Informations relatives au processus de notification d'opérations sur titres d'IB

IB est informée par diverses parties des opérations sur titres effectives et annoncées, qu'elles aient un caractère obligatoire ou volontaire. Les clients seront informés selon les étapes suivantes :

Détermination du type d'opération sur titres - chaque action est enregistrée par nos systèmes et il sera déterminé s'il s'agit d'un événement à caractère obligatoire (pour lequel aucune action n'est requise de la part de l'actionnaire) ou d'un événement à caractère volontaire (à la suite duquel l'actionnaire peut choisir entre plusieurs options).

Détermination de la méthode de notification en fonction du type d'opération sur titres

- Événements obligatoires - IB enverra une notification générale à tous les détenteurs de positions d'actions, CFD, options ou contrats à terme afin de les informer qu'un événement à caractère obligatoire va se produire. Il s'agit d'événements tels que des fractionnements d'actions, des acquisitions et des détachements de dividendes en numéraire ou en actions.

- Événements volontaires - IB vérifiera au préalable les conditions de l'offre auprès du dépositaire ou de l'agent chargé de l'opération. Une fois les conditions confirmées, IB rendra l'offre disponible sur l'outil de sélection d'opération sur titres de votre section Gestion de compte (veuillez cliquez ici pour en savoir plus sur l'outil de sélection d'OST volontaire). Lorsqu'IB rend l'offre disponible, un ticket de notification est envoyé aux actionnaires éligibles. Les clients peuvent envoyer leur sélection directement via leur Gestion de compte à l'ouverture de la période. Veuillez noter que les détenteurs de CFD ne sont pas éligibles et n'ont donc pas la possibilité de sélectionner des événements volontaires. IB déterminera les ajustements correspondants pour les détenteurs de CFD, en se basant sur ses directives relatives aux opérations sur titres.

Remarque : La création d'un aperçu de sélection peut prendre plus de temps compte tenu du traitement manuel que cela implique.

Informations concernant les litiges en recours collectif

Compte tenu de la nature du modèle économique d'Interactive Brokers et des efforts que nous déployons pour que nos coûts restent bas, IB ne peut pas suivre, au nom de ses clients, le statut des recours collectifs contre la centaine de sociétés dont les titres sont tradés par nos clients et ne peut pas non plus fournir d'informations à ce sujet. Par ailleurs, Interactive Brokers ne participe pas à la procédure de recouvrement suite à des poursuites en recours collectif concernant des titres détenus par des clients Interactive Brokers. En règle générale, si une poursuite en recours collectif aboutit ou qu'un règlement amiable est trouvé, les actionnaires reçoivent un avis de demande envoyé par l'administrateur du recours collectif. Toutes questions relatives aux poursuites en recours collectif doivent être adressées aux représentants légaux du requérant.

Remarques générales sur les informations fournies

Veuillez noter que les informations relatives aux opérations sur titres effectives annoncées qui vous sont fournies relèvent d'un geste commercial visant à proposer à nos clients des informations que nous jugeons utiles. Les informations communiquées le sont à titre informel, IB ne peut donc garantir l'exactitude, ni la rapidité de diffusion des informations. Il peut arriver que les conditions d'une offre soient modifiées sans que ces informations soient communiquées aux clients. Il incombe au client de vérifier toutes les conditions de l'opération sur titres auprès d'une tierce partie - comme par exemple sur le site Internet de la société ou les communiqués de presse - avant de prendre une décision.

Arbitrage de fusions : trading de titres concernés par des annonces de fusion/acquisition

On appelle « arbitrage de fusions » le fait de réaliser des opérations de trading sur des valeurs mobilières pour lesquelles une fusion a été annoncée mais n'a pas encore eu lieu.

Lorsqu'une entreprise décide de prendre le contrôle d'une autre société cotée en bourse, le prix par action que la société acquéreuse doit accepter de payer pour la société cible est normalement plus élevé que le prix par action en vigueur sur le marché boursier. Cette différence de prix constitue une « prime d'acquisition ».

Après l'annonce des conditions d'acquisition, le prix de l'action de la société cible augmente. En règle générale, il reste cependant en dessous du prix spécifié dans les conditions de la prise de contrôle.

Exemple : L'entreprise A accepte d'acheter l'entreprise B. Avant l'annonce de rachat, les actions de l'entreprise B s'échangent sur le NYSE à 20 USD. Les termes du rachat précisent que l'entreprise A paiera 25 USD par action, en numéraire, à l'entreprise B. Peu de temps après l'annonce de la prise de contrôle, il ne serait pas inhabituel pour les actions de l'entreprise B de s'échanger sur le marché boursier à 24,90 USD (soit un prix plus élevé que celui auquel il s'échangeait mais représentant tout de même une réduction de 40 points de base par rapport au prix négocié dans le cadre de l'accord de prise de contrôle).

Deux raisons expliquent cette réduction :

- Bien que l'acquisition ait été annoncée, elle peut ne jamais aboutir (en raison de contraintes réglementaires ou de difficultés commerciales ou financières par exemple) ;

- Le coût des frais financiers liés à la détention d'actions de la société cible

Si la société acquéreuse est cotée en bourse, la prise de contrôle peut également pendre la forme d'un accord sur la base d'un « ratio fixe » par lequel la société acquéreuse achète la société cible en échange d'une proportion fixe d'actions. Lorsqu'une acquisition sur la base d'un ratio fixe est annoncée, le prix des actions de l'entreprise cible sera lié au prix de l'action de la société acquéreuse.

Exemple : L'entreprise C, dont l'action vaut 10 USD, accepte d'acquérir l'entreprise D, dont l'action vaut 15 USD. Les termes de l'accord stipulent que deux actions de l'entreprise C seront payées pour une action de l'entreprise D. Peu de temps après l'annonce de la prise de contrôle, il ne serait inhabituel que les actions de l'entreprise D s'échangent à 19,90 USD, même si deux actions de l'entreprise C valent actuellement 20 USD

Comme pour un accord en numéraire, le prix de trading de l'entreprise cible offrira généralement une réduction par rapport au prix proposé dans l'accord en raison des obstacles et frais financiers qui peuvent intervenir. Cet écart peut également être affecté par les différences entre les dividendes perçus par rapport aux dividendes dus pour la durée de l'accord et en raison des difficultés liées à l'emprunt d'actions de l'acquéreur. Il peut arriver que les prises de contrôle prennent la forme de ratios flottants d'actions, ou qu'elles soient délimitées par des seuils autour d'un ratio flottant action pour action. Il existe également des fusions combinant actions et numéraire qui requièrent que les détenteurs de l'entreprise cible fassent un choix. Par rapport à un accord classique basé sur un échange en numéraire ou sur la base d'un ratio fixe, ce type d'accord complique la corrélation des prix de l'action entre entreprises acquéreuses et entreprises cibles. De plus, elles requièrent des stratégies de trading spécifiques très élaborées.

Que ce soit pour les accords de fusion en numéraire ou sur la base d'un ratio fixe, la réduction sur le prix du marché de l'entreprise cible tend à diminuer à mesure que la date effective de l'accord approche et passe par différentes étapes importantes telles que la mise en place du financement, la validation des actionnaires et des dispositifs réglementaires. En règle générale, le jour où la prise de contrôle a lieu, il ne restera pratiquement rien de la réduction.

Les stratégies habituelles d'arbitrage de fusions tentent de tirer profit de l'écart d'arbitrage entre le prix actuel d'échange de l'action d'une entreprise absorbée et l'éventuel prix négocié. Dans le cas d'une prise de contrôle en numéraire, une transaction d'arbitrage de fusion consiste à acheter des actions de l'entreprise cible lorsque le prix d'échange des actions de l'entreprise cible est inférieur au prix négocié, en espérant que la fusion aura bien lieu et que les actions de l'entreprise cible augmenteront à hauteur du prix négocié. Dans le cas d'une prise de contrôle sur la base d'un ratio fixe, une transaction d'arbitrage consiste à acheter les actions de l'entreprise cible et de vendre simultanément à découvert les actions de l'entreprise acquéreuse lorsque les actions de l'entreprise cible tradent à un prix réduit par rapport à celui spécifié dans les termes de l'accord, selon les calculs de prix de l'action de l'entreprise et le ratio spécifié dans l'accord. Dans tous les cas, le trader espère que la fusion aura lieu et qu'il gagnera de l'argent lorsque la réduction du prix négocié s'effacera.

Bien entendu, si un trader estime que le marché réagit trop positivement à la perspective d'un accord, il peut adopter des positions inverses à celles décrites ci-dessus - vendant à découvert les actions de l'entreprise cible et achetant potentiellement les actions de l'acquéreur.

Comme pour toutes stratégies de trading, les stratégies d'arbitrage de fusion comportent des risques.

Les stratégies d'arbitrage de fusion longues décrites ci-dessus seront avantageuses si la prise de contrôle a effectivement lieu. Si en revanche la prise de contrôle est retardée ou annulée (ou si des rumeurs de retard ou d'annulation circulent), ces stratégies peuvent générer des pertes qui dans certains cas peuvent atteindre des montants supérieurs à l'investissement de départ. Les stratégies d'arbitrage de fusions longues peuvent générer des pertes si la fusion a lieu, avec des risques de pertes conséquentes si une contre-offre est faite sur l'entreprise cible.

Cette communication vous est fournie uniquement à titre d'information et ne constitue ni une recommandation ni une sollicitation d'achat ou de vente de titres. Le trading d'actions d'entreprises concernées par des opérations de fusion annoncée est intrinsèquement risqué. Vous devez vous tenir informé des conditions et risques qu'implique la transaction proposée avant de prendre une décision de trading. Les clients sont tenus entièrement responsables de leurs décisions de trading.

How to Use the Voluntary Corporate Action Election UI - Withdraw Submitted Elections

Once your election for a voluntary corporate action has been submitted to the agent ("street"), the elected positions will be transferred by an internal booking to a new symbol to await the final allocation. At this point, the elected position will be considered "committed".

In the event a voluntary corporate action offering period is extended, the company will announce whether shares which had previously been submitted may be withdrawn from such election. In the event this is available, we will re-open the corporate action election window and will modify the shares from Committed / Unavailable to Committed / Available.

Shares which are reflected on the Voluntary CA Election UI as Committed / Available may be modified by reducing the election quantity for the previously submitted election choice (in the case of a single account) or by selecting Remove All Allocations (in the case of a multi-tiered account structure).

Once updated, a new election may be made either within the same log-in session or by returning at a later point prior to the deadline for elections.

Please know that shares for which a withdrawal has been requested will be returned to the target symbol and will become available for trading again once we have confirmed the withdrawal with the agent. This may take up to 24 hours. Should you not see a change in the symbol within your statement or through the trading platforms, please contact Customer Service directly.

Information: How Interactive Brokers processes a partial call of a US security

A partial call is when securities are redeemed for cash by the issuer prior to the maturity date of the instrument. Callable securities include bonds and preferred stocks. The issuer will announce the record date of the call at which time holders of settled positions may become subject to the call.

The US depository (DTCC) will run an allocation algorithm and assign called lots to brokers. While the issuer may announce a redemption ratio, there is no guarantee that the depository will assign the call to every broker holding the called issue at the defined date.

Upon receipt of the call information Interactive Brokers will run an impartial lottery in an attempt to assign the call evenly to all account holders whose positions have been determined to be against the position held at the depository It is important to note that while an account may be long shares, a portion of those shares may be lent or in some other way not considered part of Interactive Broker’s free position at the depository. As such those shares will not be considered when determining the allocation of the call. Also, when determining the final allocation, IB will attempt, but cannot guarantee, that the processing of a partial call does not result in an account holding a position which is less than a round lot. For instance, if Interactive Brokers is called for 2,000 bonds and the assignment of the partial call to a holder of 1,000 bonds would result in the holder being unable to close the resulting position, the holder may be excluded from the allocation process. Such exclusion may result in a holder being assigned on the call for a higher percentage of their bonds than the issuer has announced.

Assignment of calls will be handled shortly after the announcement by the depository. Customers will have the assigned position moved to a contra-symbol to await allocation of the funds to the account.

Dividend Tax Withholding on Depository Receipts

In the event an account holds a dividend paying depository receipt, at the time of the dividend payment taxes will be withheld. In several jurisdictions, IB is unable to efficiently comply in an electronic, straight-through manner with the required beneficial owner disclosure requirements. As such, dividends on depository receipts where full beneficial owner disclosure is required in order to receive beneficial tax treatment will be withheld at the maximum tax rate applicable.

Shareholders will not be eligible for reduced tax treatment on the allocation of cash through IB. All shareholders should consult their tax advisor for information on how to obtain a tax refund or tax credit for such activity.

Merger Arbitrage: Trading in Companies Involved in Pending Mergers/Acquisitions

Trading the securities of companies involved in announced but as-yet incomplete mergers is known as “Merger Arbitrage.”

When a company decides to assume control of a public company, the per-share price that the acquiring company must agree to pay for the target company is typically greater than the prevailing per-share stock price on the public exchange. This price difference is known as the “takeover premium.”

After the takeover terms are announced, the share price of the target company rises, but typically continues to hover somewhat below the price specified in the takeover terms.

Example: Company A agrees to purchase Company B. Prior to the takeover announcement, Company B’s shares trade on the NYSE for $20.00 per share. The deal terms specify that Company A will pay $25.00 in cash per share of company B. Shortly after the deal is announced, it would not be unusual to see Company B’s stock trading at $24.90 – higher than it had been trading, but still a 40 basis point discount versus the agreed upon deal price.

There are two primary reasons for this discount:

- While the takeover has been announced, it may never be completed, because of, e.g., regulatory, business, or financing difficulties; and,

- The interest cost of holding the target company’s shares.

If the acquiring company is a public company, the takeover deal may also be structured as a “Fixed Ratio” deal, where the acquiring company pays for the target company in a fixed ratio of its shares. Once a fixed-ratio acquisition deal is announced, the stock price of the target company’s shares will become a function of the acquiring company’s stock price.

Example: Company C, whose stock price is $10.00, agrees to acquire Company D, whose stock price is $15.00. The deal terms specify that two shares of Company C will be paid per share of Company D. Shortly after the deal is announced, it would not be unusual to see Company D’s stock trade at $19.90 on the stock exchange, even though two shares of Company C are currently worth $20.00 in cash.

As with a cash deal, the trading price of the target company will typically be at a discount to that implied by the deal ratio because of potential deal roadblocks and interest costs. This spread can also be influenced by differences in dividends received versus dividends owed over the expected life of the deal, and also by difficulties in borrowing the acquirer’s shares. (Sometimes takeovers are structured using floating ratios of stock, or with collars around a floating stock-for-stock ratio. There are also mergers that use combinations of stock and cash that require an election by holders of the target company. Such deals will make the relationship between the acquiring company and target company stock prices much more complicated than for standard, plain vanilla “cash” and “fixed ratio” takeover deals), and require very specific, intricate trading strategies.

For both Cash and Fixed Ratio takeover deals, the discount on the open market price of the target company tends to shrink as the closing date of the deal approaches and the deal progresses through various milestones such as the successful receipt of financing and shareholder and regulatory approval. Typically any discount largely disappears by the day that the takeover is completed.

Standard merger arbitrage trading strategies attempt to capture the spread between the current trading price of an acquired company and the eventual deal price. In the case of a Cash takeover, the standard Merger Arbitrage trade is to buy shares of the target company when the open-market price of the target company’s shares is lower than the deal price, hoping that the deal will successfully close and the target company’s shares will rise to the deal price. In the case of a Fixed Ratio takeover, the standard Merger Arbitrage trade is to buy shares of the target company and simultaneously short shares of the acquiring company when the shares of the target company are trading at a discount to the price specified in the takeover terms, as calculated by the companies’ current stock prices and the deal’s specified ratio. In both cases, the trader hopes that the deal will close, making money as the discount to the deal price decays.

Of course, if a trader believes that the market is too sanguine about a deal’s prospects, he could execute the opposite of the trades described above – shorting shares of the target and potentially buying shares of the acquirer.

As with all trading strategies, Merger Arbitrage strategies contain inherent risk.

The long merger arbitrage strategies described above are designed to profit if a takeover successfully closes; but, if the takeover is delayed or cancelled – or even rumored to be delayed or cancelled – these strategies risk losing money, in some cases more money than the original investment. The short merger arbitrage strategies risk losing money if the deal is completed, with significant loss potential if there is a sweetened offer for the target company.

This communication is provided for information purposes only and is not intended as a recommendation or a solicitation to buy or sell securities. Trading in shares of companies involved in announced mergers is inherently risky. You should make yourself aware of the terms and risks of the proposed transaction before making any trading decision. Customers are solely responsible for their own trading decisions.

Information regarding mandatory corporate actions which result in fractional shares

If your account has been approved for trading fractions and a US corporate action issues fractional shares, the fractional shares will remain in your account. However, if your account does not have permissions to trade in fractions or the corporate action is issuing non-US shares or non-eligible US shares the fractional shares will be liquidated. The processing of the liquidation will typically be done within one day of the processing of the action.

Please be aware that IBKR holds all positions in street name. As such, corporate actions which may include a round up privilege whereby a broker may request that each holder of a fractional position be rounded up will not be supported by IBKR. All such actions which result in a fractional share will be liquidated as cash. The resulting cash will be the equivalent to the value of the resulting fractional shares.

Overview of the OneChicago NoDiv Contract

The OneChicago NoDiv single stock futures contract (OCX.NoDivRisk) differs from the Exchange's traditional single stock futures contract by virtue of its handling of ordinary distributions (e.g., dividends, capital gains, etc.). Whereas the traditional contract is not adjusted for such ordinary distributions (the discounted expectations are reflected in the price), the NoDiv contract is intended to remove the risk of dividend expectations through a price adjustment made by the clearinghouse. The adjustment is made on the morning of the ex-date to ensure that the effect of the distribution is removed from the daily mark-to-market or cash variation pay/collect.

For example, assume a NoDiv contract which closes at $50.00 on the business day prior the ex-date at which stockholders of a $1.00 dividend are to be determined. On the ex-date OCC will adjust that prior day's final settlement price from $50.00 downward by the amount of the dividend to $49.00. The effect of this adjustment will be to ensure that the dividend has no impact upon the cash variation pay/collect as of ex-date close (i.e., short position holder does not receive the $1.00 variation collect and the long holder incur the $1.00 payment).

ADR Conversion Process

An American Depository Receipt (ADR) is a physical certificate evidencing ownership of American Depository Shares (ADS). An ADS is a US dollar denominated form of equity ownership in a non-US company. The ADS represents the foreign shares of the company held on deposit by a custodian bank in the company's home country and carries the corporate and economic rights of the foreign shares, subject to the terms specified on the ADR certificate.

Holders of the underlying ordinary shares may request to convert these shares into an ADR. Similarly, holders of an ADR may request to convert to the underlying ordinary shares.

Interactive Brokers will offer this conversion for the shares listed here.

Submitting Shares for Conversion

In order to request a conversion, either underlying to ADR or ADR to underlying, account holders may utilize IBKR's Voluntary Election Tool.

To access the tool, an individual account holder may:

- Log in to Portal

- Click Help to the right of the Welcome avatar in the top right corner and click Support Center.

- Scroll down to the Information & Tools section and select Corporate Actions Manager.

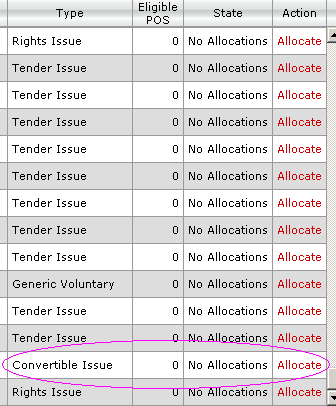

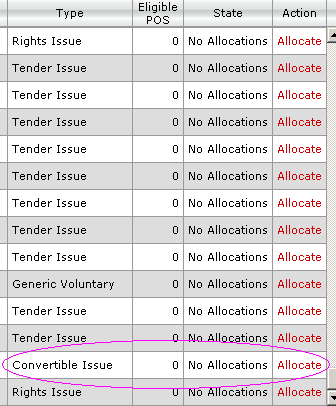

- Select the Conversions tab from the table of corporate action types.

- From the table, locate the security you wish to act upon and select Allocate from the far right of the table

To access the tool, an institutional account holder may:

- Log in to Portal

- Click Help > Support > Corporate Actions Manager.

- Select the Conversions tab from the table of corporate action types.

- From the table, locate the security you wish to act upon and select Allocate from the far right of the table

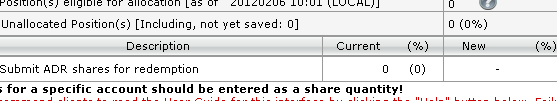

Once selected, a new screen will launch which will provide information on the terms of the conversion offer. Once you have reviewed the terms, you may submit an election.

Please note: Fees will be assessed for an ADR conversion request. While the overview description will provide an estimate of the fees, the final amount the account will be charged is dependent on the processing fee assessed by the agent at the time of the action and therefore the estimate is subject to change.

Frequently Asked Questions

Is there a minimum value required for conversion?

IBKR does not require a minimum value of ADRs or underlying shares to proceed with a conversion.

I do not see my ADR/common shares in the list of positions available for conversion.

In the event the security is not listed within the table, clients may submit an Inquiry Ticket. Within the ticket, please indicate the security you wish to convert and the number of shares. Upon receipt, IBKR will review the request and provide information on whether the action will be made available.

When can I expect my new shares after I submit my conversion request?

Once the elected shares are settled in the account, a request will be forwarded to the processing agent. While many requests will be completed within 1 to 2 business days, as the processing is dependent third party agents in various regions this is an estimate only and a given conversion may take additional time. Upon receipt of the new shares, the position will be allocated to the account.

What will happen once I submit my election?

Once the election has been submitted, a request will be forwarded to the processing agent. The shares submitted for conversion will be moved to a contra-symbol in the account which is non-marginable and non-tradeable. The shares will remain in this location until the conversion has been completed. Account holders should review their accounts to ensure the account will remain in margin compliance during the processing.

How will I know the fee associated with the conversion?

Initially the estimated fee per share will be provided in the description of the conversion. Account holders will be responsible for calculating the fee themselves based on this information. All voluntary conversions will be charged a commission of USD 500, plus a pass thru of external costs. Conversions on programs that are terminating will be charged a commission of USD 500 plus a pass through of external costs up to the delisting date. For 30 days following delisting, the commission is USD 0 plus a pass through of external costs. The commission returns to USD 500 plus a pass through of external costs more than 30 days following a delisting.

I have negotiated a rate with the ADR issuer for conversion. How can I ensure that this is the fee I am charged?

In the event an account holder has negotiated a specific rate, please supply the details of the rate as well as a contact name and phone number within an Inquiry Ticket. IBKR will review the details and once confirmed, ensure that the applicable fee is deducted from the account.

Can I convert unsettled shares?

No. Only settled shares may be submitted to the processing agent for conversion.

Dividend withholding procedures for foreign stocks traded in Japan

Foreign stocks listed for trading in Japan which issue dividends will have the cash dividend allocation subject to an increased withholding tax rate. The tax will vary based on the domicile of the stock issuing the dividend; however in general the withholding rate will be the highest withholding rate applicable and will not incorporate a reduction based on prevailing tax treaties.

This treatment is due to the tax reporting status of Interactive Brokers's clearing agent. As our clearing agent is unable to process the relevant tax declaration documentation which would allow for the application of tax withholding at a reduced rate, shareholders will be subject to the highest rate.

In order to avoid the application of the tax withholding on the dividends of foreign stocks, positions in such dividend paying stocks should be closed prior to the ex-dividend date.

We recommend that customers consult with their tax advisor for assistance in determining the eligibility, if any, for a tax credit on this withholding.

A list of foreign stocks and their applicable rates is provided below. Please be aware that the below is for informational purposes only and may not include all stocks which may be subject to the higher withholding rates.

| Stock Code | Stock Name | DividendTax Rate |

| 9399 | Xinhua Finance Limited | N/A |