Suggerimenti per la scelta delle domande e delle risposte di sicurezza

Le domande di sicurezza rappresentano solamente una delle componenti del quadro di sicurezza messo in atto da IB per proteggere i conti dei propri clienti. Di seguito offriamo una serie di semplici suggerimenti per la scelta delle domande di sicurezza, e relative risposte, al fine di sfruttare le sopra citate misure di sicurezza nel modo più efficace possibile:

1. Scegliere domande a cui si è in grado di rispondere con coerenza anche in futuro.

2. Se possibile, utilizzare risposte formate da una sola parola.

3. Fare attenzione agli spazi. Per esempio, qualora si scelga di indicare "La Spezia" quale risposta a una delle domande di sicurezza, il sistema rifiuterà la parola singola "LaSpezia".

4. Evitare risposte bizzarre o prive di senso, in quanto difficili da ricordare in futuro.

5. Selezionare una domanda difficile da indovinare e/o ricercare, con il maggior numero di risposte possibili e la cui risposta sia molto difficile da indovinare da parte di altri.

6. Selezionare una domanda la cui risposta non sia conosciuta da altri quali, per esempio, membri della famiglia, amici intimi, parenti, ex-coniugi o attuali partner.

7. Scegliere una domanda la cui risposta resti invariata nel tempo.

Market Data Non-Professional Questionnaire

Insight into completing the new Non-Professional Questionnaire.

The NYSE and most US exchanges require vendors to positively confirm the market data status of each customer before allowing them to receive market data. Going forward, the Non-Professional Questionnaire will be used to identify and positively confirm the market data status of all customer subscribers. As per exchange requirements, without positively identifying customers as non-professional, the default market data status will be professional. The process will protect and maintain the correct market data status for all new subscribers. For a short guide on non-professional definitions, please see https://ibkr.info/article/2369.

Each question on the questionnaire must be answered in order to have a non-professional designation. As exchanges require positive confirmations of proof for non-professional designations, an incomplete or unclear Non-Professional Questionnaire will result in a Professional designation until the status can be confirmed.

If the status should change, please contact the helpdesk.

Explanation of questions:

1) Commercial & Business purposes

a) Do you receive financial information (including news or price data concerning securities, commodities and other financial instruments) for your business or any other commercial entity?

Explanation: Are you receiving and using the market data for use on behalf of a company or other organization aside from using the data on this account for personal use?

b) Are you conducting trading of any securities, commodities or forex for the benefit of a corporation, partnership, professional trust, professional investment club or other entity?

Explanation: Are you trading for yourself only or are you trading on behalf of an organization (Ltd, LLC, GmbH, Co., LLP, Corp.)?

c) Have you entered into any agreement to (a) share the profit of your trading activities or (b) receive compensation for your trading activities?

Explanation: Are you being compensated to trade or are you sharing profits from your trading activities with a third party entity or individual?

d) Are you receiving office space, and equipment or other benefits in exchange for your trading or work as a financial consultant to any person, firm or business entity?

Explanation: Are you being compensated in any way for your trading activity by a third party, not necessarily by being paid in currency.

2) Act in a capacity

a) Are you currently acting in any capacity as an investment adviser or broker dealer?

Explanation: Are you being compensated to manage third party assets or compensated to advise others on how to manage their assets?

b) Are you engaged as an asset manager for securities, commodities or forex?

Explanation: Are you being compensated to manage securities, commodities, or forex?

c) Are you currently using this financial information in a business capacity or for managing your employer’s or company’s assets?

Explanation: Are you using data at all for a commercial purposes specifically to manage your employer and/or company assets?

d) Are you using the capital of any other individual or entity in the conduct of your trading?

Explanation: Are there assets of any other entity in your account other than your own?

3) Distribute, republish or provide data to any other party

a) Are you distributing, redistributing, publishing, making available or otherwise providing any financial information from the service to any third party in any manner?

Explanation: Are you sending any data you receive from us to another party in any way, shape, or form?

4) Qualified professional securities / futures trader

a) Are you currently registered or qualified as a professional securities trader with any security agency, or with any commodities or futures contract market or investment adviser with any national or state exchange, regulatory authority, professional association or recognized professional body? i, ii

YES☐ NO☐

i) Examples of Regulatory bodies include, but are not limited to,

- US Securities and Exchange Commission (SEC)

- US Commodities Futures Trading Commission (CFTC)

- UK Financial Service Authority (FSA)

- Japanese Financial Service Agency (JFSA)

ii) Examples of Self-Regulatory Organization (SROs) include, but are not limited to:

- US NYSE

- US FINRA

- Swiss VQF

Reportistica controllo e proprietà CFTC

In base alle normative della Commodities Futures Trading Commission (CFTC) i broker su future ("FCM") sono tenuti a segnalare le informazioni relative ai clienti che detengono posizioni equivalenti o eccedenti determinate soglie (es. indicazione delle grandi transazioni). Nel novembre 2013 la CFTC ha adottato un nuovo provvedimento per ampliare le precedenti regole di segnalazione, il quale richiede informazioni più esaustive in merito a titolari e addetti al controllo dei conti che effettuano trading di future commodity americani. Tale nuova normativa è nota col nome di Ownership and Control Reporting (OCR) e viene delineata di seguito tramite una serie di risposte a domande frequenti.

In base al requisito per cui ogni conto che raggiunge la soglia delle posizioni o del volume deve essere segnalato alla CFTC entro le ore 09:00 (fuso orario della costa orientale degli USA) del giorno successivo all'avvenuto riscontro, IB richiede che tali informazioni siano fornite per ogni conto che effettua trading di future commodity americani.

Ciascun titolare o addetto al controllo dei conti è tenuto a fornire le seguenti informazioni:

• Nome

• Indirizzo postale

• Indirizzo email

• Numero di telefono comprensivo del prefisso nazionale

• Identificativo della persona giuridica (LEI), ove applicabile

• Dati personali:

o Nome

o Occupazione

o Rapporto con l'entità giuridica

o Numero di telefono comprensivo del prefisso nazionale

• Relazione del soggetto con il titolare del conto

• Occupazione del soggetto

• Nome del datore di lavoro del soggetto

• Identificativo dell'entità giuridica (LEI) datore di lavoro, ove applicabile

Per "titolare del conto" si intende ogni soggetto o entità giuridica che detiene una partecipazione diretta nel conto trading.

4. Cosa intende la OCR per "addetto al controllo del conto"?

La CFTC definisce "addetto al controllo del conto" la "persona fisica che, tramite procura legale o altrimenti, controlla l'attività di trading di un particolare conto. Un conto di trading può essere associato a uno o più addetti al controllo.”

Definizione disponibile nel Codice dei regolamenti federali degli USA, 17 C.F.R. § 15.00(bb) (disponibile solo in inglese).

Si tratta di un numero assegnato dalla National Futures Organization a ciascun iscritto (es. società e individui come CTA e CPO). La NFA mantiene un sistema di registrazione online (ORS) che permette la registrazione e l'assegnazione dei numeri ID. Si invita a consultare il sito web www.nfa.futures.org

È possibile richiedere tale informazione al proprio datore di lavoro oppure effettuare una ricerca tramite questi siti web:

Il codice dei regolamenti federali degli USA richiede a tutti i broker di commissioni su future, tra cui IB, di ottenere tali informazioni dai propri clienti. Si tratta di un requisito essenziale relativo a ogni soggetto e/o entità indipendentemente dal broker di riferimento.

Sì, tali informaizoni devono essere fornite anche dai cittadini non americani che intendono effettuare trading di future commodity americani.

Tali dati sono trattati in maniera confidenziale in base alla normativa sulla privacy del Gruppo Interactive Brokers. Per maggiori informazioni si invita a visitare la pagina https://individuals.interactivebrokers.com/en/index.php?f=ibgStrength&p=priv

Il testo completo della modifica alla normativa è disponibile al sito web della CFTC:

Panoramica del Sistema di Accesso Sicuro

Indice

- Vantaggi dell'iscrizione

- Come iscriversi

- Perdita, smarrimento o temporanea indisponibilità del dispositivo

- Tipi di dispositivo

- Limiti di prelievo

La sicurezza dei tuoi asset e delle tue informazioni personali è per noi di fondamentale importanza e ci impegniamo a prendere tutte le misure necessaria a garantire la protezione dei tuoi dati dal momento in cui apri un conto presso di noi.

Vantaggi dell'iscrizione

- Soglie di prelievo più alte sia in un singolo giorno che in un periodo di 5 giorni consecutivi.

- La possibilità di cambiare le tue coordinate bancarie e il tuo indirizzo email senza dover contattare un membro del nostro Team della Sicurezza.

- L'opportunità di effettuare transazioni di finanziamento ACH & EFT oltre la transazione iniziale di 20.000 USD per il finanziamento del conto.

- La possibilità di condividere un dispositivo con più nomi utente registrati sotto la stessa persona.

Come iscriversi

Perdita, smarrimento o temporanea indisponibilità del dispositivo

Tipi di dispositivo

- SMS - Una soluzione facile e rapida per completare il l’Autenticazione a 2 livelli attraverso i messaggi di testo (SMS) inviati al tuo numero di telefono portatile.

- IBKR Mobile – Una app formula “tutto in uno” che offre una soluzione digitale molto conveniente per la tua Autenticazione a 2 livelli. Il modulo della IBKR Mobile Authentication (IB Key) che si trova nell’app supporta sia l’impronta digitale che il riconoscimento facciale e la configurazione del PIN.1 La app si può scaricare ed è disponibile sia per telefoni Android che per iPhones.

- Digital Security Card+ - Disponibile per i conti con capitale pari a 1 milione di USD o importo equivalente in altra valuta. Questa carta ha dimensioni e forma identiche a quelle di una carta di credito ed è elettronica. Infine per questo tipo di dispositivo richiede all’utente un codice PIN come livello aggiuntivo di protezione.

NB:

Gli utenti che usano un iPhone devono aver abilitato le seguenti funzioni: Touch ID, Face ID, o Passcode (per riferimento consultare le istruzioni contenute su: Impostazioni Touch ID oppure Impostazioni Face ID). Le opzioni che consigliamo sono Touch ID e Face ID. PIN/Passcode hanno una durata massima di 12 ore per fare trading. Invece il riconoscimento facciale o tramite impronta digitale consente più di 30 ore a condizione di aver compiuto l’autenticazione almeno una volta durante questo periodo di tempo. Ti invitiamo a consultare la nostra Guida Utente per maggiori informazioni su Accesso Esteso al Trading.

Limiti di prelievo

I clienti partecipanti al Sistema di Accesso Sicuro (SAS) possono beneficiare di possibilità di prelievo maggiori, mentre i clienti non partecipanti sono soggetti a restrizioni sui prelievi giornalieri e settimanali. L'importo prelevabile/trasferibile da parte di un cliente partecipante in un dato periodo di uno o cinque giorni aumenta in proporzione all'efficacia protettiva del dispositivo di sicurezza ed è mostrato nella tabella sottostante.

| Dispositivo di sicurezza | Prelievo massimo giornaliero | Prelievo massimo in 5 giorni lavorativi |

|---|---|---|

| Nessuno | 50.000 USD | 100.000 USD |

| SMS | 200.000 USD | 600.000 USD |

| IBKR Mobile Authentication (IB Key) | 1 Mio USD | 1 Mio USD |

| Security Code Card* | 200.000 USD | 600.000 USD |

| Carta di sicurezza digitale* | 1 Mio USD | 1,5 Mio USD |

| Carta di sicurezza digitale+ | Nessun limite | Nessun limite |

| Platino*/Oro* | Nessun limite | Nessun limite |

Maggiori informazioni

CFTC Ownership and Control Reporting

The Commodities Futures Trading Commission (CFTC) has historically maintained rules which require FCMs to report information relating to clients holding positions equal to or exceeding defined thresholds (e.g., Large Trader Reporting). In November 2013, the CFTC adopted a new rule which expands the prior reporting rules and which requires the collection and reporting of more comprehensive information on owners and controllers of accounts trading U.S. commodity futures products. This new rule is referred to as Ownership and Control Reporting (OCR) and outlined below are a series of FAQs relating to this rule.

In order to comply with the requirement that any account meeting the position or volume thresholds be reported to the CFTC by 09:00 ET on the day following the day in which the account becomes reportable, IB requires that all accounts trading U.S. commodity futures products provide the requested information.

The following information is required of all Owners and Controllers of an account:

• Name

• Street Address

• Email Address

• Direct Phone Number, Including Country Code

• Legal Entity Identifier (LEI), If Applicable

• Contact Person Details:

o Name

o Job Title

o Relationship to Legal Entity

o Direct Phone Number, Including Country Code

• Individual’s Relationship to Account Owner

• Individual’s Job Title

• Name of Individual’s Employer

• Employer’s Legal Entity Identifier (LEI), If Applicable

An "Account Owner" includes any individual or legal entity who holds a direct ownership interest in the trading account.

4. Who is an "Account Controller" for the purposes of OCR?

The CFTC defines an “Account Controller” as “a natural person who by power of attorney or otherwise actually directs the trading of an account. A trading account may have more than one controller.”

This definition can be found at 17 C.F.R. § 15.00(bb).

A number which the National Futures Organization assigns to each registrant (e.g., firms and individuals such as Commodity Trading Advisors and Commodity Pool Operators). The NFA maintains an Online Registration System (ORS) through which registration and assignment of the ID is provided. See www.nfa.futures.org

You may ask your employer to provide you with this information or search one of the following websies:

U.S. federal regulations require all FCMs, including IB, to obtain this information from its clients. The requirement is universal and applies to any individual or entity regardless of their broker.

Yes, if you wish to trade U.S. commodity futures products, we must collect this information from you.

This data will be kept confidential in accordance with the Interactive Brokers Group Privacy Statement. See link for details: https://individuals.interactivebrokers.com/en/index.php?f=ibgStrength&p=priv

The full text of this rule change is available on the CFTC website

Hong Kong - China Stock Connect

Hong Kong – China Stock Connect (“China Connect”) is a mutual market access program through which Hong Kong and international investors can trade shares listed on the Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange (SZSE) via the Stock Exchange of Hong Kong (SEHK) and their existing clearinghouse. As a member of SEHK, IBKR provides you with direct access to trade with eligible listed products on the Shanghai and Shenzhen Stock Exchange. IBKR clients with China Connect trading permissions will be eligible to trade SSE/SZSE securities through Shanghai and Shenzhen - Stock Connect.

Among the different types of SSE/SZSE-listed securities, only A shares (shares in mainland China-based companies that trade on Chinese stock exchange) are included in the Shanghai and Shenzhen Stock Connect.

Shanghai Connect includes all the constituent stocks of the SSE 180 Index, SSE 380 Index and all the SSE-listed A shares that have corresponding H shares listed on the SEHK.

Product List and Stock Codes for SSE

Shenzhen Connect includes all the constituent stocks of the SZSE Component Index, the SZSE Small/Mid Cap Innovation Index that have a market capitalization of not less than RMB 6 billion and all the SZSE-listed A shares that have corresponding H shares listed on SEHK.

Product List and Stock Codes for SZSE

IBKR Commission for Trading SSE/SZSE Securities

Same as trading Hong Kong stocks, IBKR charges only 0.08% of trade value as a commission with a minimum CNH 15 per order. Detailed fee rates can be found in the Hong Kong – China Stock Connect Northbound fee table.

Daily Quota

Trading under Shanghai Connect and Shenzhen Connect is subject to a Daily Quota. The Daily Quota is applied on a “net buy” basis. The Daily Quota limits the maximum net buy value of cross-boundary trades under Shanghai Connect and Shenzhen Connect each day.

If the Northbound Daily Quota Balance drops to zero or the Daily Quota is exceeded during the opening call auction session, new buy orders will be rejected. Or if it happens during a continuous auction session or closing call auction session, no further buy orders will be accepted for the remainder of the day. SEHK will resume the Northbound buying service on the following trading day.

SEHK will also publish the remaining balance of the Aggregate Quota and Daily Quota.

For details, please refer to HKEX Stock Connect FAQ or HKEX Stock Connect Rule 1407

Trading Information of Shanghai and Shenzhen Connect

|

Trading currency |

RMB |

|

Order Type |

IBKR offers various order types but will stimulate the order into limit order for execution. More information can be referred to our website.

|

|

Tick Size / Spread |

Uniform at RMB 0.01 |

|

Board Lot |

100 shares (applicable for buyers only) |

|

Odd Lot |

Sell orders only (odd lot should be made in one single order) |

|

Max Order Size |

1 million shares |

|

Price Limit |

±10% on previous closing price (±5% for stocks under special treatment under risk alert, i.e. ST and *ST stocks) |

|

Day (Turnaround) Trading |

Not allowed |

|

Block Trade |

Not available |

|

Manual Trade |

Not available |

|

Order Modification |

IBKR will cancel and replace the order for any order modification |

|

Settlement cycle |

Securities: Settlement on T day Cash from China Connect trades: Settlement on T+1 day Forex*: Settlement on T+2 day |

*Due to the unsynchronized settlement cycle, clients who exchange CNH themselves should execute the Forex trade one day prior to the stock trade (T-1) to avoid the extra day’s interest payment (considering normal settlement without involving holidays).

Trading Hours

|

SSE/SZSE Trading Sessions |

SSE/SZSE Trading Hours |

|

Opening Call Auction |

09:15 - 09:25 |

|

Continuous Auction (Morning) |

09:30 – 11:30 |

|

Continuous Auction (Afternoon) |

13:00 – 14:57 |

|

Closing Call Auction |

14:57 – 15:00 |

Half-day Trading

If a Northbound trading day is a half-trading day in the Hong Kong market, it will continue until respective Connect Market is closed. Refer to the exchange website for holiday trading arrangements and additional information.

Disclosure Obligation

If client holds or controls up to 5% of the issued shares of China Connect, the client is required to report in writing to the China Securities Regulatory Commission (“CSRC”) and the relevant exchange, and inform the Mainland listed company within three working days of reaching 5%.

The client is not allowed to continue purchasing or selling shares in that Mainland listed company during the three days notification period. Visit the IBKR Knowledge Base for more information.

Shareholding Restriction

A single foreign investor’s shareholding in a Mainland listed company is not allowed to exceed 10% of the company’s total issued shares, while all foreign investors’ shareholding in the A shares of the listed company is not allowed to exceed 30% of its total issued shares. Visit the IBKR Knowledge Base for more information.

Forced-sale Arrangement

Each IBKR client is not allowed to hold more than a specific percentage of the China Connect listing company's total issued shares. HKEX requires the client to follow the forced-sell requirements if the shares exceed the limit:

|

Situation |

Shareholding (in a listed company) |

|

A single foreign investor |

> = 10% of the company’s total issued shares |

|

All foreign investors |

> = 30% of the company’s total issued shares |

Margin Financing

Margin trading in China Connect securities will subject to restrictions and only certain A shares will be eligible for margin trading. Eligible Securities, as determined by SSE and SZSE from time to time, are listed on the HKEX website.

According to the relevant rules of SSE and SZSE, either market may suspend margin trading activities in specific A shares when the volume of margin trading activities for a specific A share exceeds the prescribed threshold. The market will resume margin trading activities in the affected A share when its volume drops below a prescribed threshold.

Stock Borrowing and Lending (SBL)

SBL in China Stock Connect Securities is subject to restrictions set by the SSE or SZSE and stated in the Rules of the Exchange.

IBHK does not offer this service at the moment.

Eligible Short Selling Securities

SBL for the purpose of short selling will be limited to those China Stock Connect Securities that are eligible for both buy orders and sell orders through Shanghai and Shenzhen Connect (i.e., excluding Connect Securities that are only eligible for sell orders).

IBHK does not offer this service at the moment.

Trading Shenzhen ChiNext and Shanghai Star shares

Trading Shenzhen ChiNext and Shanghai Star shares are limited to institutional professional investors.

Holidays

Clients will only be allowed to trade China Connect on days where Hong Kong and Mainland markets are both open for trading and banking services are available in both Hong Kong and Mainland markets on the corresponding settlement days. This arrangement is essential in ensuring that investors and brokers will have the necessary banking support on the relevant settlement days when they will be required to make payments.

The following table illustrates the holiday arrangement of Northbound trading of SSE/SZSE Securities:

|

|

Mainland |

Hong Kong |

Open for Northbound Trading |

|

Day 1 |

Business Day |

Business Day |

Yes |

|

Day 2 |

Business Day |

Business Day |

No, HK market closes on money settlement day |

|

Day 3 |

Business Day |

Public Holiday |

No, HK market closes on trading day |

|

Day 4 |

Public Holiday |

Business Day |

No, Mainland market closes |

Severe Weather Conditions

Information on the trading arrangement available under severe weather conditions can found on the HKEx website.

Where to Learn More?

Please refer to the following exchange website links for additional information regarding Hong Kong China Stock Connect:

If you have any questions regarding Hong Kong-China Stock Connect, please contact IBKR Client Services for further information.

Foreign Acount Tax Compliance Act (FATCA)

What is FATCA?

The Foreign Account Tax Compliance Act (FATCA) represents the United States efforts to combat tax evasion and abuse by US persons holding investments outside of the United States. The Act establishes a new set of tax information reporting and withholding procedures. While not expressly aimed at non-US persons, the regulations do impose withholding taxes on certain non-US entities that decline to disclose their US investors or account holders.

Under FATCA, US persons must report to the US tax authority, Internal Revenue Service (IRS), their assets held in offshore accounts. In addition, the regulations seek to require non-US financial institutions to report to the US tax authority certain information about financial accounts of US or US-owned investors and account holders.

How does this impact US Brokers, including Interactive Brokers?

As a broker based in the United States, Interactive Brokers is required to report information and make payment of withholding taxes to the IRS, for all of our customers. FATCA simply creates additional practices and withholdings to the current requirements for all US brokers.

Interactive Brokers will comply with the new rules. This may require additional disclosures by investors during the account application process, as well as expanded tax reporting. For all US institutions, FATCA becomes effective January 1, 2013. Any FATCA tax withholding requirements begin on January 1, 2014.

Additional aspects of the regulations will be phased-in over the next few years, including an expansion of US brokers reporting on US source income to non-US accounts through Form 1042-S.

What action is required for US persons?

No additional action is required for US persons holding Interactive Brokers accounts. US persons, who include US citizens, Green Card holders and other legal residents, need only to complete Form W-9 during the account application process to certify their tax status.

Does FATCA affect non-US accounts?

Yes. FATCA requires foreign financial institutions (FFIs) to furnish certain data directly to the IRS about any of their US taxpayer accounts or foreign entity accounts in which US taxpayers hold a certain level of ownership. FFI compliance with the new regulations becomes effective July 1, 2013 with the submission of electronic FFI applications to the IRS. The application forms are scheduled to be available through the IRS in January 2013.

All non-US persons and entities applying for and maintaining Interactive Broker accounts will continue to be required to fully disclose and indentify the identity of their account's beneficial owner(s). Through the IRS Form W-8, our account holders certify the beneficial owner's country of tax residence. If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply.

Some entities not ordinarily considered to be financial institutions may be categorized under FATCA as an FFI. Therefore, it is important to review the details outlined by the IRS.

Is there a summary of FFI requirements?

While the regulations and compliance are far more complex than a brief FAQ can describe, the following offers a short summary of actions required by those defined foreign financial institutions.

- Identify US taxpayers. If US taxpayers refuse to waive your non-US country's privacy or secrecy rules, then the US taxpayer account must be closed.

- Report to the IRS on the related US taxpayer activity within defined financial accounts.

- Withhold 30% US tax on US source income against any US taxpayer or foreign entity failing to disclose information or comply with the FATCA regulations.

Additional Information & Resources

The IRS remains the most comprehensive and up-to-date resource about FATCA compliance, implementation, and document filing. The IRS continues to issue news releases and forms. Please feel free to visit the IRS FATCA Website for details.

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

IRA: Retirement Account Resource Center

IMPORTANT NOTE: This article has been customized for use by self-directed Individual Retirement Account (IRA) owners for information purposes only. Persons are encouraged to consult a qualified tax professional with the investments and elections within the IRA. IB does not provide tax advice. For detailed information regarding IRAs, you may consult the IRS Publication 590-A about IRA contributions and the IRS Publication 590-B about IRA distributions.

This resource center provides a central reference point for information concerning the various IRA account types offered by IB.

Important Notice - Select IRA Tax Reporting for key information with transaction and tax reporting in your IRA.

Account Management IRA Reference

Beneficiary Options

Recharacterizations from a Roth IRA

Required Minimum Distributions

IRS Circular 230 Notice: These statements are provided for information purposes only, are not intended to constitute tax advice which may be relied upon to avoid penalties under any federal, state, local or other tax statutes or regulations, and do not resolve any tax issues in your favor.

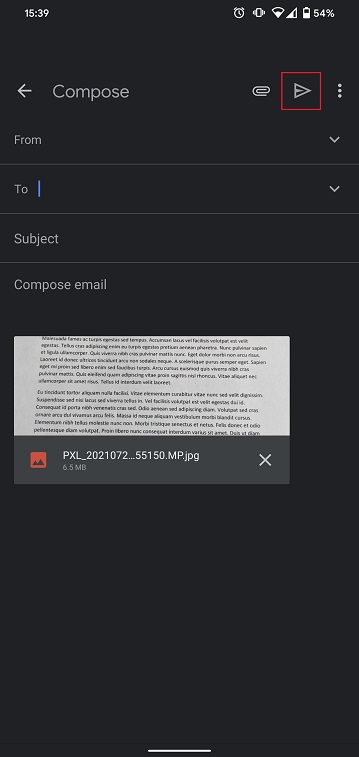

How to send documents to IBKR using your smartphone

Interactive Brokers allows you to send us a copy of a document even if you do not currently have access to a scanner. You can take a picture of the requested document with your smartphone.

Below you will find the instructions on how to take a picture and send it per email to Interactive Brokers with the following smartphone operating systems:

If you already know how to take and send pictures per email using your smartphone, please click HERE - Where to send the email to and what to include in the subject.

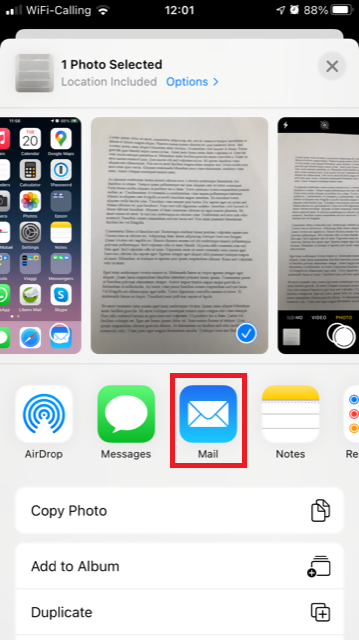

iOS

1. Swipe up from the bottom of your smartphone screen and tap the camera icon.

If you do not have the Camera icon, you can tap the Camera app icon from the home screen of your iPhone.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

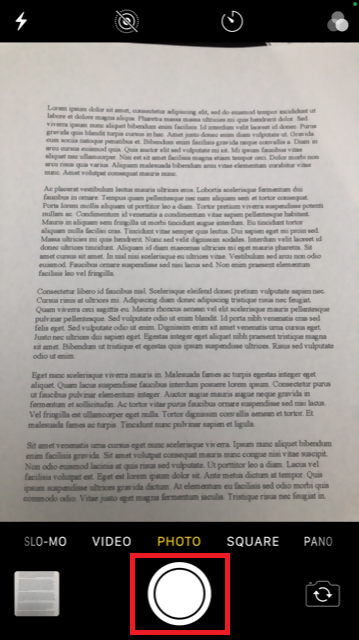

2. Place your iPhone above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Tap the thumbnail image in the lower left-hand corner to access the picture you have just taken.

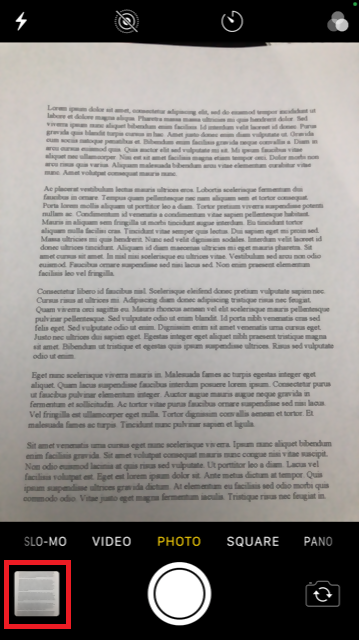

5. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

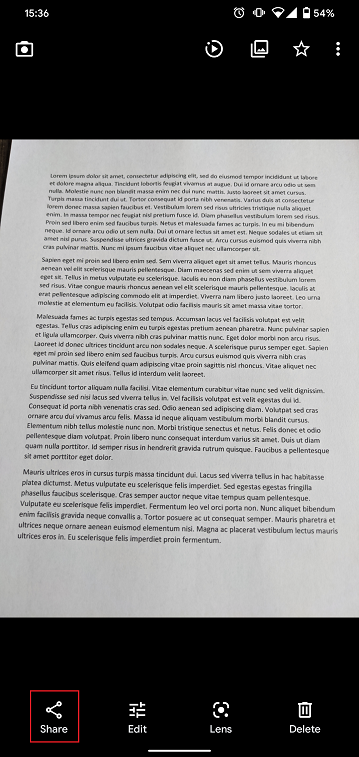

6. Tap the share icon in the lower left-hand corner of the screen.

7. Tap the Mail icon.

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

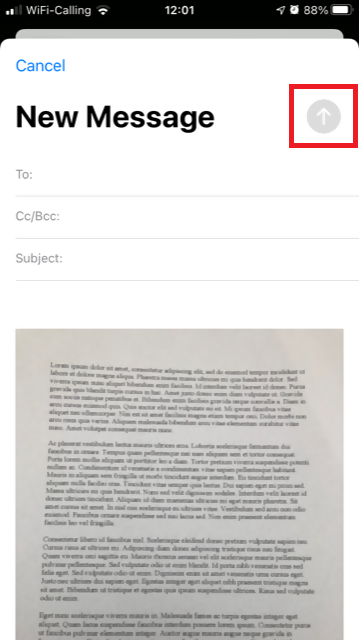

8. Please see HERE how to populate the To: and Subject: fields of your email. Once the email is ready, tap the up arrow icon on the top right to send it.

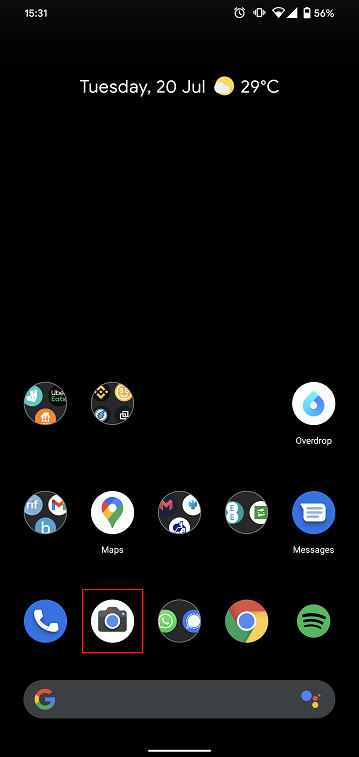

Android

1. Open your applications list and start the Camera app. Alternatively start it from your Home screen. Depending on your phone model, maker or setup, the app might be called differently.

Normally your phone should now activate the rear camera. If it activates the front one, tap the camera switch button.

2. Place your Android above the document and frame the desired portion or page of the document.

3. Make sure to have uniform, sufficient lighting and not to cast any shadow on the document due to your position. Hold the smartphone firmly with your hand/s and avoid shaking. Tap on the shutter button to take the photo.

4. Make sure that the picture is clear and the document is well legible. You can enlarge the picture and see it in detail by swiping apart two fingers on the picture itself.

If the picture does not present a good quality or lighting, please repeat the previous steps in order to take a sharper one.

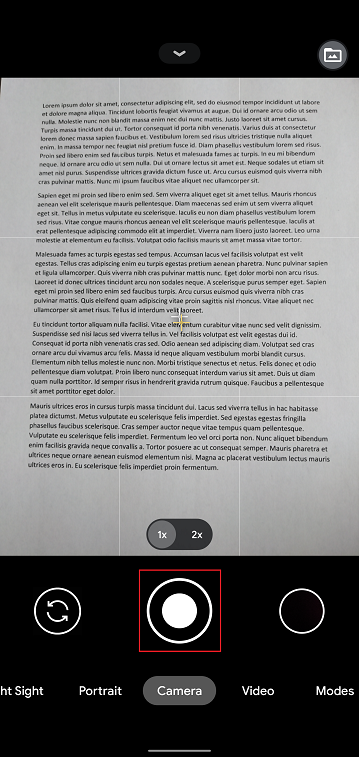

5. Tap the empty circle icon in the lower right-hand corner of the screen.

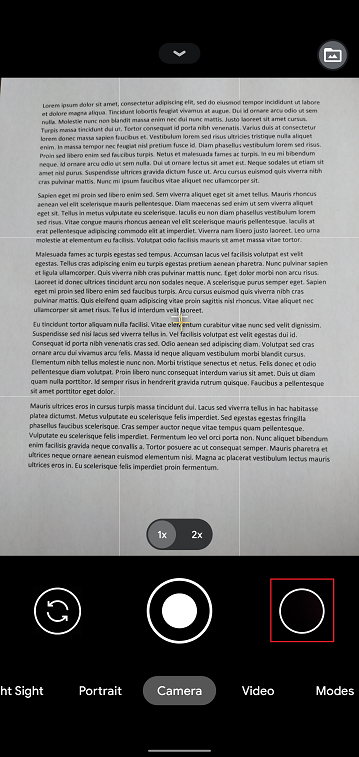

6. Tap the share icon in the lower left-hand corner of the screen.

7. In the sharing menu that will be displayed now tap the icon of the email client set up on your phone. In the example picture below, it is called Gmail but the name may vary according to your specific setup.

.png)

Note: to send emails your phone has to be configured for that. Please contact your email provider if you are not familiar with this procedure.

8. Please see HERE how to populate the To and Subject fields of your email. Once the email is ready, tap the airplane icon on the top right to send it.

WHERE TO SEND THE EMAIL AND WHAT TO INCLUDE IN THE SUBJECT

The email has to be created observing the below instructions:

1. In the field To: type:

- newaccounts@interactivebrokers.com if you are a resident of a non-European country

- newaccounts.uk@interactivebrokers.co.uk if you are a European resident

2. The Subject: field must contain all of the below:

- Your account number (it usually has the format Uxxxxxxx, where x are numbers) or your username

- The purpose of sending the document. Please use the below convention:

- PoRes for a proof of residential address

- PID for a proof of identity

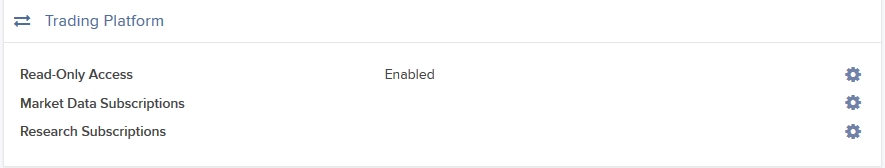

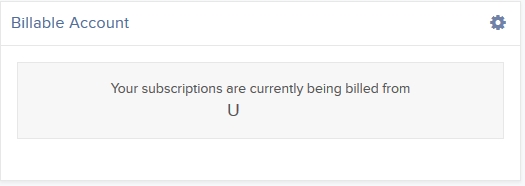

Change Your Billable Account

If you have additional linked, duplicate or consolidated accounts, the Billable Account section appears on the Market Data Subscriptions screen. Use the Billable Accounts panel to change the account that is currently being billed for market data.

To change your billable account

1. Click Settings > User Settings

2. In the Trading Platform panel, click the Configure (gear) icon for Market Data Subscriptions.

The Market Data Subscription screen opens.

3. Click the Configure (gear) icon in the Billable Account panel.

4. Select the account you want to be billed for market data, then click Save.

Beginning with the next billing cycle, your market data subscriptions will be billed to the account you selected.