Shorting US Treasuries

Interactive Brokers clients have the ability to gain direct exposure to US Treasuries on both the short and long side of the market.

Order Entry

Orders can be entered via TWS.

Cost to Borrow

The borrow fee to short US Treasuries is based on IBKR’s borrow cost and is subject to daily change. If the Treasury is borrowed by Interactive Brokers at the General Collateral rate, the customer does not incur a borrow fee.

Interest Income

Customers earn Short Credit Interest on their short US Treasury positions based on IBKR’s standard tiered rates.

.png)

Margin Requirements

Margin1 requirements on Short US Treasury positions are the same as Long US Treasury positions. The requirement is between 1% and 9%, depending on time to maturity. The proceeds of the short sale are not available for withdrawal. The amount available for withdrawal is generally Equity with Loan Value – Initial Margin.

Additional information on fixed income margin requirements can be found here.

Commissions

Selling short US Treasuries incurs the same commission cost as buying US Treasuries. IBKR’s commission schedule can be found here.

Trading Policy

Minimum short position size is $250,000 face value per CUSIP due to limitations of the US Treasury borrow market. Once the minimum position size is met, the minimum order increment is $250,000 for both short sales and buy to covers (as long as the resulting short position remains higher than the $250,000 face value minimum).

Short Sale Order Examples

| Existing US Treasury Short Position Face Value in Account (per CUSIP) | Face Value of Short Sale Order | Face Value of Resulting Position | Order Accepted? | Reason |

| Flat | $250,000 | $250,000 | Yes | Face Value of resulting position is => $250,000 |

| Flat | $100,000 | $100,000 | No | Face Value of resulting position is < $250,000 |

| $250,000 | $50,000 | $300,000 | No | Order increment < $250,000 |

| $250,000 | $250,000 | $500,000 | Yes | Order increment =>$250,000 |

Buy-to-cover orders that will result in a short US Treasury position of less than $250,000 face value will not be accepted.

Buy to Cover Order Examples

| Existing US Treasury Short Position Face Value in Account (per CUSIP) | Face Value of Buy to Cover Order | Face Value of Resulting Position | Order Accepted? | Reason |

| $500,000 | $250,000 | $250,000 | Yes | Face Value of resulting position is => $250,000 |

| $500,000 | $300,000 | $200,000 | No | Face Value of resulting position is < $250,000 |

| $500,000 | $500,000 | Flat | Yes | Order increment => $250,000 |

Payment in Lieu

When a short US Treasury position is held over the record date of an interest payment, the borrower’s account will be debited a payment-in-lieu of interest equal to the interest payment owed to the lender.

Eligible US Treasuries for Shorting

Only accounts carried under Interactive Brokers LLC and Interactive Brokers UK are eligible to short sell US Treasuries.

US Treasury Notes and Bonds with an outstanding value greater than $14 Billion can be sold short.

US Treasury Bills, TIPs, STRIPs, TF (Floating Rate Notes) and WITFs (When-Issued Floating Rate Notes) are not available for shorting.

Non-US sovereign debt is also not available for shorting.

1Trading on margin is only for sophisticated investors with high risk tolerance. You may lose more than your initial investment.

For more information regarding margin loan rates, see ibkr.com/interest

Regulation SHO Rule 204, Closeouts, and Introducing Brokers

As a US registered broker-dealer, Interactive Brokers LLC (“IBKR”) is subject to Regulation SHO, a collection of US Securities & Exchange Commission rules relating to short-selling of equity securities. Rule 204 of Regulation SHO places certain requirements on clearing brokers in the event that they fail to deliver securities on settlement date in connection with a sale of those securities. This can happen for a variety of commonplace operational reasons, and does not indicate a problem at the clearing broker. In certain circumstances, Rule 204 may require a clearing broker to not permit shorting a security for a certain period of time (unless sufficient shares of that security are pre-borrowed to cover the order marked as a short sale).

Rule 204(a) requires that a clearing broker, if it fails to deliver on a sale trade on the settlement date, must closeout its fail by buying or borrowing the relevant security a specified number of trading days later (depending on whether the sale was long or short), prior to the opening of the regular trading session on that day.

Rule 204(b) provides that if the clearing broker does not closeout its fail in accordance with Rule 204(a), the broker may not accept short sale orders from its customers in the relevant stock (the stock in which the unclosed-out fail has occurred), or place such orders for its own account, unless it has first borrowed the shares of the relevant stock to cover the new short sale order. This is colloquially known in the securities industry as being in the “penalty box” for the relevant security. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled.

Any broker that executes trades through that clearing broker, and clears and settles those trades through that clearing broker, is subject to the same Rule 204(b) restriction, as is any broker that executes away from that clearing broker, but intends to clear and settle those trades through the clearing broker.

Rule 204(c) requires clearing brokers to notify brokers from whom they receive trades for clearance and settlement of when they become subject to a short-sale restriction under Rule 204(b), and when that restriction ends. This is so that the notified brokers can avoid executing trades away from the clearing broker that are not permitted under the clearing broker’s short-sale restriction. If you have received a notice from IBKR regarding Rule 204(c), it generally means that IBKR's books and records show that you are an introducing broker or dealer that clears and settles trades through IBKR, and that also has the capability (or your client has such capability) of executing trades at away brokers or dealers for settlement through IBKR. You should not execute any short-sale order at an away broker-dealer in a security which we have notified you is shortsale restricted, unless you have first arranged to pre-borrow sufficient shares of that security through IBKR. For more information on pre-borrowing, please click here or contact us.

The above is a general description of Rule 204 of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. It is not legal advice and should not be used as such.

Operational Risks of Short Selling

Rate Risk

Holders of short call options can be assigned before option expiration. When the long holder of an option enters an early exercise request, the Options Clearing Corporation (OCC) allocates assignments to its members (including Interactive Brokers) at random. The OCC reports assignments to IBKR on the day of the long call exercise (T) but after US market hours. As such, option assignments are reflected in IBKR customer accounts on the next business day (T+1), settling on T+2. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held beforehand. Settled short position holders are subject to borrow fees, which can be high. Additionally, if IBKR cannot fulfil the short sale delivery obligation due to a lack of securities lending inventory on settlement date, the short position can be subject to a closeout buy-in.

Due to T+2 settlement mechanics described previously, traditional purchases to cover a short position on T+1 will leave the account with a settled short stock position for at least 1 night (or longer in case of a weekend or holiday).

Long in-the-money Puts are automatically exercised on expiration date. A short position as a result of the exercise carries the same risks as assigned short calls.

| Day | Short Sale | Buy to Cover | Settled Short Position | Borrow Fee Charged? | |

| Monday | OCC reports short call assignment to IBKR after market hours. | -100 XYZ stock Trade Date (T) |

Flat | No | |

| Tuesday | Call assignment and stock sale is reflected in IBKR customer’s account | T+1 | +100 XYZ stock Trade Date (T) |

Flat | No |

| Wednesday | T+2 Settlement Date | T+1 | -100 | Yes | |

| Thursday | T+2 Settlement Date | Flat | No |

Special Risks Associated with ETN & Leveraged ETF Short Sales

Introduction

While account holders are always at risk of having a short security position closed out if IB is unable to borrow shares at settlement of the initial trade or bought in if the trade settles and the shares are recalled by the lender thereafter, certain securities have characteristics which may increase the likelihood of these events occurring. Two examples are leveraged Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN), where the supply of shares available to borrow can be influenced by a number of factors not found with shares of common stock. An overview of these securities and these factors is provided below.

Overview

As background, an ETF is a security organized as a pooled investment vehicle that can offer diversified exposure or track a particular index by investing in stocks, bonds, commodities, currencies, options or a blend of assets. An ETF is similar to a mutual fund in that each share of an ETF represents an undivided interest in the underlying assets of the fund. However, unlike a mutual fund in which orders are only processed at a price determined at the end of the day, ETF shares are repriced and trade throughout the day on an exchange. To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants (typically large broker-dealers) to create and redeem ETF shares in large blocks, typically 50,000 to 100,000 shares. While many ETFs invest solely in securities, others use debt or derivatives to track and/or magnify exposure to an index. The ProShares Ultra VIX Short-Term Futures ETF ( symbol: UVXY) is one example of a widely traded leveraged ETF.

ETNs are also securities that are repriced and trade throughout the day on an exchange and are designed to provide investors with a return that corresponds to an index. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. They do not pay interest like traditional debit instruments, but rather a promise to pay a specific return that typically corresponds to an index or benchmark. The Barclays iPath® S&P 500 VIX Short-Term Futures™ ETN (symbol: VXX) is one example of a widely traded ETN.

The supply of shares available to borrow in order to initiate or maintain a short sale position may be less stable for certain leveraged ETFs and ETNs, including UVXY and VXX, due to the following factors:

- Limited Authorized Participants: The number of Authorized Participants willing to issue ETFs, particularly those that invest in derivatives (e.g., futures contracts, swap agreements and forward contracts) rather than securities and seek performance equal to a multiple (i.e., 2x) or an inverse multiple (i.e., -2x) of a benchmark may be limited. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer.

- No Authorized Participants: As ETN shares represent credit instruments, the supply of such shares is determined solely by the issuing financial institution and Authorized Participants are not involved with the creation or redemption of shares. The ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time.

- Limited Holding Period: Certain leveraged ETFs and ETNs seek to match the performance of a benchmark index for a single day rather than an extended period. They are principally used by institutional investors and other traders looking to obtain short-term exposure to an asset class, hedge other investments in a portfolio or invest as a way to gain interim exposure to a particular market while gradually investing directly in that market. These factors can result in a higher rate of turnover and less stability of share inventory available to lend for short sales.

- Margin Considerations: Shares made available for lending to short sellers often originate from brokers who maintain a lien on the shares as they’ve financed the purchase of the shares on behalf of clients via margin loans. Clients purchasing shares using borrowed funds are subject to regulatory margin requirements, compliance to which depends in part upon the value of the shares supporting the loan. As certain leveraged ETFs/ETNs are designed to provide returns in multiples of their benchmark, the inherent volatility of these products may diminish clients’ ability to maintain the position and, in turn, the broker’s ability to lend the shares.

Monitoring Stock Loan Availability

IBKR provides a variety of methods to assist account holders engaged in short selling with monitoring inventory levels and borrow costs/rebates. The level of detail available, the time frame covered and the manner in which the information is accessed vary by method and a brief overview of each is provided below.

Public Website

Interested parties may query the IBKR website for stock loan data. To start, click here and scroll down to the section titled "Stocks Available". Click the section to expand it and select the country in which the stock is listed. If the number of available issues exceeds that which can be reasonably presented on a single page, results will be organized by symbol in groups, with hypertext links allowing further drill-down. A quick search box allowing direct query for a given symbol is also provided. Query results include the product description, currency of denomination and a link titled “Check Availability” which displays the quantity of shares available to borrow upon entering your login credentials.

Public FTP

Windows

Windows Explorer

- Open windows explorer (Start > Computer)

- With "Computer" selected on the left, right click an empty space on the right side of the window and choose “Add a network location”

- When the wizard prompts for a network address, enter “ftp://shortstock: @ftp2.interactivebrokers.com” and press next

- Give the connection a name of your choosing and press next

- File explorer should now open and display all of the files in the ftp location.

Command Prompt

- Go to Start > Windows System > Command Prompt

- Type "ftp" and press enter (the prompt will change to an ftp> prompt)

- Type “open ftp2.interactivebrokers.com”

- When prompted, enter the username “shortstock” and leave the password empty.

- Use the “dir” command to show the files in the directory

- Use the “get filename.txt” to retrieve the desired file

MacOS

- Open Finder

- From the “Go” menu choose “Connect to Server”

- Enter “ftp://shortstock: @ftp2.interactivebrokers.com” and press the + button to add to your favorites.

- Click “Connect”

- If prompted, the username should be “shortstock” and the password should be left empty.

- Click "Connect"

- If all steps were done correctly the finder window should display all of the files in the ftp location.

Linux

Terminal

- Open a Terminal window

- Type “ftp shortstock@ftp2.interactivebrokers.com”

- When prompted for a password, press enter

- Type “ls” to list the contents of the ftp location

- Type “get filename.txt” to get the desired file.

- Type “bye” to end the ftp session

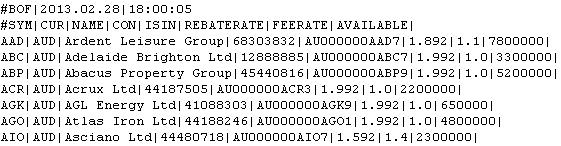

Outlined below is a snapshot of the sample file output which includes the stock symbol, currency of denomination, name, contract identifiers (IBKR’s and the ISIN), fee rates and shares available. This file may be also imported into applications such as Excel for sorting, filtering and analytical purposes.

Short Stock Availability (SLB) Tool

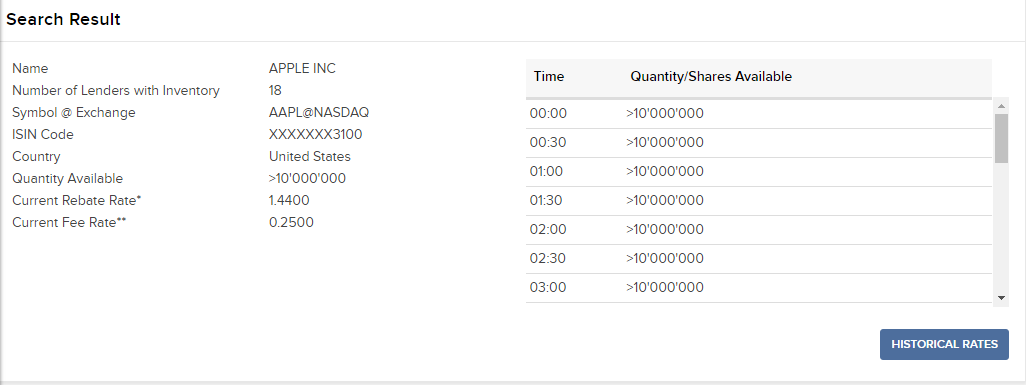

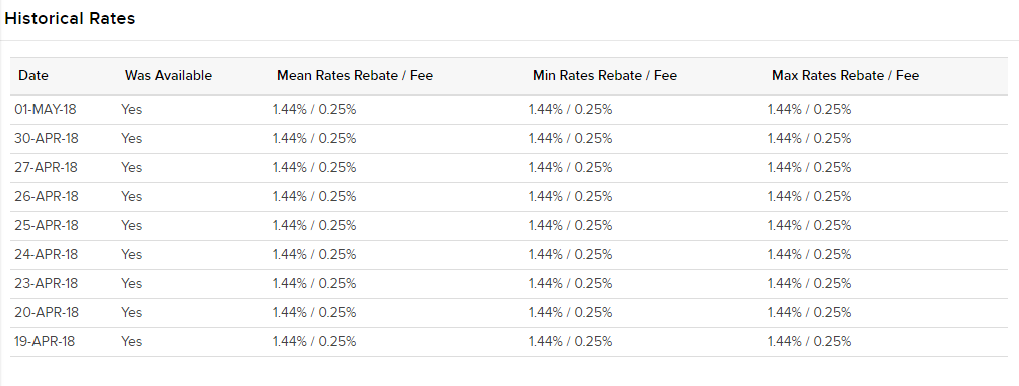

The SLB tool is available to IBKR account holders through Client Portal. Log in and select the Support section and then select Short Stock (SLB) Availability. This tool allows one to query information on a single stock as well as at a bulk level. Single stock searches can be performed by symbol/exchange, ISIN or CUSIP numbers. At the single security level, query results include the quantity available and number of lenders (note that a negative rebate rate infers a borrowing cost expressed as an annual percentage rate and, if positive, the interest rebate paid on cash proceeds securing the loan in excess of the minimum threshold). Information regarding the quantity of shares available to borrow throughout the day for the most current and past half hour increments is also made available.

In addition, borrowers interested in the trend of rates over the prior 10 day period can view the minimum, maximum and mean rates for each day.

This tool also allows one to upload a text file (with symbol/exchange or ISIN detail) and search for availability of multiple stocks in bulk within a single query. These bulk requests will then generate a .CSV file similar to the sample file output made available through the public FTP site.

Hong Kong Short Reporting Obligations

Overview

- Hong Kong regulations now require beneficial owners of shares in selected HK listed stocks to report each week short positions that exceed the threshold of HKD 30 million or 0.02% of market capitalization on the constituent stocks of the Hang Seng Index, the Hang Seng China Enterprises Index and other financial companies specified by the SFC. A list of affected of stocks can be found here:

http://www.sfc.hk/sfc/html/EN/research/short-position-reporting/specified-shares.html

- Investors with applicable positions should register directly with the SFC. Registration and guidance on the registration process can be found here.

- Reporting is expected on a weekly basis, but the second business day of the following week.

- Links for the registering and reporting can be found here:

https://portal.sfc.hk/dsp/gateway/welcome?locale=en

Guidelines, Instructions and FAQ's:

SFC announcement with links to legislation

Short position forms, guidelines, reference material and list of specified shares

Link to subscribe to SFC alert service (choose Short Position Reporting Related Matters)

For further details, please refer to the SFC website: www.sfc.hk and/or contact them via email with specific questions at shortpositions@sfc.hk

IBKR Stock Yield Enhancement Program

PROGRAM OVERVIEW

The Stock Yield Enhancement Program provides the opportunity to earn extra income on the fully-paid shares of stock held in your account by allowing IBKR to borrow shares from you in exchange for collateral (either U.S. Treasuries or cash), and then lend the shares to traders who want to sell them short and are willing to pay interest to borrow them. For additional information on the Stock Yield Enhancement Program please see here or review the Frequently Asked Questions page.

HOW TO ENROLL IN THE STOCK YIELD ENHANCEMENT PROGRAM

To enroll, please login to the Client Portal. Once logged in, click the User menu (head and shoulders icon in the top right corner) followed by Settings.

In the Trading section of the Settings page, click the link for the Stock Yield Enhancement Program. Select the checkbox on the next screen and click Continue. You will then be presented with the requisite forms and disclosures needed to enroll in the program. Once you have reviewed and signed the forms, your request will be submitted for processing. Please allow 24-48 hours for enrollment to become active.

.png)

.png)

India Intra-Day Shorting Risk Disclosure

Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. In accordance with IB’s intra-day shorting rules, traders are required to deliver shares sold or close short stock positions prior to the end of the trading session.

Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at 15:20 IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. If the position is not closed by the end of the day and the shares are not delivered by the customer before settlement, the loss on account of auction will be borne by the customer. Please note that prices in the auction market are highly variable and typically not favorable compared to the normal market.

It is important to note, IB will not take into consideration any closing orders for short stock positions placed by the customer which may still be working. If your account holds a short position ten minutes prior to the end of the trading session and you have placed working orders to close those positions, there is the possibility your closing order will execute and that IB will act to close out your short position. In this situation you will be responsible for both executions and will need to manage your long position accordingly.

A fee of INR 2,000 will be charged for this manual processing in addition to any external penalties in the case of short stock positions resulting in auction trades. As such, we strongly urge customers to monitor their positions and take appropriate action themselves in order to avoid this.

Reg. SHO Short Sale Bid Test

Effective November 10, 2010, an amendment to SEC Reg. SHO goes into effect which will place certain restrictions on short selling when a given stock is experiencing significant downward price pressure. This amendment, referred to as the alternative uptick rule (Rule 201) introduces a circuit breaker which takes effect wherever the primary listing market declares that a stock has declined 10% or more from the prior day’s closing price.

Once the circuit breaker has been triggered, a Price Restriction is imposed which prohibits the display or execution of a short sale transaction if the order price is at or below the current national best bid. As a result, short sellers will not be allowed to act as liquidity takers when the Price Restriction applies and can only participate as liquidity providers adding depth to the market. Individuals owning and attempting to sell a security subject to a Price Restriction (i.e., long sellers) are afforded a priority over short sellers in that while they are similarly prohibited from displaying or executing a sale transaction at a price below the current national best bid, they may display or execute orders at the bid. Accordingly, long sellers are allowed to act as liquidity takers.

The Price Restriction will apply to all short sale orders in that security for the remainder of the day as well as the following trading day. Note that while the Price Restriction can only be triggered during regular trading hours, the restriction itself extends beyond regular trading hours on both the first and second days. In addition, there is no limit on the number of consecutive days in which a primary listing market can trigger a Price Restriction. If a stock currently subject to a Price Restriction again declines 10% or more from the prior day’s closing price, the restriction will be re-triggered for the remainder of that day as well as the following trading day.

Rule 201 applies to all National Market System (NMS) securities; that is, stocks listed on a U.S. stock exchange whether traded on an exchange or in the over-the-counter market. It does not apply to stocks which are traded only on the OTCBB and/or PINK nor stocks of U.S. companies which are executed on a non-U.S. exchange.

Example: Assume hypothetical stock XYZ closed yesterday at $10.00 and today reports a trade at $8.99 (down 10.1%) with a NBBO of $8.98 x $9.00. As the stock has declined by greater than 10%, the primary listing market would trigger the circuit breaker, effectively prohibiting the display or execution of a short sale order at $8.98 or less even if the order was a market order or had a limit price below $8.98. The short sale order may only be displayed or executed at $8.99 or higher (assuming the stock trades in one penny increments). A long sale order could only be displayed or executed at $8.98 or higher. This Price Restriction would remain in effect for the remainder of today and tomorrow (assuming no subsequent price declines of 10% or more).

Why does the "price" on hard to borrow stocks not agree to the closing price of the stock?

In determining the cash deposit required to collateralize a stock borrow position, the general industry convention is for the lender to require a deposit equal to 102% of the prior business day's** settlement price, rounded up to the nearest whole dollar and then multiplied by the number of shares borrowed. As borrow rates are determined based upon the value of the loan collateral, this convention impacts the cost of maintaining the short position, with the impact being most significant in the case of low-priced and hard-to-borrow shares. Note, for shares not denominated in USD the calculation will differ. Find below a table summarizing the calculations per currency:

| Currency | Calculation Method |

| USD | 102%; rounded up to the nearest dollar |

| CAD | 102%; rounded up to the nearest dollar |

| EUR | 105%; rounded up to the nearest cent |

| CHF | 105%; rounded up to the nearest rappen |

| GBP | 105%; rounded up to the nearest pence |

| HKD | 105%; rounded up to the nearest cent |

For US Treasuries and corporate bonds, the collateral amount on which the borrow fee is charged will include the accrued interest.

Account holders may view this adjusted price for a given transaction in the "Borrow Fee Details" section of the daily account statement. Two examples of this collateral calculation and its impact upon borrow fees are provided below.

Example 1

Sell short 100,000 shares of ABC at a price of $1.50

Short sale proceeds received = $150,000.00

Assume the price of ABC falls to $0.25 and the stock has a borrow fee rate of 50%

Short stock collateral value calculation

Price = 0.25 x 102% = 0.255; round up to $1.00

Value = 100,000 shares x $1.00 = $100,000.00

Borrow fee = $100,000 x 50% / 360 days in year = $138.89 per day

Assuming the account holder's cash balance does not include proceeds from any other short sale transaction then this borrow fee will not be offset by any credit interest on the short sale proceeds as the balance does not exceed the minimum $100,000 Tier 1 threshold necessary to accrue interest.

Example 2 (EUR denominated stock)

Sell short 100,000 shares of ABC at a price of EUR 1.50

Assume a prior business day's close price of EUR 1.55 and a borrow fee rate of 50%

Short stock collateral value calculation

Price = EUR 1.55 x 105% = 1.6275; round up to EUR 1.63

Value = 100,000 shares x 1.63 = $163,000.00

Borrow fee = EUR 163,000 x 50% / 360 days in year = EUR 226.38 per day

** Please note, Saturdays and Sundays are treated as a Friday and will use Thursday's settlement price to calculate the required deposit.