Fees for Trading Warrants and Structured Products on Euronext

Euronext's fee thresholds on structured products and how it impacts clients' trading, for both fixed and tiered commission models

Clients that place orders and trade for more than EUR 6'000 in Warrants and Structured Products will be charged a 2.5 basis points fee with a maximum of EUR 20.

The table below displays the exchange fees for warrants and structured products when trading on Euronext:

|

Product Group |

Fee |

Minimum per Trade |

Maximum per Trade |

|

Warrants & Structured Products – trade value up to EUR 6’000 |

0.00 |

N/A |

N/A |

|

Warrants & Structured Products – trade value more than EUR 6’000 |

2.50 bps |

N/A |

EUR 20 per Trade |

Calculations:

For Cost Plus (Tiered) Clients:

Example: Client wishes to trade structured products on Euronext for a total trade value of EUR 10’000.

Scenario A:

Trade value = EUR 10’000

Fee = 2.5 Bps

As the trade value is above EUR 6’000, the fee of 2.50 bps applies and therefore an additional EUR 2.50 will have to be paid for the trade.

Scenario B:

Order 1:

Trade Value = EUR 5’000

Fee = 0.00

Order 2:

Trade Value = EUR 5’000

Fee = 0.00

As the trade value of each trade is below EUR 6’000, no additional fees apply.

Note: This calculation does not impact clients on the Fixed commission schedule.

Exchange name change

Overview:

Interactive Brokers is completing an effort to update and consolidate exchange names where appropriate. When this effort is complete, the following updates will be in effect:

- GLOBEX and CMECRYPTO will be consolidated to a single exchange, ‘CME’

- ECBOT will be updated to ‘CBOT’

- COMEX listed metals (previously reflected as NYMEX) will be updated to exchange ‘COMEX’

- NYMEX, no change

Given the breadth of products involved, we are migrating in four waves based on underlying products:

| Key | Effective Trade Date | Products |

| Wave 1 | October 30, 2022 | GLOBEX: ZAR, LB, DA, IXE |

| Wave 2 | November 6, 2022 | GLOBEX: EMD, BRE, CHF, SOFR3, E7, NKD CMECRYPTO: BTCEURRR, ETHEURRR, MET |

| Wave 3 | November 13, 2022 | GLOBEX: All remaining products CMECRYPTO: All remaining products ECBOT: ZO, ZR, 2YY, 30Y NYMEX: ALI, QI, QC |

| Wave 4 | December 4, 2022 | ECBOT: All remaining products NYMEX: All remaining "Metal" products |

I am trading via API, how does this impact me?

For API clients the only requirement would be to provide a new exchange name, for example: exchange=”CME”, for existing contracts for the affected exchanges.

Old exchanges names will no longer be available after the change.

More details can be found within our FAQs through the following link: Upcoming Exchange name Changes

Note: If you are using a third party software connected to TWS or IB Gateway and that software does not recognize the new contract definitions, please contact the third party vendor directly.

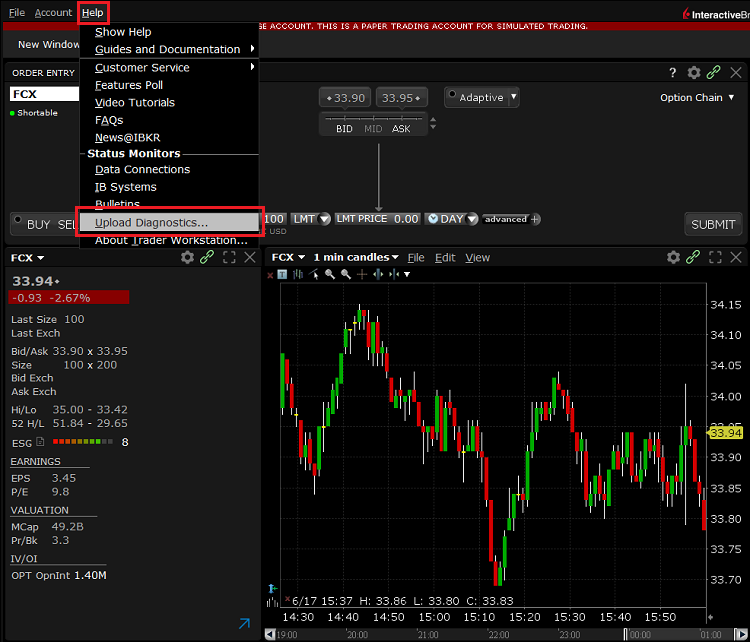

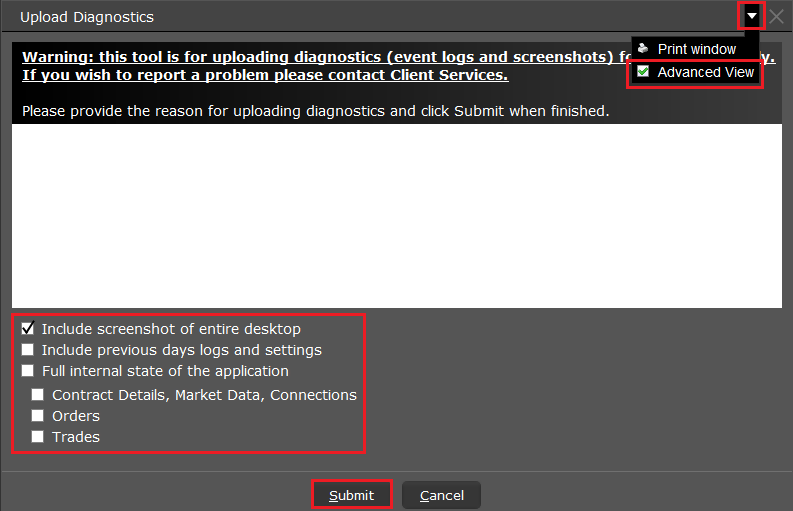

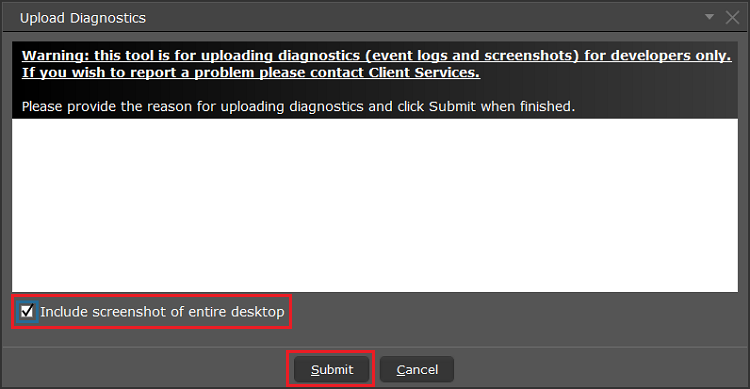

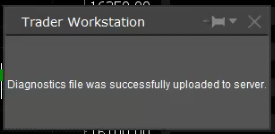

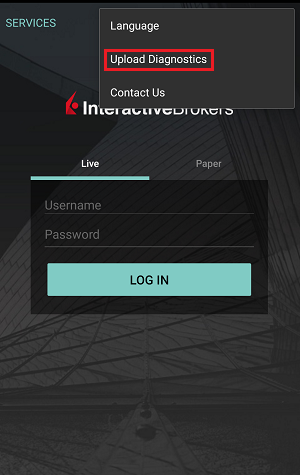

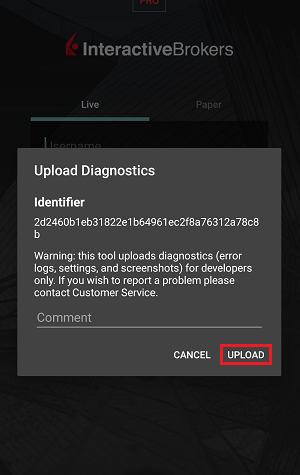

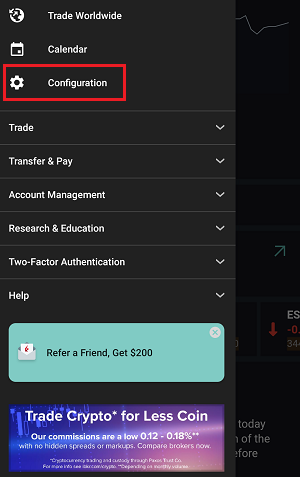

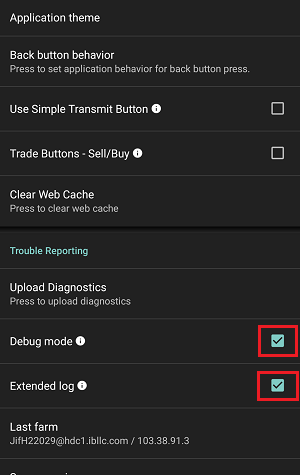

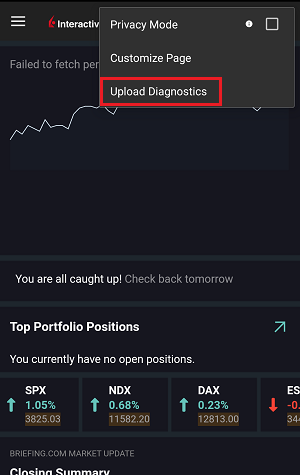

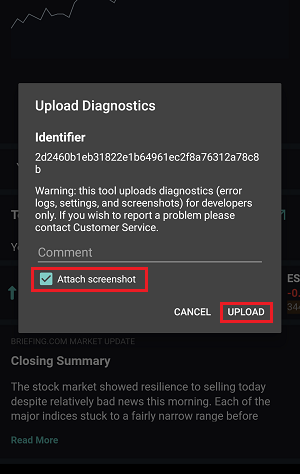

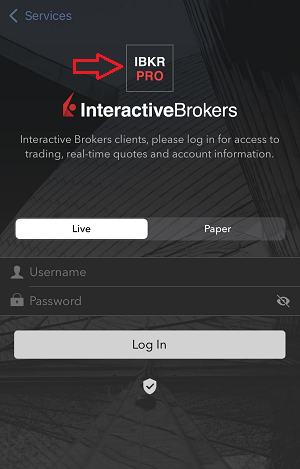

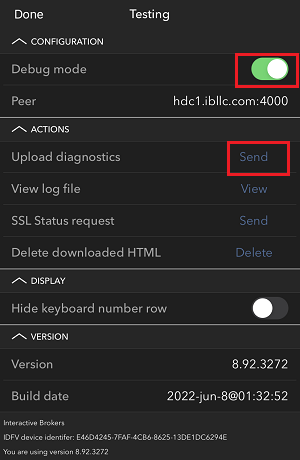

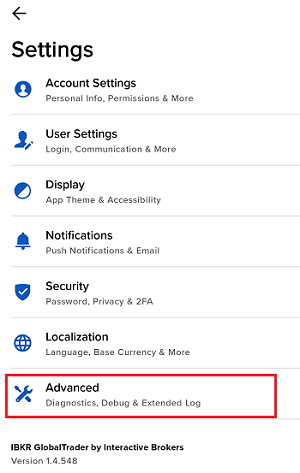

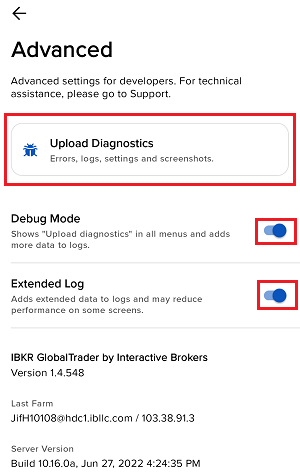

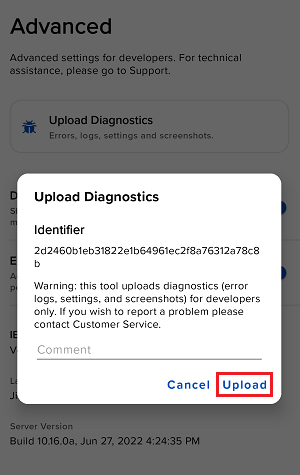

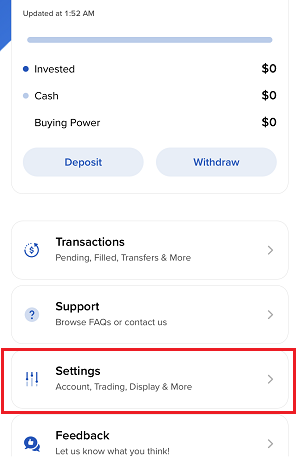

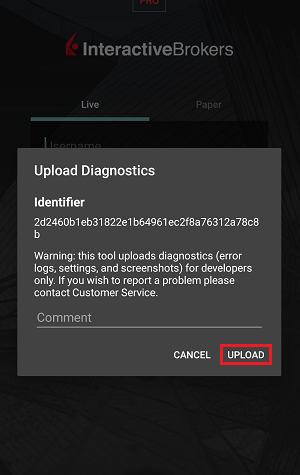

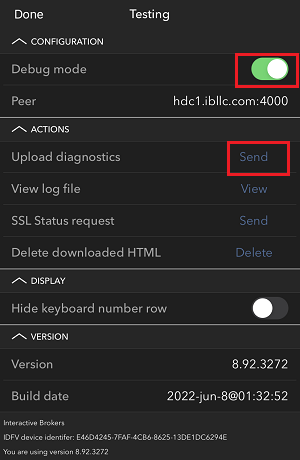

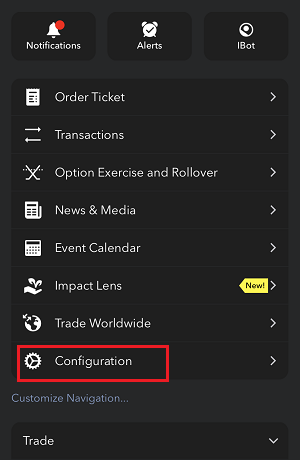

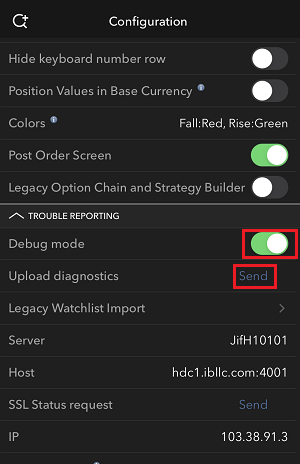

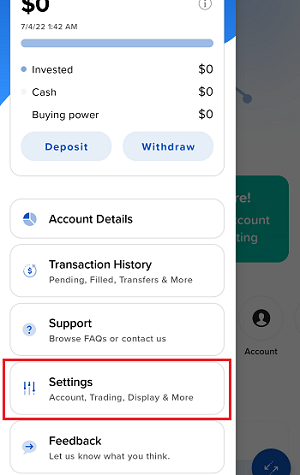

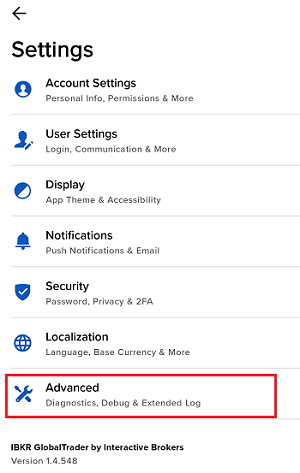

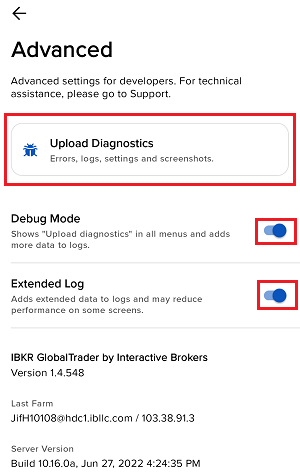

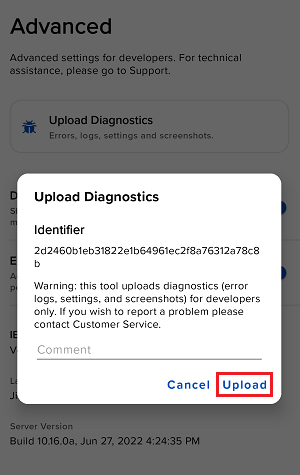

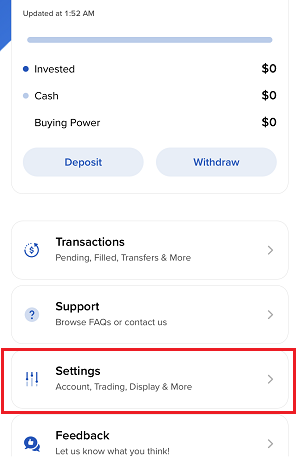

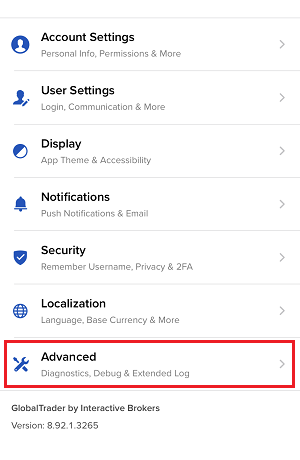

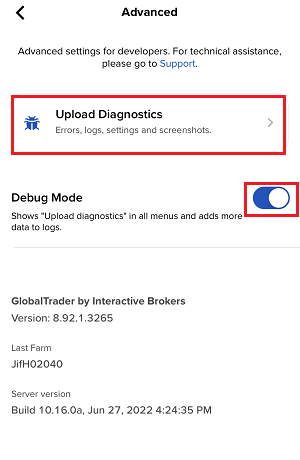

So lädt man ein diagnostisches Bündel von einer IBKR-Plattform hoch

Bei manchen unterstützungstechnischen Fragen müssen diagnostische Dateien und Logdateien zusammen mit Screenshots hochgeladen werden. Diese Informationen helfen unserem Team bei der Untersuchung und Lösung des Problems.

In diesem Artikel wird ausführlich beschrieben, wie Sie bei Interactive Brokers diagnostische Dateien und Logdateien auf verschiedenen Plattformen hochladen können.

Hinweis: Das diagnostische Bündel-Repository wird von IBKR tagsüber nicht fortlaufend kontrolliert. Sollten Sie sich ohne vorherige Anweisung von Interactive Brokers spontan dazu entscheiden, ein diagnostisches Bündel hochzuladen, melden Sie sich bitte telefonisch bei unserem Kundendienst oder erstellen Sie ein Ticket über das Nachrichtencenter. Anderenfalls bleibt Ihre Fehlermeldung unbeachtet.

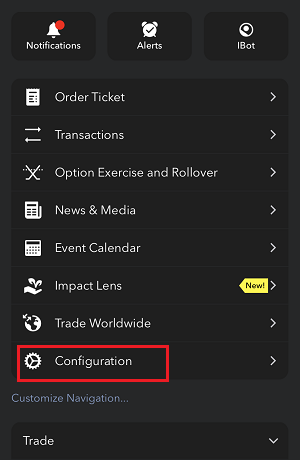

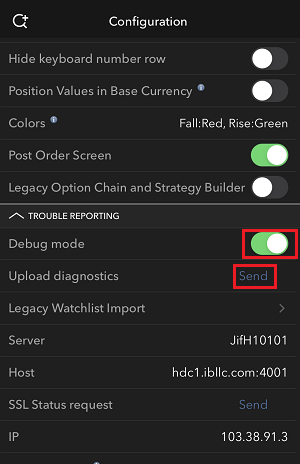

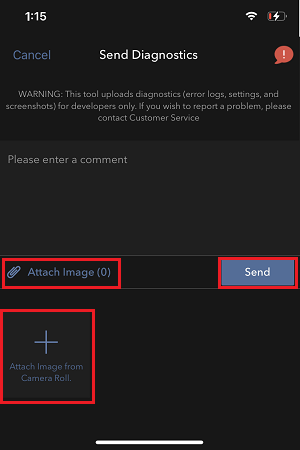

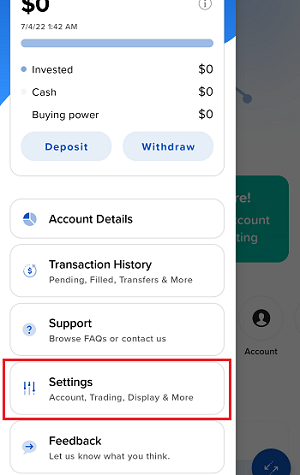

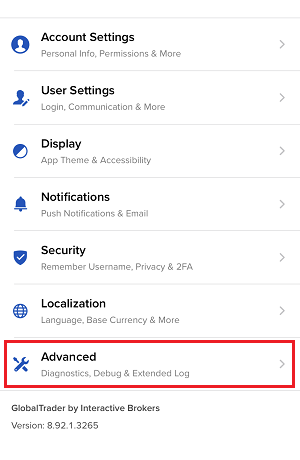

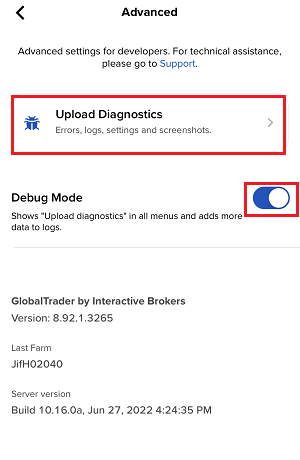

Bitte klicken Sie je nach der Plattform, die Sie verwenden, unten auf den passenden Link:

-

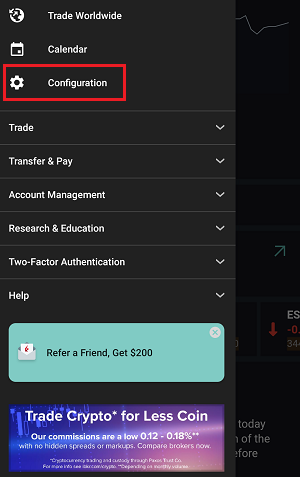

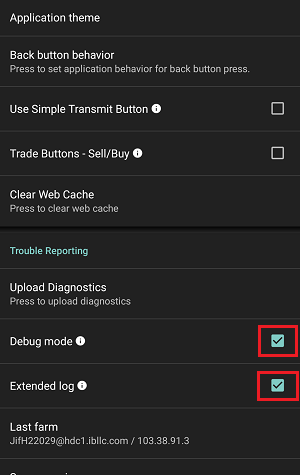

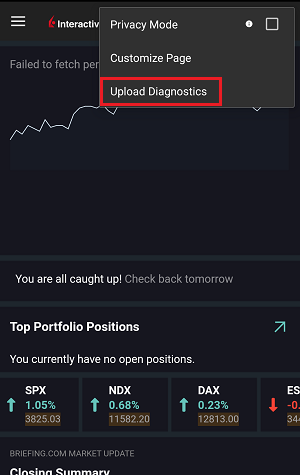

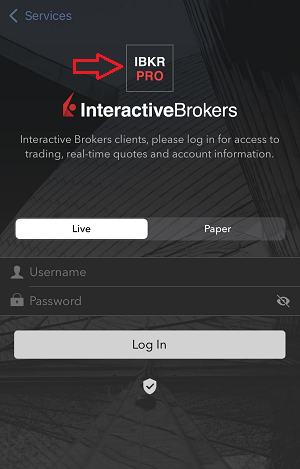

IBKR Mobile (Android)

-

IBKR Mobile (iOS)

- Bei Windows- und Linux-Betriebystemen: Drücken Sie Ctrl+Alt+Q

- Bei Mac: Drücken Sie Cmd+Option+H

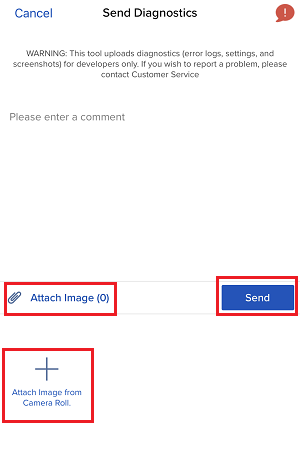

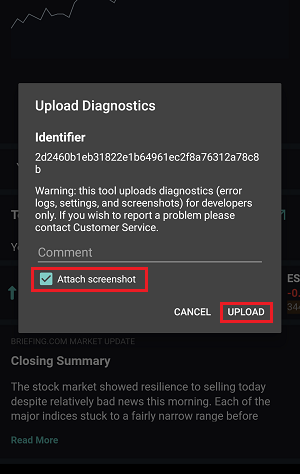

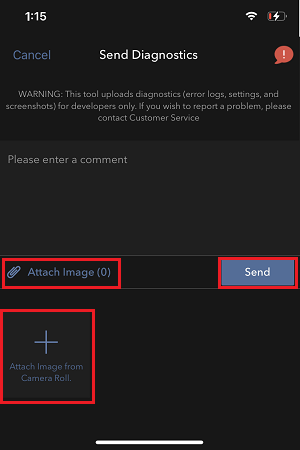

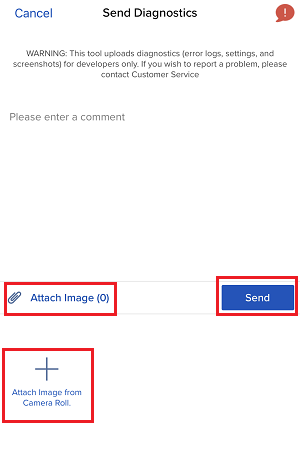

7. Geben Sie Ihre Anmerkungen in das Feld ein und tippen Sie auf ‚Bild hinzufügen‘, um den/die Screenshot/s, den/die Sie auf der Kamerarolle gespeichert haben, hinzuzufügen

Eine diagnostische Ablaufverfolgung für Client Portal kann mittels der Schritte in IBKB3512 nachverfolgt werden

Alternative Streaming Quotes for European Equities

Alternative Streaming Quotes for EU Equities

On August 1st, 2022, clients with non-professional or non-commercial market data subscriber status will receive complimentary real-time streaming Best Bid and Offer and last sale quotes on European Equities. These quotes will be aggregated from exchanges such as Cboe Europe, Gettex, Tradegate and Turquoise. The data will display in the SMART quote line and can be used to generate a chart as well.

Eligible users will see a no charge service called 'Alternative European Equities (L1)' added to their account on or before August 1, 2022. Please note this will be a default Market Data service that cannot be removed.

Users who would like to receive the full EBBO (European Best Bid and Offer) will need to subscribe to the individual exchange subscriptions.

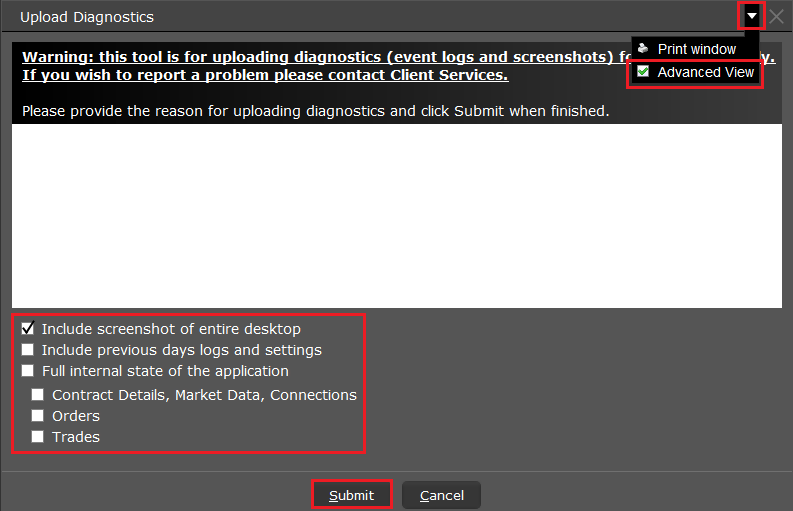

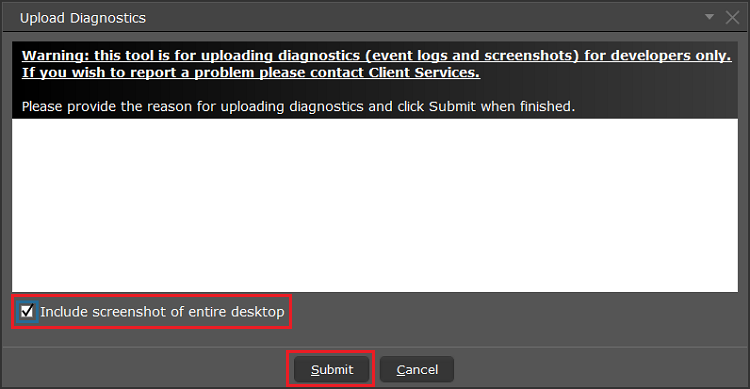

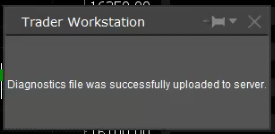

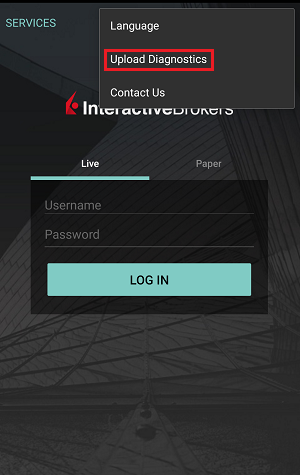

How to Upload a Diagnostic Bundle from an IBKR Platform

Some support related issues require diagnostics files and logs to be uploaded along with screenshots. The information will help our team to investigate and resolve the issue that you are experiencing.

This article will help you with detailed steps on how to upload diagnostics files and logs from various Interactive Brokers’ trading platforms.

Note: IBKR does not monitor the diagnostic bundle repository throughout the day. Should you spontaneously decide to upload a diagnostic bundle, without being instructed by Interactive Brokers, please inform our Client Services via Message Center ticket or phone call otherwise your error report will go unnoticed.

Please click on one of the links below, according to the platform you are using:

-

IBKR Mobile (Android)

-

IBKR Mobile (iOS)

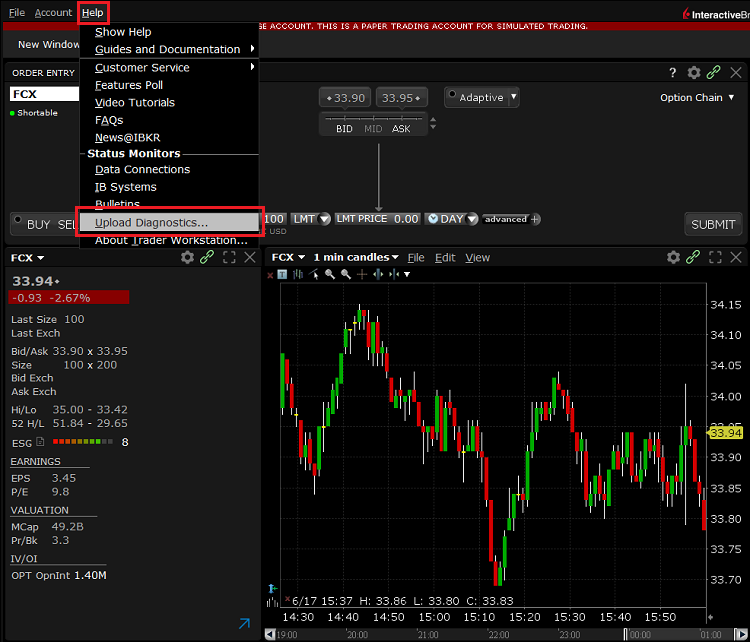

- For Windows and Linux Operating system: Press Ctrl+Alt+Q

- For Mac: Press Cmd+Option+H

7. Enter your comments in the field and tap ‘Attach Image’ to attach the screenshot/s you previously saved in your camera roll

A diagnostic trace for Client Portal can be captured following the steps on IBKB3512

Verzögertes Timing von Marktdaten

Die Anbieter von Marktdaten bieten Börsendaten in der Regel in zwei Kategorien an: in Echtzeit und zeitverzögert. Marktdaten werden in Echtzeit verbreitet, sobald die Informationen öffentlich zugänglich sind. Verzögerte Marktdaten liegen in der Regel 10-20 Minuten hinter den Echtzeitkursen zurück.

Einige Börsen erlauben die kostenfreie Anzeige verzögerter Daten, ohne dass ein Marktdatenabonnement erforderlich ist. Eine Liste der Börsen, für die wir verzögerte Daten kostenlos und ohne formellen Antrag zur Verfügung stellen (d.h. die verzögerten Daten werden bei Eingabe des Produktsymbols auf der Handelsplattform angezeigt), wird in der nachstehenden Tabelle aufgeführt. Die Tabelle enthält auch die entsprechenden Realtime-Abonnements, deren Gebühren auf der öffentlichen Website von IBKR auffindbar sind.

Bitte beachten Sie Folgendes:

- In Einklang mit den aufsichtsbehördlichen Anforderungen bietet IBKR den Kunden von Interactive Brokers LLC keine verzögerten Kursinformationen zu US-Aktien mehr an.

- Die verzögerten Kursangaben dienen Anschauungszwecken und sind nicht für den direkten Handel gedacht. Bei den genannten Zeiten können weitere Verzögerungen ohne Vorankündigung nicht ausgeschlossen werden.

Amerikanischer Kontinent

| Name der externen Börse | Name der IB-Börse | Verzögerungsdauer | Echtzeitabonnement |

| CBOT | CBOT | 10 Minuten | CBOT, Echtzeit |

| CBOE-Futures-Börse | CFE | 10 Minuten | CFE-optimiert |

| Marktdatenexpress (MDX) | CBOE | 10 Minuten | Express-Indizes zu CBOE-Marktdaten |

| CME | GLOBEX | 10 Minuten | CME, Echtzeit |

| COMEX | COMEX | 10 Minuten | COMEX, Echtzeit |

| ICE-US | NYBOT | 10 Minuten | ICE-Futures USA (NYBOT) |

| Mexikanische Derivatebörse | MEXDER | 15 Minuten | Mexikanische Derivatebörse |

| Mexikanische Börse | MEXI | 20 Minuten | Mexikanische Börse |

| Montrealer Börse | CDE | 15 Minuten | Montrealer Börse |

| NYMEX | NYMEX | 10 Minuten | NYMEX, Echtzeit |

| NYSE GIF | NYSE | 15 Minuten | Global Index-Feed der New Yorker Börse |

| One-Chicago | ONE | 10 Minuten | One-Chicago |

| OPRA | OPRA | 15 Minuten | OPRA Top of Book (L1) (US-Optionsbörsen) |

| OTC-Märkte | PINK | 15 Minuten | OTC-Märkte |

| Torontoer Börse | TSE | 15 Minuten | Torontoer Börse |

| Venture-Börse | VENTURE | 15 Minuten | TSX-Venture-Börse |

Europa

| Name der externen Börse | Name der IB-Börse | Verzögerungsdauer | Echtzeitabonnement |

| BATS-Europa | BATE/CHIX | 15 Minuten | Europäische (BATS/Chi-X) Aktien |

| Börse Stuttgart | SWB | 15 Minuten | Börse Stuttgart einschl.. Euwax (SWB) |

| Madrider Börse | BM | 15 Minuten | Madrider Börse |

| Italienische Börse | BVME/IDEM | 15 Minuten | Italienische Börse (BVME stock / SEDEX / IDEM deriv) |

| Budapester Börse | BUX | 15 Minuten | Budapester Börse |

| Eurex | EUREX | 15 Minuten | Eurex-Echtzeitinformation |

| Euronext | AEB/SBF/MATIF/BELFOX | 15 Minuten | Euronext-Cash |

| Euronext | AEB/SBF/MATIF/BELFOX | 15 Minuten | Euronext-Datenbündel |

| Frankfurter Börse und XETRA | FWB/IBIS/XETRA | 15 Minuten | Spotmarkt Deutschland (Frankfurt/Xetra) |

| ICE-Futures Europa (Rohstoffe) | IPE | 10 Minuten | ICE-Futures E.U. - Rohstoffe (IPE) |

| ICE-Futures Europa (Finanzdaten) | ICEEU | 10 Minuten | ICE-Futures E.U. – Finanzdaten (LIFFE) |

| LSE | LSE | 15 Minuten | LSE UK |

| LSEIOB | LSEIOB | 15 Minuten | LSE International |

| MEFF | MEFF | 15 Minuten | BME (MEFF) |

| NASDAQ OMX Nordische Derivative | OMS | 15 Minuten | Nordische Derivative |

| Prager Börse | PRA | 15 Minuten | Prager Börse Kassamarkt |

| SCHWEIZER Börse | EBS/VIRTX | 15 Minuten | SIX Schweizer Börse |

| Tel Aviver Börse | TASE | 15 Minuten | Tel Aviver Börse |

| Turquoise ECN | TRQXCH/TRQXDE/TRQXEN | 15 Minuten | Turquoise ECNs |

| Warschauer Börse | WSE | 15 Minuten | Warschauer Börse |

Asien

| Name der externen Börse | Name der IB-Börse | Verzögerungs dauer | Echtzeitabonnement |

| Australische Börse | ASX | 20 Minuten | ASX Total |

| Hang Sen-Indizes | HKFE-IND | 15 Minuten | Hang Sen-Indizes |

| Hong Konger Futures-Börse | HKFE | 15 Minuten | Hong Kong-Derivative (Fut & Opt) |

| Hong Konger Börse | SEHK | 15 Minuten | Hong Konger Wertpapierbörse (Aktien, Optionsscheine, Anleihen) |

| Koreanische Börse | KSE | 20 Minuten | Koreanische Börse |

| Nationale Börse von Indien | NSE | 15 Minuten | Nationale Börse von Indien, Kapitalmarktsegment |

| Wertpapierbörse von Osaka | OSE.JPN | 20 Minuten | Börse von Osaka |

| SGX Derivatives | SGX | 10 Minuten | Börse von Singapore (SGX) - Derivative |

| Börse von Shanghai | SEHKNTL | 15 Minuten | Börse von Shanghai |

| Börse von Shanghai STAR Market | SEHKSTAR | 15 Minuten | Börse von Shanghai |

| Börse von Shenzhen | SEHKSZSE | 15 Minuten | Börse von Shenzhen |

| Börse von Singapore | SGX | 10 Minuten | Börse von Singapore (SGX) - Aktien |

| Futures-Börse von Sydney | SNFE | 10 Minuten | ASX24 Rohstoffe und Futures |

| Börse von Tokyo | TSEJ | 20 Minuten | Börse von Tokyo |

Bitte TraderWorkstation (TWS) upgraden

Am 9. Dezember 2021 wurde eine kritische Sicherheitslücke in Apache’s Log4j Software Bibliothek entdeckt (jetzt allgemein bekannt als ‘Log4Shell’). Log4j wird sehr breit benutzt in einer grossen Varietät von Konsumenten und Geschäftsangeboten, Webseiten, Applikationen und Geräten um Sicherheits- und Performanceinformationen zu protokollieren. Die Schwachstelle erlaubt es unautorisierten fernen Akteuren die Kontrolle eines beeinflussten Systems zu erlangen und willkürliche Codes auszuführen. Die allgegenwärtige Natur von Log4j und die Einfachheit der Ausbeutung dieser Schwachstelle macht diese Bedrohung nicht nur kritisch, sondern ebenfalls fast universal.

WAS UNTERNIMMT IBKR UM UNSERE KUNDEN ZU SCHÜTZEN?

Wir arbeiten aktiv mit hoher Priorität daran, die Bedrohung auf mehreren Ebenen zu verringern:

- Wir haben all unsere Server, welche extern zugänglich sind (vom Internet aus) mit einer Version von Log4j versehen, die nicht anfällig auf diese Schwachstelle ist.

- Wir haben die Trader Workstation (TWS) Software und unsere TWS Installer mit einer Version von Log4j versehen, die nicht anfällig auf diese Schwachstelle ist.

- Wir haben unsere Sicherheitsinfrastruktur (einschliesslich Netzwerk Firewalls, Applikationsfirewalls, Instrusionserkennungstools, etc) mit den neuesten Schutzvorrichtungsmassnahmen aktualisiert, welche Cyberattacken feststellen und blockieren, die die Schwachstelle von Log4j versuchen zu nutzen.

- Wir fahren mit den laufenden Anstrengungen fort, alle betroffenen internen Systeme vollständig zu identifizieren und zu aktualisieren (die Systeme, auf die nicht vom Internet aus zugegriffen werden können).

- Wir beobachten weiterhin die sich entwickelnden Bedrohungen in der Branche und ergreifen bei Bedarf zusätzliche Massnahmen zur Risikominderung.

ERFORDERLICHE MASSNAHMEN

Wir sind bestrebt eine sichere Umgebung für Ihre Vermögenswerte und Handelsaktivitäten zu schaffen. Zu diesem Zweck bitten wir unsere Kunden, vorrangig die LATEST TWS Version zu verwenden, die sich automatisch aktualisieren wird. Sollten Sie die STABLE oder eine OFFLINE Version benutzen, die sich nicht automatisch aktualisiert, stellen Sie bitte sicher, dass Sie die notwendigen Schritte unternehmen, um Ihre TWS auf dem neusten Stand der Sicherheitskorrekturen zu halten.

Please Upgrade TraderWorkstation (TWS)

On December 9, 2021, a critical security vulnerability in Apache's Log4j software library was disclosed, (now commonly referred to as “Log4Shell”). Log4j is very broadly used in a wide variety of consumer and enterprise services, websites, applications, and devices to log security and performance information. The vulnerability allows an unauthenticated remote actor to take control of an affected system and execute arbitrary code on it. The ubiquitous nature of Log4j and the ease of exploitation of the vulnerability makes this threat not only critical but also nearly universal.

WHAT IS IBKR DOING TO PROTECT ITS CLIENTS?

We are actively working, with high priority, to mitigate the threat on several levels:

- We have patched all our servers accessible externally (from the Internet) with a version of Log4j that is not susceptible to this vulnerability.

- We have upgraded our Trader Workstation (TWS) software and our TWS installers with a version of Log4j that is not susceptible to this vulnerability.

- We have updated our security infrastructure (including network firewalls, application firewalls, intrusion detection tools, etc.) with the latest protection measures that help detect and block cyber-attacks that attempt to exploit the Log4j vulnerability.

- We continue our ongoing efforts to fully identify and patch any impacted internal systems (those that are not accessible from the Internet).

- We continue monitoring the evolving industry threats and adopt additional mitigation measures as needed.

ACTION REQUIRED

We are committed to providing a secure environment for your assets and trading activities. To that end, we request that our clients give priority to the use of the LATEST TWS version, which will auto-update. Should you have the STABLE or any OFFLINE version, which does not auto-update, please ensure that you take the necessary steps to keep your TWS in line with the latest security fixes.

Interaktion zwischen TWS und MacOS 12 (Monterey)

Der vorliegende Artikel befasst sich mit der Performance der Trader Workstation (TWS) auf MacOS Monterey (Version: 12), wie von mehreren Kunden bemerkt und rapportiert. Die TWS kann unerwartet einfrieren oder herunterfahren (Crash), wenn sie auf MacOS 12 läuft. Dies kann sofort während des TWS Startprozesses oder während eines späteren Zeitpunkts, nach einigen Minuten oder sogar Stunden, vorkommen.

Lösung Implementierung

Die Behebung wurde in der TWS Beta veröffentlicht, verfügbar für den Download hier

Dieser Prozess beinhaltete eine exzessive Anzahl von Tests um festzustellen, welche Java Plattform die beste für die Kombination mit der Trader Workstation ist und um zu vermeiden, dass bei der Lösung des aktuellen Problems neue Probleme entstehen.

Wir bedanken uns bei Ihnen für Ihre Geduld.

Interaction between TWS and MacOS 12 (Monterey)

The present article addresses performance on the Trader Workstation (TWS) under MacOS Monterey (version: 12), as experienced by several clients. The TWS may experience freezes or may shut down unexpectedly (crash) when running on MacOS 12. This can happen immediately during the TWS start up phase or may occur at a later time point, after some minutes or even hours.

Fix Implementation

A fix has been released in the TWS Beta, available for download here

This process included an extensive amount of testing, in order to see which of the alternative Java platforms was the best fit for the Trader Workstation and as well to avoid introducing new issues while solving the current one.

We sincerely thank you for your patience.