U.S. Securities Options Exercise Limits

INTRODUCTION

Option exercise limits, along with position limits (See KB1252), have been in place since the inception of standardized trading of U.S. securities options. Their purpose is to prevent manipulative actions in underlying securities (e.g., corners or squeezes) as well as disruptions in option markets where illiquidity in a given option class exists. These limits serve to prohibit an account, along with its related accounts, from cumulatively exercising within any five consecutive business day period, a number of options contracts in excess of the defined limit for a given equity options class (i.e., option contracts associated with a particular underlying security). This includes both early exercises and expiration exercises.

OVERVIEW

U.S. securities option exercise limits are established by FINRA and the U.S. options exchanges. The exercise limits are generally the same as position limits and they can vary by option class as they take into consideration factors such as the number of shares outstanding and trading volume of the underlying security. Limits are also subject to adjustment and therefore can vary over time. The Options Clearing Corporation (OCC), the central clearinghouse for U.S. exchange traded securities options, publishes a daily file with these limits on its public website. The link is as follows: http://www.optionsclearing.com/webapps/position-limits. FINRA Rule 2360(b)(4) addresses exercise limits and can be found via the following website link: http://finra.complinet.com/en/display/display.html?rbid=2403&record_id=16126&element_id=6306&highlight=2360#r16126).

Note that exercise limits are applied based upon the the side of the market represented by the option position. Accordingly, all exercises of call options over the past five business days are aggregated for purposes of determining the limit for the purposes of purchasing the underlying security. Similarly, a separate computation whereby all put exercises over the past five business days are aggregated is required for purposes of determining sales of the underlying.

IMPORTANT INFORMATION

It's important to note that while exercise limits may be set at levels identical to position limits, it is possible for an account holder to reach an exercise limit without violating positions limits for a given option class. This is because exercise limits are cumulative and one could conceivably purchase options up to the position limit, exercise those options and purchase additional options which, if allowed to be exercised within the five business day window, would exceed the limit.

Account holders are responsible for monitoring their cumulative options exercises as well as the exercise limit quantities to ensure compliance. In addition, IB reserves the right to prohibit the exercise of any options, regardless of their intrinsic value or remaining maturity, if the effect of that exercise would be to violate the exercise limit rule.

Ликвидация по истечении

Вдобавок к политике принудительной ликвидации клиентских позиций в случае создавшегося дефицита маржи, IB также может ликвидировать позиции на основании истечения контрактов, которое может привести к излишнему риску и/или операционным сложностям. Примеры подобных случаев приведены ниже.

Исполнение опциона

IB оставляет за собой право запретить исполнение опционов на акции и/или закрыть позиции по ним, если их исполнение или назначение приведет к дефициту маржи. Несмотря на то, что покупка опциона, в основном, не требует маржи, поскольку позиция оплачивается полностью, владелец счета обязан либо целиком покрыть стоимость образовавшейся после исполнения длинной позиции по акциям (когда "колл" исполняется на наличном счете или у акций 100%-ная маржа), либо прoфинансировать длинную/короткую позицию по акциям (когда "колл"/"пут" исполняется на маржевом счете). Если на счете недостаточно средств до исполнения, то он подвергается избыточному риску в случае неблагоприятного изменения цены андарлаинга перед доставкой. Без финансовой защиты подобный риск ярко выражен и может сильно превзойти любую стоимость "в деньгах", имеющуюся у длинного опциона; особенно по истечении, когда клиринговые дома автоматически исполняют их, начиная уже с $0,01 за акцию.

Возьмем, к примеру, счет, капитал которого в 1-ый день составляет 20 длинных опционов "колл" (по гипотетическим акциям XYZ, цена которых при экспирации составляла $1 за контракт) с ценой страйка $50 и ценой андерлаинга $51. Предположим, что по Сценарию 1 опционы исполняются автоматически и цена акций XYZ во время открытия торговли во 2-ой день составляет $51. По Сценарию 2 тоже происходит автоматическое исполнение, но цена акций XYZ во время открытия торговли во 2-ой день составляет $48.

| Баланс счета | Перед истечением |

Сценарий 1: XYZ при открытии - $51 |

Сценарий 2: XYZ при открытии - $48 |

| Наличные |

$0,00 | ($100 000,00) | ($100 000,00) |

| Акции (длинн.) |

$0,00 | $102 000,00 | $96 000,00 |

|

Опцион* (длинн.) |

$2 000,00 | $0,00 | $0,00 |

| Чистый ликвидац. капитал/(дефицит) | $2 000,00 | $2 000,00 | ($4 000,00) |

| Требование маржи |

$0,00 | $25 500,00 | $25 500,00 |

| Избыток/(дефицит) маржи |

$0,00 | ($23 500,00) | ($29 500,00) |

*У длинных позиций по опционам нет кредитных средств.

Чтобы избежать подобных ситуаций, IB симулирует влияние предстоящего истечения, учитывая возможное смещение цен андерлаинга, и оценивает риск, которому подвергнется счет при потенциальной поставке. Если он будет сочтен избыточным, IB может: 1) ликвидировать опционы до исполнения; 2) позволить уступку опционов; и/или 3) разрешить поставку и сразу ликвидировать андерлаинг. Не исключено и ограничение возможности счета по открытию новых позиций во избежание повышения риска.

IB также оставляет за собой право ликвидировать позиции вечером, предшествующим расчетному дню, если, согласно прогнозу систем IB, расчет приведет к дефициту маржи. Чтобы избежать подобных ситуаций, IB симулирует влияние предстоящего истечения, учитывая возможное смещение цен андерлаинга, и оценивает риск, которому в итоге подвергнется каждый счет. К примеру, если по прогнозу IB расчет приведет к устранению позиций (напр., опционы истекут со статусом "вне денег" или опционы с наличным расчетом истекут "в деньгах"), то наши системы определят, как это скажется на марже.

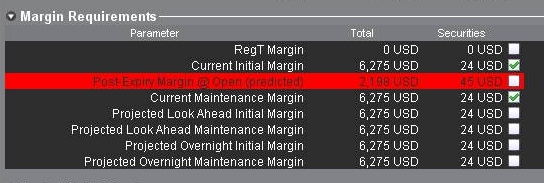

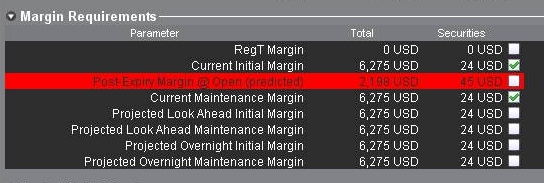

Если IB сочтет риск излишним, то позиции на Вашем счете могут быть ликвидированы, чтобы устранить прогнозируемый дефицит. Окно "Счет" в TWS содержит все необходимые показатели для отслеживания маржи. Прогнозируемый избыток отображен в строке "Маржа после истечения срока" (см. ниже); если его значение отрицательное и выделено красным цветом, то Ваш счет может подвергнуться принудительной ликвидации позиций. Расчеты этих показателей производятся за 3 дня до следующего истечения и обновляются примерно каждые 15 минут. Стоит отметить, что для иерархических счетовых структур (напр., с раздельным торговым лимитом) эта информация будет отображаться только на уровне мастер-счета, где все вычисления суммируются.

Обращаем внимание, что IB, как правило, инициирует ликвидацию, связанную с истечением, за 2 часа до закрытия торгов, но при этом может начать этот процесс раньше или позже, если на то есть причины. Приоритет ликвидации зависит от ряда показателей счета, включающего чистую ликвидационную стоимость, прогнозируемый дефицит после истечения, а также взаимосвязь между ценой страйка опциона и андерлаингом.

Фьючерсы с физической поставкой

За исключением отдельных контрактов, в основе которых лежит валюта, IB не разрешает клиентам получать или совершать поставки базового товара по фьючерсам с физическими расчетами или фьючерсным опционам. Во избежание поставок, позиции по истекающим фьючерсным контрактам следует перенести или закрыть до наступления сроков истечения (с их списком можно ознакомиться на сайте IB, выбрав "Поставка, исполнение и корпоративные действия" в меню "Торговля").

Обращаем Ваше внимание, что осведомленность о сроках закрытия является ответственностью владельца счета. IB может без дополнительного оповещения ликвидировать не закрытые вовремя позиции по контрактам с физической поставкой.

Expiration & Corporate Action Related Liquidations

In addition to the policy of force liquidating client positions in the event of a real-time margin deficiency, IBKR will also liquidate positions based upon certain expiration or corporate action related events which, after giving effect to, would create undue risk and/or operational concerns. Examples of such events are outlined below.

Option Exercise

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for the ensuing long stock position in full (in the case of a call exercised in a cash account or stock subject to 100% margin) or finance the long/short stock position (in the case of a call/put exercised in a margin account). Accounts which do not have sufficient equity on hand prior to exercise introduce undue risk should an adverse price change in the underlying occur upon delivery. This uncollateralized risk can be especially pronounced and may far exceed any in-the-money value the long option may have held, particularly at expiration when clearinghouses automatically exercise options at in-the-money levels as low as $0.01 per share.

Take, for example, an account whose equity on Day 1 consists solely of 20 long $50 strike call options in hypothetical stock XYZ which have closed at expiration at $1 per contract with the underlying at $51. Assume under Scenario 1 that the options are all auto-exercised and XYZ opens at $51 on Day 2. Assume under Scenario 2 that the options are all auto-exercised and XYZ opens at $48 on Day 2.

| Account Balance | Pre-Expiration | Scenario 1 - XYZ Opens @ $51 | Scenario 2 - XYZ Opens @ $48 |

|---|---|---|---|

| Cash | $0.00 | ($100,000.00) | ($100,000.00) |

| Long Stock | $0.00 | $102,000.00 | $96,000.00 |

|

Long Option* |

$2,000.00 | $0.00 | $0.00 |

| Net Liquidating Equity/(Deficit) | $2,000.00 | $2,000.00 | ($4,000.00) |

| Margin Requirement | $0.00 | $25,500.00 | $25,500.00 |

| Margin Excess/(Deficiency) | $0.00 | ($23,500.00) | ($29,500.00) |

*Long option has no loan value.

To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either: 1) liquidate options prior to expiration; 2) allow the options to lapse; and/or 3) allow delivery and liquidate the underlying at any time. In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

IBKR also reserves the right to liquidate positions on the afternoon before settlement if IBKR’s systems project that the effect of settlement would result in a margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account after settlement. For instance, if IBKR projects that positions will be removed from the account as a result of settlement (e.g., if options will expire out of the money or cash-settled options will expire in the money), IBKR’s systems will evaluate the margin effect of those settlement events.

If IBKR determines the exposure is excessive, IBKR may liquidate positions in the account to resolve the projected margin deficiency. Account holders may monitor this expiration related margin exposure via the Account window located within the TWS. The projected margin excess will be displayed on the line titled “Post-Expiry Margin” (see below) which, if negative and highlighted in red indicates that your account may be subject to forced position liquidations. This exposure calculation is performed 3 days prior to the next expiration and is updated approximately every 15 minutes. Note that certain account types which employ a hierarchy structure (e.g., Separate Trading Limit account) will have this information presented only at the master account level where the computation is aggregated.

Note that IBKR generally initiates expiration related liquidations 2 hours prior to the close, but reserves the right to begin this process sooner or later should conditions warrant. In addition, liquidations are prioritized based upon a number of account-specific criteria including the Net Liquidating Value, projected post-expiration deficit, and the relationship between the option strike price and underlying.

Call Spreads in Advance of Ex-Dividend Date

In the event that you are holding a call spread (long and short calls having the same underlying) prior to an ex-dividend date in the underlying, and if you have not liquidated the spread or exercised the long call(s), IBKR reserves the right to: i) exercise some or all of the long call(s); and/or ii) liquidate (i.e., close out) some or all of the spreads - if IBKR, in its sole discretion, anticipates that: a) the short call(s) is (are) likely to be assigned; and b) your account would not ave sufficient equity to satisfy the liability to pay the dividend or to satisfy margin requirements generally. In the event that IBKR exercises the long call(s) in this scenario and you are not assigned on the short call(s), you could suffer losses. Likewise, if IBKR liquidates some or all of your spread position, you may suffer losses or incur an investment result that was not your objective.

In order to avoid this scenario, you should carefully review your option positions and your account equity prior to any ex-dividend date of the underlying and you should manage your risk and your account accordingly.

Physically Delivered Futures

With the exception of certain futures contracts having currencies or metals as their underlying, IBKR generally does not allow clients to make or receive delivery of the underlying for physically settled futures or futures option contracts. To avoid deliveries in an expiring contract, clients must either roll the contract forward or close the position prior to the Close-Out Deadline specific to that contract (a list of which is provided on the website).

Note that it is the client’s responsibility to be aware of the Close-Out Deadline and physically delivered contracts which are not closed out within the specified time frame may be liquidated by IBKR without prior notification.

FAQs - U.S. Securities Option Expiration

The following page has been created in attempt to assist traders by providing answers to frequently asked questions related to US security option expiration, exercise, and assignment. Please feel free to contact us if your question is not addressed on this page or to request the addition of a question and answer.

Click on a question in the table of contents to jump to the question in this document.

Table Of Contents:

How do I provide exercise instructions?

Do I have to notify IBKR if I want my long option exercised?

What if I have a long option which I do not want exercised?

What can I do to prevent the assignment of a short option?

Is it possible for a short option which is in-the-money not to be assigned?

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Am I charged a commission for exercise or assignments?

Q&A:

How do I provide exercise instructions?

Instructions are to be entered through the TWS Option Exercise window. Procedures for exercising an option using the IBKR Trader Workstation can be found in the TWS User's Guide.

![]() Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Important Note: In the event that an option exercise cannot be submitted via the TWS, an option exercise request with all pertinent details (including option symbol, account number and exact quantity), should be created in a ticket via the Account Management window. In the Account Management Message Center click on "Compose" followed by "New Ticket". The ticket should include the words "Option Exercise Request" in the subject line. Please provide a contact number and clearly state in your ticket why the TWS Option Exercise window was not available for use.

Do I have to notify IBKR if I want my long option exercised?

In the case of exchange listed U.S. securities options, the clearinghouse (OCC) will automatically exercise all cash and physically settled options which are in-the-money by at least $0.01 at expiration (e.g., a call option having a strike price of $25.00 will be automatically exercised if the stock price is $25.01 or more and a put option having a strike price of $25.00 will be automatically exercised if the stock price is $24.99 or less). In accordance with this process, referred to as exercise by exception, account holders are not required to provide IBKR with instructions to exercise any long options which are in-the-money by at least $0.01 at expiration.

![]() Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

Important Note: in certain situations (e.g., underlying stock halt, corporate action), OCC may elect to remove a particular class of options from the exercise by exception process, thereby requiring the account holder to provide positive notice of their intent to exercise their long option contracts regardless of the extent they may be in-the-money. In these situations, IBKR will make every effort to provide advance notice to the account holder of their obligation to respond, however, account holders purchasing such options on the last day of trading are not likely to be afforded any notice.

What if I have a long option which I do not want exercised?

If a long option is not in-the-money by at least $0.01 at expiration it will not be automatically exercised by OCC. If it is in-the-money by at least that amount and you do not wish to have it exercised, you would need to provide IBKR with contrary instructions to let the option lapse. These instructions would need to be entered through the TWS Option Exercise window prior to the deadline as stated on the IBKR website.

What can I do to prevent the assignment of a short option?

The only action one can take to prevent being assigned on a short option position is to buy back in the option prior to the close of trade on its last trading day (for equity options this is usually the Friday preceding the expiration date although there may also be weekly expiring options for certain classes). When you sell an option, you provided the purchaser with the right to exercise which they generally will do if the option is in-the-money at expiration.

Is it possible for a short option which is in-the-money not to be assigned?

While is unlikely that holders of in-the-money long options will elect to let the option lapse without exercising them, certain holders may do so due to transaction costs or risk considerations. In conjunction with its expiration processing, OCC will assign option exercises to short position holders via a random lottery process which, in turn, is applied by brokers to their customer accounts. It is possible through these random processes that short positions in your account be part of those which were not assigned.

What happens if I have a spread position with an in-the-money option and an out-of-the-money option?

Spread positions can have unique expiration risks associated with them. For example, an expiring spread where the long option is in-the-money by less than $0.01 and the short leg is in-the-money more than $0.01 may expire unhedged. Account holders are ultimately responsible for taking action on such positions and responsible for the risks associated with any unhedged spread leg expiring in-the-money.

Can IBKR exercise the out-of-the-money long leg of my spread position only if my in-the-money short leg is assigned?

No. There is no provision for issuing conditional exercise instructions to OCC. OCC determines the assignment of options based upon a random process which is initiated only after the deadline for submitting all exercise instructions has ended. In order to avoid the delivery of a long or short underlying stock position when only the short leg of an option spread is in-the-money at expiration, the account holder would need to either close out that short position or consider exercising an at-the-money long option.

What happens to my long stock position if a short option which is part of a covered write is assigned?

If the short call leg of a covered write position is assigned, the long stock position will be applied to satisfy the stock delivery obligation on the short call. The price at which that long stock position will be closed out is equal to the short call option strike price.

Am I charged a commission for exercise or assignments?

There is no commissions charged as the result of the delivery of a long or short position resulting from option exercise or assignment of a U.S. security option (note that this is not always the case for non-U.S. options).

What happens if I am unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment?

You should review your positions prior to expiration to determine whether you have adequate equity in your account to exercise your options. You should also determine whether you have adequate equity in the account if an in-the-money short option position is assigned to your account. You should also be aware that short options positions may be exercised against you by the long holder even if the option is out-of-the-money.

If you anticipate that you will be unable to meet the margin requirement on a stock delivery resulting from an option exercise or assignment, you should either close positions or deposit additional funds to your account to meet the anticipated post-delivery margin requirement.

IBKR reserves the right to prohibit the exercise of stock options and/or close short options if the effect of the exercise/assignment would be to place the account in margin deficit. To protect against these scenarios as expiration nears, IBKR will simulate the effect of expiration assuming plausible underlying price scenarios and evaluating the exposure of each account assuming stock delivery. If the exposure is deemed excessive, IBKR reserves the right to either:

- Liquidate options prior to expiration. Please note: While IBKR retains the right to liquidate at any time in such situations, liquidations involving US security positions will typically begin at approximately 9:40 AM ET as of the business day following expiration;

- Allow the options to lapse; and/or

- Allow delivery and liquidate the underlying at any time.

In addition, the account may be restricted from opening new positions to prevent an increase in exposure. IBKR determines the number of contracts that will be lapsed by IBKR/auto-exercised shortly after the end of trading on the date of expiration. The effect of any after hours trading you conduct on that day may not be taken into account in this exposure calculation.

While IBKR reserves the right to take these actions, account holders are solely responsible for managing the exercise/assignment risks associated with the positions in their accounts. IBKR is under no obligation to manage such risks for you.

For more information, please see Expiration & Corporate Action Related Liquidations