查找ACATS转账的账户号码

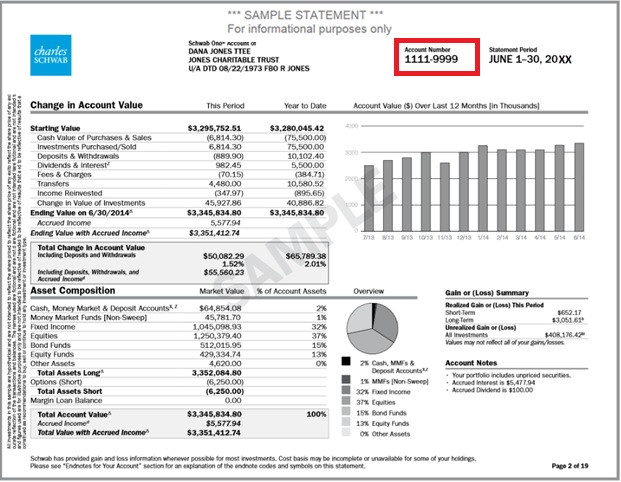

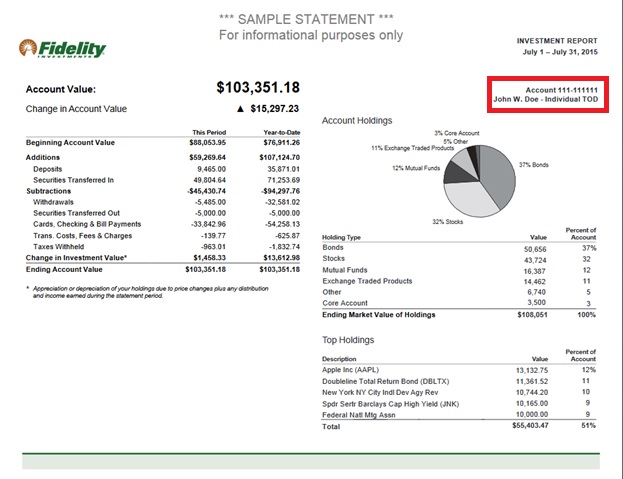

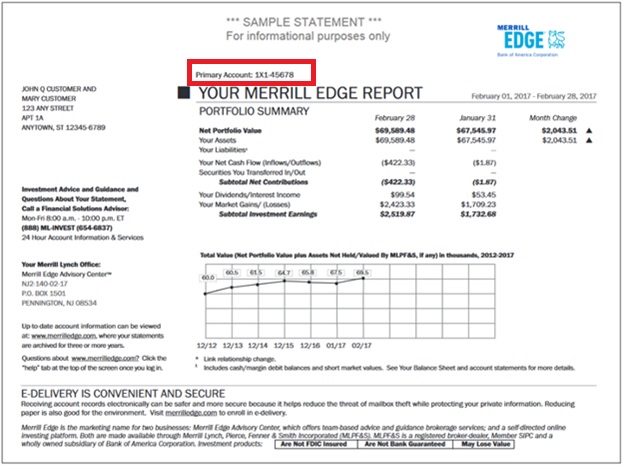

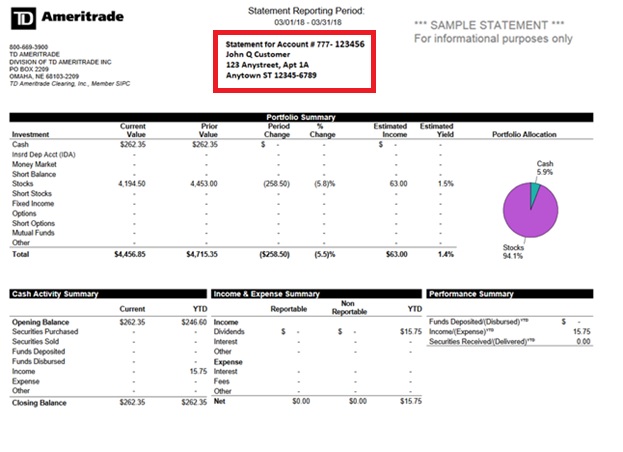

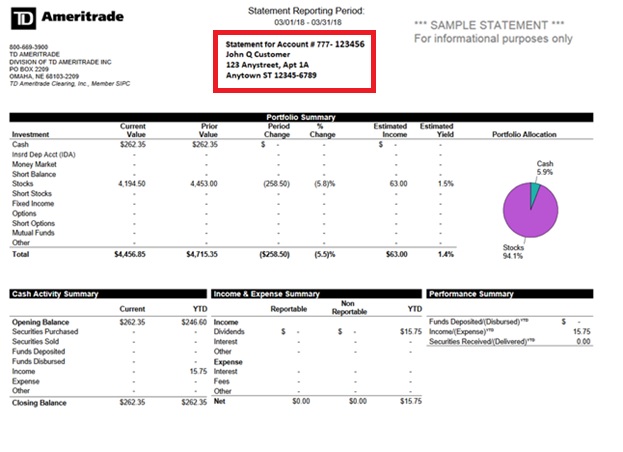

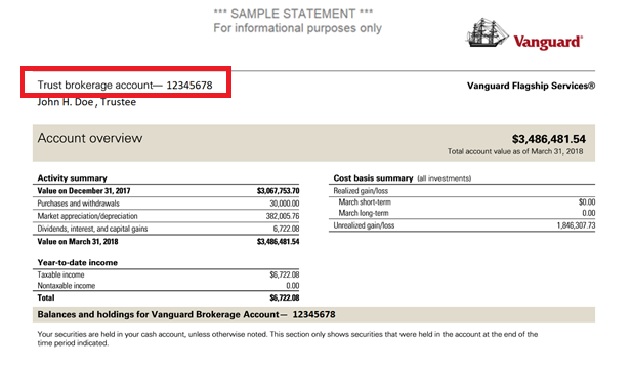

为了让您的ACAT或ATON转账顺利完成,您的经纪商必须对申请上提供的账户号码进行验证。如果账户号码无效,则经纪商会拒绝您的申请。IBKR建议客户看一下自己的经纪报表确认账户号码,下方为比较常见的几家经纪商的报表样本,红色方框标出的地方就有账户号码信息。

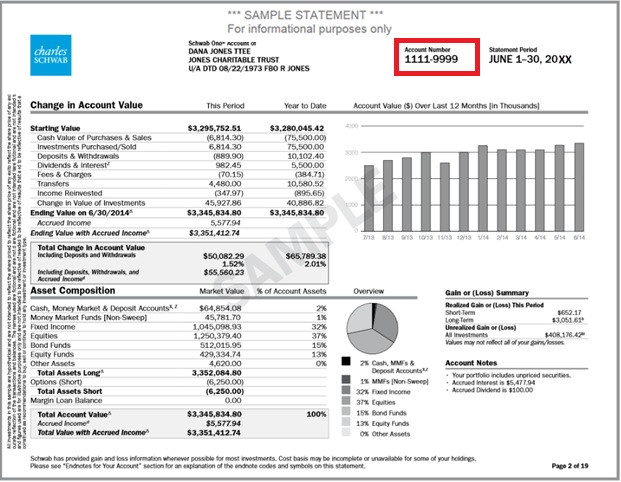

Charles Schwab - 经纪商#0164。账户号码采用8位字符,全部为数字。

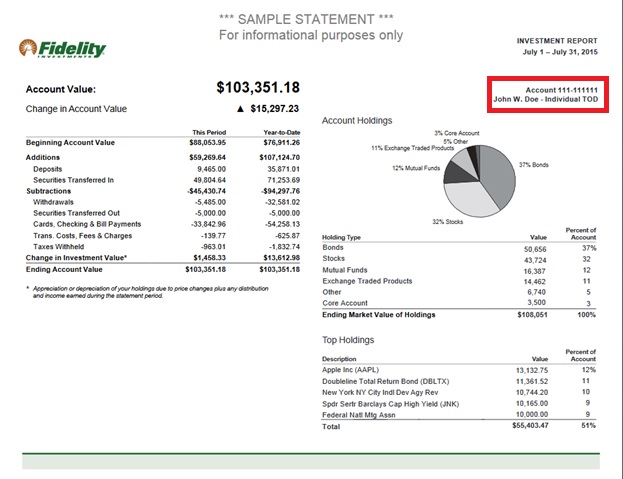

Fidelity Investments - 通过National Financial Services(经纪商#0226)提供。账户号码采用9位字符,前3位为字母数字,后6位为数字。

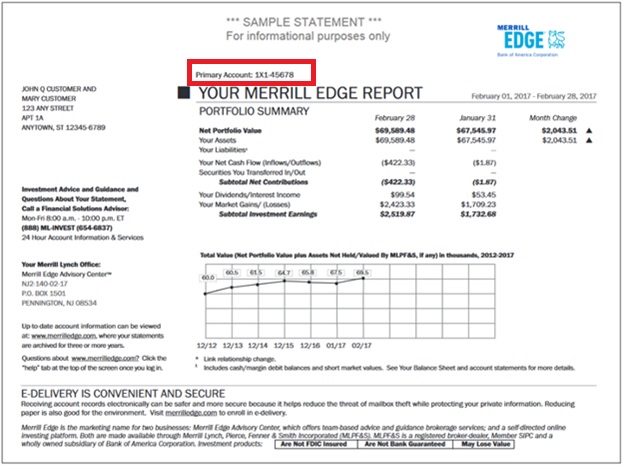

Merrill Edge - 经纪商#0671。账户号码采用8位字符,为字母数字组合。

TD Ameritrade - 经纪商#0188。账户号码采用9位字符,全部为数字。

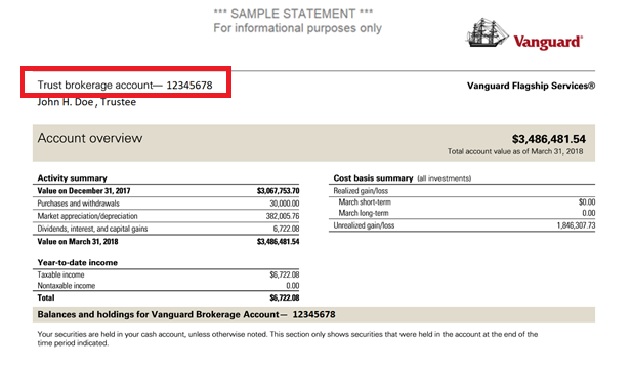

Vanguard- 经纪商#0062。账户号码采用8位字符,全部为数字。

注:本文所有经纪商报表样本图片仅出于解释说明的目的列出,其中包含的商标属于各自经纪商的财产。

美国微型市值股票限制

简介

为遵守非注册证券卖出相关法规、最小化非公开报价证券交易过程中的人工处理,IBKR对美国微型市值股票实施了一定限制。下方列出了该等限制以及与此话题相关的其它常见问题。

微型市值股票限制

- IBKR将只接受来自符合条件之客户的美国微型市值股票转账。符合条件的客户包括:(1) 资产(转账前或转账后)不低于500万美元的账户,或资产规模不低于2000万美元的财务顾问的客户;并且(2) 美国微型市值股票投资占比不到其账户资产的一半。

- IBKR将只接受符合条件的客户能够确认股票系从公开市场买入或已在美国证监会(SEC)进行过注册的美国微型市值股票的大宗转账1;

- IBKR不接受客户被OTC标记为“买者自负”或“灰色市场”的美国微型市值股票转账1或开仓委托单。持有该等股票仓位的客户可以进行平仓;

- IBKR不接受为了回补在IBKR的空头仓位而进行的美国微型市值股票转账;

- 仅执行客户(即只通过IBKR执行交易,但在别处清算)不能在其IBKR账户中交易美国微型市值股票。(IBKR可对在美国注册的经纪商例外对待);

微型市值股票常见问题

什么是美国微型市值股票?

“微型市值股票”是指市值介于5000万美元到3亿美元之间并且价格低于5美元一股的(1) 场外交易股票或(2) Nasdaq和NYSE American挂牌股票。就该政策而言,微型市值股票包括市值等于或低于5000万美元的美国上市公司股票,这种股票有时也被称为纳级股或者是在与微型市值股票相关的市场上交易。

为避免股价短期小幅波动导致股票被反复重新分类,所有被分类为美国微型市值股的股票只有在其市值和股价连续30天均分别超过5亿美元和5美元的情况下才会重新分类。

微型市值股票通常股价很低,常常被称为仙股。IBKR也可设置例外,包括对股价低但近期市值上涨的股票。此外,IBKR不会将非美国公司的ADR视作微型市值股票。

微型市值股票在哪里交易?

微型市值股票通常在OTC市场而非全国性证券交易所交易。其通常由做市商在OTC系统(如OTCBB)和OTC Markets Group管理的市场(如OTCQX、OTCQB和Pink)以电子方式报价。该类别下还包含非公开报价的股票和被指定为“买者自负”、其它OTC或“灰色市场”的股票。

此外,美国监管部门也将在Nasdaq和NYSE American挂牌、价格等于或低于5美元一股且市值等于或低于3亿美元的股票视为微型市值股票。

如果IBKR收到来自符合条件之客户的转仓,其中一个或多个仓位是微型市值股票,会怎么样?

如果IBKR收到包含微型市值股票的转仓,IBKR有权限制其中任何微型市值股票仓位的卖出,除非符合条件的客户能够提供适当的文件证明该等股票系在公开市场买入(即通过其它经纪商在交易所买入)或者该等股票已经根据S-1或类似股票注册声明表在美国证监会进行过注册。

符合条件的客户可以通过提供经纪商给出的能够反映股票买入交易的经纪报表或交易确认来证明股票确实是在公开市场上买入。符合条件的客户也可以通过提供其股票在美国证监会(Edgar系统)进行注册的备案号(以及任何可证明股票就是注册声明上所列股票的文件)来证明股票已经过注册。

注意:所有客户随时都可转出我们对其实施了限制的股票。

IBKR对主经纪账户有什么限制?

活动包含主经纪服务的客户只在IBKR同意接受的来自其执行经纪商的交易方面被视为符合条件的客户。然而,尽管主经纪账户可以在IBKR清算美国微型市值股票,但在IBKR确认股票根据上述程序可以卖出之前,相关股票将受到限制。

要为在公开市场上买入的股票移除限制,请让执行经纪商提供有公司抬头的签字函件或正式账户报表,证明股票系从公开市场买入。提供的函件或报表必须包含以下信息。如果股票是通过发行取得,则函件必须提供相关注册声明文件或链接并说明该等股票是发行股票的一部分。

经纪商函件必须包含的信息:

1) IBKR账户号码

2) IBKR账户名称

3) 交易日期

4) 结算日期

5) 代码

6) 买卖方向

7) 价格

8) 数量

9) 执行时间

10) 交易所

11) 必须有签字

12) 必须有公司正式抬头

简而言之:如果多头仓位不再受到限制则可以接受卖出多头交易。卖出空头交易可以接受。买入多头交易可以接受,但仓位将被限制,直到向合规部门提供足够资料将限制移除。不接受买入补仓交易和日内轧平交易。

如果您买入的股票被重新分类为“灰色市场”或“买者自负”股票怎么办?

如果您在IBKR账户中买入的股票之后被分类为“买者自负”或“灰色市场”股票,您将可以继续持有仓位、平仓或转仓,但无法增加持仓。

我账户中微型市值股票交易受到限制的原因是什么?

您被限制交易微型市值股票的主要原因有两个:

- 与发行方存在潜在关联:美国证监会规则144对发行人的关联方交易股票(包括微型市值股票)有一定限制。如果IBKR发现微型市值股票交易活动或持仓接近规则144规定的交易量阈值(“规则144阈值”),则IBKR会限制客户交易该微型市值股票,直到完成合规审查。

- 微型市值股票转仓:如果客户近期将微型市值股票转入其IBKR账户,IBKR会限制客户交易该证券,直到完成合规审查。

如果符合其中一种情况,相关证券交易会受到限制,客户会在账户管理的消息中心下收到相应通知。该通知将说明限制的原因以及客户为了解除限制必须采取的措施。

为什么IBKR将我视为微型市值股票发行方的潜在关联方?

“关联方”是与发行方存在控制关系的人士,如执行官、董事或大股东。

规则144适用于包括微型市值股票在内的所有证券。但是,鉴于交易微型市值股票涉及高风险,如果客户的微型市值股交易和/或持仓接近规则144阈值,IBKR将限制客户交易该微型市值股票。 该等限制在合规对客户的潜在关联方身份进行审核并作出决定之前将保持生效。

对于潜在关联方审核,为什么我需要要求每两周进行一次新的审核?

客户的关联方身份可能会在IBKR完成上述潜在关联方审核后很快发生变化。因此,IBKR认为如果客户的的微型市值股交易和/或持仓仍然接近规则144阈值,每两周刷新一下潜在关联方审核较为合适。

哪里可以查看IBKR指定为美国微型市值股的股票列表?

请打开以下链接:www.ibkr.com/download/us_microcaps.csv

请注意,此列表每日更新。

哪里可以了解更多有关微型市值股票的信息?

有关微型市值股票的更多信息,包括其相关风险,请参见美国证监会网站:https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1包括任何方式的转账(如ACATS、DWAC、FOP)、通过“南向(Southbound)”转账将加拿大挂牌股票转成美国股票的转换、为回补空头仓位进行的转账、在其它经纪商执行但在IBKR清算的IB主经纪服务客户等。

Locating your account number for ACATS transfers

In order for your ACAT or ATON transfer to be completed successfully, your broker must validate the account number provided on the request. If the account number is invalid, your broker will reject the request. IBKR recommends that clients review a copy of their brokerage statement to confirm their account number and has provided statement samples below from some of the more common brokers highlighting where this information can be found.

Charles Schwab - Broker #0164. Account Number convention is 8 characters, all numeric.

Fidelity Investments - Delivers through National Financial Services, Broker #0226. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric.

Merrill Edge - Broker #0671. Account Number convention is 8 characters, combination of alpha and numeric.

TD Ameritrade - Broker #0188. Account Number convention is 9 characters, all numeric.

Vanguard- Broker #0062. Account Number convention is 8 characters, all numeric.

Note: This article contains images of sample broker statements which are for illustrative purposes only and which may contain logos that remain the property of each of those brokers.

U.S. Microcap Stock Restrictions

Introduction

To comply with regulations regarding the sale of unregistered securities and to minimize the manual processing associated with trading shares that are not publicly quoted, IBKR imposes certain restrictions on U.S. Microcap Stocks. A list of those restrictions, along with other FAQs relating to this topic are provided below.

Microcap Restrictions

- IBKR will only accept transfers of blocks of U.S. Microcap stocks from Eligible Clients. Eligible Clients include accounts that: (1) maintain equity (pre or post-transfer) of at least $5 million or, clients of financial advisors with aggregate assets under management of at least $20 million; and (2) have less than half of their equity in U.S. Microcap Stocks.

- IBKR will only accept transfers1 of blocks of U.S. Microcap Stocks where the Eligible Client can confirm the shares were purchased on the open market or registered with the SEC;

- IBKR will not accept transfers1 of or opening orders for U.S. Microcap Stocks designated by OTC as Caveat Emptor or Grey Market from any client. Clients with existing positions in these stocks may close the positions;

- IBKR will not accept transfers of U.S. Microcap Stocks to cover a short position established at IBKR;

- Execution-only clients (i.e., execute trades through IBKR, but clear those trades elsewhere) may not trade U.S. Microcap Stocks within their IBKR account. (IBKR may make exceptions for U.S.-registered brokers);

Microcap FAQs

What is a U.S. Microcap Stock?

The term “Microcap Stock” refers to shares (1) traded over the counter or (2) that are listed on Nasdaq and NYSE American that have a market capitalization of between $50 million to $300 million and are trading at or below $5. For purposes of this policy, the term Microcap Stock will include the shares of U.S. public companies which have a market capitalization at or below $50 million, which are sometimes referred to as nanocap stocks or trade on a market generally associated with Microcap Stocks.

To avoid situations where minor, short-term fluctuations in a stock price cause repeated reclassification, any stock classified as U.S. Microcap will remain in that classification until both its market capitalization and share price exceed $300 million and $5, respectively, for a 30 consecutive calendar day period.

As Microcap Stocks are often low-priced, they are commonly referred to as penny stocks. IBKR may make exceptions, including for stocks traded at low prices that recently had a greater market cap. In addition, IBKR will not consider ADRs on non-US companies to be Micro-Cap stocks.

Where do Microcap Stocks trade?

Microcap Stocks typically trade in the OTC market, rather than on a national securities exchange. They are often electronically quoted by market makers on OTC systems such as the OTC Bulletin Board (OTCBB) and the markets administered by the OTC Markets Group (e.g., OTCQX, OTCQB & Pink). Also included in this category are stocks which may not be publicly quoted and which are designated as Caveat Emptor, Other OTC or Grey Market.

In addition, U.S. regulators also consider stocks listed on Nasdaq or NYSE American trading at or below $5 with a market capitalization at or less than $300 million to be Microcap Stocks.

What happens if IBKR receives a transfer from an Eligible Client where one or more of the positions transferred is a Microcap Stock?

If IBKR receives a transfer containing a block of a Microcap stock, IBKR reserves the right to restrict the sale of any Microcap position(s) included in the transfer unless the Eligible Client provides appropriate documentation establishing that the shares were either purchased on the open market (i.e., on a public exchange through another broker) or were registered with the SEC pursuant to an S-1 or similar registration statement.

Eligible Clients can prove that shares were purchased on the open market by providing a brokerage statement or trade confirm from a reputable broker reflecting the purchase of the shares on a public exchange. Eligible Clients can establish that the shares are registered by providing the SEC (Edgar system) File number under which their shares were registered by the company (and any documents necessary to confirm the shares are the ones listed in the registration statement).

NOTE: All customers are free to transfer out any shares we have restricted at any time.

What restrictions will IBKR apply to Prime accounts?

Clients whose activities include Prime services are considered Eligible Clients solely for the purposes of those trades which IBKR has agreed to accept from its executing brokers. However, while Prime accounts may clear U.S. Microcap Stocks at IBKR, those shares will be restricted until such time IBKR confirms that the shares are eligible for re-sale under the procedures discussed above.

To remove the restriction for shares purchased on the open market, please have the executing broker provide a signed letter on company letterhead or an official Account Statement stating that the shares were purchased in the open market. The letter or statement must also include the below required criteria. Alternatively, if the shares were acquired through an offering the letter or statement must provide documents or links to the relevant registration statement and state that the shares were part of it.

Required Broker Letter Criteria:

1) IBKR Account Number

2) IBKR Account Title

3) Trade Date

4) Settlement Date

5) Symbol

6) Side

7) Price

8) Quantity

9) Time of Execution

10) Exchange

11) Must be signed

12) Must be on Firm's official letterhead

To summarize: Sell Long trades will be accepted if the long position is no longer restricted. Sell Short trades will be accepted. Buy Long trades will be accepted and the position will be restricted until Compliance is provided with sufficient information to remove the restriction. Buy Cover trades and intraday round trip trades will not be accepted.

What happens if a stock you purchase gets reclassified as Grey Market or Caveat Emptor?

If you purchase a stock in your IBKR account that at a later date becomes classified as a Caveat Emptor or Grey Market stock, you will be allowed to maintain, close or transfer the position but will not be able to increase your position.

What are some of the reasons why Microcap Stock trading may be restricted in my account?

There are two primary reasons why you might be restricted from trading in a Microcap Stock:

- Potential Affiliation to Issuer: U.S. Securities and Exchange Commission (“SEC”) Rule 144 places certain limitations on trading of stocks (including Microcap Stocks) by an “affiliate” of the issuer. If IBKR observes trading activity or holdings in a Microcap Stock that are close to the trading volume thresholds under Rule 144 (“Rule 144 Thresholds”), IBKR may restrict the customer from trading the Microcap Stock until a compliance review is completed.

- Transfer of Microcap Stock: If the customer has recently transferred a Microcap Stock into their IBKR account, IBKR may restrict the customer from trading in that security until a compliance review is completed.

If one of the above reasons apply, trading will be restricted in the security and a notification will be sent to the customer’s message center in Account Management. This notification will describe the reason for the restriction and the steps the customer must take before IBKR will consider lifting the restriction.

Why does IBKR consider me to be a potential affiliate of a Microcap Stock issuer?

An “affiliate” is a person, such as an executive officer, a director or large shareholder, in a relationship of control with the issuer.

Rule 144 applies to all securities, including Microcap Stocks. However, given the heightened risks associated with trading Microcap Stocks, if a customer’s trading and/or holdings in a Microcap Stock are close to the Rule 144 Thresholds, IBKR will restrict the customer’s trading in the Microcap Stock. This restriction will remain in effect pending a compliance review into the customer’s potential affiliate status.

For the Potential Affiliate review, why do I need to ask for a new review every two weeks?

A customer’s affiliate status may change soon after IBKR completes the above-referenced Potential Affiliate review. As such, IBKR believes it is appropriate to refresh a Potential Affiliate review every two weeks if a customer’s trading activity and/or holdings in the Microcap Stock remain close to the Rule 144 Thresholds.

Where can I find a list of stocks that IBKR has designated as U.S. Microcaps?

A list of stocks designated as U.S. Microcaps by IBKR is available via the following link: www.ibkr.com/download/us_microcaps.csv

Note that this list is updated daily.

Where can I find additional information on Microcap Stocks?

Additional information on Microcap Stocks, including risks associated with such stocks may be found on the SEC website: https://www.sec.gov/reportspubs/investor-publications/investorpubsmicrocapstockhtm.html

-----------------------------------------------------------

1This includes transfers by any method (e.g., ACATS, DWAC, FOP), conversion of Canadian listings to their U.S. equivalent via “Southbound” transfer, transfers to cover existing short positions, IB Prime customers executing with other brokers and clearing to IBKR, etc.

ACATS Transfer Guide (US brokerage account transfers)

ACATS Transfer Guide

Introduction

Understanding the basic facts about transferring accounts between US brokerage firms can be help to avoid delays. Through this article and other Knowledge Database resources, Interactive Brokers seeks to assist with your incoming and outgoing ACATS requests.

US brokerage firms utilize a standardized system to transfer customer accounts from one firm to another. Known as the Automated Customer Account Transfer Service or ACATS, the process allows assets to move seamlessly between brokerage firms in a unified time frame. ACATS transfers are facilitated by a third party, the National Securities Clearing Corporation (NSCC), to assist participating members with timely asset transfers.

ACATS Transfer Benefits

The majority of assets may be transferred between US brokerage firms and some banks through ACATS. This standardized system includes stocks, US corporate bonds, listed options, unit investment trusts, mutual funds, and cash. Information on assets eligible for transfer is provided at "Assets Eligible..." Though impacted by multiple factors and time constraints, the accepted or rejected transfers finalize within 10 business days in most cases.

Navigating The Process

4 simple steps of the ACATS process will help you understand the flow and minimize delays. Familiarizing yourself with the transfer process helps to ensure a successful transition.

1. Incoming or Outgoing

Incoming ACATS Transfers

The financial institution that is receiving your assets and account transfer is known as the "receiving firm." Investors always work with and through the "receiving firm" to move full or partial account assets into a new broker.

Contact the "receiving firm" (Interactive Brokers) to review the firm's trading policies and requirements. You should verify that your assets are eligible for trading at the "receiving firm" before initiating the transfer request. Not all ACATS transferable assets are acceptable for trading at every brokerage firm.

Outgoing ACATS Transfers

All outgoing ACATS transfers, full or partial, must be approved by the "delivering firm." Investors, however, should work with and through the "receiving firm" in order to begin the the transfer process or to status the progress of the request.

2. Initiating Your Transfer

Investors must always begin the ACATS transfer with the "receiving firm." An ACATS transfer form or Transfer Initiation Form (TIF) must be submitted. The "receiving firm" takes your reqeust and communicates with the "delivering firm" via ACATS. The process begins with this request for transfer of the account.

For your Interactive Brokers Account, the transfer is usually submitted online. Video instruction on submitting the transfer is provided at "How to deposit funds via a full ACATS/ATON Transfer." or through Step-by-step instructions.

Note: Outgoing account transfers from your IB account should be directed to the other broker. Your request will be submitted to IB from the other broker through the ACATS electronically.

3. What to Expect

Your Account

Brokers ensure the safety and security of transfer requests by only authorizing requests between open accounts that meet the following criteria:

- Same Account Title

- Same Tax ID Number

- Same Account Type

Transfer Approval

Ultimately responsible for validating the transfer, the "delivering firm" may accept information from the "receiving firm" correcting data originally entered. Approved or validated requests result in the delivery of positions to the "receiving firm" for their acceptance. Assets may not be accepted by the "receiving firm" for the following:

- Non-marginable or Margin (credit) violation

- Not Tradable

- DTC Chill

Note: The most common reasons for ACATS rejections are outlined by clicking here.

Processing Time-frame

The processing time for each transfer request is fixed. In general, approved transfers complete within 4 to 8 business days. Almost all transfers complete within 10 business days. Each firm is required to perform certain steps at specific intervals in the process. Feel free to review the Full ACATS transfer process flow.

Fees

While Interactive Brokers does not charge a fee to transfer your account via ACATS, some brokers do apply a fee for full and partial transfers. Prior to initiating your transfer, you should contact the "delivering firm" to verify any charge.

4. Who To Contact For Help

Interactive Brokers Customer Service stands poised to assist with your incoming ACATS transfer reqeust. Click here for Customer Service contact resources.

Note: Outgoing or ACATS transfers sending accounts to another broker should be directed to the "receiving firm." Their Account Transfer Group will work with Interactive Brokers directly to complete your outgoing request.

Free of Payment (FOP) Transfers

Free of Payment (FOP) is term used by IB to refer to a process of transferring long US securities between IB and another financial institution (e.g. bank, broker or transfer agent) through the Depository Trust Company (DTC).

The FOP transfer method is often used when:

1. The delivering form is not a DTC ACAT (Automated Customer Account Transfer) Participant.

2. The customer would like to expedite the delivery of their securities. The processing time frame for securities transferred via FOP may, in certain instances, be less than that associated with an ACATS transfer.

The following steps are to be followed in order to create a FOP notice:

1. Log into Account Management.

2. Select Funding or Funds Management and then Position Transfers.

3. From the drop-down list, select the Transfer Method: Free of Payment.

4. Select the applicable transaction Type: Deposit or Withdraw.

5. In the case of a FOP Withdrawal, the steps are as follows:

- Select the Destination to whom the securities are being transferred.

- Enter your account number of the Third Party Broker Acount Information.

- Specify the security (Stock, Warrants or US Bonds).

- Enter the Symbol, Shares and the Exchange (optional) and click Add.

- Provide your electronic signature authorizing the transfer request and clicking on the Continue button.

- Verify your identity by entering your password and clicking on the Confirm Request button;

- If your account is enrolled in the Secure Transaction Program (STP), the processing of your request will take place once you enter your confirmation code and click on the Confirm Request button. If not STP enrolled, your request will be subject to security verification, requiring that you contact our Customer Service Center to validate your identity and request.

6. In the case of a FOP Deposit, the steps are as follows:

- Select the Source to whom the securities are being transferred.

- Enter your account number of the Third Party Broker Acount Information.

- Specify the security (Stocks, Warrants or US Bonds).

- Enter the Symbol, Shares and the Exchange (optional) and click Add.

- Provide your electronic signature authorizing the transfer request and clicking on the Continue button.

- A printable version of the FOP request is made available should your transferring firm require an authorization form.

7. Transfer requests are typically completed within five business days.

IMPORTANT NOTE:

While IB does not assess a fee to process FOP transfers, other firms may and we therefore recommend that you confirm with the contra-firm their policies in this regard prior to submitting a request. In the event a contra-firm does charge a fee to IB, the fee will be passed to the IB account holder.

Assets eligible to be transferred through ACATS

Instruments handled by the ACATS system include the following asset classes: equities, options, corporate bonds, municipal bonds, mutual funds and cash. It should be noted; however, that ACATS eligibility does not guarantee that any given security will transfer as each receiving broker maintains its own requirements as to which asset classes as well as securities within a particular asset class it will accept.

Account holders are encouraged to use the Contract Search link on IB’s homepage to assess transfer eligibility prior to initiating a full account transfer request. In the case of mutual funds, please click here for a list of fund families and funds offered by IB.

How do I transfer my US securities positions from my current broker to IB?

Broker to broker transfers for US securities are conducted via a process known as the Automated Customer Account Transfer Service or ACATS. This process generally takes between 4 to 8 business days to complete in order to accommodate the verification of the transferring account and positions. The request is always initiated via the receiving broker (IB in this case) and can be prompted by following the steps below.

1. Log into Account Management and select the Transfer & Pay and then Transfer Positions menu options.

2. From the Transaction Type drop-down list select 'Inbound Position'

3. From the Method drop-down list select 'ACATS'.

4. Enter the sending Broker Information in the fields provided, and click CONTINUE

5. In the Transaction Information section, indicate whether or not you wish to transfer all assets and select Yes to the authorization option.

a. Note that a "transfer all assets" election does not require that you specify any assets as an attempt will be made to transfer your account in its entirety. Account holders should note, however, that certain positions may not be on the list of securities eligible to trade at IB and others, while transferable, may be subject to a house margin requirement higher than that of the delivering broker. In the event IB receives an asset list from the delivering broker which includes ineligible positions or the aggregate of the positions transferred are such that a margin deficit would exist were the transfer to occur, IB will attempt to contact you to remedy the situation within the allocated time frame after which an automatic reject of the full transfer would take effect. Account holders may wish to minimize potential delays or problems associated with a ‘Full’ transfer request by verifying security eligibility and margin requirements via the Contract Search link located at the upper right hand corner of the IB homepage prior to initiating the transfer.

b. If you elect to not "transfer all assets", the system will require that you specify the positions you wish to transfer. Click Add Asset to add the positions you wish to transfer. Fill out the Asset Search and Transaction Information sections and click Continue.

6. On the page that appears, type your signature in the Signature field, and then click CONTINUE.

Click BACK to modify the transfer request.

Please note that brokers generally freeze the account during the transfer period to ensure an accurate snapshot of assets to transfer and may restrict the transfer of option positions during the week prior to expiration. You may wish to check with the delivering broker to verify their policy in this regard. In addition, please note if your IB account is currently maintaining positions on margin, any cash withdrawals or adverse market moves could increase the likelihood that your account falls out of margin compliance during the transfer period which may delay or prevent completion of the transfer.

IMPORTANT NOTICE

Applicants may meet the initial account funding requirement through the transfer of securities positions and/or cash via the ACATS system.