Request for Payment (RFP)

What is Request for Payment?

Request for payment is a message that you could send via IBKR and its supporting bank to your bank to trigger a real-time credit transfer directly to your IBKR account. Your bank will prompt you via push notification or e-mail to review and approve the payment request. Upon receiving your approval, your bank will send a real-time credit transfer directly to IBKR's bank and IBKR will credit your account. Real-time payments are done on a new 24x7x365 payments platform managed by The Clearing House and available to all federally insured U.S. depository institutions.

Who is eligible to use Request For Payment?

Real-time payment eligibility depends on your bank's capability to accept the request. U.S. depository institutions are actively preparing to accept RFPs and most are expected to be able to accept requests in the coming months.

What is the transaction amount limit?

The request for payment limit is determined by your bank. Initially limits are expected to be modest (approximately $5,000 to $10,000), but are expected to increase in the future. The RTP network's current credit transfer limit is $1,000,000

How long does it take for the funds to be credited to my account?

Under normal circumstances you should receive the prompt to approve the request for payment and, upon approval, the funds would be credited to your account and available to trade within a few minutes or faster.

How to deposit HUF to Interactive Brokers

What are Giro/RTGS (Viber) transfers and International Bank Transfers (SWIFT) for HUF?

There are two different transfer methods available for transferring HUF depending of the location of your bank.

GIRO/ RTGS VIBER (domestic) transfers are available at banks located in Hungary for bank-to-bank transfers while banks located outside of Hungary will likely offer International Bank Transfers (SWIFT).

Giro /RTGS (Viber) payments

The Hungarian Internal Clearing System (ICS) operated by GIRO Zrt. is a payment system for the interbank clearing of domestic HUF transfers and direct debits. It is a "Real Time Gross Settlement" system called VIBER.

Banks that are connected to it will allow you to transfer HUF quickly and inexpensively between banks located in Hungary. It will be required to know the Bank Code, Branch Code and Account number of the receiving party.

You do not necessarily have to select GIRO or RTGS (VIBER) in your online banking. Your bank may call it "Bank-To-Bank transfer" or "domestic payment method" using the details mentioned above.

SWIFT payment

The Society for Worldwide Interbank Financial Telecommunication - SWIFT - is a network that allows banks to communicate financial information securely.

SWIFT payments are offered by most banks for international money transfers, and involve a series of banks which work together to make sure your money arrives at your account.

If you transfer HUF from a financial institution outside of Hungary, the payment would likely be routed via a correspondent bank located in Hungary before reaching your account. Such payments are known as cross-border payments and often take more time to complete because of the complexity associated with involving multiple banks.

Bank transfers can take time to complete, particularly when it comes to cross-border payments, because of the complexity associated with involving multiple bank in the payment chain.

Processing bank transfers involves a number of steps, particularly for cross-border payments. These are sent via the correspondent banking network and typically pass between several different banks along the way. After being initiated, a wire transfer is sent by the debtor agent to an intermediary bank before moving on to the creditor agent. Once these steps are complete, the recipient will receive their funds.

There are a number of reasons why cross-border payments may be delayed or held up. First, not all account balances can be updated outside of the operating hours of local settlement systems. Delays can also arise if compliance checks need to be carried out, especially when a payment passes through different countries and jurisdictions.

Difference between domestic and international bank transfers

Banks make a domestic transfer to send funds to financial institutions residing in the same country or financial zone. When sending funds to financial institutions in a foreign country or financial zone, banks have to make an international bank transfer. The differences between these two bank transfers affect the number of fees banks charge and the duration it takes to complete the transfer.

How long does it usually take for my funds to arrive?

|

Payment Type |

Timing |

Approximate Cost* |

|

Giro payment |

same day up to 1 business day |

free of cost or very low cost |

|

International bank transfer (SWIFT) |

from 1 to 4 business days |

vary by bank |

*Please consult with the sending institution about the costs to process your payment as this may vary by financial institution. IBKR does not charge fees for the deposit of funds.

IBKR credits funds real-time upon receipt. Please note that we do not have influence on the speed of transfer. Please consult with your bank regarding their processing times.

Payments that are subject to additional review may take longer to credit.

現金劃轉

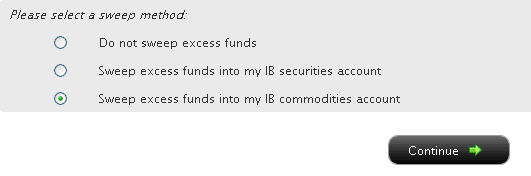

該等法規還要求所有證券交易和相關保證金交易均在全能賬戶的證券賬戶段進行,而商品交易則在商品賬戶段進行。1 雖然法規允許將全額支付的證券持倉以保證金抵押品的形成存放在商品賬戶段進行托管,但IB幷不允許這種操作,從而對抵押權應用了更爲嚴格的SEC限制性規則。鑒于相關法規和政策已對持倉應歸于哪個賬戶段作出了規定,現金是唯一可由客戶自行决定在兩個賬戶段之間來回轉帳的資産。

下方爲現金劃轉選項、選擇步驟和注意事項相關的說明。

然後,您可點擊您想要的劃轉方式對應的單選按鈕,然後選擇〝繼續〞按鈕。您的選擇將從下一個工作日起生效,幷將一直有效,直到選擇其它選項爲止。請注意,只要滿足上文中提到的交易許可設置,您可隨時更改劃轉方式,沒有次數限制。

“信用限制期”內的存款是否可以獲得利息?

答案取决于存款方式。 對于通過ACH進行的存款,利息從存款到達當日起便開始計算,資金記入賬戶前爲期四個工作日的信用限制期都會持續計息。對于銀行支票以外的支票存款,在信用限制期內不産生利息。銀行支票和電匯會在收到後立即記入賬戶,因此不受任何信用限制期的影響。

您收到的利息因市况而异。 有關當前向貸方餘額支付利息的信息,請參閱 www.interactivebrokers.com/interest

How to Deposit JPY to Interactive Brokers

Account holders depositing from a local Japanese bank should send funds via domestic fund transfer.

Please see below for more information regarding how to deposit funds into an IBSJ account.

Instructions for how to deposit JPY into your IBSJ account

A deposit notification will be required. It is recommended that you always enter a deposit notification before arranging a fund transfer with your bank.

Account holders can notify IBKR of an incoming fund transfer by entering a deposit notification in Client Portal by selecting Transfer & Pay followed by Transfer Funds and Make a Deposit.

Local bank transfers should use 'Domestic Bank Transfer.' Overseas accounts able to send JPY should use 'International Transfer.'

Banking instructions will be provided after submitting a deposit information. It is recommended that you always confirm that the banking instructions registered with your bank match those which are provided when creating a deposit notification.

Contact your bank and confirm how to complete a fund transfer using the provided bank instructions.

IMPORTANT: A deposit notification instructs your intent to send funds to your IBSJ account. Notifications DO NOT move any funds. Please arrange with your bank to send funds to your IBSJ account.

What methods can I use to fund my IBSJ account with JPY?

Local - Clients sending funds from a local Japanese domestic bank should send funds via domestic fund transfer.

International - Deposits from overseas bank accounts must use the 'International Transfer' method to send JPY to their IBSJ account. Confirm procedures with your sending institution on how to send an international wire using the provided banking instructions.

For both methods, account holders should confirm fees and procedures with their bank before sending funds. IBSJ is not responsible for fees charged by your bank.

What information does my bank need to transfer funds?

Local - Local Japanese banks will need the IBSJ bank, bank code/branch code, bank account title & address, and 7-digit destination bank account number/VAN*.

*A VAN (Virtual Account Number) is a bank account number assigned specifically to you for domestic fund transfers. It should be used exclusively for deposits initiated by yourself and should not be shared with anyone else. A VAN will not be used for international fund transfers

International - International transfers require IBSJ's bank information, SWIFT code, bank account title & address, and 10-digit bank account number. Be sure to include your name and U-account number in the memo/reference field of the transfer details. Failure to include this information may delay the arrival of funds to your account.

Contact Client Services should additional information or assistance be required.

What information does IBKR need to transfer funds?

Please create a deposit notification as instructed above.

If funds are sent without a deposit notification, proof of deposit may be requested to credit the funds to your account.

How long does it take for my funds to arrive into my IBSJ account?

Local - Your Japanese bank's daily cutoff times may affect the funds' arrival.

Should clients miss the daily deadline set by their bank, the funds should arrive the next business day. Please confirm this information with your Japanese bank.

International - The arrival of funds may take longer when sending JPY from an international bank via International Transfer (up to 3-4 business days in some cases).

Be sure to include your name and U-account number in the memo/reference field of the transfer details. Failure to include this information may delay the arrival of funds to your account.

Confirm that you have entered a matching deposit notification for your transfer. The arrival of funds may be delayed if funds are sent without a matching deposit notification.

| Payment Type | Timing | Approximate Cost | ||

| Domestic | Same day/following business day | Free to a few hundred Yen | ||

| International (SWIFT) | 1 to 4 business days | Varies by bank |

As costs vary by institution, please consult with the sending institution about the costs incurred to process your payment. IBKR does not charge fees for the deposit of funds.

IBKR credits funds to accounts in real-time upon receipt. Please note that we do not have any control over the speed/processing of your fund transfer. You may consider consulting your bank regarding processing times.

Payments that are subject to review may take longer to credit to the account.

Are third-party deposits into my IBSJ account permitted?

Funds must be sent from a bank account held in your name. Funds sent from an account using a different name will be considered third-party and will be rejected.

Does IBSJ charge for deposits?

IBSJ does not charge a handling fee for deposits.

Related fees (including, but not limited to: transfer fees, rejection fees, etc.) are to be paid by the account holder. IBSJ is not responsible for fees incurred due to rejected deposits.

Can I use a fund transfer service such as Wise or Revolut?

Fund transfer services, including Wise and Revolut, cannot be used for funding your IBSJ account. Please use a bank wire to send funds to an IBSJ account.

How to Deposit SGD to Interactive Brokers

How do I deposit SGD to Interactive Brokers?

IBKR's bank account for SGD is held in Singapore and is eligible to receive SGD transfers via domestic bank transfer (e.g. FAST) or international bank transfer (SWIFT). If your bank account is held with a local Singapore bank they will usually process SGD transfers as a domestic local transfer while clients with bank accounts outside of Singapore will use an international bank transfer (SWIFT).

We will provide you the SGD bank routing information upon completing the deposit notification in Client Portal. IBKR will provide you our bank account title and bank account number which are usually required for domestic SGD transfers from an account held in Singapore. SWIFT code will be provided for international bank transfers from a bank account held outside of Singapore. A SWIFT code is generally not required for domestic SGD transfers.

Please include your brokerage account number in the template you setup with your bank.

How long will it take for my SGD transfer to arrive?

The timing for SGD deposits varies based on the payment network your bank uses to transfer the funds.

|

Payment Type |

Timing |

Approximate Cost* |

|

Local SGD Transfer |

1 business day |

free of cost or very low cost |

|

SWIFT |

from 1 to 4 business days |

vary by bank |

*Please consult with the sending institution about the costs to process your payment as this may vary by financial institution. IBKR does not charge fees for the deposit of SGD.

Note

- IBKR credits funds real-time upon receipt under normal circumstances.

- We do not have influence on the speed of transfer. You may consult with the sending institution regarding their processing times and cut off times. Transfers that are subject to additional review may take longer to credit.

Request for Payment (RFP)

What is Request for Payment?

Request for Payment (RFP) is a message that you could send via IBKR and its supporting bank to your bank to trigger a real-time credit transfer directly to your IBKR account. Your bank will prompt you via push notification or e-mail to review and approve the payment request. Upon receiving your approval, your bank will send a real-time credit transfer directly to IBKR's bank and IBKR will credit your account. Real-time payments are done on a new 24x7x365 payments platform managed by The Clearing House and available to all federally insured U.S. depository institutions.

Who is eligible to use Request For Payment?

Real-Time Payment (RTP) eligibility depends on your bank's capability to accept the request. U.S. depository institutions are actively preparing to accept RFPs and most are expected to be able to accept requests in the coming months.

What is the transaction amount limit?

The Request for Payment limit is determined by your bank. Initially limits are expected to be modest (approximately $5,000 to $10,000), but are expected to increase in the future. The RTP network's current credit transfer limit is $1,000,000.

How long does it take for the funds to be credited to my account?

Under normal circumstances you should receive the prompt to approve the Request for Payment and upon approval, the funds would be credited to your account and available to trade within a few minutes or faster.

How to Deposit NOK to Interactive Brokers

What are SWIFT and RTGS transfer methods for NOK?

IBKR is able to receive NOK transferred via international bank wire (SWIFT) or RTGS (Real Time Gross Settlement payments system) to deposit NOK to your account, no matter if your bank is located within or outside of Norway.

Typically your bank may call those transfers just regular wire transfers, electronic bank transfers or bank-to-bank transfers and may not distinct between international bank wire versus RTGS. You may want to consult with your bank for further information

about the transfer system they use to facilitate your payment.

SWIFT payment

The Society for Worldwide Interbank Financial Telecommunication - understandably shortened to SWIFT - is a network that allows banks to communicate financial information securely.

SWIFT payments are offered by most banks, for international money transfers, and involve a series of banks which work together to make sure your money arrives at your account.

If you transfer NOK from a financial institution outside of Norway, they may require to use a so called intermediary or correspondent bank to route the payment through, before reaching your account and they are called cross-border payments.

Bank transfers can take time to complete, particularly when it comes to cross-border payments. Clients are increasingly accustomed to a payments experience that feels instant. But making a payment to another country can be much more complex and time-consuming.

Processing bank transfers involves a number of steps – particularly for cross-border payments. These are sent via the correspondent banking network and typically pass between several different banks along the way. After being initiated, a wire transfer is sent by the debtor agent to an intermediary bank before moving on to the creditor agent. Once these steps are complete, the recipient will receive their funds.

There are a number of reasons why cross-border payments may be delayed or held up. Firstly, not all account balances can be updated outside the operating hours of local settlement systems. Delays can also arise if compliance checks need to be carried out, especially when a payment passes through different countries and jurisdictions.

RTGS payment

RTGS stands for Real Time Gross Settlement and is the fastest way to sent money from one bank account to another within the country. Banks charges fees for this real time settlement, that vary by bank.

RTGS method is mostly used for transaction of high value. Its a system where there is continuous and real-time settlement of fund-transfers. You may not be able to select this transfer method in your online banking screen.

It is rather a system your bank will use in the background to transfer your funds upon your request if the funds are transferred within the country. You may consult with your bank which payment system they use to transfer funds.

How long does it usually take for my funds to arrive?

|

Payment Type |

Timing |

Approximate Cost* |

| RTGS | Same day to 1 business days | Low cost, vary by bank |

|

International bank transfer (SWIFT) |

from 1 to 4 business days |

vary by bank |

*Please consult with the sending institution about the costs to process your payment as this may vary by financial institution. IBKR does not charge fees for the deposit of funds.

Note! IBKR credit funds real time upon receipt under normal circumstances. Please note that we do not have influence on the speed of transfer. You may consult with the sending institution regarding their processing times and cut off times. Payments that are subject to additional review may take longer to credit.

通過Wise進行注資

通過與Wise進行合作,IBKR能够在您登錄IBKR平臺期間,爲您提供以下的服務:

- 把您的IBKR賬戶與WISE賬戶關聯進行注資

- 把IBKR不直接支持的貨幣(例如羅馬尼亞列伊(RON)、保加利亞列弗(BGN)、馬來西亞令吉(MYR)、印度尼西亞盧比(IDR))從您的本地銀行轉帳至Wise,然後在Wise將其兌換成IBKR支持的貨幣(例如歐元(EUR)、美元(USD)等)存入您的IBKR賬戶。

- 從現有的Wise餘額向您的IBKR賬戶轉帳以及從IBKR賬戶轉回Wise

Wise與IBKR賬戶只需要建立一次關聯。您只能與您名下的Wise賬戶進行關聯。

如這是您首次使用Wise注資方式,您將會收到與Wise賬戶關聯的提示。

所需時間方面,從您的本地銀行轉帳資金至Wise可能需要幾個小時至幾個工作日,然後需要最多一整個工作日把資金從Wise轉至您的IBKB賬戶,具體時間視乎不同貨幣而定。

資金從您的Wise賬戶轉出之後,需要幾個小時至一整個工作日才會到達您的IBKR賬戶,具體時間視乎幣種而定。

您可從IBKR賬戶提取支持的幣種(例如歐元(EUR)、美元(USD))轉帳至您的Wise賬戶。

How to Deposit DKK to Interactive Brokers

What transfer method can I use to fund my account in DKK?

IBKRs bank account for DKK is held with our Danish Bank and is eligible to receive DKK via RTGS (Real Time Gross Settlement) or International Bank Transfer (SWIFT).

IBKR does currently not support domestic transfer methods (local bank to bank transfer).

What Information does my bank need to transfer funds?

IBKR will provide you with our IBAN (International Bank Account Number) and the SWIFT code of our bank account upon completing the deposit notification in Client Portal.

If your bank is located in Denmark, they may ask you to provide local bank account details. Please explain that our account is not eligible for local bank to bank transfers and let them advise you on how to transfer funds using our IBAN/SWIFT. IBKR is working to implement local bank transfers, however we cannot provide you a date at this time when it will be available.

If your bank is located outside of Denmark, your bank will typically process payments via international bank wire (SWIFT) or the RTGS payment method. Your online banking will likely show Wire, electronic bank transfer or bank-to-bank transfer as available methods.

Your bank will select the method to transfer your funds on your behalf.

SWIFT payment

The Society for Worldwide Interbank Financial Telecommunication - SWIFT - is a network that allows banks to communicate financial information securely.

SWIFT payments are offered by most banks for international money transfers, and involve a series of banks which work together to make sure your money arrives at your account.

If you transfer DKK from a financial institution outside of Denmark, they may require the use of a so called intermediary or correspondent bank to route the payment through before reaching your account. These are called cross-border payments.

Bank transfers can take time to complete, particularly when it comes to cross-border payments. Clients are increasingly accustomed to a payments experience that feels instant, but making a payment to another country can be much more complex and time-consuming.

Processing bank transfers involves a number of steps – particularly for cross-border payments. These are sent via the correspondent banking network and typically pass between several different banks along the way. After being initiated, a wire transfer is sent by the debtor agent to an intermediary bank before moving on to the creditor agent. Once these steps are complete, the recipient will receive their funds.

There are a number of reasons why cross-border payments may be delayed or held up. Not all account balances can be updated outside the operating hours of local settlement systems. Delays can also arise if compliance checks need to be carried out, especially when a payment passes through different countries and jurisdictions.

RTGS payment

Kronos2 is Denmark National Bank's RTGS (Real-Time-Gross-Settlement) system for payments in Danish Krona and it is primarily used for settlement of large-value, time-critical interbank payments. You may consult with your bank which system they use to facilitate your payment.

You will typically not be given a choice on which method your bank will use to transfer your funds, and it depends as well on the size of payments, the banks involved in the transfer and what service your bank offers.

Difference between domestic and international bank transfer

Banks make a domestic wire transfer to send funds to financial institutions residing in the same country or financial zone. When sending funds to financial institutions in a foreign country or financial zone, banks have to make an international bank transfer. The differences between these two bank transfers affect the number of fees banks charge and the duration it takes to complete the transfer.

How long does it usually take for my funds to arrive?

|

Payment Type |

Timing |

Approximate Cost* |

| RTGS | same to 1 business day | vary by bank |

|

International bank transfer (SWIFT) |

from 1 to 4 business days |

vary by bank |

*Please consult with the sending institution about the costs to process your payment as this may vary by financial institution. IBKR does not charge fees for the deposit of funds.

Please note: IBKR credits funds real-time upon receipt under normal circumstances. Please note that we do not have influence on the speed of transfer. You may consult with the sending institution regarding their processing times and cut off times. Payments that are subject to additional review may take longer to credit.