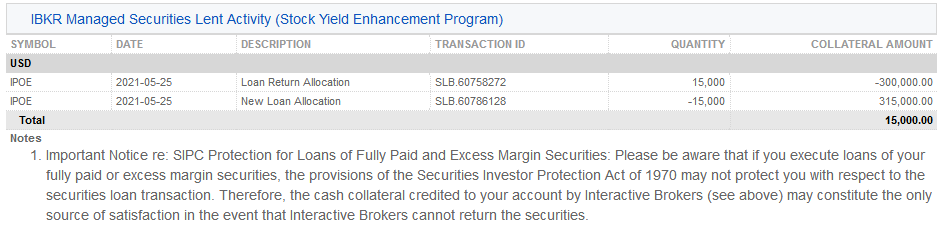

4. IBKR管理の証券貸付状況 (株式利回り向上プログラム)– 証券ごとに、貸付返却の割当(解約された貸付)、新しい貸付の割当(開始された貸付)、株数、純利率(%)、お客様の担保への利率(%)、ならびに担保額の詳細が記載されます。

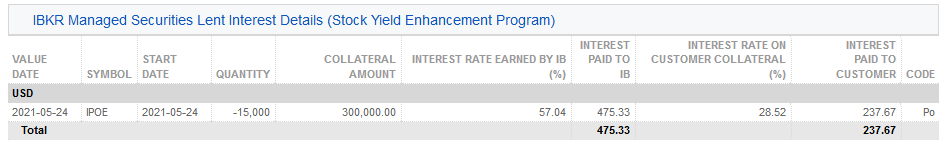

5. IBKR管理の貸付証券アクティビティ金利詳細 (株式利回り向上プログラム)– 貸付ごとに、IBKRのものとなる利子(%)、IBKRの収入({担保額*金利}/360に相当する、貸付によってIBKRのものとなる収入の合計)、お客様の担保への利子(貸付によってIBKRのものとなる収入の約半分)、ならびにお客様のものとなる利子(お客様の担保への利子)の詳細が記載されます。

注意: この項目は発生した利子がステートメント期間にUSD $1を超える場合のみ表示されます。

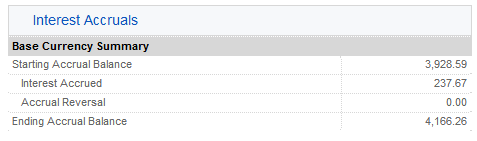

6. 未払い利息 – ここでの利子収入は未払い利息であり、その他の未払い利息と同じように扱われます(集約してUSD $1以上になる場合のみ未払い利息として、マンスリーの現金に表示されます)。年末報告のため、この利息は米国納税者に発行されるForm 1099にレポートされます。

米国上場証券オプション終値の決定方法

毎日の取引終了時に米国上場証券オプションをマークする際に弊社で使用している価格(TWSおよびステートメント上)は、オプション清算会社(OCC)の価格を基にしています。 オプション商品の唯一のクリアリング機関として、OCCは取引を決済するメンバー(IBなど)に代わって必要証拠金を計算するため、またポートフォリオ・マージン口座を管理するブローカーの使用するリスクアレイ供給のために、各オプションコントラクトの終値を算出します。

OCCによる終値は編集されるため、参加取引所による終値を反映しないことがありますのでご注意ください。 オプションは数カ所に上場され、また7つの取引所すべてで交換可能であることが多いため(よって毎日異なる価格が7つ出る可能性があります)、まとめたクオートがなく、このために編集が行われます。 このためOCCではすべての取引所で論理的には一環し、また権利行使価格や時間の裁定条件がないことを確認した単一の価格を終了時において設定します。

価格を設定する際、OCCでは先ずすべての上場取引所におけるもっとも高いビッド価格と最も低いアスク価格の中間点を取ってインプライド・ボラティリティを決定し、オプションのマーク価格を調整する反復プロセスを通じて、インプライド・ボラティリティのカーブをスムーズにします。 また、特定のインザマネーおよびアウトオブザマネーのオプションのボラティリティを制限するための規則もあります。最終的に編集される価格は小数点6桁までになります。 オプションの全体に対する編集価格算出の運用上コストのため、このプロセスはマーケット終了時において、1日1回のみ行われます。

米国証券のオプションポジションの割当てが翌日まで通知されない理由

満期日以外の日におけるアメリカスタイルのオプションに対する権利行使通知の処理はリアルタイムではなく、オプション清算会社(OCC)による夜間のバッチ処理の一部として行われます。 処理の流れは定義上、通知が割当てられる顧客に少なくとも1日遅れて行われますが、詳細は以下の様になります:

- OCCは通常、清算会員がロングポジションを保有する顧客の代理として、1日を通じて電子的に権利行使通知の送信をすることを許可していますが、 これは通常、夕方(Day E)の重要な処理が開始される前に送信されます。

- 夕方のポジション処理の流れの一環として、OCCでは受け取った権利行使通知を、清算会員のオープン金利にランダムに割り当てます。 情報はこの後、OCCによって翌日の早朝(Day E+1)に清算会員に提供されます。

- 情報が提供される時点においてIBKRなどの清算業者では、顧客に対して適時の報告を行うため、また証拠金や決済に関する情報を提供するために、その日の取引活動の処理はすでに終わらせています。 またOCCでは、清算会員の顧客のポジションをオムニバス方式(顧客の情報は持たずに清算業者の情報のみ)で行うため、清算会員では特定のポジションを持つ顧客に対し、ランダムに権利行使通知を割当てる必要があります。

- IBKRでOCCから割当ての通知を受取り、ランダムな割当て処理を完了させ次第、この割当ては該当する口座のトレーダー・ワークステーションにすぐに表示され、その日の終了時点(E+1)で日次アクティビティ・ステートメントに反映されます。

また、この処理の流れとロングオプションに残り時間がある可能性のために、IBKRでは引渡し義務をオフセットする手段として割当てられているショートポジションに対するロングオプションのスプレッドに関する権利行使通知を、OCCに自動的に提供することができません。

口座をお持ちのお客様は、口座申請の時点でオプションの取引資格の対象となるすべてのお客様に対してIBKRよりご提供させていただいている「一般的なオプション取引に掛る商品性とリスクに関するディスクロージャー」をご参照の上、ここに明記される割当てに関するリスクをご確認ください。 こちらのディスクロージャーは、OCC のウェブサイトからもご参照可能です。

ロットの詳細を含めるカスタム・ステートメントの作成

アカウント・マネジメントのカスタム・ステートメント画面より、ロットの詳細を含めるステートメントを作成することができます。

新規のアカウント・マネジメント

1. レポート > ステートメントをクリックします。

ステートメントの画面が表示されます。

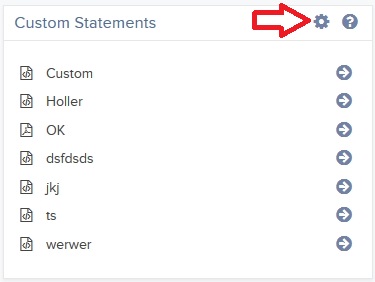

2. カスタム・ステートメントのパネルにある設定(ギヤ)のアイコンをクリックします。

アクティビティ・ステートメント・テンプレートの画面が表示されます。

3. + のアイコンをクリックして、新しいステートメントのテンプレートを作成します。

.jpg)

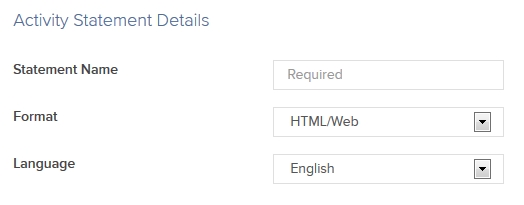

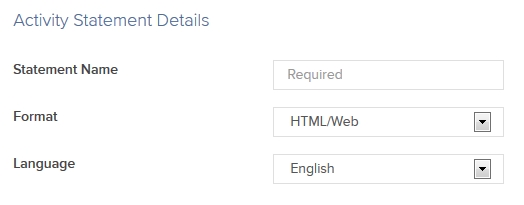

4. アクティビティ・ステートメント詳細で、カスタム・ステートメントの名前を入力して出力形式と言語を選択してください。期間も選択するようにとの表示が出ますが、これはステートメントを作成する際に変更することができます。

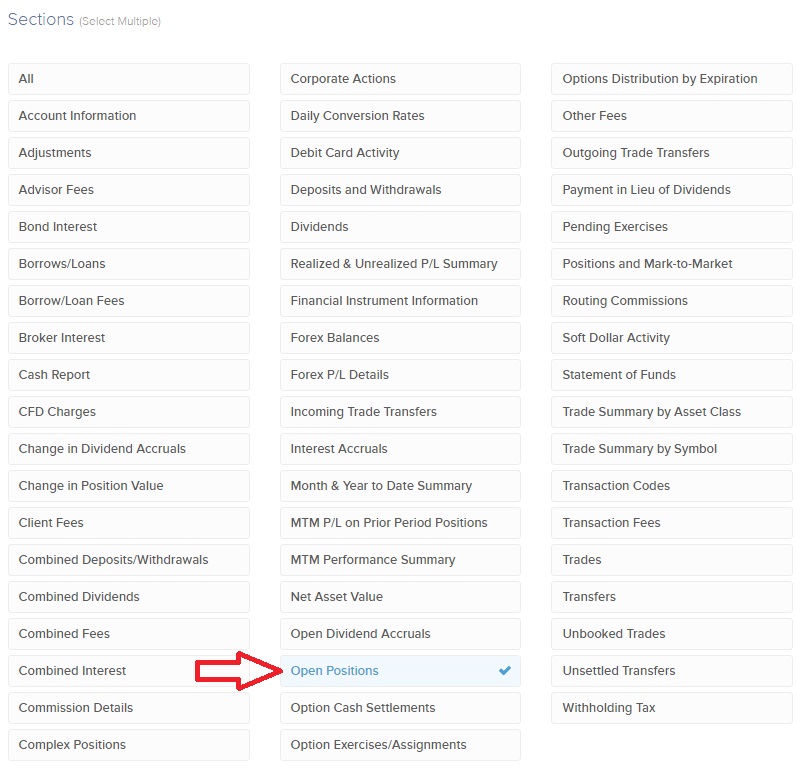

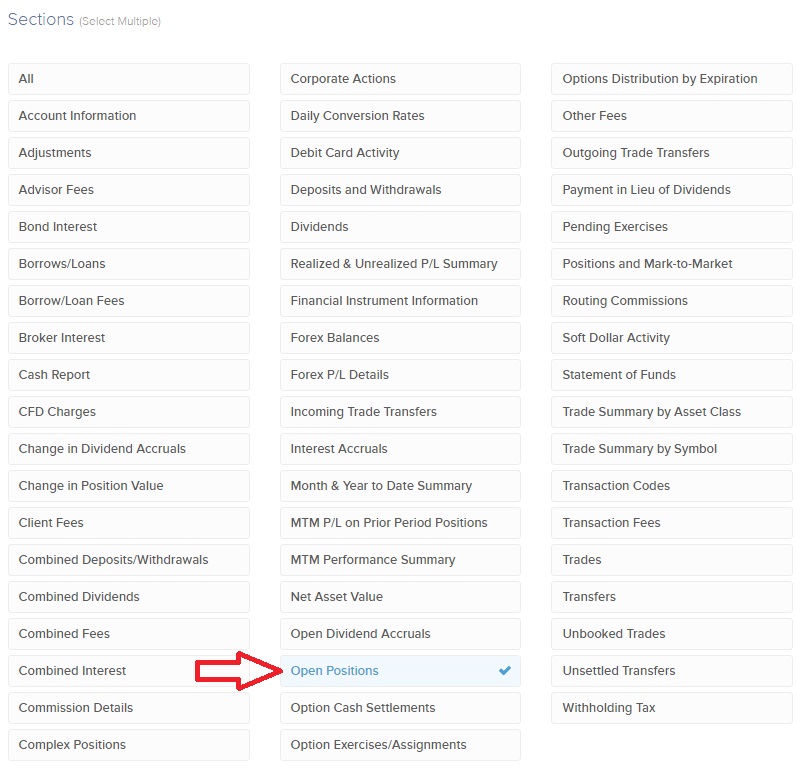

5. 項目より、カスタム・ステートメントに表示する項目をすべてクリックします。選択された項目にチェックマークが入って表示されます。ロット詳細はオープン・ポジションの項目に記載されますので、こちらのオプションを必ず選択してください。

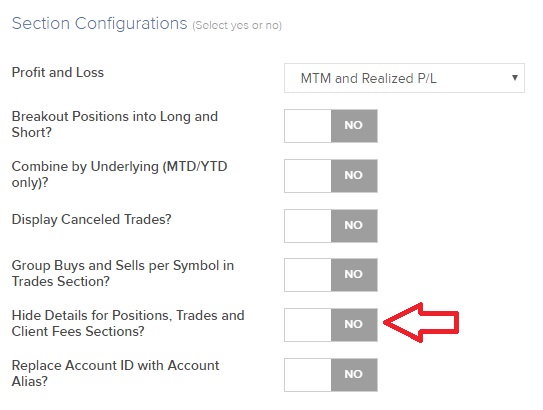

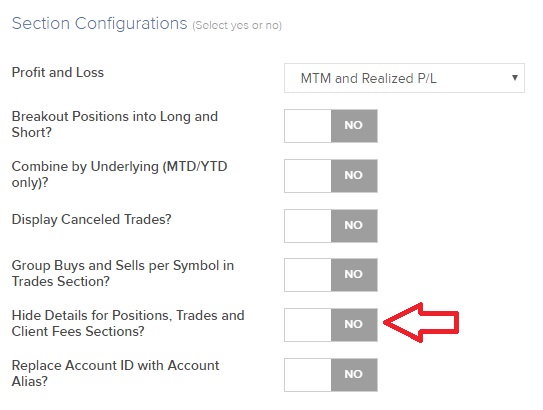

6. 項目設定より、カスタム・ステートメントでオンにするオプションを選択します。ロット詳細が必ずステートメントに表示されるよう、「ポジション取得時の詳細及びクライアントフィーの詳細を非表示にする」は「いいえ」を選択してください。

7. 続けるをクリックしてください。

8. ステートメント・テンプレートを再確認して作成をクリックします。

今後はステートメント画面のステートメントを作成するから、新しいカスタム・ステートメントを作成することができます。

従来のアカウント・マネジメント

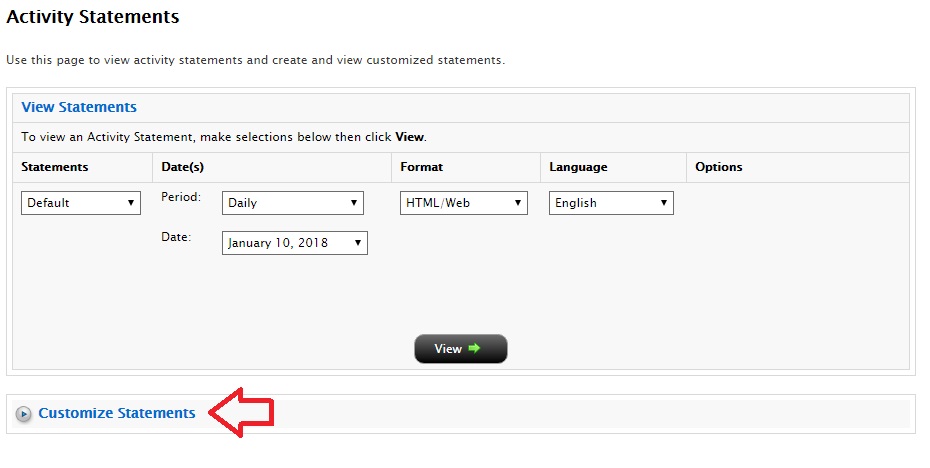

1. レポート > アクティビティ > ステートメントをクリックします。

ステートメントの画面が表示されます。

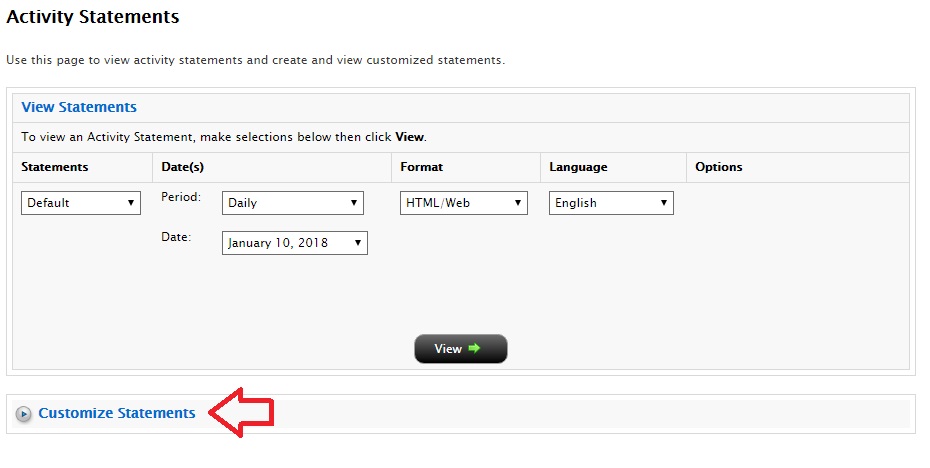

2. 青色の「ステートメントのカスタマイズ」のヘッダーをクリックします。

ステートメントのカスタマイズの項目が拡張/表示されます。

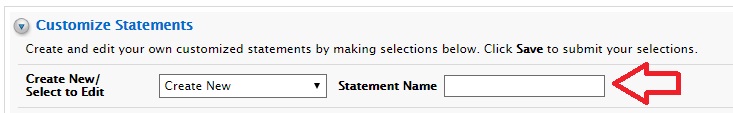

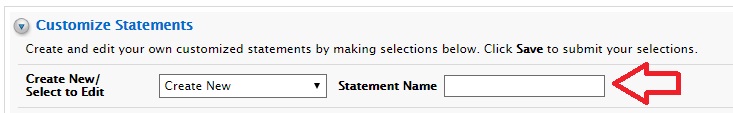

3. ひとつめのドロップダウンメニューより「新規作成」を選択し、「ステートメント名」の欄にカスタム・ステートメントの名前を入力します。

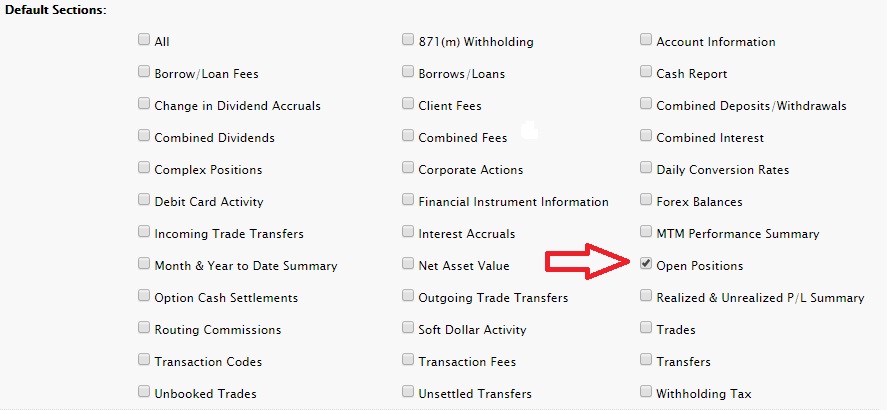

4. 初期項目より、カスタム・ステートメントに表示する項目をすべてクリックします。選択された項目にチェックマークが入って表示されます。ロット詳細はオープン・ポジションの項目に記載されますので、こちらのオプションを必ず選択してください。

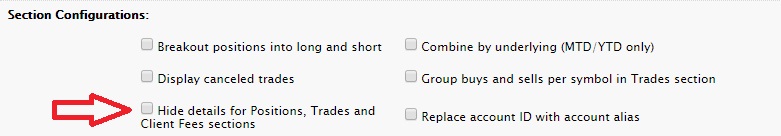

5. 項目設定より、カスタム・ステートメントでオンにするオプションを選択します。ロット詳細が必ずステートメントに表示されるよう、「ポジション取得時の詳細及びクライアントフィーの詳細を非表示にする」の項目のチェックマークを外してください。

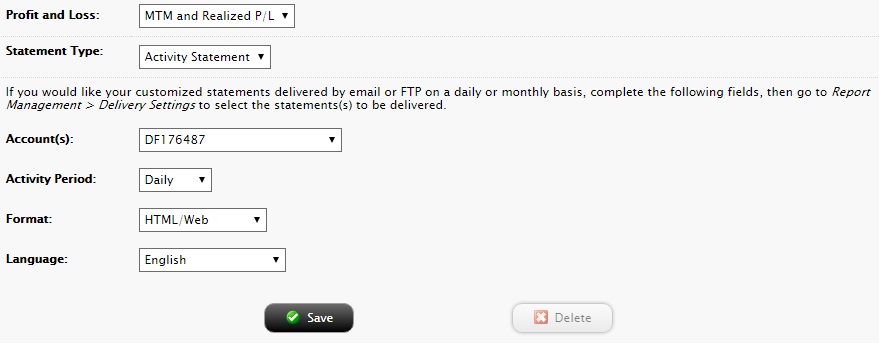

6. ドロップダウンメニューより損益とステートメントのタイプ(アクティビティ・ステートメントを選択してください)、口座番号、アクティビティの期間、形式、ならびに言語を選択してください。優先するアクティビティ期間も選択するようにとの表示が出ますが、これはステートメントを作成する際に変更することができます。

7. 保存をクリックしてください。

今後、ステートメント画面のステートメントを表示するパネルより、「ステートメント」のドロップダウンメニューからご自身の新しいカスタム・ステートメントを選択して、新規カスタム・ステートメントを作成することができます。

Create a Custom Statement with Lot Details

You can create a statement with Lot Details through the Custom Statements screen in Client Portal/Account Management.

New Client Portal

1. Click Reports > Statements.

The Statements screen will populate.

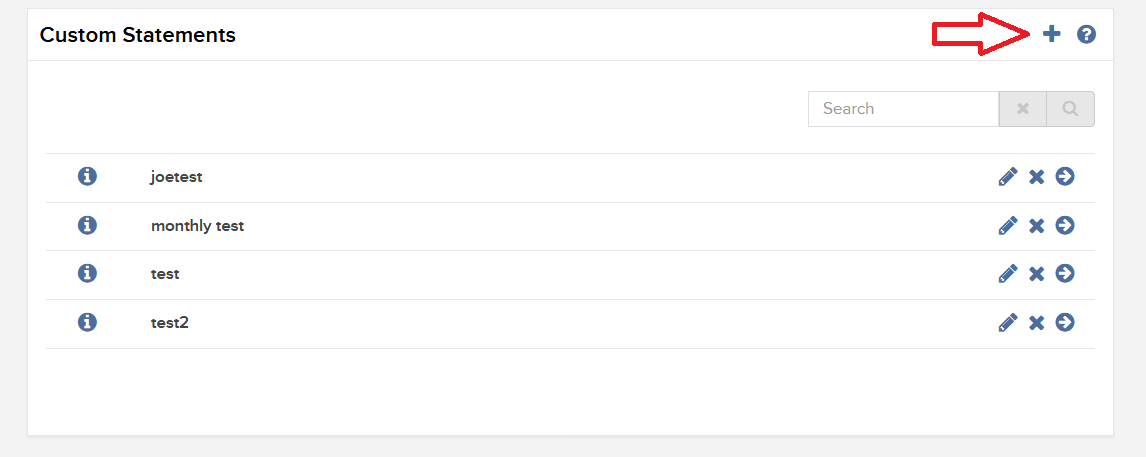

2. In the Custom Statements panel, click the + icon.

The Activity Statement Template screen will populate.

3. Click the + icon to create a new statement template.

.jpg)

4. In Activity Statement Details, enter a name for your custom statement, and select an output format and language. It will ask you to select a time Period as well, but this can be modified when you run the statement.

5. In Sections, click each section that you want to appear in your custom statement. Selected sections will appear with a check mark. The Open Positions section is where Lot Details will be located, so be sure to choose this option.

6. In Section Configurations, please select which options you wish to turn on in your custom statement. In order to ensure Lot Details are on the statement, select “NO’ for “Hide Details for Positions, Trades, and Client Fees Sections?”.

7. Click CONTINUE.

8. Review your statement template and click Create.

You can now run your new custom statement from the Run a Statement panel on the Statements screen.

Classic Account Management

1. Click Reports > Activity > Statements.

The Statements screen will populate.

2. Click on the blue “Customize Statements” header.

The Customize Statements section will expand/populate.

3. Select “Create New” from the first drop down menu, and enter a name for your custom statement in the “Statement Name” field.

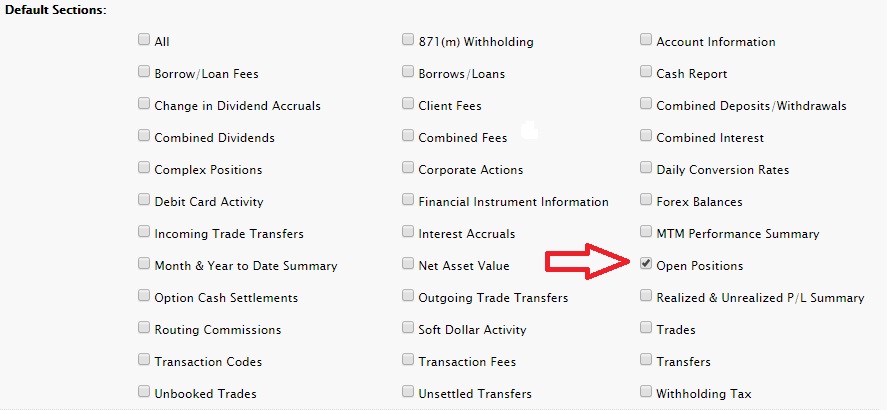

4. In Default Sections, click each section that you want to appear in your custom statement. Selected sections will appear with a check mark. The Open Positions section is where Lot Details will be located, so be sure to choose this option.

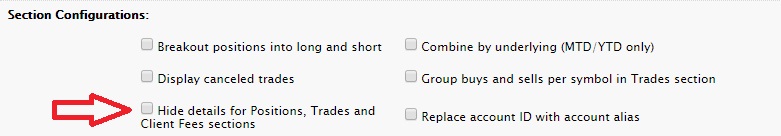

5. In Section Configurations, please select which options you wish to turn on in your custom statement. In order to ensure Lot Details are on the statement, UNCHECK THE BOX for “Hide Details for Positions, Trades, and Client Fees sections”.

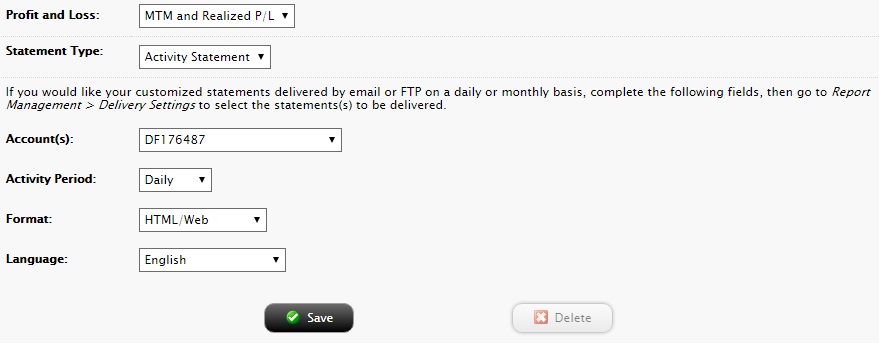

6. Select your Profit and Loss Type, Statement Type (should be Activity Statement), Account number(s), Activity Period, Format, and Language from the drop down menus. While the system does ask you for a preferred Activity Period, this can be modified when you run the statement.

7. Click Save.

You can now run your new custom statement from View Statements panel on the Statements screen by selecting your new custom statement from the “Statements” drop down menu.

How to update the US Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) on your account

If you have been informed or believe that your account profile contains an incorrect US SSN/ITIN, you may simply log into your Account Management to update this information. Depending on your taxpayer status, you can update your US SSN/ITIN by modifying one of the following documents:

1) IRS Form W9 (if you are a US tax resident and/or US citizen holding a US SSN/ITIN)

2) IRS Form W-8BEN (if you are a Non-US tax resident holding a US SSN/ITIN)

Please note, if your SSN/ITIN has already been verified with the IRS you will be unable to update the information. If however the IRS has not yet verified the ID, you will have the ability to update through Account Management.

How to Modify Your W9/W8

1) To submit this information change request, first login to Account Management

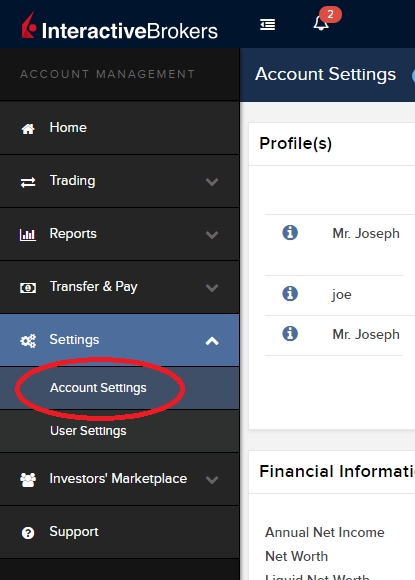

2) Click on the Settings section followed by Account Settings

3) Find the Profile(s) section. Locate the User you wish to update and click on the Info button (the "i" icon) to the left of the User's name

.png)

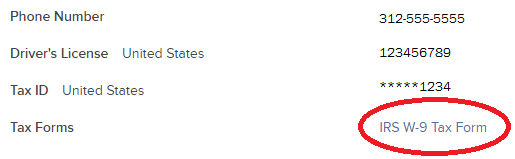

4) Scroll down to the bottom where you will see the words Tax Forms. Next to it will be a link with the current tax form we have for the account. Click on this tax form to open it

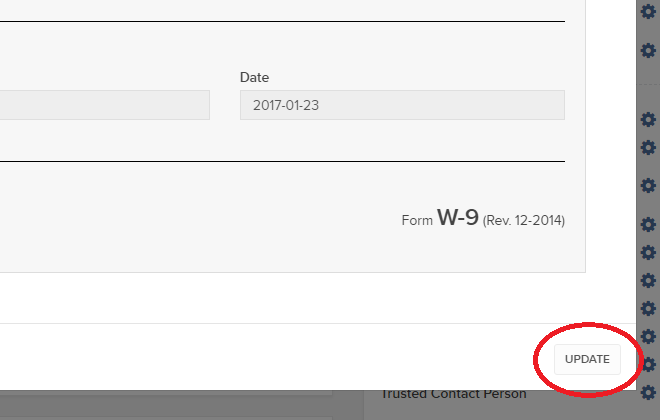

5) Review the form. If your US SSN/ITIN is incorrect, click on the UPDATE button at the bottom of the page

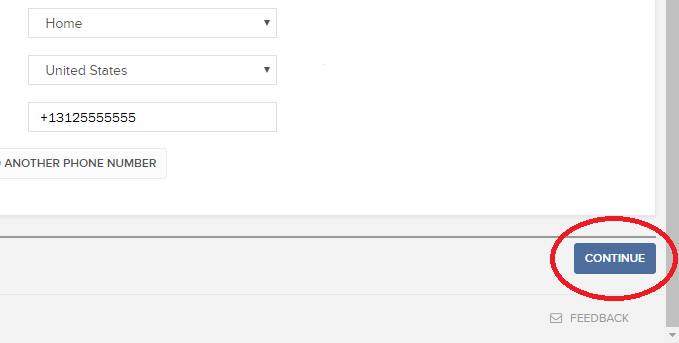

6) Make the requisite changes and click the CONTINUE button to submit your request.

7) If supporting documentation is required to approve your information change request, you will receive a message. Otherwise, your information change request should be approved within 24-48 hours.

Common Reporting Standard (CRS)

The Common Reporting Standard (CRS), referred to as the Standard for Automatic Exchange of Financial Account Information (AEOI), calls on countries to obtain information from their financial institutions and exchange that information with other countries automatically on an annual basis. The CRS sets out the financial account information to be exchanged, the financial institutions required to report, the different types of accounts and taxpayers covered, as well as common due diligence procedures to be followed by financial institutions. For more information about CRS, please visit the OECD website.

Interactive Brokers entities comply with the requirements of CRS as implemented in the jurisdictions where they are located, and report account information to the applicable government authorities. Clients reported by Interactive Brokers under CRS will receive a CRS Client Report in the Client Portal shortly after the reporting deadlines specified below. The CRS Client Report provides an overview of the information that was reported by Interactive Brokers.

- What information is reported under CRS:

- Account number

- Name

- Address

- Tax ID Number

- Tax residency country

- Date of birth

- Year-end account balance

- Gross proceeds (all sales)

- Interest income

- Dividend income

- Other income

- When and where is the information reported:

- Interactive Brokers Australia Pty. Ltd. reports to the Australian Taxation Office (ATO) by July 31.

- Interactive Brokers Canada Inc. reports to the Canada Revenue Agency (CRA) by May 1.

- Interactive Brokers Central Europe Zrt. reports to the National Tax and Customs Administration of Hungary (NAV) by June 30.

- Interactive Brokers Hong Kong Limited reports to the Inland Revenue Department of Hong Kong SAR (IRD) by May 31.

- Interactive Brokers India Pvt. Ltd. reports to the Reserve Bank of India/Central Board of Direct Taxes (RBI/CBDT) by May 31.

- Interactive Brokers Ireland Limited reports to the Office of the Revenue Commissioners of Ireland by June 30.

- Interactive Brokers Securities Japan Inc. reports to the National Tax Agency of Japan (NTA) by April 30.

- Interactive Brokers Singapore Pte. Ltd. reports to the Inland Revenue Authority of Singapore (IRAS) by May 31.

- Interactive Brokers U.K. Limited reports to Her Majesty's Revenue and Customs of the United Kingdom (HMRC) by May 31.

- Additional Notes:

- Information relating to clients of Introducing Brokers is not reported by Interactive Brokers. Introducing Brokers are responsible for their own reporting under CRS.

- Accounts held by Interactive Brokers LLC are not reported under CRS as the United States has not signed the CRS.

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

Overview of Dodd-Frank

Background

The Dodd-Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd-Frank, is a U.S. law enacted in July of 2010, the purpose of which is to prevent the recurrence of events which lead to the 2008 financial crisis. Its principal goals are to:

- Promote U.S. financial stability by improving accountability and transparency within the financial system;

- Protect taxpayers from future bailouts of institutions deemed “too big to fail”; and

- Protect consumers from financial services practices considered abusive.

For additional information, please review the following sections:

- Dodd-Frank reforms

- Dodd-Frank and your IB Account

Dodd-Frank Reforms

To accomplish its goals, Dodd-Frank proposed the following reforms:

- Enhanced oversight and supervision of financial institutions through the creation of Financial Stability Oversight Council

- Creation of a new agency responsible for implementing and enforcing compliance with consumer financial laws (Bureau of Consumer Financial Protection)

- Implementation of more stringent regulatory capital requirements

- Changes in the regulation of over the counter derivatives including restrictions upon access to Federal credit by swaps entities, establishment of regulatory oversight and mandatory trading and clearing requirements

- Enhanced regulation of credit rating agencies intended to eliminate exemptions from liability, enhance rating agency disclosure, establish prohibited activities and impose standards for independent Board governance

- Changes to corporate governance and executive compensation practices

- Incorporation of the Volcker Rule which imposes restrictions upon the speculative proprietary trading activities of banking entities

- Mandating studies intended to reform investor protection rules

- Changes to the securitization market including requirements that mortgage bankers retain a % of risky loans.

Dodd-Frank and Your IB Account

Perhaps most visible to IB account holders of all the Dodd-Frank regulations are those relating to money transfers. Here, Section 1073 of the Act introduces consumer protections designed to increase transparency with respect to the costs, timing and the right to repudiate cross-border transactions.

For purpose of Section 1073, a cross-border transaction is defined as an electronic transfer of money from a consumer in the United States to a person or business in a foreign country. As IB LLC is a U.S. based broker, all its account holders regardless of whether they are domiciled in the U.S. or not, benefit from this protection and it covers withdrawals denominated in a currency other than the U.S. dollar as well as USD denominated withdrawals sent to a non-U.S. bank. Account holders submitting a withdrawal which is covered by this regulation will be provided with a disclosure after confirming the request within Account Management. This disclosure will include the following information:

- The name and address of the sender and recipient

- The amount to be deducted from the sender’s IB account

- The amount projected to be credited to the recipient’s bank account including an estimate of fees which the receiving bank's correspondent bank(s) may charge. Note that these correspondent bank fees are not set by nor is any part of them earned by IB.

- A disclaimer that additional fees and foreign taxes may apply.

- Notice of the sender’s right to cancel the transfer request for a full refund within 30 minutes of it being authorized.

- Regulatory contact information in the event of questions or complaints.

When estimating correspondent bank transfer fees, IB takes into consideration information collected from past customer transactions in addition to data made available by our agent banks. We encourage our customers to review and consider this information when making decisions regarding cross-border transactions.